Published: January 10, 2024

The following memo outlines a strategic opportunity to long Mantle ($MNT) in anticipation of the Ethereum Dencun upgrade and the introduction of EIP-4844, or Proto-Danksharding.

Despite Mantle’s less prominent tech team compared to peers like Polygon or Arbitrum, their focus on user-oriented solutions, coupled with innovative yield and airdrop strategies, positions $MNT for potential value appreciation in Q1 2024.

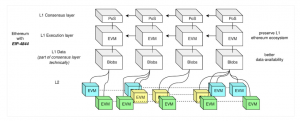

Mantle is an EVM-compatible, optimistic L2 rollup on Ethereum. It operates by handling consensus and settlement on the Ethereum mainnet (Layer 1, or L1) while leveraging data availability services through its proprietary Mantle DA, powered by EigenDA technology.

Currently, Mantle is using a simplified solution of EigenDA developed in collaboration with the EigenLayer team, pending the launch of a more comprehensive, canonical solution. The plan is to transition to EigenDA following its mainnet debut.

Despite a technical team that may not match the caliber of competitors like Polygon or Arbitrum, Mantle adopts a user-centric approach. This strategy allows them to leverage technical solutions from leading teams while focusing on delivering a superior end product. Ultimately, these initiatives are the key to growing the on-chain economy and increasing adoption.

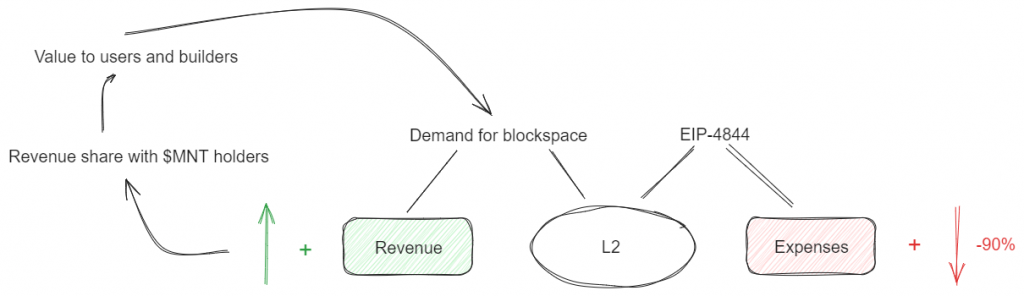

The introduction of Proto-Danksharding with EIP-4844 is the major catalyst for Ethereum L2s. This upgrade promises significant cost reductions for rollups, benefitting Layer 2 tokens like $MNT. The market may rally in anticipation, presenting an opportune moment for building a position in L2 tokens with extra catalysts ahead.

At the core of EIP-4844 lies the concept of “Blobs,” denoting Binary Large Objects. Essentially, blobs are data chunks linked to transactions, distinct from regular transactions. These blob data chunks are exclusively stored on the Beacon Chain and incur minimal gas fees.

Blobs enable the addition of more data to Ethereum blocks without inflating their size. Put simply, leveraging blobs allows for nearly a 10x increase in stored data compared to the average block size.

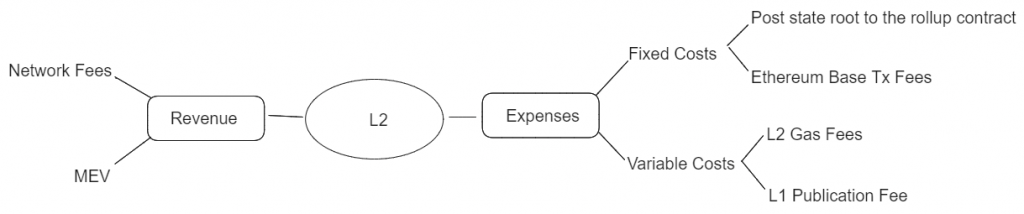

The reason for introducing blobs is to drastically reduce the Data Availability (DA) costs for rollups. Right now, publishing data to Ethereum constitutes over 90% of total rollup expenses.

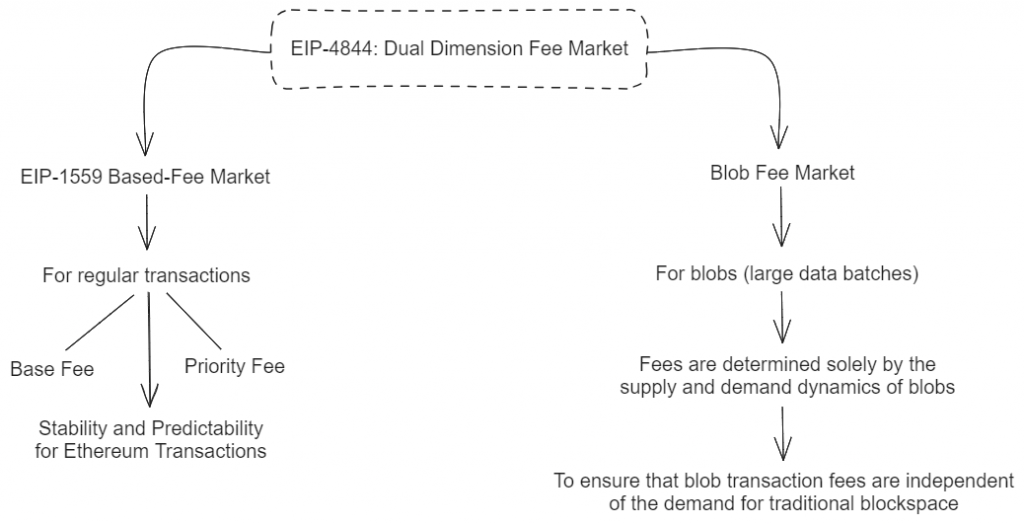

EIP-4844 introduces a dynamic fee system that departs from the traditional fee models that we see today in L2s. With the introduction of dynamic blob fees, the cost of operating on Ethereum will be influenced by two distinct markets: the regular transaction market and the blob market.

This change means that rollups will need to adapt to a fee environment where one part of their operations is subject to the conventional fee structure, while the other is more fluid, adjusting based on the specific demands for blob capacity.

To be concrete, the separation between the cost of posting L2 data to Ethereum from the standard Gas Price means that L2s can achieve significantly reduced costs when submitting their data to Ethereum, with potential cost reductions of up to 16 times or a staggering 90% lower than current gas expenses.

Source: Revelo Intel

With a focus on long-term sustainability and real yield opportunities, Mantle presents two unique real yield opportunities and one extra speculative chance:

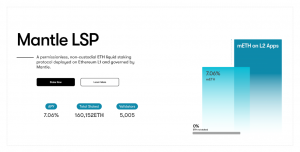

First, $mETH offers double the staking yield on $ETH deposits. This is possible as an extra subsidy is coming from the Mantle treasury itself, which is staking their $ETH holdings and passing the staking rewards to $mETH holders.

Second, $mUSD generates yield from short-term US Treasuries and bank demand deposits, allowing users to earn interest on their stablecoin positions. It is a rebasing wrapped version of $USDY and is designed to maintain a peg to 1 USD, with interest distributed via new token units issued by Ondo Finance.

Similar to $mETH, you can access yield strategies, with the most popular taking place on money markets like MYSO.

Third, Mantle has been a long-term partner of Eigenlayer. They are using EigenDA for Data Availability (DA) and they might as well have an ace under their sleeve when it comes to future airdrop opportunities.

Furthermore, we cannot underestimate the power dynamics of rollups after the Dencun upgrade, since increasing sequencer revenue might translate into an extra push that augments real yield. Unlike Optimism and Arbitrum, Mantle has already set a precedent for sharing revenue with token holders (by staking the $ETH in their treasury and sharing the yield with $mETH stakers).

Mantle is one of the few rollups that has chosen not to use $ETH for gas and rather give increased utility to the native token of the chain, $MNT. Moving forward, $MNT’s utility is set to expand beyond its role as a gas token. It will be used for staking and potentially rewarding those holders who choose to participate in such an offering. Not only does this remove tokens from circulation, but also makes it more attractive to hold $MNT, which might lead to increased buying pressure down the road.

On the supply side, the absence of token unlocks and inflation presents a stable and predictable supply scenario for $MNT, reducing the risk of market dilution. This is unlike other L2s since $MNT resulted from a token migration from $BIT, and a large portion of the supply was already emitted over time.

On the demand side, it is worth noting that the former association between BitDAO (formerly Mantle) and Bybit might have prevented the token from being listed on other Tier-1 exchanges like Binance, Coinbase, Kraken, or Upbit among others. Given the successful rebranding and having an L2 rollup in production, this can be viewed as a latent opportunity. Potential future listings could act as catalysts for price appreciation.

We should not underestimate that the L2 landscape is becoming increasingly competitive. Liquidity might flow into other networks like zkSync, Starknet, Scroll, or Linea to farm their respective airdrops. In that scenario, we would not see the TVL and volume increase that we are anticipating to see on Mantle.

However, it is important to note that there is an opportunity cost that comes with farming those networks since that money is elsewhere and not being productive on Mantle. While the other chains have raised capital at large valuations and their airdrops might be significant, we don’t know when their tokens will actually be released and whether snapshots have already been taken.

For that reason, and considering the opportunity cost of liquidity (like staking in Blast and not being able to withdraw), we don’t think that the risk-reward leans toward their favor when it comes to capitalizing on a very specific L2 catalyst like the Dencun upgrade and EIP-4844.

It is also worth noting that we have already seen the first glimpses of a power law dynamic in L2s. Even though the number of L2s is expected to increase, activity might be concentrated in one or two winners like Arbitrum or Base, and Mantle might not fall into this category.

Because of that, it is important to keep in mind that the bet on Mantle is driven by the fact that $MNT will dilute its holders less than its competitors and has more catalysts ahead in addition to EIP-4844, such as $MNT staking for farming airdrops, real-yield opportunities, incentives, and ecosystem grants…

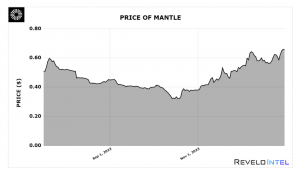

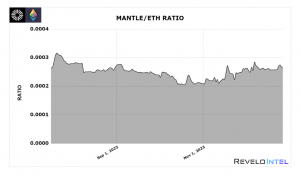

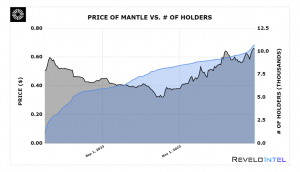

October marked a local bottom and the price is up +60% in the last 90 days.

We observe a similar trend when measuring $MNT vs $ETH as well.

Looking at both charts overlapped with USD on the left axis and $ETH on the right axis.

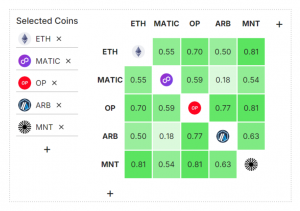

High correlation with L2s, except for $OP which has outperformed in December.

$MNT is also less correlated to $OP than $ARB, which might signal that the market has higher expectations for $ARB and $OP as the leading two optimistic rollups. This further reinforces our point that the market might not be paying enough attention to what’s going on in the Mantle Ecosystem.

$MATIC is not an optimistic roll-up and would be perceived differently by the market, especially when we take into consideration its transition from a PoS L1 to a zkEVM and the progressive development of the Polygon 2.0 roadmap.

You can learn more about Polygon 2.0 in our dedicated Analyst Insight.

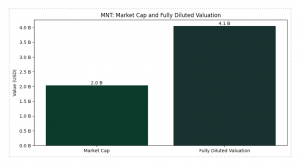

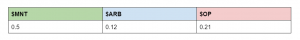

Consistently ranking in the TOP50 by market cap, Mantle features a 0.50 mcap/FDV ratio, suggesting that it is the L2 token with the lowest dilution and inflation coming up in the year ahead.

A comparison of Mcap/FDV of different L2 tokens. This is an indicator of future dilution. Note, this is a snapshot as at the time of this writing.

We can also notice a large deviation in the FDV of $OP and $ARB as the price rallied. Unlike $MNT, both of them are still yet to experience relatively large supply unlocks.

Arbitrum:

Optimism:

Note that we don’t expect large sell pressure resulting from the respective supply increases of $ARB and $OP. Instead, we aim to highlight the low volatility and expected variance in the FDV of $MNT.

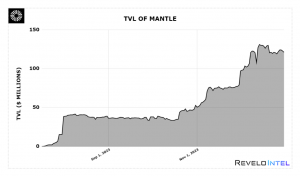

There has been an uptick in TVL, which can be attributed to sustainable initiatives that allow investors to earn real yield in $ETH and USD, such as $mETH and $mUSD respectively. Because of that reason, we don’t expect those deposits to be leaving the ecosystem any time soon.

We can also see in the chart that the cap increase by Eigenlayer in December has not caused a significant disruption in TVL, suggesting that the community has confidence in Mantle delivering good enough returns on their staked $ETH.

Nevertheless, the stablecoins mcap is still very low, barely exceeding $10M.

Similarly, the TVL is also very small when compared to Arbitrum ($2.505B) and Optimism ($882.39M). As TVL starts to increase, this will signal to the market that liquidity conditions are starting to improve, likely anticipating more on-chain activity and network fees (which must be paid in $MNT).

However, we are starting to see stablecoin inflows outpacing outflows as we enter 2024.

Mantle still features a very low TVL/mcap ratio, but it is also worth noting that the chain went live in the middle of 2023 and new projects are still being incubated with expected launches throughout 2024.

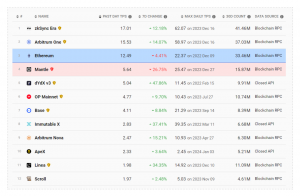

Over the past few days, there has been an uptick in on-chain activity as well, exceeding Optimism in a 30d transaction count.

mETH has also seen impressive growth over the past month after the soft launch in Q4 2022.

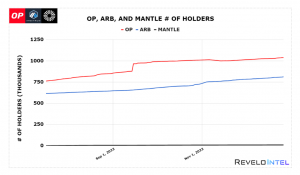

The number of tokenholders continues to increase and we don’t expect any signs of this growth slowing down. Our expectation is that the opposite will happen and the rate of growth will accelerate.

Still, the number of tokenholders is extremely low, approximately 100 times less than $OP and 80 times less than $ARB.

We expect this number to increase as more users start participating in the Mantle Journey and seeking to capitalize on the airdrop distribution by ecosystem projects.

The duration will be determined based on user feedback and on-chain activity, but this rewards program consistently incentivizes the entrant of new users through NFTs and exclusive whitelists for new drops. Additionally, MJ Miles (Mantle Journey Miles) can be exchanged for rewards at the end of the season, which amounts to 20M in $MNT for the current campaign.

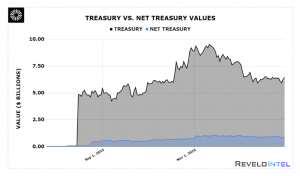

Mantle still holds the largest treasury in crypto excluding the Ethereum Foundation. Most notably, it holds $100M+ in stablecoins and $250M+ in $BTC and $ETH.

Excluding native tokens this amounts to $635M, which is more than 6 times the size of Lido’s and more than 11 times the size of Maker’s.

Additionally, the presence of native tokens in its treasury is not necessarily a bad thing, since they can be used for incentives to further grow the ecosystem and it will take a long time for the large part of it to ever hit the market in large chunks.

When it comes to the ecosystem, some of the standout projects include Merchant Moe (a spinout of Trader Joe), Eigenlayer, Ethena, Ondo, as well as others like INIT Capital (money market), Butter XYZ (all-in-one exchange), Range Protocol (On-chain asset management), Tsunami X (spot and margin trading), or Mintle (NFT marketplace powered by Rarible) among others.

It is important to also emphasize that established teams with a long track record like the Byte Masons will be launching two projects on Mantle as well: Cleopatra, and Aurelius.

As a DEX, Agni Finance currently displays over 30% in TVL dominance with $40M, followed by Ondo with $30M, FusionX, iZiSwap, and Range Protocol.

Mantle ($MNT) stands at a strategic juncture, poised to benefit from the upcoming Ethereum Dencun upgrade and the introduction of EIP-4844. Its unique approach to user experience, coupled with attractive yield offerings and a strong partnership ecosystem, positions it favorably for potential growth.

The absence of token unlocks and inflation further strengthens its investment case. Therefore, we recommend a long position in Mantle ($MNT) as a strategic investment ahead of these key developments which are expected to take place in Q1 2024. Unlike its competitors, there are more catalysts ahead in addition to EIP-4844, such as $MNT staking, better growth prospects through incentives, and lower dilution.

Revelo Intel has never had a commercial relationship with Mantle and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.