Key Points

Blockchain networks across the board need to communicate with each other for the crypto industry to evolve and prosper. Their individual ecosystems’ unique technologies, communities, programming, and applications can sometimes make this difficult. The ability for blockchains to interact and exchange both data and assets with each other is known as blockchain interoperability. Interoperability offers benefits such as scalability, access, and innovation. However, seamless interoperability between different blockchains is often challenging. This is where blockchain bridges, like Synapse, come in.

Blockchain bridges help blockchains communicate through an ERC-20 implementation of something called cross-chain messaging. The bridges can be centralized and facilitated by CEXs like Coinbase or Binance. Or, they can be decentralized and managed by smart contracts. Centralized bridges require users to trust these exchanges with their funds, which has proven risky in events like the collapse of FTX. Sometimes it takes a catastrophic event to realize the value of decentralized or trustless systems. This has led to a growing interest in decentralized alternatives like Synapse.

Blockchain Interoperability allows developers to build projects on different networks based on factors like development language, speed, cost, and network effects. However, certain products and assets are only available on certain networks. Interoperability can help build new projects, aggregate yields, facilitate cross-chain swaps, and reduce costs. Overall, this makes the process of using DeFi more affordable for average users.

Synapse originated as a project called Nerve, a fork of the decentralized exchange Curve Finance in the Binance Smart Chain (BSC) ecosystem. However, slow and inefficient cross-chain bridges made it challenging to entice users to bridge to BSC. Hence, Synapse was born as a bridge to bring funds to Nerve’s DEX, but its potential was much greater.

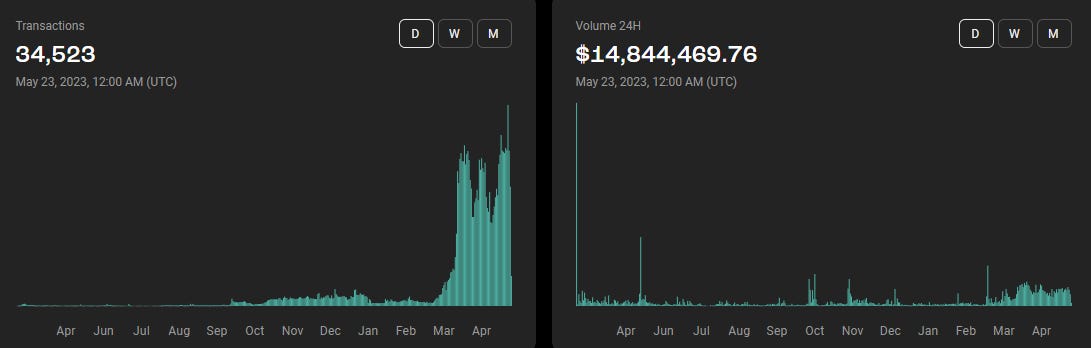

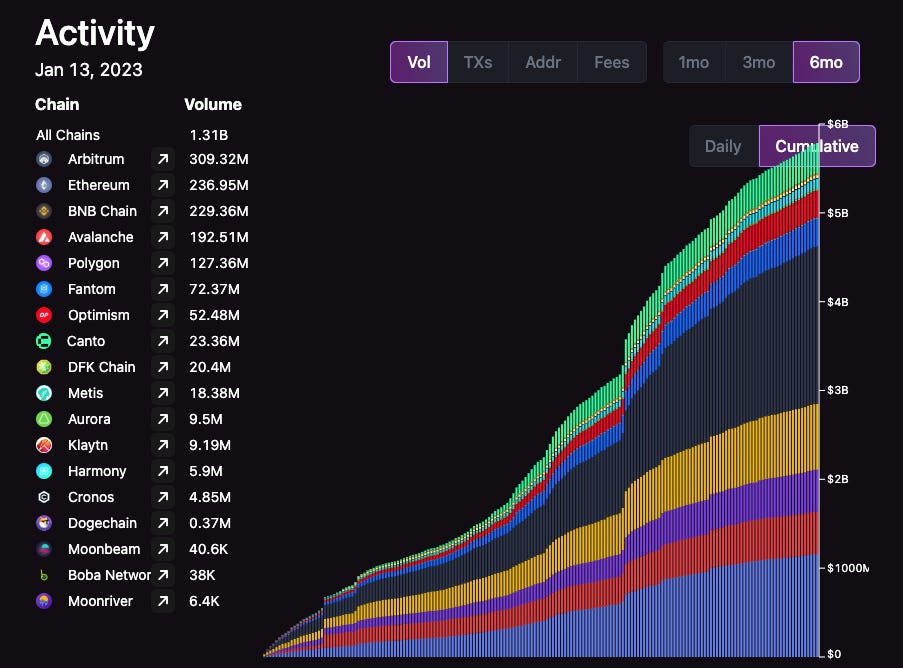

Today, Synapse is a DEX and a bridge connecting 18+ networks. It has already supported over 1.5M bridge transactions and over $13.4B in volume. There are new and novel use cases for its cross-chain messaging technology in addition to its upcoming optimistic L2 roll-up built on the OP stack. For instance, an app chain built on the OP stack like Aevo could integrate Synapse to allow for fast withdrawals. Some other features Synapse plans to roll out include cross-chain lending, cross-chain custody, prime brokerages, and governance proposals that can be seamlessly executed across chains. Synapse plans to utilize either Avalanche or Polygon supernets to expand their tokens, NFTs, and data outside of their ecosystem.

With V2, Synapse’s main attraction is the Interchain Network which is the primary focus for the developers at Synapse. The Interchain Network introduces two new significant changes to the bridge; Cross-chain Messaging, and the Synapse Chain.

V2 implements generalized cross-chain messaging, which enables arbitrary data to be sent across blockchains. This expands the use cases of their cross-chain infrastructure to include NFTs, smart-contract calls, governance, and more, allowing any dApp to be natively multi-chain. The main takeaway for users is that dApps would no longer need to have multiple instances on different chains. No more switching networks on your wallet and having to acquire gas tokens on a new chain. At least, this is the goal.

The main draw of the V2 upgrade is Synapse Chain. V2 enables an optimistic verification security model that assumes transactions on the chain are honest by default. The update also includes a network of off-chain actors responsible for submitting fraud proofs during an optimistic window. This is similar to how optimistic rollups like Arbitrum and Optimism operate. Synapse will use the native $SYN token for gas instead of $ETH. This is perhaps the most important factor to consider around Synapse V2. The protocol will rely on its own native token for security. Initially, gas will be paid in $ETH when the Synapse chain first launches. This is a temporary measure while the team plans how exactly to tie the Synapse chains’ usage to SYN.

Using $SYN as gas is especially important considering EIP-4844 aka ETH Cancun. This upcoming Ethereum upgrade aims to significantly lower transaction fees for L2s. This would make chains like Arbitrum, Optimism, and now maybe Synapse Chain, more scalable. Interested investors may want to frontrun this attention, by taking positions in some of these L2 tokens before the upgrade takes place. No dates are confirmed but this upgrade is suspected to occur sometime in the early second half of the year.

While Synapse is making waves right now for its plans to build its own chain, it is still primarily a bridge. The primary goal of Synapse Chain is actually to be a hub for liquidity from all the different chains that the bridge is connected to. Bridges that connect L2s may be seen by some as the next piece of infrastructure that benefits the most from EIP-4844. If L2s become significantly more scalable and easier to use, it makes sense that bridging volumes to and from these chains would increase. This is a good thing for Synape and the $SYN token.

The introduction of the Synapse chain further simplifies the process for developers to host their state across any blockchain in a safe and secure manner. Basically, this could lead to an increase in the number of applications built on Synapse which would boost its usage and value.

The Synapse chain will be launched as an L2 optimistic rollup with a built-in DEX and perpetuals trading platform. So far, CEXs have been the most used way to bridge between different blockchains. Some people use CEXs as a way to hide their activity from people. People who use CEXs in this way are mostly institutions or large traders that might be weary of having their wallets tracked. For most people, CEXs are an attractive alternative because they’re just much easier to use than on-chain bridges. It can be difficult to bridge assets, as different chains have different native assets and different wrapped versions of tokens. Bridges just might not support the tokens users want to send across chains, which is a common scenario. To get around this, many users are more than willing to sacrifice decentralization. This is especially true for people using CEXs primarily for bridging, as they only keep their funds on these centralized platforms for a short period of time. Synapse could become the first decentralized bridge to build an exchange.

But just because a project builds its own chain does not mean that developers will build there. This rings true for many chains, not just Synapse. A proven strategy when launching infrastructure that needs activity from others to be successful is to simply provide a couple of use cases for users right out of the gate. This way people don’t have to wait around for developers to build out the first attractive applications. In-house development of common applications like a DEX (which Synapse already has) and perps trading platform can help get the ball rolling by bringing TVL and attention to the chain. Then developers will have more of an incentive to build on Synapse Chain.

Luckily, Synapse has a history of attracting and partnering with popular projects. Their current partnership with DeFiKingdoms is one of the largest integrations in all of crypto boating over 1M users and 1.6M transactions. To put this into perspective, about 4M addresses have used Uniswap since it existed. Defi Kingdoms is still seen by some as being one of the first movers in the gaming space which has real users. Defi Kingdoms also already has deployed on multiple chains, including Harmony, Klayton, and their own Avalanche subnet. While this isn’t necessarily a new catalyst, it is worth noting as a resurgence in activity for Defi Kingdoms could be a significant driver of volume for Synapse.

With the launch of the Synapse Chain, $SYN holders are likely to benefit from ecosystem airdrops. Projects building on top of Synapse Chain will have to incentivize liquidity flow to their application one way or another. $ARB incentives were also sent to the Synapse DAO treasury. Proposals for what to use this $ARB for will start being discussed on the governance forum.

Synapse is also working on concentrated liquidity. This will make it possible to have 1:1 cross-chain quotes across all chains between L1s, L2s, L3s, and app-chains, and more. Additionally, Synapse is also working on a CCTP integration (Circle’s Cross-Chain Transport Protocol). This will further reduce the need for liquidity and $SYN incentives.

There have been several governance proposals that have been passed that change the tokenomics behind $SYN, making it potentially a more attractive buy. Single-side staking was approved in November 2022. When implemented, this will allow SYN holders to earn protocol revenue, driving up demand for the token.

SIP-17 recalibrated $SYN emissions, changing $SYN inflation to be between 5.1% to 6.3%.

SIP-19 also passed, leveraging Balancer and Aura to reduce $SYN/$ETH emissions. By migrating SYN/ETH liquidity to Balancer and incentives to Hidden Hand, Synapse has deepened liquidity even more while reducing its pool2 spend by 40%.

SIP-21 also reduced $SYN emissions and will allow Synapse to use $40M of actively managed liquidity offered by Nima Capital for a 12-month term.

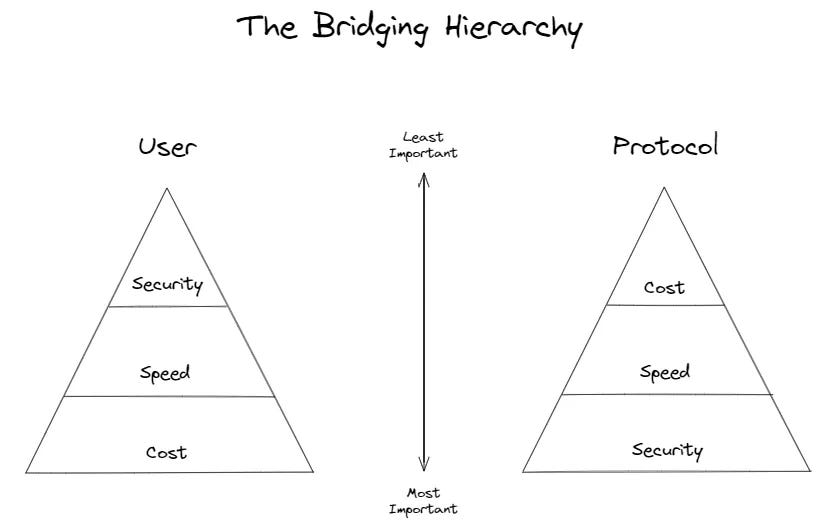

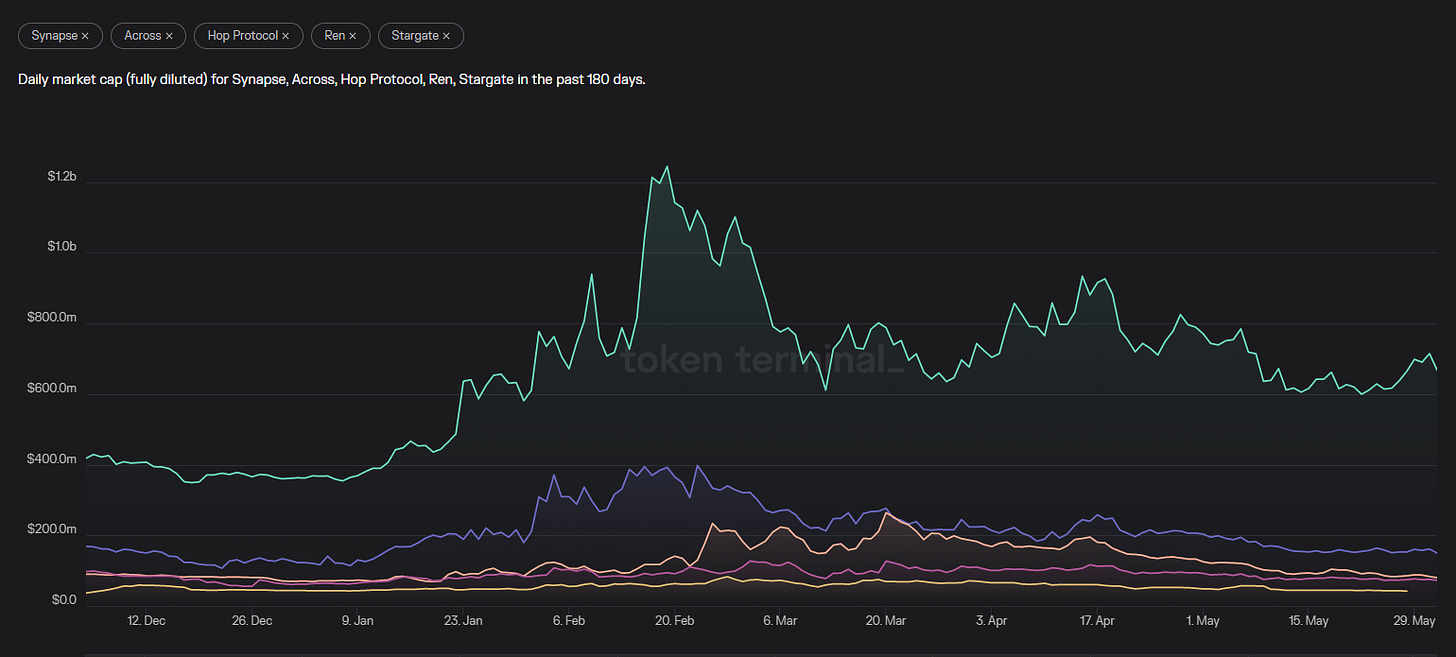

When analyzing the bridging landscape, there is one player that controls a majority of the market share. Stargate, a composable native asset bridge, is built on LayerZero technology. Stargate functions as a cross-chain DEX that allows users to swap native assets across different chains.

Stargate sees significantly much more transfer volume than Synapse. Synapse isn’t alone, as the other competitors in Hop Protocol and Across see even less volume. When it comes to volume, or really any metric that bridges may value, Synapse and its competitors lose to Stargate by many multiples.

While total volume going through bridges has increased significantly, all this volume has just gone straight to Stargate while everyone else has lost share.

Stargate boasts ~$460m in TVL. While this figure is a tenth of what it once was during more bullish times, the bridge’s TVL still dwarfs its competitors, doubling Synapse’s TVL. This high TVL can be attributed to Stargate’s LP system. Users can deposit stablecoins for LP tokens and be paid out in stablecoins as transfers are routed through Stargate. These LPs can also be farmed to earn Stargate’s native token $STG, in addition to the stablecoin swap fee payouts.

Interestingly Stargate actually has a very similar market cap to Synapse, with both around $120m-$130m at the time of writing.

On that basis alone, it is hard to justify a $SYN position in a 2 horse race with Stargate while the market still viewed it primarily as just a bridge. Granted, Stargate’s FDV is double Synapse’s, coming in at ~$432m. But the point still stands that many would prefer to just take a position in the winning protocol, rather than take a chance on the bridge taking risks and implementing new features to try and recover market share.

SYN will soon become a multi-utility asset on Synapse. It will be used to incentivize LPs and to vote on governance decisions. Most importantly, $SYN will also become the native token to pay for transaction fees in its upcoming Synapse L2 network.

The $SYN token is available on major exchanges like Coinbase, Kraken, and Binance. With the launch of single-side staking, the opportunity window to accumulate $SYN could shrink. This could happen as a result of an increasing number of holders chasing real yield from the protocol’s revenue sharing.

Synapse has already demonstrated its value in the blockchain space. It has facilitated over $11 billion in total bridge volume, nearly 1 million unique transactions, and supported over 150k unique users. The launch of Synapse V2 and Synapse Chain could increase these numbers. This could potentially pump the value of the platform and $SYN.

There is certainly potential for Synapse’s upgrades to bring attention to $SYN. On the other hand, attention could shift to $STG, the native token of Stargate. As the dominant option in the cross-chain bridging space, Stargate may very well be a more attractive option for investors. This could make a position in $SYN risky.

$SYN is valued as a bridge and not a blockchain, at least for now. And when examined from the context of a bridge, it is clear that Stargate is currently beating out all the competition. A short to mid-term $SYN trade relies on the new features of the Synapse Interchain Network upgrade outweighing the dominance that Stargate has over Synapse.

Revelo Intel has never had a commercial relationship with Synapse and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.