Key Points

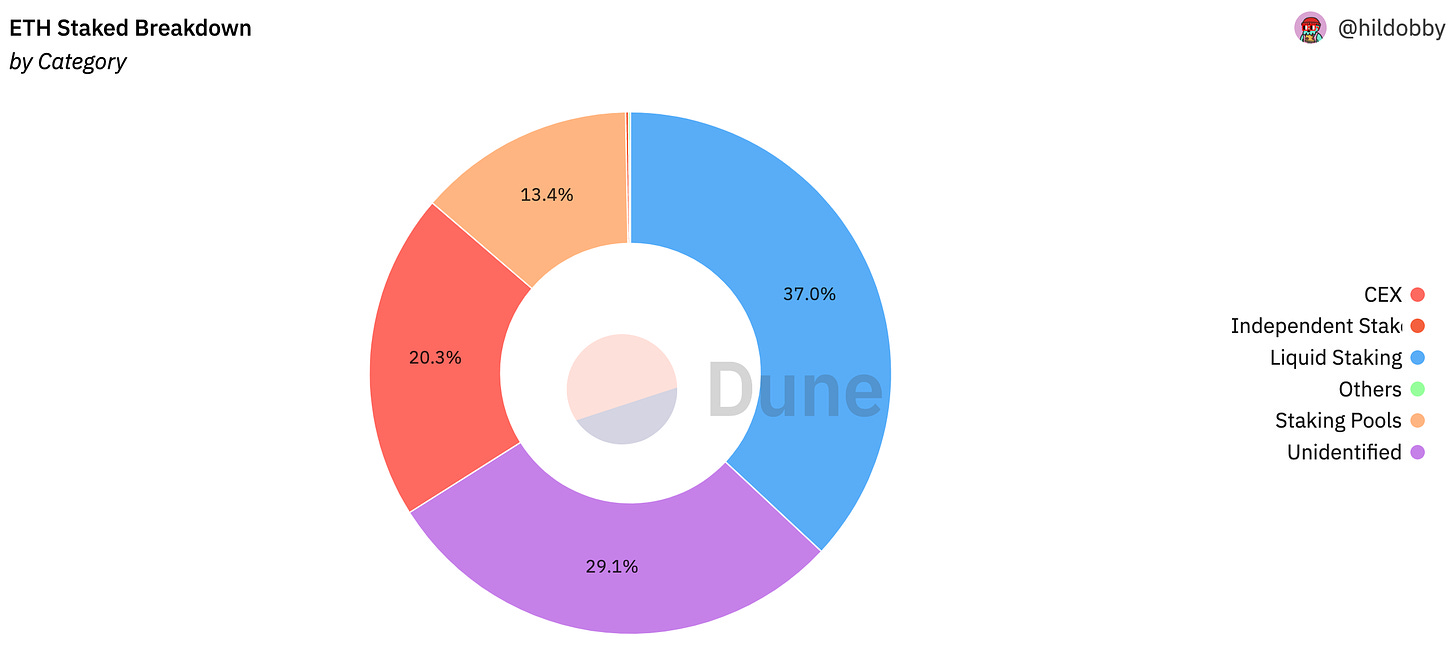

The rise of large centralized entities in the staking ecosystem, like Coinbase or Binance, has limited users’ alternatives to illiquid and custodial solutions. At the same time, one significant barrier to Ethereum staking is the minimum economic value required to participate, which currently stands at 32 $ETH per validator. At the peak of the market in 2021, this threshold was equivalent to over $100,000. Such a substantial financial commitment creates a hurdle for most users. This limits their ability to engage in staking and benefit from its potential rewards.

Another barrier is the technical expertise and infrastructure required for validating and producing blocks in the Ethereum network. This complexity poses challenges for average users who may lack the necessary knowledge and resources to participate effectively. The risk of penalties and slashing for validator misbehavior further discourages users from engaging in solo staking.

Liquid staking addresses the challenges of Ethereum staking by delegating specific responsibilities to different user groups. Stakers deposit $ETH to validators operated by node operators, who handle the technical aspects of staking, maximizing returns and scalability. This separation allows users to participate in staking without needing extensive technical knowledge or infrastructure.

After the Merge and the Shanghai/Capella upgrade, liquid staking derivatives have become a core DeFi primitive for the Ethereum ecosystem. Thanks to Liquid Staking, users can earn yield on their $ETH holdings by delegating their assets to validator nodes that will return them a tradeable staking token (LST – Liquid Staking Token). This liquid token represents a claim on the underlying $ETH that is being staked to secure the chain. In exchange for securing the Beacon Chain, validators get rewards from 3 sources:

At the same time, depositors receive ERC-20 tokens that represent a staking position. They can deploy these assets across DeFi to earn extra yield via lending, providing liquidity, use as collateral…

Each LST will have its own implementation depending on the issuing staking pool. At a high level, the user receives a token that represents the initial deposit, and, over time, either the token supply or its value relative to $ETH changes dynamically to reflect the accrued rewards from staking. Because of these different implementations, staked $ETH tokens from different pools are not fungible with each other.

Users are incentivized to adopt whatever LST has the most liquidity and opportunities to be used in DeFi. Because of this, Lido and Rocket Pool have experienced significant growth and adoption due to their first-mover advantage. Due to their Lindyness, they were the first to be integrated into major money markets like Compound and Aave.

However, the market opportunities are not limited to the use of LSTs as collateral. The fact that you can tokenize yield gives birth to LST marketplaces, LST vaults, LST-backed strategies…

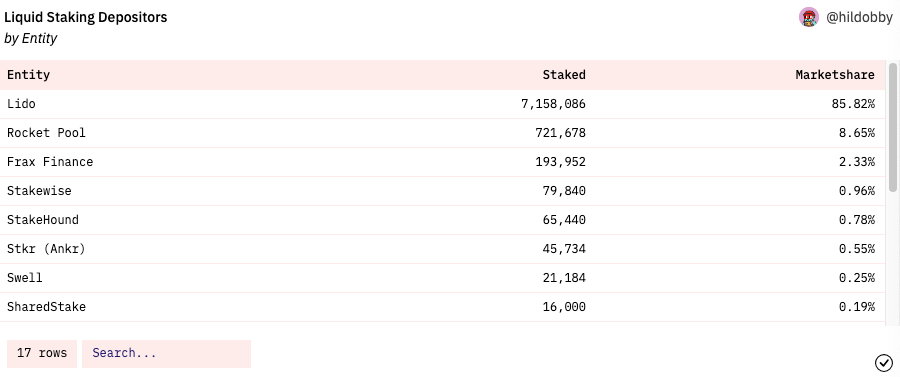

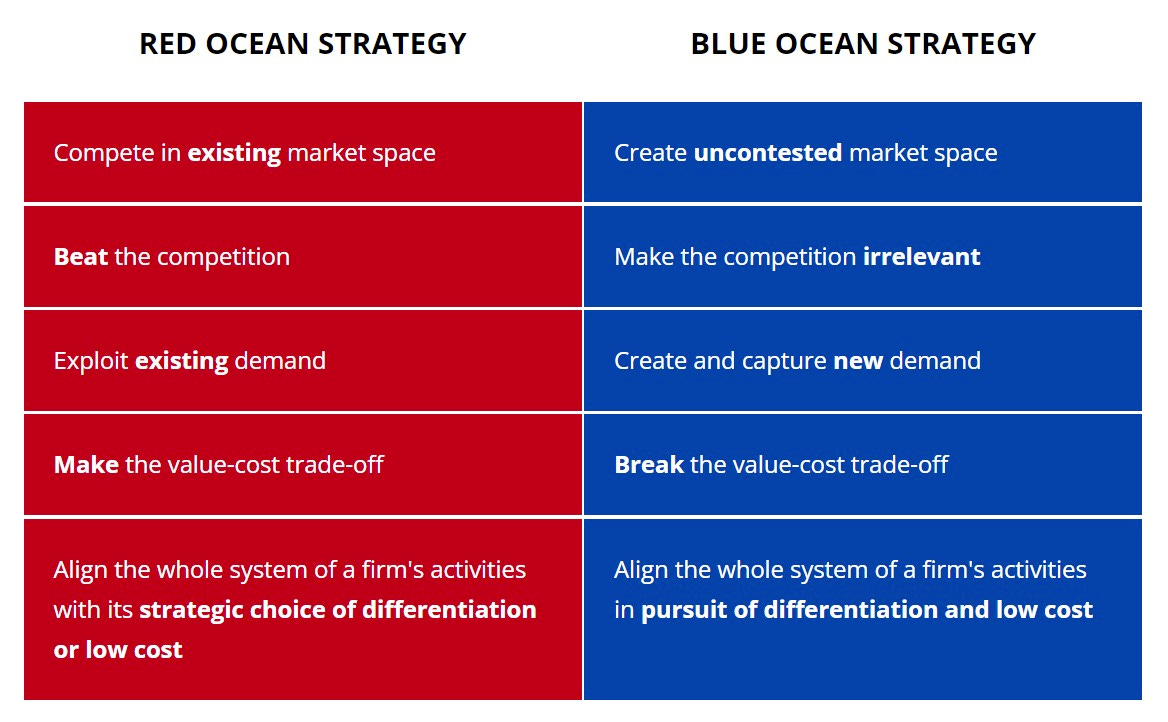

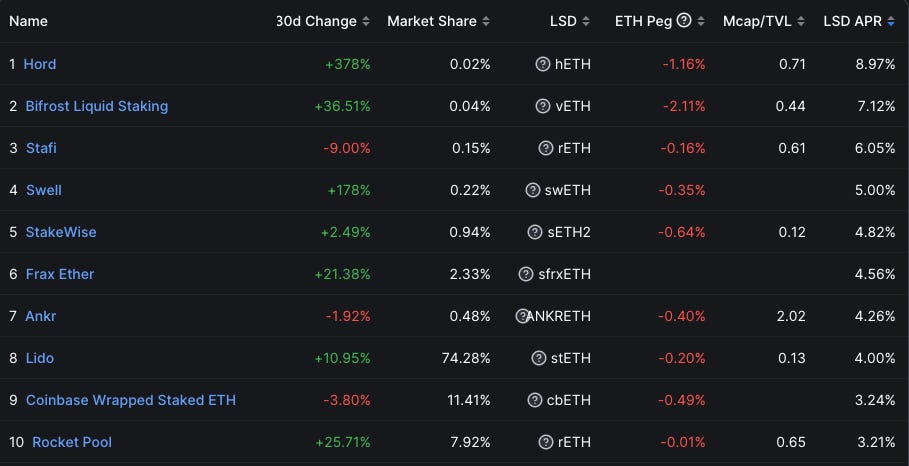

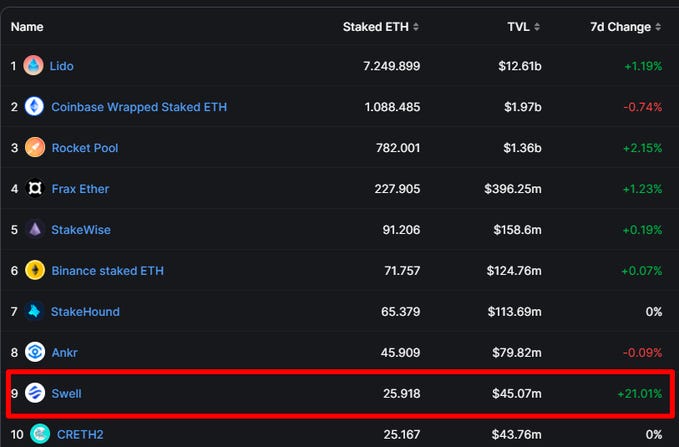

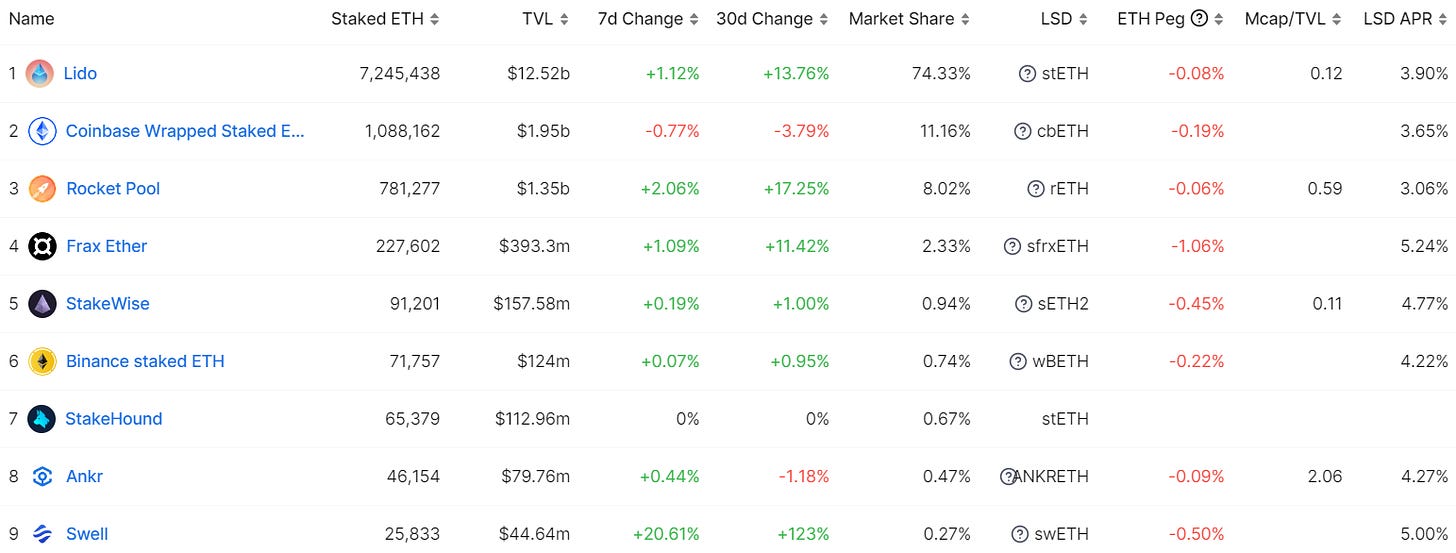

Currently, Lido takes over 70% of the LSTs (Liquid Staking Tokens) market share, With this proliferation in participation comes less opportunity for profit. The fact that $ETH yield has fallen off to ~5% gives birth to new market opportunities. Red oceans usually tend to ward off new participants entering the market. They can also be a precondition to spark a new market subsector made out of projects building on top of LSTs. On that note, there is likely an inefficiency gap when it comes to offering a better liquid staking experience, and liquid staking is the most dominant form of participating in securing Ethereum’s PoS (Proof of Stake) network.

Swell Network is banking on that exact opportunity via their simplified UI/UX and a gamified incentives program, the “Swell Voyage”. Currently, Swell not only offers a higher yield than its direct competitors but is also offering 0% fees during a promotional period. After this period, fees will be raised to 5%. This is still lower than the standard 10% take rate by most LST issuers.

This acquisition cost at the expense of charging no fees will help to bootstrap initial liquidity and gain traction without involving excessive token emissions. This way, users will reap all the rewards that come from staking and the protocol will avoid huge jumps in TVL followed by a sudden exit as soon as incentives from emissions dry out and mercenary farmers dump the rewards on the market.

The gamified experience with quests also helps to educate the community of new users and motivate them to engage with the platform. This could lead to higher user retention and creates a sense of progression as users strive to complete more and more quests. Even though these actions are taken with the expectation of an airdrop, this might end up being a powerful driver for user acquisition and word-of-mouth marketing.

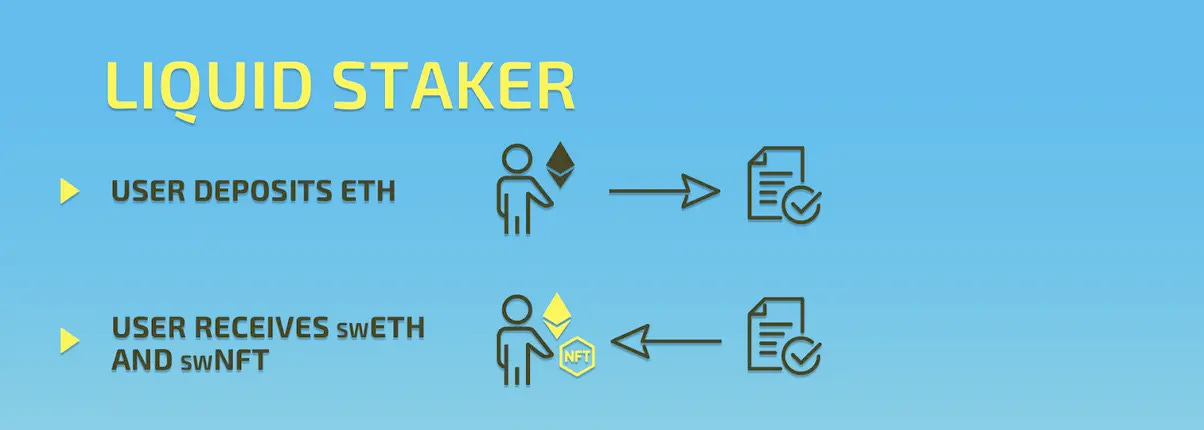

As a non-custodial liquid staking protocol, Swell stands out for offering users a seamless and accessible way to participate in Ethereum staking.

Swell Network enables users to access both staking yields and DeFi opportunities through a single interface. By staking $ETH and withdrawing $swETH, users can then deposit their LSTs into vaults. These vaults provide a productive outlet for $swETH by:

Compared to the average $ETH staking APY of around 4%, Swell stands out by currently offering the lowest-cost staking option in the market. Besides, Swell eliminates the barrier to entry posed by the 32 $ETH minimum stake required to set up a validator node on Ethereum. By significantly reducing this requirement, Swell empowers anyone to earn staking rewards with only a few dollars worth of ETH. This opens staking opportunities to a much broader range of predominantly retail participants.

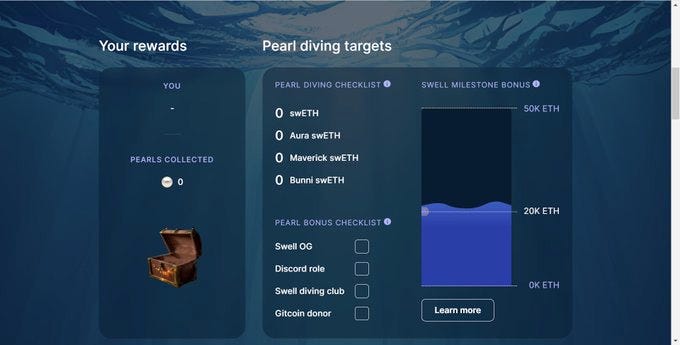

During the Swell Voyage Program, users can collect pearls by minting or holding $swETH or by providing liquidity on Pendle, Aura, Balancer, Maverick, Uniswap V3, and Bunni. These pearls will then be redeemable for $SWELL at TGE. At this time, users can earn 20 pearls for every $swETH minted through the app, and each pearl represents a portion of the $SWELL airdrop.

One of the advantages of this incentive program is not only the absence of token emissions Another benefit is its flexibility, where each chapter of the Voyage will have a slightly different objective.

The program started when staking was opened to the public. The first chapter, the prelude, ended on May 24. It allowed users to collect pearls based on their $swETH holdings and the liquidity they provided on Balancer, Aura, Bunni, Uniswap, Pendle, or Maverick. This mission continued in chapter 1 as well, where users would be rewarded based on how much and for how long they had been holding or providing liquidity.

The program also stands out because of its collaborative efforts. By tapping into existing communities, Swell is also managing to incentivize users from other protocols to boost their growth. As an example, a snapshot was taken at the Ethereum block #17119845. Rewards were allocated to holders of:

In order to claim, those users would need to mint 0.2 $swETH before the start of chapter 2.

Additionally, the protocol also expanded its presence to notable NFT communities, namely:

Similar to the holders of the governance tokens above, eligible users would need to mint 0.2 $swETH before the start of Chapter 2.

At the time of writing, there is a $swETH mint bonus where users can earn 20 pearls for every unit of $swETH that they mint.

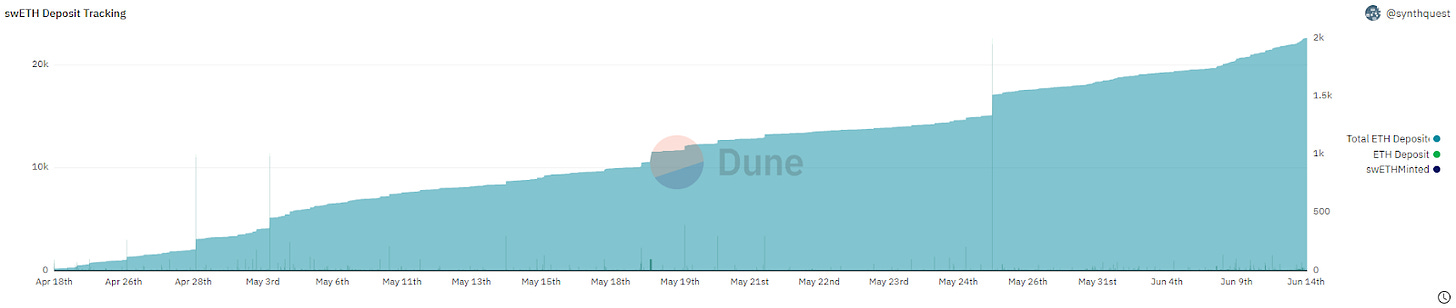

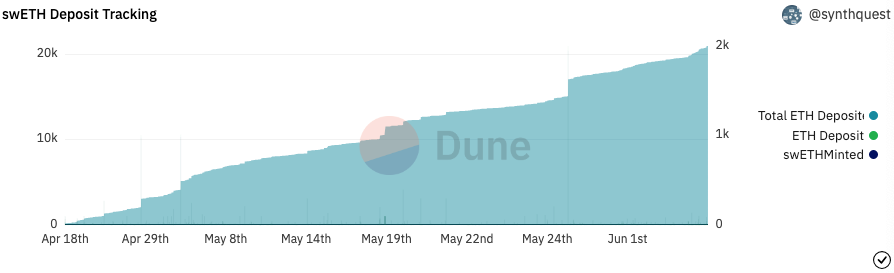

Over the past month, the amount of $ETH staked in Swell’s contracts has been consistently increasing, reaching over $30M in TVL. It is worth noting that if the protocol manages to hit $50,000 $ETH in TVL, then the total size of the distribution program will increase by 40%.

Despite being a new entrant in the market, the protocol has also entered the top 10 LSD (Liquid Staking Derivative) protocols on DeFiLlama and is currently experiencing the fastest growth in the past 7 days.

It is worth noting that this comes after pivoting from an initial marketplace model for atomic deposits. This initial model would allow users to directly deposit ETH to their validator of choice, creating a defacto staking marketplace. This model was abandoned in February 2023 and, since then, the team is focusing on an improved architecture for staking yield optimization.

The image above shows how Swell Network was meant to work before pivoting to becoming a staking yield optimizer. The illustration shows how users could delegate a stake directly into a Beacon Chain deposit contract of their choice. This way, users could choose their node operators taking into account their commission rate, experience, performance…

The valuation of $SWELL is yet to be seen, but its pricing is highly conditioned by an initial selling pressure after TGE. The fact that Swell offers zero fees and there is no minimum deposit makes it very attractive for users to engage with the protocol. This is reflected in a consistently increasing TVL. However, how much of that liquidity and the upcoming value will accrue to $SWELL is yet to be seen.

For now, $SWELL will be used for governance through delegate voting and liquidity mining. This is a customer acquisition cost that might print great numbers at the beginning but that might deteriorate with the passing of time. Governance is usually not enough to attract demand for the token. On a speculative note, it can be expected that a fee switch is implemented so that $SWELL holders can stake their tokens to access the fee revenue generated by the protocol. However, this might be still far on the horizon.

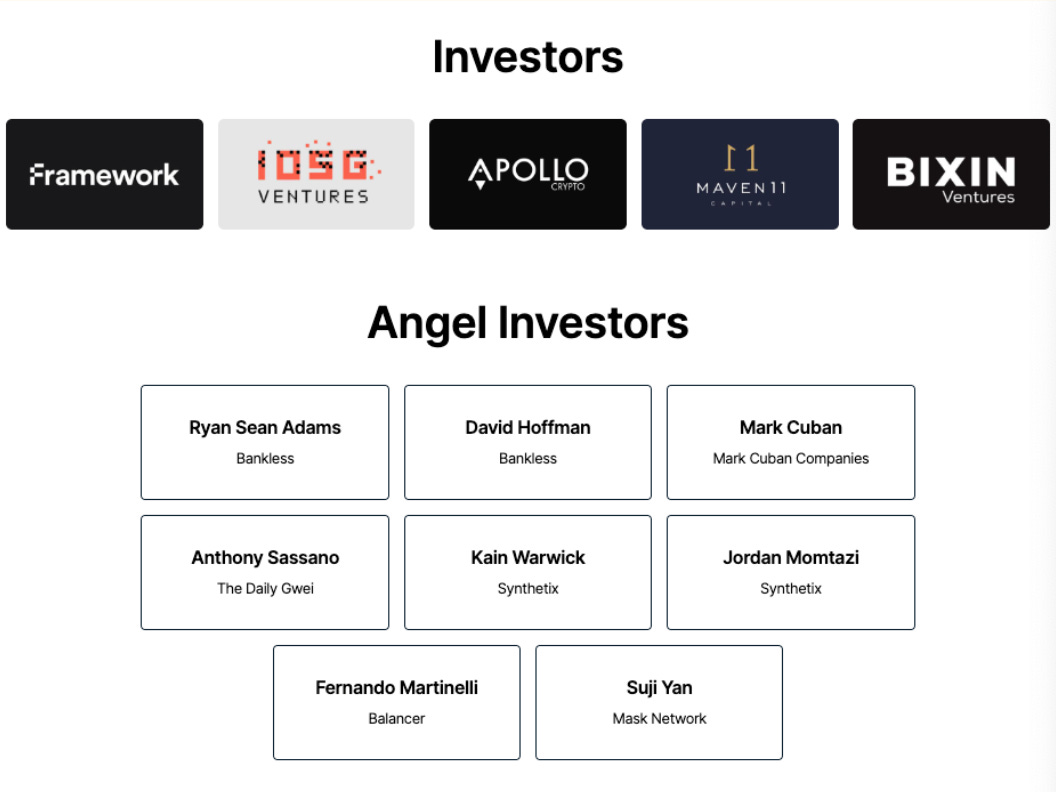

Swell Network launched its public beta in June 2022 and opened up the public testnet shortly thereafter. Around that same time, Swell closed a $3.75M seed round. The round was led by Framework Ventures and with the participation of IOSG Ventures, Maven Capital, Apollo Capital, Mark Cuban, Fernando Martinelli (Balancer), and Ryan Sean Adams and David Hoffman (Bankless), among others.

Established players like Lido and Rocket Pool are already entrenched in DeFi and the wider ecosystem, Swell’s greatest risk stems from its late entry into the liquid staking market. The existing players benefit from a powerful flywheel effect, where integrations and liquidity drive demand, resulting in more integrations and liquidity.

To effectively compete, Swell Network must execute seamlessly on its differentiated features and aggressive integration strategy with other DeFi protocols. Although the protocol has committed to incentivizing swETH liquidity and is currently running an incentives program, the successful execution of one of its “silver bullets” will be crucial in tipping the scales. If Swell Network can achieve this, it has the potential to attract marginal $ETH inflows and set off a competitive flywheel of its own.

One potential silver bullet for Swell Network is becoming the first project to implement DVT successfully. This would reduce the collateral requirement for independent operators to just 1 ETH, unlocking capital efficiency and potentially attracting a large number of independent validators.

One key aspect to keep in mind is that, while Swell will be offering lower commission rates in its early days, the overall commission rates across LST protocols could converge higher than the industry standard, due to the profitability impact for node operators.

Out of the up-and-coming recent LST protocols, Swell’s strength resides in the fact that it will be temporarily offering its service at 0 fees, thereby increasing the yield that goes to the end user. On the flip side, its heavily incentivized social engagement might be something to keep an eye on.

It can be expected that there will be an increasing amount of social mentions combined with a low number of integrations with other protocols. It is worth noting that the success of an LST is largely dependent on how composable and adopted the protocol is. On that front, Swell is competing against major players like Lido or Rocket Pools, which have integrations with nearly every major DeFi blue chip: Yearn, Curve, Aave, MakerDAO, Balancer…

Swell is taking advantage of its late-mover advantage by learning lessons from older protocols and making a tactical move through a gamified incentives program and user-friendly UI/UX..

Revelo Intel has never had a commercial relationship with Swell Network and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.