Key Points:

The next Bitcoin halving is fast approaching, currently expected to occur in April 2024. Unlike previous halvings, there is a new source for debate amongst Bitcoiners. The community now goes back and forth on using Bitcoin as a store of value or supporting DeFi activity and an increase in transaction fees.

Stacks was founded in 2017 when Muneeb Ali finished his Ph.D. His thesis laid out the foundations for a smart contract layer on top of Bitcoin to make it programmable. He released the original whitepaper and raised $50m. 6 years later, there has been rapid adoption of Bitcoin NFTs. This is in addition to increasing future security concerns for the Bitcoin network. Because of these catalysts, $STX is positioned in a unique position to capture a multi-billion market-share opportunity.

What is Stacks exactly?

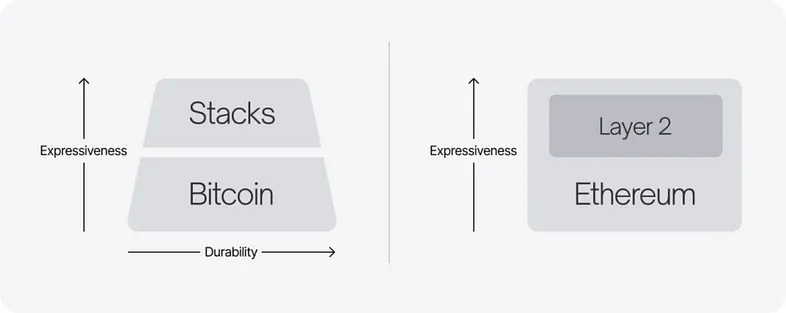

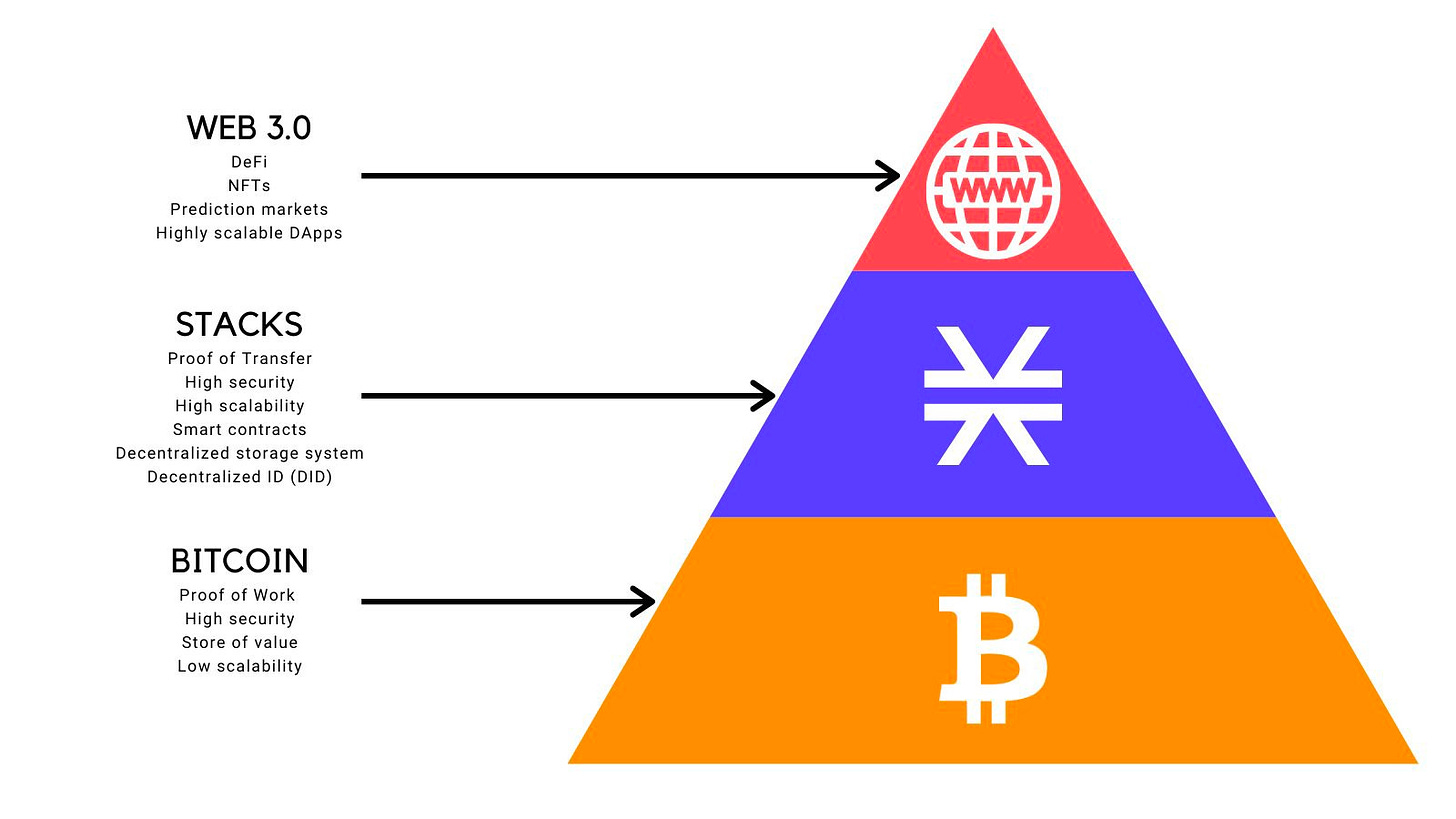

To put it simply, it is a smart contract layer for Bitcoin. The key differentiator between Bitcoin and other blockchains like Ethereum is that Bitcoin can’t natively support smart contracts. Some have proposed implementing a soft fork to the Bitcoin network, which could then allow for smart contract compatibility. To be implemented, the majority of miners would have to vote in favor of this proposal. Stacks presents its own solution, which does not require support from Bitcoiners to be put into place.

S – Secured by Bitcoin’s hash power.

T – Trust-minimized peg mechanism (see sBTC whitepaper).

A – Atomic swaps and assets owned by $BTC addresses.

C – Clarity programming language for safe and secure contracts.

K – Knowledge of the full state of the Bitcoin network.

S – Scalable and fast transactions that settle on Bitcoin.

With every halving, Bitcoin experiences a security reduction. Up until now, this has largely gone unnoticed. This is due to the significant price appreciation, with $BTC more than doubling in price every 4 years. However, as the asset class matures, the probability for $BTC to keep doubling in price becomes slim.

Bitcoin has two options for long-term security:

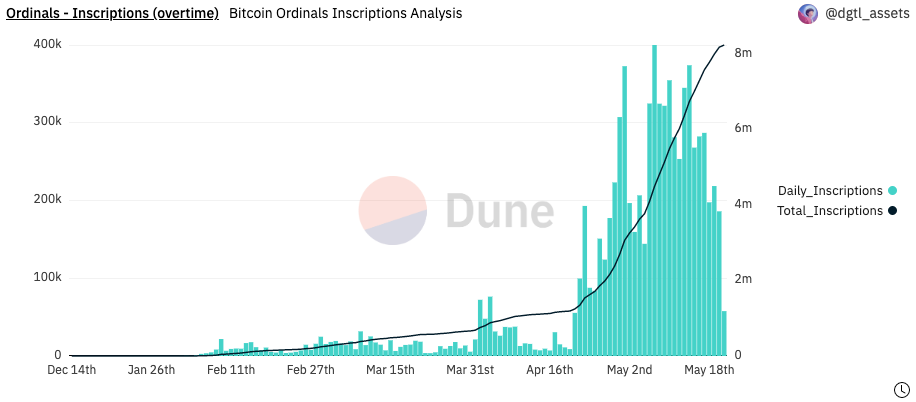

The advent of Ordinals and the recent hype around BRC20s has sparked interest in a new wave of DeFi adoption that would occur on the Bitcoin blockchain itself.

To understand BRC20s, it is important to be familiar with how Ordinals work. As a protocol, Ordinals is a system that numbers satoshis aka ‘sats’ (the smallest unit of $BTC). It does this by assigning a unique number to each satoshi.

On top of that, the protocol introduces the concept of inscriptions. Inscriptions make it possible to write text, images, audio, and video… on top of each satoshi. And since each satoshi has its unique numerical value, each one of these non-fungible tokens is considered a Bitcoin NFT. Ordinals use an order book for trading. This way, token holders and prospective buyers put up buy and sell orders that end up dictating the market price of the asset.

Ordinals also assign rarity to satoshis. Numbers are classified into the following classes based on specific events in the Bitcoin network block creation:

At the fundamental level, building and interacting with Stacks and Ordinals are two completely different things.

Stacks is a layer on top of the Bitcoin blockchain that allows developers to build Ethereum-style smart contracts that read, write, and secure data on Bitcoin.

Ordinals is a protocol that operates on Bitcoin’s layer. It does this by inscribing data up to 3.9MB on the lowest unit of account on the Bitcoin network, the satoshi. Effectively, Ordinals are minted directly onto the blockchain as a digital artifact. But unlike Stacks, Ordinals cannot support smart contracts. Therefore, it is not possible to develop a productive economy of dApps on top of it.

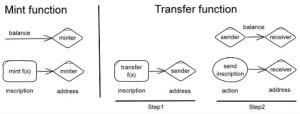

Given the rules above, the founders of the BRC20 system came up with a set of ideas based on the Ordinals protocol. Since the Ordinals protocol can create Bitcoin NFTs by assigning different properties to each satoshi, it is also possible to create Bitcoin Fungible Tokens by giving a uniform format and properties to each of the satoshis.

Following that premise, BRC20s write JSON data to individual satoshis via the Ordinals protocol. This creates a ledger of text data that can be used to parse out token holdings and transfers.

BRC20s follow a “first-come first-serve” mechanism, meaning that once a BRC20 token has been deployed, no tokens with the same name can be deployed again. Even if a new token with the same name is deployed, the off-chain part of the Ordinals protocol will mark that deployment as “invalid” and not record it. The same applies when the “mint” limit is exceeded.

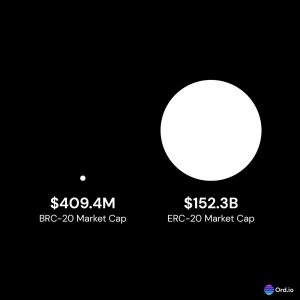

There has recently been a surge in BRC20 memecoin popularity. Memecoin season on Bitcoin Layer 1 is not just a joke anymore. The experiment has recently surpassed $1B in market capitalization. Because of this surge in memecoin trading, fees on the Bitcoin network skyrocketed. An astonishingly high volume even forced Binance to stop $BTC withdrawals twice.

More than 20,000 BRC20 tokens have been deployed over the past month. Despite being recognized by a large number of users, BRC20 tokens are simply a piece of JSON that has no practical value or business case. What’s more, BRC20 tokens cannot even be used and managed as easily as it is to deal with $BTC transactions. Because of this, they require the use of specialized wallets or third-party tools like Unisat.

BRC20s might end up giving users the illusion that they are tokens that can count on the backing of the Bitcoin network. However, that is not the case. The Bitcoin blockchain is based on encryption and consensus algorithms that have stood the test of time. Meanwhile, BRC20s are bound to the use of $BTC on the Ordinals protocol, which is a relatively recent implementation in its early stages of development. As an example, there might be unknown risks or security concerns in the process of writing text, images, audio, video and even code to the Bitcoin network.

As adoption increases, what happens when miners realize that certain satoshis are more valuable than others? What happens when miners decide to steal and roll back blocks in order to grab the right to bookmark the special blocks that have access to high-grade satoshi numbers? There could be undiscovered security implications for the Bitcoin consensus if the miner’s computing power is at an advantage.

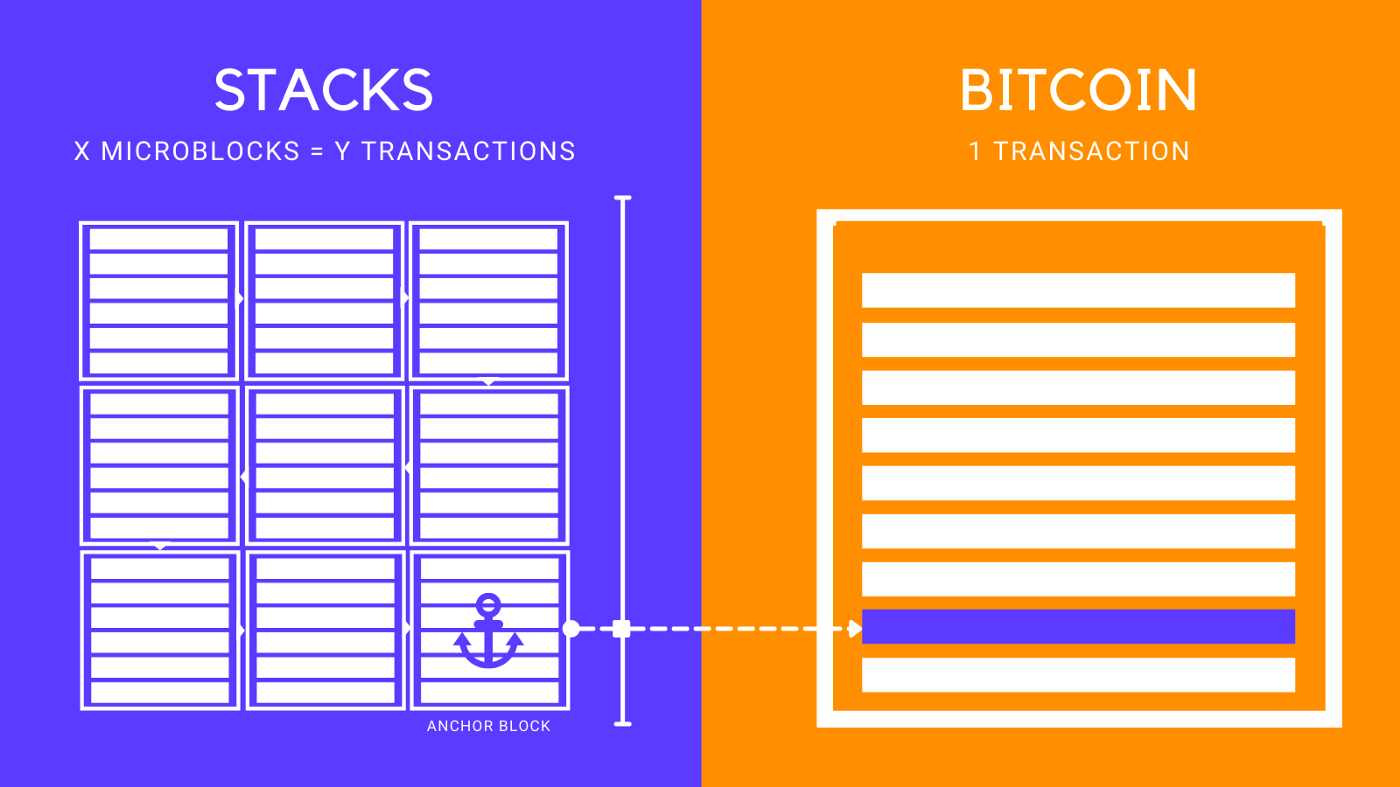

The base layer of Bitcoin was not designed to optimize for speed and scalability. As a blockchain, Bitcoin sacrifices scalability to maximize security and decentralization. This is evidenced by its ~10 minutes block-time, while other chains like Ethereum or Solana have block times of seconds.

To solve for the lack of applications and the relatively inefficient execution layer of Bitcoin, solutions like the Lightning Network, Ark, RSK, Liquid, or Stacks were created. This would make it possible to develop an ecosystem for traditional crypto applications like NFTs, DeFi, and Domain Name Services. Out of all alternatives, Stacks is currently the most adopted. It also has a token in the top 100 by market cap, $STX.

The ultimate objective of Stacks is to bring DeFi to Bitcoin, unlocking over $300B in capital and setting the stage for an upcoming Bitcoin economy. What makes it unique is that it uses the Bitcoin network as the settlement layer and adds smart contracts and programmability on top. It also adds scalability with different velocity layers on top of that, like Hiro’s subnet.

Like Bitcoin, Stacks is a decentralized blockchain network. The difference is that Stacks is a blockchain that is linked to the Bitcoin network by its own consensus mechanism. This consensus mechanism, known as Proof of Transfer, spans both chains. This way, Stacks can leverage the security of the Bitcoin network and enable decentralized apps and smart contracts.

Through Stacks, Bitcoin’s values of trustlessness and permissionless transactions can be applied to software. Instead of running on centralized servers, apps would run on the Stack blockchain itself.

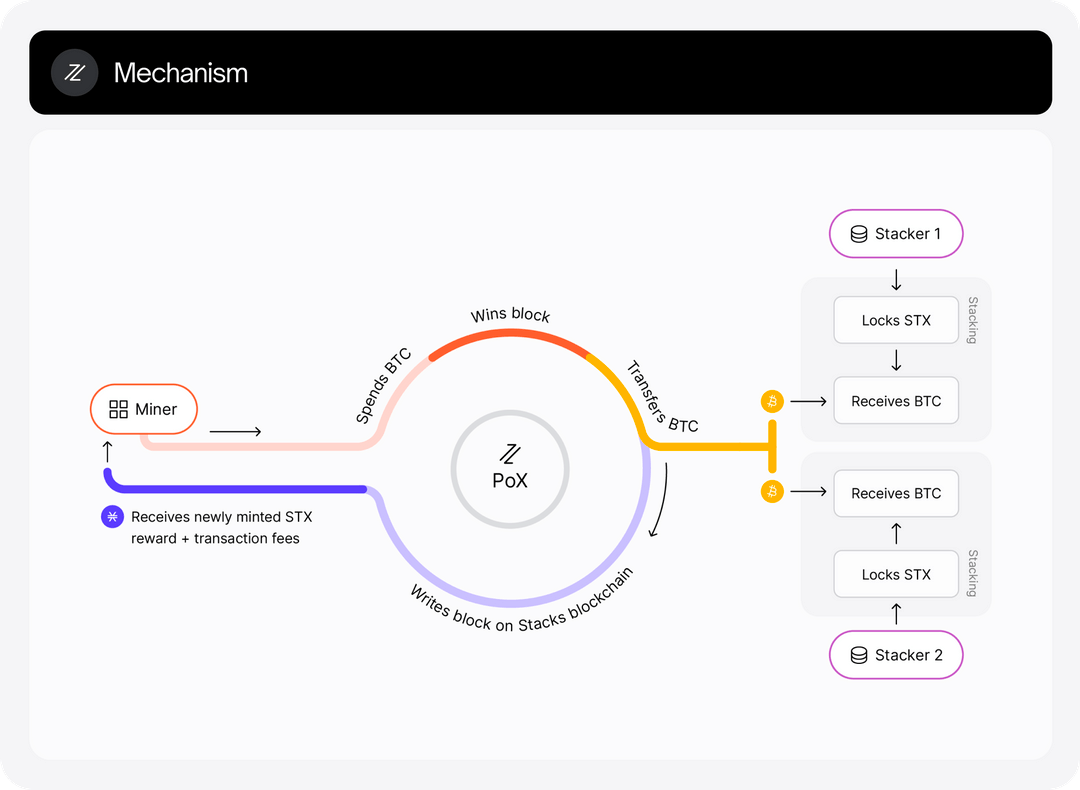

PoX, which operates similarly to Proof-of-Work (PoW), forms the underlying mechanism for the Stacks blockchain. In this system, miners validate transactions but, unlike traditional PoW models, do not receive rewards without a cost. Instead, they bid for Stacks blocks, using $BTC to receive $STX rewards for each block validated.

Interestingly, the $BTC used by miners for bidding is channeled to $STX stakers who commit their tokens to the network. This system creates a balance wherein miners perform the validation work, but rewards are also distributed to $STX holders, thereby incentivizing network participation.

This introduces multiple advantages:

It is also worth pointing out that the Stacks layer does not allow forks. This means that reorganizing transactions would require successfully attacking Bitcoin with a deep reorg attack. This is pretty unlikely to happen, as a reorg attack is extremely expensive and logistically difficult to pull off.

There are other solutions to the inefficiencies of Bitcoin. These include the Bitcoin Lightning Network, RSK, Ark, and Liquid. One of the differentiating factors of Stacks is that it has its own native token, $STX. It is used as an incentive mechanism to maintain the historical ledger of all transactions and executions on the platform. As a matter of fact, there is actual value being accrued to the $STX token.

$STX is not a mere governance or speculative token. Instead, it plays a critical role in incentivizing participation in open mining. This system ensures a sustainable distribution of rewards among $STX stakers. It offers an attractive yield that is correlated with network activity. The alternative to this would be to rely on federated or closed networks. This goes against the core principles of Bitcoin as a permissionless and censorship-resistant network.

$STX is essential to PoX consensus. It is needed to:

Clearly, the Stacks layer relies on Bitcoin in a fundamental way. One could argue that Stacks pulls value away from Bitcoin because it has its own token. This might be the case for alternative chains and their respective tokens, but $STX is required for the PoX consensus. As a result, its existence is essential to incentivize the mining of Stacks blocks with a new block subsidy. This is critical since transaction fees are not enough to sustain a blockchain ledger, at least in its early days. This is even the case with Bitcoin itself. To this day, Bitcoin transaction volume hasn’t risen nearly as much as $BTC has grown in adoption.

As we mentioned above, the $BTC used by miners for bidding is channeled to $STX stakers who commit their tokens to the network. This system creates a balance where miners perform the validation work, but rewards are also distributed to $STX holders. This incentivizes network participation.

This unique setup produces a real $BTC yield for $STX stakers, currently standing at 7% yield. Crucially, this yield is correlated with network activity. As the network’s activity grows and blocks become more valuable, the $BTC bids from miners are expected to rise. This results in an increased yield for $STX stakers. It’s important for tokens of any kind to have some sort of mechanism that ties the value of the token to the performance of the product behind it. $STX’s tokenomics and yield mechanics were designed with this in mind.

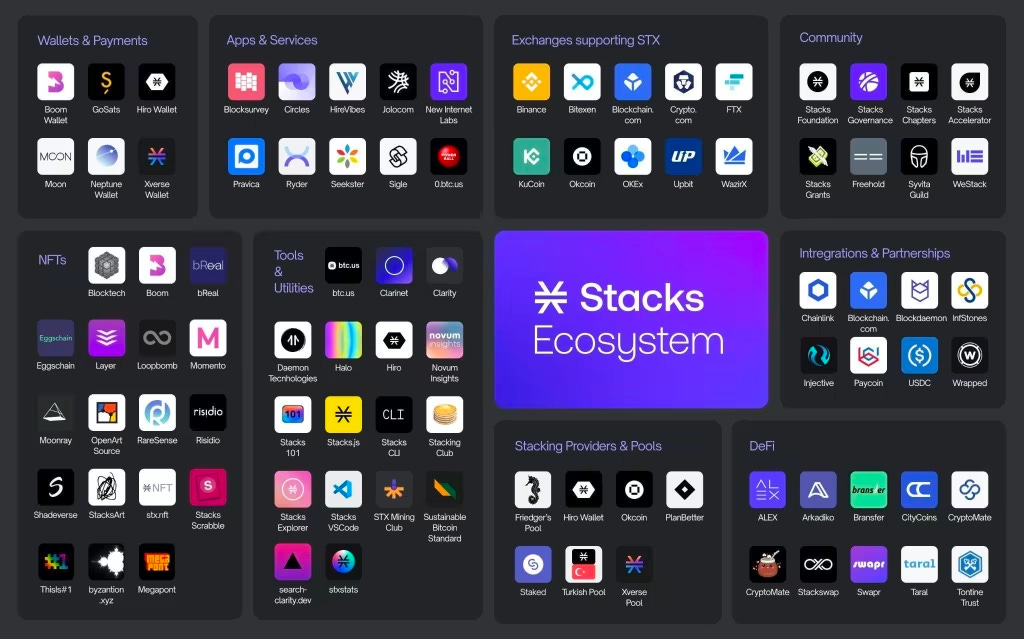

Now, we’ve outlined how impactful a large economy of dApps built on top of Bitcoin could be in the future. But how expansive is the Stacks economy right now?

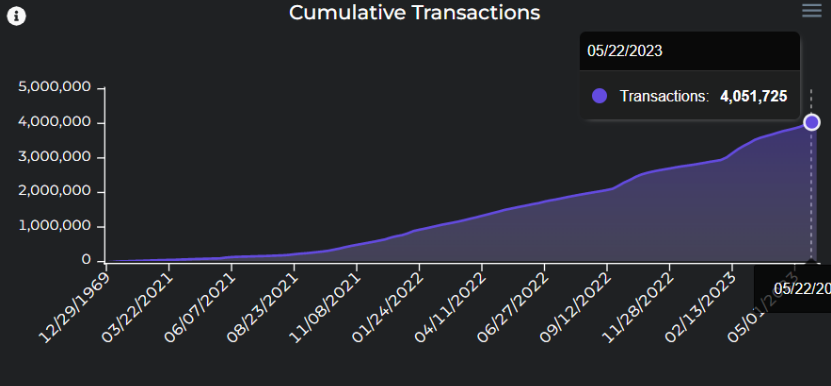

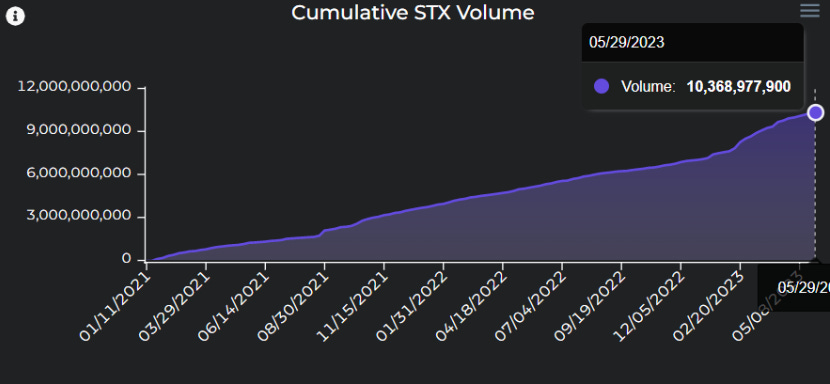

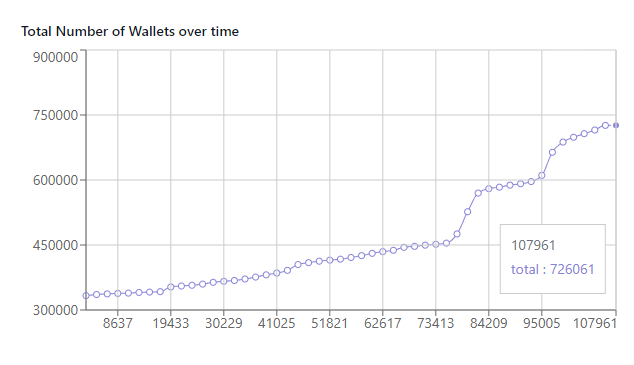

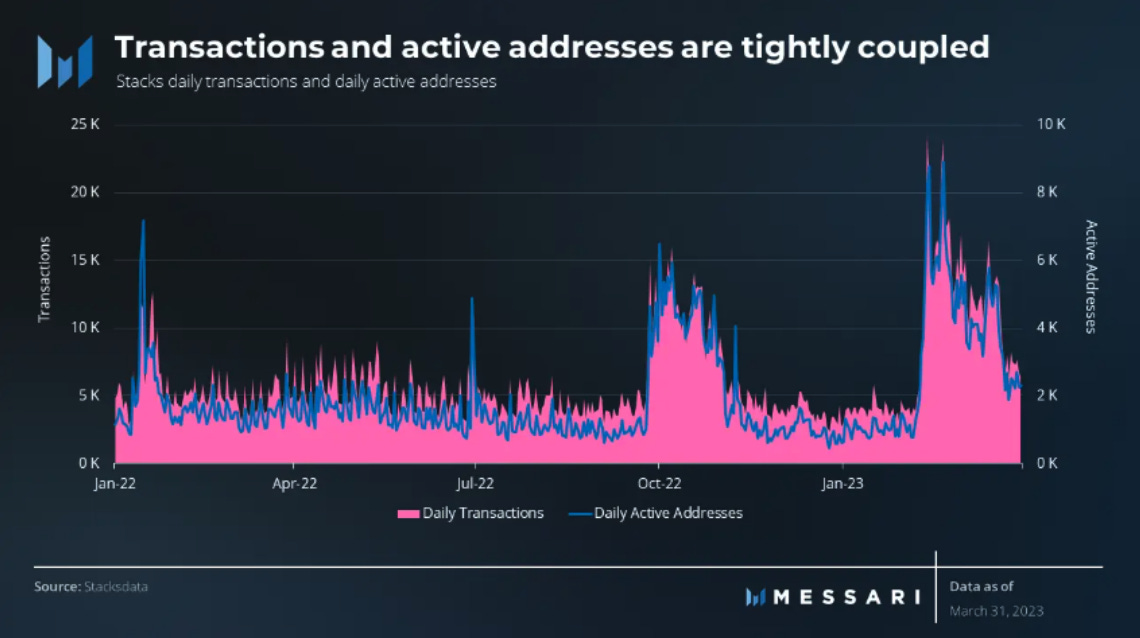

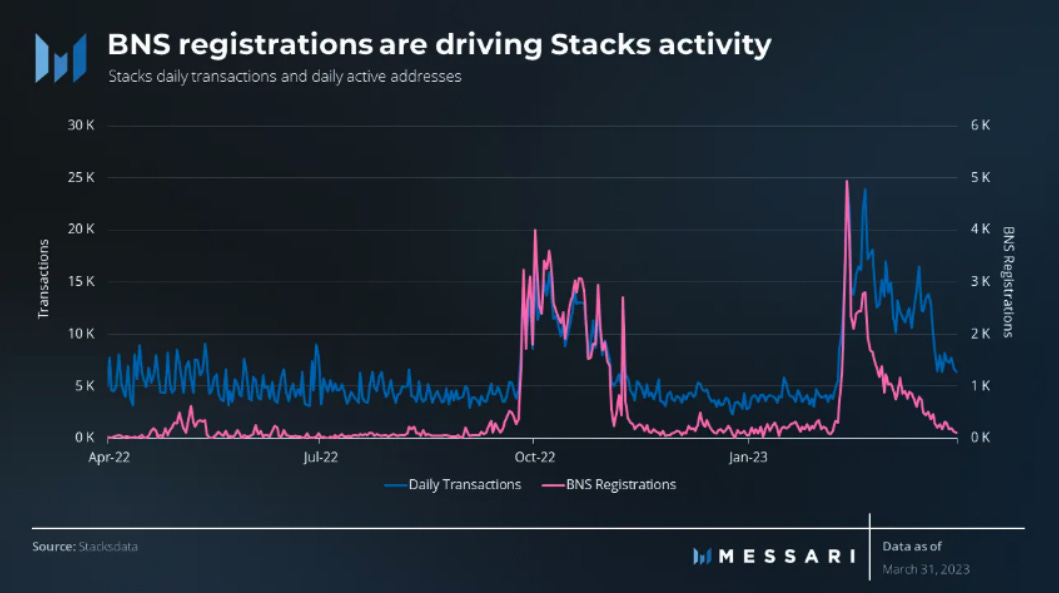

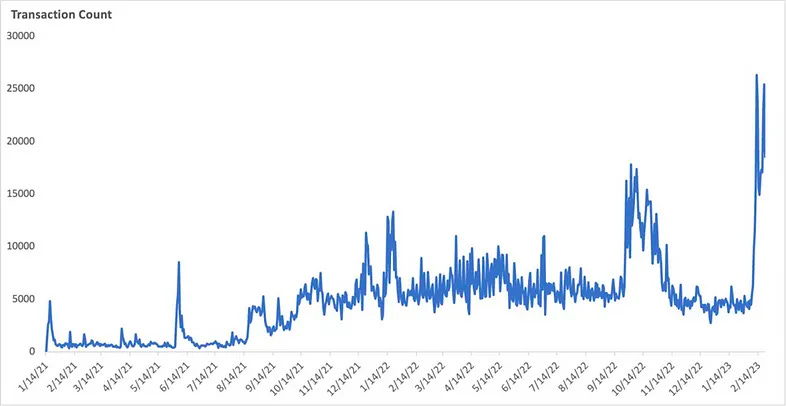

As we can see, the Stacks economy has continued to grow. Since February, both transaction count and volume have seen a steep uptrend.

This activity isn’t all coming from whales either. We can see user adoption increasing with sharp upticks in the total number of wallets. The fact that Daily Active Addresses (DAU) and the number of transactions increased in a similar trend is a sign of healthy activity. This is perhaps much more sustainable than the activity around Ordinals NFTs and BRC20 memecoins…

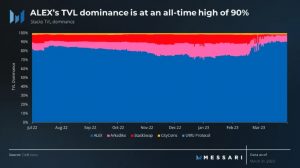

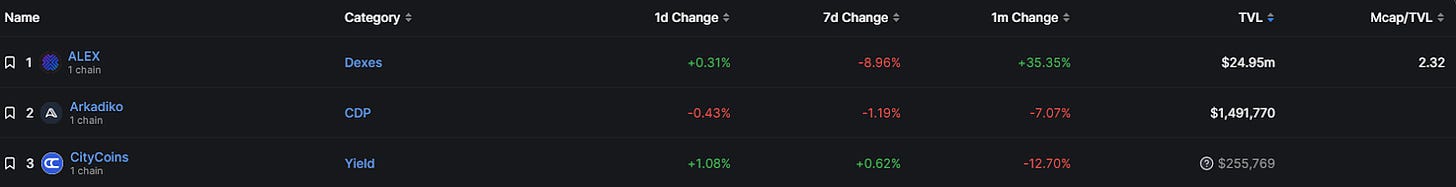

When it comes to dApps deployed on Stacks, there isn’t much variety, at least not yet. Almost all TVL is held on one DEX; ALEX. ALEX was deployed in late February. ALEX’s dominant position is more so a result of an early ecosystem than anything. It is likely that TVL will diversify once more dApps are deployed in the ecosystem.

There is one significant use case driving activity on Stacks that we haven’t talked about yet. Bitcoin Name Service (BNS) has seen more and more adoption in H2 2023. This could be a result of speculation around the future of the Stacks ecosystem. It’s unclear how many people are registering BNS names with the intent of actually using them rather than just holding them to profit sometime in the future. Between, NFTs, DEXs, and domain name services, the stacks ecosystem has all the primitives for a blockchain ecosystem. While competition may not be abundant just yet, this can change. Only recently has the ecosystem become popular among users. Before this, there was little incentive for developers to spend time deploying an application. Stacks now has a solid user base. With volume and transactions continuing to increase, developers may be more inclined to develop on Bitcoin.

Despite being the largest cryptocurrency, Bitcoin has a relatively small crypto economy. While Bitcoin has a large base of capital and users who are familiar with crypto principles, it doesn’t have the same level of programmability and smart contract capabilities as other blockchains. This lack of programmability was what ultimately inspired blockchain networks like Ethereum.

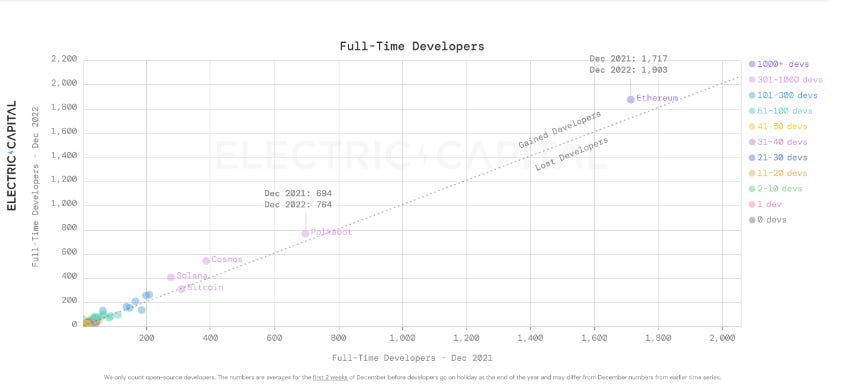

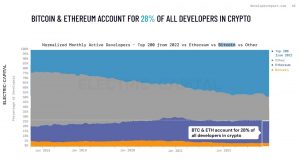

The current market share of Bitcoin is ~46% of the entire crypto market. This is followed by Ethereum, which occupies less than half of Bitcoin’s, totaling ~19%. Bitcoin’s market share has been declining in recent years, mostly because of the growth of DeFi in alternative layer 1 chains or Ethereum L2s. Nonetheless, Bitcoin still remains the most dominant chain despite a perceived lack of practical use cases. Obviously, Stacks and other solutions aim to change this flaw of Bitcoin. To put things into perspective, there are less than 400 Bitcoin developers. This is less than a fourth of Ethereum developers.

Prior to the creation of Ordinals and BRC20, in 2022, Bitcoin and Ethereum accounted for 28% of all developers in crypto. In the past, when developers thought about building decentralized applications, they rarely thought about building them on Bitcoin. That’s because they simply couldn’t. The latest developments in Stacks, however, make that possible, thanks to the introduction of fully expressive smart contracts for Bitcoin.

So far, Bitcoin has always led the industry in terms of market capitalization. It has helped the crypto marketcap to grow past $2T from scratch in less than a decade and with little institutional support. Today’s Bitcoin market cap is largely driven by hodlers who DCA into their position or just hold $BTC as a store of value. In fact, $BTC itself is not a productive asset. Currently, only a small fraction is being used in DeFi as wrapped $BTC. In other words, most of the capital in Bitcoin is not being allocated toward a productive use case.

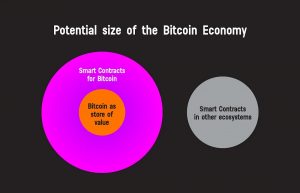

This lack of productivity helps support the narrative that Bitcoin is akin to digital gold. Following this analogy, if Bitcoin realizes its full potential as digital gold, then its market cap could still see ~10x growth from the previous high of ~$69k. This is obviously a very simplified analogy but it still illustrates an important point. Especially in a society that is becoming increasingly digital the potential value add of Bitcoin as just a store of value is immense. This could be achieved both with or without a thriving Bitcoin smart contract layer. Regardless, it is worth looking at what the potential size of the Bitcoin economy could be if more productive use cases were enabled through the use of smart contracts.

The earliest adopters of crypto have already embraced Bitcoin, and the capital is in the ecosystem. At this point in time, it can be argued that capital flows in and down, but never out. Excluding taxes, or some institutional exits from the space, money deployed into crypto tends to stay there. But regardless, building DeFi, NFTs, and DAOs on Bitcoin provides new outlets which the wealth lying dormant in Bitcoin can flow into. As more apps enter the ecosystem, this creates a positive feedback loop where productive use cases for $BTC start to emerge, unlocking even more growth for the network from new developers and users.

Zooming out, DeFi trades are still less than 1% of the global banks’ market cap. Over time, as TradFi continues to show its weaknesses and DeFi may be able to show its value. Bitcoin DeFi can catalyze much of that growth through Stacks. As a comparison, $ETH tackles multiple crypto use cases. One is the ‘ultrasound money’ narrative, the other being Ethereum’s appeal as a building ground for secure applications. In this same vein, Bitcoin can penetrate the DeFi market while still maintaining all the attractive qualities of ‘digital gold’.

The same can be applied to NFTs as well. NFTs’ popularity surged by more than 21,000% in 2021, with a market cap of over $100M. Just like Bitcoin’s fixed supply, NFTs stand out for their digital scarcity. While Bitcoin NFTs are not as popular as Ethereum NFTs yet, Ordinals has already shown how fast the Bitcoin NFT industry can grow. For example, in May 2021, Bitcoin ordinals were close to flipping Ethereum NFTs in daily volume. Ordinals recorded sales over $14M in value, just $400,000 (2.45%) shy of Ethereum’s.

The cross-chain capabilities of Stacks cannot be underestimated either. Ethereum has been notorious for scaling issues. Figuring out how to scale Ethereum has been the source of much debate. Ethereum developers have even pivoted the Ethereum roadmap to accommodate community trends. In response to thriving L2 ecosystems like Arbitrum and Optimism, the Ethereum Foundation decided to ditch its original plan of implementing shard chains. Instead, they accepted that L2 chains will be the primary way to scale Ethereum and focus on optimizing the L2 experience should be prioritized. Ethereum has seen significant growth in bridge adoption, with the TVL of locked assets in bridges increasing over time. There are currently multiple projects working on interoperability bridges to connect Stacks with networks like Ethereum, Solana, and Polygon. Currently, one of the most popular solutions is the StacksBridge, which enables users to move NFT assets between Stacks and Ethereum

Stacks as a Bitcoin layer is seen by many as the strongest contender when it comes to developing a Bitcoin economy. It provides an environment to explore the development of a standalone ecosystem, which has become a long-term necessity to generate a security budget.

Stacks supplements Bitcoin’s security by paying $BTC fees on the base layer. This has the potential to be an exceptional avenue for growth. This uptick becomes clear when looking at the spike in the number of transactions since the start of 2023.

From a technical standpoint, Stacks will undergo its Nakamoto upgrade later this year. This will facilitate the development of DeFi primitives like AMMs or NFT marketplaces.

A major outcome of the Nakamoto upgrade will be the creation of subnets, providing support for other codebases like EVM and Solidity. This addition addresses a key obstacle to ecosystem development, making Stacks a more versatile and attractive platform for developers.

Nakamoto will also reduce execution times from 10–30 minutes to mere seconds. Up until now, this has been one of the major pain points for adoption. Besides, subnets will also be able to further decrease block times by exploring the tradeoff between decentralization and speed without compromising the Stacks base layer.

Another impactful event for Stacks is the Bitcoin halving, likely to happen sometime in April 2024. The upcoming Bitcoin halving event highlights the need for a productive Bitcoin ecosystem and strengthening the role of Layer-2 solutions like $STX. It also creates an opportunity for investors to position themselves ahead of this market event. Bitcoin is obviously the primary candidate for positive price action. But its size and lower beta may push investors toward smaller, high-potential assets like $STX.

The Bitcoin halving will reduce Bitcoin’s security budget since miners will be paid less $BTC to secure the chain. Of course, this reduction in miner rewards is the same mechanism that increases $BTC’s price, since people know the coin’s inflation rate has decreased. This emphasizes the importance of developing a robust fee pool via a dynamic Bitcoin ecosystem. It is quite possible that a Bitcoin halving could accelerate a debate or narrative around new ways to incentivize miners and make sure that the network maintains its security. If this sort of rhetoric catches on in the Bitcoin community, our analysis suggests that $STX stands out among Bitcoin-related tokens that could benefit from the halving. The hype around BRC-20 may already be over, and now it is time to build a productive economy rather than simple speculation on NFTs or memecoins. Stacks has a unique and strong position in the Bitcoin ecosystem and it is likely that investment will be concentrated into fewer assets that provide real utility. Because of this, there is a strong case for $STX as the #1 candidate for this capital to flow to.

Bitcoin halvings only happen every four years, so it can be hard to find historical comparisons that match the situation $STX will be in. A better idea may be to look at how Ethereum LSD governance tokens performed leading up to the merge. The Ethereum merge from PoW to PoS was a very significant event, on par with a Bitcoin halving in terms of the impact the upgrade can have on the supply of $ETH. It is not far-fetched to believe that $STX could mirror the 600% gain experienced by Lido (LDO) in the six weeks leading up to the Ethereum Merge. In an optimistic scenario, where the Bitcoin ecosystem develops more robustly, purchasing $STX now could be akin to buying Solana (SOL) at $1 during the 2021 cycle.

The Ethereum network can also be used to compare ecosystem valuations. $ETH has a market capitalization of ~$200B and an ecosystem of L2s valued at ~$110B. The value of $ETH to $ETH L2 ratio of approximately 4.73. When the following results are translated into Bitcoin, we notice that the combined value of Bitcoin layers is dominated by the $STX token, yielding a $BTC to $BTC L2 ratio of 460.

Ethereum is better suited for composable base-layer applications than Bitcoin is. Because of this, $ETH justifiably carries a higher proportional value in its L2 ecosystem than Bitcoin, which is not inherently designed for composability. However, the disparity of ~100x in the $BTC L2 ratio highlights an enormous potential value. This is especially true if technical advancements make Bitcoin composability more feasible, and if the Bitcoin community prioritizes such efforts. The rhetoric from the Bitcoin community is pretty important to consider. Many prominent figures in the Bitcoin community do not support the newfound adoption of Bitcoin use cases. This contrasts with the Ethereum community, where it would be difficult to find an advocate who does not support new use cases for $ETH blockspace.

The disproportion in the valuation ratios between Bitcoin and Ethereum L2 ecosystems shows significant upside potential for $STX. As the developments in the Bitcoin ecosystem continue and the nuances of L2 systems become better comprehended, the current Bitcoin to Bitcoin L2 ratio of ~100x could reasonably be expected to shrink to ~10x. This shift alone signifies a potential 10x appreciation for $STX.

Despite a seemingly competitive advantage over its competitors, Stacks has experienced several roadblocks over the past few months:

On April 19th, it was discovered that a single address was able to trick the protocol into thinking they had more $STX stacked than they really did. To this day, it is still unclear whether this was a deliberate attack or not. Regardless, this allowed this Bitcoin address to siphon over 15.5 $BTC that ultimately should have flowed to honest $STX stackers.

In this scenario, Stacks was forced to revert to a proof-of-burn mechanism and unlock all stacked $STX tokens. If the amount of stacked $STX surpassed the total liquid supply of the token, nodes would have entered an irrecoverable state.

Besides this, mass censorship of transactions has become fairly common on Stacks. Currently, F2pool holds ~15% share of all Bitcoin hash power. The issue here is that when a large $STX miner happens to also be a large Bitcoin miner as well, it opens the doors for monopolization of the block-building process.

For instance, F2pool has been ignoring other Stacks miners’ transactions when they try to send $BTC to $STX stacker addresses. Instead, they have been replacing a low-value transaction with their $BTC bid. In doing so, no matter how little $BTC they send to $STX stackers, F2pool is guaranteed to win. This is because there is no competition. Essentially, F2pool pays less than $1 of $BTC for $600+ of $STX tokens every time they mine a block. This lowers the yield for all $STX stackers.

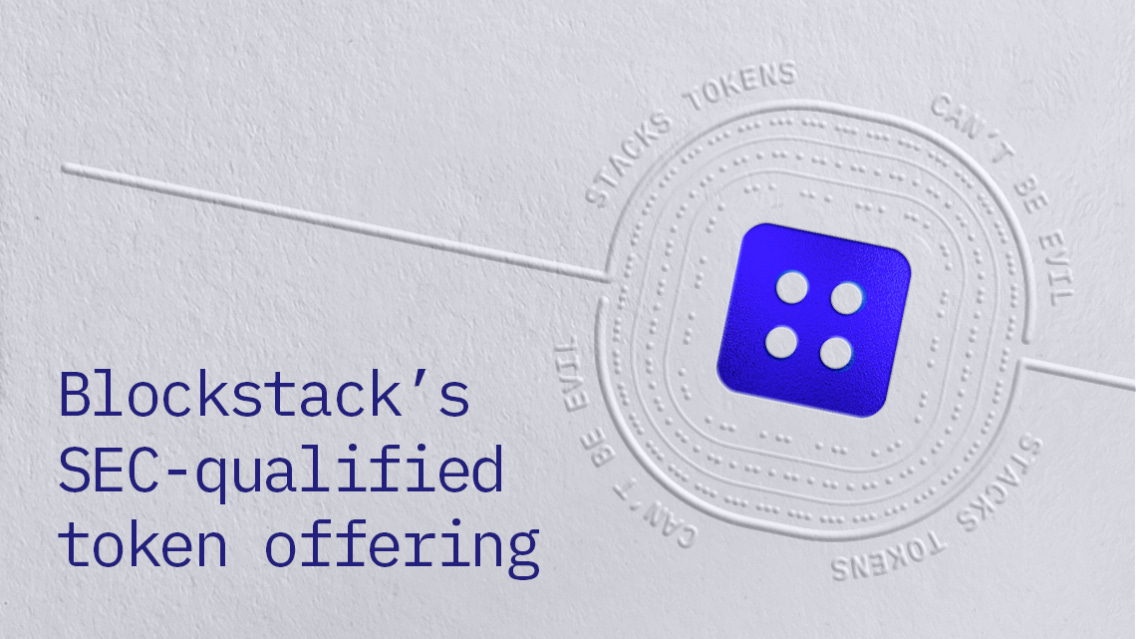

When it comes to regulatory scrutiny, it is worth noting that the $STX token sale was the first SEC-qualified offering in U.S. history. This event was the first time in U.S. history that a crypto token offering received SEC qualification, under Regulation A+ to be concrete.

Only accredited investors could participate in the 2017 offering under Regulation D. Now, thanks to this SEC-qualified offering, the general public can participate and fully interact with the network. This is the result of Stack working with U.S. regulators to come up with a legal framework that would democratize access to the network.

To clarify, Blockstack is not registered, licensed, or supervised as a broker-dealer or investment adviser by the SEC, the Financial Industry Regulatory Authority (FINRA), or any other financial regulatory authority or licensed to provide any financial advice or services.

For those looking to invest in the growing Bitcoin economy, Stacks is probably the most popular choice. There are some ongoing concerns around security and miner manipulation. Despite this, $STX is an easy way to gain exposure to the rising popularity of Bitcoin DeFi, and NFT trading. If you believe the current memecoin and NFT hype will give way to a more productive Bitcoin fee economy, it may pay to pay attention to Stacks. The other competitors in the Bitcoin L2 space simply have not caught the market’s attention to the same degree that $STX has

It is hard to overstate the importance of the potential that the Nakamoto upgrade will unlock. This upgrade makes it practical to develop productive business models and use cases on top of Bitcoin. Given these factors, $STX appears to be at the cusp of capitalizing on the significant opportunity of developing a broader Bitcoin ecosystem. This is reinforced by the momentum of development activity, growing acknowledgment of L2’s necessity, and readiness for adoption.

The most compelling aspect of the Stacks investment case is the asymmetry of its risk-reward profile. The PoX system’s structure and the correlation of yields with network activity make $STX a potential portfolio addition.

Revelo Intel has never had a commercial relationship with Stacks and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.