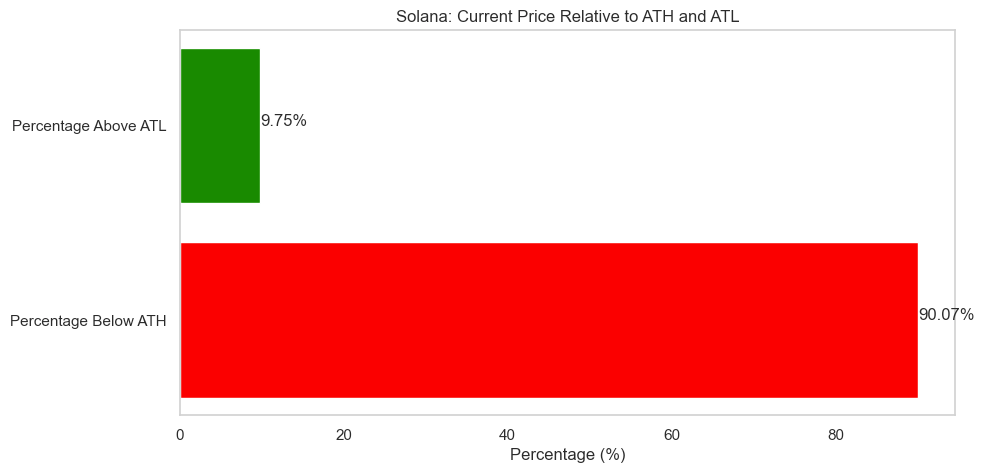

Solana has faced significant challenges from unexpected events in the past 12 months, including the collapse of FTX and recent SEC scrutiny regarding the security classification of $SOL. These occurrences have temporarily impacted Solana’s market position, with the subsequent SEC allegations resulting in exchange delistings and a ~10% decline in value during Q2.

The one comment I'll make is that I feel bad that @solana and other projects are getting hit in this way. They don't deserve it, and if ethereum ends up "winning" through all other blockchains getting kicked off exchanges, that's not an honorable way to win, and in the long term…

— vitalik.eth (@VitalikButerin) June 30, 2023

Despite these adversities, Solana stands out among blockchain platforms by offering novel use cases that are not restricted to EVM-compatible chains. One of its standout features is lightning-fast transaction speed, making it the best complement to Ethereum’s modular and rollup-centric roadmap. The content below will outline unique characteristics in both the ecosystem adoption and on-chain activity as well as technical developments that will come to fruition in the near future.

All things considered, Solana’s high performance, scalability, and developer-friendly ecosystem have propelled its significant traction within the cryptocurrency space. Despite concerns around centralization, plummeting price, and inherent issues involving FTX, Solana seems to be a volleyball that can’t quite be held underwater. By delving into the key factors that make Solana an attractive investment, we aim to highlight its competitive advantages over the EVM. We’ll demonstrate why $SOL is a compelling choice for portfolio diversification.

This investment memo thoroughly explores Solana as an enticing investment opportunity, particularly for hedging against the dominance of the Ethereum Virtual Machine (EVM) as part of a portfolio diversification strategy. Alternatively, the option to hedge and short against a positively correlated asset is presented as well.

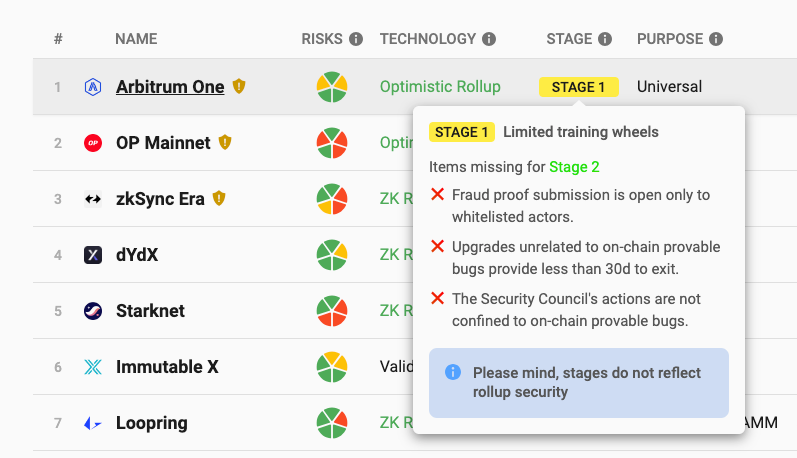

Despite more and more Ethereum layer-2s entering the market, it is yet to be seen whether Ethereum’s rollup-centric roadmap is a viable solution to scalability. So far, the advent of more standalone chains has fragmented liquidity even further, making it harder for DeFi composability and interoperability across smart contracts deployed on different chains.

The goal for layer-1s always was to accelerate self-sovereignty at scale, and with so many layers built on top (and most of them relying on centralized sequencers), it makes you question whether a modular architecture is necessarily better than a single monolith. In the end, hundreds of layer-2s make as much sense as hundreds of different layer-1s. Besides, it is also questionable if any amount of L2s can fix Ethereum’s bandwidth problem.

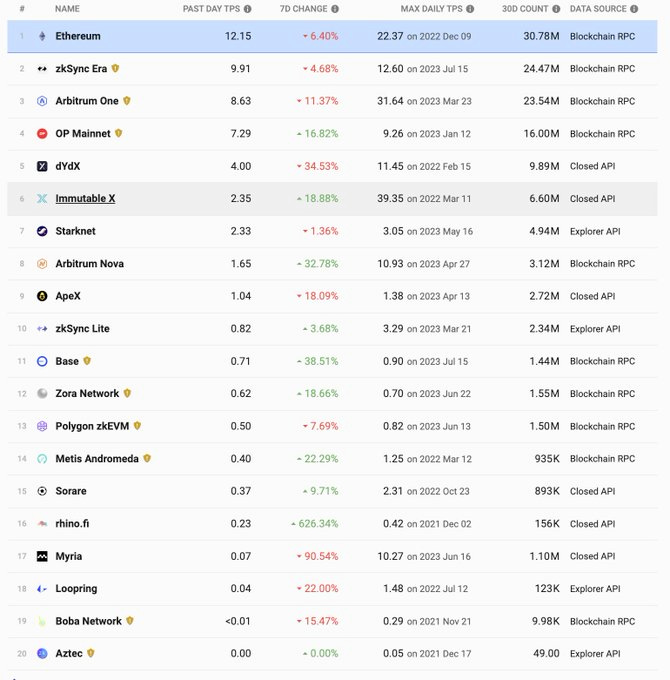

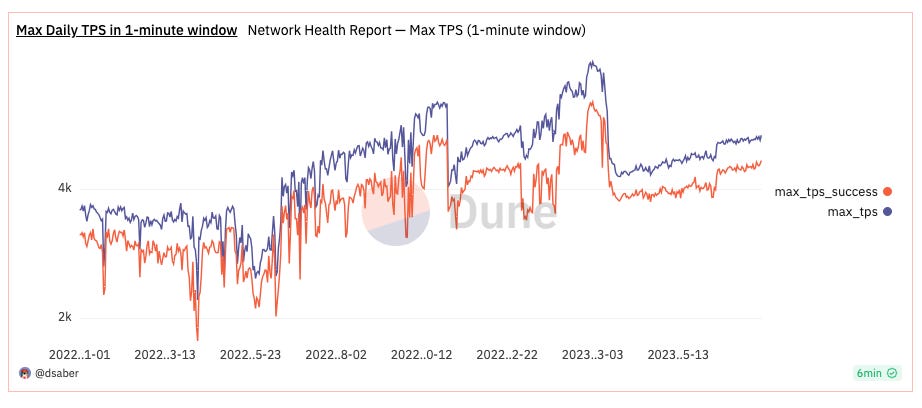

As a layer-1, there is no question about Ethereum’s role in the current market. However, there is a chance that the market is overestimating the network effects that Ethereum can achieve. And while one can make an argument for niche L2s and application-specific chains, having a bunch of generalized execution environments feels odd. As a matter of fact, high-throughput chains like Solana are currently doing more TPS (Transactions per Second) than all Ethereum layer2s combined.

As a general framework, this report will outline 3 general components. This model will help us to evaluate a layer-1 as the sum of these 3 primary components.

The combination of all these properties might converge into a multi-trillion outcome where the biggest layer-1 asset becomes the industry leader. Currently, we are on a stage where Ethereum is riding a narrative of “ultra-sound money”, chasing after the story started by Bitcoin itself. However, when we look at the third property, we can infer that the use as “money” is a function of how many people own a specific asset. As a result, we contextualize $ETH as a deflationary commodity that struggles to achieve that third property – it cannot be money if more people can’t have it. More specifically, the adoption of $ETH is hindered by its high transaction costs.

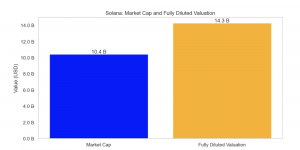

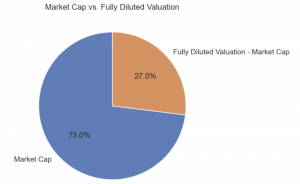

After laying out a framework to predict the value of a layer-1 asset, we will explore Solana’s economic model. This model incorporates both deflationary and low inflationary elements, aiming to contribute to a balanced and sustainable ecosystem.

The deflationary effect in Solana is achieved through mechanisms like burning transaction fees paid in $SOL. When users pay transaction fees with $SOL, those tokens are permanently removed from circulation, reducing the total supply of $SOL and creating deflationary pressure. Additionally, as the network matures, the rate of new $SOL token minting decreases, gradually reducing the overall inflation of the token supply.

A low rate of inflation in Solana is considered positive for several reasons. First, it incentivizes network security by rewarding validators for their efforts in securing the network. Without inflation, there would be less incentive for these participants to maintain the network’s security, making it more vulnerable to attacks.

Furthermore, a low level of inflation encourages spending and adoption of $SOL as a medium of exchange. If $SOL were completely deflationary, users might be tempted to hoard their tokens in hopes of their value increasing over time, hindering its circulation and adoption as a practical currency.

Moreover, the low inflation rate helps mitigate potential losses of $SOL due to lost private keys or forgotten passwords. By compensating for these losses, the network ensures a steady supply of tokens in circulation, contributing to its overall functionality.

The presence of low inflation also contributes to the long-term stability of $SOL. Predictable and manageable increases in the token supply protect the network from extreme price fluctuations, fostering a more stable economic environment.

Lastly, a low inflation rate in Solana helps reduce extreme wealth concentration. Gradual inflation dilutes the holdings of early adopters and large token holders over time, promoting a more equitable distribution of tokens and encouraging a more inclusive and decentralized ecosystem.

In a nutshell, Solana’s economic model attempts to strike a balance between deflationary pressures and low inflation to create a sustainable and robust ecosystem. The combination of these elements provides incentives for network security, encourages spending and adoption, compensates for potential coin losses, promotes stability, and reduces wealth concentration, contributing to the overall success and longevity of the Solana network, even after setbacks and non-desirable circumstances like excess VC funding or concentration of tokens in a few centralized hands.

The first generation of Solana DeFi emerged with projects like Serum, Saber, Cashio, and Sunny, among others. Behind the scenes, the reality is that Serum was FTX’s market entry to DeFi through a CLOB (Central-Limit Order Book) that would replicate FTX’s functionality without a centralized team. Additionally, Solana’s peak in historical TVL was the result of a bogus scheme put in place by an “army of anons” who admitted to creating a ‘Sybil attack’ abusing users’ trust.

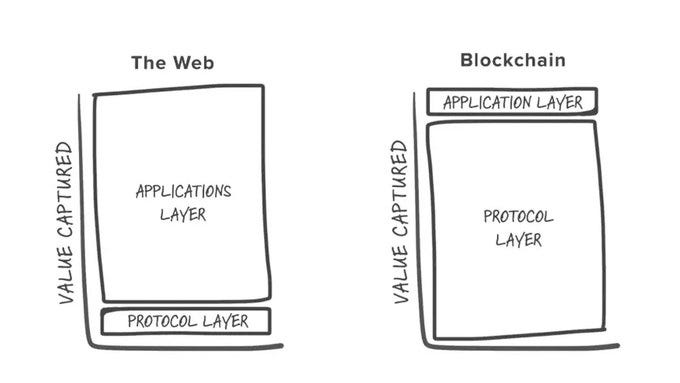

With the first-generation of projects now defunct, it is critical to assess the new wave of protocols in order to determine which of them can have staying power. However, for this specific thesis, due to the uncertainty and prematurity of the ecosystem, we will abide by the principles of the fat-protocol thesis and assume that the L1 token ($SOL) will accrue the most value. Simply put, standalone applications are subject to being disrupted, but if you are an L1 with multiple applications built on top of it, the possibility of complete disruption reduces drastically.

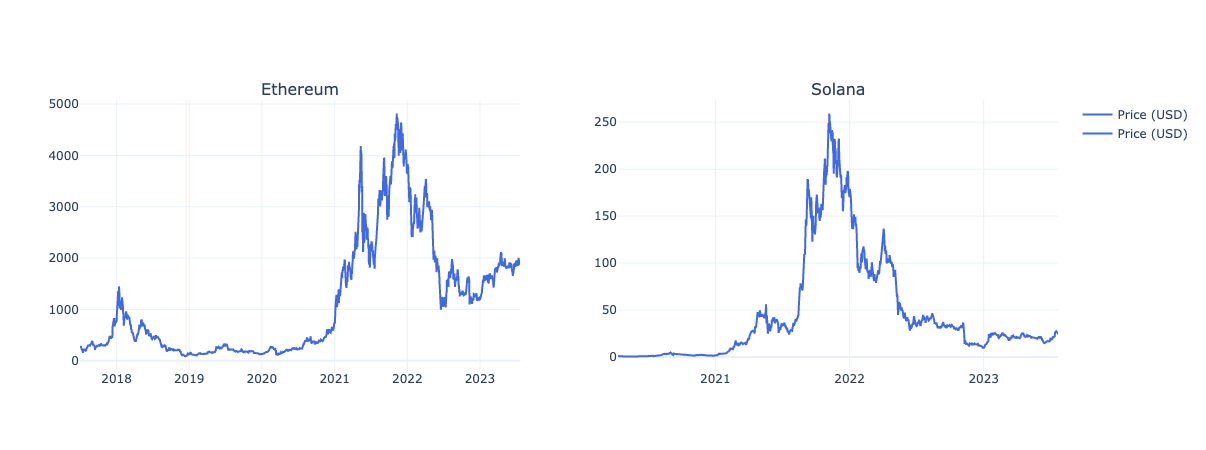

Interestingly enough, 2021 was the year that saw Solana go from $1.54 in January to an all-time-high of $259. In that same year, many other layer 1s came out with incentive programs, like Avalanche or Fantom among others. While other ecosystems gave signs of higher beta returns in terms of ecosystem-specific Dexes, money markets… Solana was one of the few chains where the layer1 token itself accrued most of the value.

That being said, Solana is in a very tactical position at this point. Multiple comparisons have been made saying that this could be similar to $ETH’s $80 low in 2018. However, we will disregard that mere observation to focus on the cause-effect relationship that exists between a layer-1 ecosystem and the layer-1 asset that powers it.

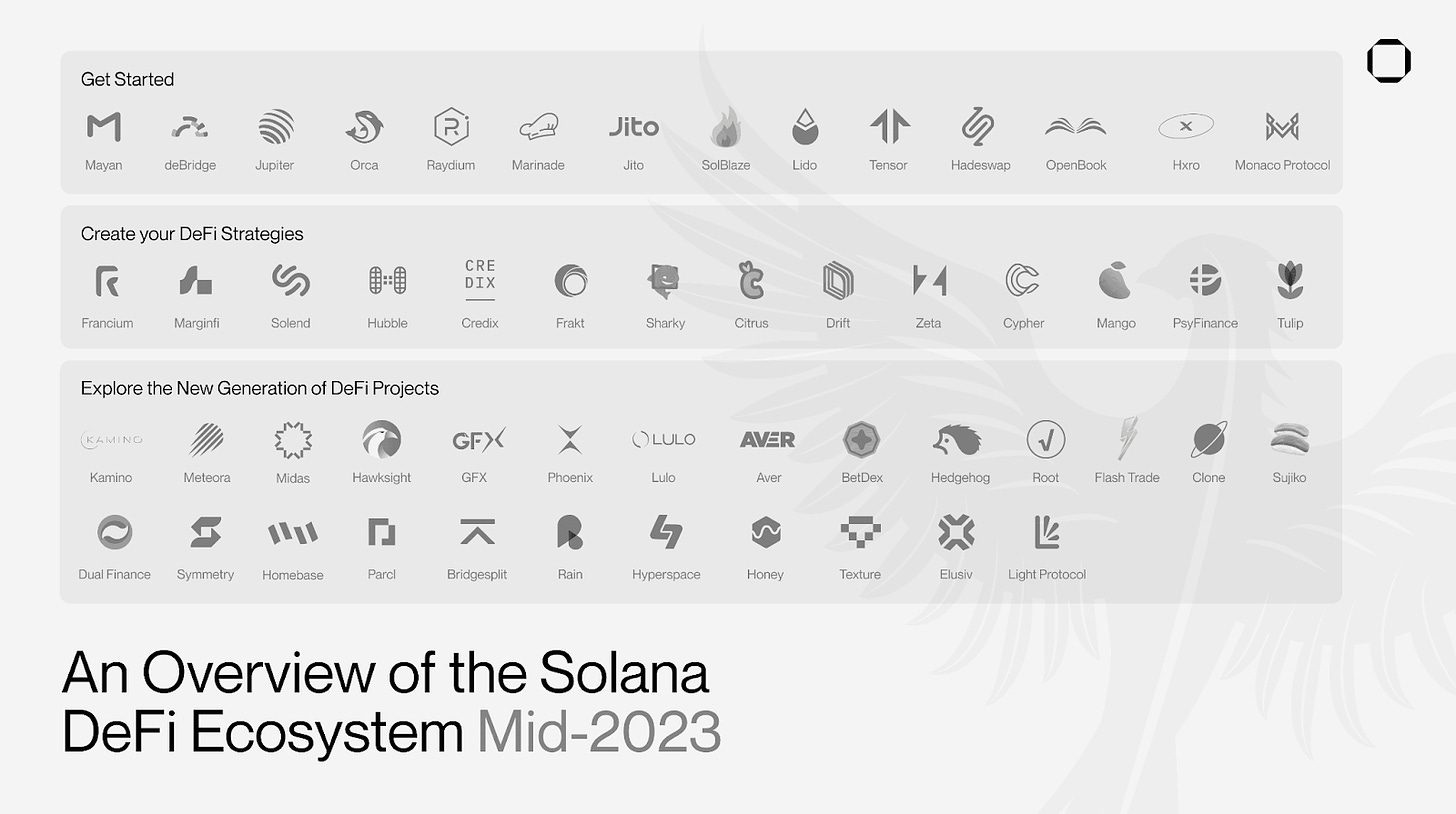

Some of the most dominant protocols at this point include Orca (consistently the top DEX and accounts for over 50% of aggregator activity for Jupiter), xNFT Backpack (a smart contract wallet that has pioneered the xNFT standard, turning NFTs into a programmable platform), Jito (a platform to distribute the network’s MEV to liquid stakers and minimize spam transactions on the network), UXD Protocol (a decentralized stablecoin backed by delta-neutral positions and overcollateralized loans), Tensor and Magic Eden (the leading NFT marketplaces), Marinade (the top liquid staking protocol), Hxro (a liquidity layer for derivatives), MarginFi (lending and borrowing across Solana’s native and bridged assets), OpenBook (an on-chain orderbook forked from Serum), and Hivemapper (a decentralized version of Google Maps where drivers are rewarded in tokens).

The list goes on with more projects introducing novel financial primitives like Phoenix, Lulo, Flash Trade, Clone, Sujiko or Symmetry.

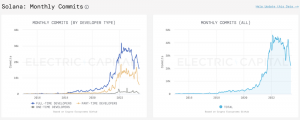

Solana has consistently ranked high in terms of growth in number of active developers, suggesting a stage of early adoption with staying power. This is happening despite a decrease in $SOL price. Native token price decreases can sometimes stagnate development on a given chain, since it decreases TVL, and creates less liquidity that may flow to new dApps.

Given the recent occurrences, however, it is worth taking a deeper look. This will allow us to see how much of the churn was associated with the loss of runway as a result of protocols holding their treasuries on FTX or other miscellaneous treasury management strategies.

Unsurprisingly, the data confirm the information that has already been published. Large ecosystem projects, like Cardinal or Friktion were shut down. Combined with a decline in interest as a whole, the decline in monthly commits can be framed as a stage of uncertainty, pivoting, and rebranding.

In this scenario, what’s relevant to assess, is the state of developer tooling. Tools like Metaplex, the Solana tool suite, or the Anchor development framework have kept on improving. As an example, xNFTs emerged as a new token standard in April and an OpenAI plugin adapted for Solana was published in May. Not only that, but $10M are available as part of an AI Grants Fund.

There are already tangible initiatives and practical use cases stemming out of this initiative, such as Solana Audits AI, which uses LLMs (Large Language Models) to identify vulnerabilities in Solana smart contracts, Solana Ecosystem Search, to answer questions about projects building on Solana by learning from their public docs, or Ask Solana, which uses LLMs that specialize in Solana’s smart contract development.

The fact that Solana uses Rust is very helpful to onboard Web2 developers. However, while Rust is still the most preferred programming language to write code in Solana, developers can also use C, Python, and, with the recent launch of Solang, Solidity developers can now be on-boarded onto Solana as well. This turns the chain into an attractive destination for all kinds of developers who wish to maximize the speed and unique capabilities of the Solana VM. In the future, support will be added for Golang, Typescript, and Move among other programming languages.

The launch of the Neon EVM represents a significant positive development for the ecosystem as a whole. By adding compatibility with the Ethereum Virtual Machine (EVM), Solana opens its doors to a broader developer community. This allows developers who are already familiar with Ethereum’s ecosystem and smart contract development to easily port their projects to Solana.

With EVM support, not only is it easier to onboard developers from EVM-compatible chains, but this also means that existing projects on other chains can be migrated to Solana with minimal effort. This provides a seamless pathway for projects seeking to leverage Solana’s superior performance, scalability, and parallel execution of transactions without having to rebuild their applications from scratch.

Note that Neon is its own standalone chain with its own token, $NEON. Its performance should be framed independently of the adoption rate of Solana. The future outlook of Neon is out of the scope of this report. Regardless, it is worth noting that this is analogous to Moonbeam on Polkadot, Aurora on Near, or Kava on Comos, all of which entered the market in the last bull run and have struggled to attract meaningful adoption.

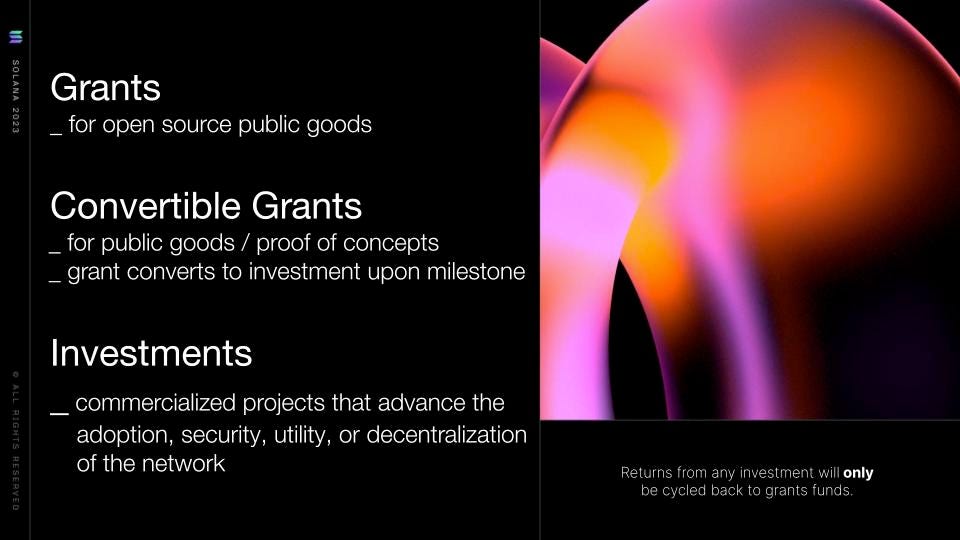

The Solana Foundation has demonstrated exceptional efforts in making the platform highly attractive for developers worldwide. One such exemplary initiative is the introduction of “convertible grants,” which serves as a testament to their commitment to nurturing sustainable and successful projects on Solana.

Learning from past mistakes, the concept of “convertible grants” is a brilliant strategy that aligns the interests of both developers and the Solana Foundation. These grants provide initial financial support to developers without demanding immediate equity or repayment. Not only does this alleviate the selling pressure of VC investments, but this approach also reduces the financial burden on developers during the early stages of development while offering the Foundation the opportunity to benefit from the project’s growth and success.

The adoption of blockchains has faced challenges, particularly in onboarding new users and bringing capital on-chain, which often involves the cumbersome process of creating accounts on centralized exchanges (CEX), transferring to custodial wallets, and then initiating transactions. This friction may hinder the industry’s growth, as potential new users might be discouraged from going through the complex onboarding process.

However, an exciting shift is occurring where the next wave of users may not need to go through the traditional onboarding route. Instead, they can participate in on-chain activities and get paid for their contributions. This phenomenon is already evident in Solana’s ecosystem, with various use cases such as users getting paid for driving around Hivemapper, creating telecommunication networks through Helium, or renting GPUs via Render Network.

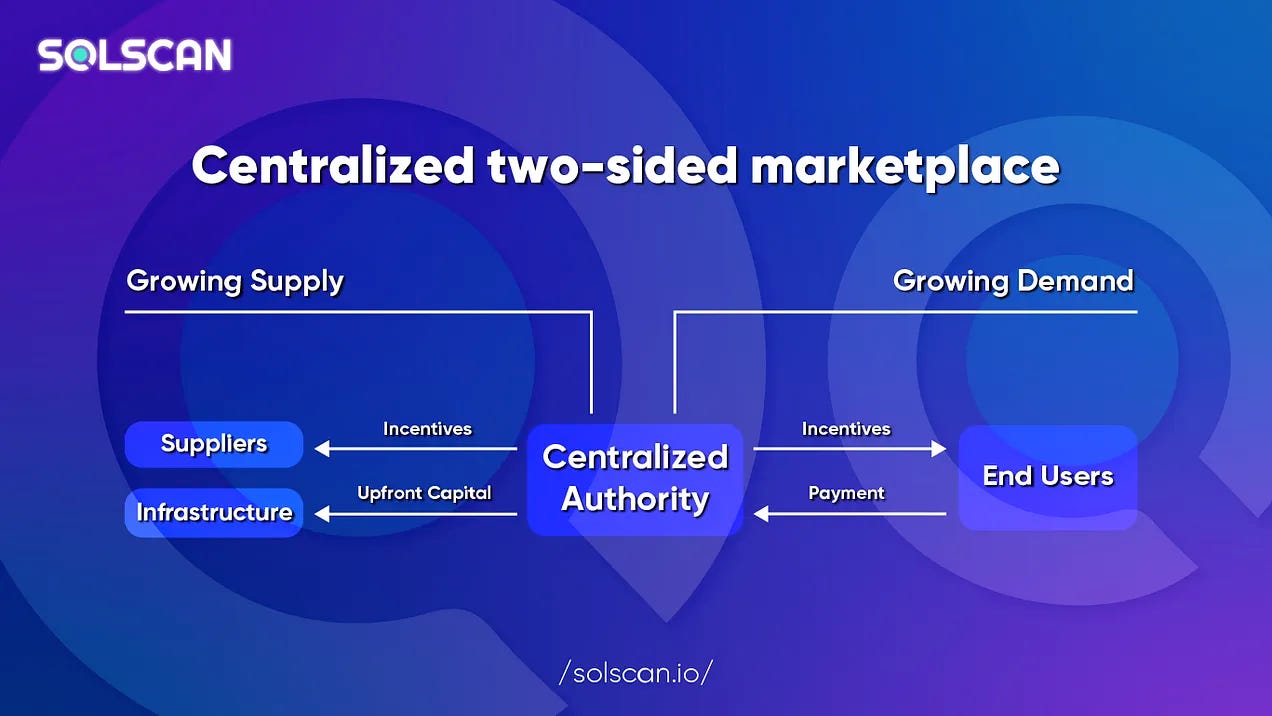

As more projects migrate their physical infrastructure to Solana, the platform is poised to become the hub for scaling up token-incentivized physical infrastructure networks, collectively known as DePIN (Decentralized Physical Infrastructure).

Crucially, DePIN networks on Solana offer distinct advantages over their centralized counterparts. Instead of relying on a single driving force to run the network, DePIN employs a novel approach by distributing network incentives to early adopters. This incentivization model motivates others to join and actively participate in the network’s operation, leading to enhanced scalability and functionality.

User experience is a critical aspect of the success of DePIN applications. To attract and retain a large, active user base, these applications must be designed with the average user in mind. If the process becomes too complicated, it may deter potential participants, hindering the network’s growth potential. Solana stands out as an ideal choice for DePINs due to its seamless user experience. With cheap gas fees, high transaction speeds, and localized fee markets, Solana offers a user-friendly environment for participants, mimicking the look and feel of traditional web2 applications.

Nevertheless, monetization and value generation are key challenges that DePINs need to address to maintain a balance between the supply and demand sides. Solana’s ecosystem allows DePINs to create a marketplace for exchanging resources and services seamlessly. With Solana’s speed and scalability, these networks can manage the increasing demands of users while ensuring trust and security, eventually accruing value to the base layer hosting their services and benefiting from their network effects.

With Solana, our mental model visualizes a new generation of users that will not optimize their use of the technology to earn liquidity mining rewards or because they care about decentralization, but because it is the easiest, cheapest, and fastest way to solve a specific problem. In that sense, we believe that Solana has the best chance of onboarding people with little to no crypto experience and small amounts of capital. This thesis was further reinforced after the launch of the Solana phone.

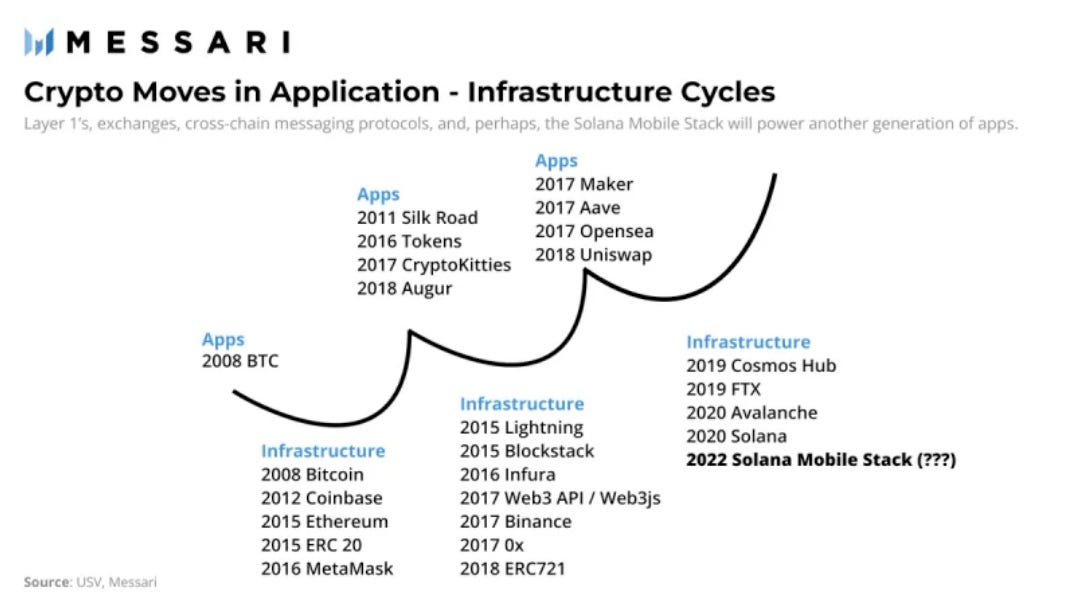

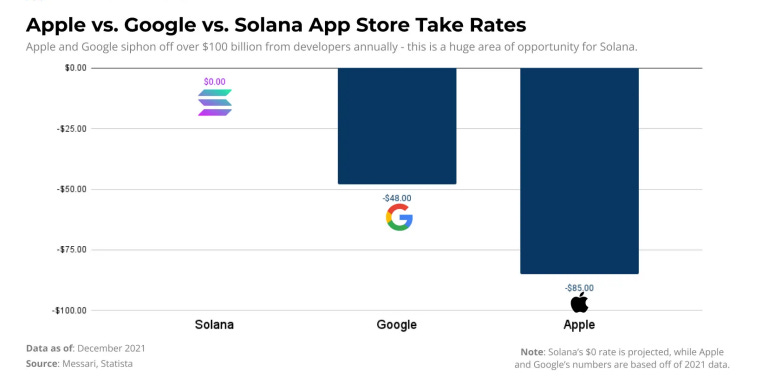

Infrastructure and applications are built in cycles, and while the current adoption rate might have been lower than expected, the Solana Mobile Stack still represents a big bet on mobile infrastructure. Not only is this convenient for users but also for developers, who might be attracted to a lower “take rate” than the standard charges from Apple or Google. This represents savings from 15-30% down to 0%, saving mobile developers millions in value over a prolonged period of time.

Mobile devices facilitate more than 65% of the global web traffic. By tailoring existing crypto apps with product-market-fit to mobile users, Solana is in a great spot to expand its total user set. This is a very strategic spot to be in and aligns extremely well with the thesis that Web2’s take rate is Web3’s opportunity.

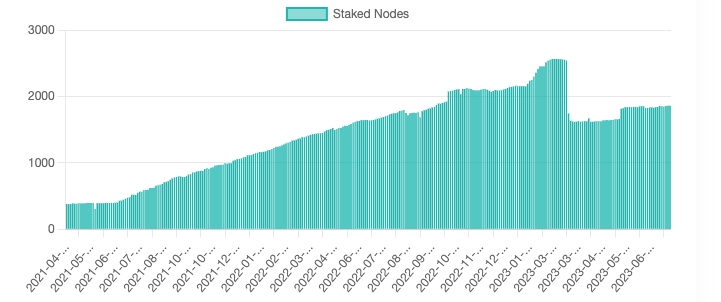

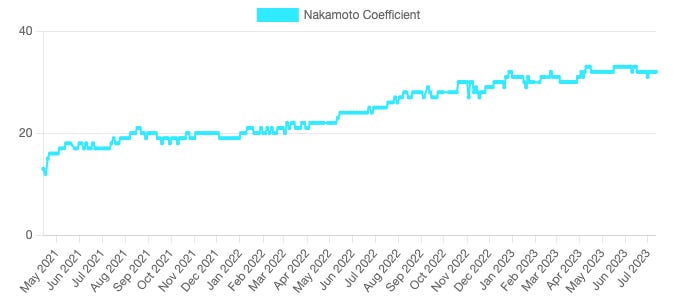

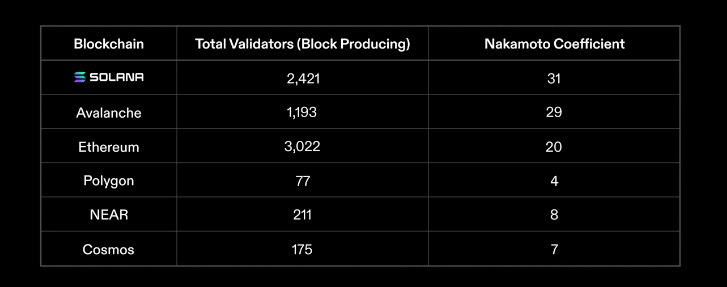

As more people come to the realization of how rollups actually work, it is important to address the fact that, despite the critics, Solana features a Nakamoto Coefficient of 32, with a total of 2,921 total nodes distributed across 31 unique countries and 392 unique data centers. This is the equivalent of 322,501 total stakers, with the number of staked validators consistently growing over the last two years.

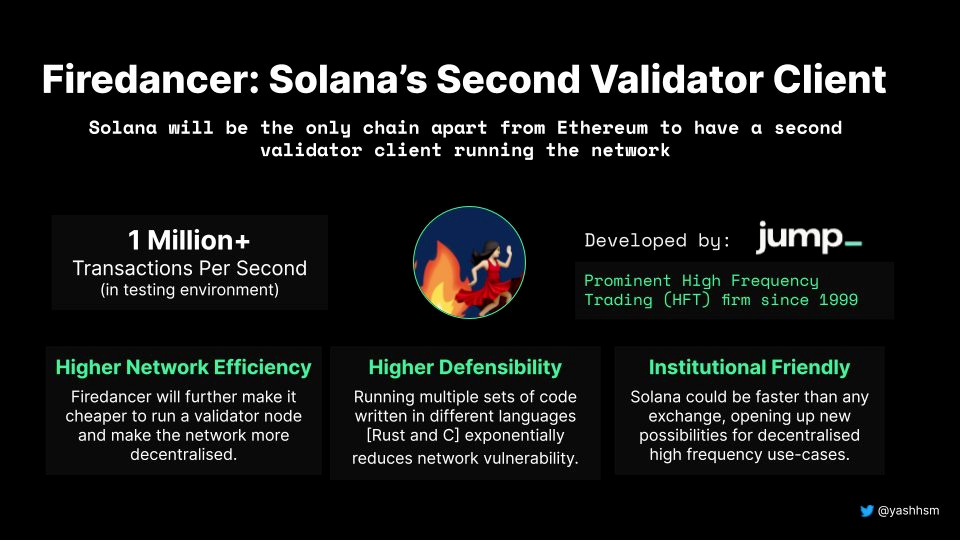

Over the same period of time, the Nakamoto Coefficient has risen from 13 to 32, meaning that the stake is becoming more distributed over time. No single provider hosts ⅓ of stake and Jump’s Firedancer is a step forward in terms of client diversity.

On proof of stake networks, the Nakamoto Coefficient (NC) is the fewest number of nodes that control at least 33.4% of voting power.

Similar to other chains, the high demand for blockspace highlighted the need to optimize the inclusion of transactions while avoiding network congestion and gas fees. In this sense, Solana’s localized fee markets definitely help it stand out against other competitors.

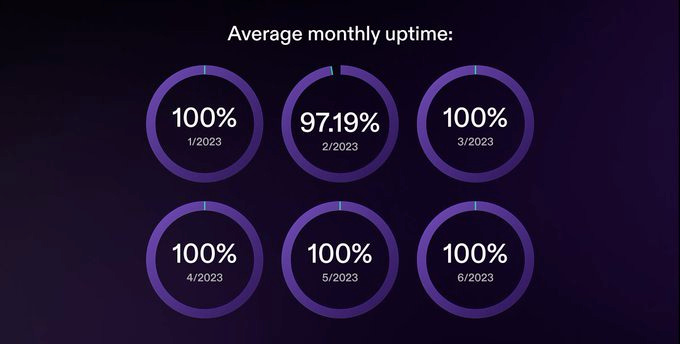

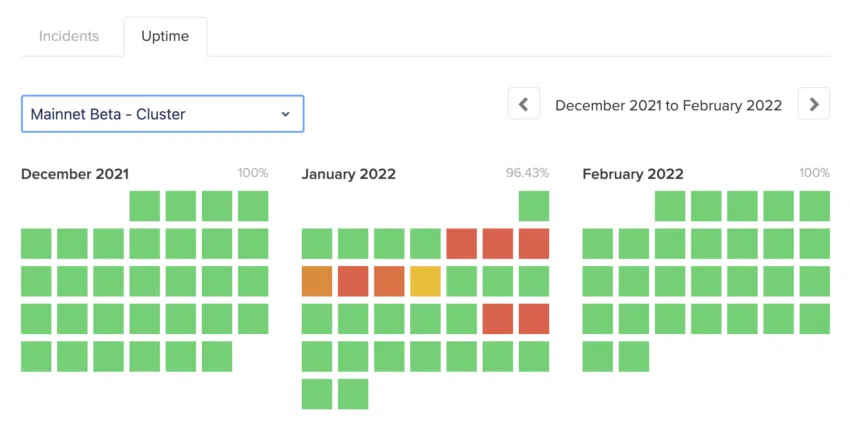

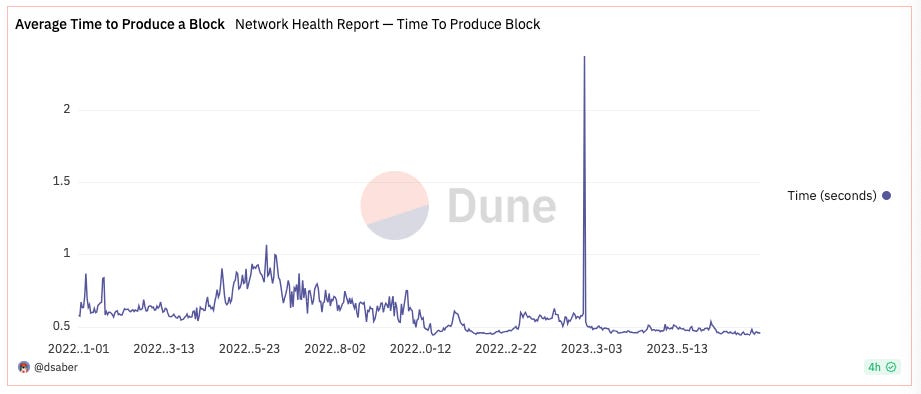

As time goes by, we can observe that Solana’s ethos of “move fast and break things” also has a component of “ruthless prioritization”. Despite its high-performance capabilities, we have seen over and over again how the chain would halt and experience network outages. At least 7 of them were recorded between 2021 and 2022. So far, after one outage in 2023, this issue has gained priority. By partnering with Jump Crypto to build a new validator client, the roadmap is actively targeting improvements to the network’s throughput capacity.

Network upgrades keep resulting in key improvements as well:

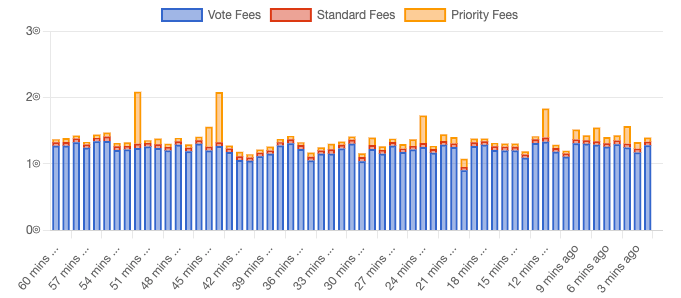

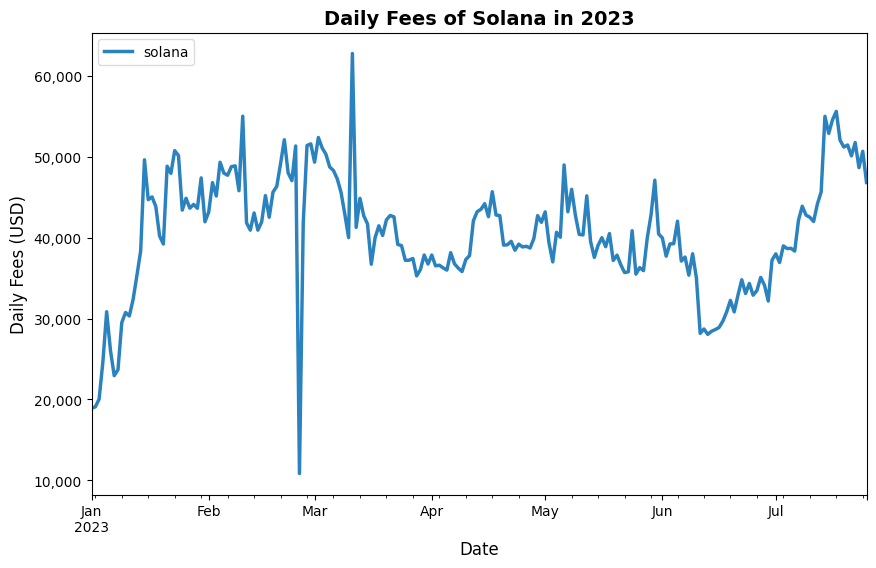

The value accrual of blockchains can be perceived as a constant sale of blockspace. However, the blockspace marketplace in Solana is structured differently to the usual scheme in most EVM-compatible chains.

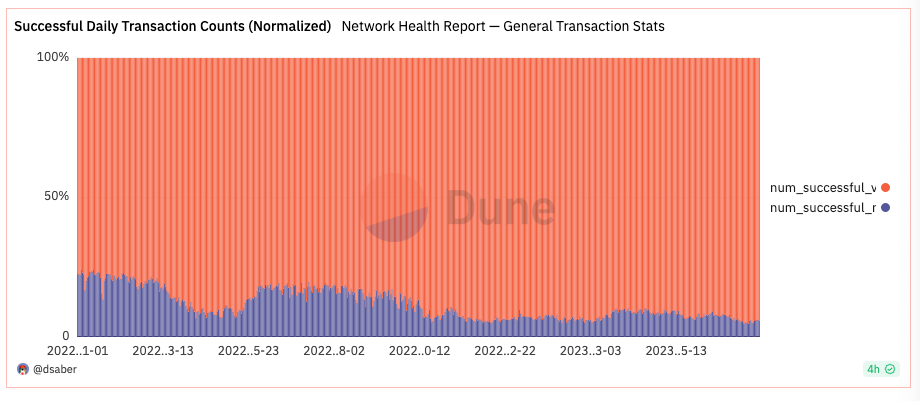

Solana enables local fee markets to protect the chain’s performance against adverse conditions of network congestion. One year ago, the network introduced the concept of priority fees on top of the existing flat base fees. As a result, priority fees became an important consideration to understand block inclusion and transaction ordering. To simplify, priority fees increase the cost of spamming the network. This has helped eliminate Solana’s past downtime issues caused by inefficient transaction processing.

Similar to Ethereum, priority fees can lead to “gas wars”. However, instead of increasing the gas price for the entire network and negatively impacting all active market participants, Solana’s blockspace is structured in a way that prevents individual hotspots of activity (i.e. an overcrowded NFT mint or excessive trading volume caused by memecoins) to expand high gas costs across the entire network.

Compare this to the global blockspace wars that take place on Ethereum, such as the BAYC Otherside land sale or memecoin seasons, leading to the need for all users to directly compete with a hotspot by raising fees to the same degree.

At the technical level, both local and global fee markets are possible on Solana, and many isolated activities can still fully saturate the demand for blockspace. However, one of the benefits is that the volatility of the global fee market is reduced.

The release of Firedancer marks a momentous milestone for Solana as it enhances the platform’s decentralization and strengthens network security. Firedancer introduces a second independent validator, a crucial aspect of decentralization that involves multiple autonomous implementations of the blockchain software.

Developed by Jump Crypto, Firedancer complements Solana’s existing validator (developed by Solana Labs), adding an additional layer of safety and liveness to the network. With two independent teams actively working on network security, the chances of a single catastrophic bug affecting both clients are significantly reduced.

Beyond the importance of increasing the diversity of the network, Firedancer is a big improvement in terms of throughput efficiency and network resiliency. The team built their own QUIC library and managed to achieve 1M tps on 4 cores. Up until this release, Solana’s throughput wasn’t limited by hardware, but by software inefficiencies. As high-frequency trading engineers, Jump came up with some innovative ideas to optimally use the available hardware. These techniques come naturally in trading but are seldom used in standard software engineering, with the current Solana Labs implementation being no exception. Among other things, Firedancer will use zero-copy networking to bypass most of the operating system’s kernel network stack and comes with its own queues and other concurrency primitives.

| Platform | Median Time-To-Finality Range |

| Ethereum | 13-20 minutes |

| ZK-Rollups | 1-2 seconds optimistic finality on L2 , ~15-20 minutes proof generation time + ~13-20 minutes Ethereum L1 time |

| Optimistic rollups | 1-2 seconds optimistic finality on L2 , ~2-8 minutes batch commitment time + ~13-20 minutes Ethereum L1 time |

| Solana | 1-2 seconds median, and up to 60-90 seconds at extremes |

| Solana + Firedancer | 400-500 milliseconds expected median, and unknown variance at extremees |

| Coinbase | 19-178 milliseconds range |

| Binance | 23-500 milliseconds range |

| Kraken | 18-172 milliseconds range |

More importantly, Firedancer brings multiple benefits to both users and developers within the Solana ecosystem. It enhances user experience through improved performance and resiliency, while developers can take advantage of better scalability, cost-effectiveness, and a common interface for seamless collaboration.

Even though a simple P/S ratio might offer some directional bias into the fundamental value accrual versus the speculative premium accrued to $SOL, this is not necessarily an adequate way to evaluate layer 1 assets.

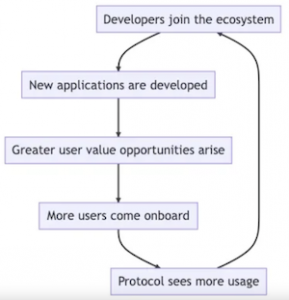

Simply put, demand for security grows as potential new use cases are unlocked and the opportunity for new users to be onboarded is created. The key realization here is that while popular metrics like revenue, throughput, or TVL are useful, the estimated growth boils down to developer and user adoption.

This report will not outline what the specific short side of a possible trade should be. Due to the variety of layer 1s, the spectrum of choices is quite broad and there are multiple details and nuances that must be considered for a proper and timely execution.

Depending on the level of conviction and risk-reward perception, many have pointed out that $SOL recently experienced a similar price move to when $ETH went to $80, especially after the liquidity crisis caused by the FTX collapse.

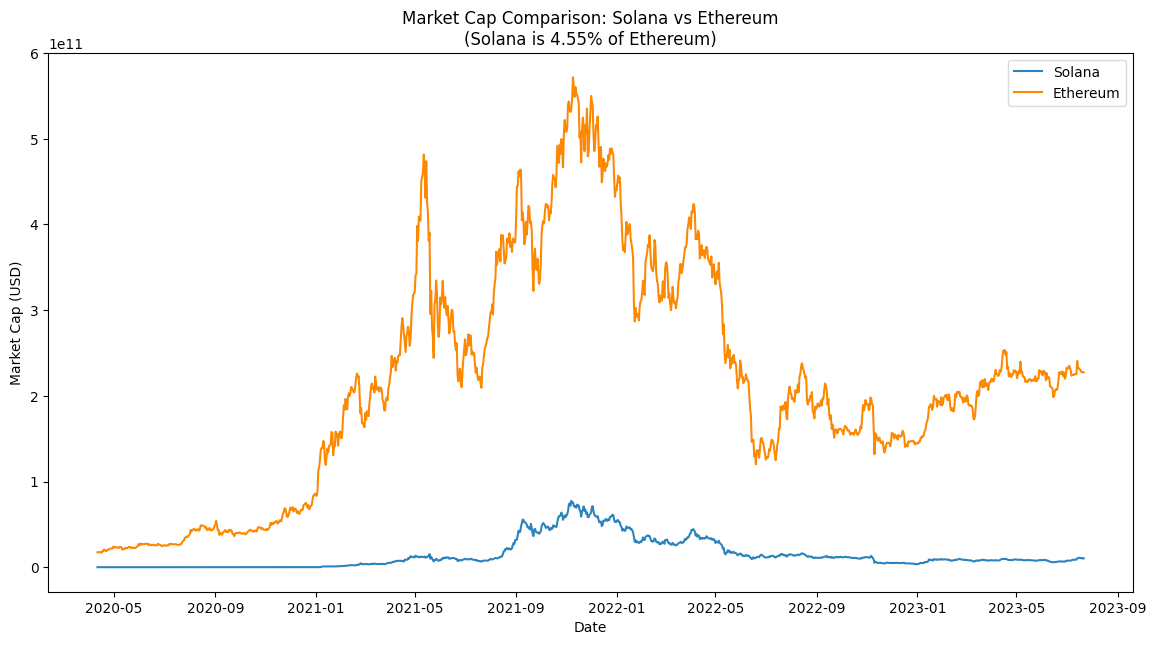

Similar to the $ETH/$BTC trade, this might take years to play out. The difference, though, is that in spite of the width of the gap in terms of market cap, there is less likelihood of Solana flipping Ethereum than there is of Ethereum flipping Bitcoin. The adoption of Ethereum is imminent and it remains the most liquid and adopted chain by several orders of magnitude.

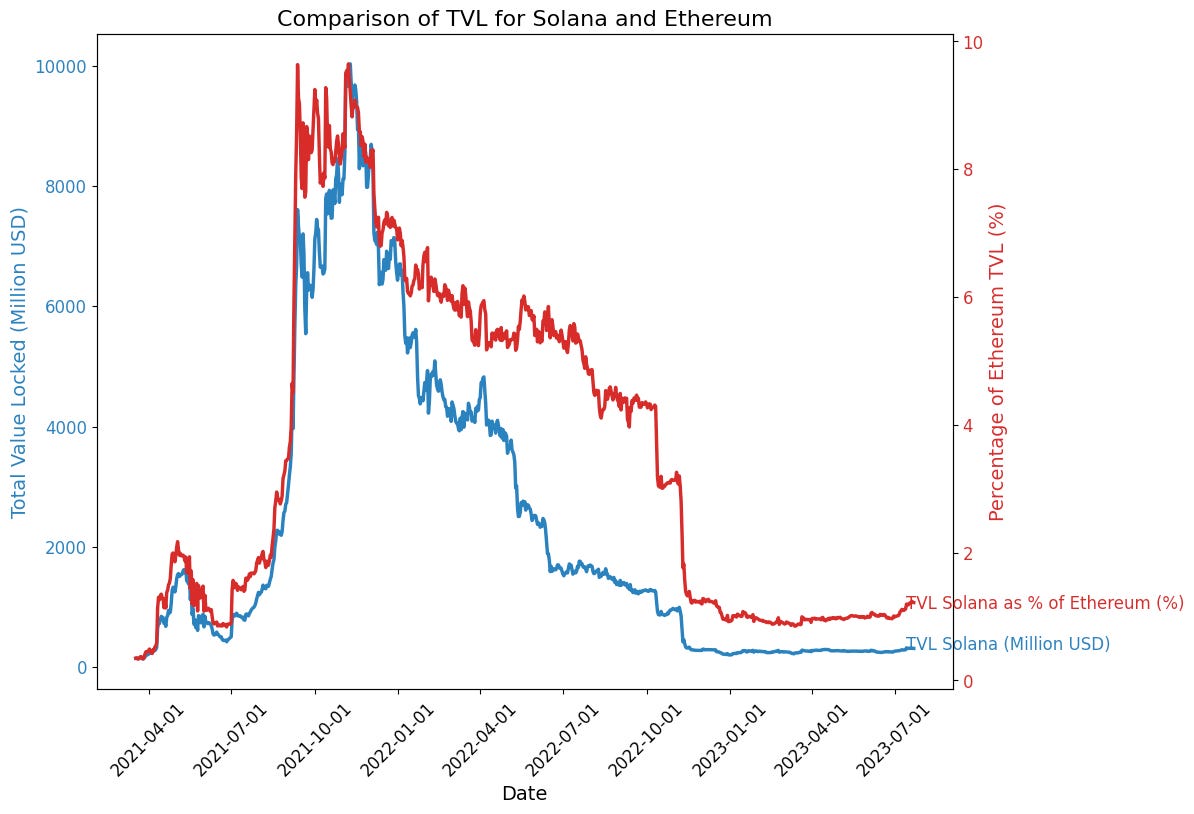

However, betting against a PoS chain powered by a deflationary asset like $ETH might not be worth it given the opportunity cost. It is also worth noting that Solana still represents less than 2% of Ethereum’s TVL and has never been more than 10% of Ethereum’s TVL.

This takes us to another question; does TVL even matter? In the world of DeFi, Total Value Locked (TVL) has been a widely used metric to assess the success and growth of protocols. However, it is essential to put this metric into perspective and consider other factors to gain a comprehensive understanding of a chain’s ecosystem. Assessing TVL alone may give a distorted view of the overall health and diversity of the DeFi landscape on any given chain.

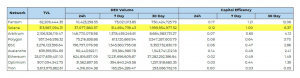

Juxtaposing TVL and volume directly, it is possible to come up with a metric that tells a clearer story about how valuable the tools built in that ecosystem are to the users of the platform.

Note that Fantom’s outcome might have been biased due to the increase in volume as a result of the Multichain incident.

The image above shows that, for every dollar of liquidity in Solana DeFi, it is being transacted almost 2x over, on a weekly basis. Conversely, there are some chains reporting high TVL numbers, like Tron, but when you calculate their DeFi Velocity it is clear that there is very minimal economic activity occurring in their DeFi ecosystems.

Even if one does not believe that Solana will ever flip Ethereum, that doesn’t invalidate having a position in a non-EVM chain. In fact, we view Solana as one of the best hedges one could have against black swan events such as zero-day exploits or vulnerabilities in the EVM, which would affect most EVM-compatible chains.

Even though Solana is a bet on monolithic chains versus modular designs, such as those of layer-2s, trading $SOL against $OP, $ARB… seems overkill. More and more layer-2s will keep coming up and growing their ecosystems with application designs that we don’t know of just yet. We are yet to find who the winners and losers of Ethereum’s Cancun upgrade will be. One scenario may be that most or all L2s will stand to gain following EIP-4844 at first before performance varies based on differences between rollups.

Given the differences between optimistic rollups, zk-rollups, and programming paradigms involved in each one of them, this report will not confront monolithic and modular chains. Instead, the thesis is that there is room for both and that it is positive for the industry as a whole for both of them to coexist and expand the use cases of blockchain technology. The blockchain trilemma is a series of tradeoffs, and a balance can only be found by not putting one belief system (decentralization) against the other (scalability), but rather by combining two ecosystems that keep showing signs of strength.

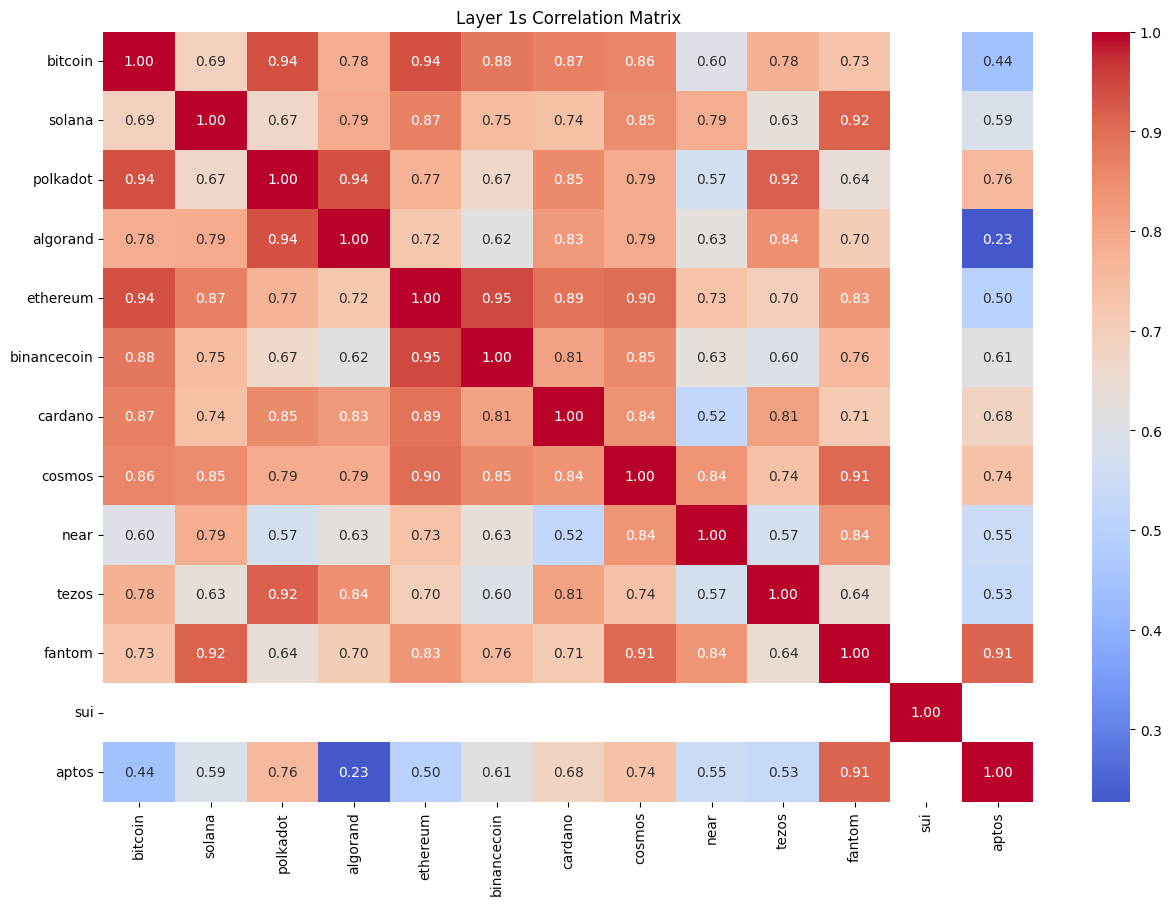

While there are layer-1s showing more weaknesses than others, Solana is still experiencing a recovery and going through a stage of growth reminiscent of its early days entering the market. This might skew the correlation ratios temporarily.

Despite the directional opportunities that might show up, a more market-neutral approach might be appropriate. One could consider going long on one asset (like $SOL in this case) and short another highly positively correlated asset. This is because if the market moves in a certain direction, both assets are likely to also move in that direction.

However, if you believe that Solana will outperform any other asset, you probably have several points that support this thesis, such as the points we’ve outlined above. These could be stronger fundamentals, better technology, more significant upcoming events, or any other number of reasons. Therefore, you could expect Solana’s price to increase more (or decrease less) compared to this other asset.

That being said, a strategic move would look at the asset of a layer-1 chain that has a high positive correlation with Solana but which you expect to underperform relative to $SOL.

Additionally, one could make a case for spot accumulation and portfolio diversification in the L1 sector. This will be helpful for hedging against both the new up-and-coming layer 2 chains as well as the dominance of EVM-compatible chains.

Excluding Solana and Forte, more than $1B in funding has been invested in the ecosystem. Even though there have been a couple of unexpected setbacks, the realization of novel unique use cases on top of blockchain technology is something that takes time – it took more than 6 years since the launch of Ethereum for DeFi summer to take place.

Considering the active developer community, potential for unique use cases, lightning-fast transaction speed, and the Foundation’s commitment to supporting sustainable growth, we believe that betting in Solana offers a favorable risk-reward profile.

All in all, the investment thesis on Solana is a way to hedge against the dominance of the Ethereum Virtual Machine (EVM). This statement also contemplates a unique value proposition that turns Solana in Ethereum’s best ally to further the adoption of blockchain technology.

Revelo Intel has never had a commercial relationship with the projects mentioned above and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.f