Key Points

Render sits at the intersection of AI, AR/VR tech, and blockchain. The Render Network is a decentralized network that uses blockchain technology to facilitate distributed GPU rendering, as opposed to centralized GPU rendering providers like Amazon AWS and Google Cloud.

You can think of the Render Network’s business model as somewhat similar to Airbnb’s. With Airbnb, idle homes can be rented for very specific windows of time. Travelers or people with a dynamic demand for short-term housing can simply book a home to live in for the specific period of time they would actually live in it, as opposed to signing a rental contract or purchasing the home outright.

In this same vein, Render connects idle GPUs with content creators who have demand for the rendering power these GPUs provide. These content creators can simply pay for how much processing power they will actually use, rather than agreeing to longer-term contracts with centralized providers that would result in money being paid even when the GPUs aren’t in use.

The Render network connects individuals or entities (referred to as “Creators”) who need rendering work with those who have idle GPU resources (known as “Node Operators”).

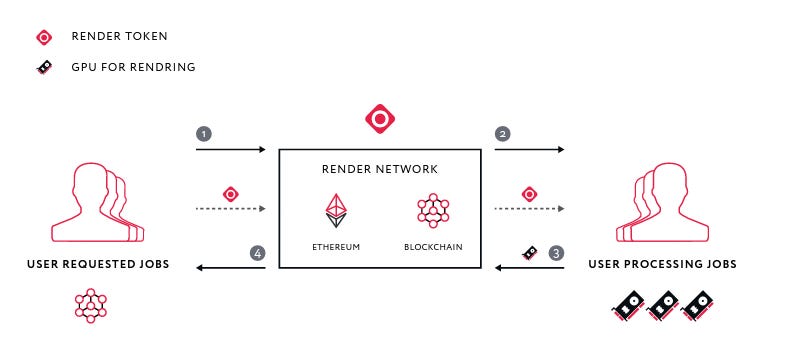

Here’s how the process of accessing GPU resources on Render works:

1) Job Submission: Creators who need rendering work done submit their files to the Render Network along with payment in $RNDR tokens, the native currency of the Render Network.

2) Job Assignment: The Render Network assigns these jobs to Node Operators, who have registered their idle GPUs on the network. The assignment of jobs is based on the capability of the GPUs and the requirements of the rendering job.

3) Rendering and Verification: Node Operators complete the rendering work using OctaneRender, a GPU-based rendering software built by OTOY, the company behind the Render Network. Next, the Render Network verifies the accuracy and quality of the rendered work.

4) Payment: Upon successful completion and verification of the render job, the Node Operator receives the $RNDR tokens from the Creator. A small percentage of the $RNDR tokens is taken by the Render Network for maintaining the network and facilitating the transaction.

To Understand how OctaneRedner works and what makes it special, it’s important to have a pretty thorough understanding of how GPU rendering in general works, and why it is needed.

Rendering is a crucial process in the field of computer graphics. Basically, rendering transforms raw data into the visual content that you see when watching a movie, or playing a game. The original graphics model contains geometry, viewpoint, texture, lighting, and shading information that describes the virtual scene that the audience will eventually see. This data, contained in a scene file, is then passed to a rendering program to be processed and output to a digital image or raster graphics image file.

Compared to other rendering software, the OctaneRender engine stands out for its accuracy in the physical space. It became the first commercial renderer to harness the power of graphics cards (GPUs) rather than relying on traditional CPU-based rendering. This allows OctaneRender to produce photo-realistic images at speeds that are orders of magnitude faster than previous renderers.

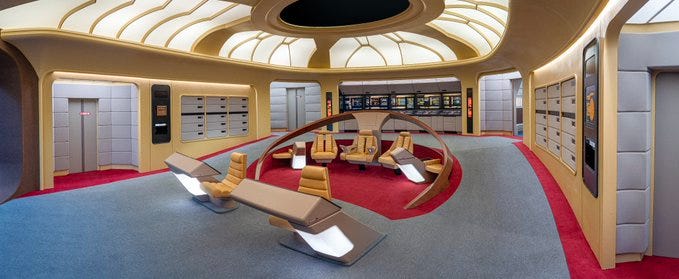

OctaneRender, in combination with the open-source ORBX media and streaming framework, provides a powerful toolset for developers and content creators to produce high-quality, realistic visuals for a variety of applications. By tracing how light and energy bounce around a scene and anchoring its algorithms in the laws of physics, OctaneRender can account for complex graphics scenarios, such as how rays of light bounce around a scene and interact with different materials and surfaces. This level of accuracy allows professionals, like architecture firms, to model elusive light-leak emissions in buildings with precision. This is an example of how this tech can be applied in real life, as opposed to just in virtual forms of entertainment, which is the most common use case for this rendering.

One of the key aspects of this advanced rendering process is understanding how light behaves when it interacts with different materials. For example, light behaves differently when it passes through glass compared to when it bounces off a metal surface. In the real world, light slows down when it passes through a medium other than a vacuum, such as water or glass. This change in speed can cause the light to bend, a phenomenon known as refraction. OctaneRender’s algorithms take this into account, allowing it to accurately simulate the way light behaves when it passes through different materials. Also, when light hits a surface, it doesn’t just bounce off – some of it penetrates the surface and scatters within the material before exiting at a different point. This is known as sub-surface scattering, and it’s particularly important when rendering materials like skin, marble, milk, and other substances that have a certain level of translucency. The OctaneRender engine can simulate these “interference patterns” to add a layer of realism to the rendered images. This refers to the way the scattered light waves can interfere with each other, creating complex patterns of light and shadow within the material.

There are plenty of practical use cases for rendering engines like OctaneRender in the real world, specifically in the fields of gaming, media, virtual reality (VR), and augmented reality (AR):

While Render may be in a league of its own when it comes to decentralizing access to GPUs specifically, its closest competitors are traditional cloud GPU providers, some of the biggest tech companies in the world.

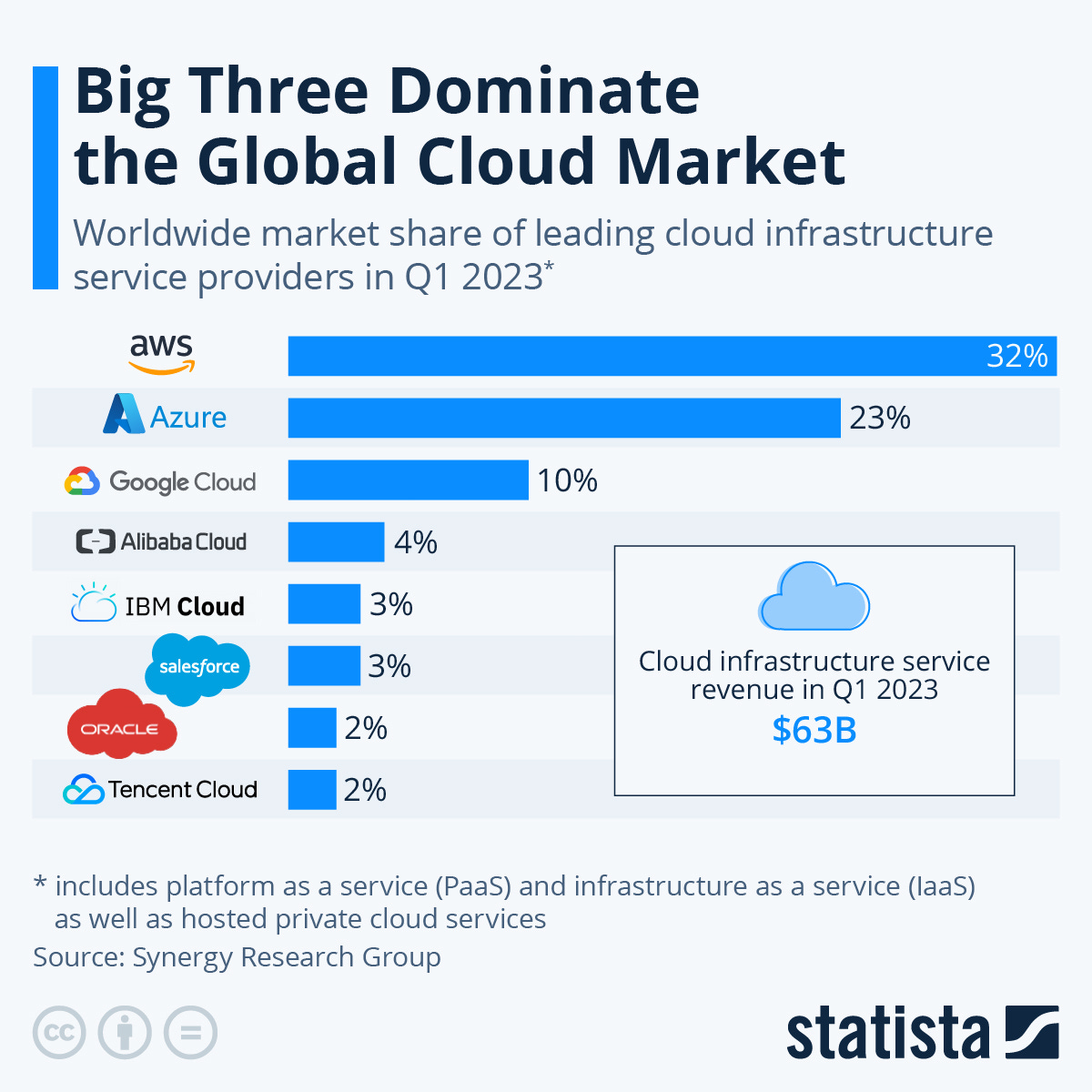

The biggest players in the cloud computing industry, and specifically cloud GPUs, are Amazon AWS, Microsoft Azure, and Google Cloud. These are all U.S.-based, publicly traded companies with market caps ranging from the hundreds of billions to trillion dollar range.

The way accessing GPU power for graphics rendering works with large providers like Amazon or Google, is that these companies take their existing GPUs in their data centers and make their computing power available for rent as cloud GPUs. This way, people who have a high demand for GPUs don’t have to physically buy and maintain these GPUs in their local machines. They can just rent the power they need from cloud GPU providers.

If we’re using the Airbnb analogy, this model used by big tech providers is akin to Airbnb buying an apartment building and then leasing out the individual units on a fixed-term lease spanning 12 months or longer. They would own and maintain the building which is drastically different from the asset-light model they actually use.

This in and of itself is an improvement from the previous alternative, which was for companies with graphics processing needs to buy actual GPUs themselves. A notable example of this is when the U.S. Air Force needed a large amount of computing power to improve algorithms for identifying flying objects in space. The military branch acquired 1,760 PlayStation 3 gaming consoles that were deemed to be energy-efficient machines with ample graphics processing ability and used them to build a supercomputer. This unique example highlights the fact that this method of obtaining processing power is clearly not ideal, for entities both big and small in a variety of industries.

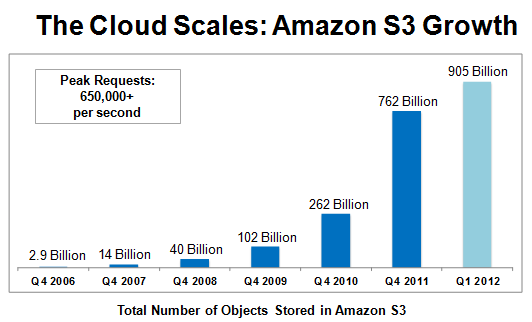

According to some estimates, many early Internet entrepreneurs may have been spending ~70% of engineering resources on building and maintaining data centers for computing power. Amazon was the 1st cloud computing solution to market, launching Amazon AWS in 2006. Around the inception of the 2010s, cloud computing demand from online businesses and app developers began to take off. The other competitors including Microsoft Azure, and Google Cloud would launch and begin to take market share from Amazon, although Amazon still retains its lead.

Today, companies big and small eliminate the need for the physical upkeep of GPUs and opt to use the services provided by cloud computing providers. By now, you should know how Render Network’s business model differs from the cloud GPU provider model. Rather than maintain and rent out GPUs, Render acts as a middleman of sorts, connecting GPU owners with prospective short-term tenants. They never own any hardware on their balance sheet.

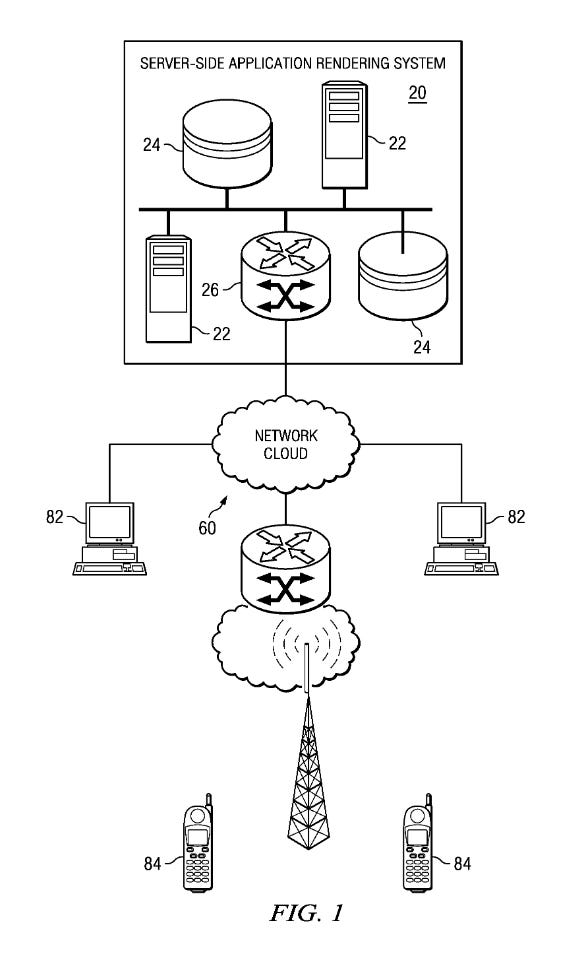

Render was not slow to adapt to developments in cloud computing. Render’s Founder, Jules Urbach, founded OTOY, a graphics rendering solutions company, in 2009. In the same year, he also released a patent outlining plans for a rendering service, resembling what would go on to become Render Network.

In addition to the unique method Render uses to provide Content Creators with GPU access, the network also has an advantage compared to centralized providers in that its creators are not reliant on any one entity. Content Creators on Render utilize a variety of idle GPUs, and different GPU providers at any given time. Render is a marketplace as opposed to a centralized provider and it aims to democratize cloud GPU rendering.

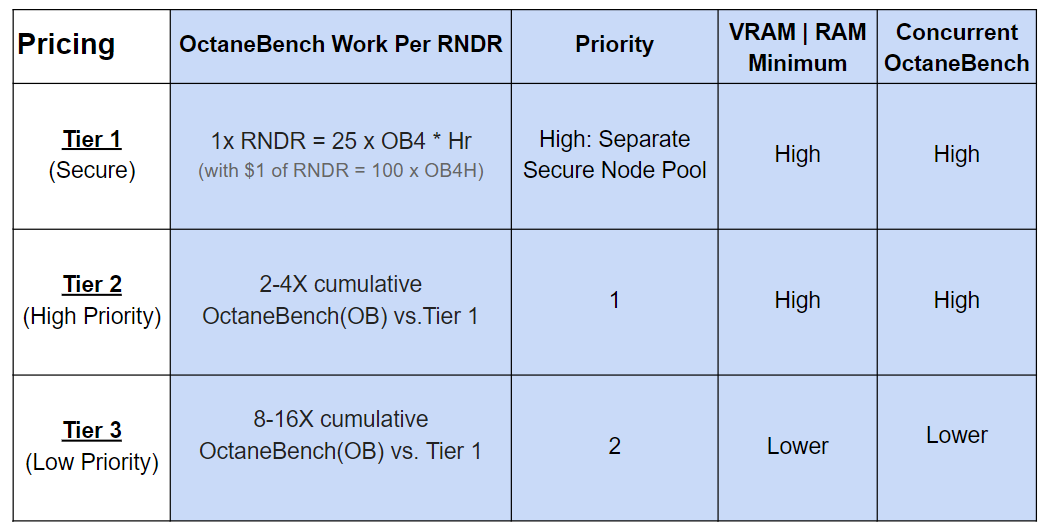

When it comes to pricing, Render varies from traditional cloud GPU price models because OTOY uses its own OctaneRender software as the benchmark for measuring processing power. Despite these differences, Render states their pricing reflects that of their competitors, including Amazon AWS. The pricing model is based on $1 worth of $RNDR, so the volatility of the token shouldn’t impact the protocol’s cloud GPU market too much.

We’ve established how Render differentiates itself from the key players in the cloud GPU industry, but the $RNDR token has its work cut out for it. The 3 biggest providers take up ~65% of the cloud computing market, with the following competitors being huge established companies like Alibaba and Oracle.

Beyond competing with big tech giants like Amazon and Google, Render also faces some level of competition from crypto-native companies. While there aren’t any specific projects tackling distributed GPU rendering, there are a handful of protocols in the decentralized computing lane:

Akash GPU Testnet now hosts amazing AI apps like AutoGPT, BabyAGI, and Stable Diffusion, flawlessly leveraging a decentralized GPU market.

This is the first instance an Opensource Supercloud can host Opensource AI.pic.twitter.com/YnRgBmiPvT

— Greg Osuri ⟁ d/acc (@gregosuri) May 17, 2023

While these projects are similar to Render in the sense that they operate in the realm of decentralized computing, they lack the association with AI and VR/AR tech that has benefited the RNDR price, and even publicly traded stocks like NVDA and AMD. Of the different sects within decentralized computing, distributed GPU provision is potentially the most exciting one, primarily for this reason.

While Akash is developing GPU support and wants to prioritize this aspect of their service, it’s uncertain how this could play out for them. The mainnet for Akash cloud GPU is rather soon, which could explain the recent rise in $AKT price in the past couple of weeks. This recent spike in price is still significantly less than what $RNDR has experienced, which could make $AKT a more attractive play in the short term for those who think interest in Render may be a little over-saturated at the moment.

Bigger and more intricate rendering jobs, such as animations spanning thousands of frames across time and space or VR walkthroughs, require more resources and external servers. Until now, no system has been able to efficiently scale rendering speed across these many dimensions of work, or tap into the vast pool of GPUs from an online network.

In fact, scaling GPU rendering power is too difficult with traditional rendering technology. There are limits on what can be done rendering locally, on a network, or even in the cloud. What’s more, it is impossible to leverage GPUs throughput efficiently without some sort of decentralized system that tracks and manages render jobs, AKA the demand side of the GPU equation.

Render leverages the untapped potential of the idle GPU supply, which is now standard component in every smartphone and PC. Currently, these GPUs remain mostly underutilized, especially when developers are not using their own GPUs for their specific rendering tasks. With PCs and mobile devices becoming more and more prevalent across developed and developing regions, the supply of idle GPUs will only continue to increase over time.

Render Network capitalizes on this idle capacity, connecting those in need of rendering work (Creators) with those who have idle GPU resources (Node Operators).

By doing so, Render Network not only provides a cost-effective and efficient rendering solution for Content Creators but also allows Node Operators to monetize their idle GPUs. As a matter of fact, both Node Operators and Creators are incentivized to participate in the Render Network. Node Operators earn $RNDR tokens for their services, while Creators get their rendering work done efficiently and cost-effectively. At the same time, the use of blockchain technology ensures secure and transparent transactions, while the OctaneRender software guarantees high-quality rendering.

OTOY, founded in 2009 by Jules Urbach, has been a pioneer in the field of GPU-based software solutions. When founder and CEO Jules Urbach started the company 14 years ago, the only way to perform a complex render job for massive projects such as Avatar or Transformers was at an expensive visual effects studio. Rendering took massive amounts of time, money, and storage space, none of which the average game developer, student, or designer could have access to.

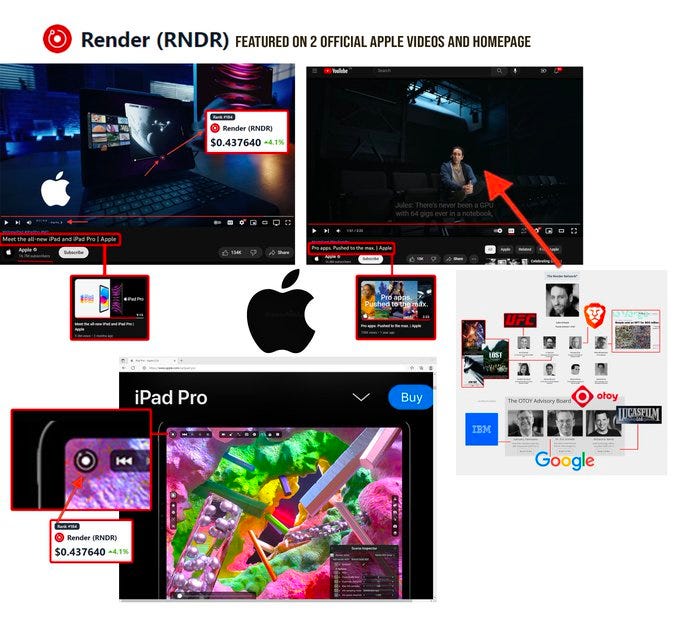

Prior to OTOY, Jules created the web’s first 3D video game platform and licensed the software to Macromedia, Disney, Warner Brothers, Nickelodeon, Microsoft, Hasbro, and AT&T. Jules has been coined by technology writer George Gilder as “the most inventive software engineer he has ever met,”. Jules has also been featured in numerous publications including Forbes, CNN Money, and All Things Digital. As a curious fact, Jules Urbach has been present at multiple Apple Keynotes presenting the Octane engine.

Since its early days, OTOY’s vision has been to democratize access to high-quality rendering tools. Jules Urbach envisioned a future where anyone could have an easy pathway to cloud-based, real-time, photorealistic, and physically correct rendering software for just a few hundred dollars. This vision led to the development of OctaneRender, the world’s first and fastest GPU-accelerated, unbiased, and physically correct renderer.

Bitcoin was first launched in January 2009. In that same year, Urbach patented his idea for a “token-based billing model for server-side rendering”; years before tokens and blockchain technology were in use.

Since its early days, the Render Network has been financed by OTOY. During its development, other organizations like Swatchbook and MR Studios also joined the effort.

After raising a $30M round in December 2021 from investors like Multicoin Capital, Alameda Research, and the Solana Foundation, the Render Network Foundation was established as a non-profit organization that will be primarily facilitating the Render Network Proposal (RNP) system, helping to set the strategic priorities of the network, and issuing grants to support them. Nonetheless, OTOY and the core developers will continue to provide services to the foundation.

In addition to some strong investor backing and an innovative Founder, Render boasts a strong advising team, including Brave browser CEO Brendan Fich, Beeple, and more.

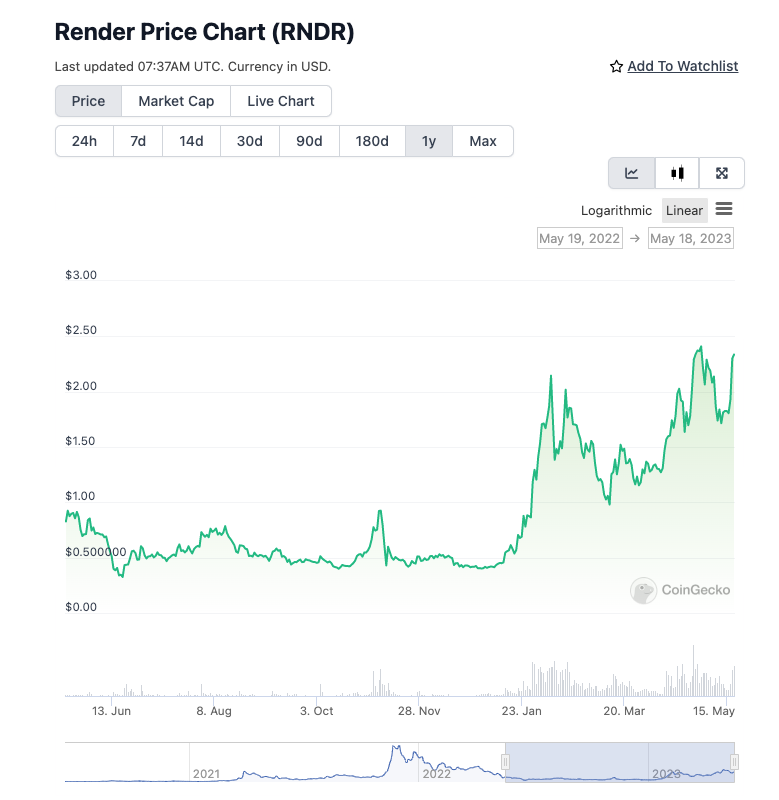

$RNDR currently ranks in the top 100 coins by market cap with over $650M and a fully diluted valuation over $950M. Since the start of 2023, $RNDR has appreciated by ~300%, reaching a high at $2.6, still far from the all-time high in the upper $8 range back in 2021. This was the outcome of the launch of the Render Network Foundation and the introduction of a new tokenomics model with RNP-1.

RNP-1 introduced a Burn and Mint Equilibrium (BME) system similar to Helium’s Burn-Mint Equilibrium. With this update, $RNDR will continue being the payment denomination between creators and node operators. However, users now burn the required amount of $RNDR in exchange for non-fungible work credits which are then distributed to node operators.

This approach provides a more flexible and responsive mechanism for balancing supply and demand within the Render Network. By dynamically adjusting the number of tokens minted based on the needs of the marketplace, the network could more effectively incentivize participation from both creators and node operators.

With RNP-1, $RNDR would be treated as a commodity asset, which aligns with the network’s long-term aim of establishing a standard for tokenized computing power. Besides, $RNDR would have the potential to become a deflationary asset, creating strong token value accrual when the Render network experiences high utilization.

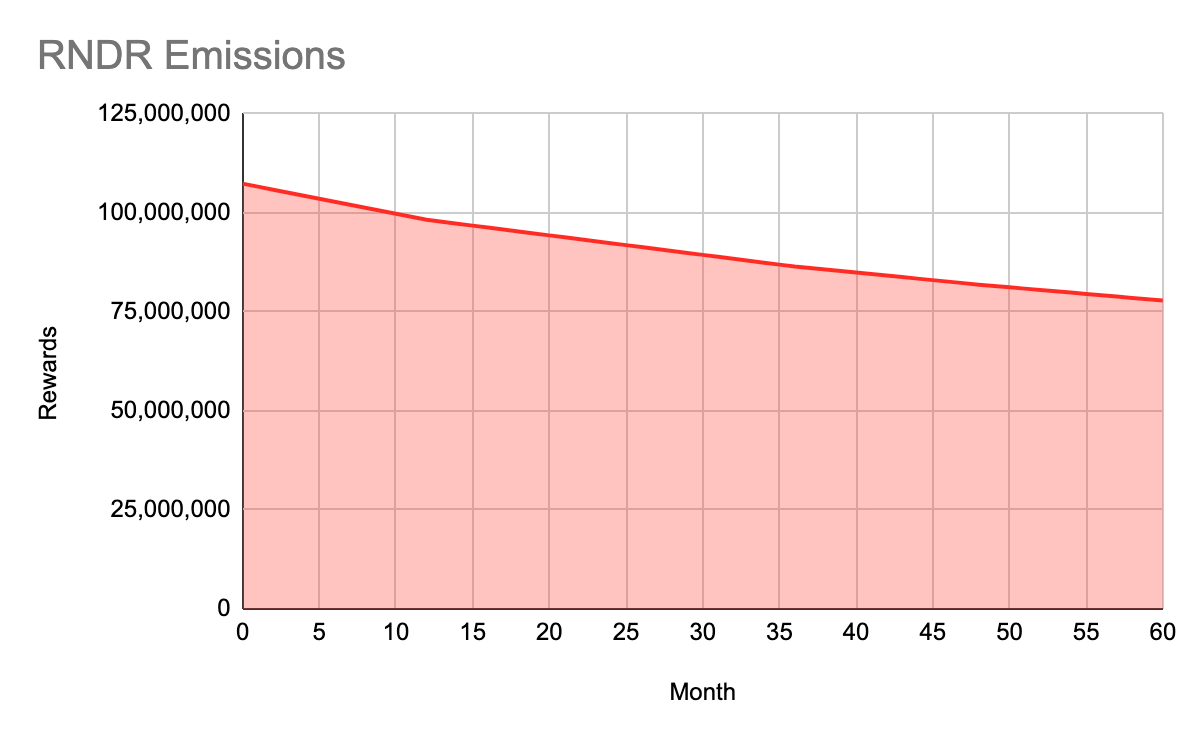

The proposal also introduces changes in the emissions schedule to cap net emissions

Schedule emissions spreadsheet: https://docs.google.com/spreadsheets/d/1vgNamfJsJeCOUnFGtrdBw7GJCtN25bXEIFOluJQAO64/edit#gid=365524340

As Apple’s WWDC (World Wide Developers Conference) approaches (June 5-9, 2023), the interest in AI-related tokens like Render increases significantly. It’s also worth noting that a 1-year free OctaneRender subscription is now included in mac pro product purchases, which could increase demand for $RNDR from actual content creators rather than just crypto market speculators.

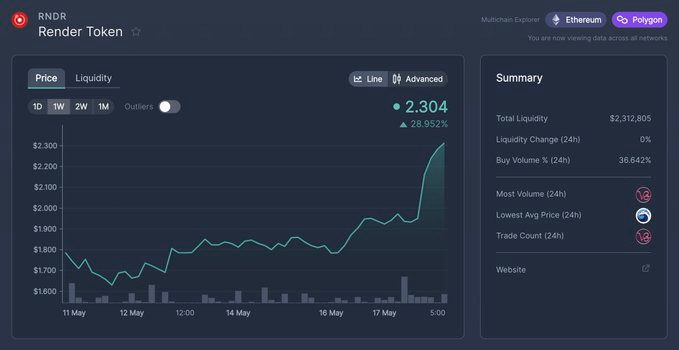

In anticipation of GPU-intensive technology being revealed, the $RNDR token price increased by 37% to $2.39. This is quite a rapid increase considering $RNDR’s $0.4 price at the beginning of the year. The token now sits close to the top 50 ranks by market cap. Being close to the Apple conference might be indicative of a very short-term rally and, while it can be reasonable to value $RNDR as a token that should belong to the top 50, its fast appreciation makes it less attractive for buying at the moment.

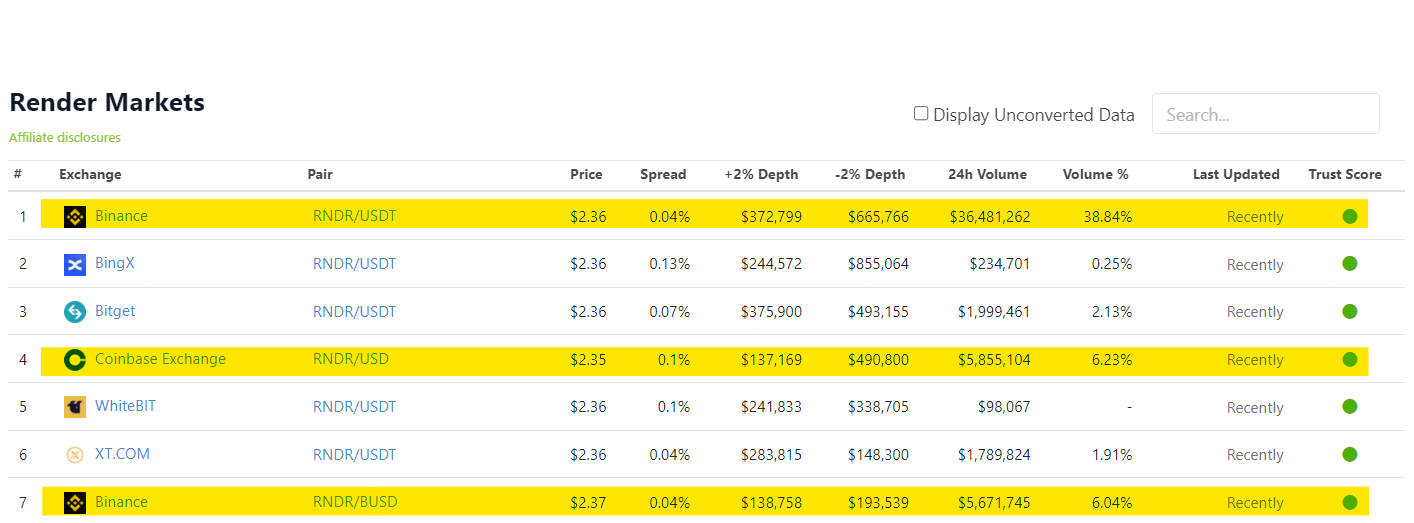

In light of $RNDR’s rapid price climb, many might expect a retrace back to lower levels. This is supported by $RNDR’s market depth. Here we can see there is significantly more ability for the market to absorb a -2% decline in $RNDR price, vs a +2% increase. This signals that more people think the price will go down and have placed limit orders at these lower levels accordingly. None of this data is significant in isolation and can change quickly, however, one should still be aware of this when considering a position.

Should the price of $RNDR fall significantly, taking a position might be more attractive, as Render continues to show potential for a bright outlook in the near to mid-term future.

Render is a project that brings a tangible use case to help power the future of VR/AR, AI, and other future trends, though this doesn’t necessarily justify taking a position during peak levels of interest. If you are bullish on AI development and GPU demand increasing, as well as Render’s unique decentralized GPU rental market, it may be worth waiting to accumulate some $RNDR. These growing trends in tech will have strong economic impacts on the world in general, certainly not just crypto. This makes $RNDR a unique potential play, as a lot of its positive or negative considerations have to do with things outside of crypto, and more related to the progression of technology as a whole.

Major cloud providers, like AWS, Microsoft Azure, Google Cloud, or Oracle sell GPUs on an always-on basis, meaning that customers often pay for server capacity that they are not actually using. For enterprises with cost constraints, this is not an affordable option in the long term. As time goes by and demand for GPUs increases due to AI development and advancements in entertainment, the need for an on-demand network where you only pay for what you use becomes more significant.

Decentralized compute networks like Render offer a solution to this problem. The Render Network bridges the gap between supply and demand for GPUs by tapping into consumer GPUs (cheaper graphics cards made for less precise use cases) and idle GPUs, increasing the supply of available resources while offering a low-cost alternative.

As the world becomes increasingly virtual, the demand for high-resolution graphics is escalating rapidly and pushing the limits of traditional rendering technology. This is a trend that is showing no signs of stopping; some even hypothesize that the rise of AI will eliminate the need for a majority of the working class in developed countries to work. Instead, people may find themselves turning to hyper-realistic virtual worlds as their primary sink of time.

Whether this plays out or not, it can’t be denied that entertainment has become more and more virtual, and more and more realistic. This transformation is not only changing the way we interact with the world but also introducing new levels of complexity for content creators and editors in the entertainment industry.

Render is uniquely positioned to disrupt the traditional GPU rental market, which is currently dominated by major cloud providers. By leveraging the vast amount of wasted computing power in consumer-grade GPUs, the Render Network can dramatically reduce the cost of GPU-based computation. This not only makes rendering more affordable but also increases the total number of renderings that can be performed and reduces the time required to complete rendering jobs.

By being at the intersection of blockchain, AI, and VR/AR, Render has the potential to capitalize on billions in liquidity inflows to these sectors. This will drive significant growth in the use of GPU-based computation, opening up new possibilities in fields ranging from entertainment to scientific research.

While the $RNDR token has seen significant price appreciation already, most of its emissions are completed. $RNDR can be a crypto-native way to bet on the rise of AI as a whole, and thus the rise in demand for GPUs.

With a strong Founder and advising team and a track record, it isn’t out of the question to think that Render can potentially compete with some of the smaller cloud service providers for market share and make significant ground over the coming months.

Revelo Intel has never had a commercial relationship with Render and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.