Published: August 2, 2023

In July 2023 Liquity engaged Revelo Intel to perform a Risk Review of their native stablecoin $LUSD.

The purpose of this report is to provide an understanding of the $LUSD product, its operational aspects, and its performance and to identify the risks that exist within the ecosystem.

We have also made considerations on how these identified risks impact competing stable coins (both centralized and decentralized)

This report does not go into the technical (smart contracts) details of the Liquity Protocol or the $LUSD stablecoin.

Revelo Intel is an independent research platform that serves as a source of reliable, consistent, and unbiased crypto research. Our analysts cover a wide variety of projects and events, in the form of comprehensive research products and services.

If you would like to enquire about this report or any of our services please contact us at support@revelointel.com

The information in this report is provided for informational purposes only. You should not construe such information as legal, tax, investment, trading, financial, or other advice. Mentioning any of the assets in this report is not an endorsement to purchase them.

Any views expressed in this report by us were prepared based on the information available to us at the time of writing. This information can change or additional information can present itself that could cause these views to change. Information may quickly become unreliable for various reasons, including changes in market conditions or economic circumstances.

Liquity USD ($LUSD) is a decentralized, immutable, over-collateralized, and governance-free stablecoin. $LUSD is minted when users deposit collateral and take out loans within the Liquity system.

The process of depositing collateral and borrowing $LUSD is referred to as opening a “Trove.” Each Trove is linked to an Ethereum address and each address can only have one Trove.

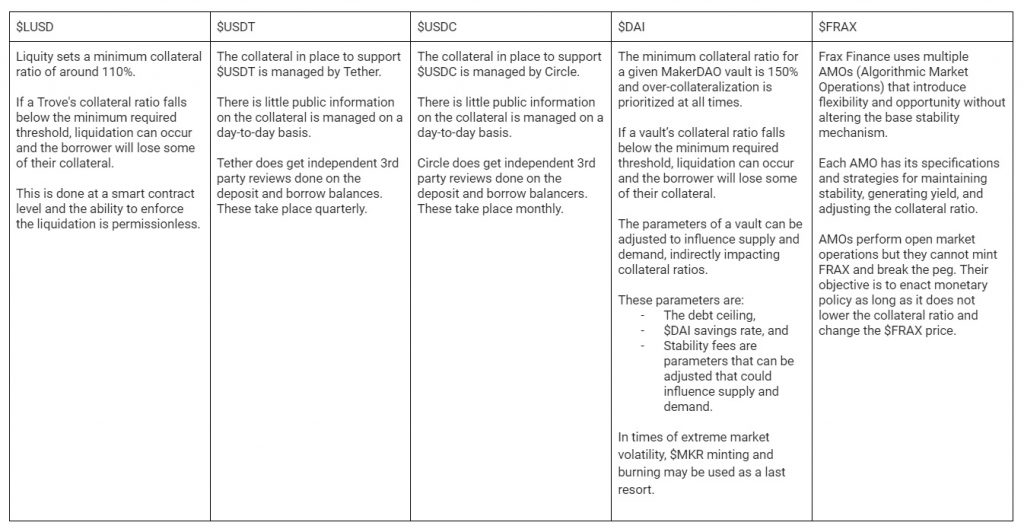

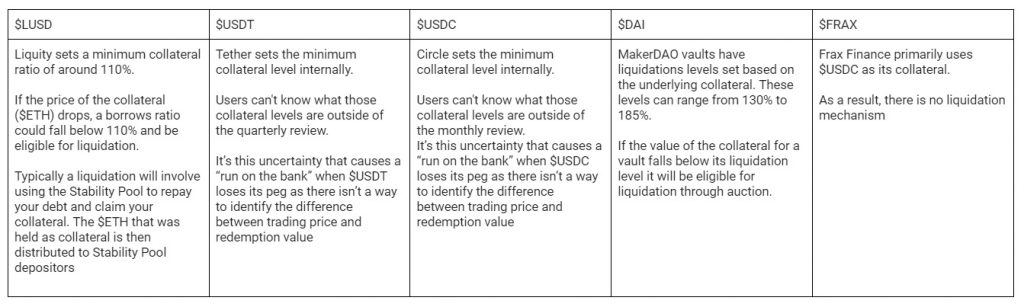

$LUSD is backed by Ethereum ($ETH), and users can borrow against their $ETH holdings with a minimum collateral ratio (CR) of only 110%. This translates to a 91% loan-to-value.

The low CR rate allows for capital efficiency and offers a competitive borrowing option to users. Borrowing $LUSD does not come with an interest charge, rather, there is a fee charged when $LUSD is borrowed or when collateral is redeemed.

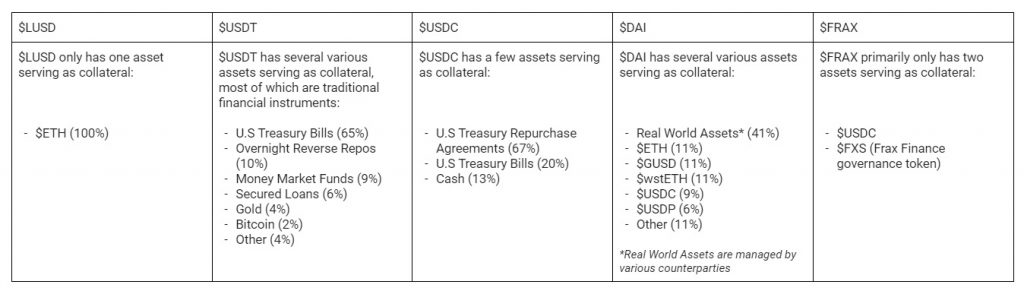

$ETH is the only collateral available in the ecosystem.

The following characteristics of $LUSD make it different from its competitors:

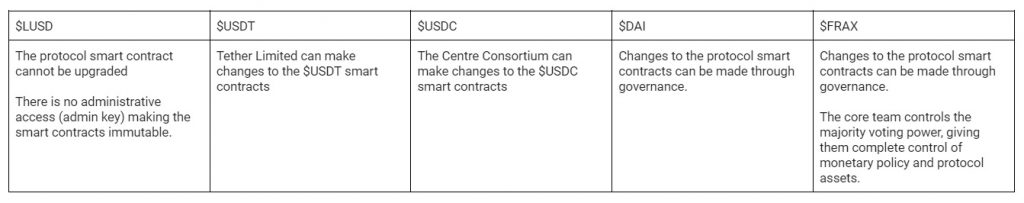

1. Immutable smart contracts

The Liquity protocol contracts are immutable and algorithms set the one-off fee based on market conditions. Because of that parameters around: interest rates, collateralization ratios or collateral assets cannot be changed.

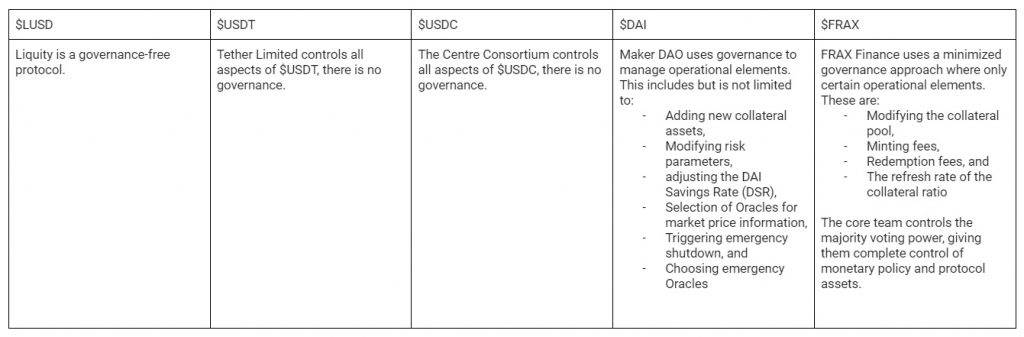

2. It is Governance Free

As the contracts are immutable, there is no model in place to govern $LUSD.

Other Collateralized Debt Positions (CDPs) protocols have a governance process that allows for the voting on parameter and/ or collateral changes. Therefore, these protocols carry the risk of a governance attack.

3. No interest charged

Liquity uses a direct feedback system enforced by borrowing and collateral redemption fees within a 0.5% – 5% range. Loans are secured by being overcollateralized, and due to the absence of dynamic and unpredictable interest rates, users can draw interest-free loans in $LUSD.

This feature ensures the stability and predictability of the protocol.

Most protocols that use CDPs rely on variable interest rates to incentivize or disincentivize borrowing. This means that the interest paid by borrowers is not the net outcome of their own debt but of the debt levels in the ecosystem.

4. Collateral Options

Liquity only uses one collateral option to mint $LUSD, that is $ETH

Other CDP protocols accept a variety of collateral options. These collateral assets may be highly volatile or have low on-chain liquidity. This could sacrifice peg stability and might increase the chances of accruing bad debt, since liquidations may not be feasible or executed timely whenever sudden price drops occur. To manage these risks, these issuers often increase their minimum collateralization ratios, thereby decreasing their capital efficiency.

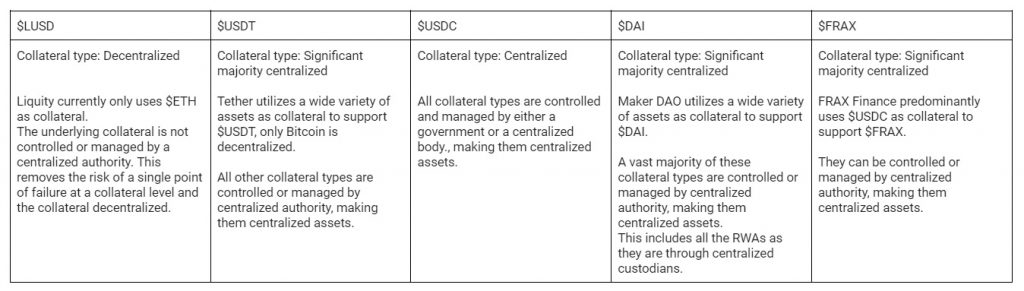

5. The underlying collateral is decentralized

The protocol’s automated monetary policy ensures that the protocol has no dependencies on the off-chain world. As an example, by not being backed by $USDC, censorship whitelists have no effect.

Within Liquity, there are two ways in which a user can generate yield:

The Troves are responsible for keeping track of the collateral and debt balances, these balances can be adjusted by adding/removing collateral or repaying debt.

The Stability Pool is the first line of defense against insolvency. It is used as a source of liquidity for repaying debt from positions eligible for liquidation. This mechanism ensures that the total $LUSD supply remains fully backed at all times.

How it works: if the value of the $ETH collateral decreases, a Trove can experience a liquidation event. Should this happen, $LUSD is taken from the Stability Pool to settle the impacted portion of the debt. In the process, some of the underlying $ETH collateral is claimed and distributed evenly to depositors of the Stability Pool.

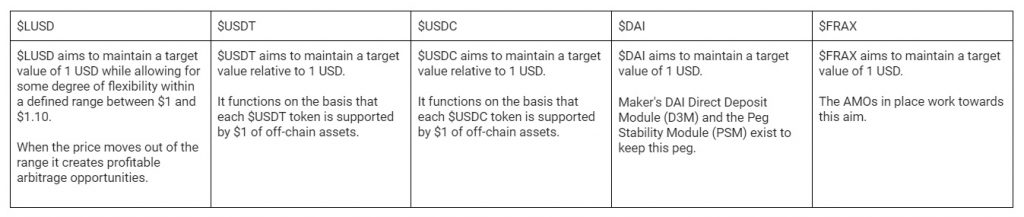

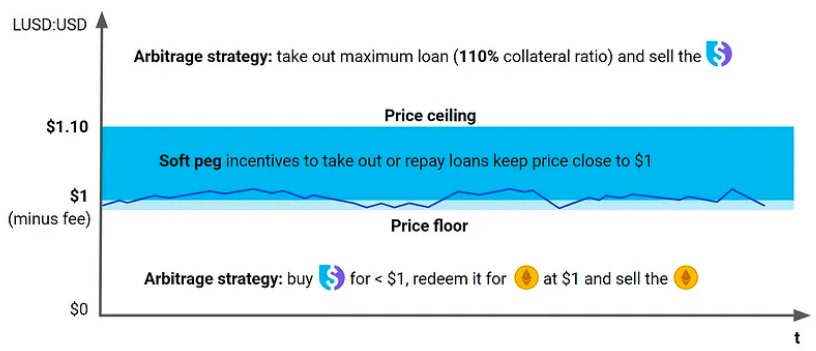

$LUSD aims to maintain a target value relative to 1 USD while allowing for some degree of flexibility.

This is achieved through the combination of: 1) having a minimum collateral ratio of 110% and 2) treating all $LUSD debt as being equal to $1. These two factors allow the protocol to create a floor and ceiling price range

In practice, this is done through two arbitrage opportunities:

1. $LUSD price falls below $1

As the system regards all $LUSD debt as being equal to $1, there is an opportunity to buy “cheaper” $LUSD to repay the “more expensive” debt recorded in the system.

There is also an opportunity to redeem collateral from Troves at risk at a discounted value (after factoring in redemption fees).

2. $LUSD price goes above $1.10

As the minimum collateral ratio is set at 110% if the price of $LUSD goes above $1.10, there is an opportunity to deposit $ETH, borrow the $LUSD, and sell the $LUSD for a profit.

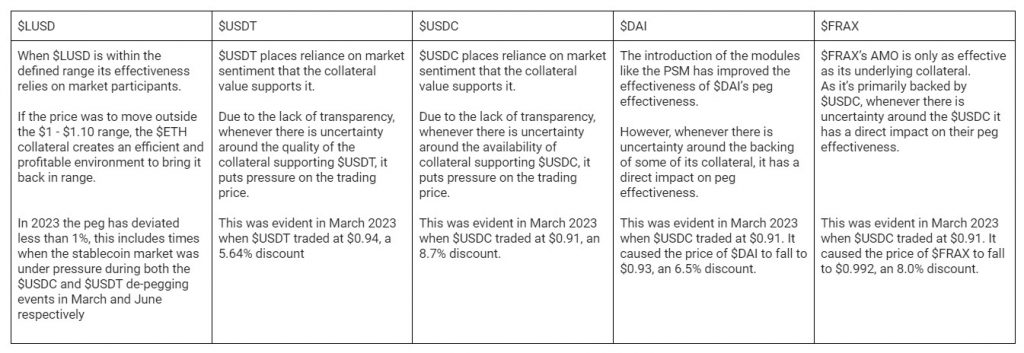

When $LUSD is within the $1 to $1.10 range a soft peg is adopted. It relies on market participants and adjusts to changing borrowing and repayment patterns. The soft peg serves three purposes:

This range allows slight fluctuations in the price of $LUSD slight fluctuations, encourages active trading, and enables price discovery without significant price slippage.

When interacting with $LUSD on the Liquity protocol, the three main aspects to consider are:

1. The impact of the soft peg on borrowing

The nature of the peg does not necessarily create significant risks around borrowing.

It provides stability and predictability to borrowers. For example: at the time of repayment, the price of $LUSD is $1.02, and the user needs to buy $LUSD (they don’t have any readily available), it is implied that they will incur a 2% fee.

The user knows that the cost of repayment will always be in the 2% range.

At the same time, minting and borrowing fees can be temporarily adjusted (based on the number of $LUSD minted or redeemed) which incentivizes actions that restore the peg. Borrowers can take advantage of this to potentially generate profits.

A soft peg allows for the potential of additional leverage compared to stable coins with a hard peg. This is due to the arbitrage opportunity that exists in the difference between the price of $LUSD debt ($1) and the soft peg (trading price).

2. The Benefit and Risks of the Stability Pool

The Stability Pool in Liquity plays a crucial role in maintaining the stability and solvency of the protocol. $LUSD holders are incentivized to deposit their funds to the Stability Pool and receive revenue denominated in $ETH from liquidated collateral as well as $LQTY rewards.

Operationally this is the process where a borrower’s collateral value falls below the required threshold and triggers a liquidation event, the Stability Pool provides the necessary liquidity to repay the debt, protecting the system from becoming undercollateralized.

During times of increased loan repayments, the stability and effectiveness of the Stability Pool rely on market conditions. If there is a severe and prolonged downturn in the market, with a significant number of liquidations and collateral losses, the Stability Pool’s capacity to cover the debt obligations may be strained.

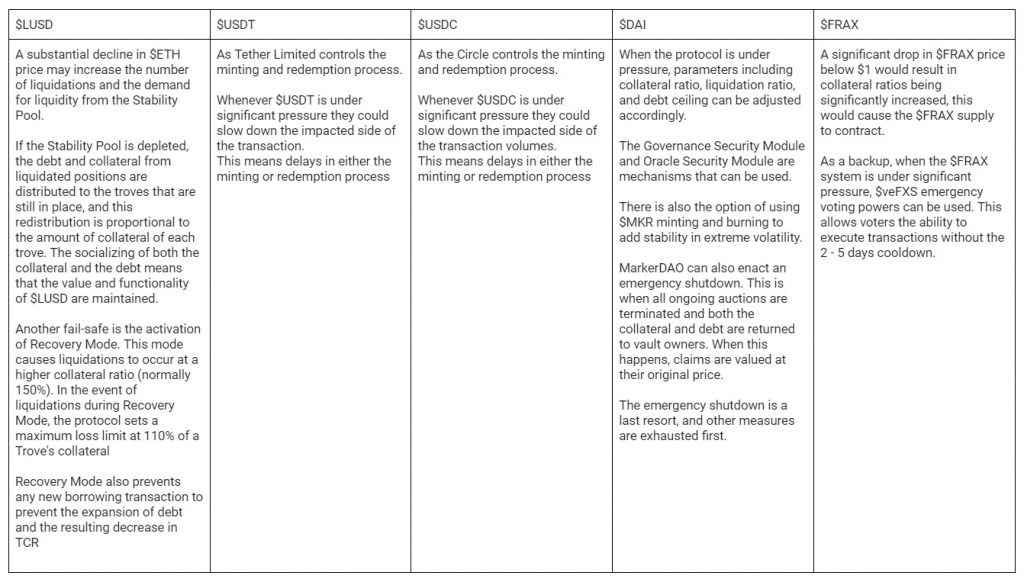

If the Stability Pool is depleted, the debt and collateral from liquidated positions are distributed to the Troves that are still in place, and this redistribution is proportional to the amount of collateral of each Trove. The socializing of both the collateral and the debt means that the value and functionality of $LUSD are both maintained.

As troves will always be overcollateralized, it creates an incentive to deposit into the Stability Pool. This is driven by Stability Pool depositors earning $ETH from insolvent loans on a pro-rata basis. The notional value of this $ETH is around 9% higher than the amount of $LUSD used to cover the debt (the math, if you factor in the 0.5% of $ETH collateral given to liquidators, comes out to be 9.45%, but it averages out to 9% because of $ETH’s volatility).

3. Recovery Mode

The Liquity protocol keeps track of the Total Collateral Ratio (TCR). This represents the ratio of the USD value of the entire collateral (at the current ETH-USD price) compared to the USD value of all the debt in the system. In other words, the TCR is the USD sum of all $ETH collateral divided by the USD sum of all $LUSD debt.

When the TCR drops below 150%, Recovery Mode is activated to encourage collateral top-ups and debt repayments. When in this mode, Troves with a collateral ratio below 150% are liquidated and the system disallows further borrowing in order to increase the TCR.

When a user is liquidated while in Recovery Mode, the loss is capped at 110% of the Trove’s collateral.

Since its launch, Liquity has only entered Recovery Mode once, which was on May 19, 2021, and lasted for approximately 2 minutes.

The combination of these three features ensures the stability and predictability of the protocol.

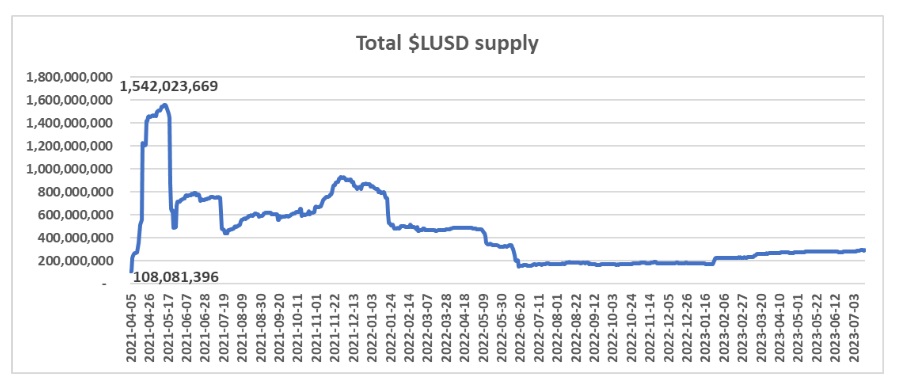

The supply of $LUSD is influenced by the market’s appetite to extend its $ETH spending power. When more users open up Troves, more $LUSD is minted, increasing the supply. Alternatively, when users repay their Troves, $LUSD is burned, decreasing the supply.

The supply of $LUSD reached its peak in May 2021. This can be attributed to the bull market at the time, which led to an increase in borrowing activity. It also benefited from $ETH’s price appreciation, which allowed users to increasingly draw higher amounts of debt while maintaining a CR of 110%.

Soon after there were liquidations across the industry, and in a very short period the price of $ETH fell from $3.4k to $1.8k. This sharp decline in collateral ($ETH) price caused over 300 liquidations and, for approximately 2 min, the protocol entered and then exited Recovery Mode. This is the only time that the protocol has entered Recovery Mode. Users looking to protect their collateral responded by settling their debt which caused a sharp decrease in the $LUSD supply. The result was that very early in the Liquity life cycle, the protocol survived a significant stress event.

There are currently 293m $LUSD stablecoins in circulation

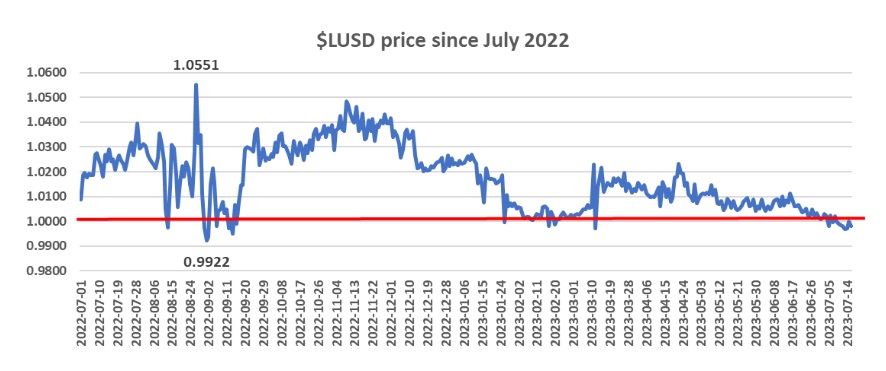

Since July 2022, the standard deviation of $LUSD has been 0.5%. In 2023 the standard deviation has been 0.42%. Over the last 12 months, the highest price achieved by $LUSD was $1.0551 (2022 August 08), and the lowest was $0.9922 (2022 September 01). Over this period, the price closed below $1 on 22 days. The design of the soft peg and profitable arbitrage has been effective in maintaining the peg.

Enhancements that have aided the peg performance are:

The majority of the $LUSD supply is on Ethereum mainnet and Layer2s, like Arbitrum and Optimism.

$LUSD can be deposited in the stability pool to earn $ETH from liquidated collateral and $LQTY rewards, currently returning 2.7% on $172m (as at July 2023) excluding $ETH obtained from liquidations.

Other opportunities include providing liquidity on Curve and staking the LP tokens on Convex. For example, the LUSD+FRAX base pool on Curve has a current vAPR of 7.98% (as at July 2023) on Convex (with 7.09% coming from $CRV vAPR), which can be increased to 8% depositing on the Convex’s Frax Booster.

Compared to other stablecoins, interest-free loans of $LUSD are more attractive for borrowers who plan to maintain their loans for a relatively long period. The minimum collateralization ratio of 110%, is lower than most DeFi protocols. The combination of these two factors can result in borrowing through Liquity being 7.5 times more cost-effective than alternative options.

Compared to competitors that offer a version of staked $ETH as collateral, Liquity still has the cost-benefit of not charging interest on an open loan. For competing protocols, during times of market volatility, the interest on the debt borrowed can exceed the yield from the staked $ETH.times of market volatility, the interest on the debt borrowed can exceed the yield from the staked Ethereum.

Loans using staked $ETH as collateral carry the added risks of the performance of the $ETH staking pool and slashing risk.

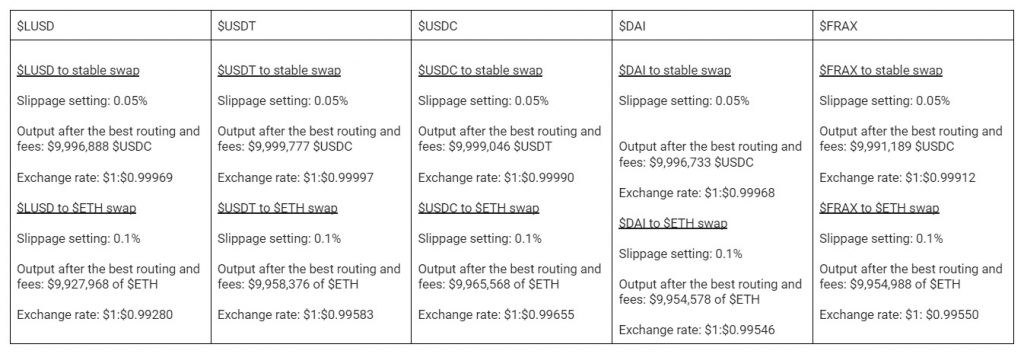

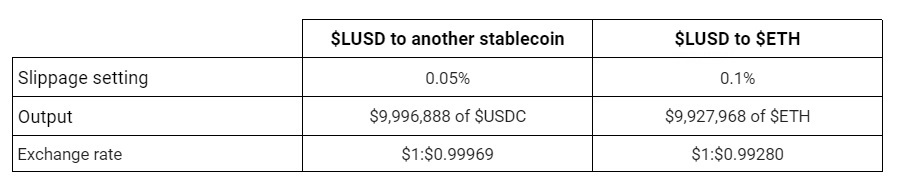

When it comes to trading, this can primarily be done on the Ethereum network. When using the DeFiLlama Meta-DEX aggregator trading $1,000,000 has the following outcomes (as at July 2023):

Compared to other stablecoins, $LUSD archives similar results to other stablecoins. A full comparison is included in the Liquidity in the market to trade with size section of this report.

Please note: Quotes were sourced based on pricing available using the DeFiLlama Meta-DEX aggregator on the Ethereum network. This pricing is subject to change based on available liquidity on the network