Published: July 8, 2023

Accumulation opportunity based on a redefined lending model and long-term growth expectations

Gearbox was launched on October 30, 2022. The project is a leverage protocol that works as a standard lending platform. Where Gearbox differentiates itself is that there are two different user profiles:

The protocol also uses the term “composable leverage”. This phrase means that anything can technically be used as collateral for leverage: NFTs, LP tokens, ERC20s…

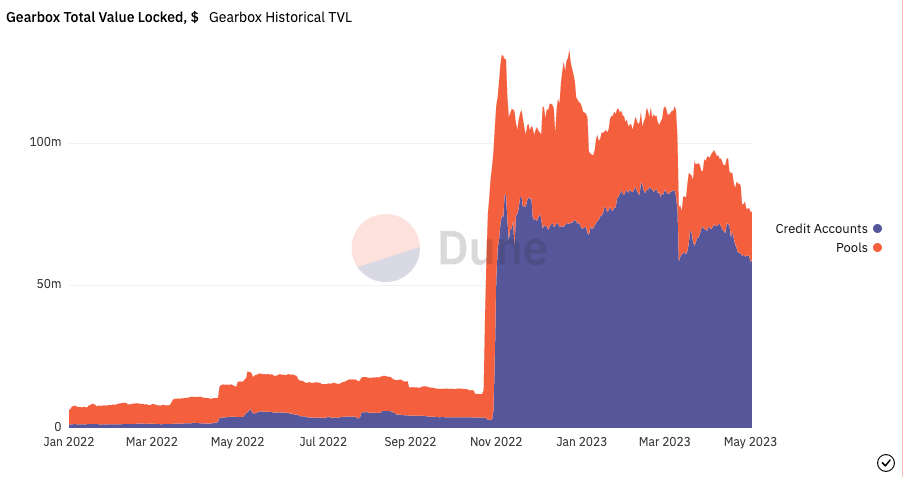

Since its launch Gearbox has crossed >$100M in TVL in Ethereum alone. They’ve also accrued $0 in bad debt, and have experienced the first glimpses of product-market-fit. Now, they’re scaling the product with more pools, more assets, and more sources of liquidity. During Q1, Gearbox managed to ride the LSD narrative. It took advantage of the fact that it could offer its users up to 10x leverage on their liquid staking derivatives positions. By adding support for long-tail assets and serving the needs of riskier borrowers, the protocol intends to increase the demand for both its core product offering and the $GEAR token.

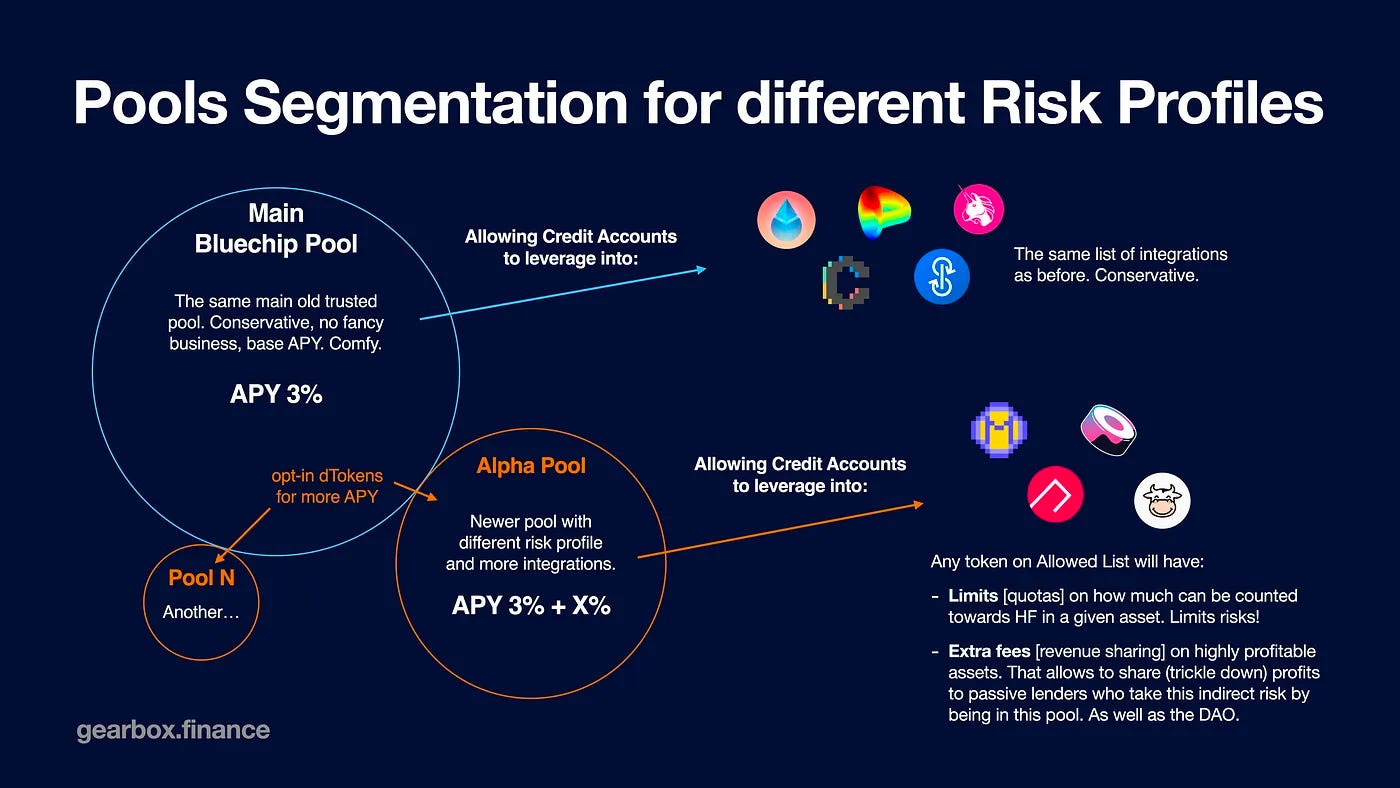

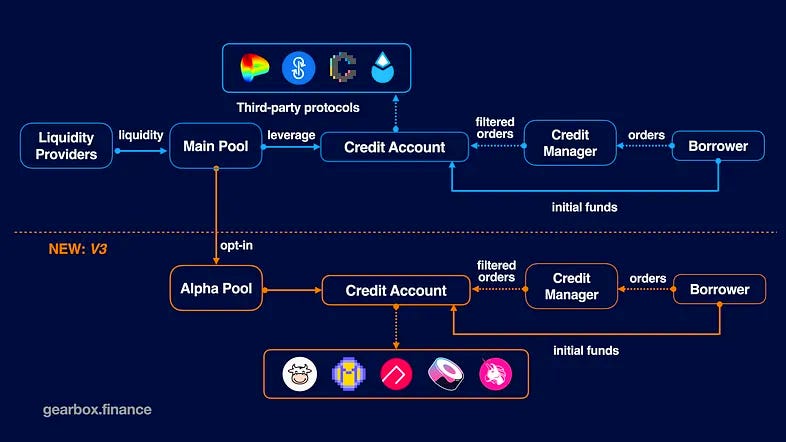

Just 4 months after the launch of V2, the V3 tech stack was unveiled, and the code was sent to audit. The update comes with multiple redefining features including:

In Gearbox, Credit Accounts are isolated smart contracts that contain both the user funds and the borrowed funds. With the introduction of long-tail assets, there will be a wide range of strategies that all borrow from the same pool. To make this possible, the actual amount of asset used as collateral on a particular Credit Account is determined by a quota (denominated in the underlying asset). Quotas are effectively limits on the overall exposure that the protocol will have to a certain asset or integration.

Borrowers can set any quota value they want, and this will determine how much of the asset is counted towards the health of their account. Similarly, borrowers will pay interest based on the size of their quota. Besides, there is a total limit per asset, such that the total sum of all quotas must not exceed the total limit of an asset. This determines the maximum sum of quotas on all accounts for a particular asset. If the limit is reached, users can’t increase their quotas until one of the existing Credit Accounts reduces theirs.

In order to adequately manage and compensate LPs for the risks they are taking, the DAO will be responsible for much of the decision-making around the protocol. A $GEAR voting process will be used for controlling parameters including:

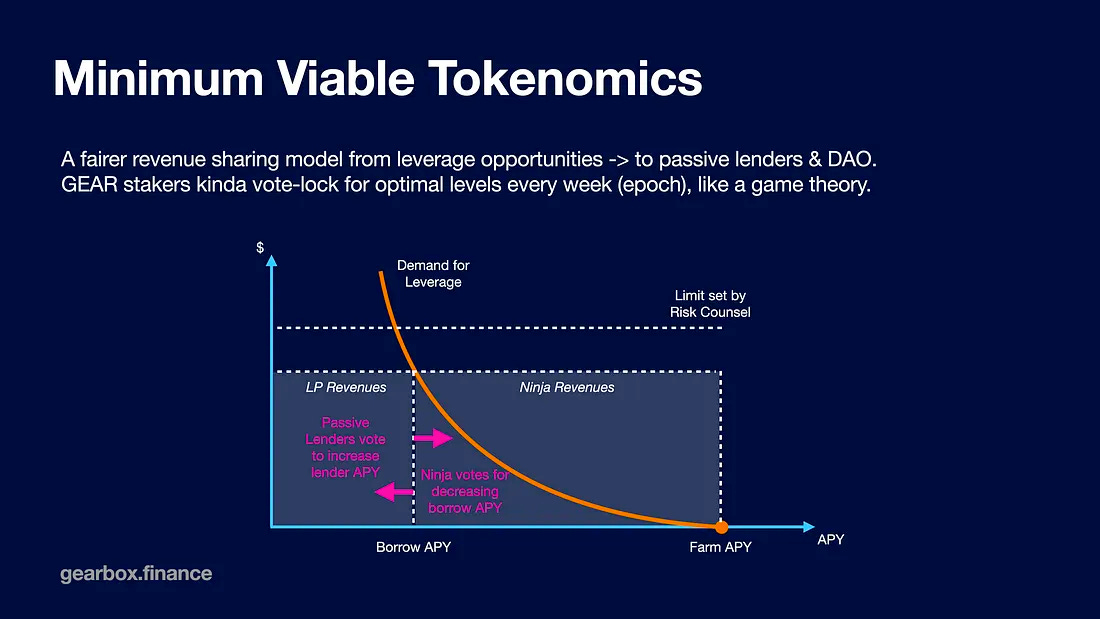

However, this sort of risk premium/revenue share tweaking needs to be constant in order to reflect changing APYs from strategies and changing risks associated with certain assets. Because of this, Snapshot voting is not as effective as it would be for other projects. Instead, a more continuous approach is needed.

Because the quota is set for each strategy, the balance of strategies is not a security term. What this does is offer is a way for the protocol to charge users higher rates for using lending pools for high-risk/reward farms.

A continuous governance approach will be the initial use case for $GEAR. For each asset, there will be 2 parameters that will both be reviewed periodically:

In this regard, the interest rates on quotas are subjective Choices to be made around interest rates include deciding which tokens should have high rates relative to others, what is a fair quota rate for borrowers to pay lenders, and more. this is where the utility of the $GEAR token comes in.

Gearbox addresses the subjectivity of interest rates on quotas by utilizing the native token to enable decentralized decision-making. A weekly voting epoch system will be implemented. This allows users to stake $GEAR tokens for a specified duration, which is determined by the DAO (most likely a withdrawal lockup of 1-4 weeks). Stakers will then be able to vote on interest rates for each individual asset.

This approach is designed to prevent flash voting and the misallocation of capital across various pools or assets. Each asset with a quota will have its own gauge integrated into the voting interface. $GEAR stakers can choose to vote in favor of either borrowers or lenders for any given asset.

Interest rates will be recalculated at the end of each voting epoch based on the votes cast at that time. All existing votes will be automatically carried over to the next epoch. This maintains an ongoing and dynamic interest rate determination process that is driven by GEAR token holders.

Active governance participation in the form of voting creates a Minimum Viable Token (MVT) model that introduces a very specific use case for $GEAR. On the other hand, the business model still lacks a revenue-sharing feature for $GEAR holders. The combination of these two factors will determine the aggregate buying pressure for $GEAR in the near future.

While revenue sharing can be an appealing incentive for token holders, it is important to consider that the Gearbox protocol is still in its early stages. Profit-sharing mechanisms for stakers or a safety module can be implemented later. Insights from DAO discussions indicate the significance of having an additional revenue source for the business. As such, stakers should expect a percentage of extra revenue in the future. In the meantime, the DAO will hold discussions to deliberate on the optimal value accrual strategy.

Currently, the protocol has minimal revenue and substantial growth potential. Consequently, sharing revenue may not be the most effective strategy during the early development phase. It should also be noted that distributing $GEAR tokens to $GEAR stakers does not inherently benefit the protocol. This practice is analogous to single-side staking of a governance token to receive inflationary rewards. As has been the case with many tokens, this style of incentivization often leads to selling pressure in the market from those liquidating their rewards.

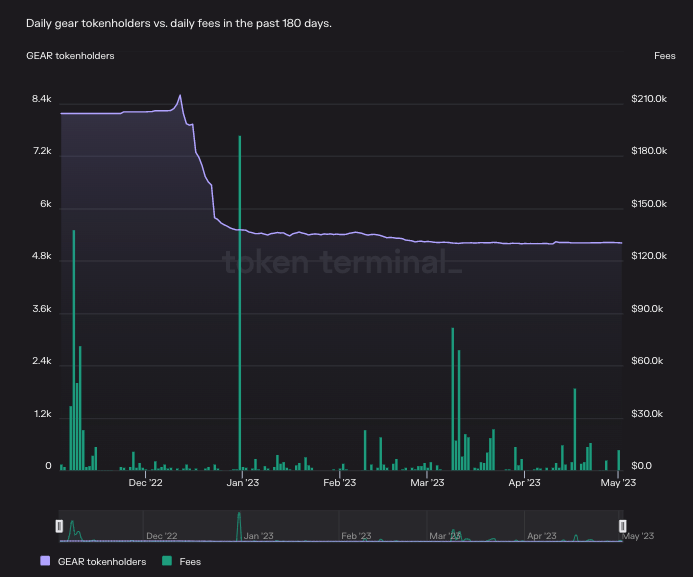

Except for very specific days with unusually high activity, Gearbox generates between $10K and $20K a day. The majority of this goes to liquidity providers (lenders) as supply-side fees.

Currently, there is regulatory ambiguity surrounding revenue sharing. If Gearbox is being governed by ‘shareholders’, it may face much less scrutiny from regulators. The DAO aims to establish a mechanism that encourages users to engage in activities that promote decentralization and foster more active participation in the protocol. For example, it may not be appropriate to grant $GEAR rewards to those who stake and vote in the Quota system gauges but do not hold Credit Accounts or serve as liquidity providers (LP users).

Currently, the majority of lender yield in the protocol is derived from liquidity mining incentives, which positions $GEAR as a customer acquisition tool. Gearbox’s upcoming V3 release comes with the introduction of riskier and more rewarding strategies. It is anticipated that this will present enhanced yield opportunities for participants.

It is worth pointing out that Frax is lending $2M in the FRAX pool, Yearn is lending $2.5M, and Balancer is lending $3.5M.

$GEAR is being used to create revenue as a customer acquisition cost in the form of incentives. Because of this, it would make sense to use that revenue to prop up the value of $GEAR, especially in a period of growth where the number of users is steadily increasing.

The DAO has manifested its intentions to come up with value accrual mechanisms for $GEAR such that there’s a good likelihood the token becomes a key component of the economy. In the meantime, short-term actions are being taken in order to encourage more participation and attract new users.

For instance, there is an ongoing liquidity mining campaign for $GEAR/$WETH liquidity providers on Curve. These users can stake their LPs in Gearbox to earn ~20%. The vast majority of this comes from $GEAR token incentives.

Similarly, GIP-51 approved to allocate $GEAR to Balancer/Aura g-USD pool bribes for $vlAURA holders that vote for the Balancer Boosted Gearbox USD pool. This is a Balancer boosted pool that earns yield from swap fees, $AURA/$BAL rewards, and $GEAR rewards. A portion of the yield goes to the DAO treasury and $veBAL while another portion is used to bribe voters to vote for the pool.

Market Opportunity vs. Opportunity Cost

While inflationary rewards can sometimes be seen as value-dilutive, they may offer strategic advantages during an extended bear market. Early participants in a liquidity mining program can leverage this opportunity to accumulate rewards over time if they have belief in the token. This enables them to amass a small-cap token, with its price close to or even below its Token Generation Event (TGE) level, which can later be utilized to generate actual yield and serve other use cases within the protocol. This approach allows investors to benefit from the growth potential and future utility of the token as the platform matures.

Gearbox must develop a long-term strategy that does not depend on third parties to ensure adequate $GEAR/$wETH liquidity. Adequate liquidity supports the ongoing liquidity mining program, enables new investors to enter, and promotes trading volume, which can raise awareness of the protocol. However, excessive liquidity can impede price discovery and lead to overspending by the DAO. Liquidity management should strike a balance. Constant changes can frustrate liquidity providers and aren’t worth the effort for minimal efficiency gains.

Currently, the Gearbox DAO generates roughly $1M annually and spends 3.33M $GEAR/month ($33,000/month) on liquidity. Although the DAO encourages actions that increase market liquidity through inflationary rewards, the treasury has maintained a stable state, ensuring sufficient runway for contributors and future development.

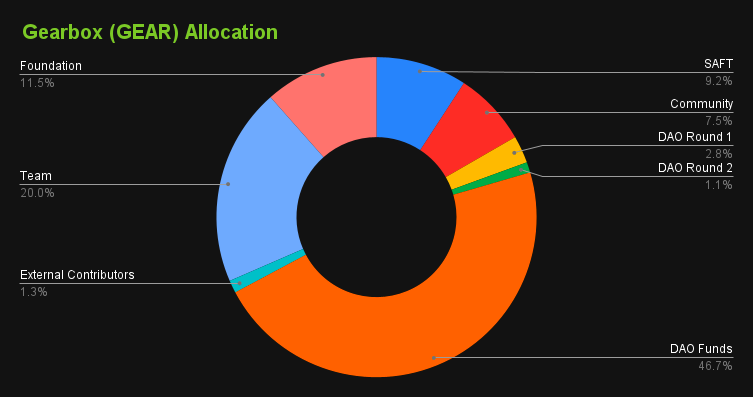

It is also worth noting that the $GEAR allocation reserves >50% of the total supply for the DAO and protocol treasury.

Following the price volatility in Q1, a governance dilemma has emerged arond the issue of liquidity mining incentives. The concern is whether these incentives create excessive liquidity. This abundance would enable early contributors to offload their tokens with ease. If token holders would prefer allowing the protocol to mature, this would provide an an exit opportunity at the cost of price slippage.

A smaller liquidity pool might discourage $GEAR holders from selling large quantities of their tokens, as they would face significant slippage. However, it remains to be seen how many new buyers might enter the market after the launch of V3, particularly since a long-term value accrual mechanism is still under development. This highlights the importance of striking a balance in liquidity management to support the protocol’s growth and stability.

The chart above overlays the number of $GEAR token-holders with the daily protocol fees. After the initial token sale and subsequent dump, there has not been excessive selling pressure for $GEAR. The protocol has managed to retain a steady number of $GEAR token-holders, regardless of the amount of fees being generated by the protocol.

It is reasonable to expect an increase in protocol revenue due to the addition of mid-tail and long-tail assets. The distribution of this revenue will be up to $GEAR stakers, and there is currently no reason why a vote on stakers getting a share too won’t be possible.

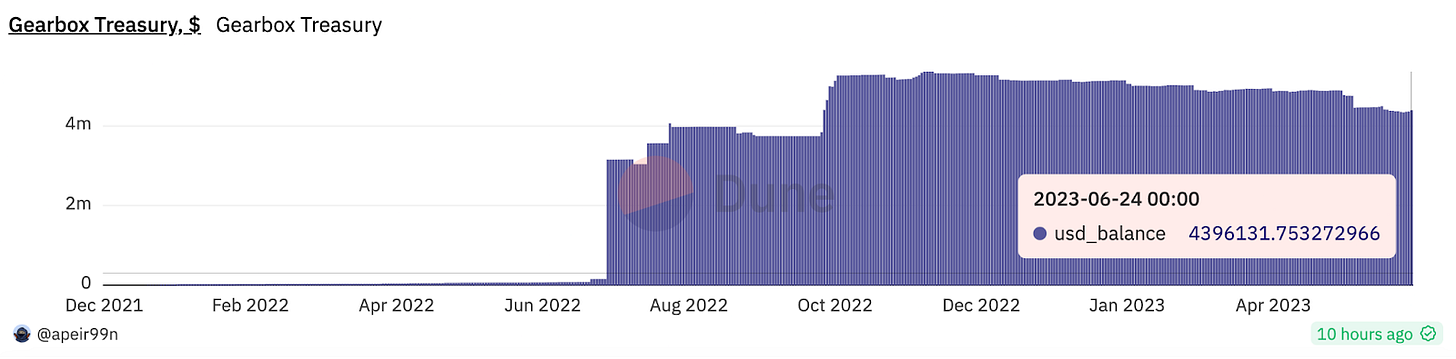

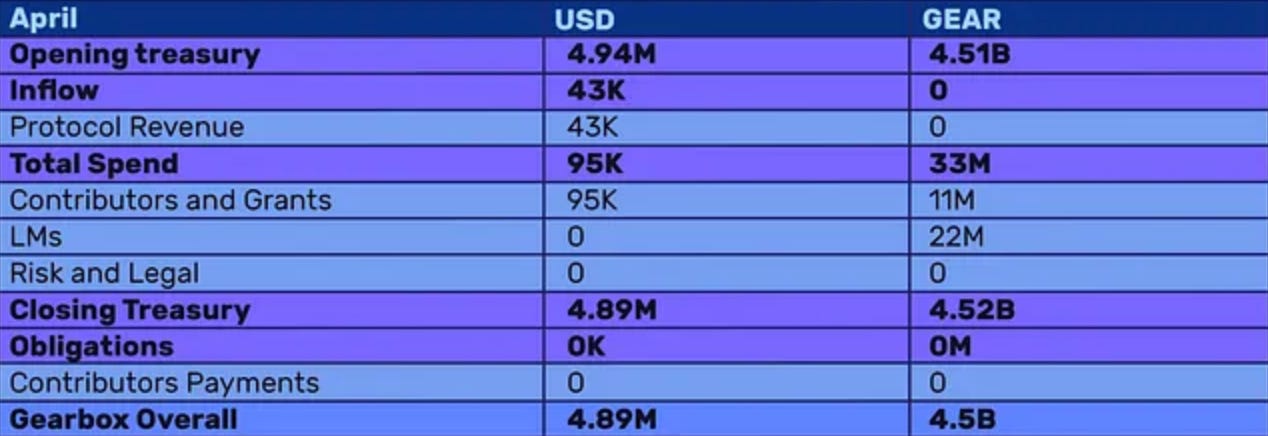

As of the end of April, the DAO treasury held $4.89M and 4.5B GEAR Tokens. By the end of the month, the realized revenue was $43,000 while expenses amounted to $95,000 ($64,000 allocated to contributors with grants and sub-DAOs funding making up for the rest).

For GEAR outflows, 22M were deployed as a part of the LM programs, and 11M were paid out to contributors.

This puts the DAO in a healthy financial place with a runway of over 2 years even after factoring in growth.

All things considered, it is expected to see volatile prices over the upcoming months. GEAR is a token with <$10M in market cap and ~$1M in daily trading volume. The TGE took place in December 2022. In less than 6 months and despite only being present on Ethereum, $GEAR has managed to achieve a FDV/TVL ratio below 1. This milestone has a lot of merit, especially considering the fact that the protocol has been operating during a guarded launch. Up until now, users had to request access in the governance forum and borrow a minimum of 100,000 $USDC, 100,000 $DAI, 75 $wstETH, 75 $ETH, or 5.5 $WBTC. These are rather large amounts for retail (~$13,000 as collateral would be needed to reach those levels with the maximum allowed leverage), which suggests that Gearbox might be positioning itself as the first DAO-governed protocol in reaching institutional adoption. This is evidenced by the DAO-to-DAO approach that the protocol has been taking, reaching partnerships with protocols such as Frax, Yearn, and Balancer. The protocol also has vault integrations with protocols like Brahma Finance and Mellow Protocol.

$GEAR currently stands at $55M FDV, which is ~66% lower than the FDV at which the DAO raised funds during its first two rounds. These rounds took place in August and September 2022 at a $150M FDV, including a 1-year lockup and 1-year linear vesting afterward.

Considering the adoption that the protocol has had, many may think $GEAR is relatively undervalued. While the project’s native token may still be rather inflationary, there is a lot on the horizon for Gearbox. This includes impactful voting on protocol parameters and the potential for revenue share. The token’s current FDV is ~ ⅓ of the venture raise price, with a market cap much lower at ~$6M. With all this in mind, a position in $GEAR may be worth considering.

Revelo Intel has never had a commercial relationship with Gearbox and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what