Published: June 27, 2023

Key Points

Bunni is a project built by the Timeless team. Even though Timeless Finance was the first product to enter the market, the deployment of Bunni ended up capturing the majority of the TVL (~$19M vs ~$200k) for the Timeless ecosystem. Timeless Finance is a yield-trading protocol, while Bunni is a Curve-gauge system for Uniswap positions.

Bunni brings an intriguing new rewards design to the DeFi landscape, being the first protocol to implement call options in the form of $oLIT as a reward for farmers. However, Bunni is not the first to think of this interesting innovation.

The announcement of ‘DAO Share Options’ (DSOs) was introduced by Tapioca DAO in their RIP liquidity mining article in October 2022. This piece captured the attention of many in the crypto community. It described the idea of using options as a way to attract non-predatory LPs. It also emphasized the importance of Protocol Owned Liquidity (POL). The idea was that since then, multiple projects started to adapt or redefine their token economic models in order to avoid overspending and becoming cash-flow positive.

There is often uncertainty when it comes to implementing a new economic primitive from scratch. Because of this, protocols would tweak the escrowed rewards of the original $esGMX model, for example. Or maybe a project would facilitate a dividends module where the protocol would share its revenue with token holders. However, one of the first protocols to take action and implement the principles put forward in Tapioca DAO’s post is Bunni via their $LIT token.

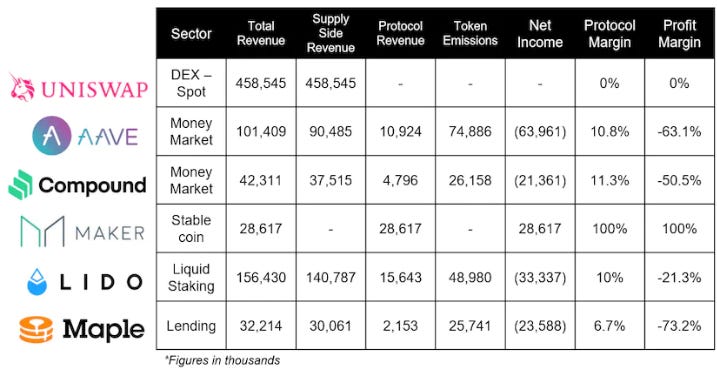

Liquidity mining is one of the unique properties of DeFi. It allows decentralized protocols to distribute ownership of their governance tokens through a series of economic incentives. For example, money markets will often reward borrowers with their native governance tokens in order to incentivize them to take out loans with the protocol. This makes it possible for users to “get paid to borrow”. This can be perceived by the market as a CAC (Customer Acquisition Cost) that will pave the way toward a sustainable revenue model. From money markets to DEXs, the typical expense used to calculate a dApps profitability is the token incentives they provide. If a project makes more in fees than it gives out in token incentives, then it’s in business. Of course, there are other protocol expenses like payrolls, but this sort of information is often hard to come by.

Liquidity mining unofficially began with protocols like Synthetix and Compound. These OG projects would subsidize borrowing costs for users through token emissions. At the time, the TVL of those protocols soared by more than 500%. Clearly, users are more likely to take initiative when provided an incentive to do so.

Back then, it was DeFi summer, and the success of smart contracts like StakingRewards.sol did not go unnoticed. Soon enough, more and more projects emerged with a similar strategy, and the competition for offering the highest APY became apparent.

As a matter of fact, this is a very appealing proposition for mercenary farmers, who operate purely based on incentives. These sorts of cold and calculated LPs will use a protocol just for the sake of farming the rewards. They will then sell them as soon as the payouts start to dry out and they figure that a higher yield can be had elsewhere. This sort of practice even occurred at an institutional level. Now-defunct market maker Alameda Research was notorious for doing this on a variety of chains.

The liquidity drain in protocols like Compound or Synthetix speaks for itself. Giving away governance tokens while getting nothing in return from users is not a sustainable business model. While crypto has a reputation for people punting on altcoins and overall reckless behavior in the markets, there is still a tendency for people to act probabilistically. People have to really enjoy the experience of providing liquidity to a project to outweigh stronger incentives that can be enjoyed elsewhere.

Liquidity mining shows that the costs of renting liquidity versus the revenue generated by the rented liquidity results in large protocol operating expenses. Protocols often end up emitting a lot more in reward tokens than they earn from fees, putting them in the hole.

Even today, it is not unusual to find protocols where borrowers pay a specific % on their loans while getting paid multiples of that in rewards for borrowing. This comes with a problem. As soon as better rewards are available elsewhere, farmers will abandon the ecosystem and flow to whatever other protocol offers the highest APY. This was a serious contributing factor to the rotations between alt L1 and L2 ecosystems like Polygon, Avalanche, Fantom, BSC, etc. While these ecosystems do have their own individual innovations and selling points, a lot of the reason people would bridge to these chains is just that the DeFi ecosystem was more nascent. This meant that new protocols could launch and offer attractive incentives. When these rewards become diluted, then onto the next chain, rinse and repeat. To simplify, protocols often end up giving away their native tokens for free and getting nothing in return.

Traditional yield farming often comes in the form of single-side staking for the native governance token. Instead, Timeless uses Balancer liquidity pool tokens to implement a ‘ve’ token model.

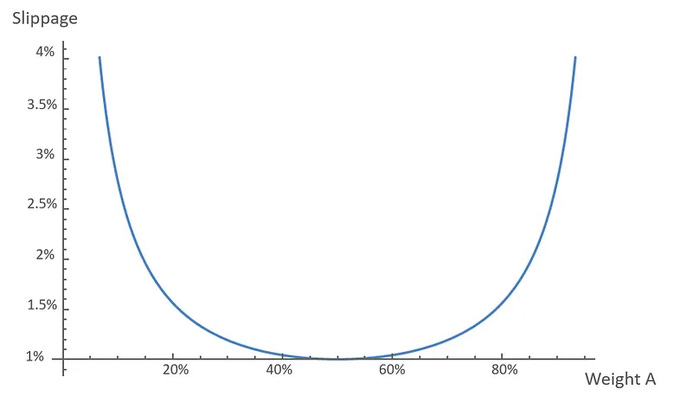

By providing liquidity in a Balancer-weighted pool, protocols can choose their desired levels of exposure to certain crypto assets. They can do this while still maintaining the ability to provide liquidity. In the case of Timeless, the protocol set up an 80/20 $LIT/$WETH pool on Balancer. This implies the expectation that $LIT will outperform $WETH.

80/20 pools that heavily weigh one token over another offer far less impermanent loss. While this is true, it comes at the expense of higher slippage when making swaps. This is due to the fact that one side of the LP pair has much less liquidity.

However, the goal of this strategy is to lock the actual LP token, in this case, an 80/20 $LIT/$WETH BPT (Balancer Pool Token), as a vote-locked position. This rather simple step is key to understanding the weaknesses of single-sided staking. As more users enter a single-sided position, the circulating tokens available for trading start to drop significantly.

When a protocol promotes single-sided staking, they are incentivizing a reduction in token liquidity. This is not desirable for users or anyone trading the token. Low liquidity for tokens results in a non-optimal trading environment: high slippage, inability to facilitate large trades, and high price volatility.

In the case of $LIT, using 80/20 BPTs offers a solution to this problem. This is because the underlying locked position is an LP token whose liquidity makes it possible for users to buy and sell as they wish. Even if a large portion of tokens are locked, there is deep liquidity – without direct incentives. This results in low operating expenses for the protocol. Additionally, the fact that users need to keep 80% of their liquidity in $LIT also creates additional buying pressure for the native token.

One of the differentiating features of Bunni with respect to other DEXs is its ability to wrap Uniswap V3 liquidity positions into fungible ERC-20 tokens. By default, Uniswap V3 positions take the form of NFTs. Bunni’s addition is more efficient than Uniswap’s NFTs for LP positions in terms of gas costs. That is because LPs using the same price range & pool share the same ERC-20 token. This spreads the gas cost of providing liquidity overall LPs and thus makes it much cheaper. On top of that, ERC20s offer more composability than NFTs, since most existing financial applications are designed for tokens rather than NFTs.

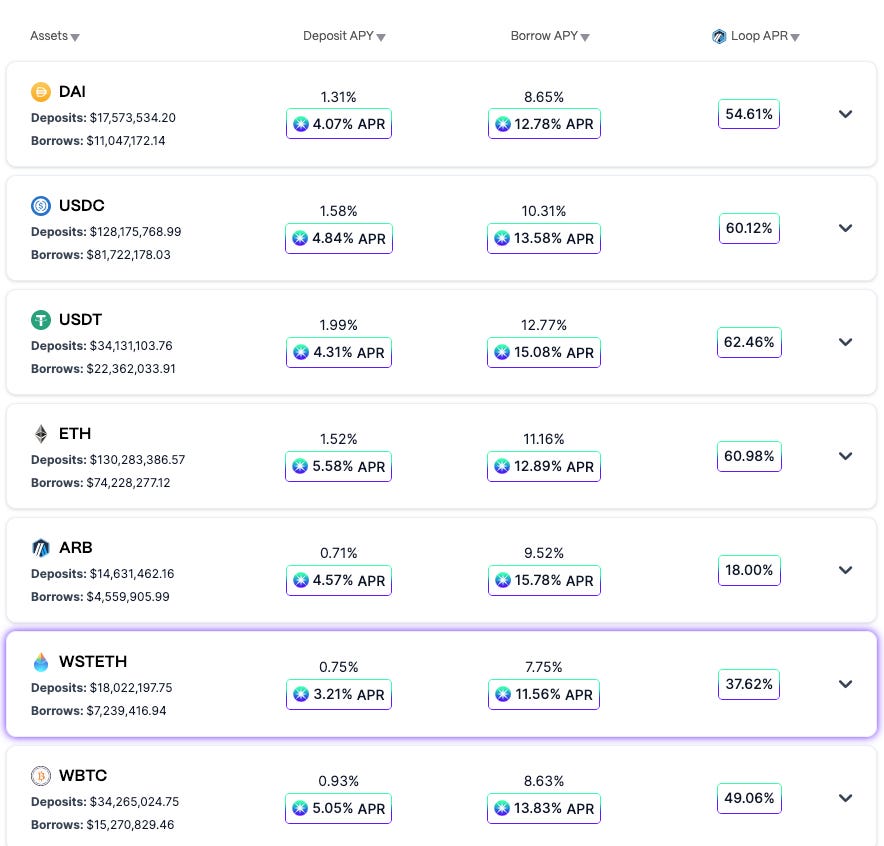

Regardless of the advantages it has as a DEX, it is critical for Bunni’s economic model to provide a sustainable revenue stream for liquidity providers while keeping the protocol solvent. The problem with providing liquidity in most DEXs is that the majority of liquidity providers end up losing money. Swap fees are usually not enough to offset the impermanent loss. This rings especially true for concentrated & passive liquidity. Concentrated liquidity can also just be too complex for many users to manage efficiently. This makes it hard to bootstrap liquidity for an asset without token incentives.

As we explained above, incentivized liquidity is unsustainable. Most protocols rely on token incentives to attract liquidity. This is basically the equivalent of renting liquidity from farmers in exchange for protocol assets. This scheme can backfire as it attracts mercenary farmers that will leave the protocol and withdraw their liquidity as soon as the incentives run out.

An important part of Bunni’s design to understand is Fungible Ownership Optimization (FOO). With $LIT, Bunni relies on a modified ve-tokenomics model as a way to incentivize liquidity and prevent mercenary farming. The key distinguishing feature is that users will lock 80/20 BPTs (Balancer Pool Tokens) as vote-locked tokens (ve positions). This way, locked positions remain productive and continue to earn revenue from swap fees. This is in contrast to locked governance tokens, which are not productive and don’t earn fees.

In order to fully disincentivize farming and dumping, the boost mechanism had to be tweaked. Instead, a farmer without any ve-tokens will not receive any rewards, no matter how much liquidity they are willing to provide. Typically, Curve allows for a maximum boost multiplier of 2.5x. What this means is that if a farmer has no ve-tokens, their liquidity is multiplied by 0.4x when deciding their weight in the staking pool.

FOO modifies the Curve equation that is used to determine the maximum boost. This change allows for a maximum multiplier of 10x. When used in combination with BPTs, this equation does is that since the farmers will likely hold ve-tokens, either for boosting or for voting on gauges, the farmers are now also the LPs for $LIT. This reduces the likelihood of farmers selling the rewards they get since they would be dumping on their own LP position.

Bunni has flexible parameters so that the community can adapt to market conditions. In multiple instances, this has proven useful. For example, TRC#45 removed the 10x max boost and implemented a max boost of 2.5x. The reason for this change was the slow growth and decreasing TVL. Part of the reason this was needed is that the yield offered by Bunni was no longer competitive compared to other sources of yield. By reducing the max boost from 10x to 2.5x, the base $oLIT reward APR of Bunni gauges would 4x. This attracts more TVL and increases Bunni’s protocol revenue. This shows the importance of iterative governance proposals to introduce positive catalysts as the market conditions degrade.

Other impactful proposals include TRC#33 and TRC#36. TRC#33 made $veLIT a cash flow asset that would earn revenue from $oLIT redemptions. TRC#36 redirected swap fees from bribes to $veLIT holders evenly instead of just those who vote for specific gauges. This allows $veLIT holders to earn real yield in $ETH and $BAL from $oLIT redemptions as well as from gauge incentives.

The improvements over the ve-token model already disincentivize farming-and-dumping. They encourage long-term liquidity provision by aligning the interests between LPs and $LIT holders. However, what’s innovative about FOO is that farmers are not rewarded at the expense of token holders.

While most projects give out their governance token for free as a reward, Bunni will sell its native token rewards at a discount. Using $oLIT instead of $LIT as the reward token transfers the cash gains from the farmers to the protocol. By selling options, farmers can get access to the governance at a discount. This all happens while the protocol earns revenue and accumulates POL.

The goal of this mechanism is to incentivize liquidity and enable the protocol to earn POL (Protocol-Owned Liquidity) while still ensuring that the native token remains liquid and productive. This is possible since Bunni uses the 80/20 BPT as a productive governance token that earns fees.

Say for instance, that the price of $LIT is $100 and the protocol offers a perpetual call option with a strike price of $90. We see a reallocation of cash, while LPs remain unaffected:

Compare this to regular liquidity mining programs where farmers don’t pay anything to the protocol:

Effectively, we can observe that by selling call options as the reward token, the protocol manages to prevent mercenary farming and earn revenue to accumulate POL. This way, the protocol keeps selling perpetual call options as a continuous token sale.

Over time, the protocol ownership will be transferred away from holders who aren’t providing liquidity and to the farmers who are providing liquidity, which optimizes the protocol ownership. Not only that but by merging farmers and LPs into one group, the protocol is also reducing the likelihood of farm-and-dumping. This significantly lowers the selling pressure of the governance token.

And since the protocol is increasing its cash reserves over time, it now has the power to back its native token with its treasury. The more the token goes up in price, the larger the treasury becomes and the lower the volatility to the downside will be. In other words, cash reserves set an indirect floor for the token price and reduce downside volatility. The more the token goes up in its initial run, the bigger the cash reserve is and the less the downside volatility will be when the run ends.

One very significant change is that protocol fees will be increased from just 5% to 50%. This is obviously a pretty large jump, matching Curve’s 50% swap fee rate.

📣 A proposal to raise the Bunni Protocol fee on swap fees to 50% has been put up for a snapshot vote by a community member. If you're a veLIT holder, you can cast your vote on this proposal within the next 3 days at the link below.https://t.co/YePRJIUo5A

— Timeless Finance (@Timeless_Fi) March 6, 2023

TRC-9 proposed to raise fees to 50%. The proposal was unsurprisingly approved by ~97% of $veLIT holders. This certainly bodes well for governance token holders and stakers, as revenue will flow to the native token. Following the approval of TRC-33 and TRC-36, 50% of past & future $oLIT revenue and 100% of protocol fees are distributed to all $veLIT holders on a weekly basis.

In addition to these proposals, there are some minor UI updates being implemented. The $veLIT page now supports voting for multiple gauges in the same transaction, saving gas for voters. Also, the Pool page now displays the volume processed by Bunni liquidity. Previously, it showed the volume processed by the entire UniSwap pool. This makes protocol data more transparent for users, perhaps making Bunni seem more trustworthy. While these changes are minor they are worth noting. UniSwap V3 is a complex application, scaring off many potential LPs. This is the reason liquidity managers and projects like Bunni were created, to help facilitate liquidity provision on the V3 platform. Anything to make the process of using Uniswap V3 is likely to be appreciated.

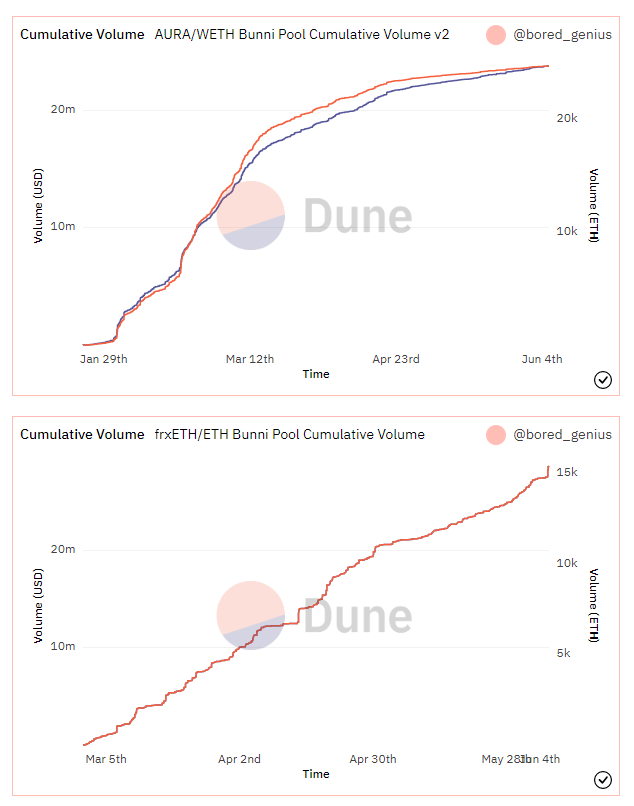

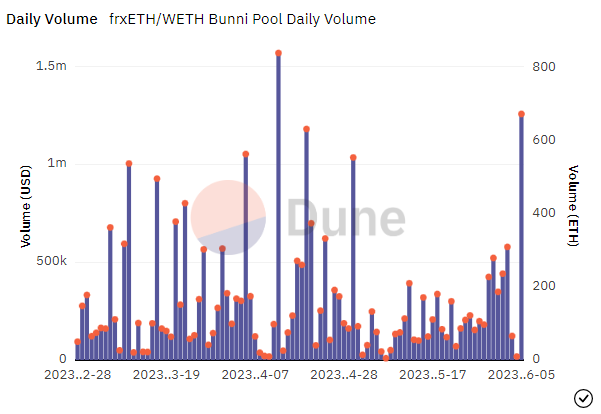

Bunni sees much less volume than competitors like Curve, and understandably so. As an up-and-coming option, Bunni is making some good progress in terms of adoption. There have also been cumulative volume increases across the board. We can see recently that capital inflows have turned positive for Bunni, despite market conditions.

Bunni is implementing some pretty interesting solutions to problems faced by many in DeFi. But with novelty comes risk. At the end of the day, FOO and the addition of Curve gauge systems on top of Uniswap is an experiment. The project is attempting to merge the best parts of two distinct protocols. The market for UniSwap V3 is different than that of UniSwap V2. There are a lot of variables impacting the success of Bunni as a project, and $LIT as the native token. Not to mention, $LIT is also the governance token behind Timeless Finance, a completely different project with its own set of variables and complexities. Considering the majority of TVL in the Timeless ecosystem lies in Bunni, perhaps investors will skew the valuation of the governance token to be based more upon Bunni than Timeless Finance. But this is all speculation, of course.

Not too long ago, the token was down ~40% in the past 30 days. But in the latter half of June, $LIT has recovered nearly all of this lost ground. With a market cap of ~$8M and an FDV of ~$47M, $LIT may not be the most attractive buy as compared to a few weeks ago. In this insight, we’ve focused less on the mechanics behind Bunni or even Timeless Finance as projects and more on the tokenomics that are being implemented. Using an 80/20 Balancer pool for staking of $LIT is innovative in and of itself, not to mention the positive attention that $oLIT could bring.

Whether these changes result in price appreciation of the underlying token remains to be seen. But either way, this style of liquidity incentivization is something to keep an eye on, especially as it may become more popular among other projects. In the past, projects new and old have taken what works and implemented it. When SushiSwap’s $xSUSHI received attention for returning fees to stakers, it spawned a wave of projects that emulated this staking design. Should the prospect of selling call options to LPs prove impactful, it is not unreasonable to think something similar could happen around projects implementing their own version of $oLIT. Even the concept of using an 80/20 BPT instead of a single-sided staking pool could see adoption from other projects. Interested projects will have to look at industry innovators like Bunni to see how demand for these tokenomics plays out and what challenges arise.

Bunni, by the team behind Timeless Finance, is a refreshing play on the current mainstream standards in DeFi. It takes what works from protocols like Uniswap and Curve, and adds its own twist. At its core, Bunni is a liquidity engine for UniSwap v3. It stacks Curve’s ve-tokenomics on top of Uniswap v3, making the DEX’s liquidity positions more efficient. The parameters around the protocol’s gauge system and tokenomics are flexible. This allows the community to respond appropriately to the dynamic DeFi market. In addition, Bunni implements an 80/20 Balancer pool for its governance token staking. This solves the problem many projects face around lowering liquidity for their native token by encouraging people to stake in a single-sided pool.

Most notably, Bunni is one of the first projects to implement call options being used to reward farmers. One of the most prevalent problems in DeFi’s history is the issue of mercenary capital. By selling call options instead of emitting inflationary governance tokens, the hope is that the intentions of both token holders and farmers will be aligned. If this solution to the perils of liquidity mining catches on across DeFi, $oLIT could see itself in the spotlight as one of the first fully-functioning examples of token discount incentives.

Revelo Intel has never had a commercial relationship with Timeless and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what