Published: June 15, 2023

Key Points

Long $ANT – short $ETH

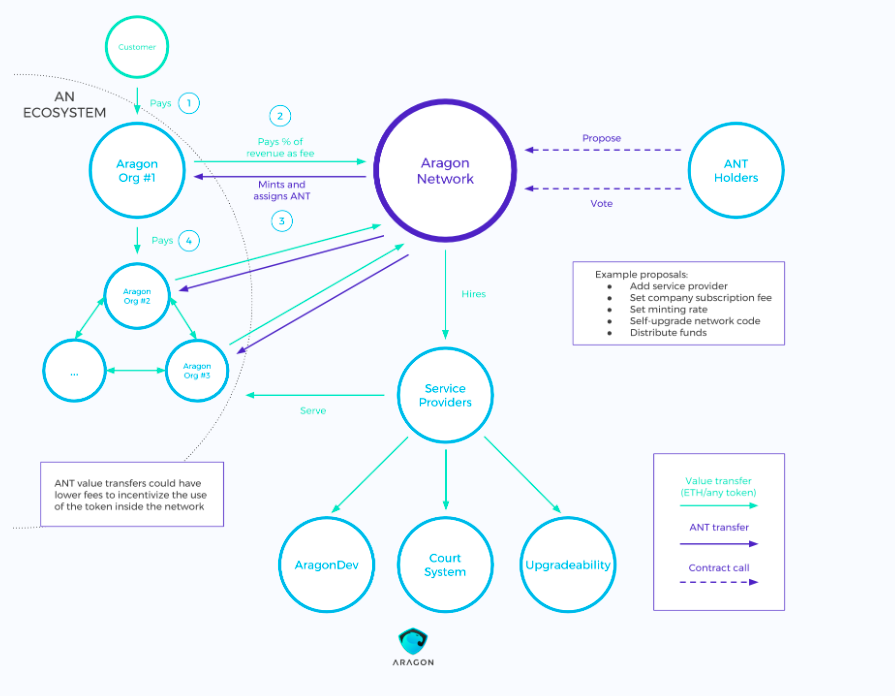

The Aragon Network Token ($ANT) is an integral part of the Aragon project. To understand the mechanics behind the token and potential catalysts, it’s important to understand what Aragon itself actually does. The project is a governance-focused dApp co-founded by Luis Cuende and Jorge Izquierdo in 2017 and launched on Ethereum in that same year. Aragon was born to enable the creation and management of Decentralized Autonomous Organizations (DAOs).

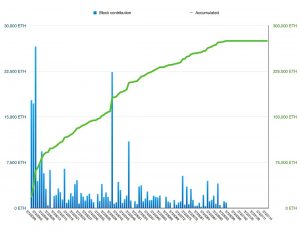

The project gained momentum following its Initial Coin Offering (ICO) in 2017, where it raised a substantial 275,000 $ETH. At the time of writing, this amounts to a hefty sum of roughly $500 million. Up until now, the capital has been managed by the Aragon Association, a non-profit entity registered in Switzerland. The group would use the funds to cover its operational expenses.

From its inception, $ANT holders were promised a say in the strategic direction and management of the project. Since then, $ANT was positioned as an asset that would generate revenues, as described in the project’s whitepaper. In essence, the ethos of Aragon promotes a decentralized and community-driven approach to decision-making, embodied by the DAO structure.

However, recent events have stirred controversy and cast a shadow over the project’s transparent and community-driven image. These events include:

In this report, we’ll delve into all of these issues and, provide insights into Aragon’s current status. And of course, we’ll discuss how these events impact the trading opportunities around $ANT.

To evaluate the potential trading opportunity, we need to establish the Net Asset Value (NAV) per $ANT token. NAV is the value of an entity’s assets minus its liabilities, divided by the number of outstanding shares (or tokens, in this case). We can estimate the NAV by comparing the total treasury value with the current market capitalization of $ANT.

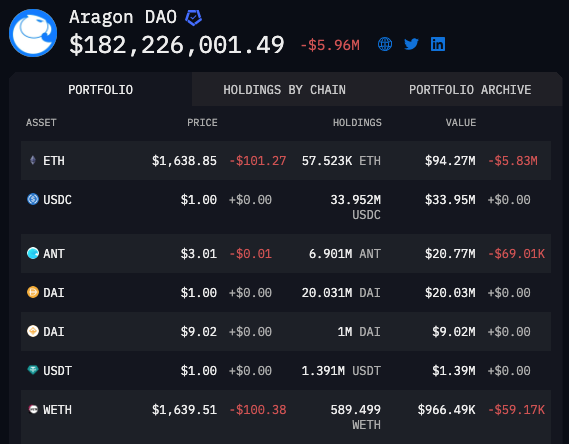

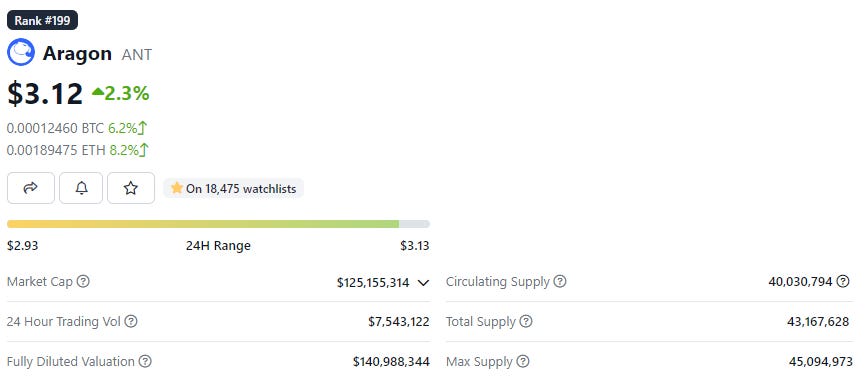

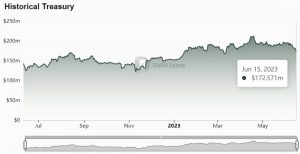

At this point in time, Aragon, via the Aragon Association, holds a substantial treasury, a sizable part of which was raised during its Initial Coin Offering (ICO) in 2017. The treasury, currently valued at ~$180 million, consists primarily of $ETH and various stablecoins. These funds were intended to fuel the project’s growth and development, thereby adding value to the $ANT token. To understand the trading opportunity, it is essential to compare the total treasury value with the current market capitalization of $ANT, currently ~$125 million.

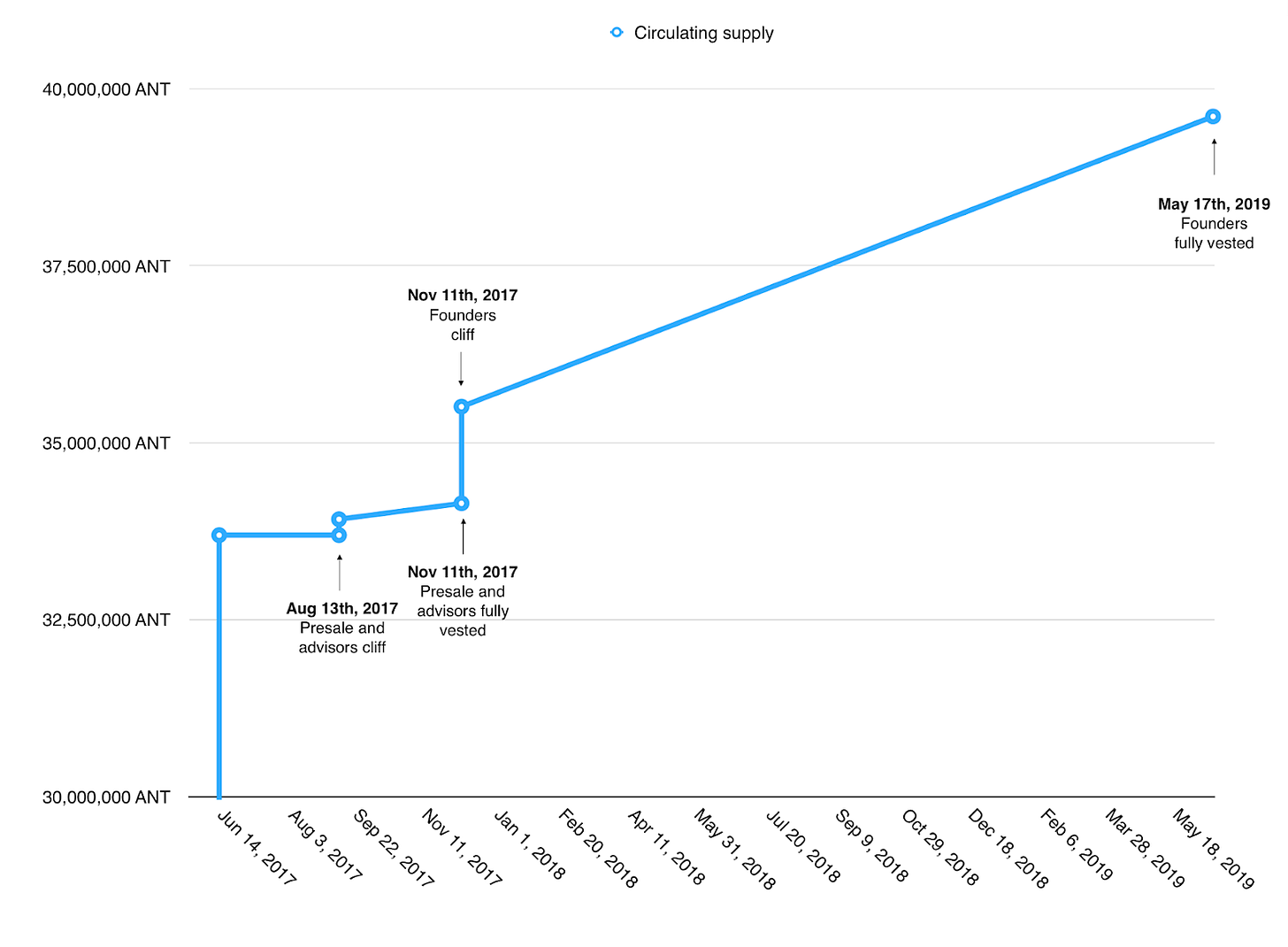

$ANT has a current circulating supply of ~40,000,000 tokens and a price of ~$3.1 per $ANT giving us a marketcap is of around $125m. The treasury holds around $150m in $ETH, $BTC, and stablecoins so the $ANT token is currently trading at around a 20% discount to that Risk-Free Value (RFV). If we take into account all the treasury assets it is trading at around a 30% discount to book value and if the token trades at book value, $ANT would be above $4.

Last year, a pivotal proposal was presented to the Aragon community. It suggested that funds from the Aragon Association should be transferred to the Aragon DAO. Such a move would further decentralize the control of the treasury and align with Aragon’s mission to promote decentralized governance. The vote passed and the transition was initially expected to take a few months.

Fast forward to today, and the process is nearly a year behind schedule. A group often referred to as “RFV” have raised questions about the delay and started demanding greater transparency. This group consists of Arca as well as other activist value investors. However, the Aragon team’s response to RFV has been a matter of contention. Community members asking questions about the delay were banned in Discord, with the team alleging a “51% attack” on the DAO.

This situation reveals potential conflicts of interest within the Aragon Association. Employees receive remuneration as long as the transition process continues. This is a pretty important point since it means that the delay could arguably be in their financial interest. Such conflicts can create tensions within the community and undermine trust in the project, potentially impacting $ANT’s market value.

The Association inaccurately labeled the entire RFV investor movement as an “attack”. They also insisted that $ANT was not a security, despite evidence to the contrary. The group claimed to have a “fiduciary responsibility” to themselves, which is directly contradictory to the definition of fiduciary responsibility.

If classified as a security, $ANT would be subject to additional regulatory scrutiny. This could have significant implications for the project and the token’s value. In terms of legal entities involved, the Switzerland-registered Aragon Association is the primary body. Due to its legal status and known team members (doxxed), it is bound by Swiss laws to fulfill its fiduciary responsibilities. This thereby adds a layer of legal security to the token holders.

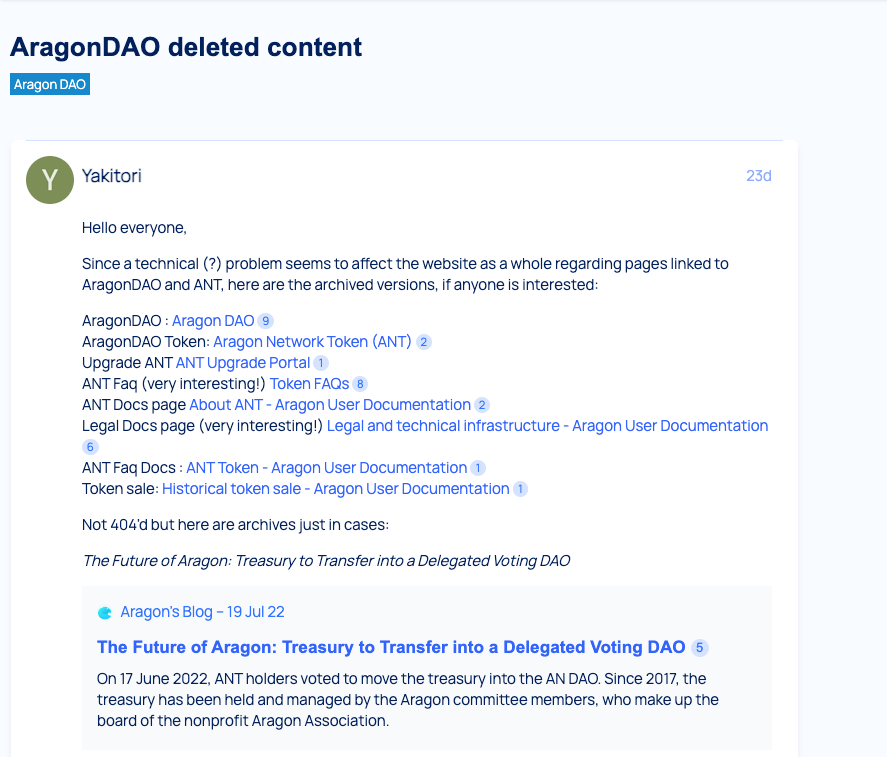

Transparency is one of the cornerstones of blockchain technologies and decentralized organizations. Aragon’s commitment to such transparency was originally apparent when it first launched. However, there have been recent instances that contradict this ethos, raising concerns among investors and community members. Following the banning of numerous investor accounts, many forum posts also began to be removed. This initially seemed to be a new occurrence. However, it soon became evident via conversations with disgruntled former employees that this was far from the first instance. During previous disagreements around acquisitions, a significant amount of the forum’s posts, which were supposed to serve as a public record of governance discussions, were deleted. Only 150 of 551 records from 2021-2022 remain, a mere 27% of all forum communications during this period. This figure doesn’t even account for content deleted during 2023. This could suggest an ongoing and deliberate effort by Aragon to scrub the forum of information intended for public disclosure.

Luckily, these forum posts were archived and backed up by the community, Either way, the sudden deletion of such records creates an atmosphere of suspicion and mistrust. Moreover, Aragon has seemingly failed to uphold its commitment to publishing regular spending reports. This lack of transparency hinders the community’s ability to gauge the project’s financial health and performance. It also casts doubts on the management’s accountability.

As an example, there are no breakdowns to explain tens of thousands spent at different conferences, leading to an inability to fully disclose finances. Several acquisitions and purchases by Aragon have raised eyebrows as well, especially those involving former team members. It is true that these acquisitions could potentially strengthen Aragon’s technical and strategic capabilities. Nonetheless, the lack of disclosure and the involvement of former team members has led to speculation about potential insider deals.

The public contention between Aragon and its investors came to light following the banning of nearly a dozen accounts from Aragon’s Discord channel. This ban was imposed as these investors expressed growing frustration with the slow progress of the promised treasury transfer.

MattyG, a former Discord moderator at RookDAO, joined the Aragon Discord amidst this controversy. His interaction with the investors suggested they wanted to shut down the DAO and ask for a redemption value. This, in turn, led to a wave of account bans even to some accounts that had not participated in the contentious conversation with MattyG. The lack of response from Aragon’s team members and community leads did not dampen the investors’ dissatisfaction.

On Twitter, Raiders attempted to use the temporary ban to generate a movement against Aragon.

Currently, Raiders are advancing a platform on the Aragon governance forum, seeking delegation to manipulate ANT as a financial instrument for profit.

— Aragon 🦅 (@AragonProject) May 9, 2023

Now, there are indeed two sides to every story, so it’s important to explain things from Aragon Association’s POV. In their eyes, the actors who were banned were a group of individuals and funds that intervened in projects whose market cap was lower than their treasury. They do this by buying the governance tokens and then using their voting power to dissolve the DAO’s treasury. This in turn triggers dividends and enforces token buybacks…

Onchain data shows that the RFV Raiders were actively stockpiling ANT in the months leading up to the attack.

In the days following the attack, the Raiders began rapidly wrapping their tokens enabling them to reach a majority vote in the Aragon DAO.

— Aragon 🦅 (@AragonProject) May 9, 2023

Joan, the head of the Aragon Association, suggested the investors propose a buyback. He did so knowing the investors had been barred from the forum and other communication channels. This left the investors with no other choice but to turn to Twitter and the press. Coindesk’s articles covering the user bans and tweets from the investors attracted widespread attention, putting Aragon’s community-centric ethos into question.

Aragon responded by stating that the investors had been asking “probing questions” and using “inappropriate language”. They also attributed the delay in treasury transfers to a lack of $wANT in the system and prompted the investors to wrap their $ANT to meet this requirement. As a result, they acquired the majority of the DAO’s voting tokens.

Arca, an investor in favor of buybacks, publicized an open letter advocating for buybacks. This was proposed due to the vast difference between the market capitalization and the DAO assets. This also clarified that it was not Arca’s intention to shut down Aragon. In fact, just after the open letter was published, investors noticed that the Aragon voting page was not functioning. Moments later, the Aragon Association announced the “repurposing” of the treasury, contradicting previous promises of deploying it to the DAO. The announcement, fraught with false claims and misinterpretations, portrayed the investors’ push as a “51% attack”. It also justified the halting of asset transfers to the DAO to preserve its developmental capabilities.

Most recently, on June 15 the Association announced it would again be delaying transfers, with more clarity to come in July. This time, their motive was to “explore options to mitigate some of the risks observed during Phase 1”. Here, Aragon is talking specifically about security considerations. They re-emphasized that the Aragon Association has the discretion to adjust the timing of treasury transfers accordingly. They also gave reasons including “evolving regulatory and market conditions“.

The Association’s latest approved resolution also saw some changes to the Treasury Consolidation plan, including:

Today, the Aragon Association acted on its fiduciary duty to secure its treasury by repurposing the Aragon DAO into a grants program.

This is a response to a coordinated attack by the group known as "Risk Free Value Raiders" who took down Rook DAO. 🧵https://t.co/tVp9QXUUsx

— Aragon 🦅 (@AragonProject) May 9, 2023

In a response to what it refers to as a “coordinated attack” by a group known as “Risk Free Value Raiders,” the Aragon Association ended up repurposing its DAO into a grants program. This fulfills the fiduciary duty to secure its treasury.

The association alleged that Arca’s involvement sought to extract financial profit from Aragon. The group, along with Arca, was also blamed for the takedowns of several DAOs, including Rook DAO, Invictus DAO, Fei Protocol, Rome DAO, and Temple DAO.

With this statement, the association reasserted that $ANT has always been a utility token. It was designed to facilitate the use of Aragon’s technology, not to be a financial instrument for personal profit. When utility tokens are manipulated for profit-making, it can potentially compromise a project’s social mission. To mitigate that problem, the DAO’s funds were repurposed into a grants program. This included an initial payment of $300,000 transferred to the DAO wallet.

In the examination of Aragon’s treasury management, significant opportunities for revenue generation appear to be overlooked. Despite boasting the 6th largest DAO treasury in DeFi, none of the assets owned by the DAO are staked. This unproductive capital is losing the project millions in potential yearly revenue. This may be more than enough to cover a substantial amount of operational expenses.

Not only that, but the project’s spending practices indicate gross operational expenses that are far higher than necessary.

Eventually, Aragon rolled back on their initial accusations of a 51% governance attack by a group of “risk-free value raiders”.

We have some explaining to do. The last few days have been stressful and we’ve miscommunicated important facts. We’re sorry.

Here’s the full story 🧵

— Aragon 🦅 (@AragonProject) May 11, 2023

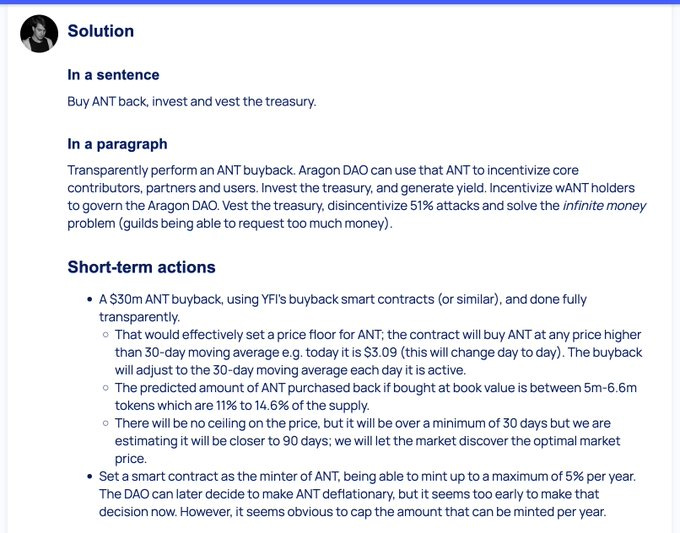

Following this, one of the founders of Aragon proposed a $30 million buyback. If accepted, this could potentially boost the price of ANT by reducing its supply, assuming demand remains constant.

This also shows the importance of the community keeping teams accountable when it comes to product development and maintaining decentralization. Even if the strategy is led by pure arbitrage and economic incentives, these actions result in a reallocation of assets and resources from a previous unproductive state.

The numbers we’ve gone into may vary as the value of assets in the treasury fluctuates. Nonetheless, the current book value is determined by excluding $ANT held by the treasury from both treasury assets and circulating supply. This has been the procedure in past DAO dissolutions.

The trade is simply to buy $ANT and short $ETH against it to hedge out most of the market risk (because the treasury holds so much $ETH). The bet here is that because the team blinked last month when faced with extreme pressure from investors, we have a strong signal that despite their efforts to fight and delay the treasury transfer over to the DAO, they will be forced to comply in some shape or form. The discount between the NAV and the market cap represents the risk that they simply do nothing.

We have spoken to some of the large investors in the situation and they are very confident in the team having to start transferring assets to the DAO or risk legal action. The founders and association members are doxxed individuals and well-known. In addition, the business Aragon is in revolved around tooling for DAOs, and the backlash they faced in May due to their action undermines their mission around building decentralized systems that operate from a place of community governance. Not respecting the wishes of token holders is something that would further deteriorate their standing.

The team wants to hold onto the huge treasury to continue their ability to fund themselves and the operations. The investors want their tokens to be valued at par. The spread between those 2 things happens is where the opportunity lies. Usually what happens is that a deal is struck whereby the team will keep $X for themselves (operations) and transfer the rest to the DAO which will narrow the discount and provide a nice profit for anyone involved at these prices.

We expect this to drag out for months and possibly even years so the idea is to remain in motion by adding to the position as the discount widens and take some profits by trimming as the discount narrows. Trading around the position in this way allows us to make gains from the tug of war that is in play while we wait for the end game.

It’s important to highlight that there is currently discussion around a buyback proposal, not a dissolution, although the mathematical logic remains consistent. This negative value can still be attributed to reasons such as:

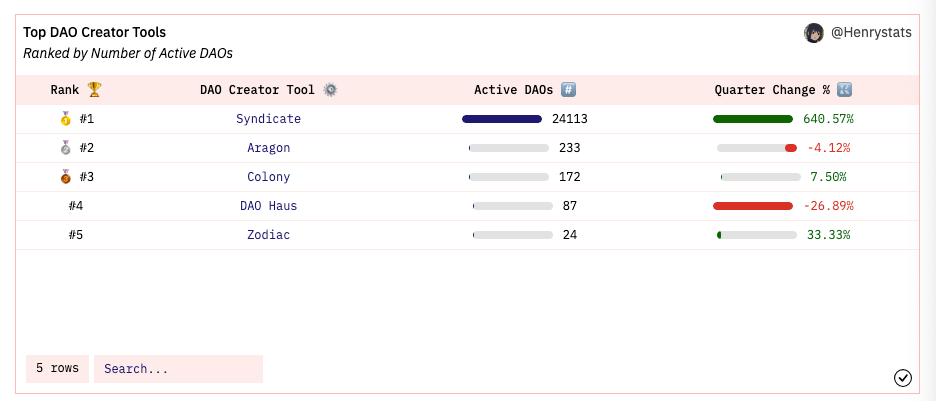

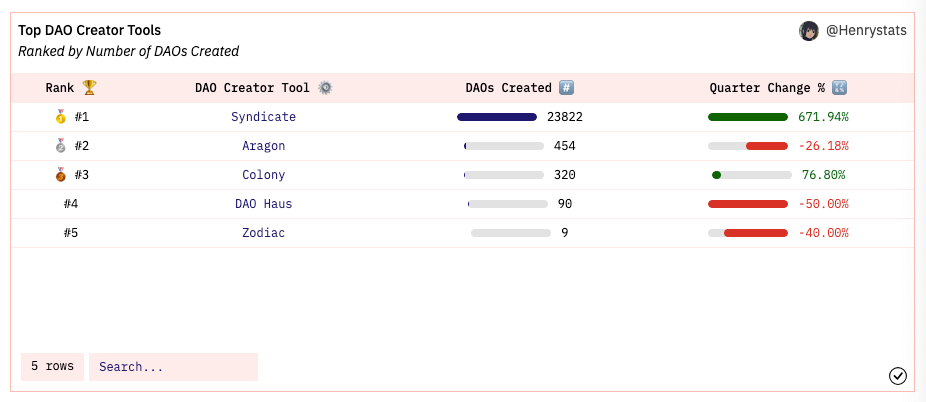

These issues call for urgent attention to ensure the long-term viability of Aragon and realize the potential value of $ANT. From the data above, we can see that Syndicate is far and away the dominant player in DAO tooling.

Despite recent setbacks, the Aragon Association’s commitment to the project’s mission and adherence to Swiss laws provide a solid foundation for $ANT. These factors combined with the association’s large treasury, suggest that $ANT could currently be undervalued. While the journey to decentralization may be bumpy, the underlying value of $ANT offers trading opportunities for those willing to ride the waves.

Revelo Intel has never had a commercial relationship with Aragon and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.