Published: December 08, 2023

Ethereum’s scalability roadmap is increasingly focused on rollup solutions, and with the ongoing adoption and the anticipated EIP-4844, Ethereum Layer 2 (L2) solutions are gaining enduring significance.

Nevertheless, valuing L2 solutions is far from straightforward. Unlike L1 networks like Ethereum, which have clear revenue sources from transaction fees and defined expenses from token emissions, Layer 2 solutions pose distinctive valuation challenges.

This report explores the complexities of valuing Ethereum Layer 2 solutions, providing insights into the economic factors that underpin their value proposition.

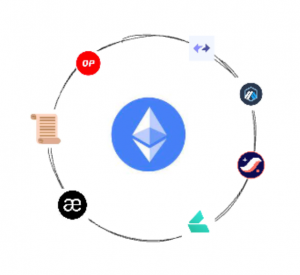

The recent strides made in the realm of rollup solutions are undeniably impressive. Since the inception of rollups in 2018, an influx of talent and research has led to remarkable advancements. These include Ethereum Virtual Machine (EVM) equivalent rollups, the implementation of bridges based on fraud and validity proofs, breakthroughs in batch data compression, and the introduction of rollup Software Development Kits (SDKs). Notably, various rollup solutions like Optimism, Arbitrum, Base, zkSync, and StarkNet have entered the market, fostering a thriving ecosystem that has left alternative L1s in a vulnerable and exposed position as the fight for market share intensifies.

While the current adoption rate has met expectations and demonstrated the feasibility of onboarding the next generation of users, the growth trajectory of Layer 2 solutions (L2s) is set to accelerate in the coming months. With EIP-4844 on the horizon and the launch of new chains such as Scroll, Linea, and Base, L2s are now in the spotlight.

The upcoming Dencun upgrade brings a notable feature, EIP-4844, also referred to as Proto-Danksharding, which marks a significant reduction in the operational costs associated with rollups. While the exact specifications of Danksharding continue to evolve, EIP-4844 paves the way for a seamless transition of the Ethereum protocol architecture to accommodate future Danksharding implementations.

Current rollup implementations face two major challenges. Firstly, there’s a data storage bottleneck as L2s process millions of transactions daily, aggregating them and submitting transaction proofs to Ethereum. Secondly, there are transaction costs associated with transmitting transaction data from L2s to Ethereum.

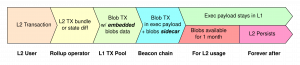

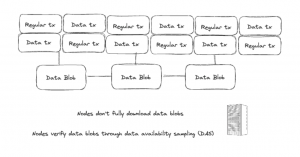

At the core of EIP-4844 lies the concept of “Blobs,” denoting Binary Large Objects. Essentially, blobs are data chunks linked to transactions, distinct from regular transactions. These blob data chunks are exclusively stored on the Beacon Chain and incur minimal gas fees. They enable the addition of more data to Ethereum blocks without inflating their size. To put it simply, leveraging blobs allows for nearly a 10x increase in stored data compared to the average block size.

The primary aim of blobs is to significantly reduce Data Availability (DA) costs, especially for Layer 1 (L1) publication of rollups. Unlike the traditional approach where all rollup data resides in Ethereum’s calldata space, blobs offer an efficient and cost-effective alternative. Since the consensus layer manages blob storage, blob transactions impose no additional demands on validators. Moreover, blob data is automatically deleted within a suggested timeframe of 30 to 60 days, aligning with Ethereum’s goal of scalability rather than indefinite data storage.

Before the implementation of EIP-4844, L1 publication costs constituted over 90% of total rollup expenses. Moving forward, EIP-4844 introduces the concept of “data gas,” a new fee category for blob transactions. This separates the cost of posting L2 data to Ethereum from the standard gas price. With its dynamic pricing based on blob demand and supply, L2s can achieve significantly reduced costs when submitting their data to Ethereum, with potential cost reductions of up to 16 times or a staggering 90% lower than current gas expenses.

“‘Blobs’ are like data chunks that make Ethereum run more efficiently. They’re stored separately, don’t bother the validators, and disappear when they’re not needed anymore. This means much lower costs and more room for data, making Ethereum faster and cheaper.”

To appreciate the significance of EIP-4844, it’s crucial to grasp the business model of rollups. The upgrade results in a noteworthy reduction in costs, while revenue expectations are likely to either remain stable or increase with heightened on-chain activity.

To gain a comprehensive understanding of EIP-4844’s influence on the economic model of rollups, it’s essential to dissect their revenue streams. Rollups derive revenue from network fees and Miner Extractable Value (MEV), a capital source currently controlled by a centralized sequencer with a monopoly on MEV.

On the cost side, rollups encounter both fixed and variable expenses. Fixed costs arise from actions such as posting the state root to the rollup smart contract, validity proofs in the case of ZK rollups, and Ethereum’s base transaction fees. Variable costs encompass L2 gas fees and an L1 publication fee necessary for storing batch data on Ethereum.

EIP-4844 introduces a dynamic fee system for blobs, where fees are determined by blob supply and demand independently of blockspace demand, departing from the traditional fee model. Consequently, Ethereum’s fee market post-EIP-4844 comprises two dimensions:

An analysis of EIP-4844’s fee market reveals several notable outcomes:

EIP-4844 changes the game for how rollups make money and spend it. With dynamic blob fees, one part of the fee market sticks to the regular rules, while the other tunes itself based on blob supply and demand. As blob demand grows, so does the cost of gas.

As the number of application-specific chains increases, the business model of Rollups as a Service becomes increasingly important. To illustrate, when compared to application-specific chains on platforms like Cosmos, Ethereum Layer 2s have distinct advantages, primarily owing to the emergence of RaaS solutions.

One key reason for this advantage is the reduction of infrastructure overhead. In the context of Ethereum Layer 2s, this process is significantly streamlined thanks to RaaS solutions. These services streamline the deployment, maintenance, and management of custom rollups, effectively addressing the technical intricacies that developers often encounter when working on mainnet development. Consequently, RaaS empowers developers to concentrate exclusively on application layer development, amplifying their overall productivity.

RaaS offers a remarkable degree of customization as well. Developers not only have the liberty to select their preferred protocols for the execution environment, settlement layer, and data availability layer but also gain flexibility in critical aspects such as sequencer structure, network fees, tokenomics, and the overarching network design. This adaptability ensures that RaaS can be tailored to meet the specific needs and objectives of a wide range of projects, enhancing the versatility of Ethereum Layer 2 solutions.

We can differentiate between two main types of services:

We could also include a third category for shared sequencer sets that could serve multiple rollups simultaneously, such as Flashbots’ Suave or Espresso.

While the current market landscape may show modest demand for custom rollup creations, there’s prevailing anticipation that as macroeconomic conditions improve and product-market fit becomes clearer, RaaS could spark the emergence of hundreds to thousands of rollups.

RaaS makes things easier, faster, and more flexible for developers. This gives them more time to prioritize and focus on the core logic and business model of their applications.

The success of rollup solutions like Optimism, Arbitrum, Mantle, zkSync, etc. is indisputable. However, when it comes to the investment perspective in rollup governance tokens like $OP or $ARB, a nuanced picture emerges.

In traditional financial markets, shareholders enjoy a range of rights, including dividends, voting power, and asset claims, which provide intrinsic value to stocks, making them appealing investments. Tokens solely representing governance power, on the other hand, lack such guarantees beyond voting on governance proposals. Since sequencer revenue generated from transaction fees does not flow to token holders, the network’s growth does not necessarily translate into an increase in token value. This raises valid questions about the value proposition of rollup tokens.

While governance rights hold inherent value, especially in Layer 2 solutions where token holders wield significant influence (as seen with Optimism’s RPGF and Arbitrum’s STIP), the absence of dividends or other income streams makes them a different form of investment.

In today’s high-interest rate environment, assets that do not offer real yield may be less appealing, particularly to conservative investors. Rising interest rates increase the cost of capital, making the opportunity cost of holding non-yielding assets more significant. In this context, $ETH, with its stable staking returns, might be a more attractive option for risk-averse investors, despite the growth potential of rollup tokens.

In financial markets, a company’s value is not solely tied to profits or dividends. Growth stocks, for instance, are valued for their long-term growth potential and reinvestment strategies. Investing in rollup governance tokens can also be approached similarly to investing in non-dividend growth stocks.

Historically, companies like Amazon have chosen not to distribute dividends but instead reinvest profits into expansion and innovation. Investors in such companies do not necessarily seek immediate returns through dividends; rather, they anticipate long-term growth and value appreciation.

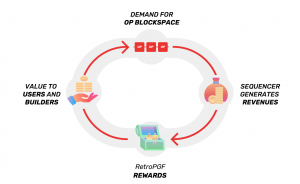

Taking Optimism and the $OP token as an example, there is a clear commitment to reinvesting earnings into ecosystem growth, fostering a virtuous cycle of increased demand for its native dApps, sequencer revenue, and RPGF. Additionally, with initiatives like the Superchain on the horizon, the bandwidth of the OP Stack continues to expand, ultimately creating a formidable moat that is hard to ignore due to network effects.

The Layer 2 (L2) landscape is evolving into a highly competitive arena, and the implicit expectation of airdrops can significantly influence user behavior within any given L2. However, it’s crucial to recognize that the valuation of a specific L2 is inherently linked to the value of the Layer 1 (L1), with network effects being the differentiating factor.

This connection becomes evident when we examine the functioning of current rollups. They charge gas fees in $ETH and must pay Ethereum for data availability in $ETH. In essence, these rollups lack the ability to enforce their own monetary policies; Ethereum dictates how much they must pay to the underlying chain.

As a result, L2s do not possess a distinct monetary premium. Nevertheless, the way L2 tokens are currently traded does not always align with this reality. Yet, as long as they can establish robust ecosystems and foster network effects, these L2s have the potential to become sovereign entities in the future, and the market may seek to anticipate and front-run this opportunity.

Airdrops can certainly sway user behavior. But here’s the twist: the value of L2s is closely tied to Ethereum (L1). L2s charge and pay in $ETH, so they don’t have their own money rules.

In this context, it becomes clear that current L2s operate as spread businesses: they charge fees to end users and retain a portion of those fees to cover Ethereum’s settlement and data availability costs. Owning the associated governance token effectively equates to holding a share of the spread generated by the L2.

Things become even more intriguing when multiple instances can be created, as seen in the case of Optimism. In such scenarios, the spread generated by these instances can flow back to the token holders. Take Base, for instance, which allocates 10 percent of its fees to Optimism.

This model unlocks greater potential for the scalability of L2 assets, setting a precedent for sharing a portion of the fees with the treasury as part of an implicit licensing agreement. This dynamic not only adds depth to the L2 ecosystem but also reinforces the value proposition of L2 tokens as they evolve and adapt within the competitive landscape.

Currently trading at approximately $195 billion, Ethereum’s value is expected to rise in tandem with the growth of rollups built on top of it. Additionally, the introduction of Rollups as a Service (RaaS) is poised to bring about a surge in both generalized and application-specific rollups entering the market.

But even though we can expect the value of the base layer to increase, L2s often trade with a higher beta compared to $ETH. Additionally, investors are likely to treat their tokens as a bet on the overall ecosystem. We advise caution with this approach, as individual projects will not think twice when it comes to migrating their codebases and users to the latest and most trending L2 at any particular moment.

Furthermore, L2s are positioned to attract more users, thereby increasing the value flowing back to Ethereum. This dynamic may follow a power law distribution, albeit to a lesser extent than what has been observed in liquid staking. Consequently, it’s possible to reverse the perspective and consider that $ETH is the actual index investors might prefer to own. As more L2s enter the market and dApps eventually spread across multiple L2s, choosing the winning chains becomes more complex. Nevertheless, regardless of the eventual winner, $ETH holders and Ethereum validators stand to benefit.

Ethereum’s value is set to rise with the growth of rollups, and Rollups as a Service (RaaS) will bring a wave of rollups to the market.

L2s have a different volatility profile than $ETH, and projects can switch between L2s quickly.

L2s will attract more users, benefiting $ETH holders and validators, but picking the winner among L2s gets tricky.

In the end, holding $ETH might be the safest bet.

The era of the L1 rotation trade appears to be in the rearview mirror. With Layer 2 (L2) solutions effectively addressing Ethereum’s scalability challenges, it’s pertinent to question the value proposition of alternative Layer 1 (L1) blockchains like Near, Avalanche, Solana, Fantom, and others.

One key differentiator lies in the ease of bootstrapping Total Value Locked (TVL). L2s enjoy an advantage in this regard since users and developers are already familiar with the tools available on Ethereum. They need only bridge their assets to the L2 chain to take advantage of reduced transaction costs. In essence, TVL that was originally on Ethereum is simply seeking a more cost-effective transaction environment.

However, it’s important to recognize that alternative L1s still serve specific purposes and offer unique features that may appeal to certain use cases.

The L1s that survive will be those that bring unique value to an ecosystem (Solana, Monad, etc.). Offering an EVM-compatible chain with lower gas fees is not enough anymore. This seems obvious now, but in the past, there were many instances where EVM-compatible chains with lower gas costs reached outsized valuations. Take Moonriver for example, an EVM-compatible chain on Kusama (the canary chain of Polkadot), which reached an all-time-high of $494 in Q4 2021 and is now trading at $4.

L2s have reduced the need for the L1 rotation trade. While alternative L1 blockchains still serve unique purposes, L2s have an advantage in TVL as they offer familiar tools and lower transaction costs.

However, diverse ecosystems, specialized features, and diversification can make alternative L1s appealing for specific use cases and risk mitigation.

The surviving L1s will be those that bring distinct value beyond just EVM compatibility and lower gas fees

One way to view this is that EIP4844 is going to significantly reduce costs for L2’s while their revenue is set to grow over time. The spread between the two is the margin these L2s make in profits. As that spread widens the odds they decide to start sharing those profits with token holders increases. Front running that logic is a reasonable approach if you are happy to wait for the pieces of the puzzle to fall into place.

As we chart the course for the future of rollup governance tokens like $OP or $ARB, it’s evident that the landscape is set for transformation. The rise of EIP4844, ERC4337, and the advent of RaaS, featuring both SDK and no-code deployment services, are poised to usher in a wave of rollup adoption.

This wave of adoption may see the rise of thousands, if not tens of thousands, of rollups. However, there is a divergence in how investors perceive the value of these governance tokens. On one hand, challenges like the absence of traditional value capture mechanisms and the influence of a high-interest rate environment may limit the potential upside of rollup tokens. On the other hand, some investors may liken these tokens to non-dividend growth stocks such as Google, Amazon, and Tesla, recognizing their potential for higher valuations driven by long-term growth prospects.

As we venture into an even more competitive landscape, it’s essential to remain adaptable, considering the evolving dynamics and unique characteristics of rollup governance tokens.

Revelo Intel has never had a commercial relationship with […] and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.