Published: July 16, 2024

In traditional financial (TradFi) markets, the exchange of stocks, ETFs, commodities, futures, and other assets has historically been facilitated through centralized exchanges. These exchanges are controlled by entities such as banks, brokers, and payment processors, which act as intermediaries between traders and investors. They provide the necessary infrastructure and software to enable the trading of various assets under different types of products.

Centralized Exchanges (CEXs) like Coinbase and Binance were among the first to allow investors to trade crypto assets, playing a critical role in onboarding users and allowing them to go from fiat to crypto and vice versa. However, the advent of modern blockchains made it possible to bypass these intermediaries and facilitate the creation of decentralized products, services, and business models that carry fewer trust assumptions and conduct their activity transparently on-chain.

Decentralized Exchanges (DEXs) can be used for trading spot assets (swaps or transfers of the underlying involving an exchange of ownership) or derivatives (financial instruments that derive their value from underlying), and they can take the form of Automated Market Makers or variants of peer-to-peer (P2P) marketplaces like order books, where users can trade while retaining the custody of their assets. By settling transactions directly on-chain, the actual exchange of assets takes place through smart contracts that anyone can audit, contrasting with the opacity and permissioned access of traditional financial transactions. Because user funds do not pass through a third party’s wallet during trading, DEXs reduce counterparty risk and mitigate the principal-agent problem posed by centralized actors running their operations in a black box.

In recent years, especially after the FTX bankruptcy, substantial investment has flowed into DEXs, both for spot and derivatives (mostly perps), with each project trying to narrow the gap between CEXs and DEXs while maintaining decentralization. However, even though DEXs can offer benefits such as self-custody, transparency, and permissionless access, they often suffer from a worse UX when compared to CEXs. All things being equal, most users would resort to trading on CEXs (provided they are allowed to do so and don’t face any kind of access restriction) since that’s where they onramp their capital, can trade on the phone, trade execution is fast and seamless, etc. After all, blockchains are slow and carry a lot of limitations in terms of performance, while off-chain servers don’t have to worry about that and can scale almost ad infinitum by growing both vertically (adding more resources to existing infrastructure), and horizontally (adding more machines to handle the extra load).

Fortunately, there is a middle ground that can take the best of both worlds. Not everything needs to be run on-chain, since that would limit performance; and not everything can be run off-chain, as that would limit transparency and introduce additional counterparty risk. The sweet spot lies in offering trade execution with latency in the order of milliseconds, to compete with CEXs, while settling transactions on-chain – thus matching orders off-chain but leaving a transparent record on a censorship-resistant and immutable ledger.

In crypto, on-chain activity tends to be dominated by spot volume, mostly attributed to the democratization of access to permissionless token launches (i.e. anyone can easily mint a token and make it tradeable by providing liquidity in an AMM), while derivatives are more popular off-chain, often traded on CEXs for the most liquid tokens. Out of all derivatives, perpetuals remain the most popular option because of their capital efficiency in the form of (1) access to leverage up to 100-1000x, (2) the ability to speculate both long and short, and (3) deeper liquidity as a result of increasing demand, which results in narrower spreads that make it more attractive for traders.

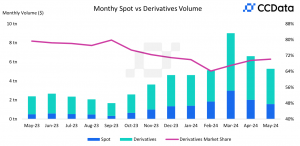

As of May 2024, the derivatives market represented 70.1% of the entire crypto market, suggesting that most activity occurs off-chain and on centralized exchanges.

Figure 1: The derivatives market represents 70.1% of the entire crypto market

Source: CCData. As of May 2024.

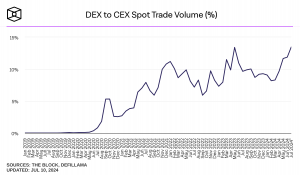

The figure below illustrates the historical DEX to CEX Spot Trade Volume (%) from January 2019 to June 2024. Notably, the DEX market share has consistently increased on average, with a significant spike in the last few months, rising from under 10% to ~14%. Despite this growth, CEXs continue to dominate the spot market.

Figure 2: DEX to CEX Spot Trade Volume: ~14%

Source: The Block. As of July 10, 2024

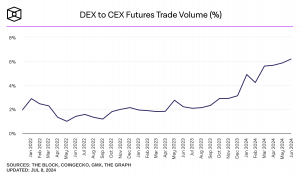

On the other hand, when examining the DEX to CEX Future Trade Volume (%), the situation appears less favorable for DEXs, with a market share of ~6%. We’ll explore the reasons for this discrepancy compared to the spot market shortly.

Figure 3: DEX to CEX Future Trade Volume: ~6%

Source: The Block. As of July 8, 2024

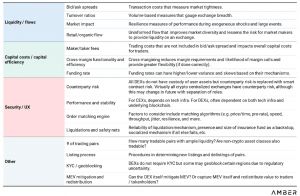

At first glance, the data seems contradictory. We observe strong growth in the DEX market share for spot trading, yet the market share for perpetual contracts remains low. This can be attributed to the complexities of building on a blockchain compared to traditional technologies that leverage centralized databases, especially for trading assets. Several factors must be considered from the perspective of final users, including traders, investors, institutions, and market makers.

CEXs typically offer a superior and more user-friendly experience (UX) with features like smoother fiat on/off ramping. They provide greater liquidity, making it easier for traders to execute large orders without significant slippage. CEXs also offer a wide range of trading options, including perpetual contracts, spot markets, and cross-margining, covering different trading preferences. Additionally, high-frequency traders find CEXs attractive due to their robust infrastructure and speed, offering low latency and enabling algorithmic trading strategies. Conversely, DEXs have struggled with scalability, user experience, and capital efficiency barriers, limiting their appeal.

To simplify, let’s say that, DEXs face additional challenges navigating the trade-offs between decentralization and user experience, making an effort to match the benchmarks set by CEXs.

The table below outlines a good starting point for evaluating these platforms.

Figure 4: General Criteria to Evaluate Exchanges

Source: Amber Research.

To finally answer our question about whether DEXs may be considered superior to CEXs, it is evident from the data that there is a rising interest in DEXs among users, indicating significant growth potential. The key to unlocking this potential lies in the ability of DEXs to match, or at least closely approximate, the user experience provided by CEXs while maintaining a high enough degree of decentralization, assuming that self-custody is the most important feature and that they are comfortable running some computation off-chain to achieve better performance.

Moreover, incidents like the FTX debacle have accelerated the shift in user preferences towards self-custodial and transparent trading options. Following the FTX bankruptcy, substantial investment has flowed into DEX projects, with each attempting to bridge the gap between CEXs and DEXs while preserving decentralization.

Starting from these premises, this report will first cover the sector outlook of the DEX landscape and how common design choices have led to liquidity fragmentation and misalignment of interests with native chains. This will set the stage to introduce Vertex and its vision to eliminate the trade-offs users face between control and performance when choosing between CEXs and DEXs. We will explore the principles that guided Vertex Edge’s design as well as its potential to solve liquidity fragmentation and align the incentives between DEXs and the native blockchains they operate on (rather than launching their own appchain and fragment liquidity even more. Next, we will go into detail about Vertex’s order book and matching engine, highlighting what sets Vertex’s Edge apart from other competitors. We will analyze in detail how Edge works, its unique features, and the benefits it offers to both the ecosystem of the underlying chain, and its users. Finally, we will examine which chains it is currently available on (Arbitrum, Blast, and Mantle), and provide evidence of the positive impact on liquidity it is bringing.

Vertex’s mission is to bring the performance and features of CEXs on-chain while preserving the core benefits of self-custody, transparency, and permissionless access inherent to DeFi. It is a cross-margined DEX protocol offering spot trading, perpetual contracts, and an integrated money market, all within a vertically integrated application on Arbitrum.

Vertex utilizes a hybrid order book-AMM design, combining a high-performance central limit order book (CLOB) with an integrated automated market maker (AMM).

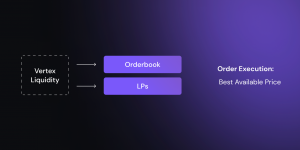

Figure 5: The Hybrid Order Book-AMM design of Vertex.

Source: Vertex Protocol.

The Vertex sequencer, Edge, is a custom, parallel EVM implementation of an off-chain order book and trading engine written in Rust. Currently, it operates as an independent off-chain node; however, Vertex already has a sequencer decentralization strategy in progress with more announcements in the near future. Its job is to handle trade ordering and routing from the protocol layer, matching orders within the same chain and across Vertex instances on different chains. On-chain perps were not feasible on Ethereum prior to L2s, due to the high gas costs and latency required to achieve consensus among distributed nodes. L2s emerged to move execution off-chain, with a sequencer taking care of ordering transactions and settling batches on-chain on Ethereum. However, this still carries some limitations imposed by the underlying Virtual Machine (VM) and block time of the L2. For that reason, Vertex leverages an off-chain order book that achieves average order-matching execution speeds of 5-15 milliseconds and supports 15,000 transactions per second (TPS), making it competitive with CEXs. Hence, it provides a low-latency, central-limit order book (CLOB) for traders who want to place limit orders, engage in faster trading, and execute automated strategies. These are also desired properties for market makers, who play a critical role in providing liquidity for traders to conduct their operations. Note that by moving this logic off-chain, the sequencer also protects traders on Vertex from validator MEV on the underlying blockchain.

Simultaneously, the on-chain AMM’s pooled liquidity complements the bids and asks on the CLOB, serving as an additional market maker that interacts via smart contracts. This setup increases liquidity as positions from pairwise liquidity provider (LP) markets also populate the order book.

Figure 6: Unified source of liquidity: CLOB and AMM

Source: Vertex Protocol.

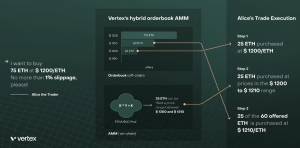

In other words, the sequencer ensures trades are filled with the best available liquidity, simultaneously utilizing limit orders and LP positions. If the sequencer fails, the DEX defaults to a traditional xy=k model, ensuring the on-chain AMM continues to function as the protocol’s fallback, a mode referred to as “Slo-Mo Mode”.

Figure 7: Trade execution example through the hybrid order book-AMM model.

Source: Vertex Protocol.

This hybrid liquidity model offers several distinct advantages, such as the ability to ensure more consistent liquidity, as the DEX can always rely on the AMM when order book depth is insufficient. This setup facilitates the bootstrapping of markets with passive AMM liquidity while still allowing for customization through limit orders on the order book. Together, this allows Vertex to deliver extremely low-latency trading while still offering efficient liquidity utilization across a wide range of markets for different tokens.

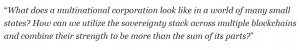

On February 14th, 2024, Vertex announced an upgrade of its order book (the sequencer), introducing Edge, with two main goals in mind: (1) addressing the liquidity fragmentation within the DEX landscape due to the large number of projects deployed on multiple chains (all of them competing with each other to attract liquidity), and (2) making sure to align incentives between the underlying chain and the application layer by solving for the inherent conflict of interest between general purpose chains and DEXs built on sovereign appchains.

Edge’s unique value proposition is the introduction of the first Synchronous Order book Liquidity layer that unifies cross-chain liquidity in DeFi, effectively extending the capabilities of its sequencer to any supported base layer ecosystem or, in other words, any EVM-compatible smart contract. It operates off chain as a CLOB and it aggregates orders from different chains. This means that it allows users to trade against unified cross-chain liquidity on a single DEX without having to move liquidity from Chain A (e.g., Arbitrum) to Chain B (e.g., Blast).

Importantly, unlike other competitors who decide to launch their own chain and compete for attracting liquidity, Vertex aligns its incentives with native chains by settling all trades on the originating chain, and paying fees to the base layer. This design improves liquidity and achieves economies of scale as more chains integrate with it. By settling trades on the chain where they originate, Vertex ensures that liquidity is not fragmented across different chains, but instead aggregated and utilized more efficiently. This approach improves the overall trading experience with deeper liquidity and makes Vertex an attractive protocol for chains to have in their ecosystem.

Most recently, the DeFi space has seen an impressive increase in the number of perpetual DEXs, now exceeding 150 derivatives protocols across multiple chains. This rapid growth, fueled by the strong product-market fit of perp DEXs, has resulted in fragmented liquidity across various DEXs and chains, posing challenges for both traders and liquidity providers. Total Value Locked (TVL) in DeFi derivatives has jumped from $1.8 billion to $3.4 billion since the start of this year, underscoring the growing adoption and demand for these products.

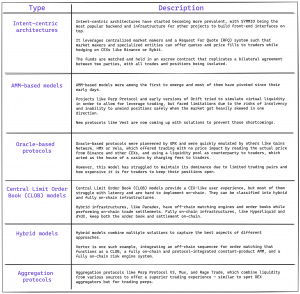

Each DEX differentiates itself by developing unique designs for its product offerings. Several DEX designs exist, each presenting distinct benefits and trade-offs in terms of feature sets, scalability, and decentralization. This diversity and competition have supported significant advancements and innovation, introducing new models with their own advantages and drawbacks. Six main types of infrastructure have been developed in the DeFi space: (1) intent-based/centric architecture, (2) AMM-based models, (3) oracle-based models, (4) Central Limit Order Books (CLOBs), (5) hybrid models, and (6) aggregation protocols.

Figure 8: DEX Designs: The six main types

Source: Revelo Intel.

Despite these advancements in the DEX sector and efforts to improve user experience and performance, including the development of CLOB exchanges and off-chain order books to minimize MEV and improve trading execution, CEXs continue to dominate. Additionally, most DEXs focus on specific product offerings, such as either spot or perpetual contracts, but not both. Furthermore, as we will cover in the next section, these advancements bring new challenges.

In examining DeFi’s evolution, we see protocols increasingly becoming foundational layers. This trend is especially noticeable in the derivatives market, where protocols are shifting from applications with limited control to entities that can set terms of engagement, such as fee discounts, revenue sharing, and incentive campaigns. This has led to the realization that some applications were leaking value that they could capture themselves. For instance, rather than paying fees to an underlying L1 or L2 chain they could launch their own appchain and keep those profits for themselves.

Building derivatives before the advent of L2 solutions like Arbitrum and Optimism was extremely challenging due to Ethereum’s high gas costs. These L2s made on-chain options and perpetuals viable, allowing projects like GMX, Kwenta, Dopex, and Lyra to lead the market. However, despite their initial success in the 2022 bear market, design flaws became apparent. Pricing derivative instruments is inherently difficult. Even with lower L2 transaction costs, creating an on-chain order book isn’t always feasible or competitive with CEXs like Binance or Deribit. While AMMs have worked, they are capital inefficient and foster a PVP zero-sum trading environment.

Given the on-chain scaling issues faced by performant trading engines built on L1/L2s, many DEXs are increasingly choosing to follow the narrative that modular solutions are the answer, leading to the launch of their own appchains. Appchains are new execution environments specifically tailored to optimize the sovereign app, where interoperability with the base layer (e.g., Arbitrum or Optimism) allows for the transfer of assets between the appchain and the base layer.

Within the DEX landscape, many order book perp protocols chose this solution as they require scale and high performance. However, this performance comes at a cost. The need for a distinct execution environment means app chain DEXs are effectively bridging deposits and withdrawals in and out of the underlying base layer. Additionally, trading activity is confined to the appchain’s execution layer instead of the protocol layer (e.g., Arbitrum). As Vertex co-founder, Alwin Peng, describes:

This approach contradicts what L1/L2 chains aim for (1) Total Value Locked, (2) user activity, and (3) trading volumes. The rise of cross-chain technology inherently disperses these figures between different chains, moving them away from the base layer and introducing additional risks. Models such as cross-chain deposits via bridging or appchain DEXs do not achieve these goals efficiently and introduce new challenges and problems for both users and the ecosystem. For the former, it results in a poorer user experience, wider spreads, additional smart contract risks, and the dispersion of their assets across multiple chains, wallets, and protocols. For the latter, it results in value being leaked and capital being migrated to a separate chain that competes for the same liquidity, creating a conflict of interest and misalignment of incentives.

By design appchains move assets away from the base layer, outsourcing their economy to their own native chain. This nullifies the on-chain settlement of trading activity in an existing L1 or L2 ecosystem, reducing base layer blockspace demand and diluting the perceived value and utility of individual base layers. In addition to that, this approach leads to an ever-growing fragmentation of liquidity across different protocols and chains.

dYdX V4 launched its own appchain by migrating to the Cosmos ecosystem. The goal behind the dYdX Chain is to be fully decentralized end-to-end, including its consensus mechanism, order book, and matching engine. To trade on dYdX, users first need to generate a dYdX Chain Wallet and then deposit $USDC from one of the available chains (Ethereum, Avalanche, or Arbitrum) to start trading.

Hyperliquid is a fully on-chain order book perp exchange on a Proof of Stake (PoS) L1 built from the ground up. It uses a custom version of Tendermint optimized to provide end-to-end latency of less than 1 second and capable of processing 100k orders per second. To trade on Hyperliquid, users can bridge $USDC from chains like Arbitrum to the Hyperliquid DEX.

Aevo supports options, perpetual futures, and many other products within a single margin account. It exemplifies the strategy to launch their own rollup with a Rollup as a Service (RaaS) provider, combining off-chain matching with on-chain settlement, Aevo’s smart contracts run on the Aevo Rollup, which is an EVM-based Ethereum optimistic roll-up on the OP stack. Trades are created and settled on the smart contracts that live on the Aevo Rollup, meaning that deposits into the Aevo Rollup use the Optimism Standard Bridge, but users can also deposit $USDC from other available chains like Ethereum, Optimism, or Arbitrum.

Vertex’s goal is to address these challenges and solve the liquidity fragmentation problem that would come up when they attempt to deploy different instances of their protocol on different chains. This is why they came up with Edge, which is off-chain infrastructure for aggregating cross-chain liquidity.

According to Peng, the defining questions for Edge were clear:

This vision is based on the premise that it’s a misconception that DeFi platforms need to build their own application-specific rollups (appchains) to become foundational layers and leverage their own stack for network effects. Unlike competitors such as dYdX or Aevo, Vertex recognizes that rollups and application-specific chains are becoming commodities. Instead of relying on external RaaS providers or building a blockchain from scratch, Vertex, through Edge, can deploy its risk engine on any existing EVM blockchain or L2 rollup by simply deploying a smart contract on the underlying chain for settlement.

This approach emphasizes the importance of aligning incentives between EVM chains and the application layer, a principle embedded in Edge’s design. As a result, Edge allows Vertex to currently be the only multi-chain perps exchange aligned with every chain it is built on.

Since trades from Vertex Edge’s cross-chain trading engine settle on-chain, all on-chain activity remains on the host chain (e.g., Arbitrum, Blast, Optimism). Each Vertex instance displays the combined order book liquidity of all connected chains on the app’s trading interface, but activity and value accrue to the host chain rather than an alternative settlement or execution layer, a common problem with many cross-chain solutions. Matched orders aggregate at the Sequencer (Edge) level but still settle locally on-chain to the user’s origin chain. Thus, a trade can match between a user on Blast and a user on Arbitrum, with settlement occurring on both chains simultaneously. This architecture ensures that on-chain trading activity is never extracted from the supported base layer for settlement elsewhere, aligning incentives between the protocol and app layer and resolving the inherent conflict of interest between general-purpose chains and DEXs built on sovereign app chains.

Therefore, unlike other platforms, users trading on Vertex DEX don’t need to bridge their funds from the native chain (e.g., Arbitrum) to an app chain or rollup. They can start trading directly from their wallet.

At its core, Vertex Edge introduces a synchronous order book design. This design packages Vertex’s powerful DEX into a shared liquidity layer spanning multiple blockchains with features such as: (1) a cross-chain order book that integrates liquidity across different chains, increasing market depth and reducing slippage, (2) unified money markets to offer more consistent and reliable lending and borrowing opportunities, (3) spot and derivatives trading with enhanced efficiency and lower latency (i.e. traders can do carry trades on the same platform).

Hence, its offering is not limited to just a specific product like perpetuals, instead, it spans a complete suite of features and products that resemble the CEX’s user experience and performance, namely via spot, lending, and perps. All of this is achieved while aligning incentives with the base layers and creating an environment that significantly improves liquidity and usability.

As already stated previously, Edge is primarily a major upgrade to the Vertex sequencer. It amplifies the sequencer’s scope of capabilities, extending them cross-chain to any supported base layer ecosystem.

Edge maximizes the capabilities of Vertex’s trading engine, creating a multi-chain future where liquidity is no longer fragmented across chains. Instead, liquidity from all supported Edge chains is combined, aggregated at the Vertex sequencer level, and settled locally on-chain to the original base layer of a cross-chain Vertex instance.

Think of Edge as a virtual market maker operating between exchange venues on different chains. The sequencer’s state is divided (sharded) across supported chains, processing and duplicating incoming orders from each chain. Orders from one chain are matched with liquidity from multiple chains.

Both sides of the trade are executed, with the sequencer (Edge) taking the opposite side of the trade and automatically balancing liquidity between chains. The sequencer mirrors only resting liquidity (maker orders) across the sharded states of Vertex instances on different base layers. Taker orders are unchanged and are submitted directly from an independent Vertex instance to the sequencer’s unified liquidity layer, Edge.

Order matching between chains happens simultaneously, with the sequencer’s consolidated liquidity profile sharded and distributed to each Vertex instance. Consequently, Edge can match incoming orders from one chain with the combined order book liquidity of all base layers connected to the Vertex sequencer.

Figure 9: Edge Orderbook: High-Level Look

Source: Vertex Edge.

Edge enables the sequencer to operate on multiple chains simultaneously without fragmenting liquidity across them. Each inbound order from a Vertex instance can be viewed as a request to update a balance on-chain, resulting in settlements being processed on the specific chains (e.g., Vertex on Arbitrum) where the corresponding balances need to be adjusted. Orders from different blockchains are matched with unprecedented efficiency due to this interconnected liquidity network.

Figure 10: Edge: Liquidity Hub for Crypto.

Source: Vertex Edge.

Synchronizing liquidity across multiple chains eliminates barriers that cause bottlenecks and fragmented liquidity pools. By integrating the liquidity profiles from various chains, Edge allows users to trade against unified cross-chain liquidity on a single DEX interface without needing to switch from Chain A to Chain B. In contrast, traditional cross-chain solutions often divide and dilute liquidity across platforms.

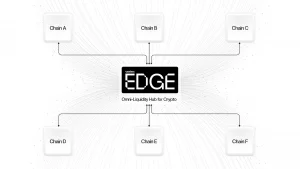

Assume there are two Vertex instances, Arbitrum and Blast. Alice submits a market order (taker) on Blitz to go long on the $ETH perpetual at price X. The sequencer (Edge) matches the order against the best liquidity after examining the orders aggregated across the two Vertex instances on Arbitrum and Blast. The best offer comes from John, who is trading on Arbitrum. John is now short on Arbitrum, and Alice is long on Blast. In the middle, the sequencer (Edge) takes equal opposing positions on each chain. Edge is now short on Blast and long on Arbitrum. Edge injects Alice’s matched order into the sequencer queue of batched orders to render and settle on-chain to Blast, simultaneously sending John’s order to be settled on Arbitrum. Over time, Edge will continually build long and short positions on local chains. Periodically, liquidity between chains will be aggregated, and settlement will be made on the backend.

Figure 11: Cross-chain Perpetual Futures Trading.

Source: Vertex Edge.

Edge moves settlement from one chain to many chains. The outcome is that liquidity fragmentation across chains is supplanted by additive, positive-sum orderbook liquidity on a single layer spanning multiple chains.

Any on-chain smart contract deployment of Vertex on an independent base layer (L1 / L2) is a Vertex Edge instance. For example, Vertex (Arbitrum), Blitz (Blast), and Mantle are the first instances of Vertex on different L2s, respectively.

A Vertex Edge instance on any base layer has several key properties. First, liquidity from the chain supported by Edge (e.g., Blitz on Blast) is aggregated and unified at the sequencer level with all other Vertex Edge instances (Arbitrum, Blast, Mantle) in a synchronous order book liquidity layer. Second, the app interface uses the same UI kit and back-end as the Vertex app on Arbitrum but adapts design features and user-facing elements for different Vertex Edge instances. Third, the shared liquidity is accessible by any base layer (Arbitrum, Blast, Mantle) connected to Edge. Finally, each Vertex instance displays the combined order book liquidity of all connected chains on the app’s trading interface.

As Vertex instances proliferate across ecosystems, the scaling of liquidity benefits all instances. For example, the usage of a new Vertex instance on a non-Arbitrum chain enhances order flow and liquidity for Vertex on Arbitrum. Order book liquidity on the non-Arbitrum instance is injected into a synchronous order book, combining liquidity from both Vertex on Arbitrum and the non-Arbitrum instance.

The aggregated liquidity via Edge is accessible to any user of a cross-chain Vertex instance and is displayed as a single, synchronous order book on the app’s interface. Settlement of matched orders still occurs locally on-chain to the user’s origin chain, positively impacting the local chain’s blockspace demand.

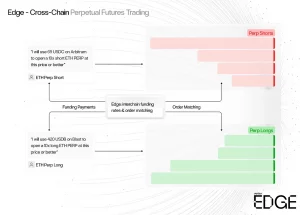

It is worth noticing that Edge is not only about cross-chain liquidity and interest alignment with native layers. Thanks to Vertex’s vertically integrated offerings (spot, perpetuals, and money markets) and cross-margined account structure, this entails more than just additional perp DEXs accessing consolidated liquidity. Instead, Vertex’s design offers amplified benefits to all users across each instance and underlying network through its core product suite: (1) Spot Markets, (2) Perpetual Markets, (3) Money Market.

Figure 12: The Edge Triangle

Source: Vertex Edge.

As a note, the cross-chain spot market feature has not yet been activated with Edge, but it is on the roadmap as more chains are supported. However, it is already live on perpetual markets.

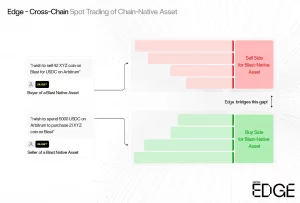

Through Vertex’s spot market, users can trade native spot assets across chains without needing to access the network of any specific asset. This will be key to reduce friction between networks and bridging risks. With the synchronized orderbook aggregating liquidity, sellers on one chain gain access to buyers on multiple chains, optimizing market depth and potentially reducing slippage.

Figure 13: Cross-chain Spot Trading of Chain-Native Assets.

Source: Vertex Edge.

Additionally, Vertex’s cross-margined accounts with spot and perpetual products, enhance basis trading opportunities across ecosystems, further optimizing market efficiency through Edge. Unified funding rates on Edge also streamline trading to be a much more efficient experience than the current alternative, whereby the same protocols on different chains have differing funding rates due to liquidity fragmentation.

Finally, Edge’s money markets enable users to maintain collateral on their preferred chain without asset bridging, again reducing friction and expanding collateral options to enhance liquidity and trading efficiency. For example, in DeFi platforms like MakerDAO or Compound, users can deposit various types of collateral to mint stablecoins or take out loans. If these platforms supported multi-chain collateral without the need to move assets across chains, it could streamline the user experience for borrowing / lending between chains with more options and flexibility. In fact, more collateral types tend to result in more liquidity as users from various chains contribute to the total collateral pool, increasing efficiency by simplifying the process of collateralization and borrowing. The synchronous order book layer retains Vertex’s embedded money markets through cross-margin accounts, ensuring consistent interest rates across chains. This consistency facilitates easier cross-chain spot trading, enabling traders to access assets in different ecosystems without the need for stablecoin bridging, further optimizing yields for passive lenders. More specifically, Vertex Edge will eventually enable a single $USDC deposit interest rate across all Vertex Edge instances, enabling capital to flow freely between ecosystems. This generates cheap loans for the most active traders and ensures that passive capital allocators receive optimized yields.

Figure 14: Cross-chain Money Markets and Interest Rates.

Source: Vertex Edge.

A consistent interest rate curve is key for enabling cross-chain spot trading. It makes it easier for traders to access assets in different ecosystems without bridging any stablecoins between chains. Without this capability, tokens remain siloed within their native ecosystem, which is a suboptimal outcome if the goal is additive, synergistic liquidity effects across multiple chains.

In effect, any Vertex Edge deployment will create what amounts to a native DEX and money market for the host base layer, producing a similarly positive impact on blockspace demand and activity as any other dApp deployed to that chain. Liquidity is synchronized on one orderbook spanning multiple chains, and alignment is created between the host chain and Vertex through Edge.

In summary, Vertex Edge instances provide several key benefits to the base layer networks on which they are deployed:

Vertex Edge produces net increases in blockspace demand for the underlying base layer due to the batched settlement model the Vertex sequencer deploys natively on-chain. On-chain settlement occurs on both chains that Edge uses to match a given order with its combined liquidity profile. This not only unifies liquidity across the chains but also increases the local blockspace demand for any chain supported by Vertex Edge, creating positive-sum effects.

This topic is becoming increasingly relevant for L2s, which are now drafting proposals to explore new ideas and strategies for commercializing blockspace. These conversations have now started taking place after Ethereum’s EIP-4844, which implemented blobs and, while it made it cheaper to transact on L2s, it also resulted in a decrease in sequencer revenue.

Users of a given base layer gain direct access to cross-chain liquidity through Vertex Edge. This approach helps retain on-chain capital within the base layer ecosystems, as there is less need for capital outflows in search of better DEX liquidity. Adding each new chain to the network achieves economies of scale, where every chain benefits from the liquidity and activity of all other connected chains. This creates a healthy, virtuous cycle of growth and increased liquidity.

Vertex Edge significantly cuts development costs and resources required to launch DEXs on an L2. It maintains a unique cross-chain liquidity profile through its synchronous order book model. Vertex’s robust order book DEX has already proven its product-market fit on Arbitrum, offering deep liquidity across 50+ markets. Upon deployment, every instance benefits from this existing scale, eliminating the need to develop new technology and saving the capital required to build deep liquidity.

The expansion of the network connected to Vertex Edge began with the integration of the first cross-chain (non-Arbitrum) instance: Blitz on Blast. To understand the benefits that Edge offers, we can refer to The Watchmen’s dashboard on Flipside.

Blitz was a relatively new DEX compared to Vertex, with a smaller user base. If it had to bootstrap its own order book from scratch, it would have taken considerable time. However, thanks to the integration with Edge, Blitz users immediately gained access to the liquidity already available on Arbitrum.

The image below shows the taker volumes on Arbitrum on the left and the maker volumes on Blast on the right on a daily basis. Imagine a trader trying to market long on Blitz, where the best quote for the trade on Edge comes from another trader on Arbitrum. Edge facilitates this by executing the trade on Blitz as a short, while simultaneously being a long taker on Arbitrum. For instance, on March 30th, Edge facilitated approximately $65.4M of liquidity (out of $87.3M in total volume) from Arbitrum and acted as a maker for the same amount on Blitz. As shown in the image on the right, since the launch of Blitz on Blast, users placing maker orders have mostly used the liquidity on Edge provided by users from Arbitrum. Over time, as the DEX on Blast gains traction, this ratio is decreasing as liquidity on Blast grows.

Figure 15: Edge helps to bootstrap liquidity since day one.

Source: The Watchmen on Flipside.

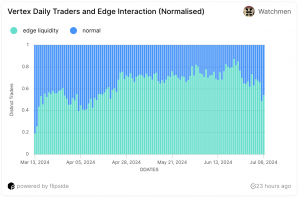

The benefits of Edge are also evident for traders on Arbitrum. The following image shows the percentage of distinct traders on Arbitrum who interacted (green bar) or did not interact (blue bar) with Edge on a given day. On any given day, traders on Arbitrum had the opportunity to interact with Edge liquidity from Blast between 40% to more than 80% of the time.

Figure 16: Vertex (Arbitrum) daily traders and Edge interaction.

Source: The Watchmen on Flipside.

More recently, Vertex announced another release on Mantle. As of today, users such as DeFi users, automated traders, and market makers / institutions can benefit from unified cross-chain liquidity on three L2s: Arbitrum, Blast, and Mantle. Users from Mantle immediately benefited from the liquidity provided by both Arbitrum and Blast, while also having the time to grow their own user base and native liquidity through market makers, thus contributing to the overall cross-chain liquidity. Therefore, it is worth noting that as more chains are integrated, the benefits of this unified liquidity effect will continue to strengthen, offering a winning solution for both users and chains.

By integrating a synchronous order book that spans multiple blockchains, Vertex Edge effectively addresses the rising problem of liquidity fragmentation, a persistent issue in the DeFi sector, by unifying liquidity across various chains. By ensuring that each additional deployment on new chains increases overall liquidity, Vertex Edge ensures that users benefit from a more consistent and deeper liquidity pool, leading to better trading experiences.

Vertex Edge stands out in its vision to align the interests of decentralized applications (dApps) with the base layers they operate on. By settling trades on the originating chain, Edge ensures that liquidity is not dispersed across multiple chains but rather pooled and utilized more efficiently within each native ecosystem. Aligning the app layer with the underlying network allows more blockchains to integrate Vertex Edge into their ecosystems, potentially offering native incentives to increase adoption. This not only improves the overall trading experience but also improves the economic activity on each participating blockchain.

With features such as reduced latency, lower fees, and access to extensive cross-chain liquidity, Edge delivers a complete product suite on par with CEXs. At the same time, it adheres to the core principles of DeFi by providing transparency, self-custody, and decentralization.

The case studies of Vertex’s deployments, such as Blitz on Blast and Mantle, highlight the practical benefits and real-world impact of Edge. These deployments demonstrate how Vertex Edge can bootstrap liquidity from day one, leveraging the existing liquidity on other chains to provide a seamless and robust trading environment. As more chains integrate with Vertex Edge, the network effects and liquidity benefits will continue to amplify, creating a virtuous cycle of growth and improvement.

In conclusion, by addressing liquidity fragmentation and aligning incentives across chains, Edge provides a sustainable and scalable solution for the future of decentralized trading. This innovation not only improves the functionality and appeal of DEXs but also contributes to a more robust and interconnected DeFi ecosystem, ultimately offering users a superior trading experience without compromising on the core values of decentralization and transparency.

Arbitrum Gas Tracker. Nansen | Link

Carolina, (2024) Cross-chain Liquidity: The Next Iteration of Perp DEXs. Blockworks | Link

CCData, (2024) Exchange Review. CCData Research | Link

Chainlink Education, (2023) What are Automated Market Makers (AMM)? | Link

Chainlink Education, (2023) What is a DEX?. Chainlink | Link

Integretee Network, (2024) DEXs: The What, The Why, and The How of Decentralized Exchanges. Medium | Link

Leal J., (2024) What is an Appchain? A 5-minute explainer. thirdweb | Link

Otoko R., (2024) Mastering perp dexes (Part I, II, III). Published on Substack | Part 1, Part 2, Part 3

Peng A., (2024) Thread about the thinking that influenced Edge’s design. X | Link

Sharma S., (2023) The Rollups-As-A-Service Primer. Binance Research | Link

The Block. Decentralized Finance: Derivatives | Link

The Block. Decentralized Finance: Exchange | Link

The Watchmen, (2024) Vertex Edge – Cross Chain Liquidity. Flipside | Link

Vertex Edge, (2024) Introducing Vertex Edge: The Future of Liquidity is Synchronous. Published on Medium | Link

Vertex Edge, (2024) Vertex Edge: EVM Alignment & Advantages for Base Layers. Published on Medium | Link

Vertex Edge Website | Link

Vertex – Market Intel. Revelo Intel | Link

Vertex – Project Breakdown. Revelo Intel | Link

Vertex Protocol Documentation | Link

Vertex Protocol Website | Link

Revelo Intel is engaged in a commercial relationship with Vertex Protocol as part of an educational initiative and this report was commissioned as part of that engagement.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.