Published: June 12, 2024

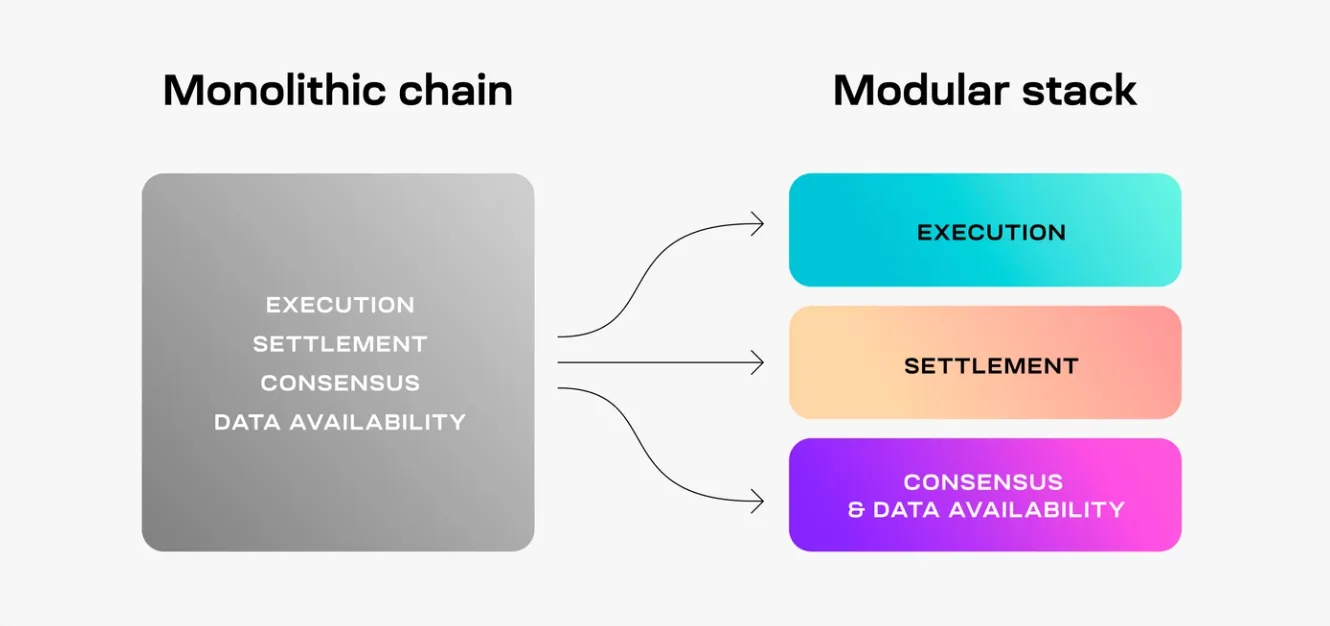

For over a decade, blockchains have consistently used a “monolithic” architecture, where each chain manages its own execution, settlement, consensus, and data availability directly on-chain.

During this time, various theories and technologies have emerged to address the blockchain scaling trilemma, the challenge of achieving decentralization, security, and scalability simultaneously.

Finding the optimal approach to scalability has been driven by the increasing sophistication of decentralized applications (“dApps”) and the growing demand for block space, which pushes blockchain throughput to its limits.

Recently, the concept of blockchain modularity has emerged. This theory suggests that the core functions of blockchains (execution, settlement, data availability, and consensus) should be separated into different layers or networks. This approach aims to increase the efficiency of each component without compromising on any other aspect.

The ongoing modular expansion is proving to be a viable alternative to the monolithic approach. However, it is also bringing to light a liquidity fragmentation issue. With an increasing number of new Layers 2 (L2s) and AppChains being deployed, the blockchain space is becoming increasingly fragmented. By the end of 2023, despite the Dapp industry’s 124% YoY increase in its Unique Active Wallets (UAW), reaching 4.2 million daily UAW, we are still far from achieving global adoption.

The two main pain points of living in a multichain world are:

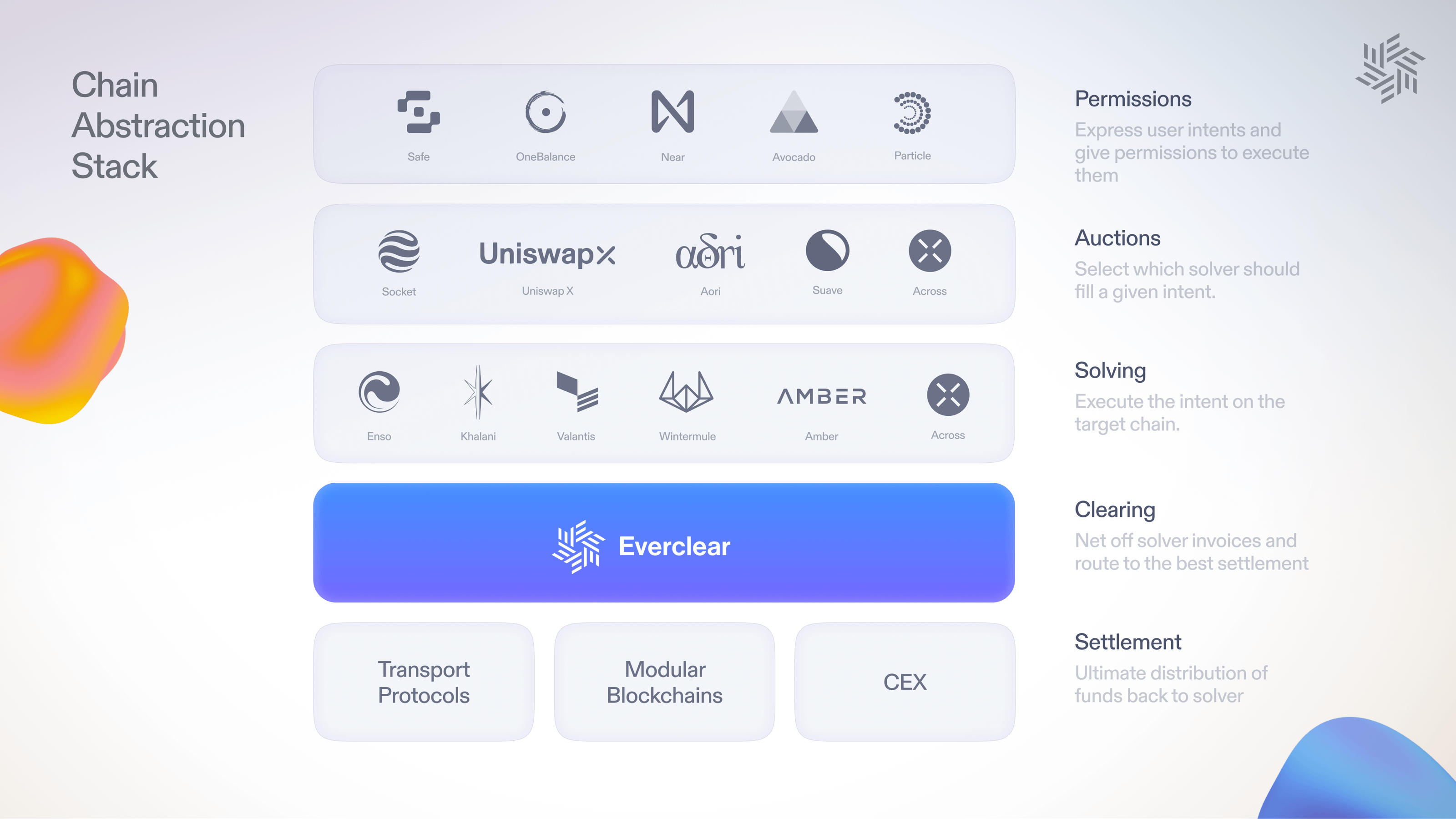

Everclear (previously Connext) was the first project to propose a new design pattern and toolkit for applications to solve both issues: Chain Abstraction. The core concept behind it is that users should never need to know what chain they are on.

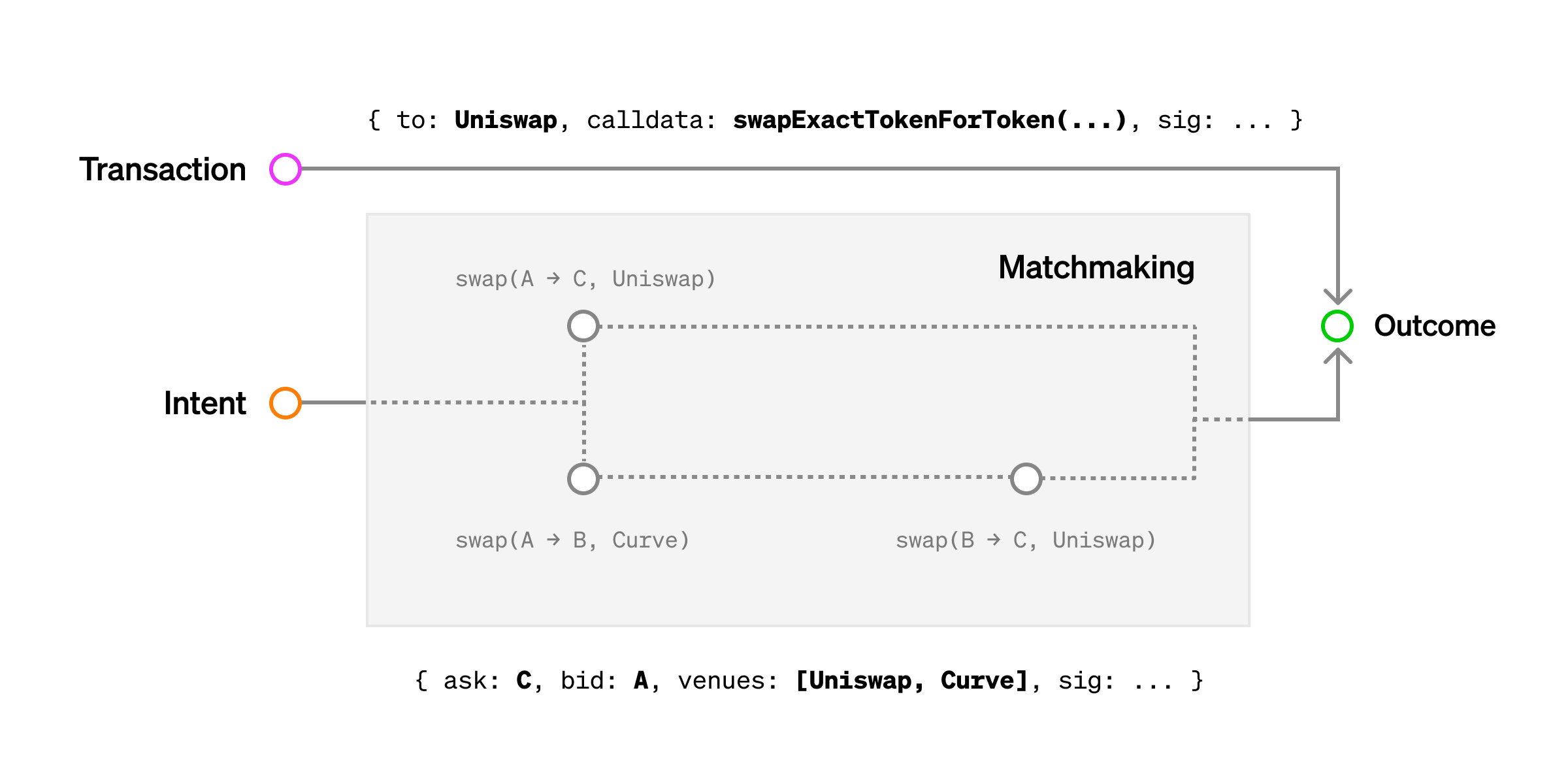

Nowadays the most popular implementation involves the use of “intents”. In a non-blockchain setting, intents are a concept that refers to the desire or want for something to happen. The ending is likely to be specified, but not the how and where to find it. Applied to blockchain terms, there is a desired end state (for example a user who wants to buy a certain number of tokens) but the exact path or trace to follow about how to reach that end is not specified (for example what DEX to use, whether to split into multiple smaller swaps, etc).

Importantly, the difference between a transaction and an intent is that a transaction explicitly refers to “how” an action should be performed while an “intent” refers to “what” the desired outcome of that action should be. For instance, if a transaction says “do A then B, pay exactly C to get X back”, an intent says “I want X and I’m willing to pay up to C”.

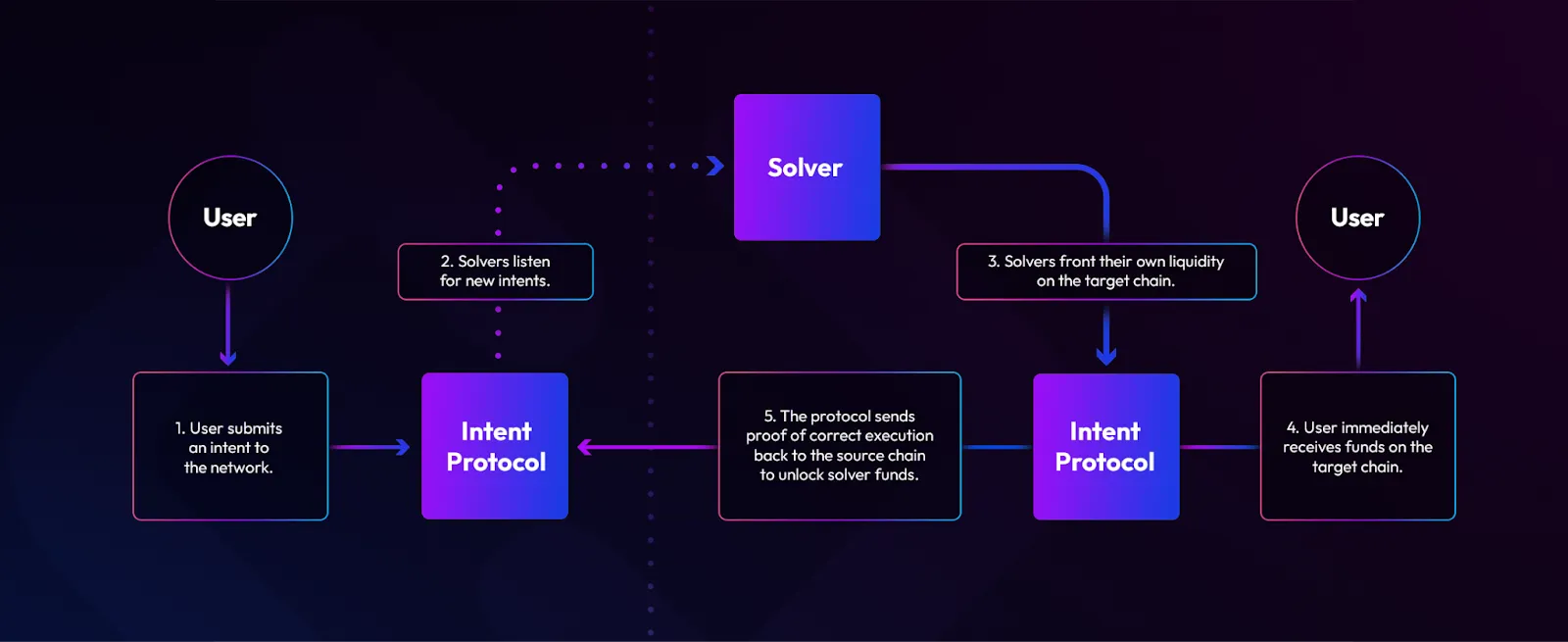

This way, intents-based systems allow users to specify their desired outcomes, and a service provider, known as a solver, handles all the complexity. The solver identifies the most efficient way to fulfill the request and executes it on the user’s behalf.

Intents offer a method for achieving Chain Abstraction, but their economic viability may be limited to a select few chains and assets. Why? Currently, solvers, market makers, and CEXs operate in isolation in a player vs player (PvP) setting. They compete against each other to fill user intents and are responsible for managing their own inventory across chains. In other words, there is no unified system for market participants to coordinate capital flows and settlement between chains.

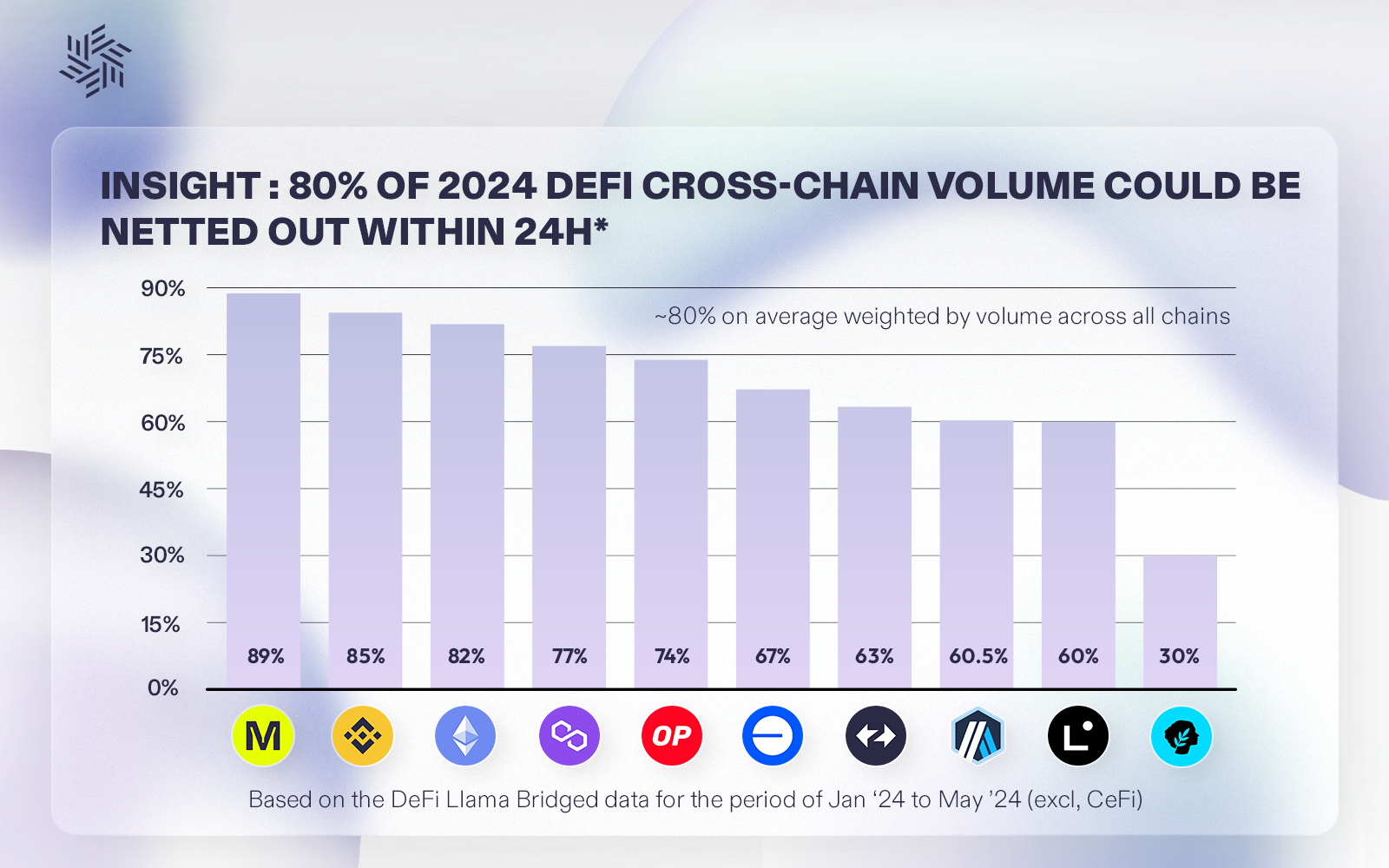

However, an analysis based on the DeFi Llama Bridged data (from Jan ‘24 to May ‘24, excluded CeFi) shows that over 80% of inter-chain transfers in a typical 24-hour period are nettable (the effect of one order can be offset by the effect of another). As an example, this means that out of every $1 flowing into Arbitrum on a typical day, $0.80 flows out.

Building on this insight, Everclear identified an opportunity to address the rebalancing challenge that results in liquidity fragmentation and centralization within the solver ecosystem. It aims to fill this gap by introducing a novel primitive: the Clearing Layer, a decentralized network designed to coordinate the global netting and settlement of capital flows between chains.

Everclear (formerly Connext), a modular interoperability protocol, was founded in 2017 as an L2 R&D team, it built the first intent-based bridge in 2021, and introduced the Chain Abstraction vision last year.

As a modular protocol, it facilitates the secure transfer of funds and data between chains, allowing developers to build cross-chain applications (xApps) or Web3 applications that interact with multiple domains (blockchains and/or rollups) simultaneously.

Over time, it has expanded its support to a total of 10 chains. As of now, it has over $1B in TVL and powers Renzoʼs L2 Restaking, the largest Chain Abstracted application on the market, through its “Restake From Anywhere” module.

The transition from the Connext brand to Everclear reflects the experience gained over the years and a commitment to addressing the liquidity fragmentation issue that limits user experience and broader adoption of the cross-chain ecosystem. Everclear will be the new brand, with a core focus on the Clearing Layer, a new component of the modular stack designed to coordinate the global netting and settlement of capital flows between chains.

The existing Connext bridge UI and intent protocol will become a flagship example of Everclear and will be rebranded as part of the mainnet launch. As of 3rd June, the Everclear testnet is live and ready for integration with solvers, market makers, and intent protocols. The system is built as an Arbitrum Orbit rollup in partnership with Gelato RaaS, and uses Hyperlane & Eigenlayer to power secure connections to other chains. The alpha mainnet launch of Everclear is scheduled for early Q3. To ensure user safety and adopt a progressive approach to decentralization, the alpha release will include certain limitations and guardrails. The native token of Everclear will be $NEXT, and the protocol will be governed by the Everclear DAO.

Monolithic blockchains, like Ethereum and Solana, handle execution, settlement, consensus, and data availability all within the same layer in a generalized manner. This approach limits their ability to specialize in any single function, thus constraining them to the scalability trilemma.

In contrast, modular blockchains aim to distribute these functions across multiple specialized chains. The core idea of the modular blockchain thesis is the separation of roles: instead of one network managing all core functions, the modular approach divides responsibilities (such as execution and data availability) across different, specialized networks. By disaggregating the components of a monolithic Layer 1 (L1) blockchain, each layer can be optimized for specific functions, improving decentralization, security, and scalability as needed. The rationale is that the combined efficiency and customization of these specialized layers can achieve significantly higher performance and flexibility.

As mentioned in the introduction, the modular approach is emerging as a viable alternative to the monolithic architecture, with an increasing number of L2s and AppChains being deployed. By examining various metrics, it is possible to assess the success of the modular thesis.

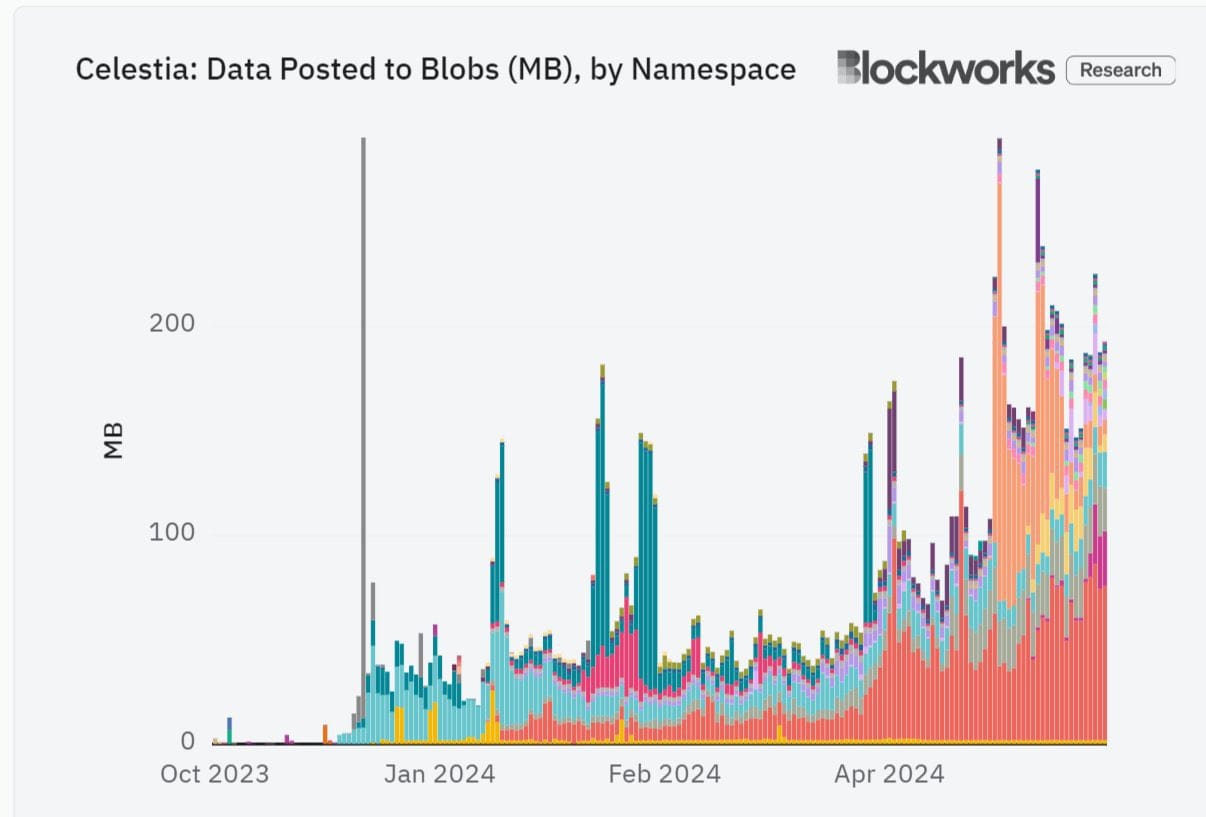

Celestia adopts a modular design specializing in the data availability (DA) component. The increasing number of users posting data to Celestia’s blobspace indicates the growing popularity of modular designs in the blockchain space. Since inception, the daily data posted to Celestia’s blobspace has steadily increased and now consistently reaches 200 MB per day.

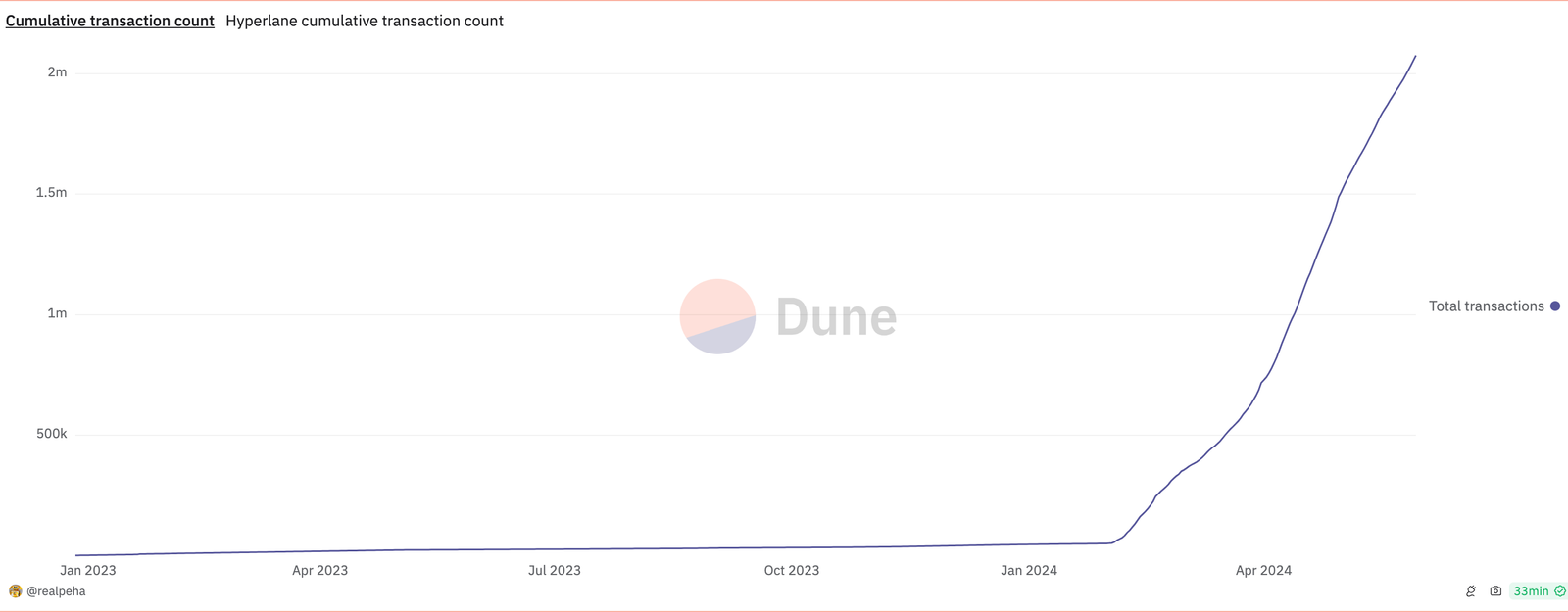

Hyperlane, an interoperability layer for the modular stack which allows messages to pass across blockchains, has surpassed 2M in cumulative transaction count.

Moreover, currently there are 53 rollups and over 250 chains live, and this number is growing exponentially.

While this growth is promising, it also highlights a significant issue: widespread fragmentation in terms of liquidity and user experience. Users shouldn’t need to know or care which rollup they are interacting with. Expecting crypto users to know whether they are using Optimism or Base is equivalent to expecting web2 users to know whether they are using AWS or GCP.

The fragmentation of users and liquidity across different blockchains is becoming a significant obstacle for Web3 applications. Interacting with a dApp across various chains is currently difficult and time-consuming, even for experienced crypto users.

In the crypto space, users must deploy liquidity across multiple L1s and L2s, deal with a suboptimal user experience due to fragmented on-chain liquidity sources, and navigate the technical complexities of these systems.

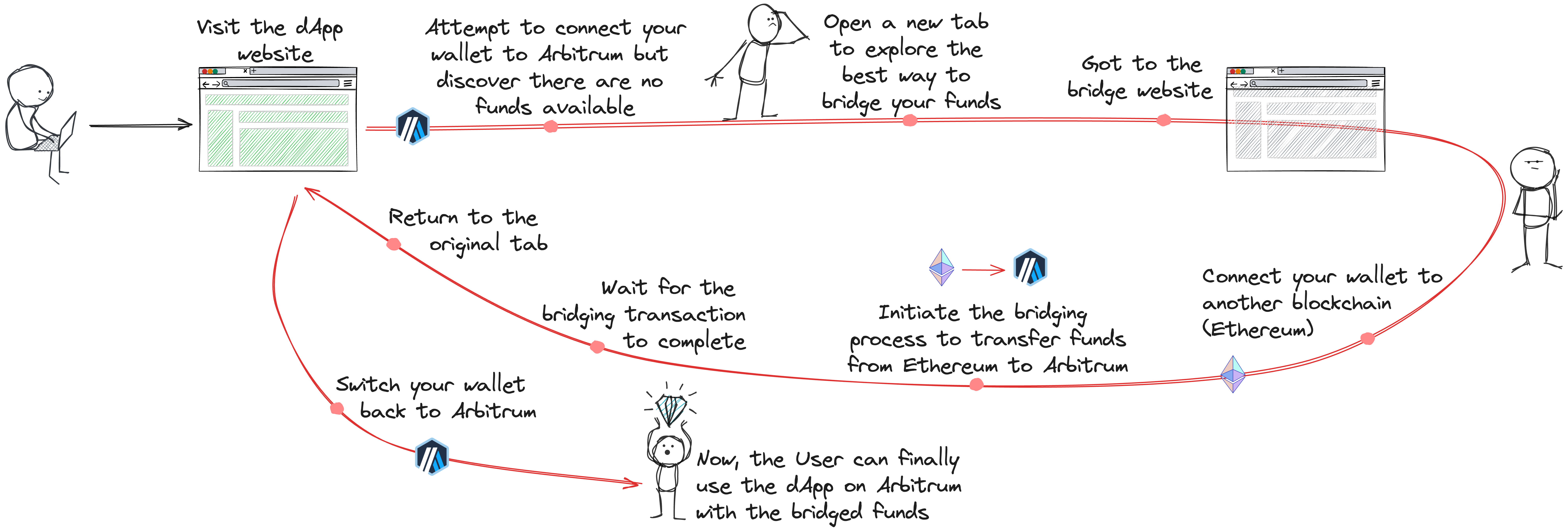

To illustrate this complexity, imagine you want to interact with a decentralized application (dApp) on the Arbitrum network, but your funds are currently stored on the Ethereum blockchain:

This flow is simply inadequate for any application aiming to onboard users beyond the most crypto-native individuals. Furthermore, as more L2s are launched, the user experience becomes increasingly fragmented and frustrating.

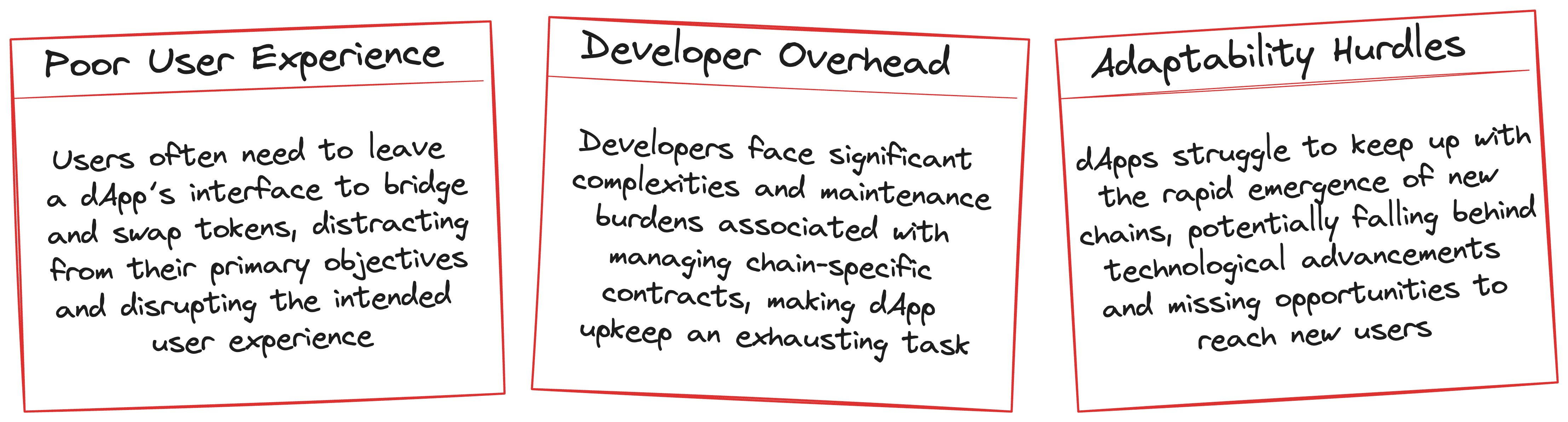

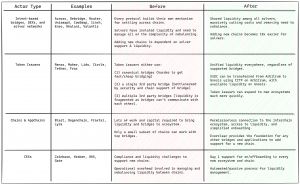

Overall, the expansion of dApps to multiple chains presents challenges for all actors involved, not just the end users:

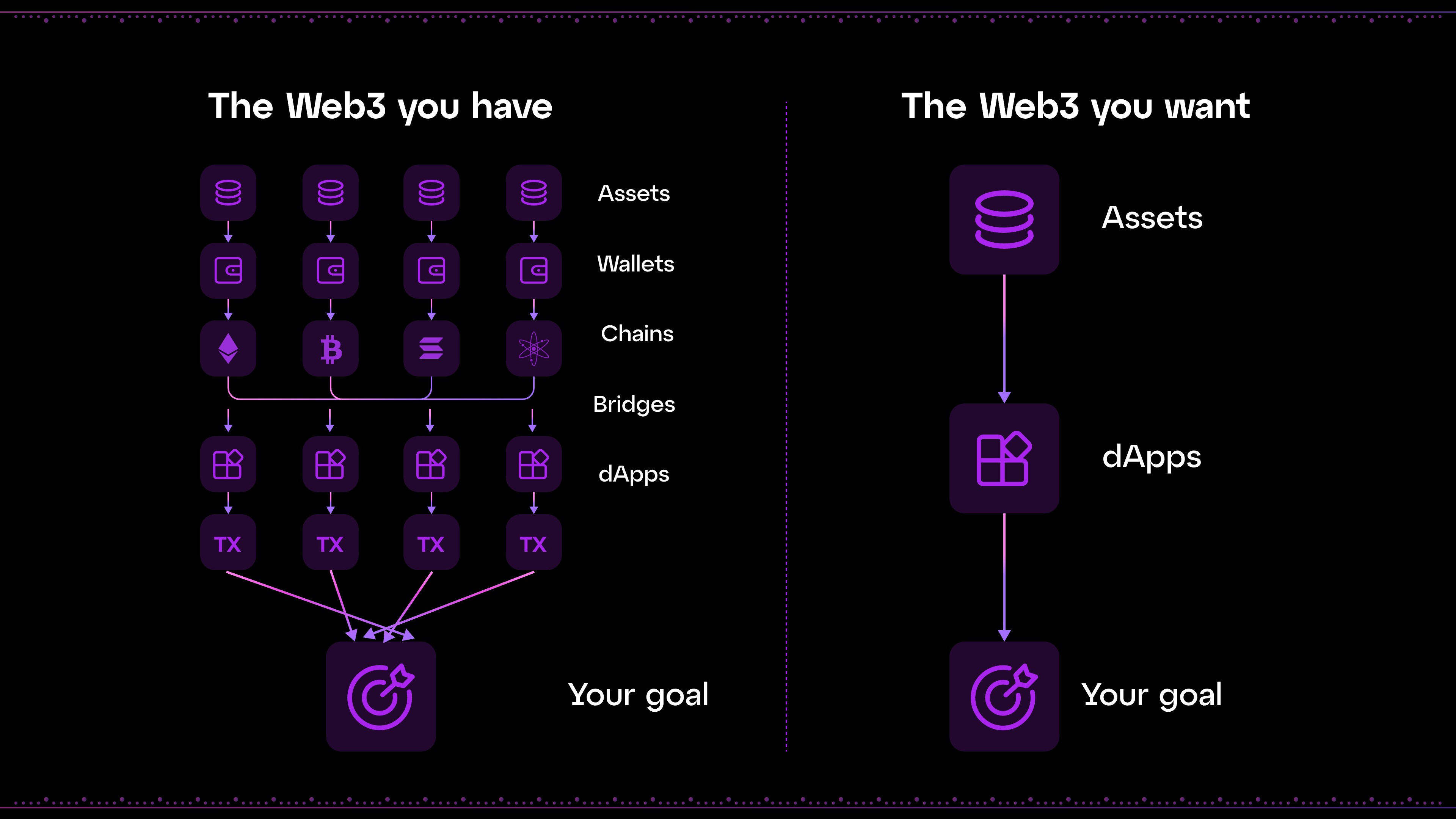

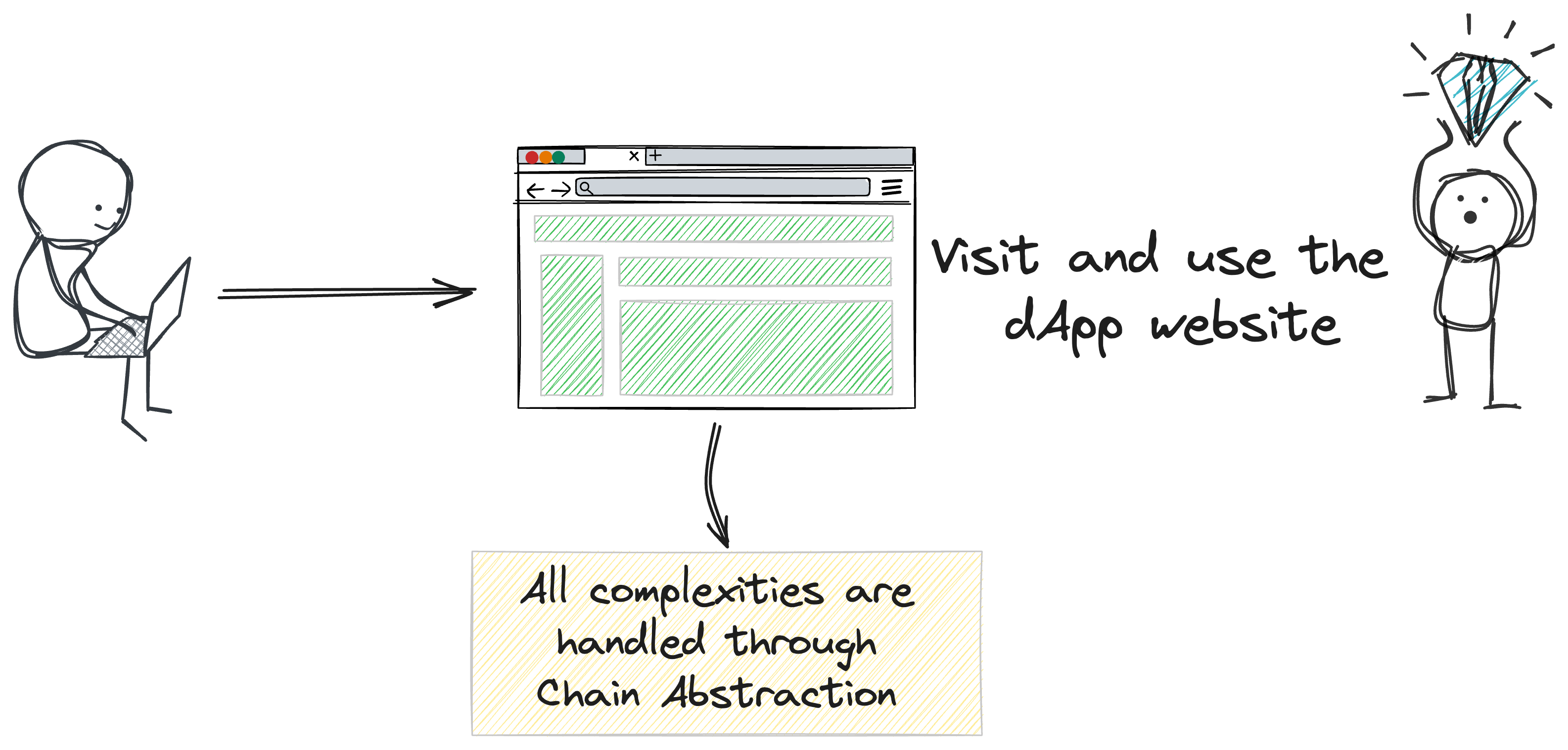

Chain Abstraction aims to hide chain-specific information from the user, simplifying interactions and improving the overall user experience.

Chain Abstraction is a design pattern aimed at improving the dApp user experience by minimizing the need for users to be aware of the specific blockchain they are interacting with. It simplifies the blockchain’s technical complexities and nuances, delivering a seamless user experience where users are unaware that they are using the blockchain.

This is achieved by eliminating the UX frictions typically associated with managing multiple blockchains and distancing end users from front-end blockchain interactions. With Chain Abstraction, users no longer need to switch networks, sign transactions on different chains, or pay gas fees on another chain.

In essence, the goal of Chain Abstraction is to enable users to interact with any dApp from any chain using any token, all within a single, unified user interface (UI).

Referring to the user journey example from the previous chapter, the simplified user journey with Chain Abstraction would be as follows:

This pattern can be applied to any dApp user flows: (1) participating in an airdrop or LBP from anywhere, (2) depositing funds into a pool or vault from anywhere, (3) paying for infrastructure or middleware from anywhere, (4) purchasing an NFT or POAP from anywhere, (5) staking $ETH in an LST protocol from anywhere, (6) restaking ETH/LSTs in an LRT protocol from anywhere, and more.

In conclusion, Chain Abstraction offers the following benefits

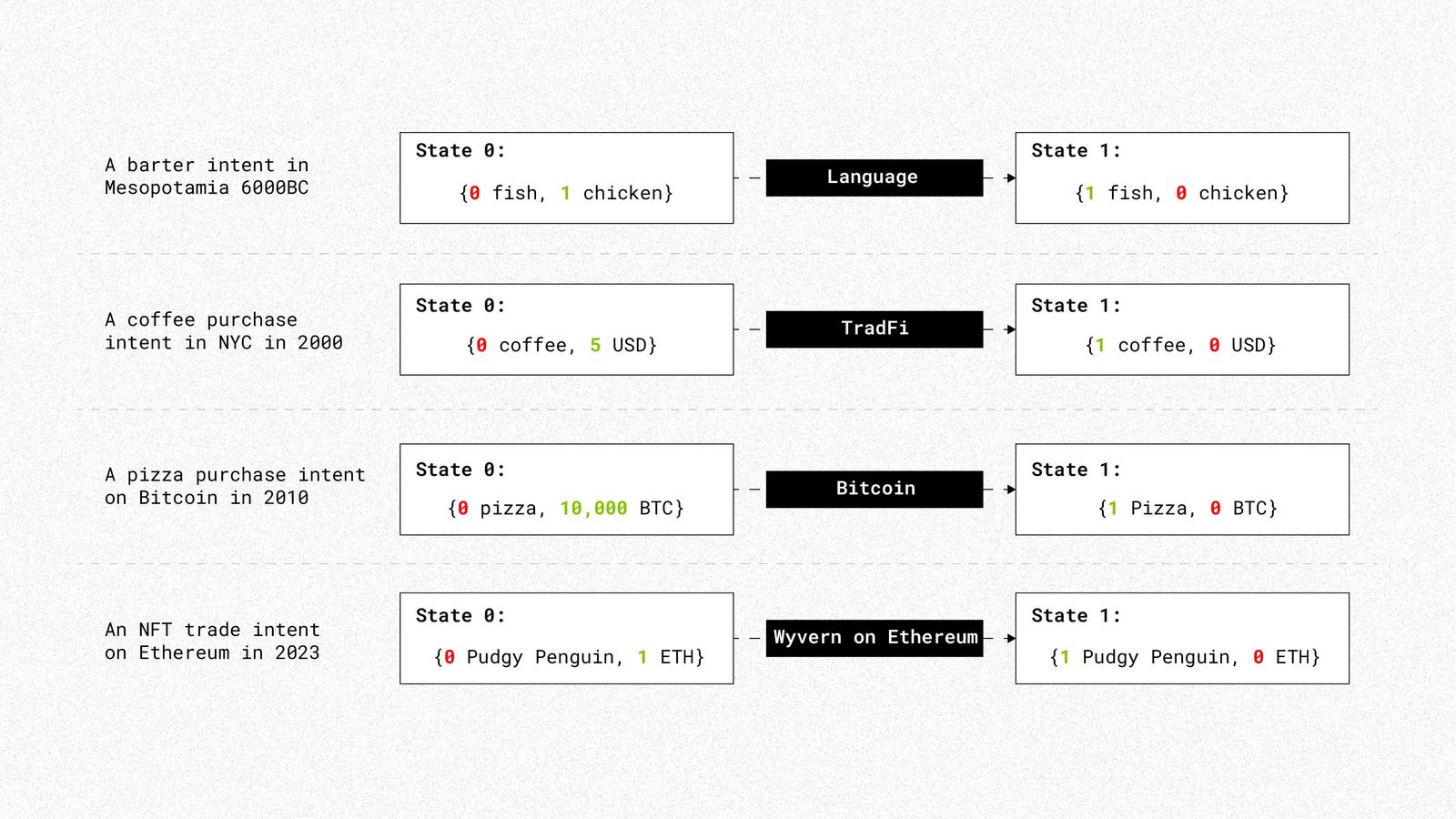

An intent is an expression of an individual’s desired end state(s). Whenever someone needs something, they subconsciously formulate a virtual intent in their mind. This could be anything from wanting fish, coffee, pizza, or even an NFT. An intent includes information about specific parameters, and a solution is only valid if it satisfies the conditions related to those parameters. Unlike a transaction, which provides a set of instructions to be executed, an intent outlines an ideal end state. As Liesl Eichholz put it, “A transaction specifies the journey, while an intent specifies the destination”. Intents are indifferent to the journey. As long as the desired outcome is achieved according to the user’s specified conditions, the path to that destination is irrelevant to the user.

The number and diversity of mechanisms available to fulfill intents have significantly evolved over time. From the early barter systems of 6000 BC Mesopotamia, we now have a wide array of mechanisms including fiat currencies, traditional financial infrastructure (TradFi), Bitcoin, and Ethereum.

Transactions and intents both involve users delegating the construction of the ultimate computational path (the journey) to a third party. The key difference lies in who defines this path. Currently, applications construct transactions on behalf of users, considering user preferences in isolation rather than within the broader market context.

In a standard transaction-based flow, a transaction signature authorizes the validator to follow a specific computational path against a certain state, with a tip incentivizing the validator to execute this path. In contrast, an intent does not specify a particular computational path but rather permits any path that satisfies certain constraints. By signing and sharing an intent, a user effectively grants recipients the authority to choose the computational path on their behalf.

This distinction allows for a more precise definition of intents as signed messages that authorize a set of state transitions from a given starting state. Transactions, a special case of intents, allow for a unique transition.

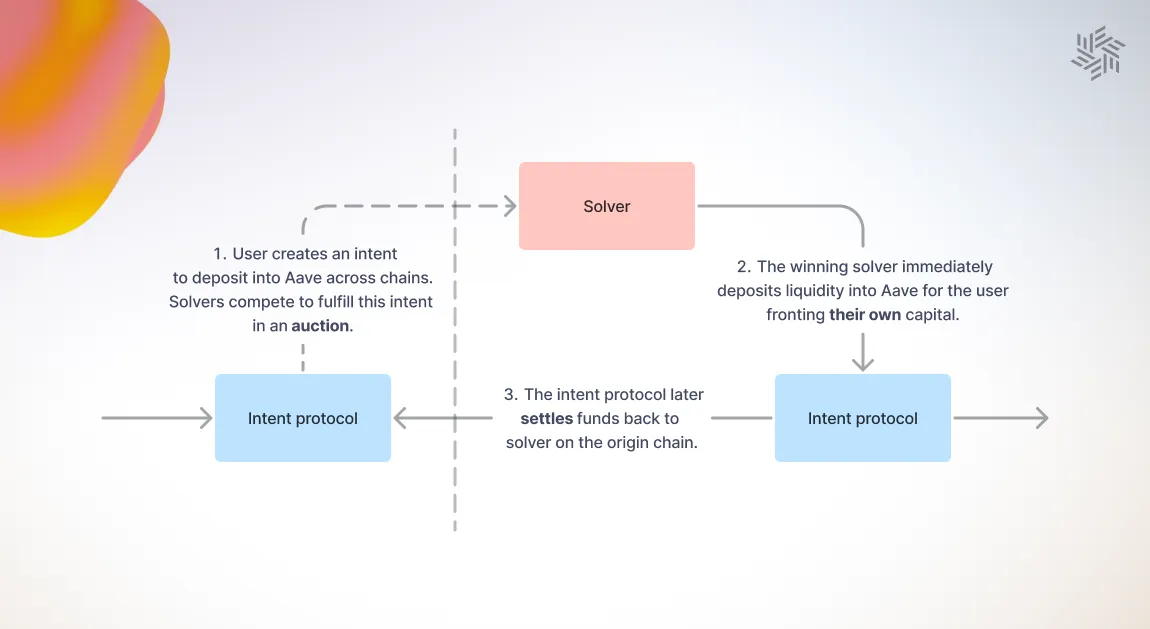

Intents-based systems play a crucial role in achieving Chain Abstraction. Typically, intent-based protocols achieve decentralization by outsourcing to a network of solvers that compete to fulfill user requests with the best possible solutions.

The goal solvers aim to achieve is to: (1) fulfill as many intents as possible, (2) to the greatest extent possible, and (3) with maximum efficiency. This competitive system should ensure that no single central party is responsible for meeting all user needs, promoting a more distributed and efficient approach.

Solvers play a crucial role in intent-based systems by providing users with the desired assets on the destination chain, front-running capital from their own inventory. This enables users to receive funds instantly. In return for their services and the risk they assume, such as potential delays or losses in repayment due to the finality risk associated with cross-chain bridging, solvers charge a fee.

It is important to note that solvers typically receive repayments in various tokens across different chains. As a result, they must frequently rebalance and maintain liquidity across multiple chains to continue offering their services effectively.

It is evident that running a solver is challenging, with numerous barriers to entry and competition (see “An Analysis of Intent-Based Markets”):

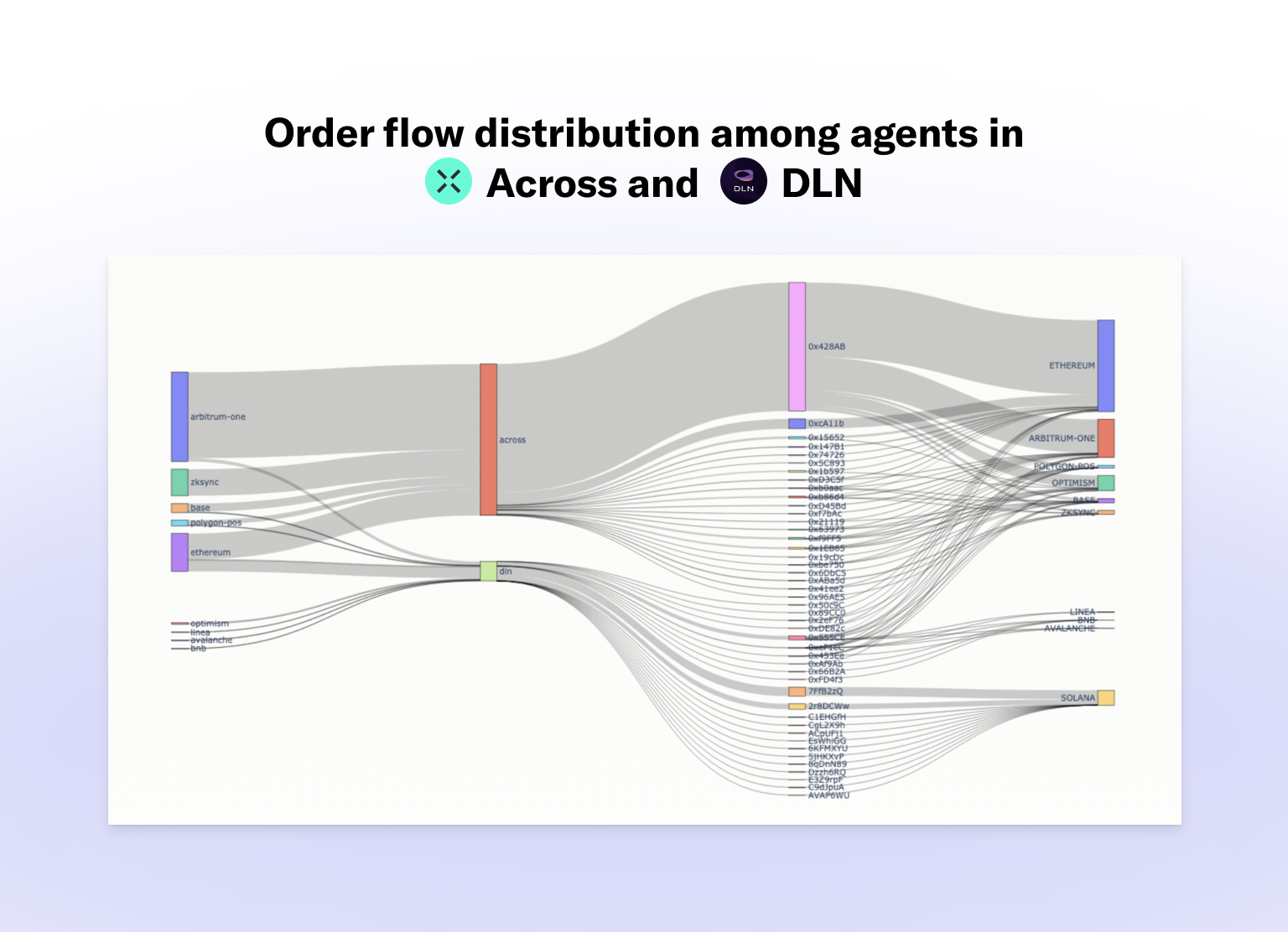

To confirm what was stated above, Li.FI Research conducted an analysis of order flow fulfillment in Across V2 and DLN using data from Anera Labs’ dashboard, “Illuminating the Cross-chain Intents Landscape” (note that the data for this study was collected over a one-week period, from January 26, 2024, at 13:00 (UTC) to February 2, 2024, at 13:48 (UTC).

Across has 22 agents, and DLN has 26 agents bidding for order flow. The analysis reveals that only a few solvers win most of the order flow. In Across, a single solver often wins the majority of orders over $500. This dominance is even more pronounced for orders exceeding $25,000, where one solver captures over 97% of the volume.

Key takeaways from Li.FI Research indicate that a select few solvers dominate nearly all of the order flow, often with the most successful solver being run by the team behind the protocol. Additionally, there is a lack of competition among solvers for each order, as a significant percentage of auctions involve only one bidder, resulting in no bidding contest. This situation exposes a clear centralization risk among intent-based bridges at the solver level, posing concerns related to liveness, censorship resistance, and poor execution of order flow.

One of the main issues limiting entry and competition in the solver space is the need for intent solvers (as well as market makers and centralized exchanges) to rebalance their liquidity. Rebalancing is a complex and costly process, and only the largest and most sophisticated solvers manage it well enough to be successful.

Hence, a unique challenge for cross-domain intents is optimizing settlements to provide the best experience for solvers. Currently, most intent systems, such as Connext v0 and v1, settle funds back to solvers on the source chain, which complicates the rebalancing process.

This approach creates several challenges for solvers.

First, there is liquidity path dependency, as solvers may be repaid on chains they do not prefer or with tokens they do not want to hold. Consequently, solvers tend to only solve intents on paths they approve, which fragments liquidity and poorly utilizes their capital.

Second, solvers are often repaid on less utilized chains. Since they provide funds on the destination chain but are repaid on the origin chain, their liquidity flows in the opposite direction from user funds. Over time, this causes solver liquidity to accumulate on less utilized chains, necessitating frequent rebalancing to remain profitable.

Finally, rebalancing is both expensive and complex. Solvers must compare prices across multiple bridges and exchanges to find the most cost-effective rebalancing method. As this process is unique for each chain and asset, the operational complexity increases exponentially with more chains and assets. To maintain capital efficiency, solvers need to rebalance regularly, incurring additional fees that are ultimately passed on to the user through higher service charges.

Moreover, the challenges arising from the current fund settlement mechanisms extend beyond solvers:

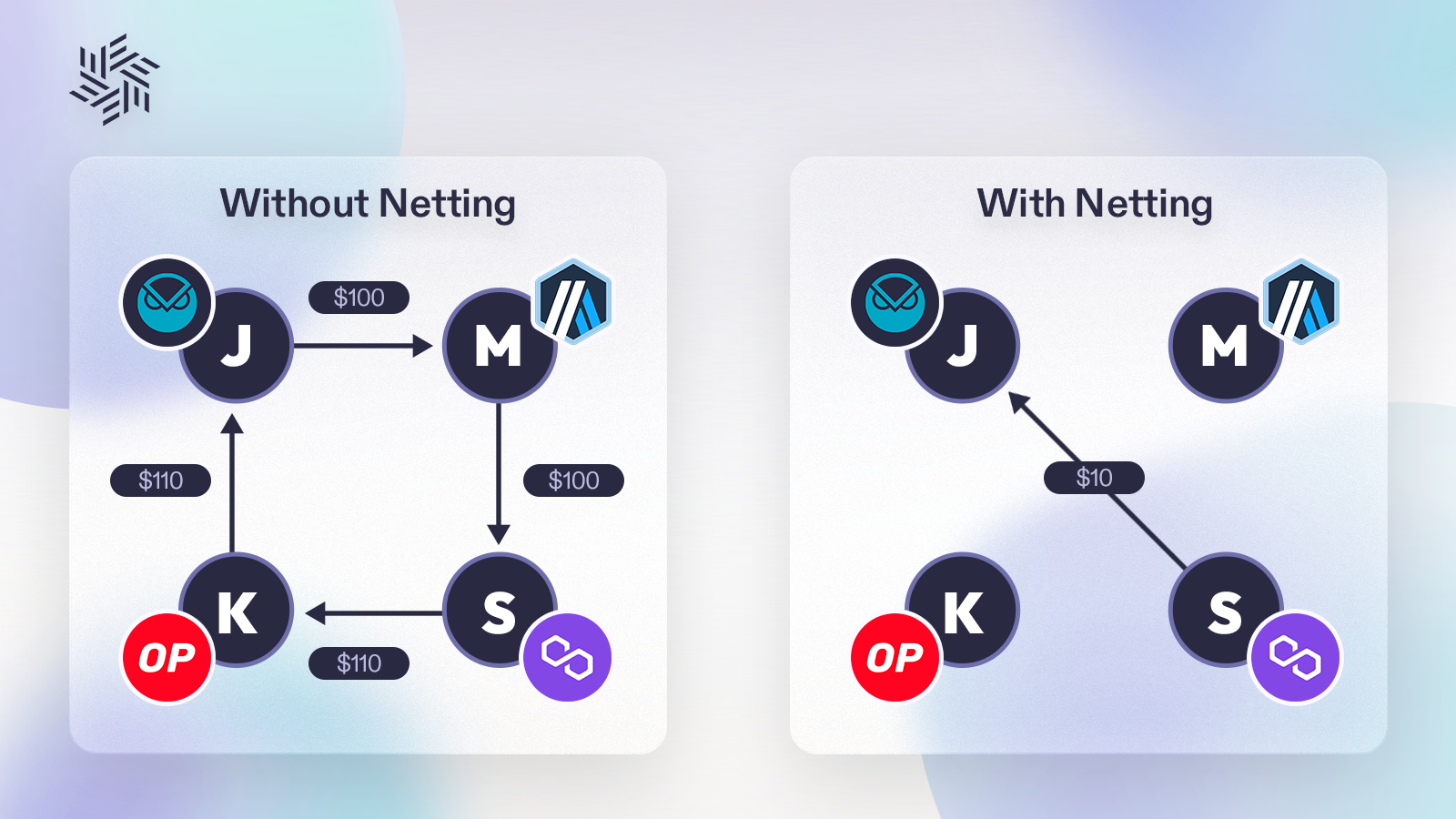

Today, these actors can only remain competitive by maintaining large amounts of liquidity on each chain they support. This allows them to personally net some of the transactions. For example, if funds flow more heavily from Arbitrum to Optimism on some days and from Optimism to Arbitrum on others, they can offset these movements internally.

The core issue is that everyone is playing an isolated, player vs. player (PvP) game with their interchain liquidity. There is no shared system for market participants to coordinate capital flows and settlements between chains.

Examining global fund flows between chains reveals that bidirectional flows dominate the current interchain market. This indicates that, on average, around 80% of daily inflows and outflows between chains can be netted, significantly reducing operational costs and easing many of the rebalancing challenges solvers face today. In essence, for every $1 transferred into a given chain each day, $0.80 is transferred out.

Taking advantage of this insight, Everclear saw the opportunity to address the rebalancing challenge that leads to liquidity fragmentation and solver ecosystem centralization by proposing a novel primitive: the Clearing Layers, a decentralized network that coordinates global netting and settlement of capital flows between chains.

By netting transactions and integrating with the most efficient settlement mechanisms for each asset or ecosystem, Clearing Layers can significantly reduce the costs and complexity of rebalancing for solvers, market makers, and centralized exchanges (CEXs).

To understand how a clearing layer works, consider the analogy of the Visa network. When a customer pays for coffee with a Visa card, funds are not immediately transferred between banks. Instead:

Just as Visa sits between the user payment interaction and the final settlement, the Clearing Layer sits at the foundation of the Chain Abstraction stack, facilitating efficient fund transfers and settlements across different blockchain ecosystems.

Everclear aims to be the first Clearing Layer, coordinating the global settlement of liquidity between chains with the goal of solving fragmentation issues of modular blockchains. It aims to achieve that through the integration of this new layer within the current modular stack

The Clearing Layer can plug into transport protocols like IBC, Hyperlane, and LayerZero, as well as the canonical bridges of chains and even centralized exchanges, to enable transactions to be settled at the best possible price.

The main benefits of Everclear are substantial.

First, through netting, Everclear enables market participants to net their flows between chains, significantly reducing costs and complexity by up to 10x. By tracking all interchain flows as credits, Everclear can clear and offset capital flows in various directions, minimizing the need for actual settlement. This allows solvers to scale effortlessly, programmatically selecting how they prefer to be repaid and eliminating the costs and complexities associated with cross-chain rebalancing.

Second, Everclear supports programmable settlement, allowing for the creation of connections and coordination between messaging protocols, canonical bridges, centralized exchanges (CEXs), and any other mechanisms used to deliver funds to users.

Lastly, permissionless liquidity and chain expansion are crucial for the system’s effectiveness. For chain abstraction to work, it must be universally applicable. Everclear’s model facilitates permissionless liquidity for new chains, providing a foundation for any intent-based bridge and chain-abstracted application to build upon.

Everclear is built as an Arbitrum Orbit rollup with off-chain data availability (DA) in partnership with Gelato RaaS. The system utilizes Eigenlayer and Hyperlane to connect with other chains.

It is possible to think of Everclear as a shared computer designed to calculate optimal settlements, where anyone can write strategies that integrate with bridged token standards, messaging bridges, and more. Users (solvers, market makers, centralized exchanges (CEXs), intent protocols, …) use Everclear by depositing funds into Gateway contracts deployed to each supported chain. The Everclear rollup then reads the state of every Gateway in batches using Hyperlane and their Eigenlayer AVS under the hood.

Figure 18: Everclear: How it Works

Source: Everclear

At launch, Everclear issues “invoices” for all pending settlements and clears them using a Dutch Auction mechanism. In each epoch, the system attempts to settle all invoices (in first-in-first-out order) using available liquidity from deposits. If there is insufficient liquidity, the system discounts the price of an invoice until an arbitrageur provides the necessary liquidity.

Alice and Bob are solvers for Aori and Connext, respectively. Alice prefers to fill and settle on Arbitrum, while Bob prefers Optimism.

On a given day, Alice fills a 10 $ETH transaction from Optimism to Arbitrum, and Bob fills a 20 $ETH transaction from Arbitrum to Optimism. The funds from these transactions, 10 $ETH and 20 $ETH respectively, are deposited into Everclear on their corresponding chains.

Everclear then settles Alice’s 10 $ETH transaction by using 50% of Bob’s 20 $ETH deposit, transferring the amount to Arbitrum at almost no cost. However, when it comes to settling Bob’s transaction, Everclear faces a liquidity issue, as there are only 10 $ETH available on Optimism, not enough to fully settle Bob’s 20 $ETH request.

To resolve this, Everclear auctions off Bob’s invoice, discounting its price from $1 to $0.99. Charlie notices this auction and deposits 9.99 $ETH on Optimism. As a result, Everclear settles Bob’s transaction by providing him with 19.99 $ETH on Optimism. Charlie now holds an invoice for 10 $ETH, having made a profit of 0.01 $ETH.

Ultimately, both Alice and Bob end up back on their preferred chains, ready to fill more transactions. This entire process occurs with zero operational work on their part and at almost no cost.

Everclear’s target market includes anyone seeking to facilitate transactions between chains without concern for the duration of solver repayment. This includes intent-based bridges such as Across, Connext, and Debridge, as well as intent-based decentralized exchanges (DEXes) like Uniswap, CoW Swap, and 1inch.

Figure 19: The benefits of Everclear’s Clearing Layer by Actor Type

Source: Everclear; adapted by Revelo Intel.

These protocols all face a common challenge: their intent solvers must rebalance effectively to scale across multiple chains. By integrating with Everclear’s shared clearing layer, these projects can achieve improved liquidity, better pricing for their users, and a straightforward path to expand to as many chains as desired.

The modular blockchain thesis, which separates the core functions of blockchains (execution, settlement, consensus, and data availability) across specialized layers or networks, is proving to be able to improve efficiency and scalability. Proof of that is the increasing number of L2s and AppChains being deployed.

However, it also comes with two key issues for the interchain space: (1) the fragmentation of liquidity across different chains, and (2) the fragmentation of users that leads to user experience (UX) complexity, expensiveness, and slowness.

Chain Abstraction simplifies user interactions by hiding the complexities of underlying blockchain infrastructure, allowing users to interact with decentralized applications (dApps) seamlessly across multiple chains.

Intents-based systems play a crucial role in achieving Chain Abstraction, enabling users to specify desired outcomes without detailing the exact computational paths. Solvers, which are specialized third parties, execute these intents by managing and rebalancing liquidity across chains.

Despite these advancements, liquidity fragmentation and the challenges of interchain transactions remain significant. Solvers face high operational costs and complexities in rebalancing liquidity, which limits entry and competition within the solver ecosystem.

Everclear emerges as a solution to these issues. By introducing the first Clearing Layer, Everclear’s goal is to coordinate global netting and settlement of capital flows between chains. This decentralized network aims to reduce operational costs and complexity, making it easier for solvers, market makers, and centralized exchanges (CEXs) to manage liquidity across multiple chains.

The transition from Connext to Everclear underscores a commitment to addressing liquidity fragmentation and enhancing user experience in a multichain environment.

Across, (2023) Dodging the Finality Bullet, A Guide to Finality Risk. Published in across.to (Medium) | Link

Andy, (2024) The ongoing modular expansion of 1000s of chains is at a critical point. Twitter | Link

Anera Labs, (2024) Illuminating the Cross-chain Intents Landscape | Link

Avran, (2024) Celestia: The Modular Money Thesis. Published in Coinmonks (Medium) | Link

Bhuptani A., (2023) Introducing Chain Abstraction. Published in Connext (Medium) | Link

Bhuptani A., (2024) Introducing Everclear: The First Clearing Layer. Published in Everclear (Medium) | Link

Blockworks, (2024) The definitive guide to chain abstraction. Blockworks News | Link

Buterin V., (2023) The Limits to Blockchain Scalability. Vitalik Buterin Website | Link

Caldera, (2024) What is the Modular Blockchain Thesis?. Caldera Guides | Link

Chand A., (2024) The Untold Trade-Offs in Intent-Based Bridges. Li.FI | Link

Chitra T., Kulkarni K., Pai M., Diamandis T., (2024) An Analysis of Intent-Based Markets. arXiv | Link

Connext, (2024) Devs, your users deserve a better multichain UX. Twitter | Link

Connext Academy | Link

Connext Website | Link

Eichholz L., (2023) Introducing Essential: We Are Intents. Essential | Link

Gherghelas S., (2024) Dapp Industry Report 2023. DappRadar | Link

Kilbourn Q., Konstantopoulos G., (2023) Intent-Based Architectures and Their Risks. Paradigm | Link

Kim C., (2023) Scaling Blockchains: The Modularity Thesis. Galaxy Research | Link

Nagesh M., (2024) Scaling Blockchains: Embracing Modularity. Binance Research | Link

OurNetwork, (2024) ON-238: Modular Networks. OurNetwork | Link

Particle Network, (2024) Realized Vision: Modular Chain Abstraction. Particle Network Resources | Link

Sun Yin A., (2023) An Introduction to Intents and Intent-Centric Architectures | Link

Timofeev P., Imajinl, (2024) The 0-1 of Chain Abstraction. Shoal Research | Link

Vavaenesh, (2024) History of Intents: The Present. Published in Connext (Medium) | Link

Vavaenesh, (2024) Q1 unwrapped: Connext in 2024. Published in Connext (Medium) | Link

Vavaenesh, (2024) Restake from Anywhere: pioneering L2 staking with Connext. Published in Connext (Medium) | Link

Wetzel B., (2023) Intent-Based Architectures and Projects Experimenting with Them. Medium | Link

Revelo Intel is engaged in a commercial relationship with Everclear as part of an educational initiative and this report was commissioned as part of that engagement.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.