Published: June 10, 2024

Price volatility poses a significant barrier to participation in the crypto market, deterring newcomers from trading or investing in this asset class. Repeated instances of extreme market fluctuations have resulted in billions of dollars in liquidations, making the market less appealing for more passive or risk-averse investors. This volatility particularly discourages newcomers to the space, as they are reluctant to compromise their capital in such an unpredictable environment.

Figure 1: Total Crypto Market Liquidations (from Nov-23 to May-24).

Source: Coinglass.

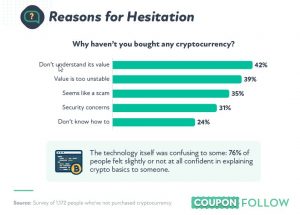

A 2022 survey found that nearly 40% of individuals who had not yet purchased cryptocurrency were hesitant to do so because of concerns about price volatility. High volatility and frequent liquidations can create a negative sentiment around the underlying asset. This perceived risk can deter risk-averse investors due to rapid price swings creating a sense of fear and uncertainty.

Figure 2: Reasons for Hesitation about Buying any Cryptocurrencies.

Source: Coupon Follow (as of 2022).

Derivatives instruments can help to offset part of that volatility and hedge against the unpredictability of the market. However, these instruments are fairly complex and non-intuitive for the average investor. For example, options involve a fairly deep understanding of quantitative indicators, the greeks, choosing among different maturities, etc. Another problem comes when we consider that most of these instruments are offered by centralized exchanges who take custody of your assets.

DeFi offers a solution to this problem, allowing users to stay in control of their assets while protocol developers take advantage of new innovations and can offer payoff structures that are not available in option exchanges like Deribit or other futures platforms.

Among existing instruments, regardless of whether they are offered by a centralized or decentralized provider, the traditional Black-Scholes options pricing model continues to dominate. This is a method that has historically been used for determining fair premiums in options pricing (the price that the buyer of the option pays to the seller for the rights conveyed by the option contract). Options are contracts that enable traders to buy or sell a particular asset at a set price on a future date. This model, which has been widely used in traditional finance, was adapted for cryptocurrencies when Deribit launched Bitcoin options trading in 2016. Today, it has also been adopted by DeFi protocols aiming to enable options trading on-chain.

However, traditional models like Black-Scholes face challenges in the crypto market. They rely on assumptions of constant volatility and lognormal asset price distribution, resulting in pricing inaccuracies during extreme market fluctuations. These models also fail to adequately handle market crashes and sudden, large price movements, leading to expensive and complex options contracts that lack effective strategies for significant asset value changes.

To address the limitations of traditional methods like Black-Scholes in pricing risk, Bumper was launched by the end of 2023, offering a novel approach to protect the value of crypto assets while potentially profiting regardless of market direction. The protocol was designed to optimize a trilateral tradeoff: minimizing taker premia, maximizing maker yield, and minimizing protocol insolvency risk.

Since launch, Bumper has continuously innovated, particularly by integrating Artificial Intelligence to further enhance protocol efficiency and performance. This AI-driven approach helps to dynamically price premiums based on real-time volatility, allowing Bumper to crunch market data, predict trends, and manage the risks associated with the unprecedented speed and dynamic nature of crypto.

Bumper is a non-custodial and permissionless DeFi protocol. At its core, it acts as a risk management tool designed to protect the value of crypto assets from downside volatility and market crashes. While Bumper shares similarities with stop losses, options desks, and insurance policies, it stands out due to its unique architecture, functionality, and approach to risk management. These elements allow Bumper to offer an additional benefit: it can also be used as a trading tool. In particular, Bumper introduces a novel approach to trading, enabling users to potentially generate gains regardless of market direction, all while maintaining protection for their assets. Furthermore, by progressively integrating three AI tech stacks into its technology, Bumper is able to further optimize yields and premiums, making it even more cost-effective as a trading tool.

Unlike put options, which involve buying a contract with a fixed premium and gambling on price movements, Bumper protects tokens you already own and its premiums are calculated dynamically based on actual market volatility.

As a trader, you can open a position on Bumper by depositing your asset and choosing a protected minimum value: (1) if the asset price goes up, so does the value and you retain your asset, (2) if the price goes below your floor, at the end of your term you can exit with a stablecoin and accumulate more assets at a lower price; as an alternative, you can pocket the stablecoin and preserve the value of the assets held.

Similarly, you can also participate in the protocol as a liquidity provider, earning yield on your deposit without continually monitoring price action, writing quotes to sell investment contracts, and finding buyers for those contracts.

Figure 3: With a Bumper position the user can gain both on the ups and downs

Source: Bumper.

The protocol offers a range of autonomous functions that enable users to protect the value of deposited tokens such as Bitcoin (wBTC), Ether (wstETH), with others to be added. These deposits are locked for a fixed period of time, such as 7 days, 30 days, 120 days, etc.

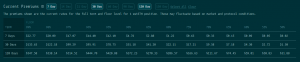

Figure 4: Example of Dynamic Premiums for Different Terms and Floor Levels

Source: Bumper App.

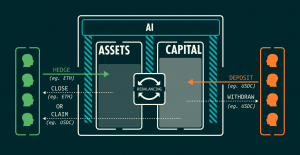

Protection ‘Taker’ deposits are pooled together and incur a regular, dynamic premium. This liquidity is provided by ‘Makers’ who deposit stablecoins ($USDT) into a corresponding pool that backs the protected value of Taker assets. A novel rebalancing mechanism ensures equilibrium between Taker and Maker pools if they diverge too far from their set thresholds.

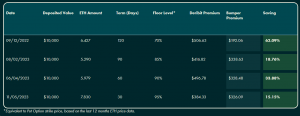

Since its launch on Arbitrum in December 2023, Bumper has consistently outperformed traditional put option pricing on Deribit by up to 30%, marking a statistically significant improvement over the traditional Black-Scholes option pricing model. Bumper’s dedication to innovation has continued beyond its initial launch; to further improve the protocol’s performance, Bumper has underscored its focus on AI as a main component of its strategy.

Figure 5: Bumper’s novel Approach has Consistently Outperformed Traditional Option Pricing

Source: Bumper.

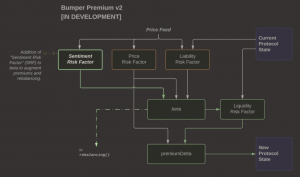

Bumper’s core function is a pooled risk market that leverages Artificial Intelligence (AI) to optimize efficiency. By progressively integrating three AI tech stacks (price prediction, sentiment analysis, and technical analysis) into its existing technology, Bumper aims to improve the calculations for price premiums and rebalancing. Utilizing real-time volatility data and signals from Large Language Models (LLMs), the protocol aims to anticipate market trends and adjust proactively.

Figure 6: Bumper’s Core Function: A Pooled Risk Market which Leverages AI to Optimize Efficiency

Source: Bumper.

Artificial Intelligence (AI) is set to drive unprecedented societal change and widespread economic disruption, creating new opportunities across all industries, including crypto. The rapid advancement in AI technologies, such as Large Language Model (LLM) compute, Large Language And Vision Assistants (LLAVA), Reinforcement Learning from Human Feedback (RLHF), Retrieval Augmented Generation (RAG), and Long Short-Term Memory (LSTM), has dramatically improved the capabilities of predictive models. These breakthroughs have also accelerated the speed of calculations, making real-time analysis and decision-making possible, which was unattainable just a few years ago.

Bumper exemplifies a project that credibly aims to integrate AI to improve its protocol. As previously anticipated, Bumper’s AI integration strategy revolves around three key AI tech stacks, each designed to address specific challenges and augment the protocol’s capabilities:

To validate the accuracy and effectiveness of its prediction models, Bumper employs a proprietary Agent-Based Modelling (ABM) approach. ABM is a computational technique that simulates the actions and interactions of autonomous agents (such as individuals, groups, or entities) to evaluate their impact on the overall system. These agents adhere to predefined rules and can learn, adapt, and evolve based on their experiences and interactions.

Agents are important as Bumper operates as a two-sided marketplace of makers and takers: users on one side hedge by locking in a floor price for a set term and pay a premium for that, while users on the other side deposit stablecoin liquidity to earn yield. Pricing the cost of this premium to satisfy both sides of the marketplace needs to be optimized: if it’s too expensive, takers won’t participate; if it’s too cheap, it’s not attractive for makers to deposit and put their capital at risk. The challenge is finding a sweet spot, which becomes more complicated as prices move and volatility changes. This is why Bumper’s ABM tool is so important, as it allows for dynamic adjustments to fairly price premiums according to real-time volatility, ingesting signals from LLMs to pre-empt market trends and rebalance proactively.

Using this ABM approach to support its AI integration strategy, Bumper forecasts an economic improvement of 5-25% in the protocol’s efficiency, effectively balancing the trilemma of Lower Premiums, Higher Yields, and Solvency Robustness.

The first AI tech stack is related to Price Prediction, utilizing a 70-billion parameter Large Language Model (LLM). Bumper trained this LLM with financial data, including Price (open, high, low, close) and Volume metrics of Bitcoin price datasets. The LLM is fine-tuned using Reinforcement Learning from Human Feedback (RLHF), rewarding the model for predictions that match normalized actual price data. The figure below provides a visual representation of the Price Prediction for Bitcoin using Bumper’s 70-billion parameter LLM.

Figure 7: Close Price Prediction Using a 70B Parameter LLM

Source: Bumper.

Initially trained on daily open/close prices and later on hourly data, the ongoing process aims to eventually incorporate tick data for even greater precision. Given that $BTC tick data consists of hundreds of terabytes, it used Retrieval Augmented Generation (RAG) to convert relational database information into data vectors. RAG technology not only enhances LLM performance but also facilitates the integration of multiple real-time asset price feeds, crucial for RLHF, within existing LLM context windows.

The second AI tech stack focuses on Sentiment Analysis. By leveraging a pre-trained 8 billion parameter Large Language Model (LLM), Bumper can analyze vast amounts of financial Natural Language Processing (NLP) data to gauge market sentiment with unparalleled granularity. Through fine-tuning and advanced NLP techniques, Bumper gains valuable insights into speculator disposition, allowing for a deeper understanding of market dynamics and trends.

Bumper’s pre-trained LLM ingests extensive financial NLP data, categorizing sentiment into detailed scores and distributions to provide a nuanced understanding of market sentiment. The model is fine-tuned using Bidirectional Encoder Representations from Transformers (BERT) to label opinions, attitudes, and emotions, with specialized NLP training to identify distinct financial vocabulary.

Bidirectional Encoder Representations from Transformers (BERT) is a state-of-the-art natural language processing (NLP) model developed by Google. It is designed to understand the context of words in a sentence by looking at both the words before and after the target word, rather than just the words that precede it. This bidirectional approach allows BERT to capture the full context of a word, leading to more accurate interpretations of meaning.

Equipped with attention mechanisms that allow the model to weigh the importance of different words in a sentence when determining the contexts and transformer-based structures, the LLM effectively discerns market sentiment and investor behavior, signaling future market trends.

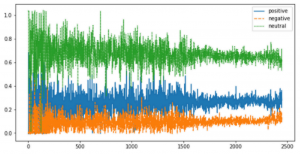

Figure 8: Discerning Market Sentiment To Signal Future Market Trends

Source: Bumper.

The third AI tech stack focuses on Technical Analysis. Bumper is developing a novel approach by training a Large Language And Vision Assistant (LLAVA), a multimodal model that combines vision-based analysis of price plot images with NLP-driven interpretation of technical indicators. This integration enables Bumper to make informed decisions based on historical price data and market trends.

The process consists in converting historical Bitcoin price data into graph plot images. These images are then labeled with technical markers such as support/resistance levels, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). The LLAVA model processes both these visual data points and the associated NLP technical indicators.

Figure 9: Example of Labeled Image With Technical Markers

Source: Bumper.

This end-to-end multimodal model connects a vision encoder with a Large Language Model (LLM), allowing the system to analyze and interpret complex market data. Additionally, the model incorporates Long Short-Term Memory (LSTM) for historical time series prediction, enhancing its ability to predict future market movements based on past trends.

Bumper’s triple-tier AI approach enables the protocol to anticipate market trends, dynamically price premiums based on real-time data streams, and proactively rebalance positions.

Streaming data in real-time, as opposed to traditional options desks that use implied volatility (IV) to calculate potential prices over a week or more, is an objective that represents a significant leap in efficiency for the protocol. Predicting prices just 15 minutes ahead would greatly reduce slippage in short-term price evaluations, thereby improving capital protection, and Bumper achieves this by leveraging AI technologies applied to real-time data.

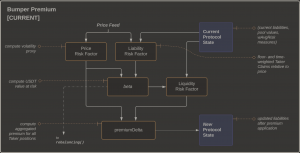

These AI integrations were developed with the goal of producing signals that feed into a single value, termed ‘beta’ within the protocol, a value which is already crucial for calculating premiums and rebalancing.

Figure 10: The Central Role of ‘beta’ in Calculating Premiums and Rebalancing

Source: Bumper.

Through this AI-driven approach, Bumper aspires to further improve the protocol efficiency and effectiveness in risk management, ultimately offering robust protection and increased returns for its users – better price protection for traders (takers) and more yield for liquidity providers (makers).

Figure 11: Integrating AI into Bumper Protocol

Source: Bumper.

This report has highlighted the critical need for effective risk and protection management solutions in the inherently volatile cryptocurrency market. Among the various solutions available, Bumper Finance, since its launch at the end of 2023, has introduced a novel approach compared to traditional methods. In particular, while maintaining protection for their assets, Bumper introduces an innovative trading approach, enabling users to potentially profit regardless of market direction. Moreover, in an ongoing commitment to innovation and efficiency, Bumper has recently rebranded to emphasize its focus on AI-driven solutions, which are now both practical and powerful.

Bumper’s current integration efforts include three AI tech stacks: price prediction, sentiment analysis, and technical analysis. These cutting-edge AI methodologies are designed to predict market movements minutes in advance, enhancing the dynamic calculation of premiums and rebalancing processes with the final goal of further optimizing the critical trilateral tradeoff of minimizing taker premia, maximizing maker yield, and minimizing protocol insolvency risk.

Revelo Intel is engaged in a commercial relationship with Bumper as part of an educational initiative and this report was commissioned as part of that engagement.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.