Published: October 18, 2024

MetaDAO is a meta-governance protocol on Solana that empowers other DAOs and protocols with a different choice from the standard token-based voting. By putting Futarchy into practice, it unlocks a price-driven democracy where markets break the governance mold. Through MetaDAO’s Futarchy decision markets anyone, regardless of how many governance tokens they hold, can speculate on what they think will happen to a protocol’s token price should a given proposal pass, or fail. This data is aggregated and used to give a final pass or fail result based completely on which result decision market participants thought would yield a higher price. Partner protocols, which include Drift, among other Solana-based projects, will then base their decision-making for specific proposals completely on the end result of this market.

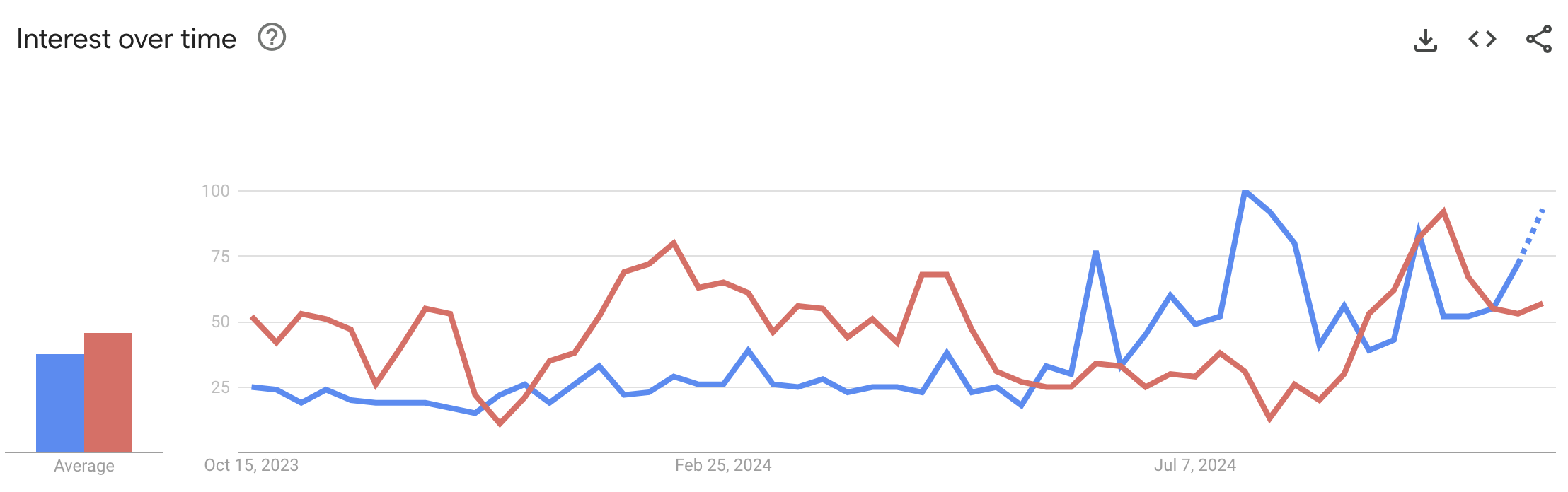

Figure 1: Google Trends – Prediction Markets Interest (blue) vs Decision Markets Interest (red)

Source: Google Trends

On the surface, MetaDAO’s implementation of decision markets is relatively simple. The concepts that inspired the protocol’s creation date back decades, with the term Futarchy first coined by economist Robin Hanson back in 2000. MetaDAO actually represents the first implementation of Futarchy since the concept’s inception, initially envisioned as a way to govern in the real world. It is these broader political and theoretical principles that give MetaDAO a high ceiling beyond its current product. With growing distaste for various facets of real-world governance, and the recent rise of prediction markets, MetaDAO finds itself in a unique position, operating as the sole player in the field of Futarchy, which is a subset of the broader information and decision markets sector

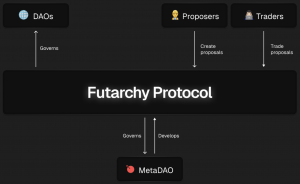

MetaDAO’s most insightful offerings come through its Futarchy protocol, which the team develops and maintains. The Futarchy protocol is where protocols and traders interact with the alternative governance principles that MetaDAO has brought on-chain. To provide proper background knowledge, this section will give a brief synopsis of what Futarchy means.

The term ‘Futarchy’ was first coined nearly 25 years ago. The concept was first described in a paper by economist Robin Hanson titled “Shall We Vote on Values, But Bet on Beliefs?”. In this paper, Hanson basically addresses and acknowledges various flaws in the democratic system, specifically in the U.S., but also in a more abstract sense. To combat these issues, two dramatic changes are proposed, emblematic of the paper’s title:

At first, these ideas didn’t actually have a name. In the original paper, this process of putting prediction markets to work to decide public policy is merely called the ‘decision market’. In a later manifesto, Hanson would go on to give this brainchild a proper name: Futarchy. The name stems from the idea that this newfound form of rule was the ‘governance model of the future’, to some effect. Aside from some lighthearted debate and brief press coverage, these ideas basically have remained dormant for over 20 years, until MetaDAO opted to bring them on-chain.

In a nutshell, prediction markets allow participants to bet on the outcome of an event, while decision markets take this concept further by using these bets to make actual decisions. Futarchy, in turn, applies decision markets to govern nations by letting market participants decide on policies based on their expected impact on key metrics, such as economic performance.

Initially, MetaDAO was created with the goal simply being to produce the first active example of Futarchy in action. The team, led by Prohp3t, the anon Founder of MetaDAO, gained meaningful mindshare for the unique Futarchic principles that could be applied to the DAO’s governance, and even received inquiries to help design similar systems for other DAOs. It is from this point that the focus shifted to serving existing DAOs, specifically in the Solana ecosystem (i.e. a Futarchy provider offering Governance as a Service).

In MetaDAO’s implementation of Futarchy, the token price of a protocol’s native governance token is assumed to be the de facto measure of welfare. This is applied in such a way that the ‘vote on values’ half of the statement that makes up the concept of futarchy explained above is already established, simplifying matters significantly. The Futarchy protocol in its current state only addresses the ‘bet on beliefs’ aspect.

The parameters to be decided upon are mostly up to the DAO team members, and are specific to each proposal. The DAO can dictate how long a proposal’s decision market is active, the positive price difference between the ‘pass’ and ‘fail’ price that must be reached to result in a proposal passing, minimum liquidity thresholds, and TWAP sensitivity parameters. From here, a proposal can then be created.

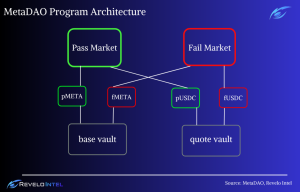

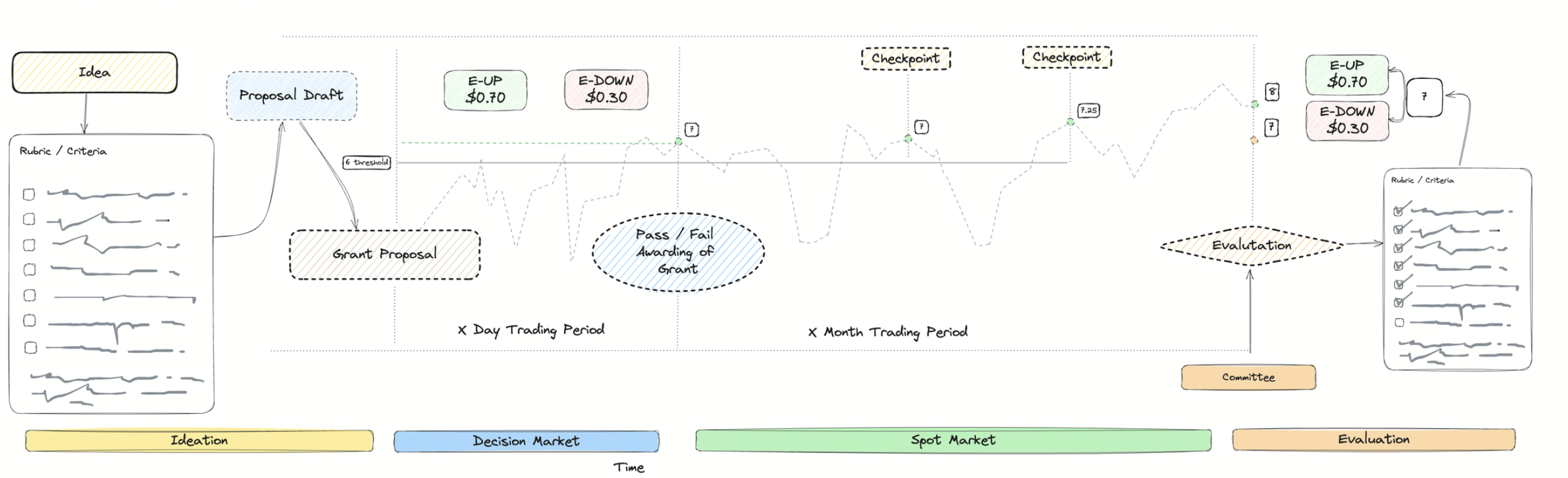

Figure 2: Futarchy Protocol Architecture

Source: MetaDAO Docs

Proposals provide a brief blurb specifying necessary information, upon which market participants then have to decide whether they think the proposal should pass or fail to increase token price as much as possible. When it comes to actually trading these proposal’s decision markets, each market participant is ‘betting’ two times. Users trade both the pass and fail market, regardless of which choice they think is the optimal choice.

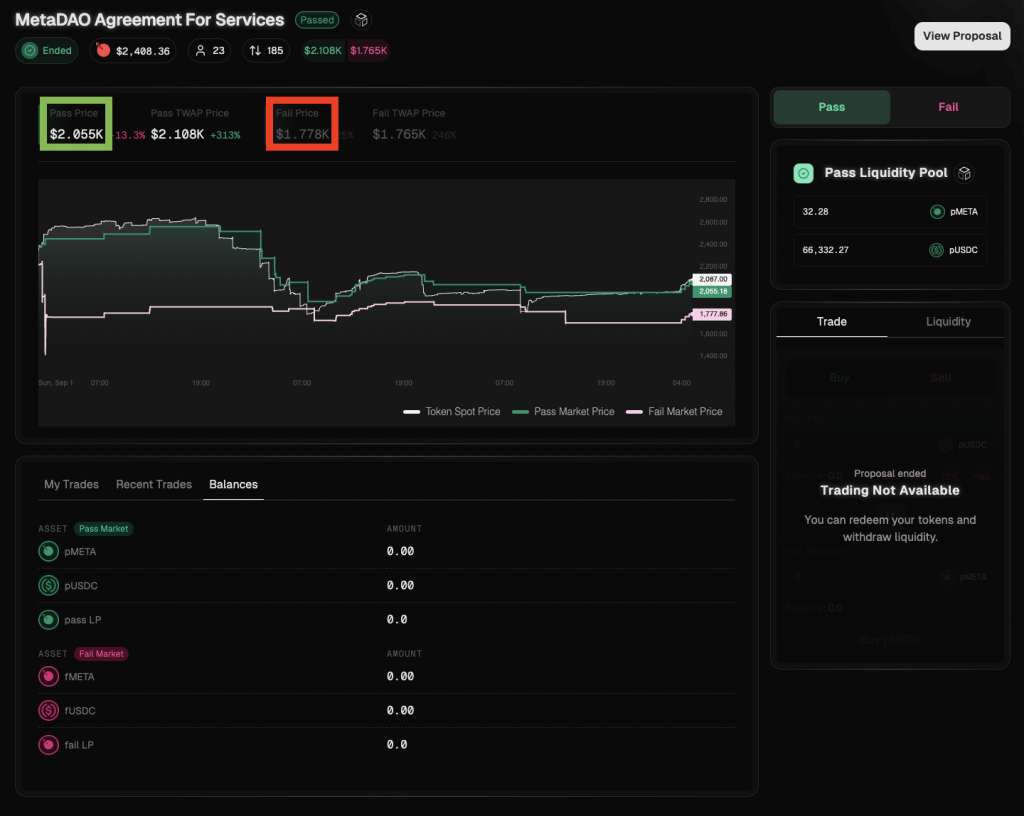

Figure 3: Pass Price vs Fail Price

Source: Futarchy Protocol | Pass Price vs Fail Price

Users can actively gauge the probability of a proposal passing or failing while the market is live—based on whether the pass or fail token price is higher. Traders can express their views on both, by taking positions on the decision market AMMs. This is a little different from what market participants might be accustomed to when using prediction markets on platforms like Polymarket, where there is little distinction between the “Yes” and “No” options on a given outcome more or less mean the same thing and have similar odds.

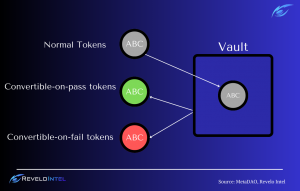

The way trading works on Futarchy is that users deposit either $USDC or the native governance token of the DAO whose proposal is being traded, and they will mint two sets of conditional tokens. Two markets are effectively created, one for each outcome, namely a pass market and a fail market. Each market consists of its own conditional $USDC and native governance tokens.

Figure 4: Interacting with Proposal Vaults

What a user does with their conditional tokens is what determines their outlook in this market, and ultimately, what drives the price for each outcome. If a user thinks that the pass token price is too low and that the proposal passing would actually raise token price more than what is currently priced in, they would ensure that their conditional tokens in the pass market are indeed denominated in the native token. If they think the pass price is too high, then they would instead opt to hold pass $USDC (pUSDC). This same process is used in the fail market. Price impact is how these pass or fail tokens have their values adjusted.

Figure 5: Pass and Fail Markets

For example, a user could deposit 100 $USDC, and they will then mint 100 pass $USDC (pUSDC) and 100 fail $USDC (fUSDC). If the user deems the pass price too low, they would swap their pUSDC for pMETA (or the corresponding pass governance token of the protocol being traded). If the price is too high, and they think the price might actually sink lower should the proposal pass, they would simply hold their pUSDC to express this view. Conversely, the user could then also swap their fail $USDC (fUSDC) for fMETA, if they believe that the fail price is too low. Whether or not the proposal passes or fails determines which set of tokens is returned back to the user, to be redeemed for underlying tokens.

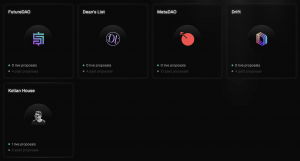

To get a pulse on the growth trajectory and adoption of on-chain Futarchy markets…, we can take a look at MetaDAO’s own Futarchy proposal markets. MetaDAO’s own Futarchy markets are also the most actively traded, seeing far more volume than the other partner protocols in Drift, FutureDAO, and Dean’s List. In total, just under $700K has been traded on the Futarchy platform, ~$624K of which is attributed to MetaDAO’s own decision markets. MetaDAO is also the most active market creator, putting out 21 proposal markets, while partnered protocols combined have put forth 11.

Figure: 6: MetaDAO & Partner DAO Proposals

Source: Futarchy Protocol

This brings to light an important issue – the fact that not every decision a team needs to make should be put to a decision market. We’ll discuss this in greater detail below.

The DAO governance sector is one that remains extremely inefficient to this day, despite the vast amounts of time, effort, and money thrown at it. On-chain governance is often implemented as it is seen as somewhat of a prerequisite for decentralizing and distributing ownership of a protocol, rather than an optimal way to actually make decisions.

Proclaiming that on-chain governance in crypto is in a bad state is not exactly a controversial statement these days. This is actually a consensus view held by many in the industry. This has been the case for quite a long time, and while there have been meaningful attempts at reinvigorating the DAO governance process, teams building in this sector have not found much success, regardless of how much money they may have raised.

Figure 7: Token governance sacrifices efficiency for representation

Source: @mrjasonchoi on Twitter

Figure 8: Futarchy’s potential edge on traditional token governance

Source: @defi_monk on Twitter

The current state of DAOs retains some of the worst qualities of decentralized governance. Discussion processes on governance forums are chaotic and unorganized, and many voters often complain that the team has the final say in decision-making. Token-based voting ensures that only large token holders have much of a say. Over time, bribing and the proliferation of ‘Dark DAOs’ (DAOs who purchase votes ambiguous, removing some of the transparency from onchain governance) have become commonplace, with the integrity of DAO governance falling on the list of priorities.

This setup has resulted in a scenario where protocols may be more open to experimentation. While actual adoption of Futarchy is sparse for now, it stands to reason that there will be a sufficient amount of protocols that would be willing to use the Futarchy system for select proposals, especially as MetaDAO expands its scaling abilities and onboards more DAOs. Futarchy fits the permissionless and decentralized ethos of DeFi very well, and the lack of innovation in the governance space can push protocols toward Futarchy.

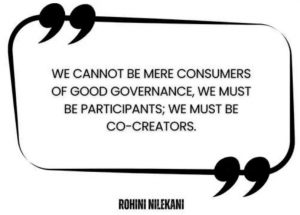

Figure 9: Rohini Nilekani on Governance

Source: Revelo Intel – Annual Intel

Prediction markets have notably been one of the few bright spots in crypto during 2024’s dullish months, but the concept is definitely not without its flaws. Below we will explore some of the more intricate problems with prediction markets in their current form, which implementations of Futarchy may or may not potentially be able to solve.

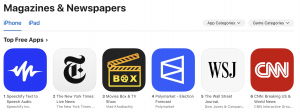

Polymarket has seen quite a bit of traction recently, even rising in the app store rankings to the #4 spot under ‘’Magazines & Newspapers’. The Polymarket app doesn’t even let users place bets or interact with the markets, the mobile experience only serves as a data point to gauge sentiment ahead of the US election.

Figure 10: Polymarket App Ranking

Source: App Store Rankings

As the app name ‘Polymarket – Election Forecast’ suggests, the Polymarket app is purely election-focused, with no mention of any of the various other markets that users can find on the Polymarket website. This, along with various political commentators and media companies who continue to cite Polymarket odds in their coverage, shows that there actually is demand for this data, whether it is accurate or not.

Figure 11: Elon Musk Amplifying Prediction Market Utility

Source: Elon Musk – Twitter

To address the matter of data accuracy, there is no way to easily gauge ‘accurate’ or ‘inaccurate’ when it comes to either polling or prediction markets until an event’s outcome is actually determined. Conditions simply need to be put in place to minimize the role of biases. In a polling setting, this looks like adjusting for demographic differences between states, age of poll participants, perceived biases, and other factors to try and make the results of the poll more representative of a greater population. In prediction markets, the task is easier, simply create a reasonable resolution condition, and hope that a given market receives enough interest and liquidity to maximize ‘truthfulness’. Some go as far as to set certain thresholds of liquidity that a given market must meet in order to be taken seriously. For the most part, the consensus seems to be that only the election market on Polymarket really meets this threshold, with over $1B in volume traded.

When it comes to using prediction markets as a data point, decision markets can’t really improve on this front. For better or worse, in the decision market system, these odds are going to be used to make a decision. For many of the proposals on the Futarchy protocol, there is really no comparable market to gauge truth or accuracy against.

MetaDAO’s value add is not in its use as a data point, but in its use as a tool for speculation, and most importantly, its role as an actual decision maker. The difference between prediction markets and decision-makers is simple: prediction markets measure what participants think will happen, while decision markets give participants the power to determine an outcome collectively. There is no question of inaccuracy or discrepancy between prediction market odds and the outcome – they are 1:1.

As a tool for attracting more mainstream adoption, decision markets are also not likely to improve on the offerings of prediction markets. Elections are already a topic that younger demographics have less interest in and are not likely to bet on, taking more interest in things like sports betting. A prediction-market-like product for crypto DAO governance proposals is an even more niche and esoteric topic. However, MetaDAO’s Futarchy protocol might attract a more sophisticated crowd. In the same way that prediction markets have gained attention from people in politics and media, Futarchy might see some coverage and mindshare from those interested in alternative governance models.

Decision markets can perhaps be seen as somewhat adjacent to the concept of shareholder primacy, the mechanism that typically binds corporate decision-making to prioritize the interests of shareholders above all else. In the U.S. and some other Anglo-American countries like the U.K., the concept of shareholder primacy mandates that most companies are typically supposed to act in ways that maximize shareholder value. While this applies to both public and private companies alike, having a publicly listed stock puts the market’s thoughts on a company’s decision-making right out in the open, applying more pressure on the company and C-suite.

Decision markets effectively make the concept of shareholder primacy even more explicit, making the role of the market proactive, rather than reactive. Futarchy casts away any guises of social impact, or decision-making based on the premise of operating as a public good, which does come up in DAO governance more than traditional corporate governance. Instead, MetaDAO’s Futarchy protocol effectively says the quiet part out loud when it comes to DAO governance and asks ‘does a decision increase token price?’. Futarchy goes beyond simply acknowledging token price as a primary measure of decision-making, but it highlights it as the only measure upon which decision-making should be based upon.

There are a whole host of considerations when it comes to evaluating the potential of MetaDAO, and the Futarchy Protocol. MetaDAO is the first implementation of truly public Decision Markets, the first rollout of Futarchy. Below are some potential flaws in the current Futarchy implementation.

Just like prediction markets, decision markets are subject to potential market manipulation. One can even make the case that they are more susceptible to market manipulation because of their nature; decision markets are more consequential as they’re actually used to make decisions, raising the stakes. Profiting from manipulation in prediction markets perhaps involves some amount of creativity, as seen in a Polymarket market manipulation attempt, which sought to move the main elections market in order to change the outcome of a derivative market predicting which candidate would lead by a certain date. Ultimately, manipulation attempts on Polymarket have not proven successful thus far.

Decision market manipulation may not be as directly profit-driven, on a short-term basis. Perpetrators may be looking to make more long-term impacts on a protocol in which they have a vested interest. Market manipulation, in both prediction markets and decision markets, is a problem that is likely to be less common the more efficient a market is. This mostly just means that the more liquidity, the less manipulation is likely to succeed. Traditional markets see the use of algorithms taking advantage of those placing bids out of range in an attempt to drive prices in a certain direction. Because of this, the correction of manipulation attempts can take place very quickly, while this process would likely take longer in less liquid and efficient markets.

In the case of decision markets, a manipulation attempt has already been attempted at a large scale on the Futarchy platform, under MetaDAO’s 7th proposal. This attempt was even responsible for the majority of the total protocol volume traded. MetaDAO’s seventh proposal, brought to the table by Ben Hawkins of the Solana Foundation, sought to mint 1,500 $META tokens to Hawkins’ wallet for $50K. This would basically allow him to acquire tokens at a price of ~$33, lower than the spot price at the time. Hawkins spent $250K trying to bid up the price of the pass META token to change the outcome manually.

The market, even at this nascent stage of MetaDAO’s history, rejected this attempt. In this scenario, market manipulation may have even helped to strengthen the utility of decision markets and bolster confidence. This attempt significantly boosted trading volume at a time when $META’s market cap was very low and there was not much volume traded on the platform at all, seemingly encouraging traders to engage with the platform to take advantage of Hawkins ‘noise trading’.

One potential flaw in MetaDAO’s Futarchy system has to do with the visibility of information on the supply side vs the demand side. This is not something unique to decision markets, or even crypto, by any means. It isn’t a problem that is necessarily solved by giving more incentives to voters either.

Users of a protocol or product may be very in tune with the state of things on the demand side, but not the supply side. In crypto, this could be something simple, like users identifying a need to create a better UX or a simpler onboarding process. What they don’t know is the resources and manpower required to achieve this. This potentially sets at odds the decision-making abilities of teams vs community members, or decision market participants.

Teams can combat this by providing specific information regarding company operations as they pertain to specific proposals, but this still doesn’t take everything into account. And of course, teams may not always want to disclose this information around protocol operations. This is an area of improvement that MetaDAO has acknowledged and plans to mitigate in some ways.

Another flaw of Futarchy is settling on a means of measurement. Right now, this takes the form of a governance token’s price. Market participants decide whether a proposal should ‘pass’ or ‘fail’, based on whether they think it will positively or negatively impact the price.

This measure is somewhat superficial, as there isn’t a specific time period upon which traders are assuming a price will move. The mechanics of the Futarchy Protocol release ‘Pass’ or ‘Fail’ tokens to traders after the market trading is concluded, and a decision is made. So the Futarchy AMM prioritizes proposals that will impact price one way or another, quickly.

This is good for important proposals; an example that MetaDAO Founder Prohp3t often uses is Uniswap turning on the protocol fee switch. This proposal would likely elicit a significant positive or negative reaction in the price of $UNI, whether it passes or fails.

Figure 12: Dramatic $UNI price increase following fee switch proposal

Source: TradingView

However, most proposals have much lower stakes and typically involve more mundane topics than something as important as token holders receiving revenues. This reduces the potential margin of profit, presenting a small market opportunity for the vast majority of proposals.

Beyond the time-contingent aspects of token price and the relative indifference that most proposals see, there is also the more existential matter of what token price even means to a protocol. For starters, many protocols don’t even have a token. If they do, there are all sorts of other factors that may affect a token’s price besides one-off proposals. Factors like tokenomics and general market conditions are likely to outweigh the role of reactions to individual proposals when it comes to impacting token prices, even on a short-term basis.

The MetaDAO team has taken this into account. Until this point, token price is assumed to be the measure of the well-being of any DAO participating in the Futarchy protocol. This is ignoring half of the premise of Futarchy, which prescribes ‘voting on values and betting on beliefs’. The team has acknowledged this and addressed how they plan to implement ‘voting on values’ going forward, via Value Resolved Decision Markets. This is a work-in-progress mechanism, by which the MetaDAO team will work with prospective DAOs to create a rubric for grading the effectiveness of proposals, specifically, grants. At this point, Value Resolved Decision Markets have yet to be traded at scale, and their effectiveness is unknown.

Source: MetaDAO Docs

The implications of Futarchy can potentially extend far beyond crypto. Increasing dissatisfaction with the state of governance in the real world, whether it be in the US or elsewhere, is noteworthy. One doesn’t need to look much further than this upcoming election to come to this same conclusion. This election might be one of, if not the most noisy, attention-grabbing elections that many voters can remember. There will almost certainly be great dissatisfaction no matter who wins, not to mention the probability of gridlock in Congress preventing much from being changed anyway. The battle between electoral candidates has spilled over into crypto, and it is increasingly hard to ignore.

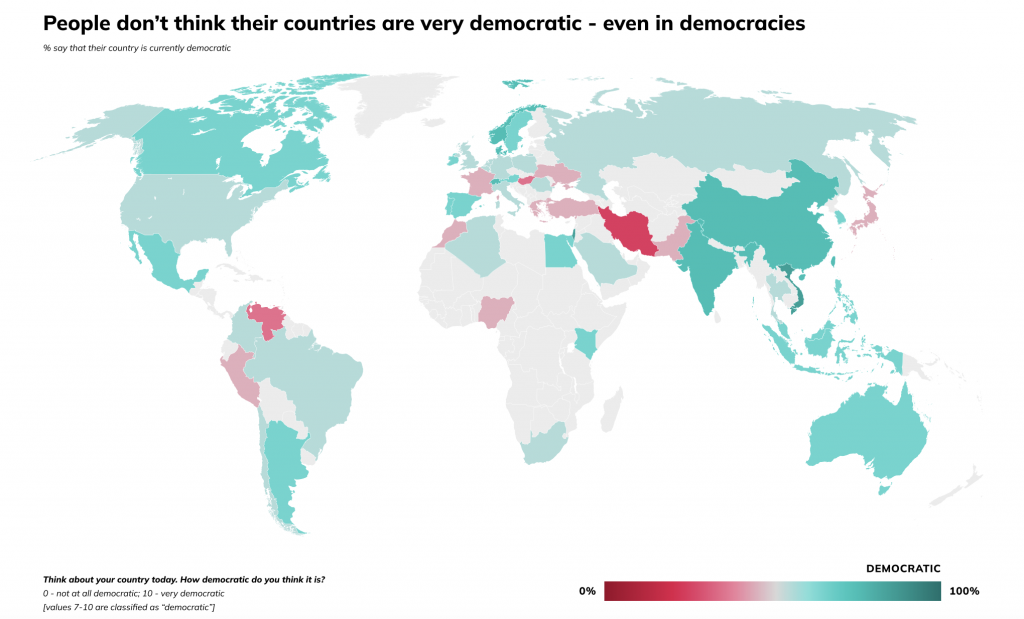

The idea that sentiment around politics and governance has deteriorated in recent years is widespread, and one can reference data to corroborate this claim, even if few would disagree to begin with. According to the 2023 Democracy Perception Index, the general fear of unfair elections among Americans increased from 49% to 61% from 2021 to 2023, a 12% increase in a two-year span. Elections aren’t the only point of contention – faith in the general democratic system isn’t very high either.

Figure 14: Perceived Lack of Democracy in Western Nations

Source: Democracy Perception Index 2024

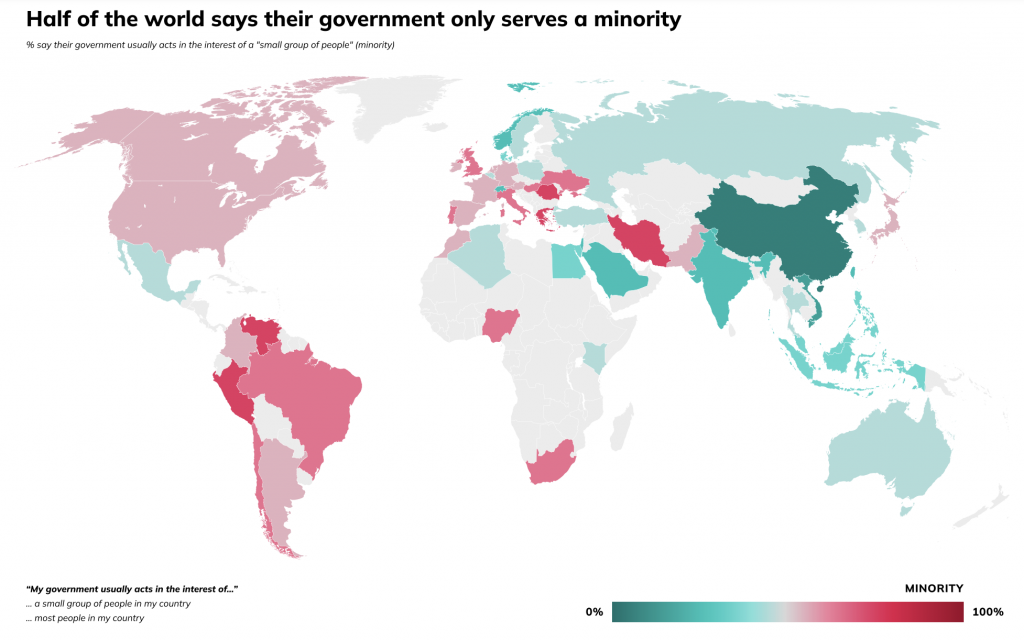

Ironically, two of the top 3 countries when ranked by their population’s perception of national democracy are Vietnam and China, places typically regarded as not democratic at all. This might suggest that economic development and growth are really the main drivers of a population’s perception of democracy, as these are also the two fastest-growing economies of the last couple of decades. Below, we can also see that populations have even less faith in government accountability, and believe that politicians serve a select few.

Figure 15: Perceived Lack of Democracy in Western Nations

Source: Democracy Perception Index 2024

For one reason or another, It is becoming increasingly commonplace to express a lack of faith in governing bodies in the U.S. and various other countries. Dissatisfaction with the political environment may bring more eyes to alternative governance ideas, though some might call this far-fetched. MetaDAO itself does not look to cater to governments, seeing its role as mostly contained to the private sector, specifically in crypto. But one can’t help but notice a dotted line between these on-chain governance experiments and their application in a public-sector setting.

Even if MetaDAO and real-world governance currently are not connected in any way, shape, or form, this doesn’t mean that mindshare can’t overlap. One of the goals laid out by the MetaDAO team is to create a system of decision-making that works better than the current standard, both in and outside of crypto. MetaDAO’s ambitions include expanding their governance services to large corporations, outside of crypto.

In the same way that Polymarket has gained recognition from various political commentators, media companies, and other figureheads, MetaDAO may be pointed to as a potential alternative in reference to government decision-making. For these reasons, MetaDAO and the Futarchy Protocol put themselves forward as a protocol to keep an eye on, with one of the largest potential scopes of any crypto project.

All of these factors lay out potentially memetic properties of MetaDAO and the Futarchy protocol. This could contribute to value accrual for tokens operating in this area, with $META potentially being the sole recipient of these flows, for now. The days of Futarchy potentially dictating important outcomes and being used to make high-stakes decisions likely will not be soon, if they come at all. Alas, crypto is nothing but experimentation, and the fast-moving, permissionless on-chain environment of crypto, especially on Solana, gives the project everything it needs to get feedback in a timely manner, adapt, and perhaps, flourish.

MetaDAO represents a completely novel experiment not being conducted anywhere else, as the first protocol to release an implementation of Futarchy. The team has chosen the most optimal environment to give this experiment everything it needs to potentially play out and grow into something more meaningful, in crypto. Iterating on existing prediction markets and potentially solving some of the problems present in DAO governance, MetaDAO provides an enticing alternative to the standard token-based protocol governance model.

MetaDAO is essentially playing in a league of its own, and its growth is dependent on growing the market share that the project itself has created. There isn’t really anyone else building in the Futarchy sector at this time. In addition to simply being a very unique project with a stand-alone goal, MetaDAO has a very high ceiling in terms of what it can achieve and the impact the protocol can have. How the team goes about executing and whether or not they can successfully attract more adoption and build up an ecosystem of like-minded DAOS will serve as the primary means to judge the penetration of decision markets and Futarchy.

References

Revelo Intel – Annual Intel 2023 | Link

MetaDAO Docs | Link

MetaDAO Website | Link

MetaDAO IQ.wiki | Link

Futarchy Website | Link

“Shall We Vote on Values, But Bet on Beliefs?” (2000), Robin Hanson | Link

“Futarchy: Vote Values, But Bet Beliefs” (2000), Robin Hanson | Link

“Using Prediction Markets to Enhance US Intelligence Capabilities” (2001), U.S. CIA | Link

“Where do I disagree with Robin Hanson?” (2007), Tyler Cowen, published in Marginal Revolution | Link

“The Buzzwords of 2008” (2008), Mark Leibovich, published in New York Times | Link

“People don’t think their countries are very democratic – even in democracies” (2024), Democracy Perception Index 2024 (2024), Democracy Perception Index 2024 | Link

“Threats to Democracy in America” (2023), Democracy Perception Index 2023 | Link

“Shareholder Primacy” (2023), Corporate Finance Institute | Link

“Did a Polymarket trader rig election odds for a side bet?” (2024), Protos | Link

Disclosures:

Revelo Intel has never had a commercial relationship with MetaDAO and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.