Published September 11, 2024

Inverse Finance, originally founded in late 2020, is the decentralized autonomous organization (DAO) that develops and manages FiRM, the Fixed Rate Money Market protocol.

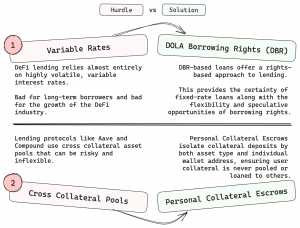

FiRM was created with the primary goal of addressing two major challenges in the DeFi lending landscape: variable interest rates and cross collateral pools. It addresses these challenges through the introduction of DOLA Borrowing Rights (DBR) and Personal Collateral Escrows:

Figure 1: FiRM to address two major challenges in the DeFi lending landscape

Source: Inverse Finance; Revelo Intel adapted.

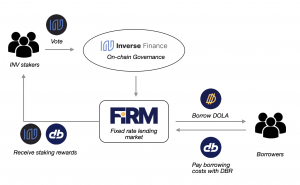

Starting from these features as the foundation of Inverse Finance, the Inverse Finance DAO ecosystem is built around three tradeable tokens: $INV, $DOLA, and $DBR. These tokens together form the FiRM lending market.

Figure 2: Inverse Finance DAO Tokens Ecosystem

Source: Inverse Finance Documentation.

$INV is the governance token that grants holders with voting power within the DAO. It can also be staked (xINV) to receive two different kinds of staking rewards and it can be used as collateral for long-term, fixed rate borrowing on FiRM.

$DOLA is a stablecoin pegged to the U.S. dollar, designed to maintain a value as close to $1 as possible with minimal volatility. Unlike algorithmic stablecoins, It is backed by retractable debt, ensuring each $DOLA is fully collateralized by assets staked in FiRM or by the Liquidity Provider token in a liquidity position created by a DOLA Fed. Like $INV, $DOLA can be staked to become sDOLA, a yield-bearing synthetic stablecoin that derives its yield from the revenues of FiRM; users receive a constant stream of DBRs, which are auto-compounded into more $DOLA.

$DBR is an ERC20 token that represents the right to borrow $DOLA in FiRM. A user with a single $DBR has the right to borrow one $DOLA stablecoin for up to one year with no interest.

This report explores the mechanics of fixed-rate borrowing on FiRM, the role of $DBR within the protocol, the current economic incentives of $INV, and its upcoming developments. In particular, regarding the upcoming initiatives, Inverse aims to expand $INV’s availability to multiple chains (Layers 2) by introducing sINV, a wrapped version of $INV. sINV will leverage an ERC-4626 vault to automatically capture and compound $DBR rewards into a single token, increasing liquidity and user flexibility across various blockchains.

Variable rates can be unpredictable and volatile, especially within the crypto market where the role of speculation and leverage is quite high. This is often attributed to the standard use of utilization-based interest rates that fluctuate based on supply and demand.

On the main DeFi lending platforms like Aave and Compound, interest rates are set automatically using an algorithm coded into each platform’s smart contract. Variable interest rates fluctuate (up or down) depending on the supply and demand for tokens available, i.e. on the amount of tokens deposited and borrowed.

In general, if there is excess capital being supplied to a market, interest rates are low in order to incentivize borrowers to take out cheap loans. On the other side, if the available supply of a token is running low, interest rates will go up to encourage borrowers to repay their loans as well as to attract more depositors to earn a greater supply APY. For this reason, when a user borrows using variable rates, the interest costs can vary a lot, which in turn can affect the health of the loan, or even lead to unwanted liquidations. The longer the borrowing term, the less favorable variable interest rates become for borrowers due to the unpredictability of future interest costs.

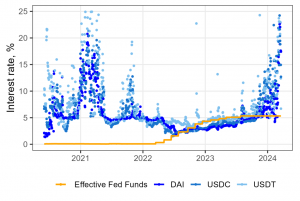

At the start of January 2022, the average intraday rate charged to borrow a stablecoin ($DAI, $USDC, $USDT) on the platforms Aave v1, v2 and v3, and Compound v2 and v3 was close to 5%. However, since the end of 2023, DeFi rates have significantly increased to 25% and above (interest rates above 25% are not shown for readability reasons); for comparison and to better assess the volatility against traditional finance markets, the orange line represents the effective Fed Funds rate.

Such an increase in interest rates can deteriorate the health factor of the loan, regardless of the collateral price, and may trigger total or partial liquidation of the position. This is why variable interest rates are typically recommended for short-term positions (e.g., see also Aave App information on variable rates).

Figure 3: DeFi Borrow Rates for the Main Stablecoins ($DAI, $USDC, $USDT)

Source: Banque de France. Last observation: March 19, 2024.

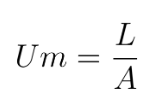

To automatically calculate interest rates, DeFi lending protocols typically employ linear or nonlinear functions based on the available market liquidity. Since loans on these protocols have unlimited maturities, variable interest rates can fluctuate from the initiation of the borrow position.

Variable rate models enable lending protocols to dynamically adjust interest rates according to the ratio of funds borrowed to supplied, managing liquidity risk through user incentives to support liquidity: (1) when capital is available, low interest rates to encourage borrowing, (2) when capital is scarce, high interest rates to encourage repayments of debt and additional supply.

At the core of all these interest rate models is the utilization rate which indicates the availability of capital within the pool. For a market 𝑚, total loans 𝐿 and gross deposits 𝐴, the utilization rate is:

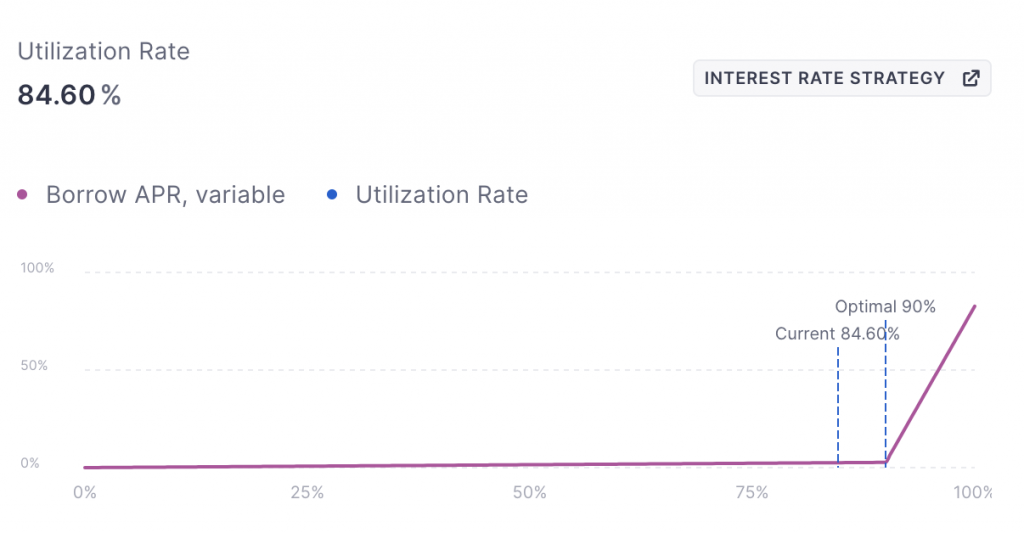

One of the most commonly used interest rate models employs kinked rates where the interest rate curve is divided into two parts around an optimal utilization rate or threshold set by the platform. This model, used by protocols like Aave and Compound, adjusts borrower and saver incentives sharply beyond the optimal utilization rate. When utilization rates are low, interest rates rise gradually, but beyond the threshold, they increase steeply to manage capital efficiently.

This inflection point aims to maintain the equilibrium utilization rate near a “target rate” (e.g., 90% in the case of Aave V3 $USDC Ethereum market in Figure 4), as a high utilization rate attracts lenders to the platform. The specific parameters differ across platforms and tokens, depending primarily on the risk profile of each crypto token.

Figure 4: “Kinked rates” model on $USDC Ethereum market with a target rate of 90% – Aave V3

Source: Aave V3 App. As of Aug 20, 2024.

Some protocols, like Aave, since not long ago, allowed borrowers to choose between variable and stable interest rates. However, since offering truly fixed rates on top of a pool is challenging with their model due to the fluctuating cost of borrowing money based on market conditions and available liquidity, Aave currently does not provide stable rates. Besides, it is important to note that the “stable” interest rate is not entirely stable, as it can be revised in the event that it significantly deviates from the market average. As stated from Aave documentation:

“Stable rates act as a fixed rate in the short-term, but can be re-balanced in the long-term in response to changes in market conditions. […] The stable rate, as its name indicates, will remain pretty stable and it is the best option to plan how much interest you will have to pay. […] In certain conditions, the protocol enables stable rates to be rebalanced to avoid a large percentage of liquidity being borrowed at a stable rate below market variable rate. The exact conditions where stable rates may be re-balanced are different by protocol version (i.e. V3 conditions).”

The demand for more predictable interest rates has been a constant throughout the history of finance. In traditional finance, borrowers who opt for fixed or adjustable rates look for the ability to plan their finances in advance, ensuring predictability in their expenses and the possibility to hedge their investments with greater certainty.

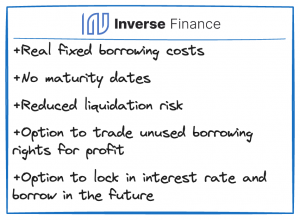

The Inverse approach to eliminate interest rate volatility and create a more attractive fixed-cost lending regime isolates the interest expense in a loan and restructures it as a borrowing right. This is achieved through a special fungible token known as a Token Borrowing Right (TBR). TBRs grant their holders the right, but not the obligation, to borrow a specific token for a fixed period. They are purchased before issuing a loan and are gradually spent over time, proportional to the loan amount. Unspent TBRs can be held as a hedge against rising rates or traded on the open market for speculative purposes.

To execute a loan on the market contract, the user must have a positive TBR balance in their wallet. Once the loan is initiated, the TBR balance begins to decrease linearly over time, proportional to the loan amount and according to the terms specified in the lending contract. For example, one TBR is required for every token borrowed over a 12-month period. The TBR balance must always remain above zero to maintain the loan. As the TBR balance nears zero, the user can add more TBRs to avoid forced replenishment at an unfavorable rate. If the loan’s value drops below the specified collateral factor, liquidation may occur to ensure repayment.

The first implementation of Token Borrowing Rights has been developed for Inverse Finance’s $DOLA stablecoin: DOLA Borrowing Rights or “DBR”. $DBR is an ERC20 token that represents the right to borrow $DOLA in FiRM, so rather than paying interest on a loan, a borrower can pay for the right to borrow a token. It can be viewed as an initial upfront cost of borrowing, eliminating the ongoing interest accumulation typically seen in DeFi borrowing.

With $DBRs, once borrowing costs are locked, there is no way to raise the rates or costs. $DBRs allow users to set the cost for their loan with 100% predictability. Additionally, $DBRs can be added at any time to extend the loan or borrow more $DOLA, enabling longer borrowing durations. Finally, since the duration is not fixed, it is possible to borrow varying amounts of $DOLA for different lengths of time, such as 1,000 $DOLA for six months or 4,000 $DOLA for three months, and so on.

It’s important to note that you can lock in your borrowing rate today without needing to borrow immediately. By keeping the tokens in your wallet, you have the flexibility to borrow when you are ready, or sell them at a higher price, potentially profiting from the price difference.

Figure 5: $DBR Main Benefits

Source: Inverse Finance; Revelo Intel adapted.

With this approach, $DBR addresses the volatility issues inherent in variable rate lending and overcomes many of the limitations of conventional fixed (or “stable”) rate lending in DeFi. This enables users to benefit from the certainty of fixed-rate loans and from both short-term and long-term flexibility.

Borrowing $DOLA can be done in two ways: (1) through Inverse Finance’s FiRM or (2) via third-party variable-rate lending protocols.

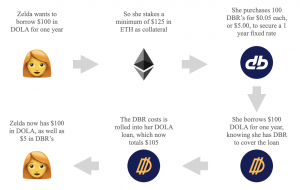

The process to borrow $DOLA consists of three steps:

Figure 6: Simple $DOLA loan using DOLA Borrowing Rights (DBR)

Source: Inverse Finance.

As the borrowing starts, the $DBR balance in the wallet will decrease gradually (every block) till 0 after 1 year. As 1 $DBR is required to borrow 1 $DOLA for 1 year, approximately 0.00274 $DBR is burned from the borrower’s balance per day per $DOLA. For example, a user who has borrowed 1,000 $DOLA will have 2.74 $DBR burned daily. If the $DBR in the wallet approaches zero but the user wishes to keep the loan open, he can simply buy more $DBR to extend the loan duration.

Additionally, users can choose to limit their upfront $DBR expense when initiating a loan and add more $DBR later. Hence, they can increase their $DBR balance at any time to extend the loan’s duration or to support additional loans.

$DBR supply is adjusted according to a $DBR Issuance Rate that encompasses two methods of adding $DBRs to the marketplace: (1) $DBR Streaming Rewards and (2) $DBR XY=K Auctions.

The rate at which $DBRs are issued into the market is done at a rate set by the Fed Chair multisig and subject to governance vote. The $DBR reward rate is the rate of new $DBR being issued per second, globally. For example, a reward rate of 1.0 is equivalent to 1 $DBR per second, 60 $DBR per minute, 3,600 $DBR per hour, 86,400 $DBR per day or 31,536,000 $DBR issued per year. The issuance is split among all $INV currently deposited on FiRM. When a user claims $DBR, the exact amount is minted to their wallet, adding to the circulating supply of $DBR.

Regarding $DBR Streaming Rewards, they are streamed to $INV holders who stake their $INV on FiRM at a rate specified in the application. These $DBRs are continuously streamed with each new block mined on Ethereum, and users can claim their streamed $DBRs at any time. The $DBR issued to $INV stakers is in addition to the inflation-adjusted $INV rewards, making the additional $DBR staking rewards akin to real yield.

Since January ‘24, $DBR is also introduced into the marketplace via $DBR XY=K auction, a type of dutch auction that provides users with a way of purchasing large blocks of $DBR without causing upwards pressure on $DBR prices, as it increases the current depth of $DBR liquidity on the market for buyers. The DAO sets a yearly max budget of $DBR to be used by the auction.

The XY=K Auction allows users to buy $DBR using $DOLA in a permissionless way. During the auction, the price of $DBR (per $DOLA) continuously decreases every second until a purchase is made, at which point the price increases. MEV bots are likely to monitor the auction, executing arbitrage transactions between it and the TriDBR pool on curve as soon as it becomes profitable.

By assessing the current amount of $DOLA lent out on FiRM and determining if this quantity should be maintained, increased, or decreased it is possible to manage the $DBR supply through adjustments to the reward rate.

If the current policy aims:

A higher market swap rate for $DBR increases the cost of borrowing $DOLA, creating friction in acquiring new $DOLA borrowers and impacting product adoption. Therefore, to facilitate the ramp-up of $DOLA borrowing on FiRM, it is essential to issue new $DBR into the supply to meet the borrowing demand for $DOLA.

An increase in $DBR supply will generally lead to a lower $DBR price which in turn makes borrowing $DOLA on FiRM more attractive. As $DBR is burned over the life of a $DOLA loan, the $DBR reward rate will correspond to the amount of $DOLA loans on FiRM.

To expand the amount of $DOLA lent out on FiRM, the yearly $DBR issuance rate is adjusted to the expanded $DOLA lending target. For example, if 5,000,000 $DOLA is loaned on FiRM but the target is 8,000,000 $DOLA, the $DBR issuance rate should be set to 8,000,000 DBR per year.

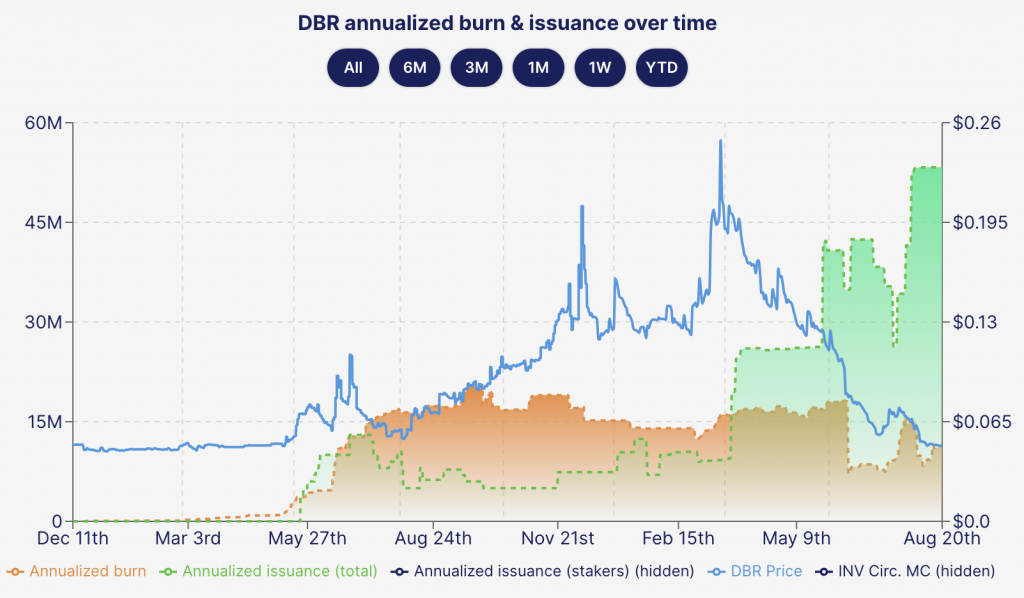

Introducing new $DBRs into circulation allows the market to more efficiently reach an equilibrium that maximizes $DOLA borrowing on FiRM, making it more attractive to both new and existing users. Since March ‘24, there has been a substantial increase in the supply of $DBR which went from an annualized issuance of 9.2M to 53.3M, leading to a decrease in price from a peak price of $0.2485 to $0.049, thereby reducing borrowing costs.

Figure 7: DBR Annualized Burn, Issuance, and Price

Source: Inverse Finance as of Aug 20, 2024.

The increase in $DBR supply aligns with the rapid expansion of $DOLA’s circulating supply, which has reached an all-time high by the end of June ‘24.

Figure 8: DOLA Circulating Supply Evolution

Source: Inverse Finance. As of Aug 22, 2024. Excluded from circulation: $DOLAs sitting in markets and in Fed Farmers.

Like many governance tokens, $INV provides holders with voting power in the Inverse Finance DAO, allowing them to directly control essential operating and development functions of the DAO’s treasury, products, and operations.

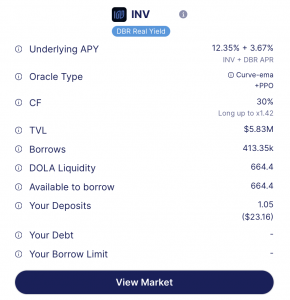

Its staked version, represented by xINV tokens, however introduces other economic incentives and benefits for the holders, other than retaining their voting power. First, $INV stakers are able to borrow $DOLA against their staked position for long maturities and at fixed rates. Second, they get two forms of continuous staking rewards: (1) $INV anti-dilution staking rewards, and (2) DBR Real Yield Streaming Rewards.

The $INV token does not have a coded or “hard capped” supply so its circulating supply can change periodically based on the current policy in place, through on-chain governance votes; however, a part for a buyback happened in 2021, at the moment no formal buyback policy is in place.

For this reason, as the circulating supply of $INV is more prone to periodic expansions or emissions which are used to fund various DAO initiatives and expenses, the anti-dilution staking rewards were introduced to mitigate the effects of this periodic $INV supply expansion. The goal of these rewards is to incentivize the long-term holding of $INV by users and reduce price volatility.

$INV stakers receive $INV rewards continuously with every Ethereum block mined (roughly 6,400 times a day). $INV emissions directed to $INV stakers are designed to be higher than emissions directed elsewhere by rewarding stakers with $INV reward APYs that closely track $INV supply expansions. This ensures that $INV stakers are protected from dilution and own an increasing proportion of the supply.

Separate from anti-dilution rewards, $INV stakers receive real yield streamed in the form of DBR rewards calculated on a per $INV basis, which can be held, swapped, or used to service a $DOLA loan on FiRM. $DBRs increase every block proportionally to the number of $INV a user has staked relative to the total amount of $INV staked. For example, if a wallet owns 1.5% of all $INV staked, then it will receive 1.5% of new $DBR issuance via streaming.

$DBR streamed to $INV stakers is in addition to the inflation adjusted $INV rewards which make the added $DBR staking rewards akin to Real Yield. The $DBR APY will vary as $DBR is issued in relation to $DOLA borrowing on FiRM.

$INV stakers who receive $DBR streams are likely to take one of the following actions:

When considering $DOLA borrowing costs, if the swap rate of $DBR is high, $INV stakers are likely to exchange their streamed $DBR for other crypto tokens, which will reduce the market swap rate. Conversely, if the $DBR market swap rate is low, $INV stakers are more likely to use $DBR to borrow $DOLA or hold it for future use. This behavior constrains the new $DBR entering the market, which can lead to an increase in the $DBR swap rate as new borrowers open positions on FiRM.

Issuing $DBR to $INV stakers aligns the interests of $DOLA users and $INV voters within the DAO. This approach creates a direct connection between the value generated from $DBR burns, which occur as a result of $DOLA borrowing in FiRM, and the value of holding $INV voting power. As $DOLA is borrowed and $DBR is burned, the demand for $DBR increases. This dynamic benefits $INV stakers by providing them with a continuous stream of $DBR, which they can use to fund borrowing or trade for other assets.

It is also worth noting that, the more $DOLA that is borrowed, the more $DBR is burned. As $DBR is burned, more $DBR is streamed to $INV stakers; when the $DBR rewards exceed the $DBR burns, borrowing can effectively become cost-free in $DBR terms.

Simultaneously, it enhances the value proposition of $INV as a governance token, encouraging more users to participate in the DAO’s decision-making process. This interconnected value flow ultimately strengthens the DAO’s ecosystem, as both $INV stakers and the broader DAO benefit from the increased utility and demand for $DOLA and $DBR.

Currently, $INV is available on the Ethereum mainnet and CEXs like Coinbase. However, to receive xINV anti-dilution and DBR streaming rewards, $INV must be staked exclusively on Ethereum mainnet through FiRM.

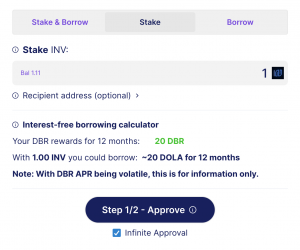

Figure 9: Staking $INV on FiRM

Source: Inverse Finance App. as of May 23, 2024.

Once staked, xINV can be used as collateral for $DOLA loans, and the user starts receiving staking rewards.

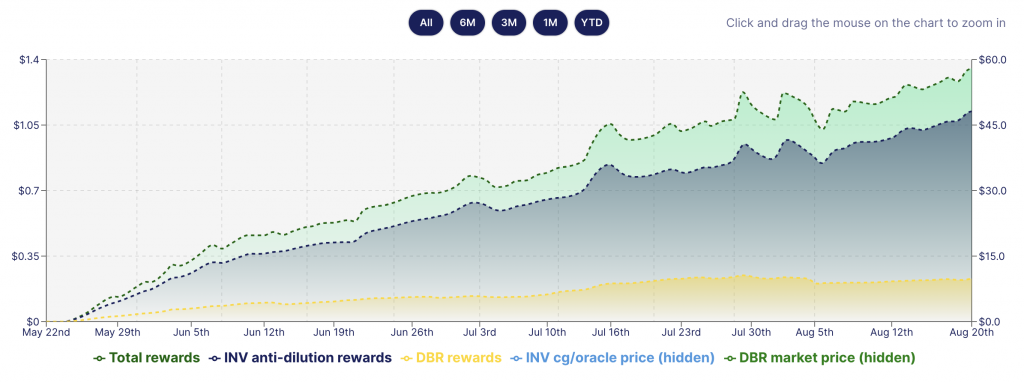

Figure 10: Staked $INV Position Evolution: $INV anti-dilution rewards and DBR rewards.

Source: Inverse Finance App. As of August 20, 2024.

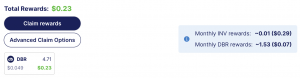

Until today, claiming $DBR streaming rewards involved a manual process, which could be inconvenient and incur high gas costs.

Figure 11: $DBR Rewards Manual Claiming

Source: Inverse Finance App. as of August 20, 2024.

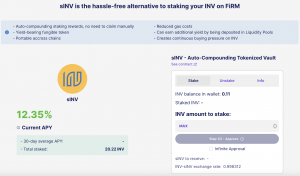

These inconveniences—staking exclusively on the Ethereum mainnet and manually claiming DBRs—have been addressed by the launch of sINV on September 10th, as detailed below.

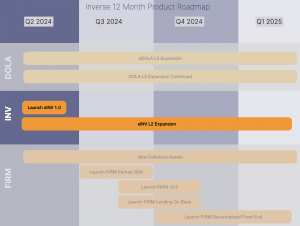

The Inverse 2025 Roadmap proposes three main initiatives to improve and expand their products: (1) sDOLA everywhere, (2) $INV everywhere, (3) FiRM 2.0.

Figure 12: Inverse 2025 Roadmap

Source: Inverse Finance Blog.

Focusing on $INV, on September 10th, Inverse launched sINV with the goal of offering $INV staking on a cross-chain basis. sINV is a wrapped version of $INV that uses an ERC-4626 vault – similar to sDOLA – that automatically captures $DBR rewards and, along with INV anti-dilution rewards received by $INV stakers on FiRM, autocompounds them into a single token. This token can be used in a LP pair, as lending collateral, traded on new chains, and more.

Figure 13: sINV: Auto-Compounding Staking Rewards, Yield-Bearing and Portable across Chains

Source: Inverse Finance Website

ERC-4626 is a tokenized vault standard. Vaults are smart contracts that take in token deposits and do something with those tokens to provide token rewards to the depositor. Before ERC-4626, without a standard implementation, each protocol needed to implement their own adapter, leading to more errors, more attack vectors, and wasted development resources. Standardizing vault implementations allows to harmonize the specifications of yield-bearing vaults and makes it easier for applications, plugins, and tools to integrate with vaults.

By embracing the ERC-4626 standard, Inverse’s goal is to take sINV to new chains like Base and many other L2s. Besides, this new approach to stream and manage rewards through the new sINV token has significant potential to add continuous buy pressure for $INV as $DBR designated for the sINV vault will be continually swapped for $INV, tightening even more than today the coupling between FiRM and $INV. In addition to increased demand, there will also be benefits in terms of deeper all-chain liquidity and volume.

At least initially, the only caveat with sINV is that governance rights for holders will be gone and to vote in governance they will still require staking $INV on mainnet as it works today. This caveat will be addressed in a future governance overhaul, but it is deemed as a low priority for the next 12 months.

As of the time of writing, the $INV staking market yield opportunities on Ethereum mainnet are as follows:

Figure 14: $INV staking & $DBR streaming market

Source: Inverse Finance App. As of September 10, 2024

FiRM by Inverse Finance offers a significant innovation in the DeFi lending space by introducing fixed-rate borrowing options, which address the unpredictability of variable interest rates. This approach provides borrowers with more stable and predictable financial planning, useful in the volatile crypto market. The introduction of $DBR tokens, which allow users to borrow $DOLA at fixed rates without the constraints of traditional fixed-rate loans, represents a flexible and efficient alternative to existing DeFi lending models.

Looking ahead, Inverse Finance’s ambitious roadmap includes several key developments aimed at improving the utility and accessibility of $INV. One of these initiatives, just launched on September 10th, is the introduction of sINV, a wrapped version of $INV designed to extend its availability across multiple chains, particularly Layer 2 (L2) solutions. This move is expected to increase $INV’s liquidity and user engagement by making it easier for users to stake and manage rewards across different blockchains.

The deployment of sINV leverages the ERC-4626 tokenized vault standard, which simplifies the integration of yield-bearing vaults with various applications, plugins, and tools. By adopting this standard, Inverse Finance aims to create a more seamless and efficient staking experience, automatically capturing and compounding $DBR rewards into a single token that users can utilize across different platforms. This strategy not only improves the staking experience but also ensures continuous buy pressure for $INV, potentially driving up its value and deepening its liquidity.

4626 Alliance – A Tokenized Vault Standard | Link

Aave Documentation: Borrowing | Link

Aave Protocol, (2020) Whitepaper v 1.0 | Link

Aave V3 Documentation: Borrow Interest Rate | Link

Barthélemy J., Delaneau C., Martignon T., Nguyen B., Pallum M.R., Zitan S.T., (2024) Interest Rates in decentralized finance. Banque de France | Link

Frangella E., (2020) Aave Borrowing Rates Upgraded | Link

Gudgeon L., Werner S.M., Perez D., Knottenbel W.J., (2020) DeFi Protocols for Loanable Funds, Interest Rates, Liquidity and Market Efficiency | Link

Haridy N., (2022) FiRM: The Fixed Rate Money Market Protocol. Inverse Finance | Link

Haridy N., (2024) Inverse 2025 Roadmap | Link

Inverse Finance, (2022) FiRM And DBR Explainer Video. YouTube | Link

Inverse Finance, (2023) DBR Explainer Video. YouTube | Link

Inverse Finance: About FiRM | Link

Inverse Finance: Governance, (2022) Proposal to launch DBR Token | Link

Inverse Finance: Governance, (2023) Proposal to Begin Issuance of new DBR Tokens | Link

Inverse Finance: Governance, (2024) Increase Max Rate on Virtual xy = k DBR Auction | Link

Inverse Finance – App | Link

Inverse Finance Documentation | Link

Revelo Intel is engaged in a commercial relationship with Inverse Finance as part of an educational initiative and this report was commissioned as part of that engagement.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.