Zaros is a perpetual futures decentralized exchange (perps DEX) that utilizes Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs) to enhance capital efficiency and provide additional real yield opportunities to Liquidity Providers (LPs). The protocol allows LST and LRT holders to optimize their rewards by contributing liquidity to perpetual markets. It supports trading perpetual futures on-chain, collateralized by USD and LST vaults and introduces its native stablecoin, $USDz.

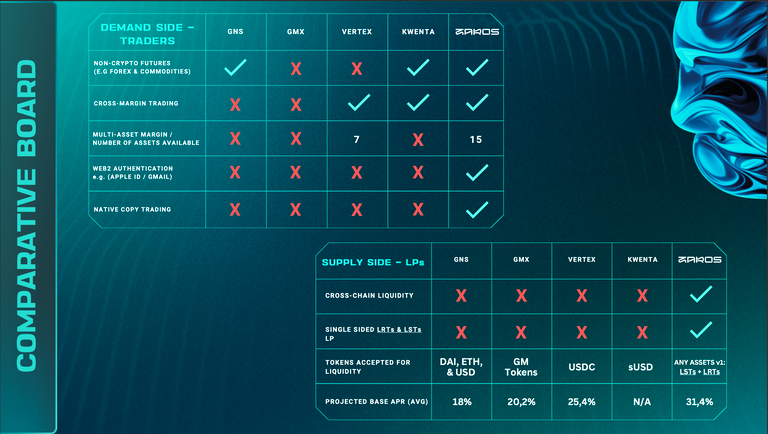

Perpetual futures trading in the DeFi space has faced significant challenges, such as limited trading pairs, liquidity fragmentation, and open interest imbalances that often lead to losses for liquidity providers (LPs). Traders also encounter operational complexities and inefficiencies, particularly when managing collateral and navigating liquidation processes. Zaros addresses these issues with a unified liquidity provisioning model via a ZLP vault that efficiently directs liquidity across markets, reducing fragmentation and improving capital utilization. This allows the trading of a diverse array of assets including crypto, FX, and commodities.

Zaros distinguishes itself with its market-agnostic LP model and risk clusterization for managing open interest. These features offload risk management to traders, allowing the protocol to support a broader array of perpetual markets while maintaining the economic sustainability of liquidity pools. As a result of this approach, the risk management burden is shifted away from LPs, enabling a more diversified and robust trading ecosystem.

Additionally, Zaros introduces the $USDz stablecoin, pegged to the US dollar and backed by LSTs and other collateral within the protocol’s vaults, such as LRTs. This stablecoin plays a crucial role in providing liquidity for leverage trading and ensures a stable source of value within the ecosystem. The stability of $USDz is maintained through dynamic strategies and over-collateralization mechanisms.

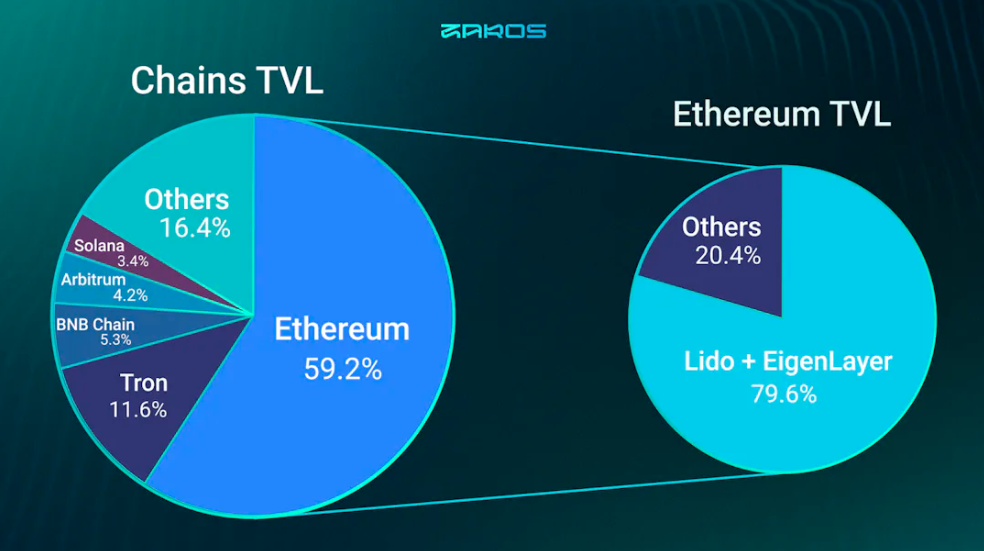

Zaros stands out with its strategic focus on derivatives, liquid staking, liquid restaking, and stablecoins. The protocol leverages the liquidity of LSTs and LRTs, tapping into the large liquidity that lives on Ethereum and using it as collateral to back the $USDz stablecoin and enable perpetuals trading.

While Ethereum liquidity helps to bootstrap these markets and grow the supply of the $USDz stablecoin, there are limitations when it comes to building complex derivatives instruments on Ethereum mainnet. The high gas costs and slow transactions don’t enable efficient trading. For that reason Zaros deploys its core protocol contracts on L2s like Arbitrum.

On the one hand, LST/LRT holders, who contribute $ETH to validator stakes, can further maximize their rewards by restaking on Zaros as LPs, earning an extra source of yield from underwriting perpetual swaps. On the other hand, traders can tap into this liquidity to conduct operations on the Zaros perpetuals DEX and speculate on the direction of the market, hedge against volatility, earn yield on carry trades, etc.

Zaros employs $USDz as its native stablecoin for several reasons. Firstly, $USDz streamlines collateral management by serving as the primary settlement asset. This reduces the complexities associated with managing multiple external stablecoins and ensures that all transactions within the Zaros ecosystem are seamless. By having a native stablecoin, Zaros can better control and optimize the liquidity available on its platform, which enhances the overall trading experience.

Moreover, using $USDz helps mitigate risks associated with external stablecoins, such as depegging or regulatory challenges. By relying on $USDz, Zaros can maintain a more stable and reliable trading environment, which is crucial for attracting and retaining traders. This stability is further supported by the fact that $USDz is over-collateralized, providing an additional layer of security and trust within the ecosystem.

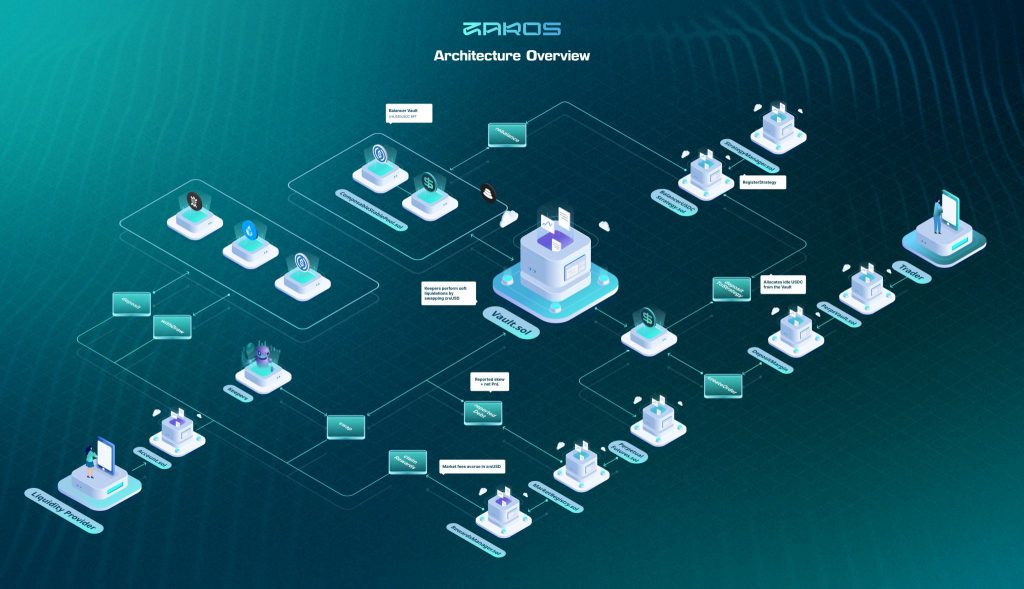

LPs and traders both play crucial roles within the Zaros ecosystem, each contributing to the platform’s functionality in distinct ways. LPs provide the necessary collateral to support perpetual futures markets by depositing their LSTs and LRTs into the ZLP Vaults. These vaults aggregate liquidity and use it to underwrite swaps on the perpetual DEX. In return, LPs earn a portion of the trading fees generated by the DEX, alongside continuing to earn staking rewards from their LSTs and LRTs. This dual-earning mechanism makes providing liquidity on Zaros particularly attractive. A soft liquidation mechanism protects LPs from significant losses, thereby maintaining the stability of the liquidity pool.

Traders interact with Zaros by depositing collateral assets to open and manage positions on the perpetual DEX. When traders deposit collateral into their accounts, it is used to back their trading positions. Profitable trades result in gains settled in $USDz, which are then added to the trader’s account. Conversely, if a trader incurs losses, the collateral in their account is used to cover these losses. In situations where significant losses occur, the soft liquidation mechanism is triggered to protect the overall liquidity pool, ensuring that the market remains stable and that the interests of both traders and LPs are safeguarded.

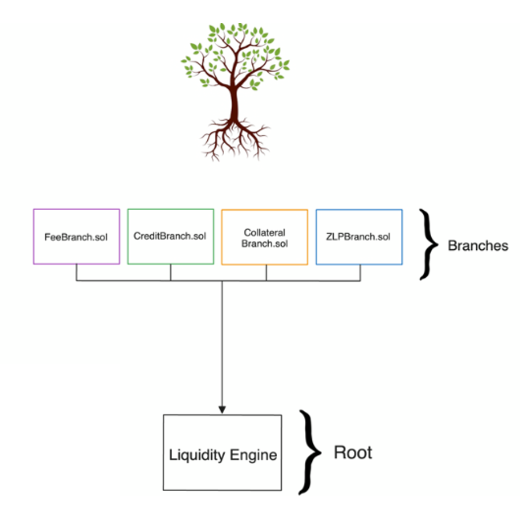

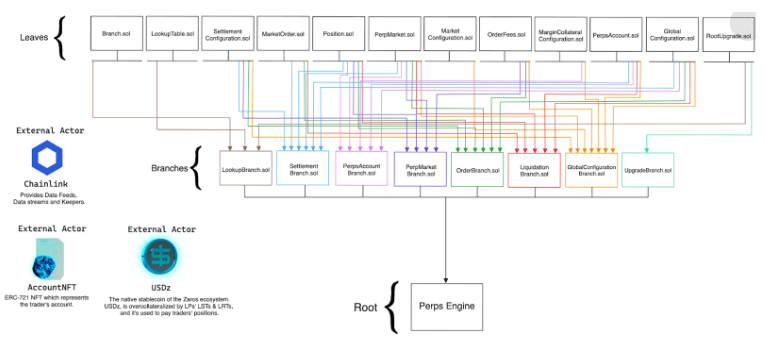

Zaros introduces the Tree Proxy Pattern to optimize and manage the routing of transactions and requests for a modular, efficient, and future-proof design of its perpetual DEX.

The Tree Proxy Pattern draws inspiration from EIP-1822, EIP-2535, and EIP-7504, incorporating the strengths of these proposals while striving to overcome their limitations. It is designed to be compatible with EIP-7201, enabling the use of well-audited libraries like OpenZeppelin. This compatibility allows for leveraging unlimited implementation contracts without the baggage of complex terminology.

The Tree Proxy Pattern builds upon the strengths of the Diamond Pattern while offering solutions to its problems. This design is particularly appealing because of its programmer-friendly approach, modularity, compatibility features, and opinionated proxy pattern.

The Tree Proxy Pattern (TPP) uses the metaphor of a tree to describe its structure.

| TPP Terms | Common Name | Structural Component |

| Root | Proxy | Acts as the entry point to the architecture, channeling requests to appropriate modules. |

| Branch | Implementation (Module) | Represents modules, a collection of functionalities grouped by logic or purpose. |

| Leaf | Functions and Storage | Denotes functions, the smallest unit within the architecture, thoroughly unit tested to ensure reliability. |

| LookupBranch | List of delegated functions | Introduced for further granularity, the LookupBranch enables a more refined control over the integration and execution of operations within the system. |

| LookupTable | Namespace’s Lookup | LookupNamespace – Central to our architecture is the LookupTable, facilitates the efficient management and invocation of functionalities. |

| RootUpgrade | Upgrade | N/A |

Branches – These are collections of leaves (functions) that have been tested in isolation and are ready for integration testing.

Leaves – Prior to integration, each function undergoes rigorous unit testing to verify its performance and reliability.

Namespace Functionalities and Storage – Functions are categorized and managed through namespaces, facilitating their identification and execution while maintaining a preliminary version for future updates.

Zaros Core introduces a robust framework for its perpetual futures and liquidity engines, leveraging the Tree Proxy Pattern.

The Zaros ecosystem is also supported by three key external actors that play significant roles in its operation and integration into the broader blockchain landscape.

The Perps Engine facilitates access to standalone smart contracts that represent isolated markets. Therefore, the creation of each new market requires that an independent smart contract is deployed. This ensures that all trading pairs and their associated risks remain isolated from each other. As a result, the performance of one market does not impact others.

The core components of the Perps are as follows:

Branches

Leaves

Zaros Liquidity Engine utilizes the Tree Proxy Pattern, which consists of Leaves, Branches, and a Root for its structure. This engine is supported by a modular architecture, including critical components such as FeeBranch.sol, CreditBranch.sol, CollateralBranch.sol, and ZLPBranch.sol.

This module is at the core of the protocol’s functionality, empowering liquidity providers to participate effectively in the ecosystem. Some key features include:

Collateral Allocation to Supported Vaults:

Liquidity providers (LPs) contribute their collateral to ZLP Vaults. Each Vault is designed to serve specific purposes and assets, ensuring efficient collateral allocation.

Backing $USDz Stablecoin:

The collateral provided by LPs is utilized to back the minting and maintenance of $USDz.

Leveraging $USDz for Trading:

The $USDz stablecoin, backed by collateral from LPs, is instrumental in enabling the creation of liquidity within Zaros’ perpetual futures markets.

Traders can utilize $USDz as a trading asset, allowing them to get exposure on a wide range of asset pairs available on Zaros, including cryptocurrencies, commodities, and foreign exchange (FX) assets.

Trading Fees as Compensation:

In return for the credit provided by liquidity providers (LPs) in the form of $USDz, the integrated markets within Zaros pay trading fees to each respective Vault.

These trading fees serve as compensation to LPs for their contribution to the liquidity pool.

Benefits to Liquidity Providers (LPs)

LPs play a crucial role on Zaros by providing credit to its markets. LPs take the risk of being the counterparty to traders and in exchange for this risk they are compensated with trading fees. A significant 70% of the trading fees collected by the Perpetuals DEX is redistributed to Liquidity Providers (LPs) who participate in the ZLP Vaults.

Benefit to Traders

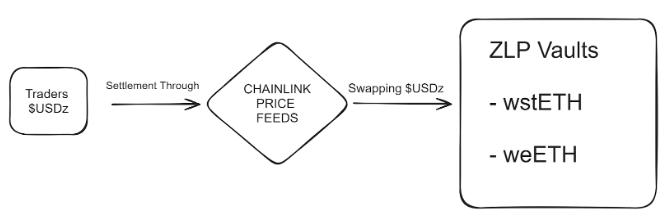

$USDz is paid out to profitable positions, and is accounted as debt by the CreditBranch.sol. Traders can swap $USDz to any of the ZLP Vaults underlying collateral at any point in time, using Chainlink’s Data Streams prices for settlement. This ensures traders can have a smooth experience on Zaros while the system remains collateral agnostic, enabling the DAO to smoothly spin up new ZLP Vaults.

Zaros is the issuer of the $USDz overcollateralized stablecoin, which is used as a stable unit of credit within the platform

$USDz achieves its price peg of $1 through a combination of mechanisms:

$USDz plays a crucial role in various aspects of the Zaros protocol:

Zaros Protocol’s ZLP Vaults stand out by leveraging LSTs and LRTs as collateral. This approach provides several distinct advantages compared to other LP-based perpetual DEXs.

Enhanced Yield Opportunities: LSTs and LRTs, such as $stETH and $sfrxETH, offer consistent staking rewards. By using these tokens as collateral, Zaros enables LPs to earn both staking rewards and trading fees. This dual earning potential significantly enhances the yield opportunities for liquidity providers.

Capital Efficiency: Using LSTs and LRTs as collateral allows Zaros to maintain a high level of capital efficiency. Traditional perpetual DEXs rely primarily on stablecoins and non-interest-bearing assets for collateral (such as $USDC, $ETH, $wBTC). In contrast, Zaros’s approach ensures that the collateral itself generates yield, reducing the opportunity cost for LPs and enhancing the overall liquidity of the protocol.

Risk Management and Liquidity Provisioning: Zaros employs a sophisticated risk clusterization method and a funding rate system to manage open interest effectively. This system categorizes assets into risk tiers and dynamically adjusts funding rates based on market conditions. As a result, liquidity is directed where it is most needed, ensuring that the protocol can support a wider array of perpetual markets without overextending its risk exposure.

Flexible Collateral Management: The ZLP Vaults are designed to support a variety of collateral types, allowing LPs to choose between LSTs, LRTs, and stablecoins. This flexibility enables LPs to optimize their collateral strategy based on market conditions and personal risk preferences. Additionally, Zaros’s use of ERC-4626 vault standards ensures seamless integration and interoperability with other DeFi protocols, further enhancing the utility and flexibility of the ZLP Vaults.

Soft Liquidation Mechanism: Zaros introduces a soft liquidation mode to handle positions approaching the liquidation threshold. This mechanism allows arbitrageurs to acquire collateral assets at a discount, reducing the likelihood of sudden and significant losses for LPs. The soft liquidation approach helps maintain market stability and provides additional opportunities for profit through arbitrage.

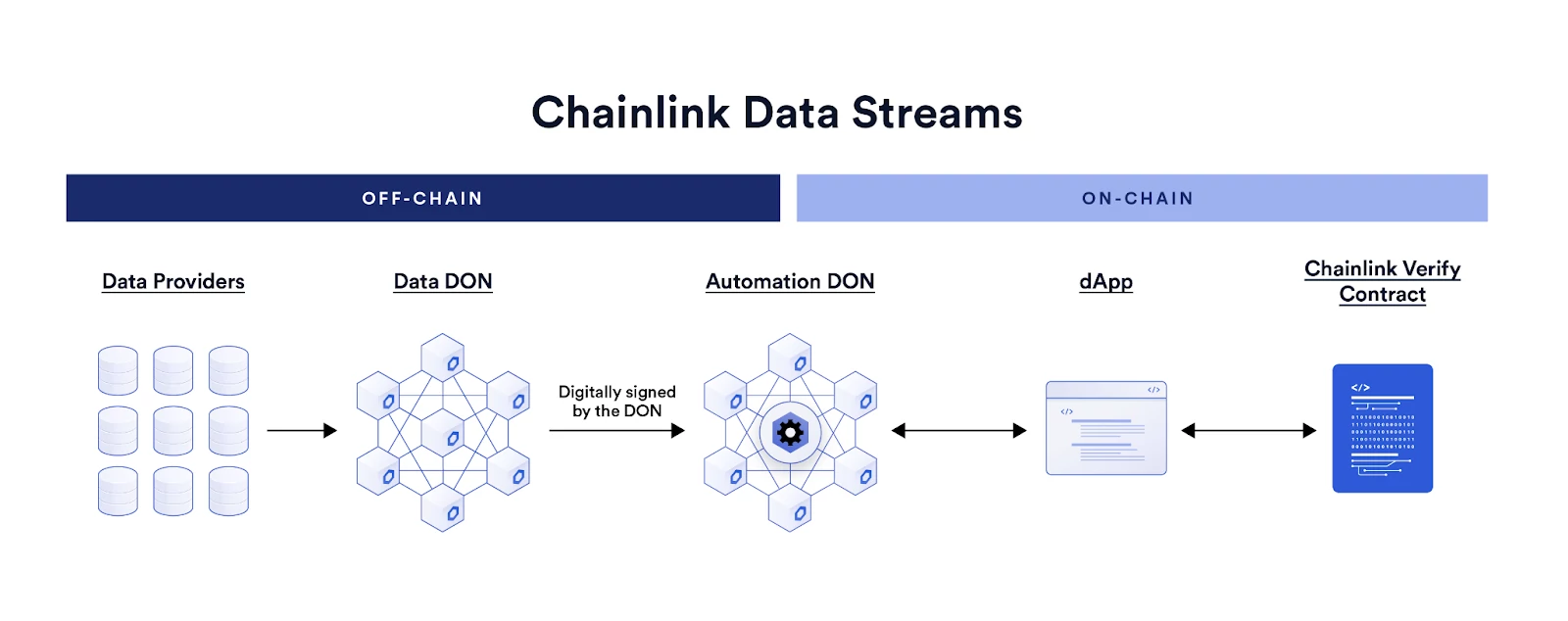

Zaros relies on oracles, specifically Chainlink Data Feeds and Streams, to integrate dependable and decentralized data into the blockchain. This data, sourced from multiple independent Chainlink nodes, underpins the accuracy and transparency of all transactions and operations like matching orders, liquidations, equity and margin valuations.

Keepers

Zaros employs specialized entities called keepers to maintain market stability and efficiency. These automated functions perform two key tasks:

Chainlink Automation empowers keepers by deploying custom logic triggers. This framework guarantees reliable and precise keeper functionality, essential for the overall platform’s performance. The synergy between keepers and oracles is a collaboration that automates critical processes, such as liquidations, based on accurate real-time data. This symbiotic relationship ensures:

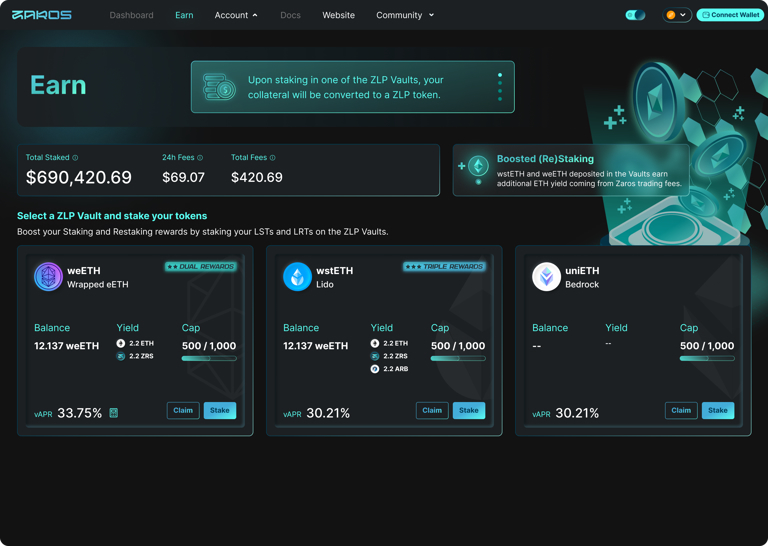

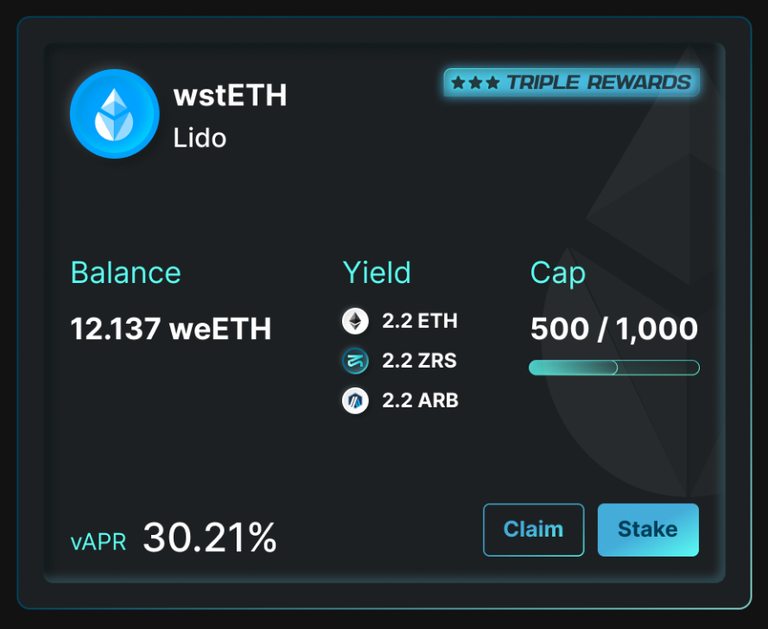

These are specially Boosted ZLP Vaults, they represent a different class of vaults engineered to maximize yield for liquidity providers (LPs). Unlike standard ZLP vaults, these advanced vaults are distinguished by the level of rewards they offer, ranging from dual to triple, quadruple, or more, with each category explicitly labeled for clear identification.

Key Features

They provide liquidity providers with an unparalleled opportunity to enhance their yield through a diversified and optimized rewards system.

Zaros leverages account abstraction to provide a seamless and secure DeFi experience, enhancing the functionality and user experience of smart contract wallets.

Users can set up rules to transfer funds if a wallet remains inactive for a specified period, ensuring assets are not lost

Smart contract wallets on Zaros can implement flexible security policies, such as requiring multiple signatures for high-value transactions or limiting daily spending. Users can also recover accounts without seed phrases, enhancing accessibility and security.

Social Login: Users can access their accounts using social logins, with multiple devices and third-party services acting as guardians for account recovery and security.

One-Click Transactions: Simplifies the transaction process, making it as easy as conventional finance operations.

As an oracle-based model, the protocol uses off-chain oracles to aggregate accurate pricing. Zaros utilizes Chainlink’s low latency off-chain oracle price feeds (Data Streams). This provides three price points: bid, median, and ask. Zaros uses the bid/ask as the base (depending on the order side) and applies a “price impact” based on market configuration (scale and skewness).

Funding rate is a crucial mechanism to ensure alignment between perps and spot market prices. In perps, it is normal for prices to diverge due to the Open Interest (OI) in the markets. When the OI is 0, the prices of perps and spot essentially converge. However, as the number of long and short positions increase, the perp prices tend to deviate from the spot price.

Long bias: When there are more long positions than short positions, the price of perps tends to rise above the spot price. To counterbalance this, the funding rate mechanism comes into play. Long position holders pay a fee to short position holders to maintain their positions. This fee acts as a disincentive for excessive long positions, pushing the perp price down closer to the spot price.

Short bias: When there are more short positions than long positions, the price of perps tends to fall below the spot price. In this scenario, short position holders pay a fee to long position holders. This payment incentivizes longs, thereby pushing the perp price up towards the spot price.

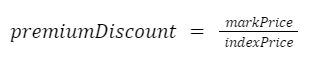

The premium discount can be calculated with the following formula:

The process to adjust the funding rate based on the premium discount falls into two scenarios, depending on the initial result’s position relative to a specific clamp range. The operations proceed as follows:

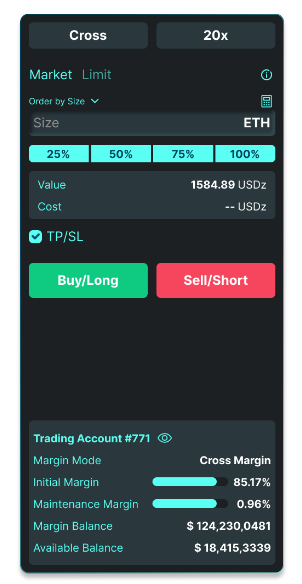

Scenario 1: Outside the Clamp Range

When the computed outcome exceeds the boundaries of the clamp range, the funding rate is approximated to the interest rate. The formula is expressible as:

![]()

This is because the adjustment formula:

![]()

simplifies to the interest rate, reflecting an unaltered funding rate beyond the clamp limits.

Scenario 2: Within the Clamp Range

For outcomes nestled within the clamp range, adjustment is essential to keep the rate within predetermined bounds (-0.05% to 0.05%). The calculation involves adding the premium discount to a clamped value, falling within these bounds, of the difference between the interest rate and the premium discount:

![]()

In this formulation, the clamp function acts as a regulator to ensure the funding rate’s alignment with set parameters, thereby maintaining it within a sustainable range.

Interest Rate Determination

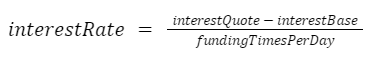

The interest rate is a critical component in calculating the funding rate. It is determined as follows:

Where:

The usual value for the interest rate is 0.01% (1 basis point, bps).

The funding Interval is 1 Hour.

Funding Times Per Day:

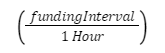

Impact Notional

The impact notional is the value that a trader’s position would need to be adjusted by to maintain a specified level of impact on the market price.

This measure helps Zaros to standardize its trading impact across different market conditions and liquidity environments. The default value is $100,000.

Price Impact Premium

A coefficient set by Zaros’s risk team, this premium adjusts the price impact of trades according to the current market conditions and Zaros’s liquidity position. It plays a crucial role in formulating the desired price impact by modulating how aggressive or conservative the trading strategy should be in light of current market dynamics.

Desired Price Impact

This is a key metric that outlines Zaros’s goal for influencing the market price. It is calculated as follows:

![]()

aiming to achieve a specified change in the market price through trades.

Skew Scale

The skew scale adjusts the market position based on the desired price impact. It is calculated by dividing the impact notional by the desired price impact. This calculation ensures that trades adjust the market price in a controlled manner, in line with Zaros’s strategic goals.

A user’s position is subject to liquidation if their Account Value drops below the RequiredMaintenanceMargin. This process is vigilant, with Chainlink Keepers tasked to continuously monitor positions against maintenance margin requirements. They utilize an eventTrigger mechanism to initiate liquidations, enhancing market stability.

The calculation is as follows:

![]()

Where:

The liquidation process leverages Chainlink oracle data feeds for accurate price referencing, ensuring liquidations are executed at the oracle’s quoted price.

This task is facilitated by LiquidationBranch.sol, which adheres to predetermined upper and lower price boundaries during the liquidation phase.

eClusters enable the grouping of markets based on factors like asset correlation, promoting a more diverse and robust set of perpetual futures markets.

The image below shows correlation clusters using Spearman’s rank correlation and fractional differentiation. In the picture, $BTC, $ETH, and $BNB are highly correlated, which means that they are strong candidates to participate in the same liquidity share of the cluster. We can also see that $ADA, $DOT, $SOL, and $XRP also have moderate to strong correlations, so they can be grouped together in the same liquidity cluster as well. On the other hand, we can also observe that $PAXG is an asset with no correlation inside the cluster. This means that its risk/liquidity provisioning should be treated separately.

The Zaros protocol was developed in response to limitations in the current on-chain trading perpetual futures space.

Current models like Synthetix and GMX suffer from fragmented liquidity. Liquidity providers (LPs) struggle to distribute capital efficiently across various markets due to limitations in choosing which markets to support. This leads to situations where some markets have high open interest but low utilization, hindering overall efficiency.

Furthermore, On-chain perpetuals currently lack the user-friendly experience of centralized exchanges (CEXs). Complex interfaces and management burdens discourage wider adoption by traders accustomed to a smoother experience.

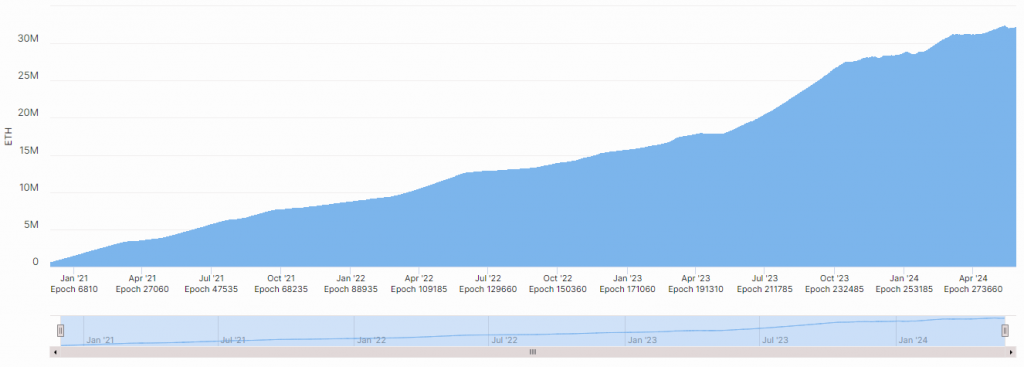

Finally, Zaros addresses significant demand as LSTs and LRTs represent a significant and rapidly growing segment of DeFi allowing holders to earn staking and restaking rewards while maintaining liquidity increasing capital efficiency and product variety in perpetual futures trading.

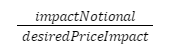

In Zaros, there are two types of users, traders and liquidity providers.

To engage in trading, users select their desired margin type and leverage amount. Currently, Zaros offers cross-margin mode only. Margin represents the collateral deposited to secure a position. While higher leverage allows control over a larger position with a smaller deposit, it increases the risk of liquidation.

Once a position is opened, users can monitor their profit or loss and adjust their position size or leverage as necessary. Increasing leverage enhances the risk of liquidation, but it also frees up collateral for deployment in other trades.

On the trading interface, traders can choose a market buy/long order or a limit sell/short order.

Users can establish both take profit and stop loss orders. These orders automatically close the user’s position upon reaching a designated price point. Slippage tolerance represents the acceptable deviation between the anticipated price and the price at which the order is filled.

Liquidation occurs when the value of the user’s collateral falls below a specific threshold (maintenance margin). To prevent liquidation, users can add more collateral or decrease their position size.

Traders within the Zaros ecosystem have their positions settled in $USDz, promoting a stable trading environment. The stablecoin’s over-collateralization, backed by liquidity providers, fosters confidence and continuity in trading activities.

Zaros seamlessly integrates TradingView into their perpetual DEX platform, enhancing the trading experience for users. TradingView, renowned for its advanced charting tools and user-friendly interface, allows Zaros traders to analyze market trends, create custom indicators, and execute informed trades directly from the DEX interface.

Traders can create multiple trading accounts, potentially increasing capital efficiency and diversifying trading opportunities. This flexibility enables traders to implement different strategies for each account, potentially catering to various risk profiles or asset classes within the perpetual futures market offered by the platform.

Utilization of cross-margin is the default trading mode on the platform, allowing traders to leverage their entire account balance for positions. Additionally, users can create and manage multiple trading accounts through ERC-721 NFTs within a single digital wallet. This multi-account system grants traders more granular control over margin allocation and risk management, potentially enabling them to implement diversified trading strategies.

Once traders have deposited collateral into their cross-margin trading account, they have the flexibility to create leveraged positions on any of the supported perpetual futures contracts and automatically have their open positions’ profit used as margin balance. Cross-margin is the default leverage trading mode on Zaros’ perpetuals DEX, but traders that desire to separate their strategies into different portfolios can easily mint multiple trading account NFTs under their same EVM wallet to achieve granular margin & risk control.

| ISOLATED MARGIN | CROSS MARGIN |

| Allows Traders to assign a single margin position. | Grants you the margin across all active positions in your portfolio. |

| A perfect fit for high-risk margin trading. | Great for traders who look to control multiple positions at once. |

| Any compromised margin will be isolated from other positions of a trader. | Gives you a higher chance to avoid a margin call and subsequent account loss. |

Using Liquid Staking Tokens (LSTs) as margin collateral on Zaros allows users to leverage the staked value of LSTs while simultaneously earning staking rewards. This dual-income stream means that traders can maximize their potential returns not only through leveraged trading but also by continuously earning from their collateral. For instance, using stETH as collateral allows a trader to leverage their position in ETH/USD perpetual futures while the underlying stETH continues to generate staking rewards, enhancing overall profitability. This is similar to Binance’s Coin-margined product, but for Zaros, PnL is settled in $USDz.

Traders can exploit the differences between funding rates on the perpetual futures markets and the staking rewards from LSTs and arbitrage these differences to earn additional profits.

Zaros incentivizes Liquidity Providers to contribute to their ecosystem by offering them a share of trading fees and opportunities to earn yield.

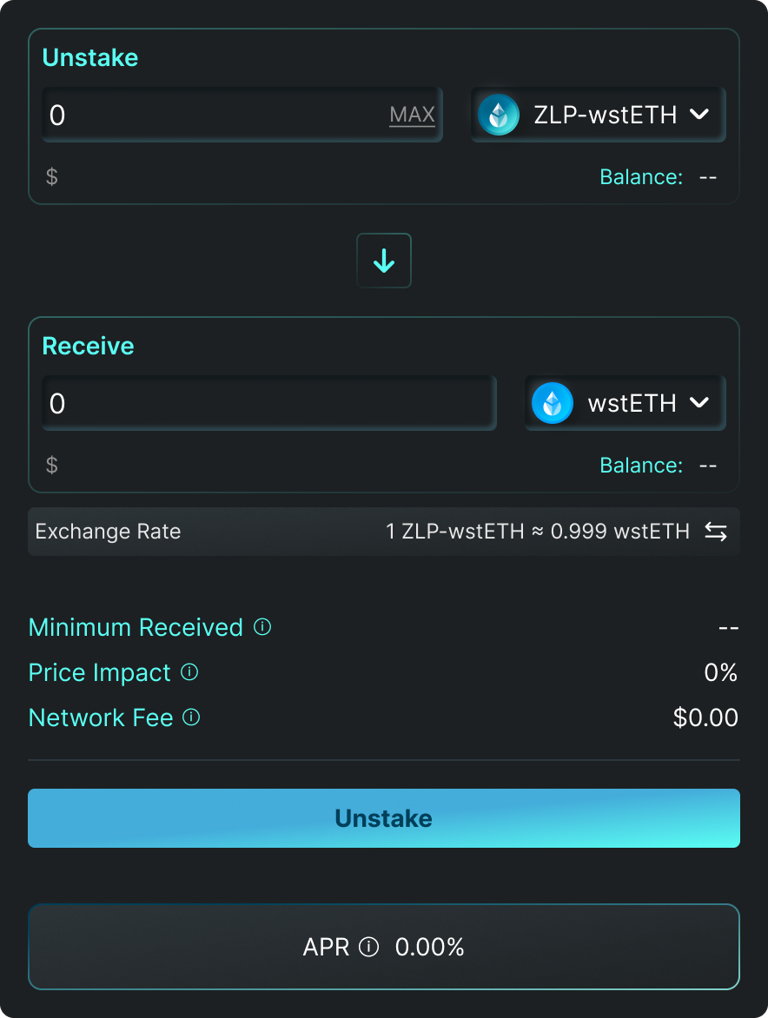

Liquidity providers can deposit their LSTs and LRTs into ZLP Vaults to earn a share (70%) of the trading fees generated by the Zaros perpetuals DEX. These vaults also manage a portion of the protocol’s $USDz reserves, ensuring efficient asset allocation. They also have access to dual, triple or quadruple rewards by staking into the Boosted Restaking Vaults.

LPs can choose which pool to stake in based on their desired asset (like $wstETH from Lido) and easily stake or unstake their holdings through the platform.

To stake on Zaros, LPs pick a pool (like $wstETH from Lido), choose an amount, and confirm the transaction fee in their wallet.

Unstaking involves selecting the desired pool, entering the amount (a minimum 0.01 wstETH), and confirming a fee in their wallet. Their assets will then be unstaked shortly after.

Perpetual futures, commonly referred to as “perps,” are a DeFi financial instrument that allows traders to speculate on the future price of an asset without an expiry date. Unlike traditional futures, perps do not settle on a specific date, which means traders can hold positions indefinitely as long as they can maintain the necessary margin. This flexibility makes them particularly appealing for long-term price speculation and hedging in the crypto markets.

In this landscape, Zaros positions itself as a comprehensive solution designed to improve capital efficiency and expand the DEX market share, enable trading for FX and commodities, and foster a user friendly, robust and efficient ecosystem for on-chain perpetual futures trading.

Zaros is also intertwined in the liquid staking sector of DeFi. The liquid staking industry currently dominates DeFi, representing its largest sub-sector.

It’s no surprise that numerous protocols are emerging around the restaking concept, trying to get their piece of the pie in this market.

Source: beaconcha.in – History of Daily Staked ETH

Despite being a relatively new sector, it has quickly claimed the top spot among the DeFi categories in terms of Total Value Locked (TVL).

Recognizing the opportunity, other projects entered the sector. AAVE began incorporating LSTs into its operations, Prisma Finance utilized LSTs to back a stablecoin, and Zaros is leveraging LSTs and LRTs to bootstrap perpetual futures markets.

As an LP-Based model, Zaros aims to capitalize on the growing demand for LSTs in the Perps market. For that, the protocol will iterate and improve other liquidity management models, such as those introduced by Synthetix, GMX, and others.

However, Inherent issues of liquidity fragmentation and capital inefficiency present among LP-Based Perps DEXs have posed significant challenges to users. Zaros’s innovative approach aims to overcome these challenges, potentially positioning itself as a strong contender in the perpetual DEX space.

Zaros plans to address liquidity fragmentation through innovative eClusters and distinguish itself as the most capital-efficient platform, leveraging Liquid Staking Tokens (LSTs) to support its stablecoin, $USDz.

| DEX | PROS | CONS |

| Synthetix |

|

|

| GMX |

|

|

| Zaros |

|

|

Centralized exchanges (CEXs) have historically dominated futures trading in terms of volume and asset availability. However, recent events in 2022 (like the fall of FTX) have shed light on transparency issues within centralized entities, making decentralization an attractive prospect. As a result, Decentralized exchanges (DEXs) are gaining traction, as they offer users full custody of their assets and the promise of a more transparent and secure trading environment. This trend presents a significant opportunity for platforms like Zaros. In this context, Zaros will compete against protocols like dYdX, Synthetix, GMX, and Gains Network among others.

CEXs still hold a substantial share of the perpetual futures market, with significant trading volume and open interest.

Decentralized exchanges, however, are still in the early stages of development, contributing a modest percentage to the overall trading volume. However, this nascent stage is viewed as a promising sign for the future.

By offering a user experience similar to centralized exchanges while ensuring users retain full custody of their assets, Zaros aims to capitalize on the growing demand for decentralized solutions. For that, the protocol will iterate and improve other liquidity management models, such as those introduced by Synthetix, GMX, and others.

Zaros’ value proposition lies in the scenario it creates for both traders and liquidity providers (LPs). LPs can boost their rewards by staking LST/LRT tokens on the platform, earning 70% of trading fees. Meanwhile, traders benefit from enhanced liquidity and favorable trading conditions, encouraging active engagement. The platform’s decentralized nature ensures transparency and security, fostering trustless interactions. It creates a destination for leverage trading, driven by mutually beneficial incentives and a focus on real-yield rewards.

Liquid Staking Tokens (LSTs) are derivatives representing a user’s staked assets, predominantly proof-of-stake (PoS) coins. These tokens maintain the inherent value of the staked asset while offering added benefits such as liquidity, enhanced yield, and accessibility. LSTs can be traded on secondary markets, enabling users to access funds without unstaking assets, and can be utilized in DeFi protocols to earn additional returns beyond staking rewards. LSTFi leverages these attributes to build a network of integrated DeFi protocols, facilitating the use of LSTs in diverse financial instruments such as lending, borrowing, and derivatives trading.

Key Components of LSTFi

LSTFi is comprised of several interrelated components:

History and Future of LSTFi

LSTFi emerged to address the limitations of traditional staking methods, particularly the challenge of illiquidity. Since its inception, the total value locked (TVL) in LSTs has surged, exceeding billions of dollars, reflecting widespread adoption. The future of LSTFi is uncertain, but, with increasing interest from traditional financial institutions, technological advancements, and evolving regulatory frameworks it is expected to drive further growth.

Restaking, pioneered by EigenLayer, allows users to stake tokens across multiple networks simultaneously, enhancing rewards at the cost of increased slashing risk. This approach optimizes the utility of staked tokens, benefiting both stakers and networks by enabling the activation of dormant staked tokens across various protocols.

Restaking allows users to stake coins on the main network and other protocols concurrently, thereby securing multiple networks. EigenLayer’s native restaking involves Ethereum validator node operators managing assets through smart contracts. Liquid restaking, though currently paused, permits users to exchange staked assets for Liquid Staking Tokens (LST), which are then restaked on the protocol.

Restaking offers significantly enhanced rewards for stakers and cost-effective security enhancements for new protocols. It enables scalable security based on demand, ensuring flexibility and cost-efficiency in network security management. However, challenges include the limited utility of Liquidity Provider (LP) tokens once staked.

Zaros plans to address liquidity fragmentation through innovative eClusters and distinguish itself as the most capital-efficient platform, leveraging LSTs and LRTs to support its stablecoin, $USDz.

Zaros stands out by providing access to a diverse array of oracle-based perpetual markets.

The protocol prioritizes user experience by offering an intuitive and easy-to-use platform. It caters to both novice and experienced traders, while also supporting professional-grade trading tools.

Zaros’ core contracts are written in Solidity and can be deployed on any EVM compatible chain.

The protocol will initially go live on Arbitrum, with plans to deploy on Monad and expand to more chains over time.

Zaros generates revenue by charging trading fees to traders who engage in perpetual futures trading on its platform. These fees are typically set as a percentage of the trading volume or a fixed fee per trade. Traders pay these fees when they open or close positions, and Zaros collects them as a source of income and/or distributes them with LPs.

This fee is determined based on the market and taker rate, which varies depending on the market skew and the side of the order. The rate is measured in basis points (bps) and differs for each market.

A flat fee initially set at 20 cents. This fee is intended to cover the keeper’s gas costs.

A flat fee of 5 USD. This fee is applied when an account’s Maintenance Margin Ratio (MMR) exceeds 1, resulting in liquidation.

The Zaros Revenue Distribution system is responsible for managing the allocation of $ETH yield accrued by the protocol through fees paid by traders using Zaros’ trading products.

70% to ZLP Vaults: The majority of accrued $ETH is sent to the ZLP Vaults LPs, since they’re the ones market making to Zaros and creating its liquidity.

15% to veZRS Lockers: This portion of the revenue generated is allocated to veZRS lockers, incentivizing long-term holding and participation in the ecosystem.

10% to the DAO Treasury: This allocation is reserved for the DAO Treasury. This portion empowers the DAO with funds to support its decision-making processes.

5% for Buyback and Burn of $ZRS: The remaining revenue is used to buy back $ZRS tokens from the market and subsequently burn them, reducing the overall supply.

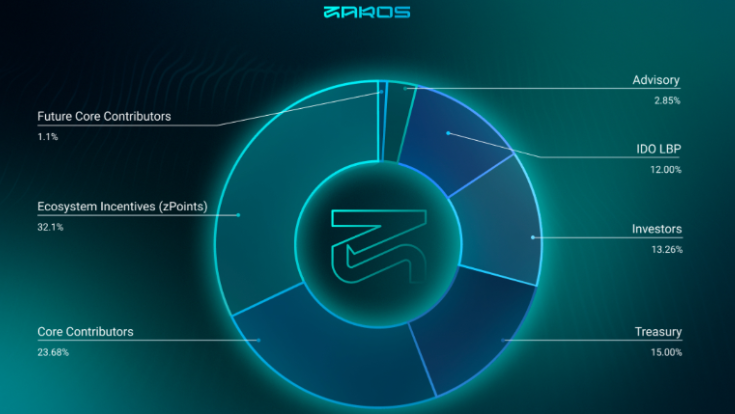

$ZRS is the native utility token of the Zaros ecosystem, adhering to the ERC-20 standard, it grants holders voting privileges within the Zaros DAO, fee-sharing from the leverage trading DEX, and swap fees from the $ZRS-$ETH pool on Balancer.

The $ZRS Token Distribution is as follows:

Investors – 13.26%: Allocation for early investors with a 6-month cliff and a 12-month vesting period.

Future Core Contributors – 1.1%: Token allocation for upcoming core team members with cliff and vesting periods.

IDO LBP – 12.0%: Token allocation for the Initial DEX offering, to be launched through Fjord Foundry’s LBP. No cliff, no vesting.

Ecosystem Incentives (zPoints) – 32.1%: Includes incentives for initial protocol participation, ongoing incentives for protocol participation for the next 4 years, and airdrops.

Treasury – 15.0%: Reserved tokens for operational needs, opportunistic fundraising, and ongoing expenses. No cliff, vesting schedule.

Advisory – 2.85%: Tokens allocated to advisors with a 6-month cliff and an 18-month vesting period.

Core Contributors – 23.68%: Token allocations for the core team members with a 6-month cliff and a 24-month vesting period.

Investors – 13.27% on TGE, a 6-month cliff and a 12-month vesting period.

Future Core Contributors – 0.0% on TGE, cliff and vesting period TBD.

IDO LBP – 12.0% on TGE, No cliff, no vesting schedule.

Ecosystem Incentives (zPoints) – 3.6% on TGE.

Treasury – 0.750% on TGE, No cliff, No vesting schedule.

Advisory – 0.0% on TGE, 6-month cliff and an 18-month vesting period.

Core Contributors – 0.0% TGE, a 6-month cliff and a 24-month vesting period.

veZRS is an NFT obtained through the deposit of LP tokens from the $ZRS/$ETH 80/20 pool on Arbitrum.

At its core, veZRS leverages a vote escrow system where users deposit LP tokens from the $ZRS/$ETH 80/20 pool into an escrow contract. In return, users receive a veZRS NFT, which confers governance rights proportional to both the quantity of the LP tokens deposited and the duration of the lock period, which can extend up to one year. This model ensures that the longer tokens are locked, the greater the voting power granted, incentivizing long-term commitment to the platform’s governance.

Traditional vote escrow models, such as veCRV from Curve, have demonstrated significant benefits in fostering active governance participation. However, they often inadvertently reduce liquidity in their respective pools, as tokens locked for governance cannot be traded or utilized otherwise. The ve80/20 model, as adopted by veZRS, mitigates this issue by requiring the lock-up of LP tokens rather than raw governance tokens. This infusion of additional liquidity directly into the pools enhances overall liquidity, reduces slippage, and stabilizes token prices.

Central to its launch strategy is the deployment of a Liquidity Bootstrapping Pool (LBP) on Fjord Foundry, representing a strategic approach to introducing the Zaros token ($ZRS) into the market. Distinctive features of LBPs include:

Following the Initial Dex Offering, Zaros will establish a DAO to guide the direction of the protocol’s development and progression.

The Zaros DAO acts as a governance system to ensure the community’s involvement in decision-making processes.

Key Components

Non-transferable governance tokens, representing a combination of $ZRS wallet balance, veZRS voting power, and locked $ZRS balance. gZRS are soulbound tokens, ensuring voting power is tied to individual community members.

Smart contract risk pertains to the security and reliability of the underlying contracts that govern the protocol. This risk will vary based on factors such as the protocol’s complexity, audit history, and upgradability.

This involves liquidity risk as a result of liquidity conditions in the overall market. There is a cost associated with fees imposed by external protocols, slippage, as well as depeg risk of $USDz.

Each eCluster, managed by the Cluster Manager smart contract, has an Automatic Deleveraging (ADL) mechanism by which the protocol automatically deleverages winning positions during a black swan event. This would occur in market events where traders on one side of the market, even with all the protection mechanisms like the funding rate, price impact and order fees applied, still manage to completely drain the credit allocated to a given eCluster and mint all $USDz available to it. If this mechanism were to fail for any reason (e.g smart contract failure), it could potentially mint more $USDz than its underlying backing and cause an undercollateralization event.

There could be extreme scenarios or slashing events that might cause a LST or LRT to lose the peg with the underlying asset. In that scenario, if there is a significant gas spike, the smart contract might not intervene in a timely manner or efficiently offload the LST or LRT Vault’s collateral through the protocol liquidations. As a result, the system could end up with undercollateralized $USDz units in circulation.

However, this is highly unlikely, since this would involve a smart contract failure in addition to a black swan slashing event on an LST combined with significant network congestion on Ethereum. In a black swan event, depending on the intensity, the protocol should be able to safely offload LST collateral for $USDC and then keep $USDz backed 1:1 to $USDC.

It would require a failure in the soft liquidation mechanism in addition to the LST black swan event to have it play out in a way that the protocol wouldn’t be able to sufficiently offload the given LST for $USDC.

The Team has mentioned that Zaros will be audited by Cyfrin Audits and subsequently, a competitive audit competition of the Zaros’s smart contracts will be placed on CodeHawks.

Oracle manipulation risk pertains to the potential exploitation of oracles to manipulate asset prices and affect protocol operations. This could take place in scenarios when it is very easy to alter asset prices due to low liquidity conditions.

With Chainlink, Zaros remains dependent on the oracle’s overall functionality. If a critical vulnerability is discovered in Chainlink, it could potentially impact Zaros as well. However, LSTs are among the most liquid tokens in the market and Chainlink has proven to be a solid oracle provider.

Guilherme brings a wealth of experience in marketing and e-commerce growth. With five years of experience in e-commerce and two years in blockchain projects, Guilherme has co-founded an investment DAO and a startup accelerator. He is dedicated to driving innovation, growth, and user experience in the blockchain space, with a particular focus on onboarding traditional finance (TradFi) users to DeFi.

Pedro Bergamini (0xPedro)

Pedro is a seasoned blockchain professional with over four years of experience in blockchain projects. Pedro has also served as the Head of Blockchain for Illuvium, a prominent AAA crypto game. During his tenure, he successfully deployed smart contracts that secured over $1 billion of Total Value Locked (TVL) on the Ethereum blockchain.

Edson has a strong background in building and validating machine learning models. Curious, motivated, and diligent, he is experienced in finance and familiar with quantitative reporting. In his career, he developed a backtesting system to evaluate stock market strategies and produce automated reports.

Estevan is a seasoned engineer with full-stack development expertise, previously holding roles at Illuvium and HorizonDAO.

Gabriel is a growth marketing lead with a strong track record with previous roles working with industry leaders like Binance and Russell Marketing.

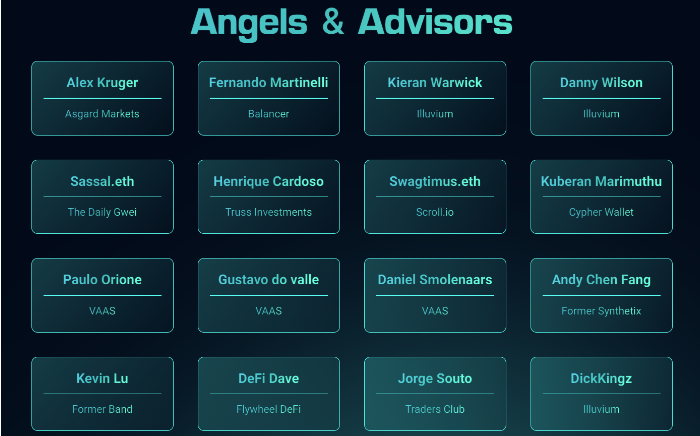

Zaros Protocol raised $1.8 million in funding from prominent backers including SNZ Holding, Seven Capital, Cogitent Ventures, Dutch Crypto Investors, Rocky Holding, Honey Island Capital, base dAO and other angel investors.

Among the team of advisors we find notable figures such as:

Traditional futures trading has a historical foundation dating back to the 19th century, primarily linked to central grain markets. Over time, futures trading has evolved into a global practice where individuals and institutions engage in contracts primarily for speculation and risk management.

Perpetual futures, on the other hand, are a more recent development, distinct from traditional futures due to their lack of fixed expiration dates. Perpetual contracts are essentially swap agreements that never expire. Crypto traders utilize them to speculate on digital asset prices and open highly leveraged positions without the need for direct cryptocurrency ownership.

Perpetual futures trading attracts various types of traders, each with their own strategies and goals. That includes speculators, hedgers, or funding rate arbitrageurs.

What are Liquid Staking Tokens (LSTs)?

Liquid Staking Tokens are tokens that represent staked assets, such as $ETH or other assets, and can be used across DeFi, for example as collateral for trading on Zaros. They allow users to maintain exposure to staked assets while unlocking liquidity and, in the case of Zaros, earn boosted staking rewards.

What are Liquid Restaking Tokens (LRTs)?

Liquid Restaking Tokens (LRTs) are tokens representing staked assets that, through restaking protocols, enable users to secure multiple decentralized networks, allows investors to stake their already staked assets in other protocols without withdrawing the original staked assets, and earn rewards from both the original protocol and the underlying Proof-of-Stake blockchain.

What are the ZLP Vaults?

The ZLP Vaults are single-sided LPing smart contracts that take the underlying collateral provided by Liquidity Providers (LPs), and lock it to increase the caps of Zaros perpetual futures markets. LPs earn ETH fees paid by traders in exchange for lending their collateral for the generation of Zaros liquidity.

What’s the difference between traditional futures and perpetual futures trading?

Zaros offers perpetual futures contracts that do not have fixed expiration dates, making them more flexible for traders. It also utilizes Liquid Staking Tokens as collateral, allowing users to participate in trading while staking their assets.

What is the role of the Zaros native token ($USDz)?

$USDz is a central component of Zaros’ architecture as its settlement asset. When traders realize profit, $USDz is minted and sent to their account’s margin. Then, it can be swapped to any of the ZLP Vaults underlying collateral priced at $1 using a low-latency oracle provider.

How is $USDz backed?

Liquidity providers’ collateral is sent to one of the supported Vaults.

How does Zaros communicate between its liquidity engine and deployed markets?

Zaros leverages Chainlink’s CCIP to enable cross-chain communication between its L1 liquidity engine and L2 deployed markets. It’s a crucial piece to achieve the vision of providing traders synchronous, deep liquidity and boosting LP’s rewards across deployments powering products at supported L2s.

What is Chainlink’s Cross-Chain Interoperability Protocol (CCIP)?

Chainlink CCIP provides a single simple interface through which dApps and web3 entrepreneurs can securely meet all their cross-chain needs. You can use CCIP to transfer data, tokens, or both data and tokens across chains.