Published: May 12, 2024

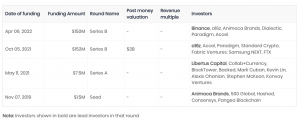

The concept of Web3 gaming and the metaverse gained significant traction in the last market cycle, allowing users to own, buy, and sell digital assets with verifiable ownership rights. This set the foundation for creating gaming economies on-chain, enhancing the value of gaming assets and allowing players to monetize their skills. However, with the advent of AI and new L1 and L2 chains entering the market, the narrative has lost significant mindshare over the past months.

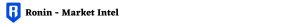

Source: kaito.ai – The Metaverse and GameFi narratives have been declining in narrative mindshare over the past 12 months, currently representing ~7% of the total.

Inside this market sector, Axie Infinity set the stage for how large the total addressable market (TAM) for gaming digital assets is. The price of $AXS soared from $3 in June 2021 to a local top of $82 in September, and finally to an ATH of $157 in November.

Source: Coingecko – $AXS Price Action

Even though we have seen more heated narratives in crypto since the start of the year, such as AI, L2s, memecoins, or restaking, we believe that the increasing number of active wallets and users in GameFi is going unnoticed. This opens up a window of opportunity to frontrun what might become one of the strongest narratives later this cycle. While Ronin has been growing steadily, it has done so in relative peace. Our view is that if crypto is to surpass previous cycles high, we will need to have consumer adoption by everyday people.

The Ronin Chain was specifically designed for gaming applications. Developed by Sky Mavis, the team behind Axie Infinity, it aims not only to speed up transactions and lower costs for the end users, but also offers capabilities for easier onboarding, such as the Ronin Wallet.

Sky Mavis is a technology-focused gaming studio founded in early 2018 by a group of co-founders including Trung Nguyen (CEO with a background in software engineering) and Aleksander Leonard Larsen (COO and growth with extensive experience in the gaming industry). The studio’s popularity is largely attributed to their success with Axie Infinity, highly dependent on the upside provided by the $AXS token, which became one of the pioneers and most successful games in crypto.

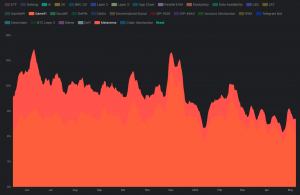

High caliber investors such as a16z, Animoca Brands, Binance, Paradigm, etc. have backed Sky Mavis across 4 funding rounds (1 seed and 3 early stages), totalling $311M in total ($152M in the largest round).

Source: tracxn – Binance was the lead investor in Sky Mavis’s latest funding round on April 6, 2022.

The development of Ronin was motivated by the need to address the scalability and transaction cost issues that Axie faced in its early days. However, there is a greater vision underscoring the value proposition of Ronin, aiming to build a broader ecosystem of Web3 games.

On the competitive side of things, we saw first-hand how gaming, NFTs, and the metaverse experienced exponential growth during the last bull market, led by projects such as Axie Infinity, The Sandbox, and Decentraland. At that time, specifically on October 28, 2021, Facebook formally announced their name change to Meta, adding more fuel to the fire.

Source: TradingView – The price of $SAND peaked after Facebook’s rebranding, recording a price increase of over 800% in less than a month.

Source: TradingView –$MANA’s price rallied 5x, also coinciding with Facebook’s rebranding announcement.

Even though many put all their chips betting that the Metaverse would unlock mass adoption for blockchains, only a few hold that view nowadays. Mindshare continues to subdue and projects working at the intersection of gaming and crypto are still in early stages, with limited products and low user engagement. In the current environment, the consensus is that SocialFi and applications like Farcaster or FriendTech are a more efficient onboarding mechanism to crypto rails than Web3 gaming.

Source: kaito.ai – GameFi currently represents 8% of the total narrative mindshare in crypto measured over the past 12 months.

However, despite the market’s slow recognition, some of the market leaders of the previous cycle have learnt their lessons and are primed for a resurgence. Axie is no longer a pet’s or pokemon-like game that experienced a downward spiral due to bad economic design, or so-called “ponzinomics”. Instead, the Ronin blockchain is now aiming to host the largest user base in all of crypto gaming.

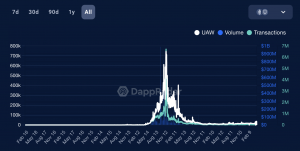

At its peak, Axie Infinity saw ~730k+ UAW (Unique Active Wallets) interacting with the game’s economy and in-game items. Today, the game’s user base is a far cry from what it once was, sitting at below 40k UAW.

Source: DappRadar – Axie Infinity UAW has been on a steep decline.

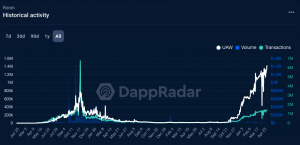

Meanwhile, another game built on the same blockchain (Ronin) boasts around the same UAW that Axie Infinity once did at its peak, and it is not receiving nearly the same level of attention the former did last time around. This game is Pixels.

![]()

Source: DappRadar – Pixels UAW are approaching the highs reached by Axie at its peak.

In its prime, Axie’s native token, $AXS, was valued at a market cap of over $10B. However, as time went by, the consensus among market participants switched towards favoring gaming infrastructure providers rather than betting on individual games. When you bet on a provider or gaming studio you automatically get exposure to all games built on top, which helps in terms of risk diversification. As such, we saw attention rotate from $AXS to tokens like $IMX or $GALA among others.

Today, Axie ($AXS) and Pixels ($PIXELS) are the two most popular games on Ronin. The former has a market cap of $1B despite being 95% down from all-time-highs, while the latter is hovering around $300M in market cap. Currently both projects have the same FDV of $1.9B. However, given the dilution that comes with dual token models, like Axie’s $AXS and $SLP, as well as the large inflation from token incentives, we advocate for putting our chips on Ronin, which is the actual infrastructure layer powering both games.

Using $RON as a proxy to bet on Web3 gaming also allows us to take advantage of the liquidity premium that is associated with Layer-1 tokens and availability on major exchanges. $RON is listed on Binance, Coinbase and OKX. With over 30% of the tokens in circulation, $RON is currently trading at $880M market cap and $2.7B FDV.

Ronin is an EVM-compatible blockchain specifically designed for gaming, optimizing for near-instant transactions, negligible fees, and frictionless UX. It was originally created primarily to support Sky Mavis’s flagship game, Axie Infinity, but its adoption grew rapidly it currently hosts 15 dApps recording more than 1M UAW, 1M+ transactions a day and $5M+ in daily volume.

Source: DappRadar – Ronin historical activity.

With over $4B in transactions, Ronin is setting up to become one of the most dominant gaming chains in the market, also acting as the primary marketplace and distribution channel for the games deployed on top.

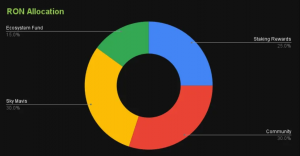

Backing Ronin is the $RON token, which was launched through a pool on its native Katana DEX. There were no private sales and the initial supply was distributed through an incentivized liquidity program. Issuance is reduced every quarter, and the total supply is capped at 1 billion, which will be reached 108 months after issuance.

Source: Coingecko – $RON token allocation.

As the native token of the chain, $RON is used for transaction fees, governance participation, and to secure the chain by staking tokens to earn income from inflationary emissions.

Despite a complicated launch and suffering one of the largest exploits in the history of crypto resulting in a $650M loss, Ronin quickly recovered in 2023, attracting numerous world-renowned game studios such as Foonie Magus, Directive Games, Bali Games, Tribes Studio and Bowled.io

At a current market cap of $23 billion, the Web3 gaming sector has recently seen a surge in activity and interest. Within its projects, Ronin has successfully proven to be an effective primary distribution channel for crypto games, as evidenced by the recent success of Pixels Online after migrating from Polygon.

Currently, Ronin has a market cap of $880 million, ranking eighth in its category, while Immutable leads at $2.9 billion. However, excluding the valuation, Ronin stands out based on several key metrics.

Source: Ronin Blog – The fastest growing gaming blockchain (as of Mar, 5 2024)

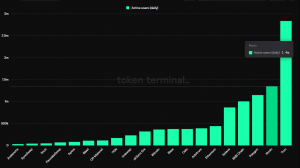

Although volumes remain far below 2021 levels, Ronin is now the second most-used blockchain, having experienced a significant spike in the last six months. Additionally, there have been 3.37 million unique active users over the past 30 days.

Source: Nansen – Ronin Active Addresses as of May 7, 2024.

Ronin reached over 1.4 million active users, marking an increase of approximately 1,790% since November 2023. As of May 9, Ronin has approximately 18.9 million total addresses, an average of 1.28 million daily transactions over the last 30 days, and a TVL of $183 million (bridged TVL $1.06 billion).

Source: TokenTerminal – Ronin ranks in second place in terms of Daily Active Users (DAUs), only behind Tron, which is largely dominated by $USDT transfers.

In 2024, Ronin matched its previous all-time high (ATH) of $4.23, but has since retraced by approximately 40%, with its current price at $2.8. Given the expanding gaming sector and Ronin’s strong performance metrics, if the bull market persists, there is potential for Ronin to exceed its all-time-high and enter a new phase of price discovery.

Source: Coingecko

Investing in $RON offers exposure to the broader Web3 gaming market, helping to diversify risks from over-allocating capital to a specific game. Games often struggle with stickiness and user-retention, even in Web2. Because of that, Ronin stands as a “picks and shovels” choice for the gaming sector in crypto. This allows us to capture the upside of multiple games that decide to launch on the platform. Eventually most of those games will go through ups and downs, with some of them riding short-term waves of hype and only a handful of them staying for the long term.

Ronin’s versatility extends beyond hosting some of the most popular games in Web3, like Axie Infinity and Pixel. The ambition is to become the platform of choice for the games that will be used the most in the future. So far, this hasn’t gone unnoticed, as notable games like Apeiron and Wild Forest, as well as NFT communities like Cyberkongz have recently started diverting all their efforts towards growing their communities on Ronin. Another distinguishing factor is the support for DeFi primitives, as exemplified by the Katana DEX, Metalend, or Mavis Market (NFT Marketplace).

Active wallets serve as a critical metric when it comes to analyzing an ecosystem, and Ronin excels in those numbers. This helps to gauge interest and can be used as a leading indicator to indicate future activity on the network. A higher number of users often translates into more transactions and signals usage of the applications built on the underlying chain, driving demand for the native token. Also, a growing number of active users can bolster investors’ confidence, as outsiders are more likely to project stronger network effects into the future. Together, this is a key unlock to achieve a virtuous cycle where more active users can lead to more developers building on the chain, further onboarding new users and pushing demand for the native token exponentially higher.

Now that staking functionality has been enabled for $RON, and we already have a precedent with $PIXEL, if you are planning to hold $RON as a spot position, you might as well stake to decrease dilution and increase your chances of getting airdrops from ecosystem projects.

The primary risk associated with investing in $RON stems from the broader uncertainties in the Web3 gaming sector. Even though a lot of capital has been allocated to gaming studios for building Web3 games, we cannot underestimate how complex this challenge is and how long the development process will take.

While $RON benefits from not being reliant on the success of a single game like Axie, it is ultimately an EVM-compatible chain, which might be quite inflexible and limited when compared to other high-throughput chains like Solana or Sui. Nonetheless, provided that most logic is executed off-chain, the EVM already has strong network effects and has proven to be resilient over time.

At the same time, while betting on an ecosystem that gives broad exposure to gaming can help us hedge our downside, it also caps the potential to ride fast price movements to the upside by individual games. For instance, should a game like Pixels rise in prominence, $RON would likely underperform relative to the $PIXEL token.

In conclusion, while the development timelines for Web3 games are typically longer than those for DeFi protocols, it is essential to remain invested if you really have conviction in this market sector. As we continue waiting for AAA games to hit the market, we believe that betting on growing ecosystems that have potential to be leaders seems the most sensible play.

Revelo Intel has never had a commercial relationship with Ronin or SkyMavis and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.