Published: March 11, 2024

Focusing on strategic cycle positioning and asset selection, we challenge the view of holding $ETH or generic index-like investments. Our conviction lies in the belief that the truest expression of a bullish stance on $ETH is through investing in assets that are going to outperform $ETH if our thesis is right. Betting on the NFT craze that is about to begin if the market keeps doing well makes a ton of sense, however, we have no interest in picking winners and losers in the individual NFT market.

In the report below we double down on our original $BLUR thesis, targeting an opportunity to leverage the allure of high-priced items as instruments of social capital, as well as the inevitability that follows, being that everyone with a heartbeat will be launching an NFT collection driving volumes upwards. The tale of prestige and social flex is as old as time, and the digital nature of NFTs makes them a legible and widely adopted asset class.

The previous cycle witnessed an explosion in NFT popularity, propelled into the mainstream by celebrities like Jay-Z, Snoop Dogg, Stephen Curry, Paris Hilton, and Steve Aoki, who adopted NFTs as digital extensions of their identities. With rising prices in crypto and in a world where social standing is paramount, we argue that NFTs are primed for a revival. Our view is that $BLUR is the most efficient vehicle to capture the upside of this asset class as “the Uniswap of NFTs”.

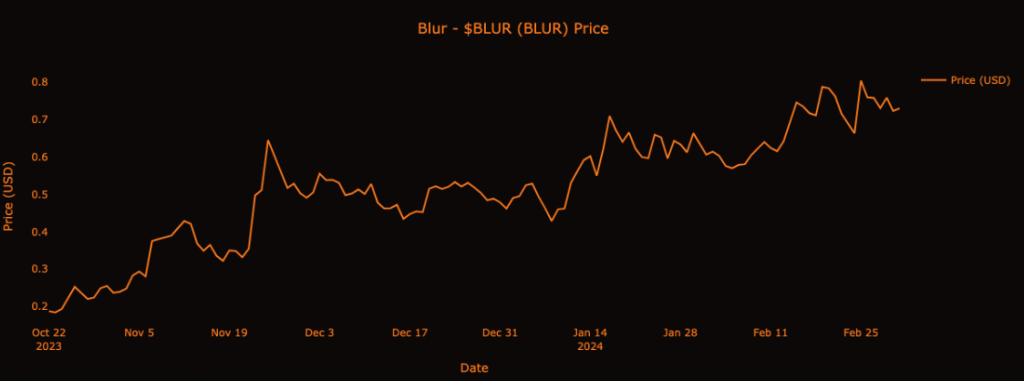

When we first spotlighted $BLUR as the North Star for JPEGs on November 16, 2023, the price was hovering around $0.35. Our original thesis expressed a bullish and contrarian perspective in anticipation of a large unlock of 300M tokens (30% of the total supply). This bold stance was soon vindicated by the announcement of Blast, propelling the price to nearly double its value, now trading around the $0.7 mark.

This time we find ourselves in a very similar position, expecting a steep upward trend in the price of $BLUR. The forthcoming phase with Blast will also be driven by Blast-related unlocks and incentives. We think that this development can also serve as the catalyst to propel further growth in an NFT Renaissance.

Launched in October 2022 and founded by @PacmanBlur (Tieshun Roquerre), Blur raised an $11M seed round led by Paradigm. The venture started with a strategic maneuver to “vampire attack” OpenSea by launching the $BLUR token, rewarding more than 100,000 recipients with over $240M in tokens. That was the beginning of the end of OpenSea’s market dominance. Largely criticized for its complacency, reluctance to introduce a token, and predatory fee structure (which includes a 2.5% charge on secondary sales and fees ranging from 2.5% to 10% on primary drops), the current market statistics paint a telling picture, with Blur reaching a market share as high as 80% at the beginning of 2024.

Source: Dune – Hildobby

As OpenSea continued to rest on its laurels, Pacman raised $20M to build Blast, making it clear that in crypto no incumbent is safe. In an attention economy like crypto, it is worth trying to anticipate the often unpredictable shifts in user preferences and behaviors. The fact that Blur was originally built for “professional NFT traders” and OpenSea for “retail collectors” fails to account for qualitative aspects that extend beyond mere utility—such as identity, community, and status.

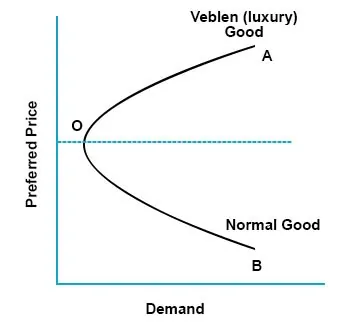

By prioritizing the social capital inherent in the NFT market, $BLUR not only captures the economic value of these assets but, more importantly, taps into the speculative dynamics that have characterized assets like Bitcoin. The speculative premium attached to NFTs is fueled by a growing social consensus around their value. As these narratives proliferate, the price and desirability of NFTs ascend in tandem. This phenomenon is the result of NFTs being perceived as Veblen goods—products whose demand increases with their price, contrary to conventional economic wisdom.

As Veblen goods, the allure of NFTs lies in their ability to signify exclusivity, luxury, and status. As the prices of $ETH and NFTs soar, so too does their appeal. The 2nd order effect of this in a bull market is that there will be an explosion of NFT collections minted, spurring a frenzy of trading as everyone from brands and artists to grifters and speculators look to strike it rich. In addition to what we saw last cycle, it is our view that due to the increased social credibility the crypto space has this time around, many of the world’s top brands and personalities will aim to use NFTs to build real value for their customers and their fans. These collections have the potential to be high-ticket items raising the bar for trading volume.

If the above position is correct, then $BLUR can capture the upside with increasing revenue from a marketplace like Blur, a lending market like Blend, and an entire ecosystem of dApps on Blast, extending network effects. We expect the impact of this phenomenon to be pronounced on Blast with incentives for minting and trading NFTs, as well as offering an attractive motive for development teams to deploy on a chain with plenty of whales and a fully reset level-playing field.

Attempting to play the NFT game and picking winning collections is not something we can model or handicap. Our play is simply to expose ourselves to the sector in a meaningful way by investing in the ‘picks & shovels”. The embedded upside in Blur is they are attempting to win the category by moving faster than everyone else.

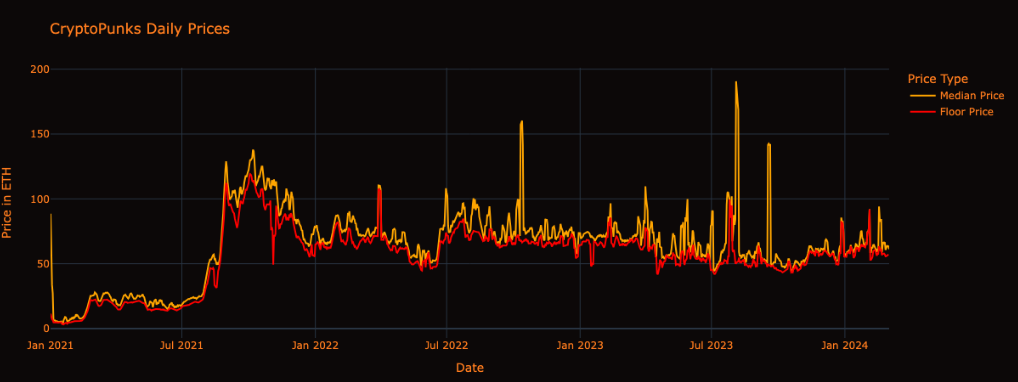

In our quest to find a higher beta on $ETH, we consider the floor price of CryptoPunks as a barometer for the NFT market. The demographic of CryptoPunk holders diverges significantly from the archetypal NFT enthusiast as well. These individuals tend to exhibit a “diamond-handed” attitude that underscores how NFTs have carved out a niche through artificial scarcity. The absence of a roadmap means zero execution risk, turning them into the purest form of cultural, social, and collectible value on Ethereum.

Evergreen Ubiquity refers to the ability of an asset, brand, or concept to achieve and maintain widespread recognition and relevance across generations. This view transcends the ephemeral allure of passing fads like older PFP NFTs (Profile Picture NFTs). This pursuit of Evergreen Ubiquity is why the iconic brand of CryptoPunks has helped to etch the place for NFTs in the culture of crypto.

NFTs leverage the intrinsic human inclination towards status and social capital accumulation. People naturally gravitate towards platforms, assets, and communities that offer the most efficient avenues for enhancing their social standing. This seemingly small market can lead to the discovery of larger ones, and we are betting that $BLUR will be the currency and commodity for NFTs to thrive as an asset class.

Founder intuition is critical to navigating these waters. This is exemplified by how Pacman set out to solve the “cold start” problem faced by most L1s and L2s: incentivizing liquidity through yield and other unpredictable rewards. Contrary to other L2s, where asset values stagnate or depreciate over time due to the absence of yield, Blast provides users with a yield-bearing structure that has not only attracted over $2B in TVL but also catalyzed a vibrant ecosystem of developers and projects eager to build on Blast.

The strategic deployment of a hackathon-like competition, dubbed the Big Bang, further exemplifies Blast’s innovative approach to ecosystem development. By creating a positive feedback loop where developers are rewarded with points—transferable as benefits to their early users—Blast fosters a cycle of sticky liquidity and enhanced user retention. This creates a dynamic where liquidity is both incentivized and rewarded, where developers are empowered to innovate, and where users are engaged in a mutually beneficial growth narrative.

Pacman and his team have shown that they understand that “distribution is king”. Their success in garnering distribution and attracting users stands as a testament to how they manage to achieve product differentiation in the NFT space. However, since the initial announcement, the backdrop of Blast has been marked by negative sentiment. This dissonance between perception and reality has inadvertently set the stage for a “hated rally.”

CORRECTION: Users of the layer-2 network @Blast_L2 have bridged over most of the $2 billion in a pre-launch deposit contract to a new Blast address known as “ETH Yield Manager.”

Reporting by @oknightcryptohttps://t.co/UqLGy6Dicz pic.twitter.com/6mW2efJqSG

— CoinDesk (@CoinDesk) March 1, 2024

Source: Coindesk on X

With the increasing popularity of Blur and Blast, it is becoming more and more clear that the next NFT cycle will markedly differ from its predecessor. Unlike the earlier phases of NFT trading, which were characterized by relatively straightforward buy-and-hold strategies, the forthcoming cycle will be marked by the abundance of easy options to get leverage on and hedge NFTs, offering traders more sophisticated instruments to manage their exposure.

The introduction of new lending and trading primitives cannot be overstated. As the bull market re-emerges, it is anticipated that fee switches will activate. The potential for these protocols to generate unprecedented earnings is not merely speculative; it is grounded in the recognition of their starting point from a relatively low base today.

The relatively low switching costs for users in NFT marketplaces highlight an opportunity for Blur to capture even more market share. This is reinvigorated by Blur’s strategic focus on the Asian market, a region with rapid adoption of NFTs, as we saw with Ordinals.

Market outcomes are influenced by both asset fundamentals and the psychology of participants. Blur is a clear example that aggressiveness, timing, and skill are key ingredients for success. For that reason, we should not underestimate Pacman’s hints that there is something brewing and to be released in April, coinciding with the Bitcoin halving.

The introduction of a points system in Blur was a novel approach at its inception, and it has now been widely adopted across the industry. We expect something similar to occur with the concept of yield-bearing L2s. This is just the nature of the game, and getting copied is the badge of honor.

If you look at many of the recent launches you’ll notice a lot of elements from Blur and Blast. We will likely see more of this as it’s just the nature of the game. Thanks for sharing with me 🙂

— Pacman | Blur + Blast (@PacmanBlur) February 20, 2024

Down the road, we believe that chances are high that Pacman will start sharing Blast’s sequencer revenue with $BLUR stakers. Proactively positioning before this narrative gains momentum is crucial for capitalizing on the anticipated market revaluation of $BLUR.

There is a recognized urgency to enrich $BLUR’s token economy to curb potential depreciation. Presently, the token’s primary utility is limited to governance voting, which underscores a need for expansion. The implementation of a fee switch, supported by Pacman, addresses this by introducing a tangible utility that enhances the token’s value proposition.

This is a great proposal. Excited for the Uniswap community to implement this, and for the Blur community to be able to learn from Uniswap’s experience! https://t.co/cdHx5rxtLL

— Pacman | Blur + Blast (@PacmanBlur) February 24, 2024

As we introduced in our first insight, a proposal to turn on the fee switch was already attempted by Arca in the past. Our initial assessment suggested that this initiative might have been premature. However, the launch of Blast indicates a ripe environment for its implementation. This not only strengthens $BLUR’s token utility with a value capture mechanism but also aligns with broader market recovery expectations for NFTs.

It wouldn’t surprise us to see other initiatives beyond revenue sharing, such as facilitating NFT trades on Ethereum with reduced gas fees, facilitated by a Blast subsidy. Coupled with strategic measures to improve market accessibility and reduce transaction costs, users staking $BLUR might capture not only the price upside but also benefit from fee discounts and other rewards, such as airdrops from ecosystem projects.

Aggressive, zero-sum competitive business tactics are probably not needed today. The market is definitely not large enough to warrant such strategies. Blast is a step in the right direction, and this is a great opportunity to align the incentives of $BLUR token holders with Blast ecosystem projects.

The NFT market is growing beyond the boundaries of Ethereum, witnessing significant adoption with Bitcoin Ordinals and new NFT standards that are only possible on Solana. There is also a large number of alternative L1s and NFT-specific L2s in the market, such as Zora, Immutable X, Flow, Rari Chain, Lukso, and Frame… all of which will compete against Blast for market share.

That being said, we don’t foresee any disruption to Blur’s dominance in the near future, at least before the announcement that is coming in April. At that point we will reevaluate the position one more time, tracking Blast’s ecosystem growth and discussion around revenue sharing for $BLUR.

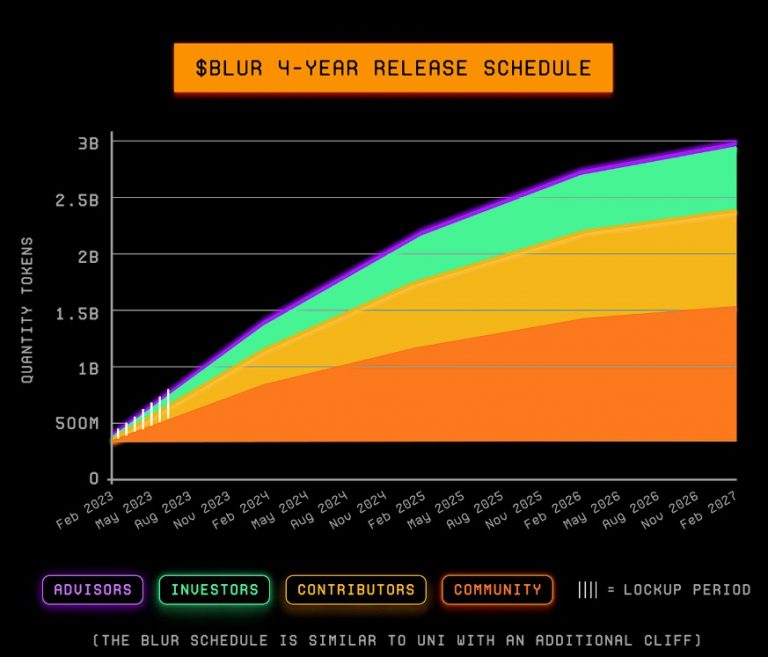

In the context of inflation or upcoming token unlocks, core contributors’, advisors’, and launch partners’ allocations continue to vest on an identical schedule.

Revisiting our former analysis has reaffirmed our conviction in $BLUR as a higher beta alternative to capture $ETH’s upside ahead of 1) an upcoming catalyst for $BLUR coinciding with the $BTC halving, and 2) the potential approval of an $ETH spot ETF in May.

Despite challenges from emerging competitors, we perceive overly negative sentiment across the board. Coupled with the anticipation of value accrual in the form of revenue sharing, a bullish scenario would materialize with an unexpected “hated rally”. This would catch most investors by surprise and force them to jump on the bandwagon at higher prices.

Finally, we present the case that a token migration from $BLUR to $BLAST might even be on the table, adding an extra surprise factor to our bullish stance.

Scaling into a position on red days seems prudent between $0.6 and $0.7. We believe that the market will give us plenty of opportunities to do so, which allows us to be patient.

Revelo Intel has never had a commercial relationship with Blur and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.