Published: November 16, 2023

The following report makes a case for a small portfolio allocation betting on the NFT sector. We anticipate a significant upswing in the NFT market, driven by factors such as SocialFi’s success and decentralized casinos.

Small markets often lead to the discovery of larger ones, as seen in traditional markets. In this context, $BLUR positions itself as the go-to NFT marketplace, akin to $UNI in the DeFi space.

More specifically, we outline an idea where we advocate for watching out for the end of Blur Season 2, which ends on November 20th, 2023. This will result in 300M $BLUR being distributed to farmers who have largely taken losses while attempting to game their airdrop allocation.

As a result, we argue for a strategic market positioning where we expect there to be selling pressure and use this to our advantage, as a potential opportunity to pick up what we consider to be a cheap token with good value accrual coming up in the near to mid-term future.

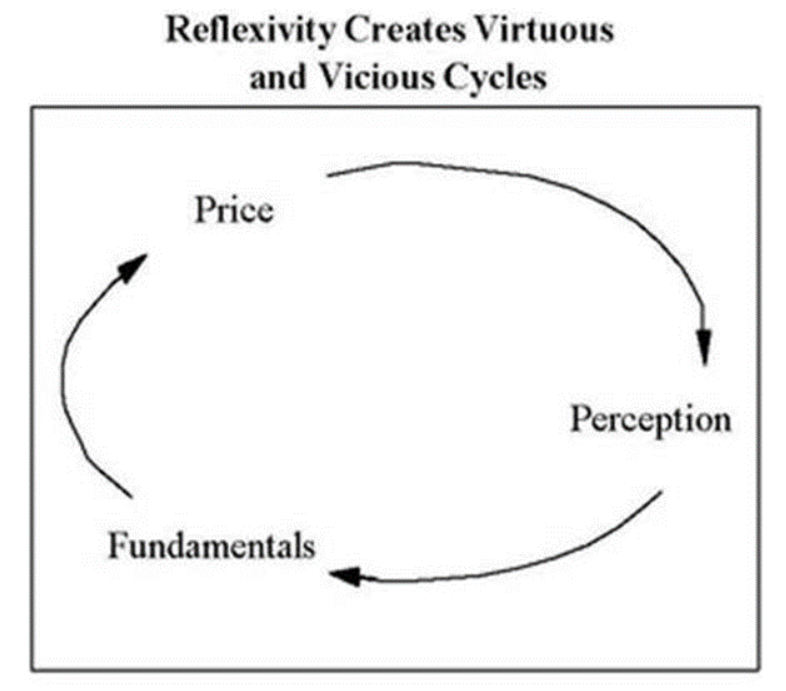

Historical patterns reveal that speculative activity is a natural phase for emerging financial markets. Market outcomes are influenced by both asset fundamentals and the psychology of participants.

This forces us to be nimble and eventually approach some investments from a strategic speculative perspective and niche focus.

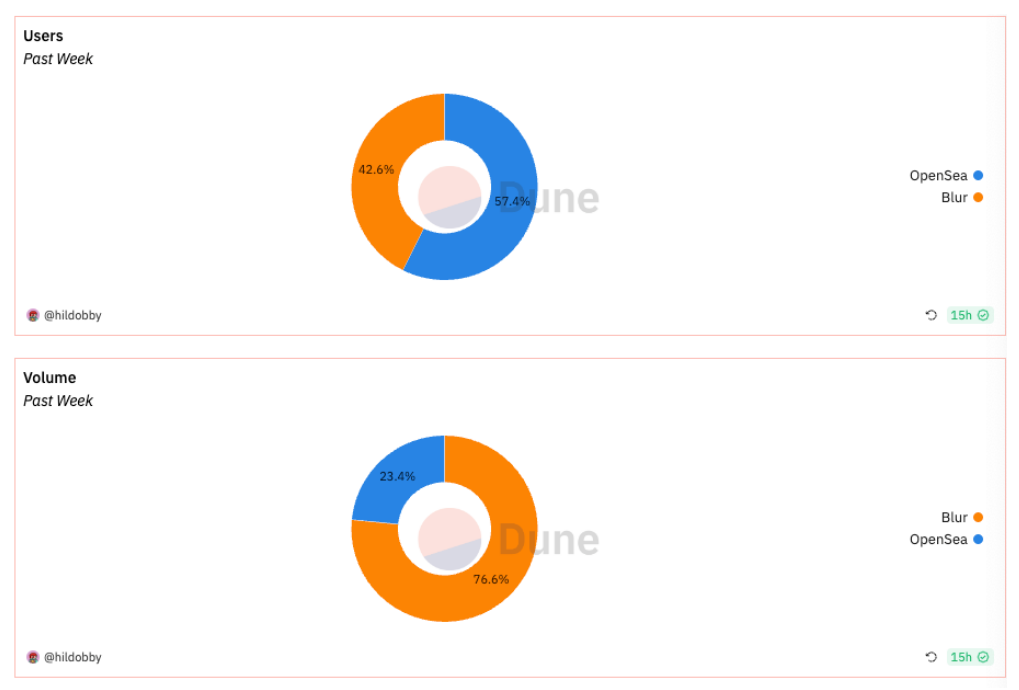

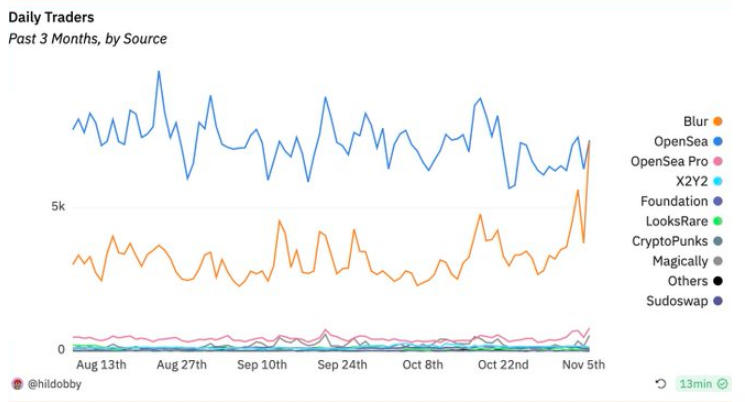

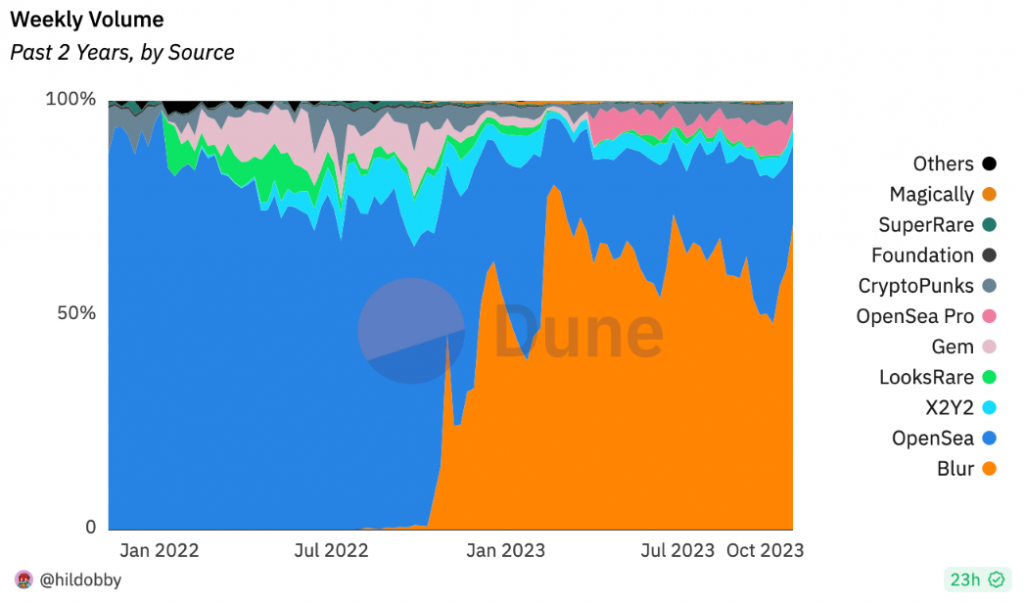

Niche markets and tailored products, exemplified by Blur in Ethereum and Tensor in Solana, are key to success in the NFT sector. Understanding the distinctions between collectors and traders allows for focused solutions. This is what made it possible for these teams to dethrone incumbents such as OpenSea, which focused too much on novice retail users to the detriment of a better UX for professional NFT flippers.

Niche markets and tailored products, exemplified by Blur in Ethereum and Tensor in Solana, are key to success in the NFT sector. Understanding the distinctions between collectors and traders allows for focused solutions. This is what made it possible for these teams to dethrone incumbents such as OpenSea, which focused too much on novice retail users to the detriment of a better UX for professional NFT flippers.

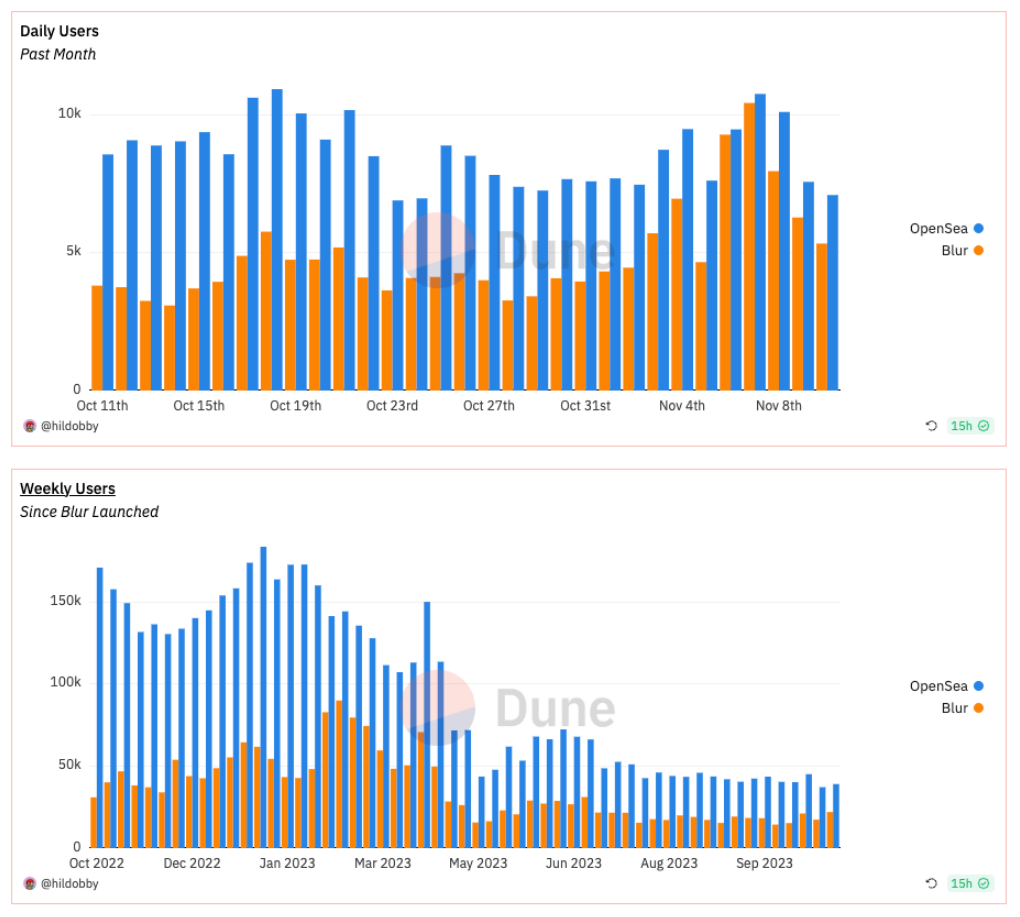

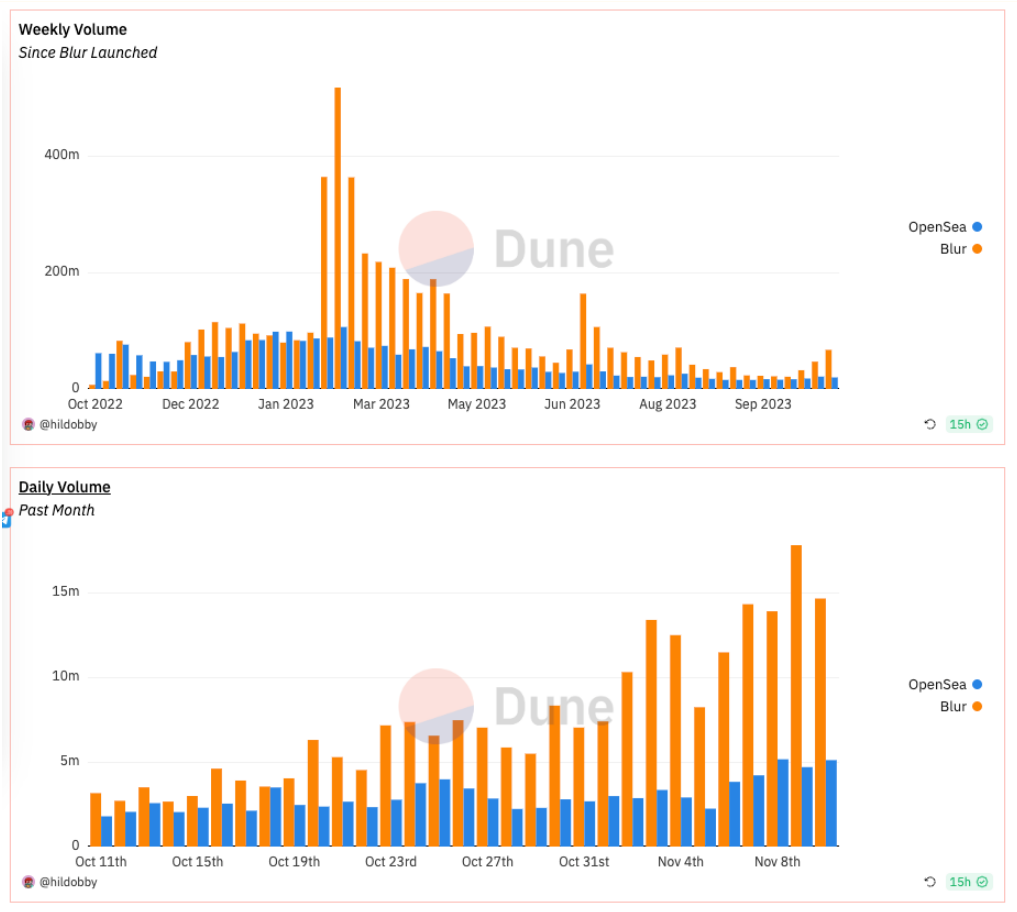

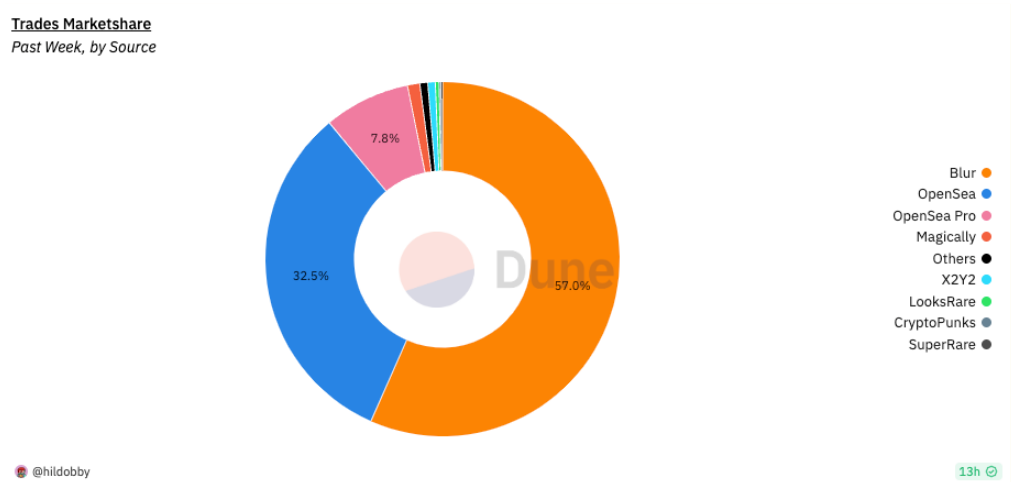

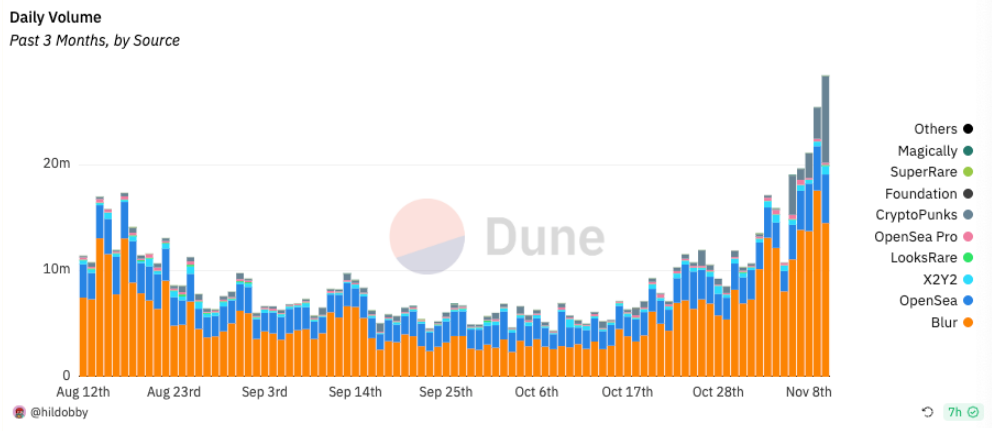

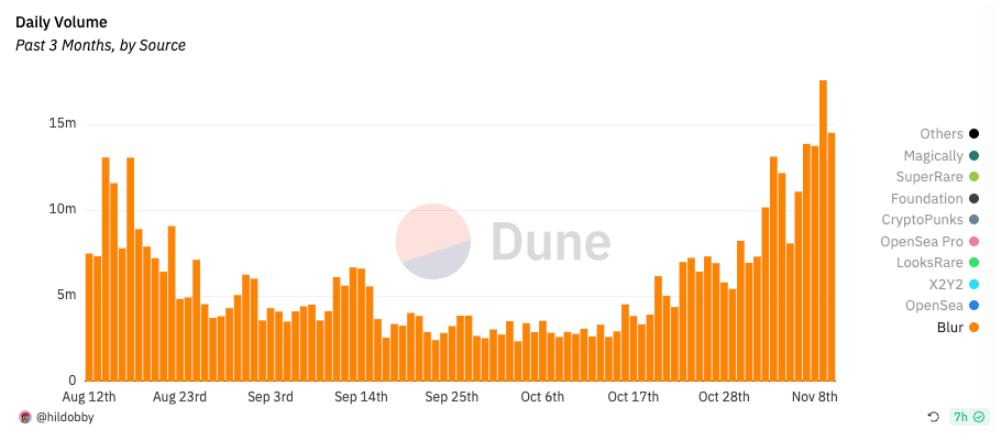

Consider the difference in trading volume despite having a lower number of active users.

Consider the difference in trading volume despite having a lower number of active users.

However, this trend where OpenSea dominates in the number of users might start to change as well.

Successful ventures often start by solving narrow problems for a small user group, and founder intuition plays a crucial role in navigating these markets efficiently.

Rather than speculating on the TAM (Total Addressable Market) of JPEGS, Pacman and the rest of the Blur team focused on ruthless prioritization. They catered to the needs of the existing audience: professional NFT traders who flip JPEGs as if they were “altcoin with pictures”.

The landscape remains uncertain, with the potential for new trends and integrations in gaming. We believe the NFT market will experience significant growth at some point in the next cycle, with select collections outperforming $ETH.

This is the reason why we advocate for concentration on a small portfolio allocation rather than betting on a basket of assets that eventually might be filled with losers and failed ventures.

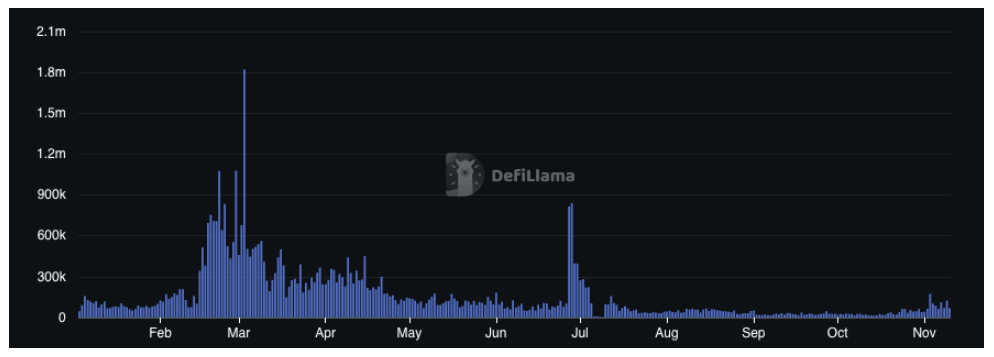

Research shows that NFT market efficiency has improved overall since Blur’s orderbook bids went live at the start of the year.

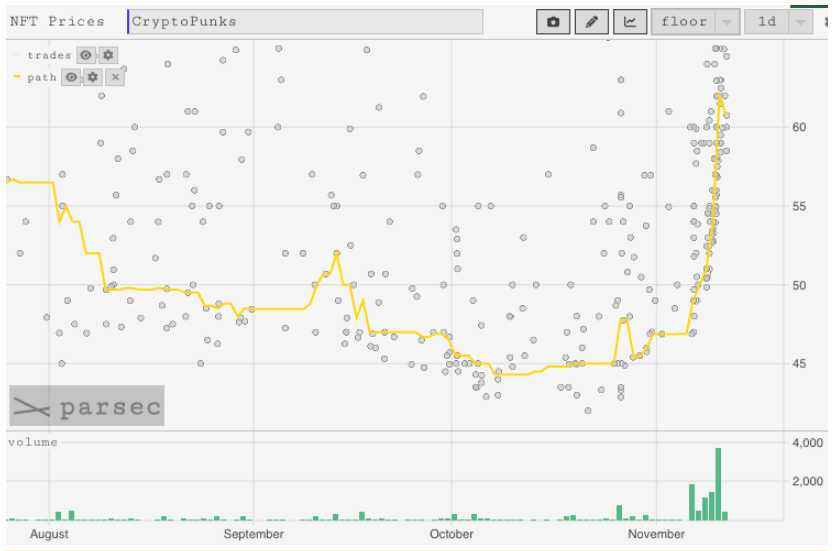

Punks serve as a barometer for the NFT market, showing promising signs of growth. Increased activity and trading volumes in various NFT collections suggest further market growth as we approach the end of the year.

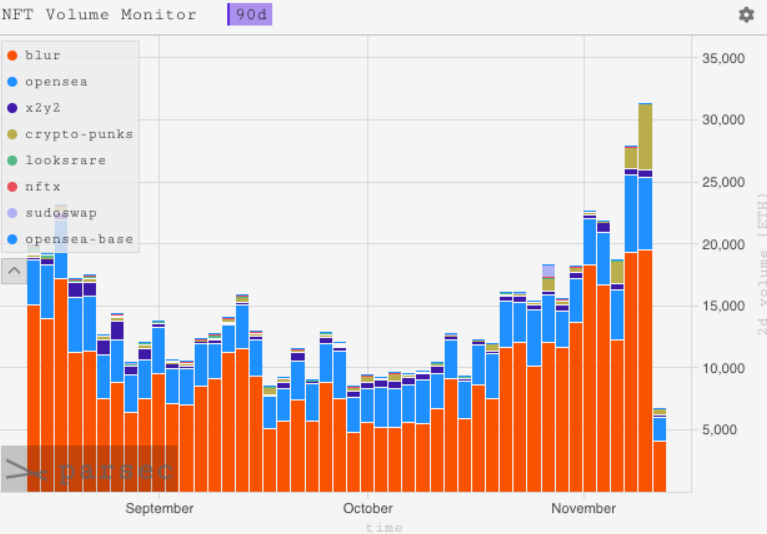

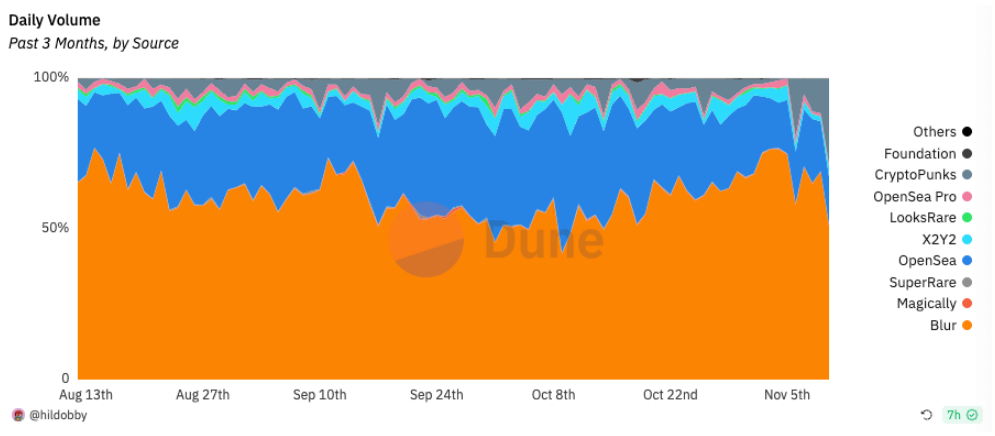

We can also observe how $BLUR has gained significant market share in NFT trading volume in a short period.

But to fully grasp this investment thesis, we must first provide some context surrounding the utility of the $BLUR token.

But to fully grasp this investment thesis, we must first provide some context surrounding the utility of the $BLUR token.

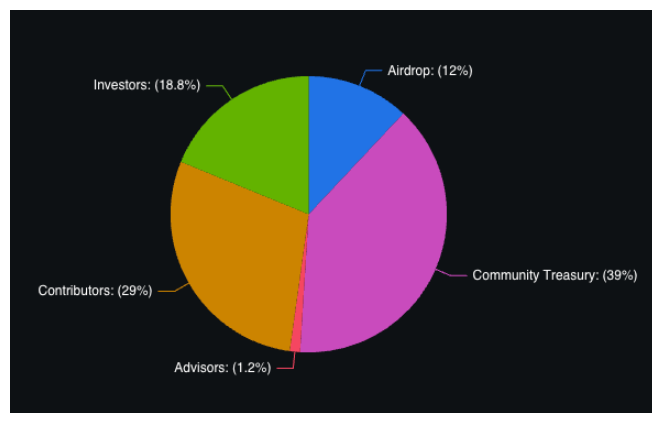

Up until now, the only current use case for token holders is governance voting. Furthermore, the lack of active governance and further token utility has led to a supply overhang for token holders. However, this is about to change soon.

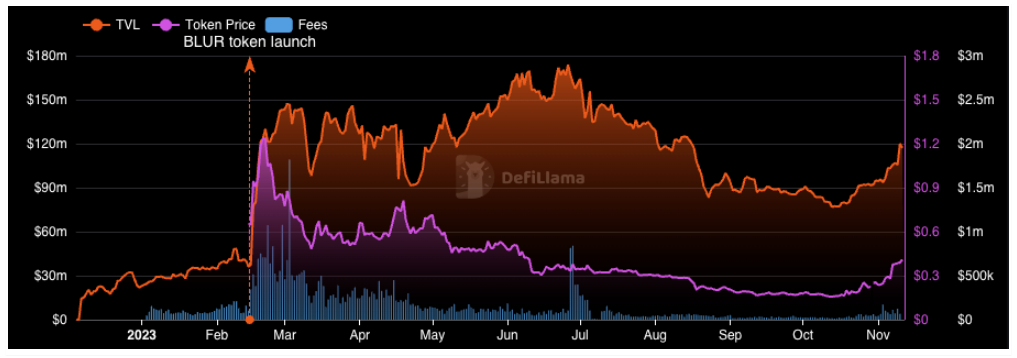

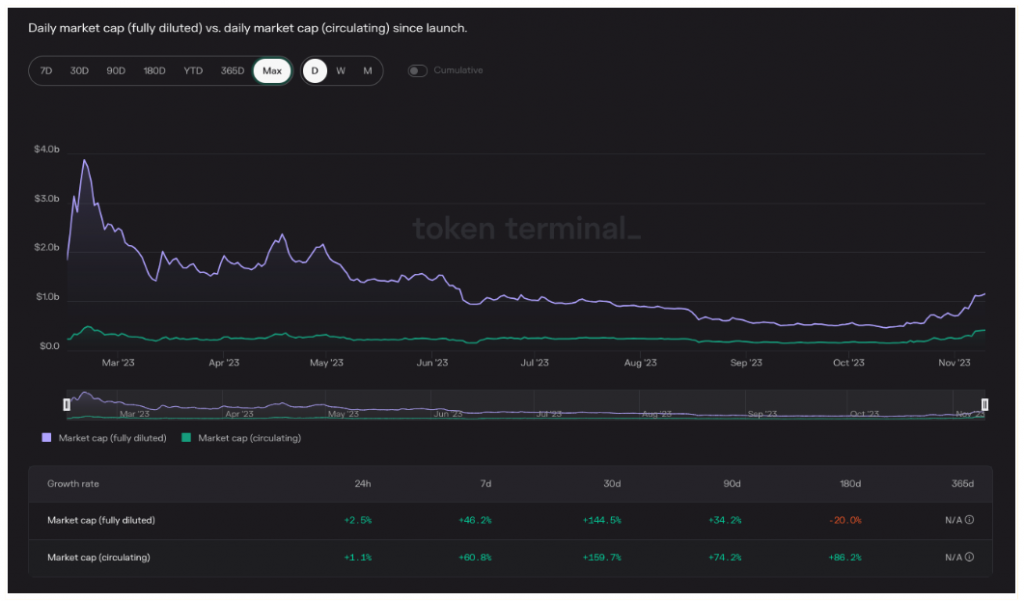

$BLUR’s price YTD has underperformed ETH, with a market cap that is approximately -30% from token issuance. The truth is that providing marketplace liquidity becomes less attractive as the price declines, more so as points farming activity with airdrop expectations starts to drop.

The involvement of funds like Arca is important to consider (they have also made a speculative bet on Rollbit). On October 12th, Arca submitted a forum post to the Blur governance forum to turn on the fee switch.

For context, when $BLUR was first released, the tokenomics outlined a 180-day freeze on governance voting in a fee switch on the platform (freeze now expired).

For context, when $BLUR was first released, the tokenomics outlined a 180-day freeze on governance voting in a fee switch on the platform (freeze now expired).

Arca’s proposal introduces a 1% base trading fee for the Blur marketplace. The fees collected would be systematically used to buy back and burn $BLUR tokens daily.

Additionally, recognizing that imposing fees on all marketplace transactions may impact its dominance, Arca also proposes a tiered fee structure that offers fee discounts for users holding $BLUR tokens. Users holding $BLUR tokens will receive fee discounts based on the amount of tokens in their wallet, adding a valuable utility use case for the token.

We can see a clear narrative shift that can induce a repricing in the valuation for $BLUR. Up until now, TVL and price have followed each other.

However, as discussions around a protocol fee switch start to come by, we must focus on volume rather than TVL. Despite fees being on a downtrend during most of the year, activity is starting to pick up in anticipation of Season 2.

Taking a pessimistic outlook of $5M in daily volume, this translates into $1.8B annualized, from which we can estimate a take rate of 0.7% (assuming some traders will enjoy discount fees). This amounts to $12.7M worth of buybacks every year

Taking a pessimistic outlook of $5M in daily volume, this translates into $1.8B annualized, from which we can estimate a take rate of 0.7% (assuming some traders will enjoy discount fees). This amounts to $12.7M worth of buybacks every year

Considering this ignores Blur’s lending business (Blend) as well as how fast the team ships new features, we believe that the current P/F (circulating) of 20.9x still represents a cheap valuation – provided that NFT trading volumes eventually recover.

Considering this ignores Blur’s lending business (Blend) as well as how fast the team ships new features, we believe that the current P/F (circulating) of 20.9x still represents a cheap valuation – provided that NFT trading volumes eventually recover.

In this stage, token burning could be the way to go for implementing revenue sharing without the hassle of having to distribute revenue to token holders (and all the legal implications associated with it). This is also a mechanism that can help to offset inflation.

In this stage, token burning could be the way to go for implementing revenue sharing without the hassle of having to distribute revenue to token holders (and all the legal implications associated with it). This is also a mechanism that can help to offset inflation.

Blur Season 2 ends on November 20, and we still don’t see any competitors that can disrupt Blur’s growth given the current user base. The Season 2 airdrop is estimated to result in over 300M $BLUR tokens being offered as rewards for loyalty, bidding, listing, and lending points.

Similar to how the initial airdrop in Season 1 sparked a new wave of interest, Season 2 incentivizes bidding, listing, and lending against NFTs on its platform with $BLUR. This has proven to be a highly effective strategy in capturing market share from then-leading marketplace OpenSea.

Similar to how the initial airdrop in Season 1 sparked a new wave of interest, Season 2 incentivizes bidding, listing, and lending against NFTs on its platform with $BLUR. This has proven to be a highly effective strategy in capturing market share from then-leading marketplace OpenSea.

In the end, this results in a large supply of tokens entering the market, which we will use alongside $BLUR’s price action to time appropriate entries. We expect to see selling pressure since this will imply an airdrop of approximately 12% of the total supply. It is also worth noting that this is a long overdue event, initially planned for April 2023.

Other invalidations on this trade would derive from the fee switch proposal being ahead of its time. In this scenario, one could argue that turning on the fee switch at this point in time might not be the most appropriate decision considering that price sensitivity for NFTs is at an all-time high, trading volumes are low, and floor prices continue to bleed across the board.

However, it is worth noting that we don’t expect the fee switch to be turned on in the next weeks or months. Instead, we want to frontrun that narrative so that we have a position by the time the market starts pricing in this opportunity.

As farmers switch to other platforms, such as FriendTech, the liquidity is already low and higher trading volumes are needed to kickstart a flywheel that ultimately leads to more appetite for speculation and demand for NFTs rather than “meme assets”.

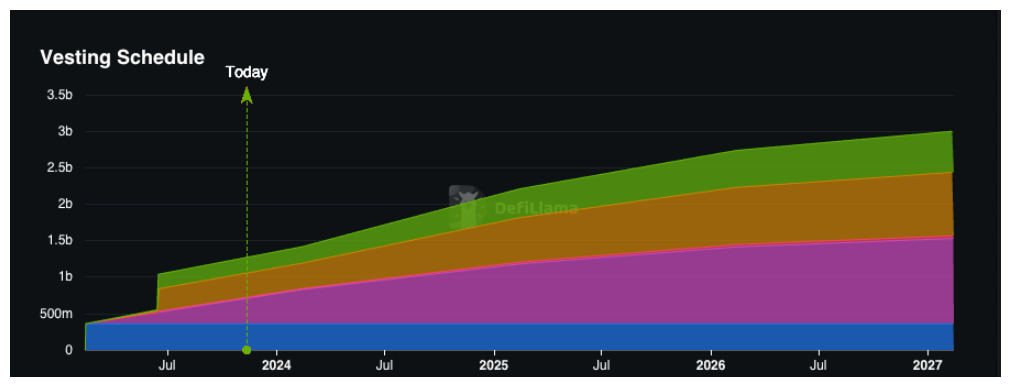

We must also take a look at the current emissions and potential unlocks, which will increase the supply over the next 3-4 years, acting as a headwind.

Note that the advisor allocation vests over 48-60 months with a 4-16 month cliff. DefiLlama illustrates this with the pessimistic assumption that all advisor allocations unlock on a 4-month cliff and 48-month vesting.

At the same time, it is also worth noting that, while praised by professional traders for boosting liquidity for popular NFT collections amid the bear market, the marketplace has faced criticism from retail investors and collectors. This retail-oriented audience argues that “points farming” has caused floor prices to be left at the mercy of large farmers looking to maximize their points with little regard for art or community.

At the same time, it is also worth noting that, while praised by professional traders for boosting liquidity for popular NFT collections amid the bear market, the marketplace has faced criticism from retail investors and collectors. This retail-oriented audience argues that “points farming” has caused floor prices to be left at the mercy of large farmers looking to maximize their points with little regard for art or community.

For our purposes, this criticism is not relevant, since our investment thesis contemplates value accrual through a fee switch that will be driven by trading volume coming from professional traders, not retail collectors.

All things considered, we acknowledge that the current market conditions may not be favorable for implementing a fee switch. However, there is a sense of urgency within the community to address $BLUR’s token economy before token depreciation continues.

In addition to that, we will closely track the end of Season 2, set to end on November 20. With over 10% of the total supply entering circulation, the token could see increased selling pressure as participants look to cash in their rewards.

Since the initial delay from April 2023, many traders have experienced substantial losses on their NFT trading ventures while attempting to maximize their airdrop and points allocation. These users are likely to try to recoup their losses by selling their newly acquired $BLUR.

All in all, $BLUR is up 46% in the last 7 days and 178% in the last 30 days.

Revelo Intel has never had a commercial relationship with Blur and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.