Published: November 28, 2023

The Polygon 2.0 roadmap transcends Polygon’s former identity as a mere Layer 1 alternative with a good Business Development strategy, spotlighting its technological prowess in the realm of Zero-Knowledge Proofs (ZKPs). Polygon’s strategic acquisitions of leading ZK teams have positioned it at the forefront of a market with scant competition, a fact not yet reflected in current data or investor sentiment.

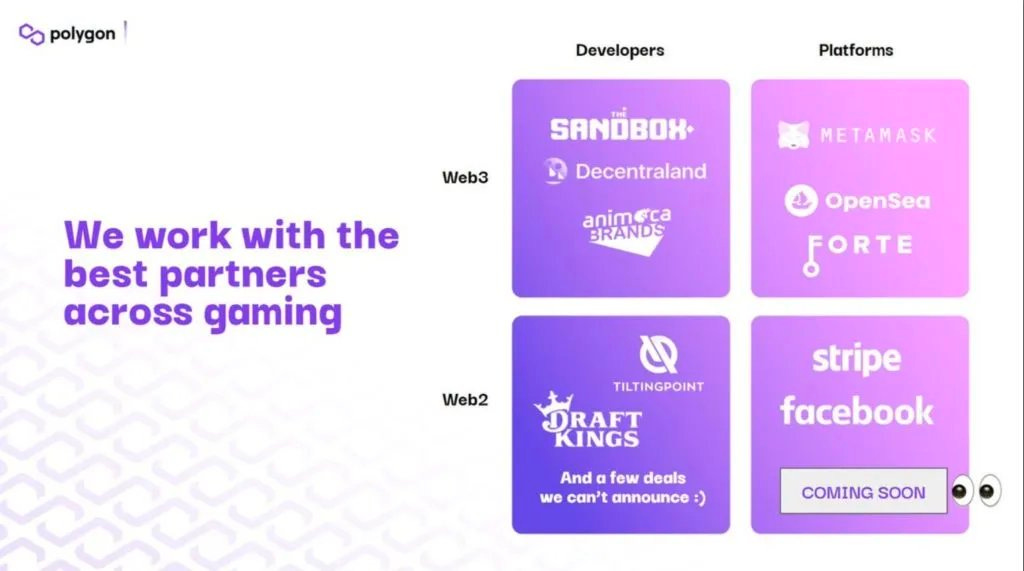

With Polygon 2.0, the platform leverages its extensive production experience and diverse partnerships to expand its reach, from fintech and real-world assets to gaming and SocialFi, signaling both leadership and upside potential.

In crypto, perception often lags behind reality, and our view is that Polygon currently suffers from this phenomenon. Despite pioneering breakthroughs like zkEVM, Miden, and Supernets (more on this later), the market response, particularly in the form of $MATIC performance, has been quite subdued.

Our view is that the main reason for this is a lack of understanding of A) what is significant about 2.0 and B) what the implications are in a competitive setting.

Our goal with this report is to provide color on these 2 points for Revelo members so that we can collectively hold an edge over the rest of the market as things develop.

The recent attention to Ethereum’s EIP-4844 underscores the market’s reactive nature. While it’s hailed as a catalyst for L2 tokens, the real game-changer – Polygon’s foundational shifts – remains undervalued. This discrepancy points to a significant opportunity: savvy investors who recognize and act on Polygon’s unpriced fundamentals could gain a considerable advantage.

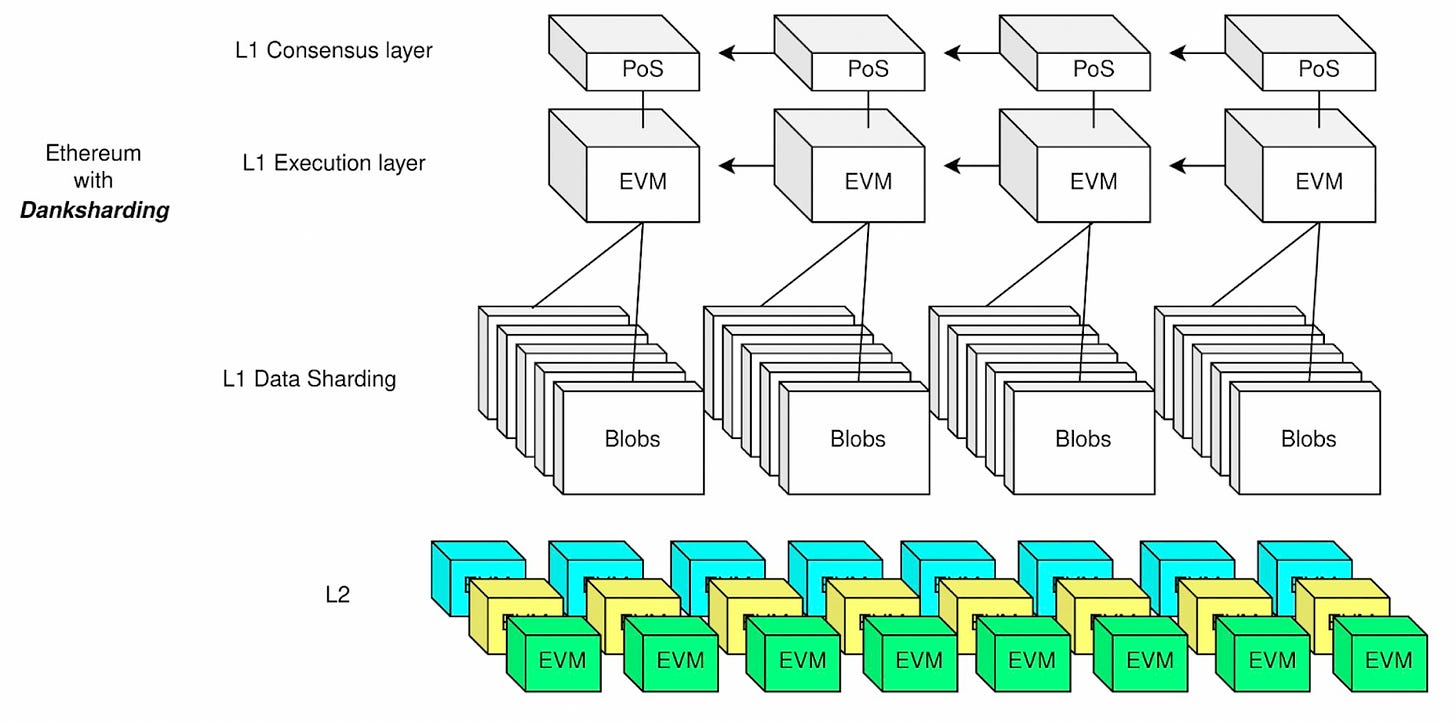

EIP-4844, also referred to as Proto-Danksharding, will be implemented in the upcoming Dencun upgrade, expected to take place in Q1 2024. What’s important about it is that it will significantly reduce the costs for L2 rollups. Currently, L1 publication costs constitute over 90% of total rollup expenses. After the upgrade, thanks to dynamic pricing based on supply and demand, L2s can achieve significantly reduced costs when submitting their data to Ethereum, with potential cost reductions of up to 16 times or a staggering 90% lower than current gas expenses.

Polygon is no longer another L1 alternative chain with great execution on the Business Development front. Polygon’s journey is more than just a series of partnerships and product launches, and we believe that most investors have not yet caught up to the foundational shifts that have been occurring within the ecosystem.

In 2021, Polygon acquired some of the best ZK teams and their given stacks. Today, Polygon is building something that once complete, there is very little competition for. and in our opinion, the current data does not include any of that future state. What started with Polygon PoS has now evolved to become a technology powerhouse with the Polygon zkEVM, Polygon Miden, Polygon Supernets, Polygon CDK, Polygon ID, and the Polygon Chain Indexer Framework.

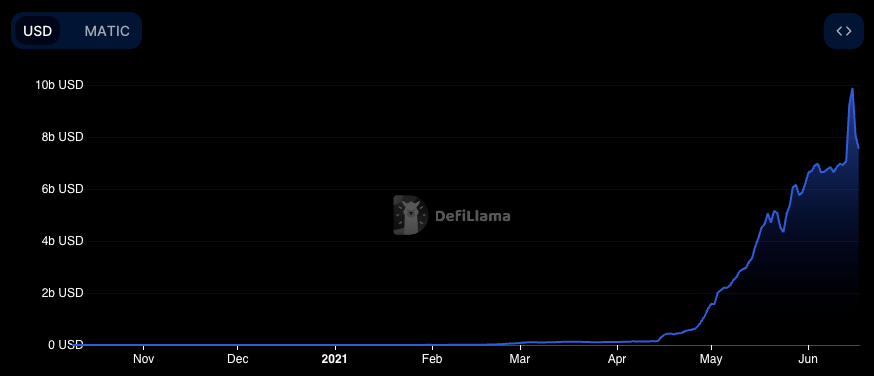

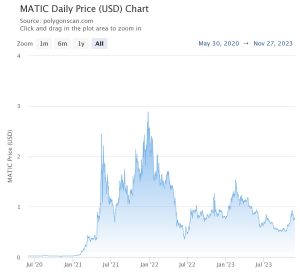

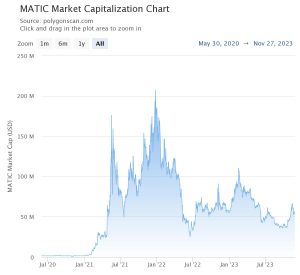

Founded in 2017, the original Matic Network emerged as a scalability solution for Ethereum that used plasma technology, a topic recently highlighted by Vitalik in his blog. Later rebranded to Polygon, the PoS chain launched in 2020 and became extremely popular during DeFi summer, when Ethereum gas costs skyrocketed and the network was often congested. The success was largely attributed to its low transaction fees, as low as $0.015, as well as the EVM compatibility (in an era where L2s were still under development).

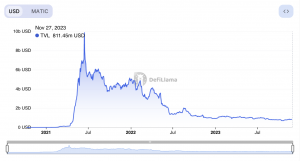

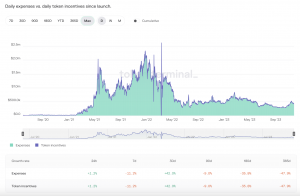

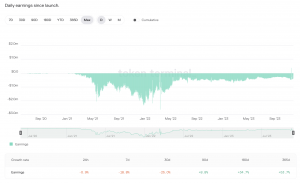

Source: DefiLlama

During that time, many competitors entered the market with alternative L1s that used the EVM and introduced slight changes in the consensus mechanism of the chain. However, in the long run, and as more Ethereum L2s enter the market, being an EVM-compatible L1 with low gas costs is no longer enough to gain market share.

Being aware that standing pat was not going to be a winning strategy, Polygon continued to innovate and completed the acquisition of Hermez for $250M and Mir Protocol for $400M in December 2021. Months later, in February 2022, Polygon received a $450M investment from 40 VC firms led by Sequoia Capital India, Softbank, & Tiger Global via the $MATIC private token sale.

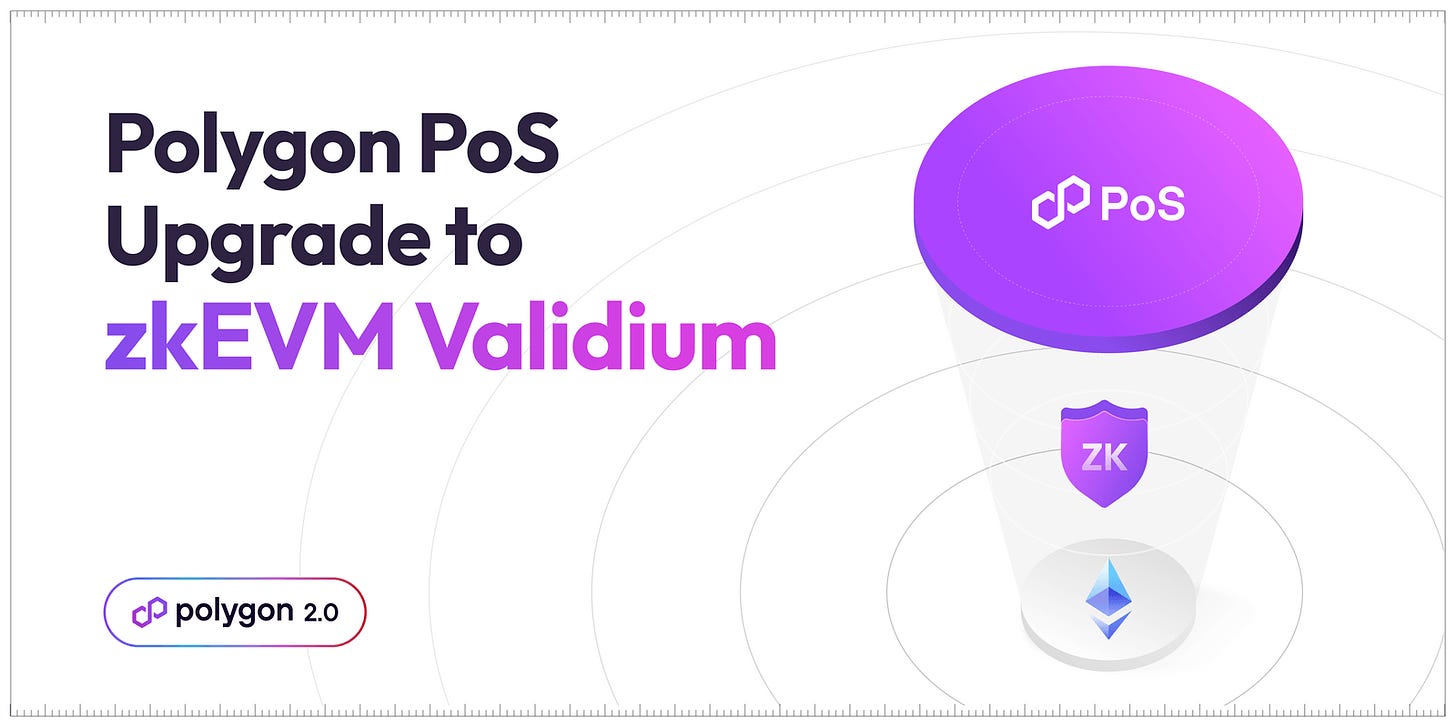

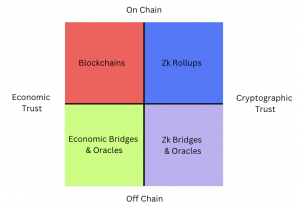

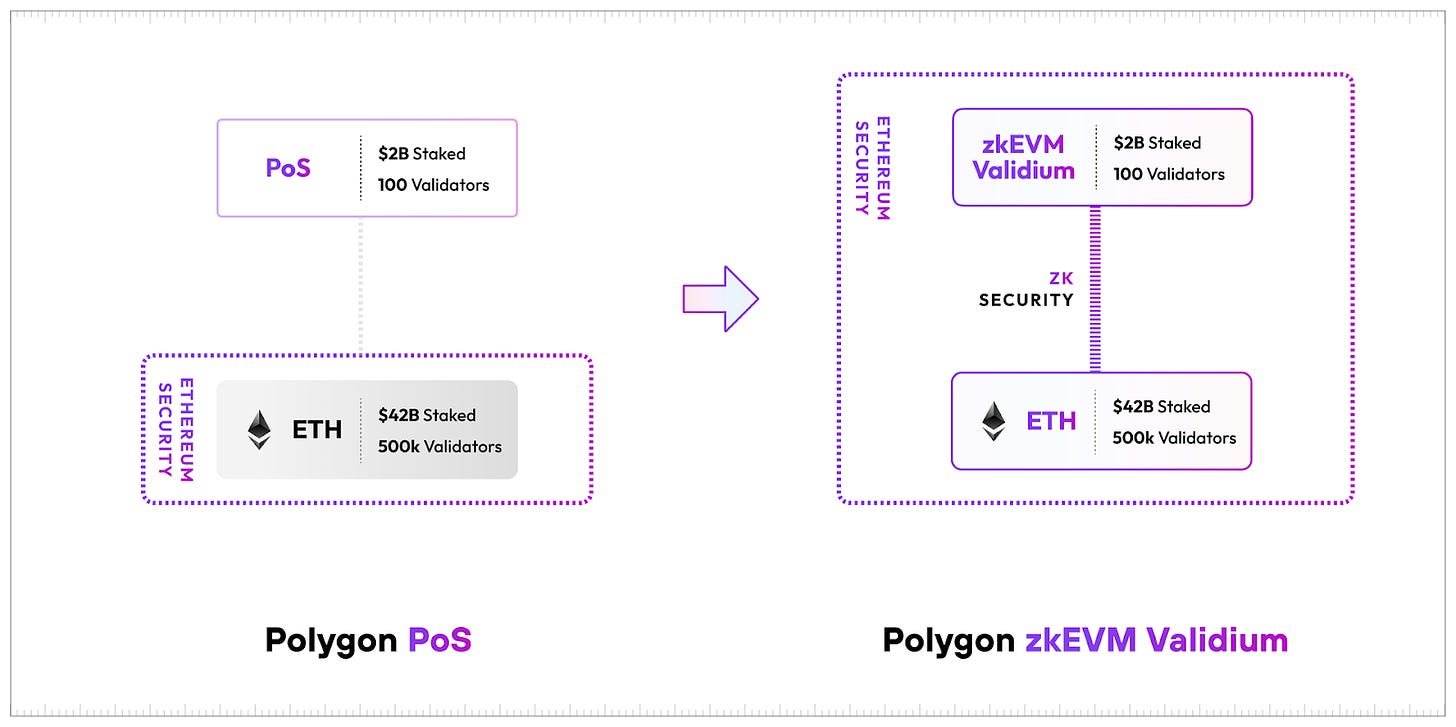

Currently, the Polygon PoS network employs a plasma-like design with 100 validators reaching consensus on block commitments to Ethereum. Polygon 2.0 will transition Polygon PoS into a zkEVM validium that combines ZK proofs’ cryptographic security with off-chain transaction data storage for cost reduction. This change is at the core of what is significant, the Polygon 2.0 rollout.

zkEVM validiums represent a paradigm shift. The main tradeoff with traditional rollups is that publishing transactions to the settlement layer is expensive and limits throughput. The key difference is that validiums offer similar security guarantees to rollups (ZK proofs guarantee the validity of transactions), but transaction data is made available off-chain.

They offer substantially lower fees and increased scalability compared to traditional rollups by offloading transaction processing to a secondary layer. This approach ensures the efficient handling of thousands of transactions per second, mirroring the capabilities of centralized systems, making it an ideal platform for DeFi, NFTs, and other high-volume applications.

You can think of a validium as the low-cost and higher throughput sibling of a rollup. In this case, the Polygon zkEVM leverages Ethereum to publish transaction data and verify proofs. This gives validiums notable advantages over rollups:

One of the most significant advancements in Polygon 2.0 is the cost-effectiveness of generating proofs. On Polygon zkEVM, the cost to prove a 10 million gas batch is just $0.0259, or $0.00005 per transfer.

To understand the Polygon 2.0 story you need to first understand the 5 major components contributing to the rollout: zkEVM, Supernets, CDK, Miden & ID. We will go into some detail on these below, and although it may get technical at some point, we will explain the significance of each with a ‘punchline’.

Polygon’s strategic acquisitions of Hermez and Mir Protocol have been pivotal in developing the Polygon zkEVM, which is an EVM-compatible zk-rollup solution. Being EVM compatible is of course extremely important for adoption amongst developers while maintaining a focus on scalability and security.

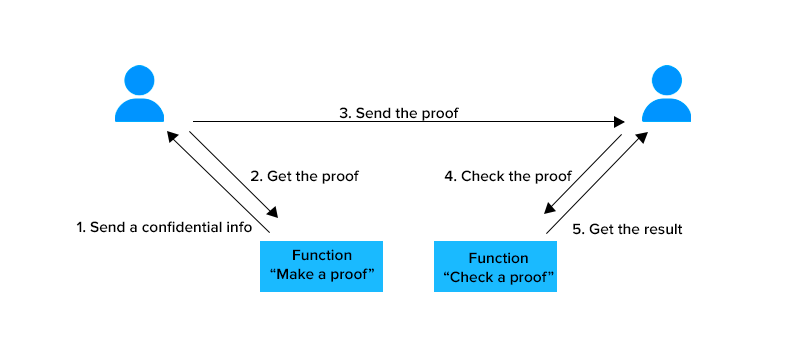

In a very simplified manner, ZK Proofs make it possible to confirm requirements without revealing the underlying information. For instance, you could show that you meet the age requirement without ever revealing the contents of your ID.

The greatest strength of ZK Proofs is that they unlock efficiency and privacy: it is faster to verify a ZK proof than to check the original data and the actual verifier learns nothing about the actual data. This introduces a new dimension of cryptographic trust in crypto – prove once, verify forever. The implication here is that you need to use less data to achieve the same end result which is of course more efficient, cheaper, and faster.

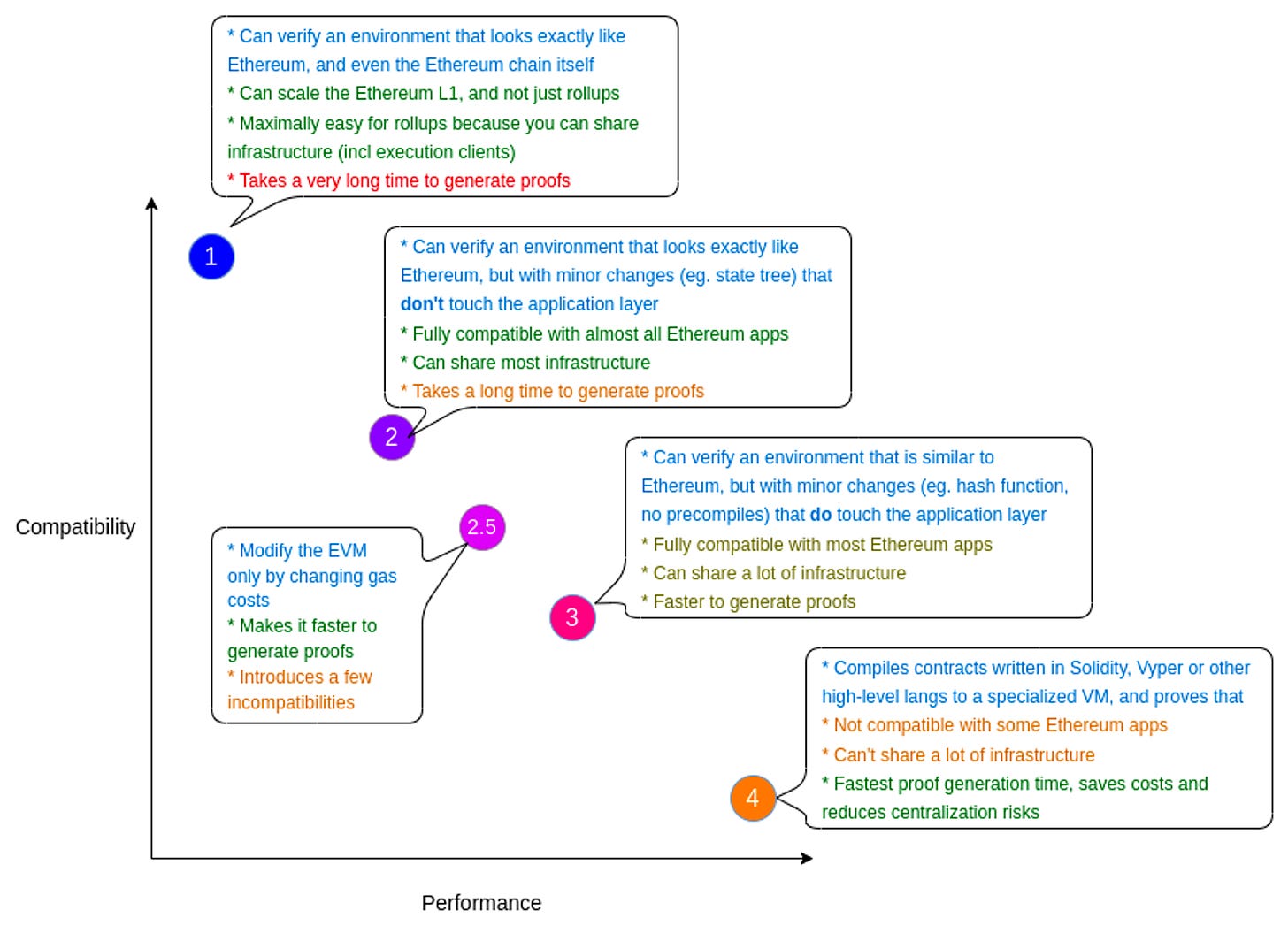

Zero-Knowledge Proofs (ZKPs) are integral to zk-rollups, but the EVM was not originally designed with zero-knowledge technologies in mind. As a result, implementing EVM-compatible zk-rollups is highly demanding due to the need to generate ZKPs for EVM executions.

Vitalik Buterin’s categorization of zk-rollups highlights the varying degrees of EVM compatibility, with Type 1 being the most compatible. Polygon zkEVM sits comfortably in Type 3, similar to projects like Scroll and Linea, offering direct support for EVM bytecode. This classification means developers can easily adapt existing Ethereum tools and smart contracts, a critical edge over Type 4 rollups such as zkSync Era, which require a shift to a zero-knowledge-centric language.

Unlike other projects that build their virtual machines or transpile Solidity, Polygon zkEVM supports Ethereum’s opcodes directly. This approach may not offer the highest scalability, but it crucially provides a developer-friendly environment, allowing the use of existing Solidity code for dApp development.

In the Polygon zkEVM, transaction fees are paid in $ETH. This is not necessarily bearish for $MATIC, since rollups ultimately need to pay gas fees to Ethereum for settlement, meaning that even if $MATIC was used for transaction fees, it would eventually need to be sold to cover gas expenses.

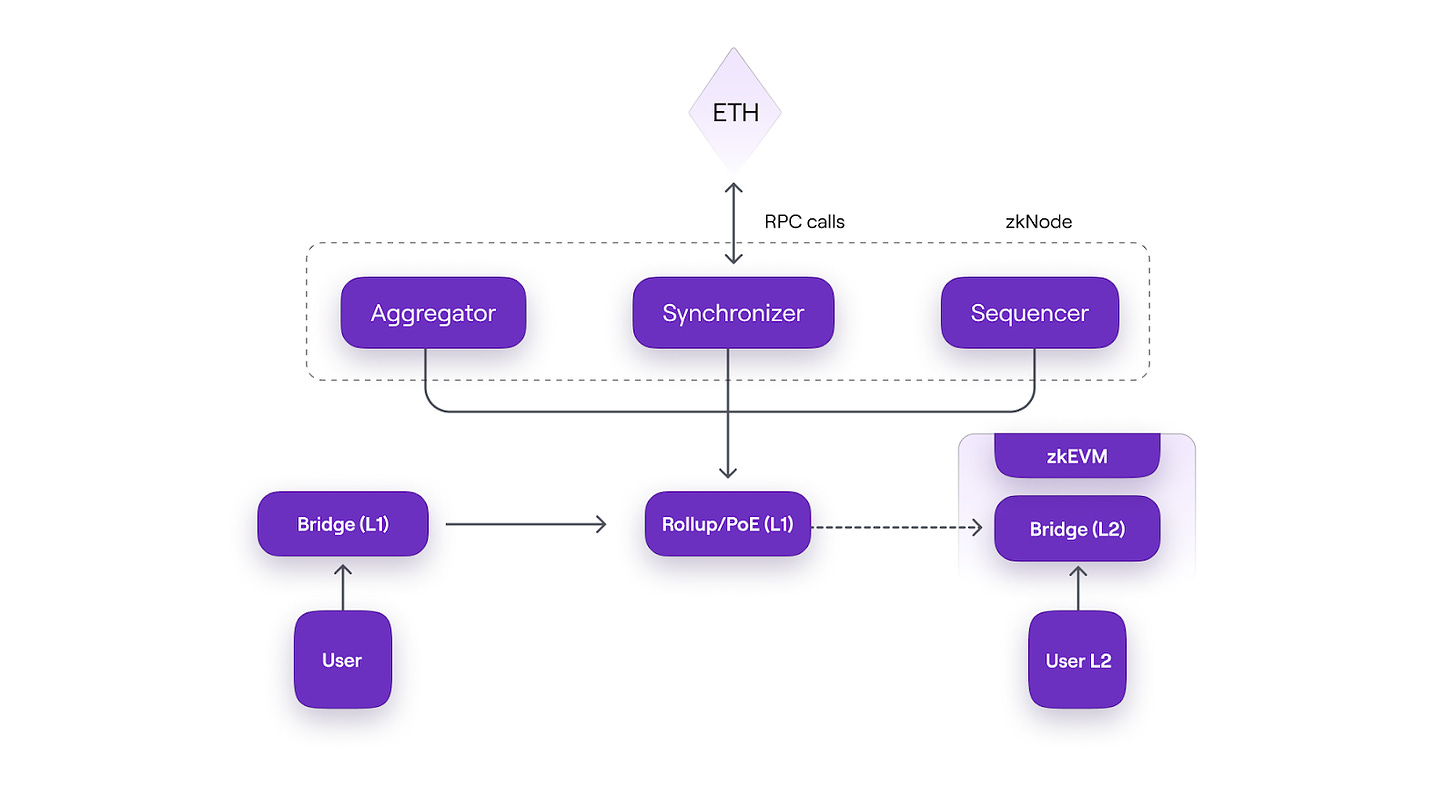

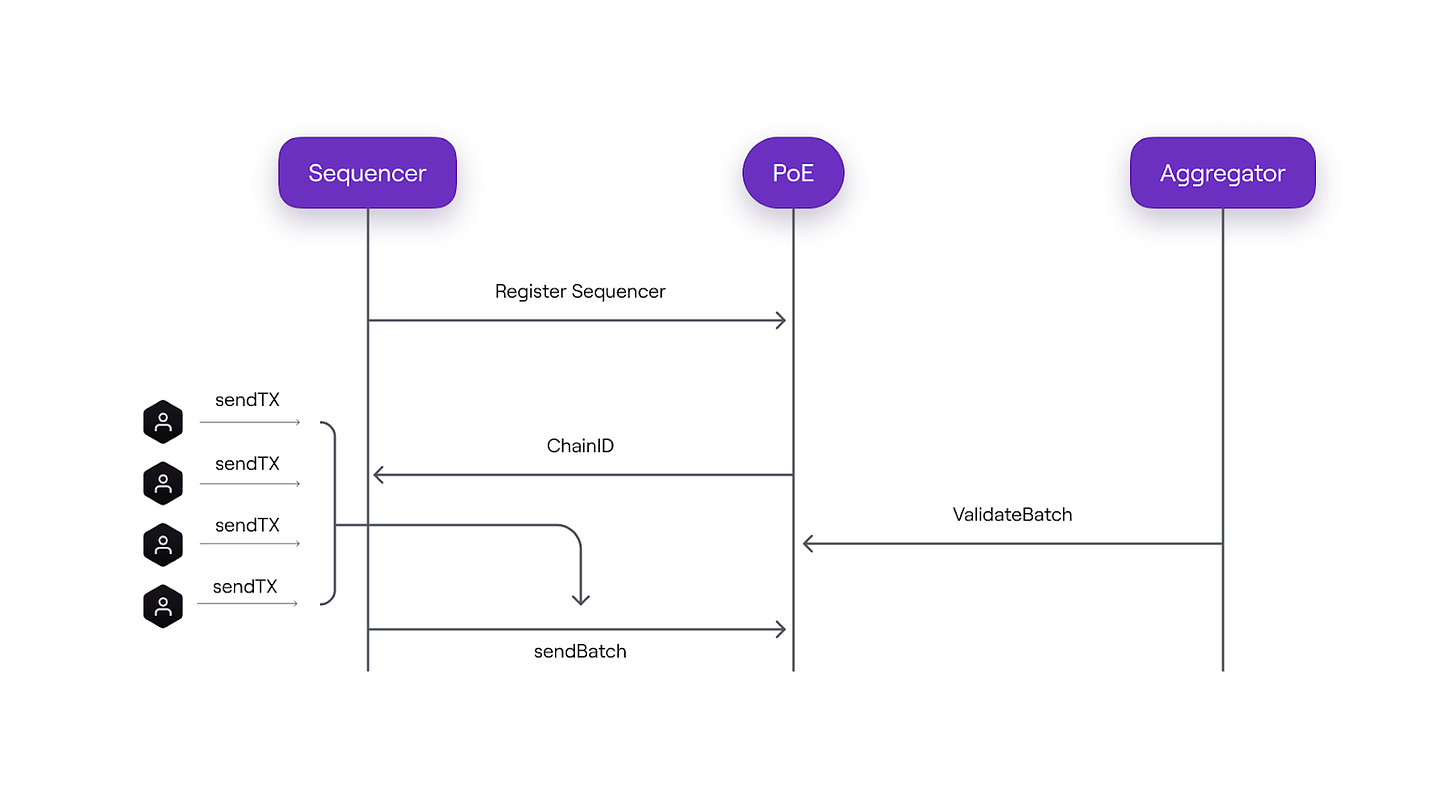

Demand for $MATIC will come from its use in the Proof of Efficiency (PoE) mechanism, which is responsible for ordering transactions, generating validity proofs, and managing the incentive scheme. The PoE process consists of two key elements – Sequencers and Aggregators, working together to ensure transaction validity.

While the drive towards scalability has been a significant focus of ZK research, we should not underestimate the potential that lies in ZK applications such as the secure sharing of secrets, confidential on-chain identities, off-chain security assurances, and interoperable trust.

zkEVM roll-ups have a significant advantage over traditional roll-ups because they can process transactions faster and at a lower cost without compromising on security or EVM compatibility.

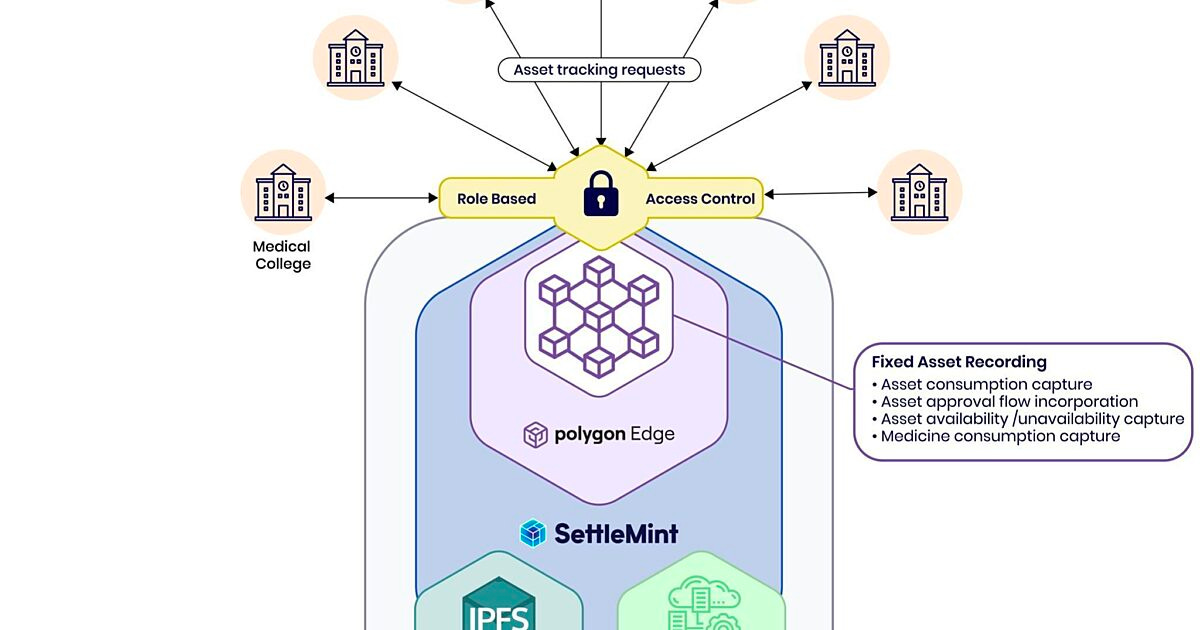

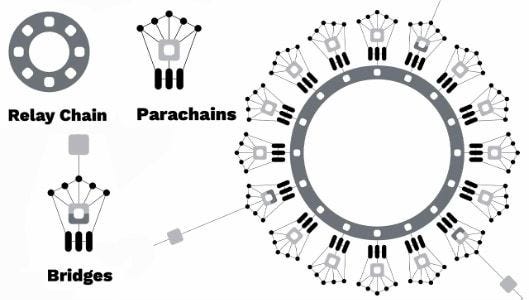

Polygon Supernets, akin to Cosmos’ appchains or Avalanche’s Subnets, serve as EVM-based app-specific chains. These chains are customizable and developers can tailor these chains to suit the specific requirements of their enterprise or service.

Currently, Polygon Supernets demand a minimum of 3-4 validators and a cap at a maximum of 100. They operate as L1 networks utilizing the Polygon Edge technology stack and the PolyBFT consensus algorithm. One could argue that app-specific L1 chains come with the problem of weak initial security, primarily because they operate as independent chains requiring separate pools of validators.

Polygon 2.0 addresses this because Supernets will extend their functionality to enable zk-rollups and validiums. They will be able to utilize a shared pool of validators from the broader Polygon 2.0 ecosystem as well. This is a pivotal shift since they will no longer need to maintain their separate pools of validators.

With Polygon 2.0 supporting the zkEVM and validium modes, there will be Polygon validators that will act as sequencers determining the order of transactions. In the case of validiums, they will ensure data availability as well. This might also open up opportunities for those validators to earn additional rewards in addition to the transaction fees from participating in Polygon Supernets.

For reference, Nubank, Gameswift, Palm Network, and Nexon are examples of companies that are currently developing their networks using Polygon Supernets.

Supernets are highly customizable EVM app-specific chains that do not have the cold start security issue other such chains face when rolling out.

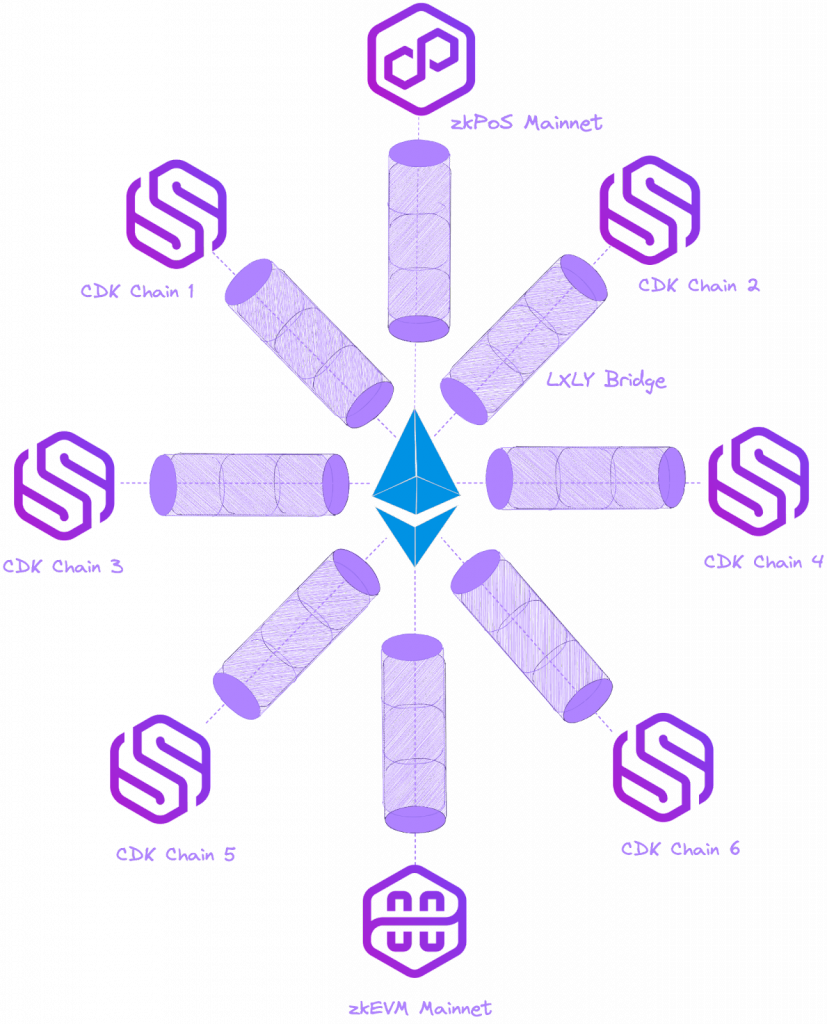

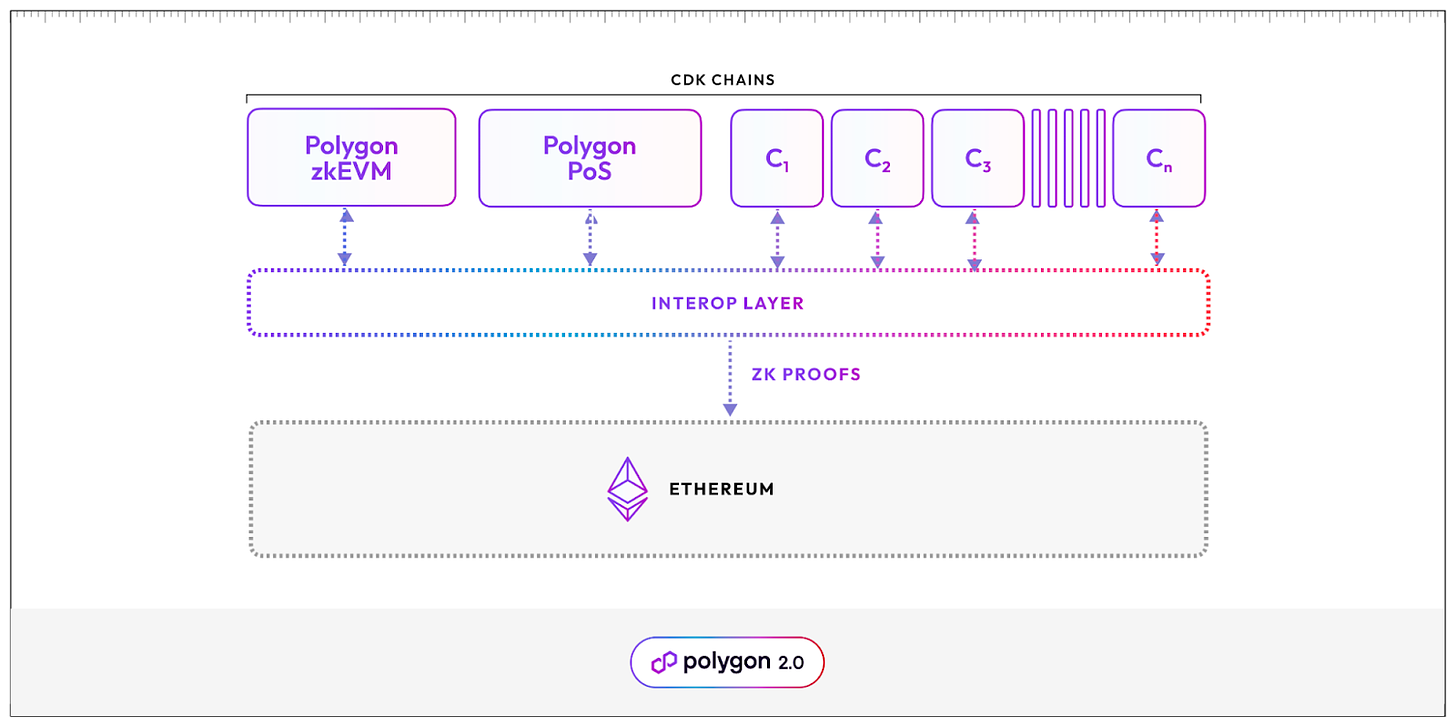

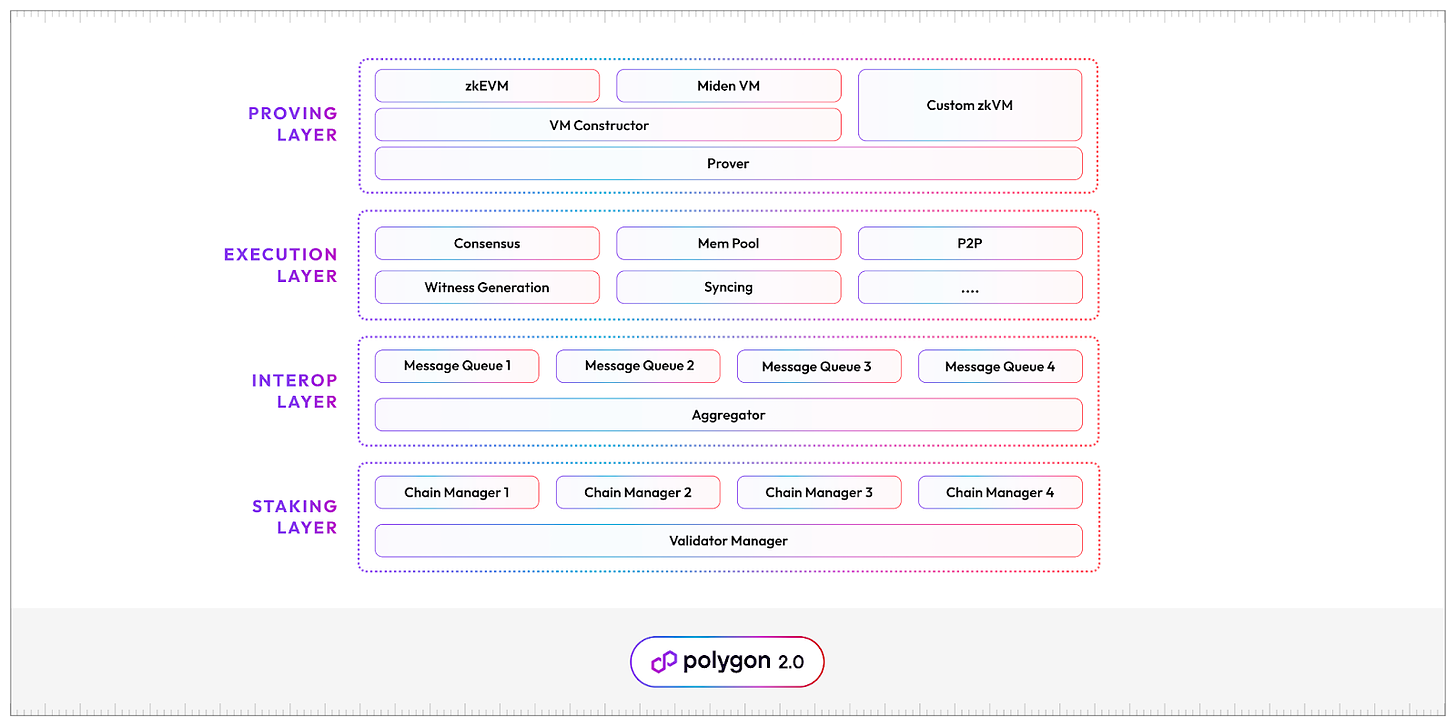

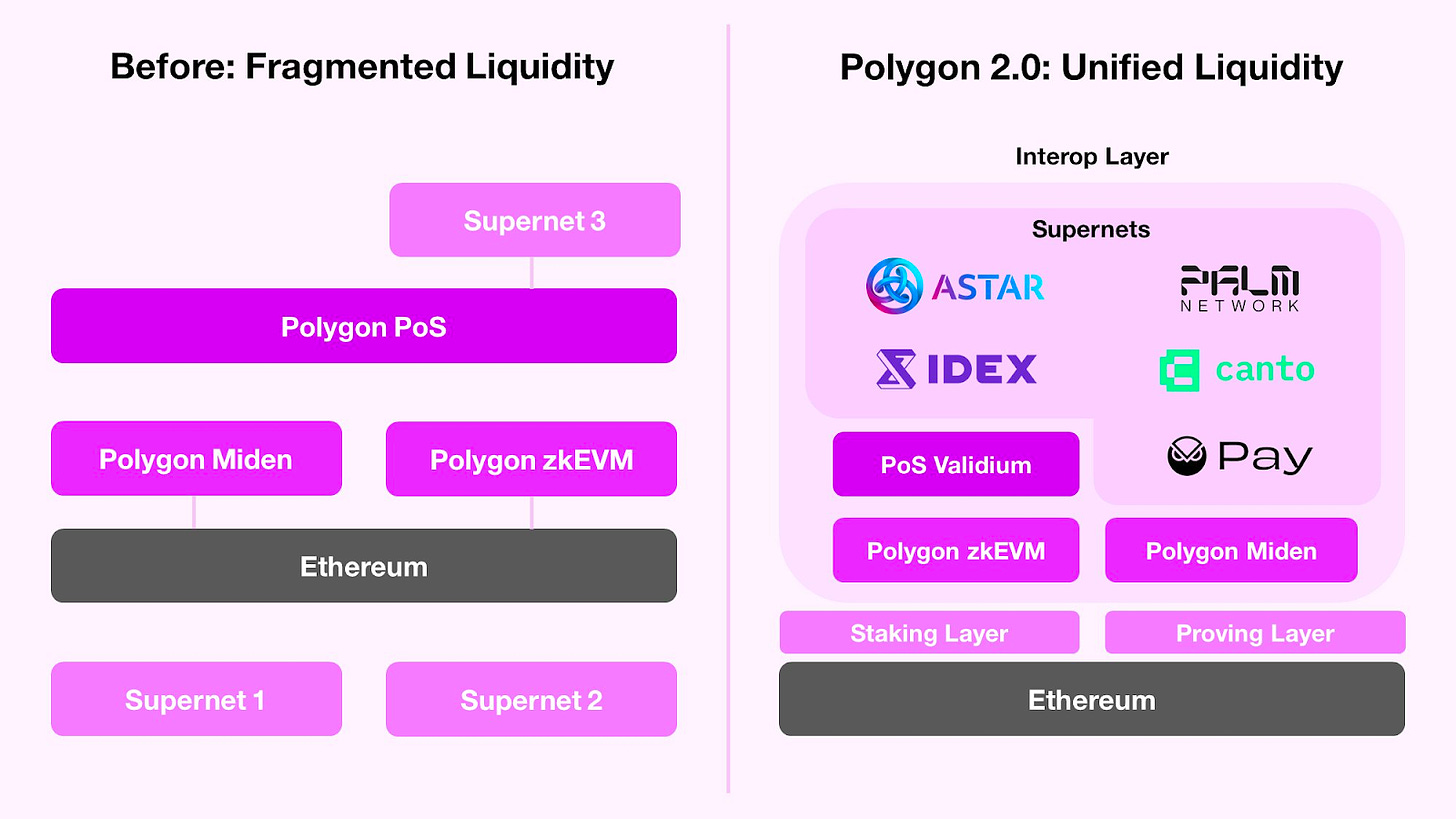

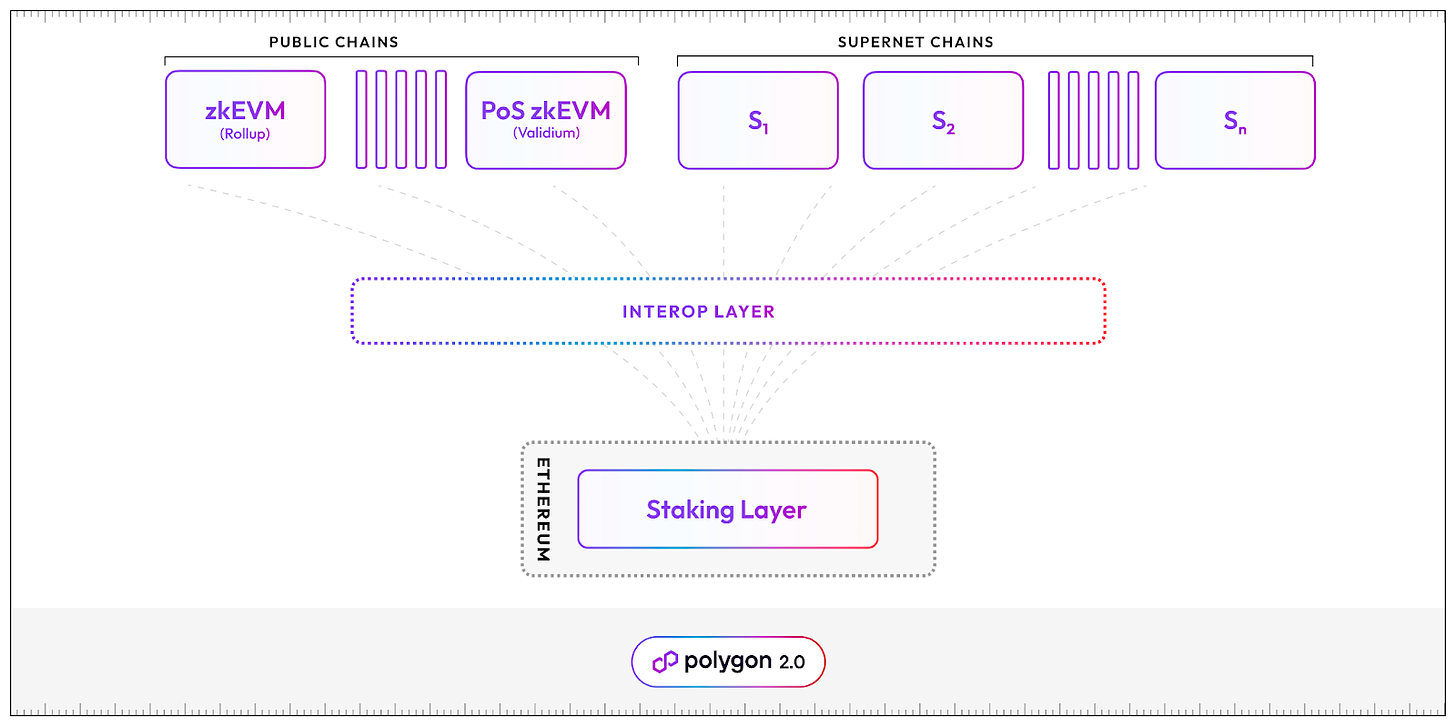

One of the significant challenges in blockchain ecosystems is liquidity fragmentation, particularly in the app-chain ecosystem. The introduction of the Polygon CDK addresses this issue by providing a ZKP-based cross-chain solution through the Interop Layer – bear with us we will explain!

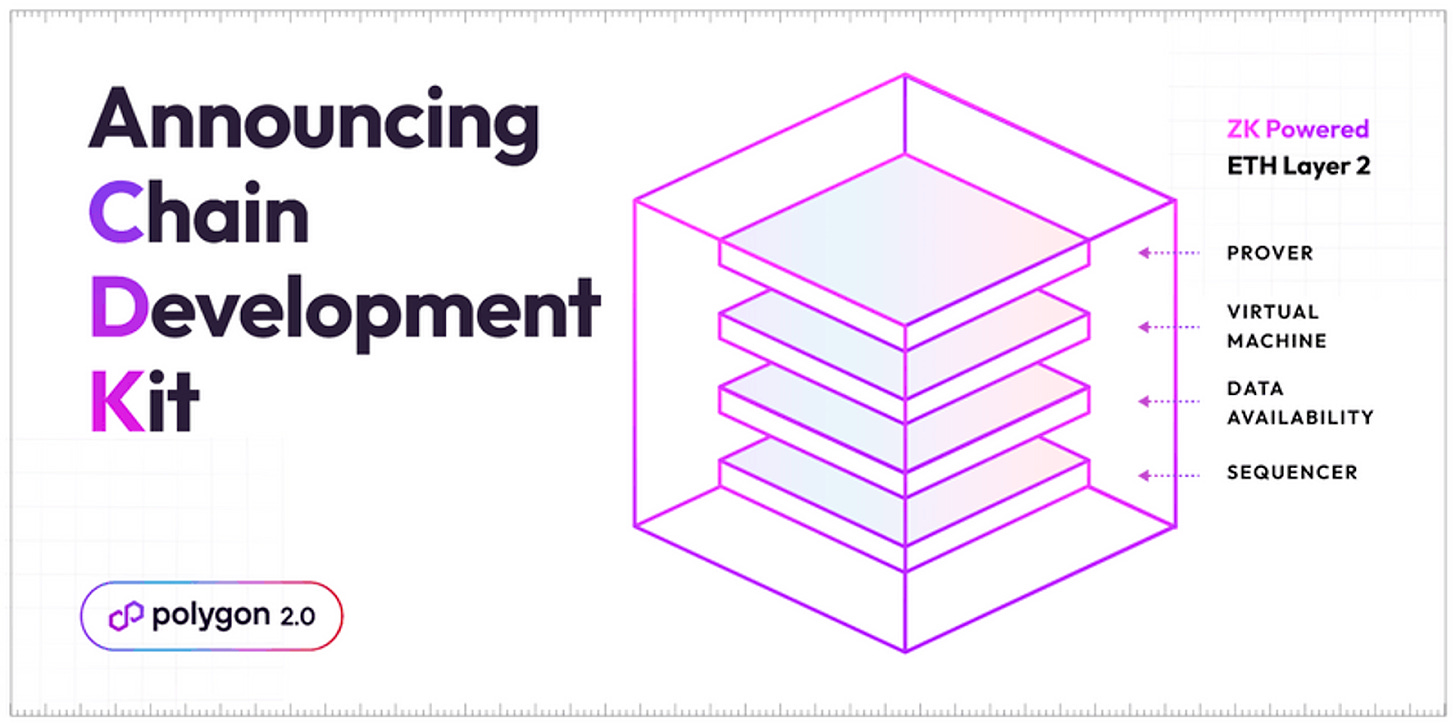

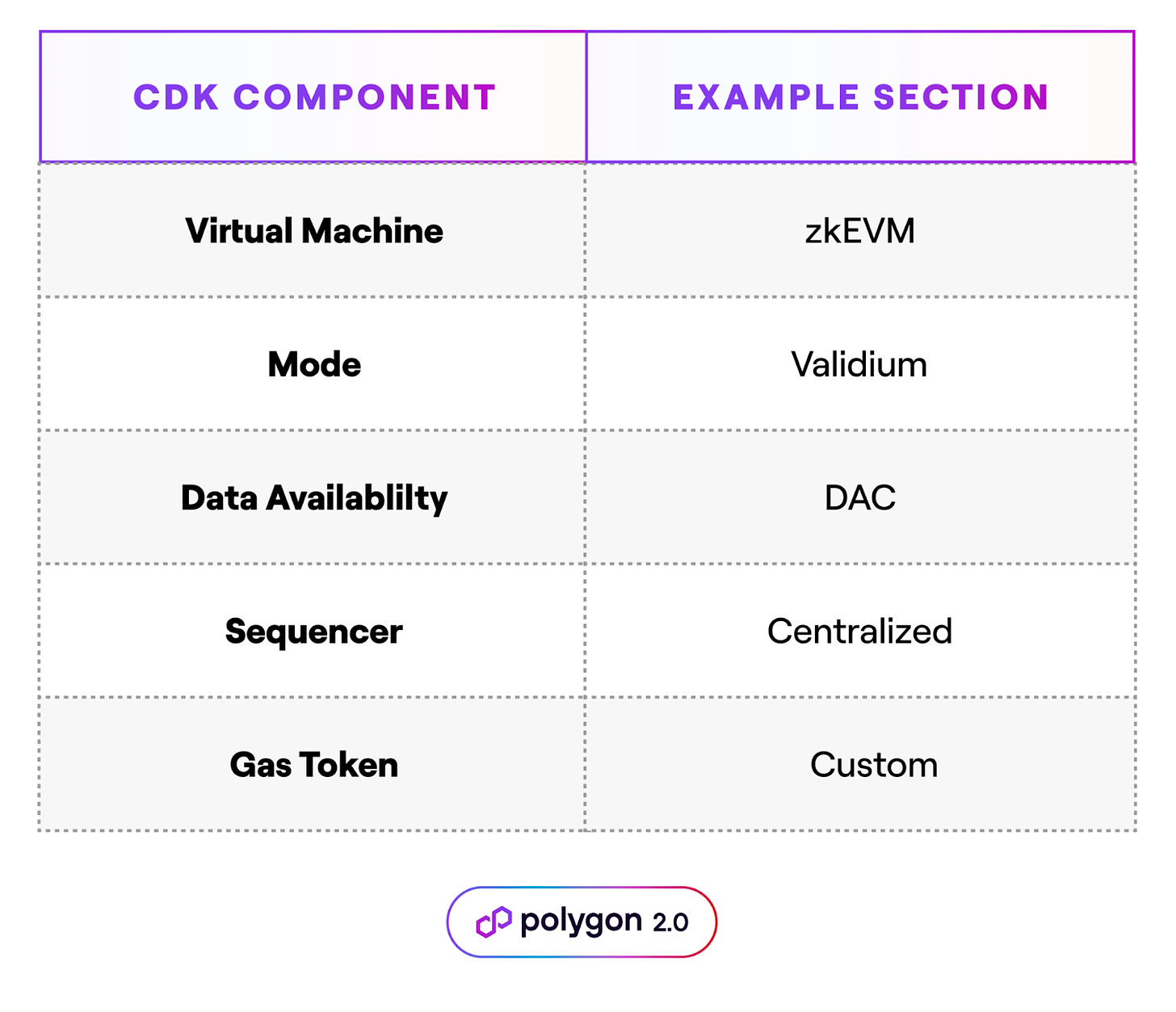

The Polygon CDK (Chain Development Kit) is an open-source chain development kit that makes it possible for anyone to build ZK-powered L2s. This is the key to unlocking an ecosystem of application-specific chains deployed to fit very specific use cases with configurable performance and cost. Most importantly, all chains built with the Polygon CDK are interoperable with each other, unifying liquidity without any additional security or trust assumptions. This point is a significant and material value proposition for any builder considering where to launch their app-specific chain.

One of the reasons behind calling it a CDK rather than a stack is because the Polygon CDK offers a variety of different zkEVMs and prover stacks. These efforts have been largely driven by the acquisition of the Mir and Hermez teams, who have contributed experience integrating different prover stacks, client-side high-throughput VMs, and the Hermez Type Stark/Snark that is powering the Polygon zkEVM today.

Polygon can offer all of this customizability in one kit, while all the other zkEVM projects are still in the process of actively trying to get one stack working. This shows that Polygon is already one significant step ahead and can now focus on offering a unified prover experience that can serve multiple VM types (Miden, WASM, EVM…).

Moving forward, the CDK will play a critical role in enabling developers to build ZK-powered Layer 2 solutions that can be interoperable with each other. This interoperability is achieved by connecting the respective L2s to a neutral interoperability layer, without the need to use a shared sequencer setup for atomic composability.

While several blockchain projects have released their blockchain development toolkits, Polygon CDK stands out as a clear cross-chain solution provider within Polygon 2.0. Polygon CDK automatically connects to Polygon 2.0’s Interop Layer, enabling seamless cross-chain communication in a trustless manner via ZKP. This offers a user experience as if everything is happening in a single network which as you can imagine, has some exciting implications, especially for large non-crypto-native businesses looking to build blockchain-based solutions for their specific purposes. The real-world business partnerships Polygon has been stacking over the last few years now start to make a lot more sense.

Its unique features and commitment to interoperability have attracted a growing number of projects. Notable examples include Astar Network, Gnosis Pay, Canto, Palm Network, IDEX, X1 (OKX) and we anticipate this trend will accelerate into 2024 and beyond.

Polygon CDK offers extensive customization options, allowing developers to tailor their CDK Chains according to specific requirements, which again is a material value proposition vs what is available in other systems.

In addition to the CDK, Polygon also offers a Chain Indexer Framework, which simplifies the process of indexing EVM-based chains. It is an open-source event-driven framework that can help development teams to build data pipelines with real-time data queries.

Source: Polygon Docs

The CDK lets developers build their app chains in a highly customizable way that no other system can currently provide while each of these chains are interoperable with each other. That interoperability allows for shared liquidity but also a much more seamless experience for the end user. These 2 benefits are going to create significant demand in 2024 from developers and businesses looking for a place to build out their initiatives.

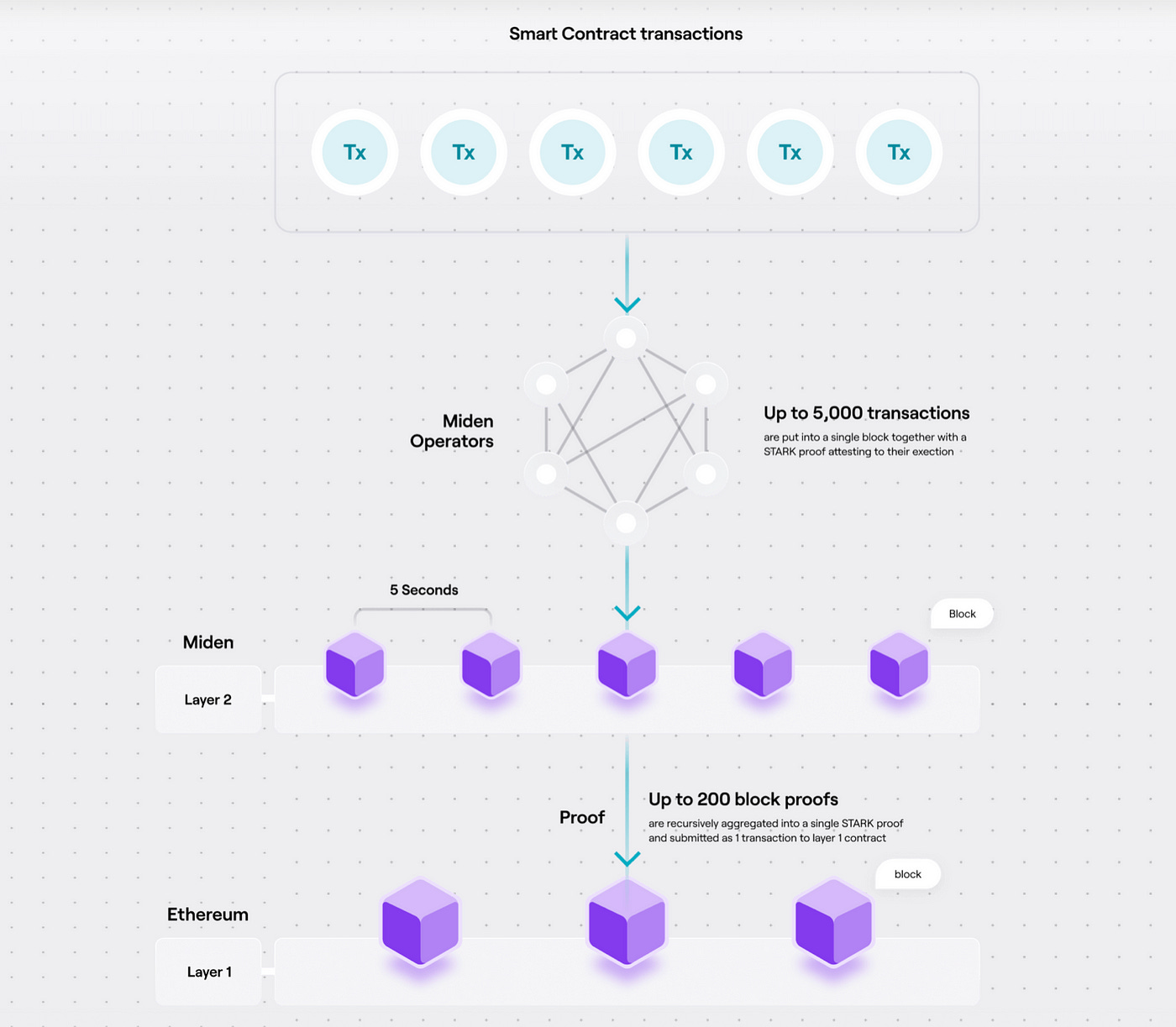

Beyond the zkEVM, Polygon is also pioneering with Polygon Miden, a non-zkEVM ZK rollup focusing on performance and privacy, Miden puts more emphasis on performance over EVM compatibility by using STARK-based zero-knowledge technology, unlocking higher throughput and enhanced privacy. It will be a supernet as part of the Polygon 2.0 system and as we discussed above, will be interoperable with other chains within the same system, allowing them to leverage privacy and performance solutions in an efficient and useful way.

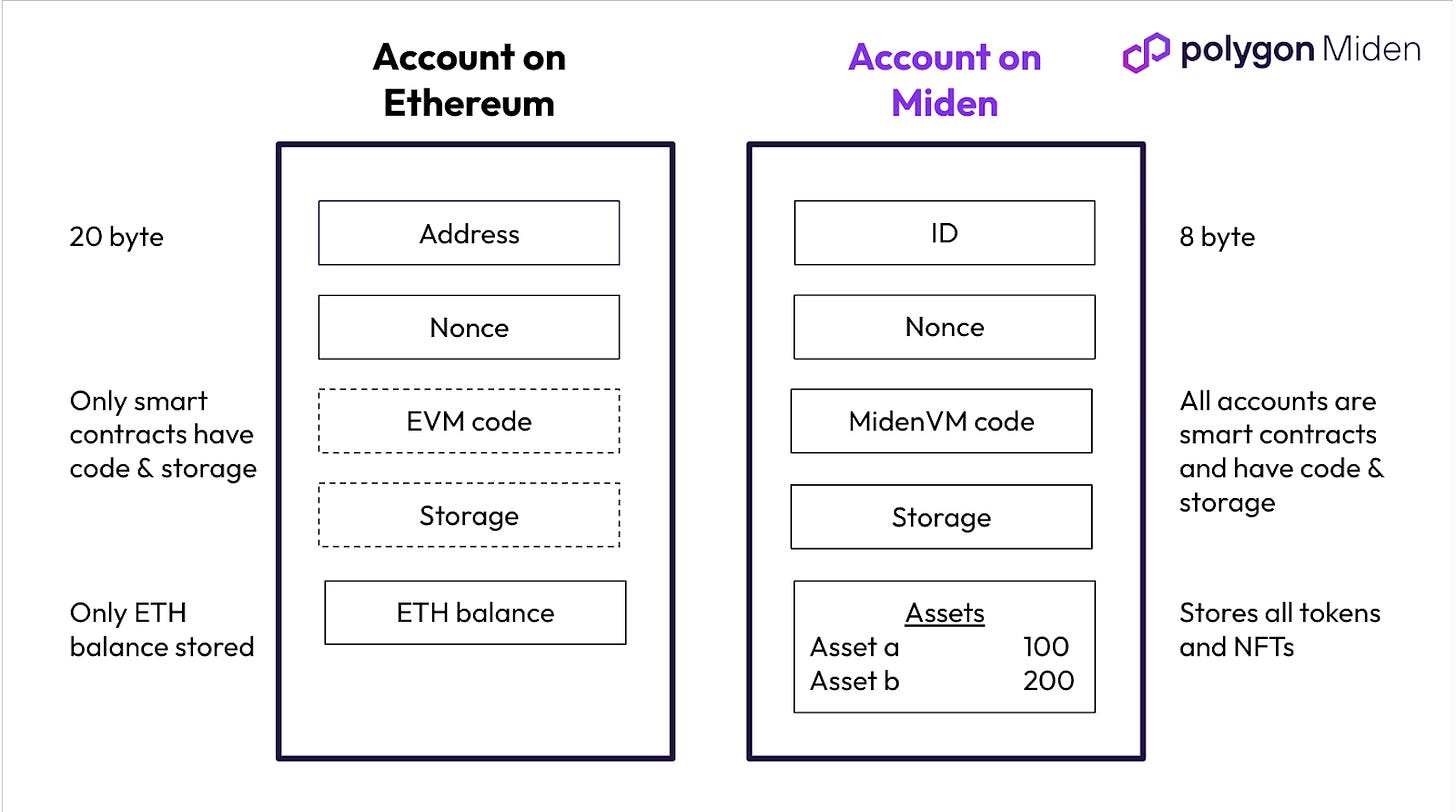

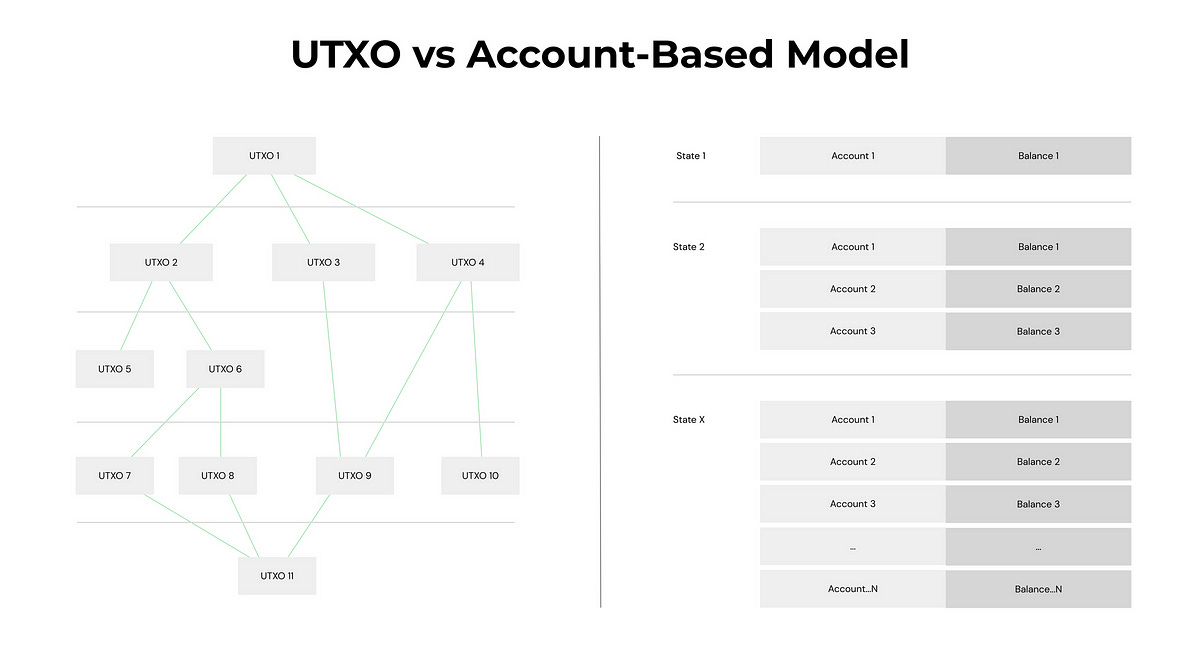

Unlike Polygon zkEVM’s approach, Miden VM adopts a UTXO model and a hybrid state, which initially might pose a challenge for developers but promises long-term benefits, especially in response to the growing demand for privacy in blockchain transactions.

Source: Polygon Blog

A standout feature is that individual accounts can also maintain their own state, executing their smart contracts locally. This is relevant because most chains require users and nodes to operate by referring to a single global state. However, Miden introduces the possibility for accounts to selectively update other accounts’ states, and their own state’s validity can be proven through zk-proofs. This makes it possible to introduce novel use cases for privacy features. Since users will be able to execute private smart contracts in a local environment, they will also be able to selectively maintain their privacy.

Source: Polygon Docs

Furthermore, Polygon Miden’s adoption of a UTXO model creates opportunities for use cases that are challenging in account-based systems. In an account-based model, vulnerabilities in a single contract can have widespread repercussions, but in Miden’s UTXO-based system, assets are stored locally in individual accounts, greatly reducing the attack surface.

Source: Zetachain Blog

In the past, many enterprises have shown their concerns with interacting with public blockchains because of their transparency. Miden offers a solution to that problem and positions itself as a network with a unique value proposition encompassing scalability, security, and privacy among other features.

With Polygon Miden, scalability, and privacy go hand in hand, allowing users to execute Turing-complete privacy-preserving smart contracts, which is rare in the L2 landscape.

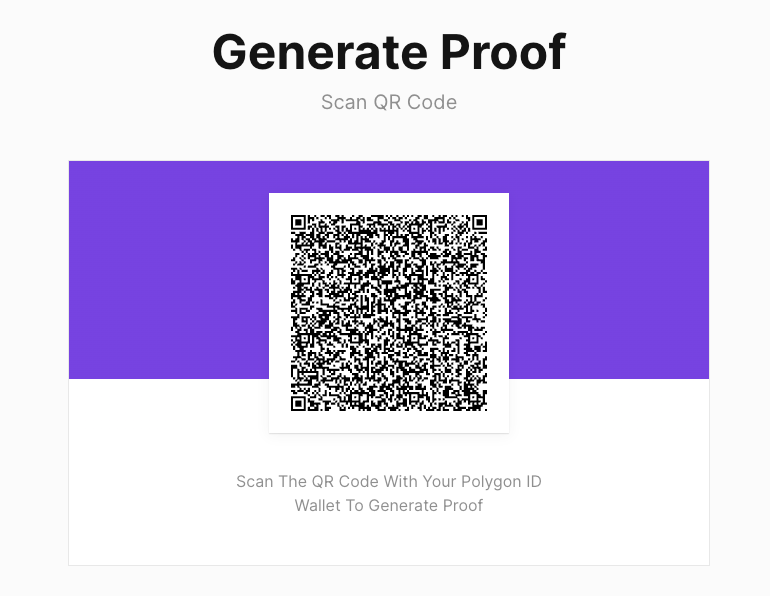

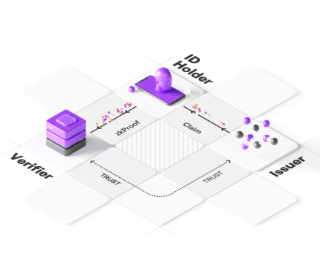

Given the frequency of data leaks, verifiable credentials (VC) are one of the most well-known use cases for zero-knowledge proofs. Polygon ID offers open-source technology that enables decentralized identity supporting a broad range of verification methods, from documents to biometrics. The goal is to enable a self-sovereign identity (SSI) layer for Web3.

In the offline world, each individual is inherently unique. Online, demonstrating this uniqueness requires a protocol capable of affirming that a user is a distinct human being. Polygon ID steps in to provide this assurance in the digital environment. It establishes a long-lived credential that attests to the user’s uniqueness, aligning with the concept that offline, one is always uniquely oneself.

The protocol complies with DID (Decentralized ID) standards to ensure compatibility and interoperability with other solutions. In addition to that, Polygon ID also provides a comprehensive toolkit, including identity verification protocols and identity wallets in the form of SDKs, simplifying integrations with third-party services.

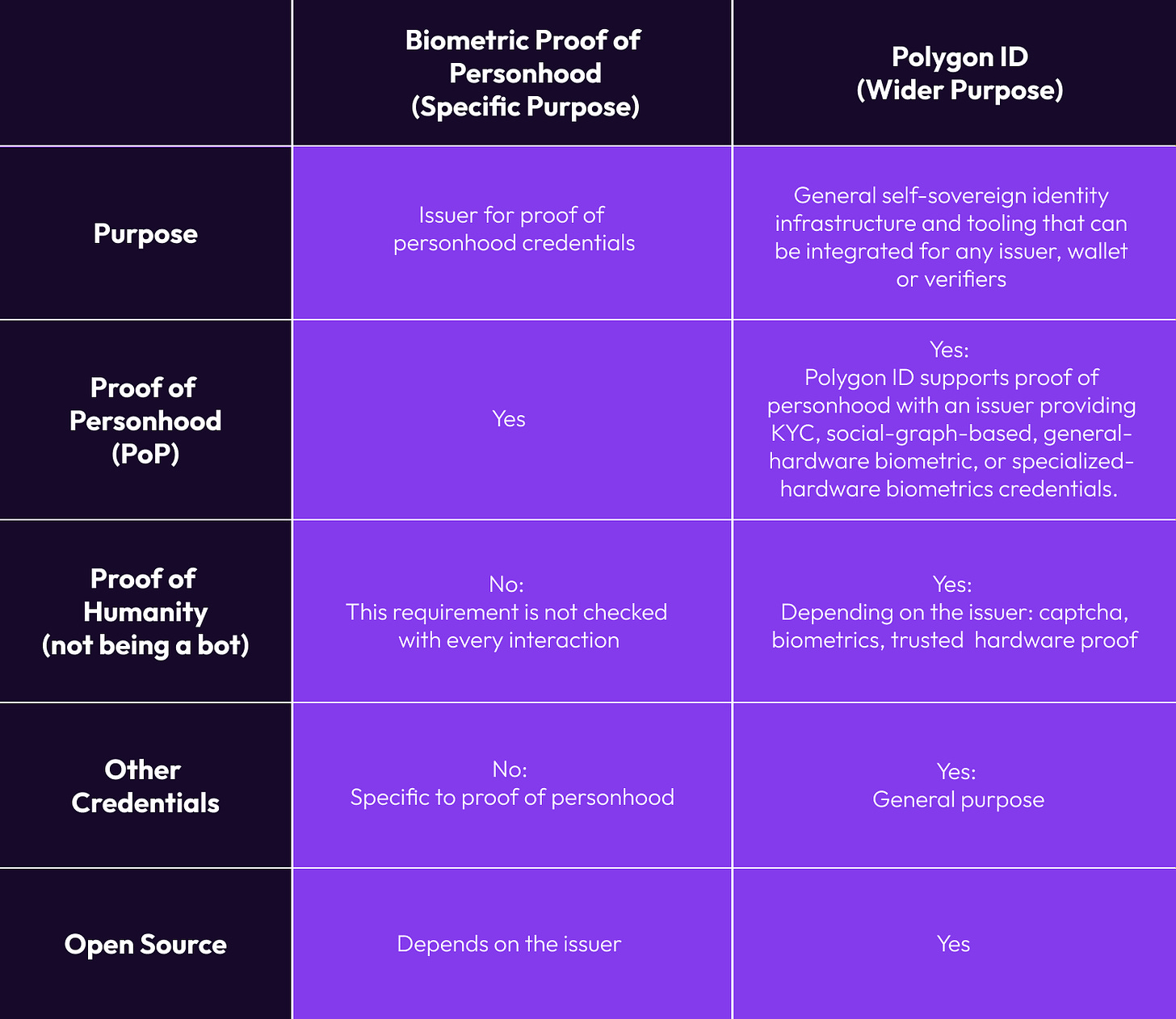

While some issuers focus on biometric proof-of-personhood credentials, Polygon ID distinguishes itself by providing a broader and more comprehensive identity infrastructure. Biometric issuers may meet the first criterion of proving uniqueness but may not always fulfill the requirement of Proof of Humanity, which is equally essential in the online world.

Source: Polygon Blog

Any chain or dApp within the Polygon system will be able to use this ID protocol to fit its specific use case without the need to integrate with an external ID system or solution. From the user perspective, they will need to prove their identity a lot less frequently than in other systems, and possibly even just once when entering the Polygon system, instead of having to show credentials to each dApp they interact with.

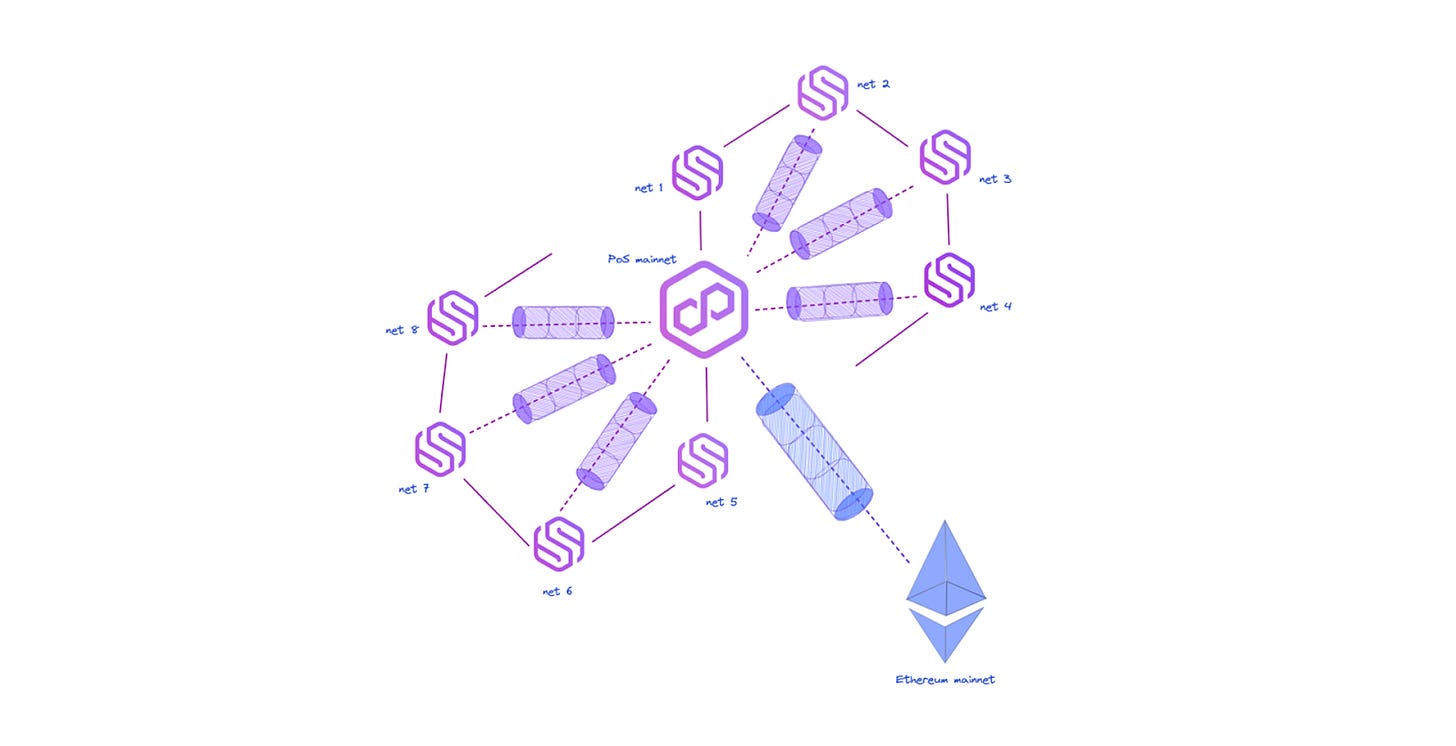

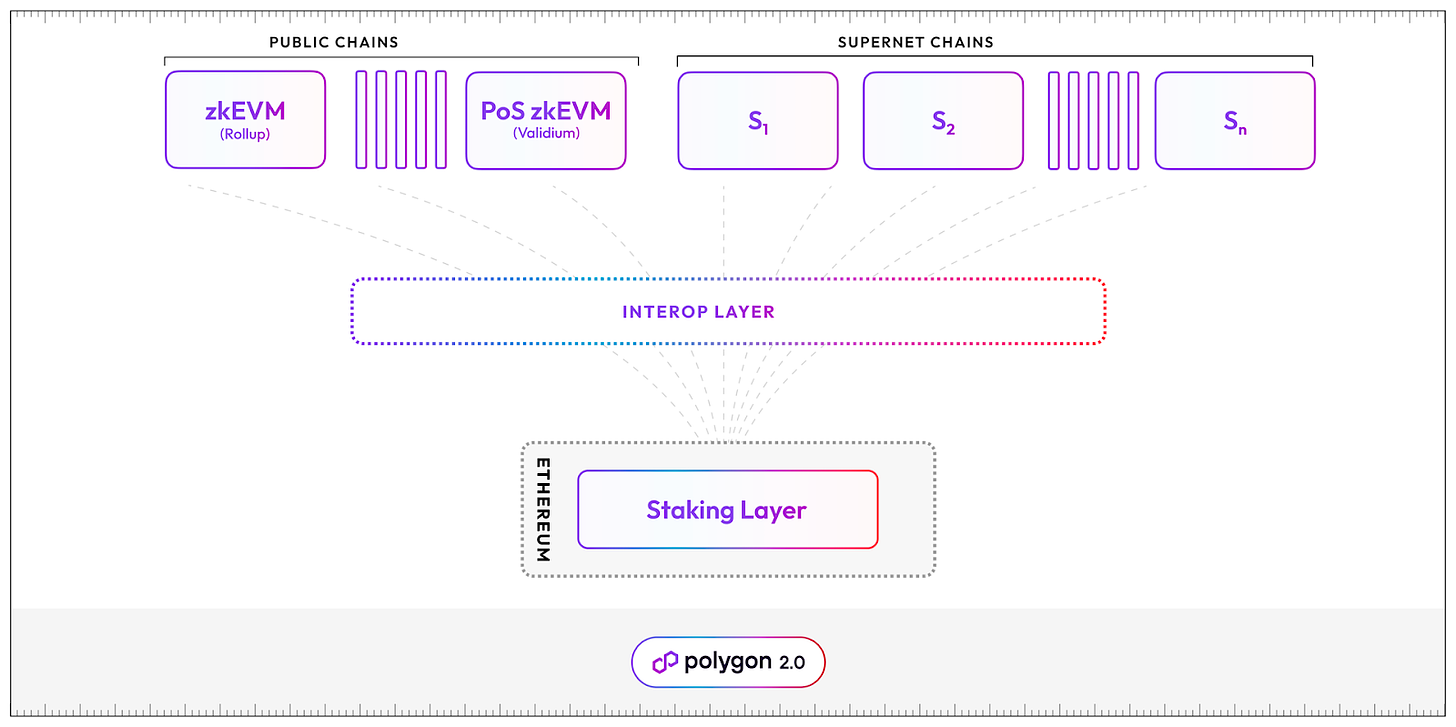

Polygon 2.0 is a series of proposed upgrades that will unify all Polygon protocols with ZK tech into a unified liquidity layer that can achieve unlimited scalability, allowing anyone to send or receive value without having to go through any intermediaries or trusted third parties.

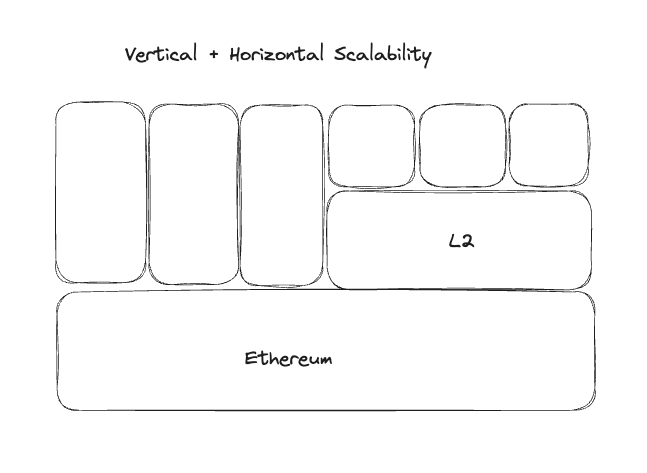

Central to Polygon 2.0’s roadmap is the transformation of Polygon Proof of Stake (PoS) into a validium-based system, leveraging the power of ZK Layer 2 (L2) chains. This shift achieves a unique blend of vertical security and horizontal scalability.

Source: Polygon Docs

A notable enhancement in Polygon 2.0 is the introduction of validity proofs in the validium model, which replaces the lack of a fraud-proof system in Polygon PoS. This addition fortifies computational verification on the base layer, augmenting security. Additionally, validiums store transaction data off-chain, optimizing for scalability.

Even though the tradeoff with validiums is that they must ensure data availability outside of Ethereum, Polygon PoS already counts with 100+ validators and ~$2B at stake, which can serve as a secure and reliable guarantee of data availability.

Source: Polygon Docs

The architectural restructure in Polygon 2.0 creates four fundamental layers, underpinning Polygon’s vision for scalability, interoperability, execution, and security. This new model enables Polygon to harness Ethereum’s security while facilitating seamless communication across numerous Polygon chains. It essentially delivers an experience akin to a single network, yet with infinite scalability.

Source: Polygon Docs

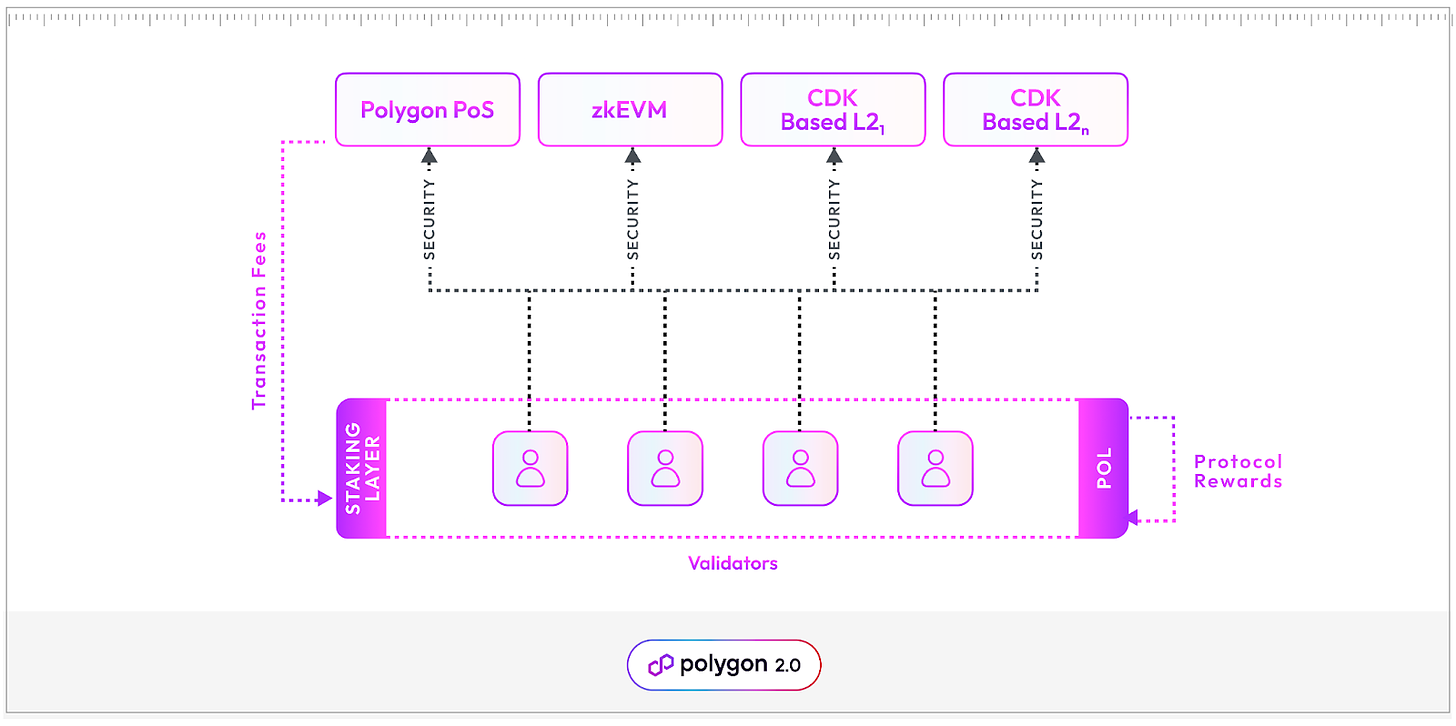

This way, the staking layer will play the role of being a multichain coordinator of the Polygon ecosystem, which will be enabled by the Polygon CDK.

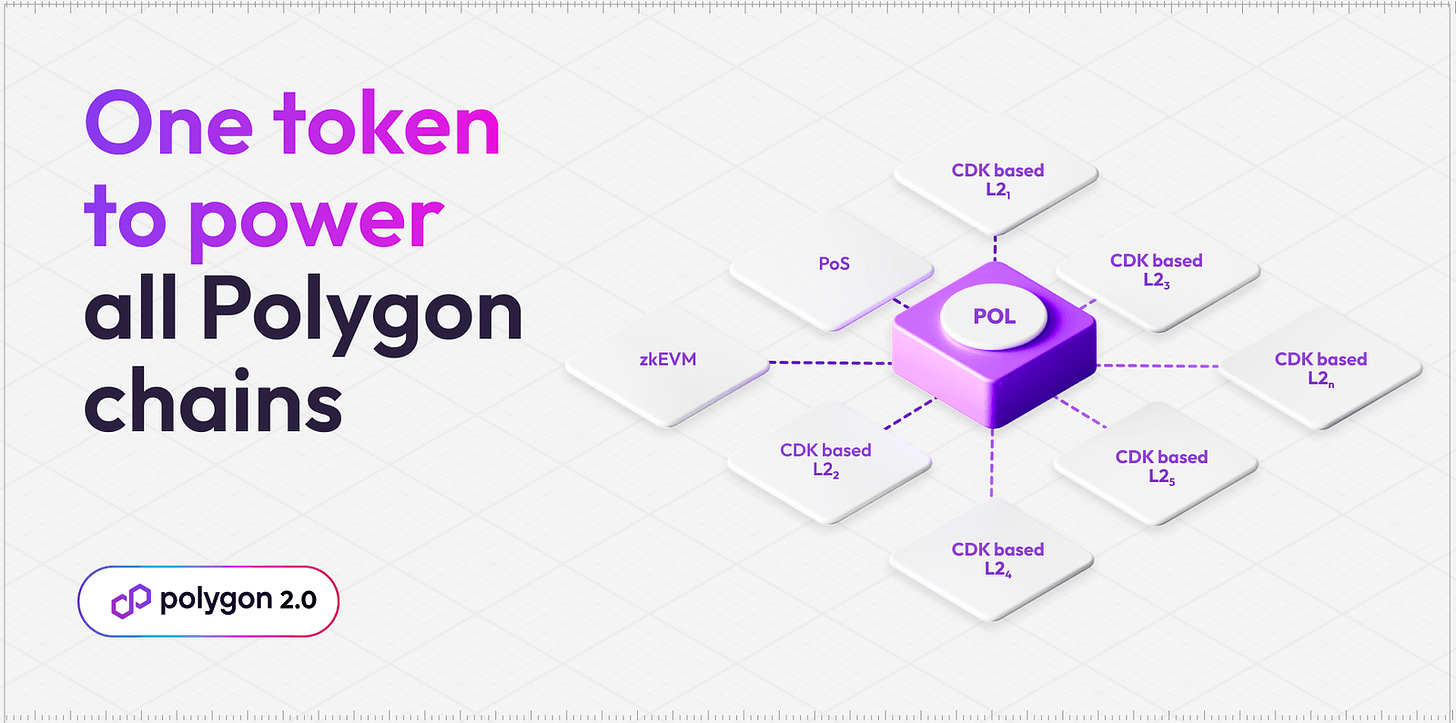

The evolution of Polygon’s tokenomics with the introduction of $POL in Polygon 2.0 represents a significant shift from the existing $MATIC token, which has been instrumental in staking and transaction fee payments.

Contract address for $POL on Ethereum: 0x455e53CBB86018Ac2B8092FdCd39d8444aFFC3F6

With a current circulation of over 9.3 billion out of 10 billion $MATIC tokens, the proposed migration to $POL marks a new chapter in Polygon’s ecosystem. The new $POL token will provide ecosystem security, allow for infinite scalability, and facilitate ecosystem growth and community ownership.

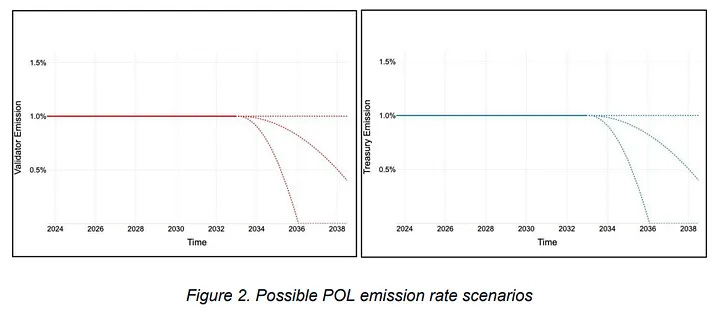

The initial supply of $POL tokens stands at 10 billion, with a 1:1 migration from $MATIC tokens. However, with Polygon 2.0, the upgrade will introduce an annual 2% inflation, which is relevant when it comes to having a competitive advantage over other L1s that cannot afford to have such a low inflation rate (Solana and Aptos have ~6% inflation rate, for Avalanche it is ~7%, for Near it is ~5%…). For reference, the current inflation rate of Bitcoin is ~1.8%.

Source: Polygon

With a focus on security, scalability, community ownership, and governance, $POL aims to play a pivotal role in realizing the vision of Polygon as “The Value Layer of the Internet”. The objective is to use inflation to incentivize validators while promoting the sustained growth of the ecosystem.

While $POL shares characteristics with tokens like Polkadot’s $DOT, Cosmos’ $ATOM, and Avalanche’s $AVAX, especially in validators’ cross-network participation, it carves out its niche. Unlike Polkadot’s auction-based parachain model, Polygon 2.0 enables more open and accessible deployment of Polygon Chains. Additionally, its governance structure and inflation rates set it apart from $ATOM and $AVAX.

With $POL, token holders stand to benefit from the accrual of value through transaction fees and protocol rewards across all ZK L2s within the Polygon ecosystem. This dynamic could create a self-reinforcing cycle where increased adoption of the Polygon CDK boosts demand for $POL, further incentivizing validators and stakers.

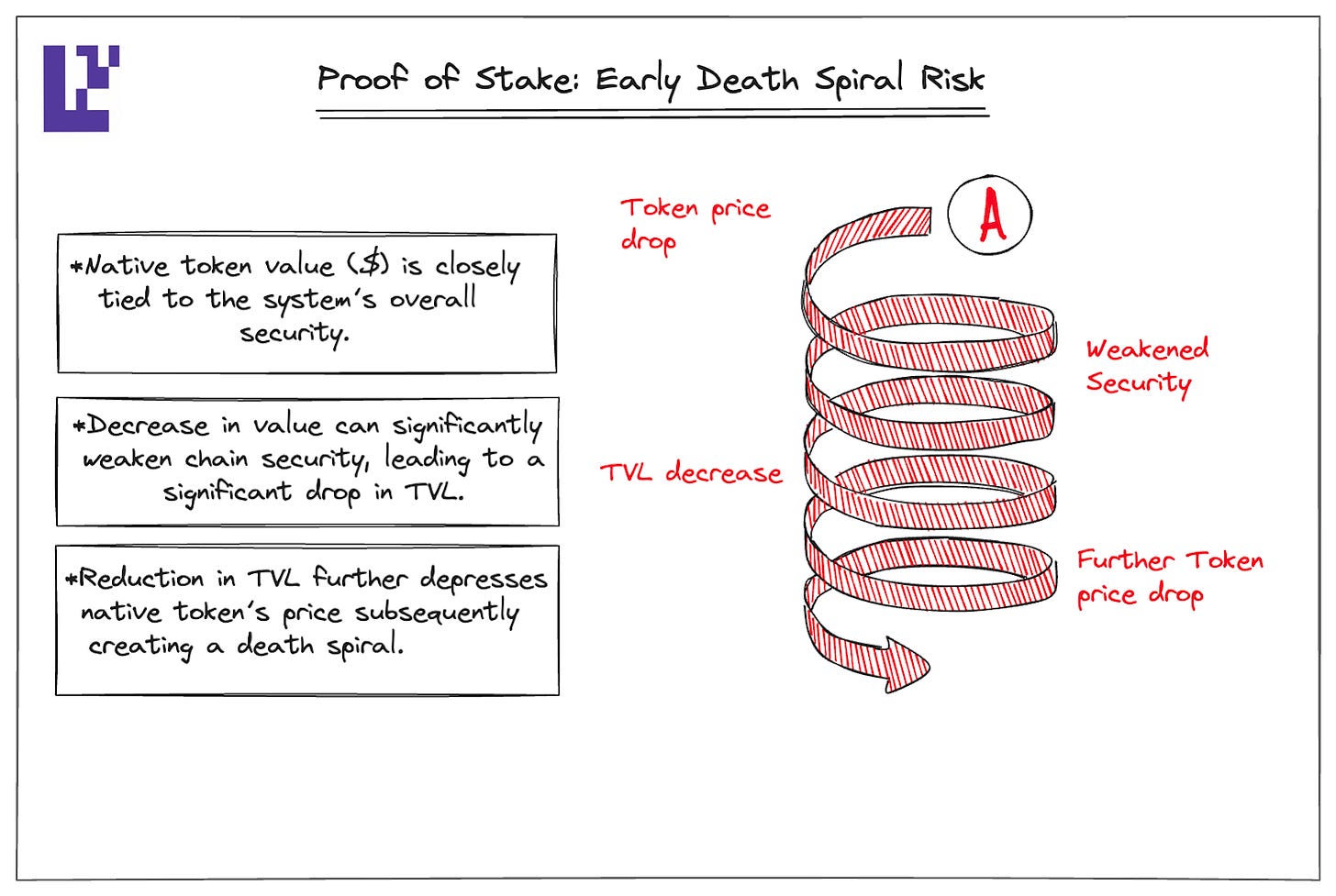

As a result, the transition from $MATIC to $POL offers a strategic advantage, circumventing the challenges of launching a new token, such as market volatility and limited access. This continuity is crucial in Proof of Stake networks, where the native token’s value is intrinsically linked to the network’s security.

Source: Eigenlayer blog

Even though it is a 1:1 token migration (due to technical requirements), this is still a paradigm shift in terms of tokenomics. Before, $MATIC was the native token of a PoS Ethereum sidechain. Now, $POL becomes the token that will validate an entire ecosystem of interconnected L2s, which results in 3 main sources of value accrual:

Ultimately, this comes to show that $POL is a highly versatile and productive token that can accrue value from not one but multiple chains.

Source: Polygon

Source: Polygon

The migration from POL to MATIC is seamless and further improves the value proposition of the validator role – in addition to validating multiple chains, validators can also perform multiple roles on a single chain.

These roles include (i) validation in the narrow sense, i.e. accepting transactions and generating blocks, (ii) zero-knowledge proof generation, (iii) participation in DACs (Data Availability Committees) and any other useful work on any Polygon chain.

Source: Polygon

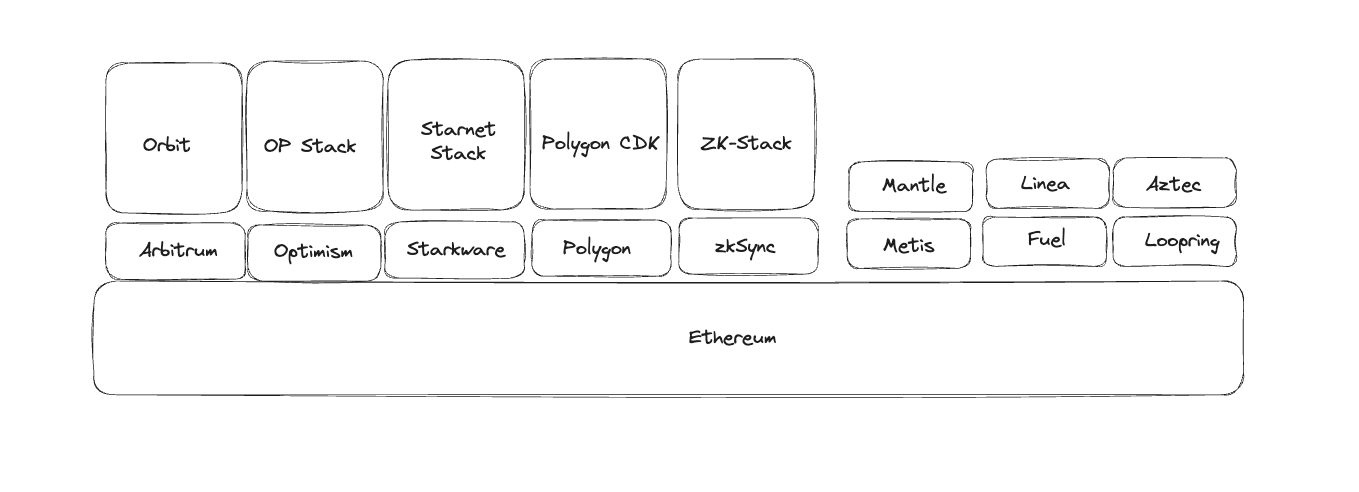

The competitive landscape for Polygon, particularly in the context of its 2.0 upgrade, is defined by its position within the broader ecosystem of Layer 2 (L2) and Layer 1 (L1) platforms. This landscape is characterized by a diverse range of competitors, each with its unique strengths and offerings.

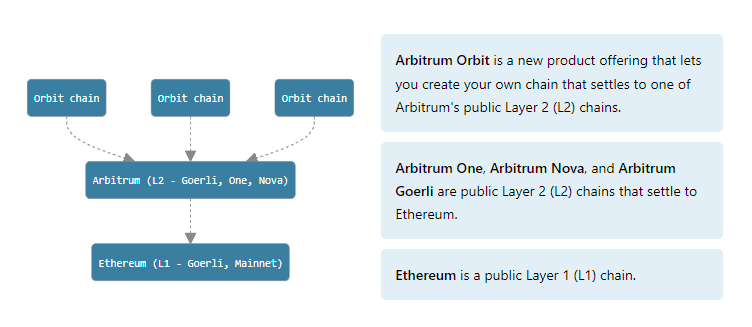

On the one hand, Polygon competes with other Ethereum Layer 2 scaling solutions. This includes projects like Optimism and Arbitrum, which use Optimistic Rollups, and zkRollups-based solutions like zkSync and StarkWare. Each of these platforms offers different approaches to scaling Ethereum, with trade-offs in terms of speed, security, and decentralization.

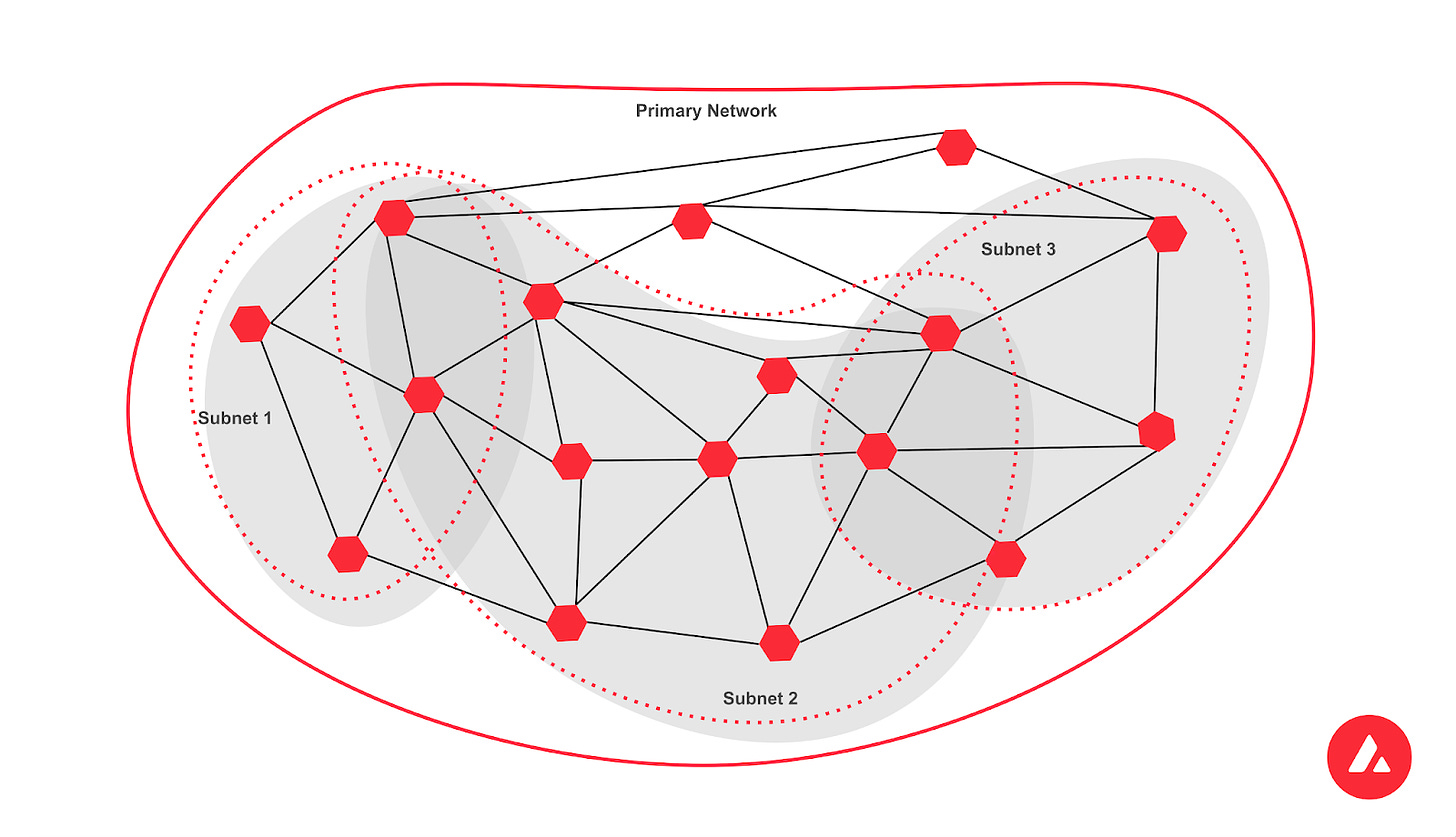

On the other hand, beyond Ethereum-based L2 solutions, Polygon also competes with other blockchain networks that aim to provide scalable and interoperable solutions. These include established players like Binance Smart Chain, Solana, and Avalanche, which have gained traction for their high throughput and low transaction costs.

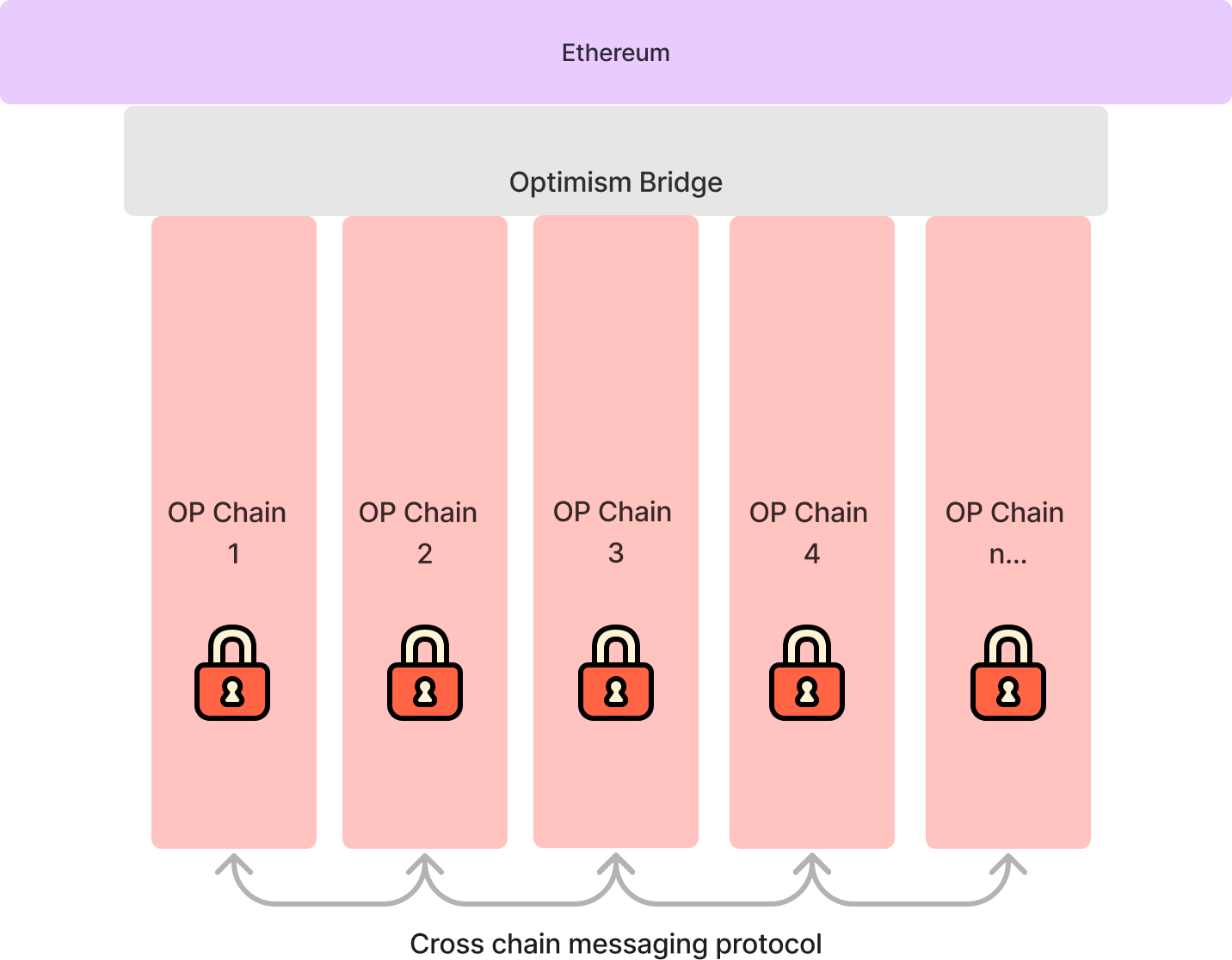

We are witnessing the advent of rollup chains building on top of Ethereum. Some of them are introducing their own roll-up frameworks, leading to a shared tech stack that enables more customized and usable infrastructure along with shared development tools.

However, since the OP-Stack launched its first rollup framework, other projects have announced their rollup frameworks as well. This can lead to more fragmentation, and since there is no established cross-chain interoperability solution just yet, each framework comes up with its own set of tradeoffs.

For example, dApps built on Optimism and Arbitrum can not talk to each other natively and organically, which fragments liquidity but also introduces bridging risks for users.

Amidst this backdrop, Polygon 2.0 stands out with its commitment to core principles like independent data availability, composable interoperability, near-instant finality, and unified liquidity. A key player in this scenario is the Polygon CDK, which we discussed at length earlier. The CDK offers modularity and scalability, focusing on liquidity aggregation, data availability, and interoperability. It allows dApps and chains within the Polygon ecosystem to talk to each other with far-reaching implications for both developers and users alike.

Polygon 2.0’s vision is to provide a high-performance Layer 2 scaling solution, prioritizing scalability and user-centric features. Developers gain the flexibility to tailor chains according to specific needs, ranging from execution environments to gas tokens, thus aligning with diverse project requirements.

Polygon 2.0’s approach to rollup interoperability is not just about connecting different chains; it’s about creating a cohesive, efficient, and user-friendly ecosystem. This ecosystem aims to bridge the gaps between various rollups, ensuring seamless interactions and transactions across them.

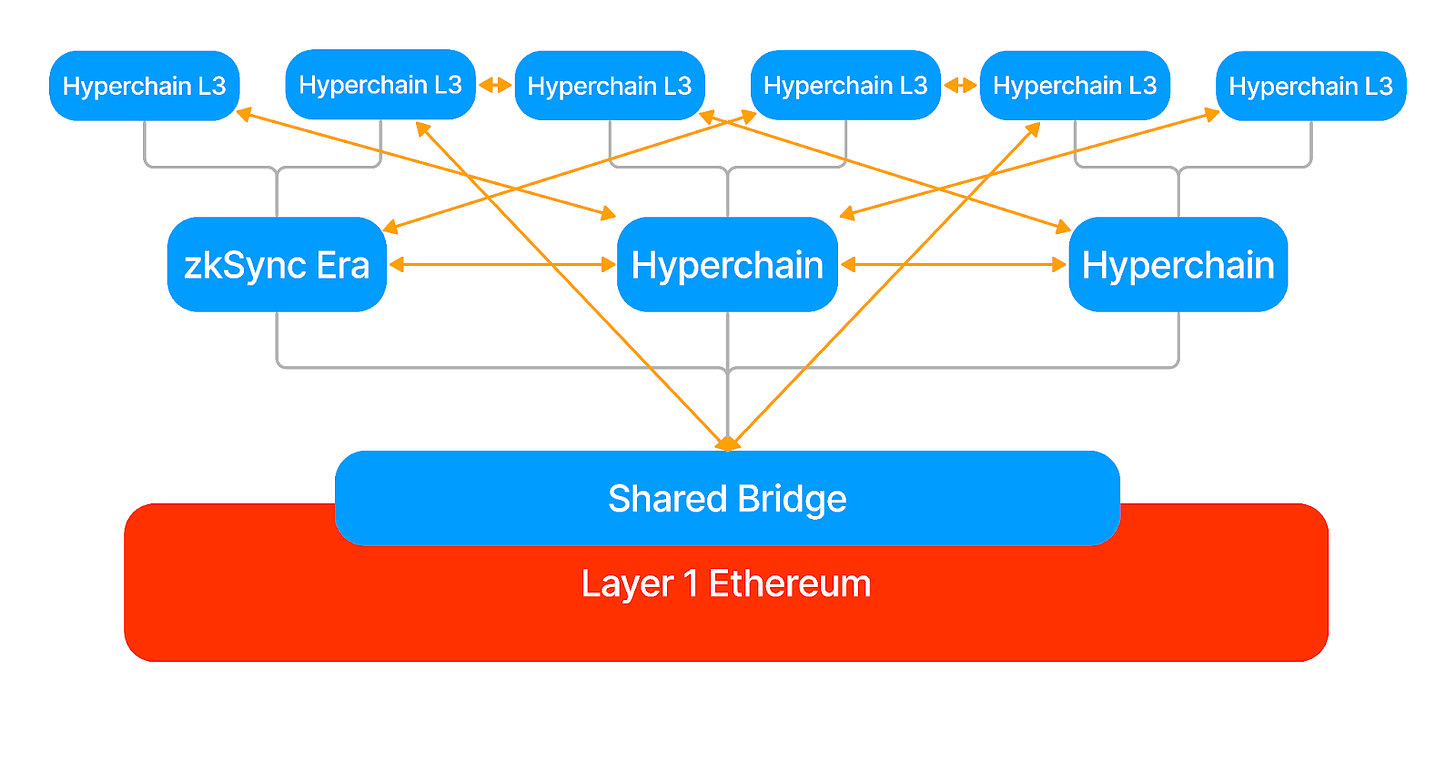

The rollup framework arena is becoming increasingly competitive, as various solutions vie to enhance scalability and reduce transaction fees within the Ethereum ecosystem. Key players like Optimism, Arbitrum, zkSync, and Polygon are leading the charge, each with distinct visions and strategies.

Source: Optimism Docs

Source: zkSync Docs

Source: Arbitrum Docs

Despite these advancements, rollup frameworks face challenges related to interoperability and decentralization. Many are operated by a single entity, controlling both sequencer and prover functions, raising centralization concerns. Interoperability within the same framework often depends on this central entity, and there is yet no clear advantage in interoperability between different frameworks. For instance, seamless interaction between OP-Mainnet and Base or between zkSync Era and Polygon zkEVM is not a reality at this moment.

To solve the issues of decentralization, utilizing a shared sequencer or prover can enable atomic interoperability, where a transaction in the source chain guarantees execution in the destination chain, enhancing decentralization and security.

When it comes to interoperability across different frameworks, exploring third-party interoperability solutions such as Polymer, LayerZero, Axelar, Hyperlane, etc., can offer more flexibility and speed, complementing safety-focused intra-framework solutions.

Polygon already features a broad ecosystem of dApps across multiple verticals, ranging from DeFi and RWAs to SocialFi and gaming. As a result, despite the migration to the Polygon zkEVM, the transition will be almost frictionless, avoiding the cold start problem of most L1s and L2s attempting to attract new projects.

Some of the most notable apps are listed below, and the number keeps growing. See Polygon ecosystem for more.

Despite the advancements in general-purpose rollups, there are still limits to scalability for L2 block space and L1 batch posting costs. For Polygon, the first use cases of building zkEVMs using the Polygon CDK (Chain Development Kit) are now coming to fruition. As an example, the Polygon CDK facilitates the development of specific appchains that require tailored functionality such as fast finality for DeFi, low latency for gaming, privacy for enterprise blockchains…

For instance, most recently Canto announced a migration from being an L1 in the Cosmos ecosystem to becoming an L2 focused on RWAs.

We're thrilled to announce Canto is building with @0xPolygonLabs to migrate to a ZK L2 on Ethereum– powered by Polygon Chain Development Kit (CDK).

This ZK chain will be dedicated to Real World Assets in support of the next wave of application-layer adoption via neofinance. pic.twitter.com/x04dMIHsg7

— Canto (@CantoPublic) September 18, 2023

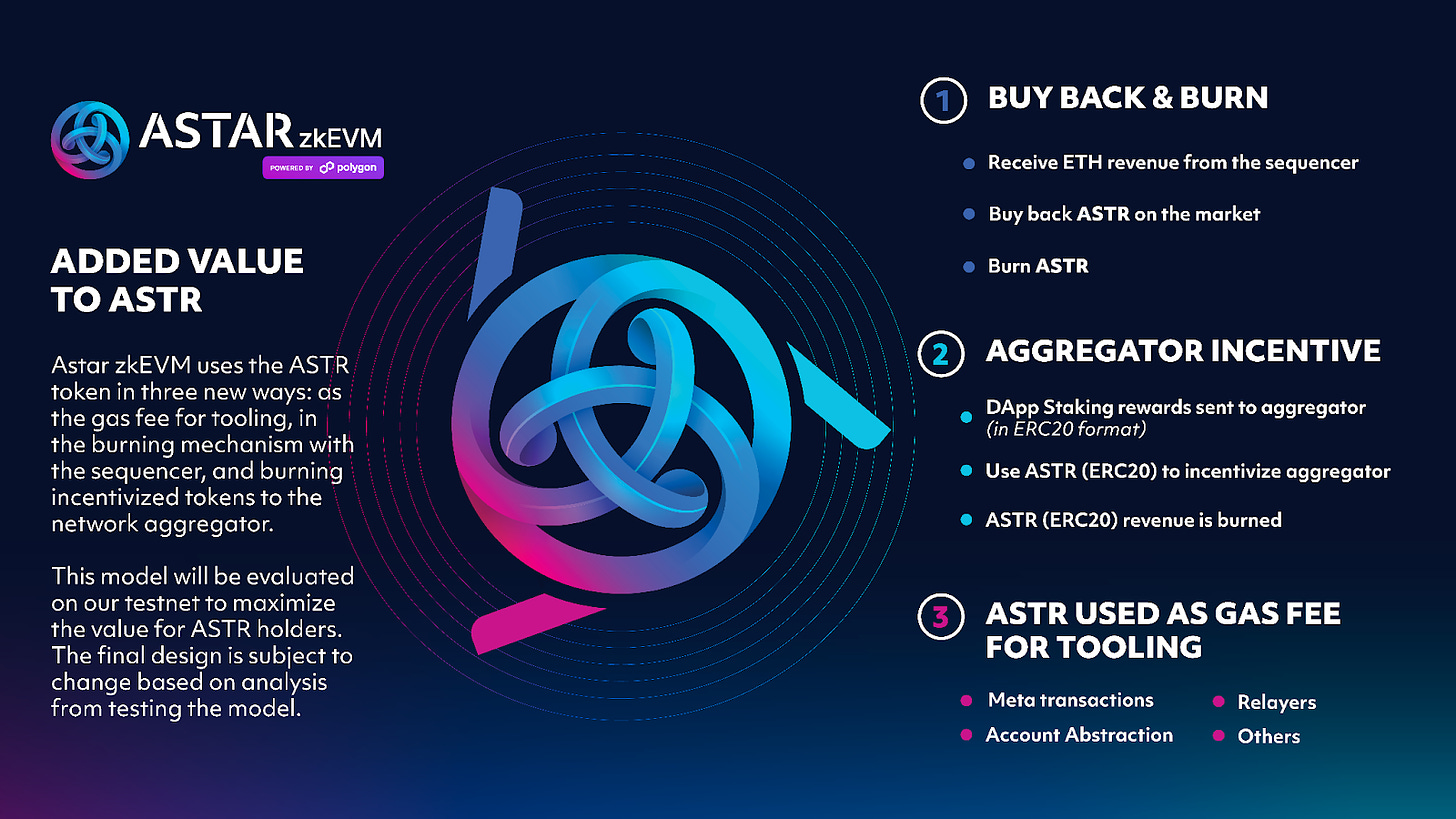

Another recent development involves Astar, which is the most widely used parachain in Polkadot and extremely popular in Japan. They announced the Astar zkEVM using the Polygon CDK and supporting various features powered by the Polygon CDK-based Gelato RaaS (Rollup as a Service) platform. The highlights of Astar’s new zkEVM imply using $ETH as the gas token but collecting sequencer revenue to buyback and burn $ASTR, which will be used as an incentive for aggregators as well as for payments in tooling.

The Polygon CDK is the access point for developers to unlock the benefits of Polygon 2.0: infinite scalability and unified liquidity. From the Polygon zkEVM to Immutable and CapX, we are seeing more and more projects taking advantage of building their L2s on the Polygon CDK, such as Gnosis Pay, Aavegotchi, Manta Network, Idex, or Palmfdn.

In addition to the projects above, Polygon also achieved a remarkable milestone by partnering with Near. Polygon Labs and the NEAR Foundation are teaming up to develop a ZK prover for WASM chains in order to bridge the gap between the WASM-based chains and the overall Ethereum ecosystem.

This integration puts together the two specialties of both projects, namely Polygon’s expertise in ZK and Near’s expertise in WASM. In simple terms, this will enable zkWASM, a new runtime environment to generate ZK proofs for native WASM.

This partnership signifies the growing interconnectedness of EVM and WASM chains, helping WASM chains align with Ethereum. This alignment includes features like allowing Cosmos ecosystem chains to pay gas fees in $ETH and facilitating the launch of WASM-based appchains with lower data availability costs

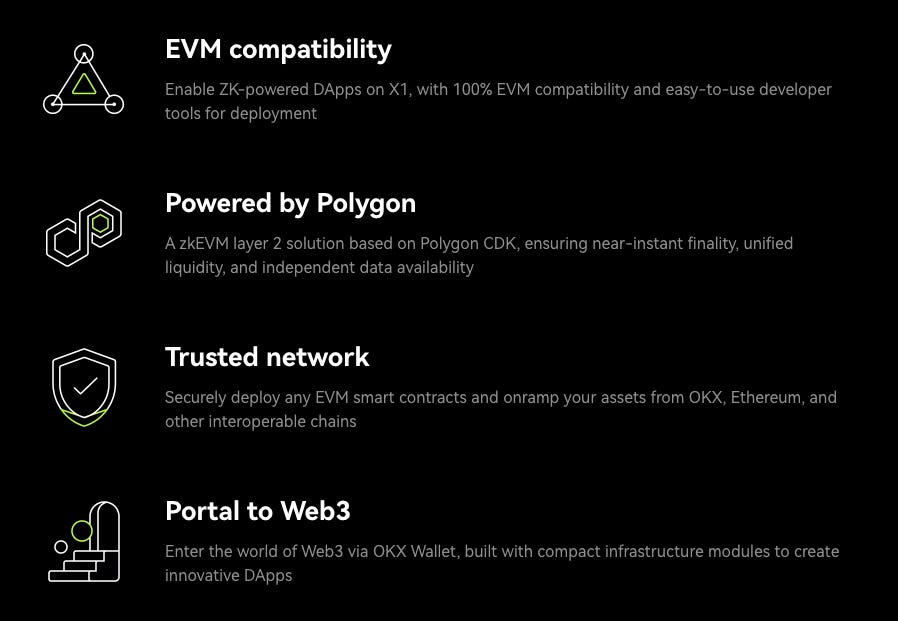

What’s more, this trend seems to be just kicking off. It is not just crypto-native projects that are exploring the Polygon CDK. OKX announced X1, a ZK-powered L2 that connects OKX, one of the largest exchanges, with the Ethereum community, using $OKB as the X1 native token, allowing users to move value seamlessly between OKX and X1.

Polygon’s influence extends beyond the blockchain space to India’s burgeoning IT industry and crypto ecosystem. India’s expertise in technology, combined with its growing adoption of cryptocurrencies, positions Polygon strategically to leverage these developments. Initiatives like the Nailwal fellowship are a testament to Polygon’s commitment to nurturing talent and fostering innovation within the Indian market.

It is often said that Polygon has one of the most competent Business Development teams in crypto. The reality is that even without being an L2 and despite increasing L1 competition, Polygon PoS has stood out from other competitors by onboarding a broad range of companies.

The low fees and high transaction speeds make it very attractive for real-world businesses to build on top. Arguably, you could say that for every alt L1. With Polygon’s transition to a validium, scalability will be enhanced significantly. However, the key differentiator stems from its versatility to offer many solutions, from Polygon zkEVM to Miden, Polygon ID, and Supernets.

The transition from Polygon PoS to validium mode also validates Polygon’s commitment to expanding the Ethereum ecosystem and leveraging its existing user base and network effects.

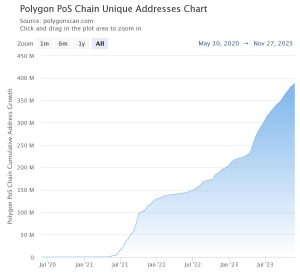

Polygon’s track record is a testament to its allure for businesses, driven by a history of successful partnerships and an average of ~400,000 daily active addresses, recording over ~$2M transactions per day. Excluding Ethereum, it is the network with the highest activity.

The network is actively utilized in various market sectors beyond DeFi, the most representative being the tokenization of RWAs.

The network is also used in the public sector by governments and public and local agencies interested in experimenting with blockchain technology.

Polygon is also actively collaborating with tech companies such as Opera’s Crypto Browser. Adobe’s creator community Behance has also adopted Polygon PoS. At the same time, SK Telecom, the largest telecommunication firm in South Korea, supports Polygon PoS in its NFT marketplace and upcoming crypto wallet. There are partnerships with hardware companies as well, such as Nothing, which plans to integrate Polygon’s products into its Nothing smartphone OS (Operating System).

The variety of use cases expands to gaming as well, a market sector that has the potential to unlock mass adoption for Web3. While there are many other blockchains embracing Web3 gaming, Polygon offers a very strong value proposition thanks to its large user base. Moreover, game publishers can choose to build their custom chain with Polygon Supernets instead of deploying as a dApp on the public network. This solves challenges such as liquidity and user fragmentation. Operating as an L2 based on Ethereum can address these challenges.

Some examples of existing games utilizing Polygon PoS include The Sandbox, Decentral Games’ Ice Poker, Intella X, or Delabs Games. On the other end, Nexo, the largest gaming platform in Korea, is developing Maple Story N through Polygon Supernets. Not only that, but Immutable X (known for its gaming-specific blockchain) has recently collaborated with Polygon Labs to introduce the Immutable zkEVM (currently on testnet).

NFTs are tokens that represent digital ownership. The key benefit is when all complexities are abstracted away and customers don’t even realize that they are interacting with a blockchain. That makes them one of the easiest technologies for traditional Web2 companies to adopt and get started with a Web3 strategy.

Regardless of the underlying use case of the NFT, user lock-in is critical for these companies. In this regard, NFTs offer unique advantages that are not possible with standard loyalty programs. However, for this to be effective, there is a requirement that the blockchain does not degrade the user experience. Otherwise, it could have the opposite effect. So far, real-world examples suggest a successful implementation of NFTs into the Polygon ecosystem.

Polygon has become the go-to chain for gambling and prediction markets. Protocols like Polymarket or Azuro started their journeys on Polygon and expanded later on to other chains. The network effects of the existing user base and native support for stablecoins were key factors to take into account.

SocialFi

Polygon is also the chain chosen by Lens, a portable web3 social graph and one of the leaders in the SocialFi sector.

Achieving mass adoption in blockchain requires a strategic approach that combines the strengths of various blockchain network models. The unified security, scalability, and seamless interoperability offered by the combined approach position it as a promising model for widespread blockchain adoption.

Some blockchain networks, like Solana, Sei, Aptos, and Sui, opt for optimizing a single chain. The advantage here is seamless composability among different decentralized applications (dApps) within the chain. However, this approach may face limitations in network performance due to the lowest-performing nodes and potential centralization as nodes require high-spec hardware for scalability.

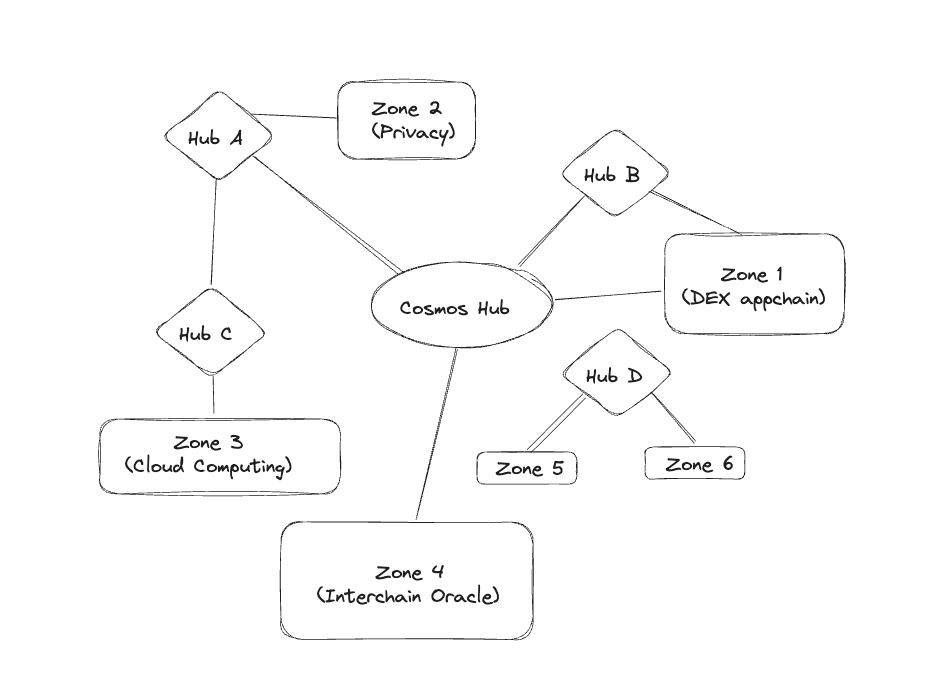

Other networks such as Cosmos, Polkadot, and Avalanche take a different route by creating an ecosystem comprising multiple Layer 1 (L1) networks with cross-chain protocols. While theoretically scalable through parallel scaling, this approach can lead to reduced composability and ecosystem fragmentation due to the asynchronous nature of various networks.

Source: Cosmos Hub

Source: Polkadot

Source: Avalanche

Most recently, L2s like Optimism, Arbitrum One, and Starknet, focus on vertical scalability through roll-up technology. This involves performing computations off-chain while benefiting from the security of the base layer. Even though this approach offers high composability within one network, it may have limitations when scaling vertically using the same structure.

In addition to Polygon Chains, several prominent roll-up networks, including Optimism’s OP Stack, Arbitrum’s Orbit, zkSync’s ZK Stack, and Starknet’s Fractal Scaling, also aim to improve scalability both vertically and horizontally

Polygon 2.0’s advances towards combining elements from the above methods, harnessing their respective strengths. In this model, multiple Layer 2 (L2) or Layer 3 (L3) networks share the same base layer. This approach offers unified security at the base layer, theoretically unlimited scalability through parallel networks, and seamless interoperability and composability.

Source: Polygon Docs

The major difference is that all Polygon solutions will share a common layer, i.e. the Staking Layer and the Interoperability layer. Other zkEVM, zkEVM Validium, and Supernets will build on top of this base layer, with transactions across all solutions being processed in parallel, allowing for better scalability.

In a reply to a tweet comparing TVL across zkEVM L2s, Sandeep has already hinted that “there is no rule that an existing token can’t do a massive airdrop.”

https://twitter.com/sandeepnailwal/status/1656262074950094850

Crypto is still a nascent and small industry. The market cap of all crypto combined is still smaller than Amazon. As the rate of adoption increases, Polygon is in a unique position to bridge the Web2 and Web3 worlds. It already has a first-mover advantage in partnerships with leading and global Web2 companies like Starbucks, Reddit, Nubank, Adidas… In other words, some of the largest brands in the world are already putting their chips into Polygon as their blockchain of choice, whether it is for consumer applications or for bridging the realms of TradFi and DeFi.

These brands have millions of users. Starbucks has over 30 million active members worldwide. Adidas has over 1.5 billion followers on social media. Nubank has over 50 million customers. Reddit has over 50 million daily active users. Disney has over 190 million Disney+ subscribers…

Not only are these brands trusted by their users, but they also have spent years building trust with their users. When these brands partner with Polygon, it sends a signal to their users that Polygon is a reliable platform for them to get onboarded onto Web3.

Originally, $MATIC has been used as the staking token to reward validators of the Polygon PoS. The token is also used for paying transaction fees.

Initially, the total supply contemplated 10,000,000,000 $MATIC, of which more than 9,300,000,000 are already in circulation. The Polygon 2.0 upgrade will also introduce an annual 2% inflation, which is significant when it comes to having a competitive advantage over other L1s that cannot afford to have such a low inflation rate (Solana and Aptos have ~6% inflation rate, for Avalanche it is ~7%, for Near it is ~5%…) – note that these numbers change as a result of burning mechanisms or token unlocks.

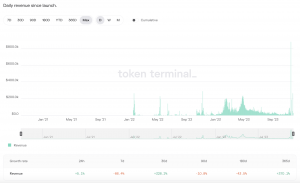

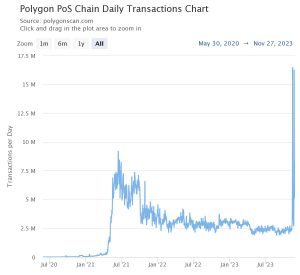

It is also important to note that Polygon implements EIP-1559. For instance, almost $1M $MATIC was burnt as a result of the 17M transactions that took place on November 16. Even though this burn is unusual (7x higher than the historical ATH), it contributed to 3% of the cumulative burn. So far, $27.4M $MATIC has been burned.

Daily fees since launch for Polygon PoS. This represents the total transaction fees paid by users.

Daily revenue since launch for Polygon PoS. This represents the share of transaction fees that are burned (accrue to $MATIC holders).

Daily expenses since launch for Polygon PoS. This represents the total on-chain expenses for the protocol (currently only includes token incentives).

Daily-earnings since launch for Polygon PoS. This represents revenue minus token incentives.

Most recently, Polygon PoS handled 16+M transactions, with a peak throughput of 255 tps, which is around 2-3 times the entire Ethereum ecosystem combinated.

The total transaction fees generated on Nov 16 was ~$1M. Block rewards totalled more than 155,000 MATIC.

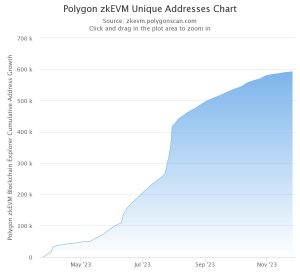

There are signs of growth in Polygon PoS in parallel to the development of Polygon’s zkEVM.

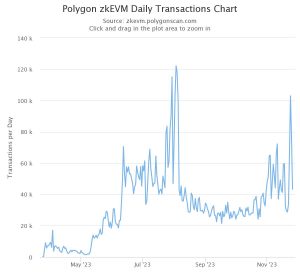

The number of unique addresses has been consistently increasing on Polygon’s zkEVM.

Daily P/F ratio (Fully Diluted) vs. Daily P/F ratio (Circulating) since the beginning of the year for Polygon PoS.

Daily P/S ratio (Fully Diluted) vs. daily P/S ratio (Circulating) since the beginning of the year for Polygon PoS

Polygon is building something that there will be very little competition for once it is complete, and the current data does not include any of that future state.

As we conclude our exploration of Polygon 2.0, it’s clear that Polygon is not just evolving; it’s fundamentally reshaping its value proposition. The introduction of technologies like Polygon zkEVM, Miden, Polygon ID, and Supernets underlines a commitment to versatility and functionality, catering to a diverse range of applications and use cases.

The key to Polygon’s success has been being an attractive platform for a wide variety of businesses across the globe. The ecosystem has already laid a strong foundation for businesses to thrive, ranging from fintech to gaming companies. Most notably, Polygon excels in both technical expertise and financial backing, which is a rare combination in the industry. This dual strength positions it for long-term success.

At this time, Polygon is in a unique position to leverage both its track record with partnerships and years of experience in production. With the Polygon 2.0 upgrade and the $POL token migration, it is poised for further growth if adoption catches up.

The exciting aspect about the pieces of the puzzle that comprise Polygon 2.0 is that it is starting to resemble a one-stop shop for builders that solves some of the existing issues that have been widely discussed over the last few years and in this report.

Our view is that providing these components under one umbrella along with the interoperability layer is going to ignite significant demand in building within the Polygon system.

Revelo Intel has never had a commercial relationship with Polygon and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.