Published: November 1, 2023

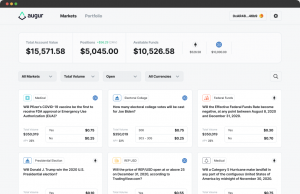

Prediction markets were one of the first use cases for crypto, becoming very popular during the ICO era with projects like Augur. However, stablecoins were not mainstream back then, and oracles were not consolidated or mature enough yet.

The development of prediction markets in crypto has also faced regulatory challenges, especially in the United States. These challenges stem from concerns about gambling laws and potential manipulation. Regardless, betting markets could also improve our governing institutions – a prediction worth testing.

We believe that it’s no coincidence that Vitalik has shown optimism in this market sector for so many years. It comes to no surprise that so many projects had worked on tackling this problem during the early days of Ethereum. Now that there are multiple stablecoins and oracles with staying power, we argue that there is no better time to start placing bids on this market sector.

The prediction markets, if those count as defi.

— vitalik.eth (@VitalikButerin) November 3, 2020

In this report, we will explore the reasons behind the renewed interest in crypto prediction markets, emphasizing their unique advantages over traditional counterparts.

The specific valuation estimates and competitive analysis about existing projects working in this field will be presented in a separate report.

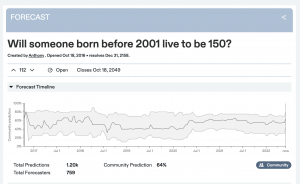

Prediction markets are a type of derivative market where participants can bet or speculate on the outcome of various future events, ranging from political elections and sports events to financial market movements and even more obscure or niche predictions. Essentially, they enable betting on virtually anything. They provide a valuable tool for risk management, decision-making, and gaining insights into future trends.

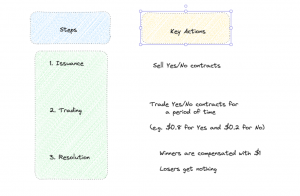

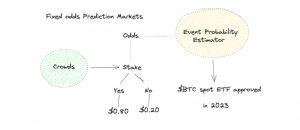

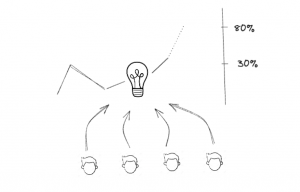

These markets operate on the principle of the wisdom of crowds, harnessing the collective knowledge and insights of participants to forecast outcomes. Most often, prediction markets take the shape of binary options, where the outcome is either 1 or 0. They work by allowing people to buy and sell contracts that pay out depending on the outcome of a future event. For example, someone might buy a contract that pays $1 if the $BTC spot ETF is approved before the end of the year, or sell a contract that pays $1 if the ETF is not approved in 2023.

As more people buy and sell, the prices of prediction market contracts change to reflect the collective belief of the market participants. For instance, if a contract that the $BTC spot ETF will be approved before the end of the year is trading at $0.80, this means that the market believes there is an 80% chance of this event happening.

From our analysis, crypto can offer a unique opportunity to leverage the full potential of this derivative instrument, ranging from speculation to insurance. Think of trivial use cases such as lending $USDT and betting that it will depeg as a way of getting insurance on your deposit.

It’s a game of skill that produces socially valuable information as an output. 🙂

— vitalik.eth (@VitalikButerin) November 3, 2020

Prediction markets can be used to predict a wide range of events, as well as to elicit information about people’s beliefs about future events. This has several advantages over traditional forecasting methods, such as pools and surveys:

Most often the business model for decentralized prediction markets will consist in collecting fees from traders and market creators. As a result, the earnings can be calculated subtracting token emissions from the revenue generated by the protocol.

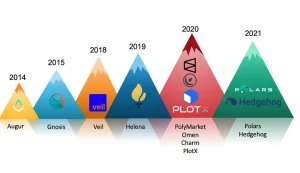

In crypto, prediction markets have evolved over the years. Founded in 2014 by Joey Krug and Jack Peterson, Augur became the first prediction market on Ethereum. The native token was $REP, which stands for “Reputation”. The token was used for staking and reporting on the outcomes of events, while users could create and trade prediction markets on various topics.

One year later, Gnosis, founded by Martin Köppelmann and Stefan George, introduced another Ethereum-based prediction market platform. Instead of staking, Gnosis relied on a unique Dutch auction mechanism for determining event outcomes.

Started in 2020, Polymarket has recently entered the scene and gained popularity for its focus on political and current events prediction markets. Most notably, users can trade in $USDC, making it more accessible to mainstream users.

Outside of crypto, offshore centralized providers often set limits and cap how much size you can bet on a specific outcome. This mirrors the challenges seen in the sports betting industry, limiting the ability of individuals to leverage their insights and intuitive skills. Crypto prediction markets eliminate these barriers, empowering users to capitalize on their unique knowledge without arbitrary limitations.

Everywhere we look we can find opportunities for betting on unpredictable outcomes. The logic of prediction, combined with betting instincts, is not only implicit in gambling applications but also in lotteries and insurance contracts. But outside of crypto, the final say is at the whim of centralized operators.

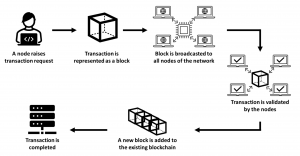

Using a blockchain and decentralized ledger is a game changer in this regard, as it allows for the creation of global and open markets that effectively discard centralized operators. For a prediction market to thrive, the most important properties are transparency and offering an uncheatable platform for users. Unlike other use cases, such as exchanges, DeFi has a competitive advantage over centralized incumbents.

With data and information available on-chain, smart contracts can protect the rights and interests of participants to the greatest extent.

Crypto prediction markets redefine market creation, enabling anyone to propose and bet on virtually anything. This flexibility is highly attractive for the existing user base. Unlike traditional markets, crypto prediction markets are not bound by predefined events, providing a dynamic platform for speculation.

When you buy a lottery ticket or gamble on a sports event, there is only one way to participate, which is by buying the ticket or placing a bet. This is a black-or-white result for any given player. But with decentralized markets, participation is two-fold: as a trader or as a liquidity provider. Not only can users trade on the outcome of a certain event, but they can also create events, provide liquidity, or participate in reporting the outcome of events.

Traditional prediction markets operated by centralized entities are also responsible for determining what markets you can or cannot trade. In other words, it is impossible to bet on events that are not listed in the marketplace.

Crypto offers a solution to this problem, enabling a new business model for market creators. Anyone from anywhere in the world can create a new market at any time. This unlocks the opportunity to bet on anything, which is highly attractive for the current user base in crypto.

Ranging from politics to sports, economy, culture, or entertainment, decentralized prediction markets offer a highly versatile revenue stream for market creators.

As an example, Vitalik Buterin proposed using prediction markets to create a decentralized content moderation mechanism, addressing the challenges of identifying and filtering out malicious or undesirable content on social media platforms. This makes it possible to efficiently filter out malicious content while addressing the limitations of centralized moderation.

To avoid the risks associated with a centralized moderator (e.g., insider trading on the betting markets), the proposal suggests using a decentralized autonomous organization (DAO). A decentralized DAO can enhance transparency and credibility, making it less susceptible to manipulation. While there is a possibility of manipulation, such as users upvoting their own content, the scheme introduces a cost to manipulation and creates arbitrage opportunities for users willing to vote/bet against manipulative actions. This can deter manipulation attempts as well.

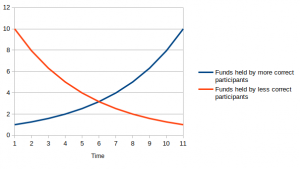

When it comes to blockchain-based prediction markets, instead of assuming that market efficiency results from the majority of participants being rational, we view it as an outcome of evolutionary dynamics within the industry.

The cryptocurrency industry is still nascent and relatively young. Additionally, it remains a niche technology sector that is still highly disconnected from mainstream financial markets. Moreover, it lacks expertise in fields such as electoral politics. Consequently, the promise of prediction markets might not fully materialize just yet.

Nonetheless, this disconnect can create opportunities for participants to gain an edge through accurate predictions. The outcome of prediction markets serves as a form of natural selection. Participants who correctly predict events like election outcomes can experience capital growth, while those who make incorrect predictions face capital losses.

Unlike traditional assumptions about human rationality and learning, this perspective doesn’t rely on participants “getting wiser” or learning from their mistakes. Instead, it focuses on the outcomes of their predictions. This highlights some advantages that prediction markets have over stock or commodities markets in terms of producing accurate signals: in prediction markets, prices are bounded between 0 and 1, limiting the impact of outlier events and reducing noise in the signal.

Considering that you can create your own markets, this opportunity is even more attractive as more participants join the industry. As more people realize that prediction markets work correctly, their fears will slowly disappear, making them more inclined to participate.

From our viewpoint, the market opportunity for prediction markets is being significantly underestimated. The derivatives markets cater to over a quadrillion dollars in size. Obviously, there are multiple derivative instruments involved, and not all of them are of the same size.

However, we have seen over and over again how those projects that make it big in crypto are the ones that leverage the existing user base rather than speculating on a TAM (Total Addressable Market) that is not here yet and might never set foot in this industry. Consider for example interest rates derivatives and fixed income, which encapsulate more than $400T in TradFi, and contrast that with the lack of product-market fit they have found in crypto so far.

In traditional markets, there are often debates about efficient markets, where the prevailing market price should theoretically reflect all available information. However, skeptics of prediction markets question this efficiency in traditional prediction markets due to limitations such as low bet limits and high fees, which might discourage well-informed participants from correcting mispriced tokens.

However, this is not the case in blockchain prediction markets. They do not impose bet limits and have lower fees, allowing for better nuances of information dissemination in the digital age.

Something something if you disagree, it's free money so you should go and participate?

(And I'm saying this as someone who actually has already made a bet on the election result😃)

— vitalik.eth (@VitalikButerin) September 3, 2020

Considering that there is a US election year around the corner, we anticipate increased interest in prediction markets. The conditions for political meme assets to thrive were not present during the last presidential election cycle. However, the landscape has significantly evolved since then. We have already experienced memecoins and NFT collections achieving 9 figures and even 10 or 11 figure valuations. Donald Trump’s presence in the crypto space, through an NFT collection and associated Ethereum address, can draw his supporters into the crypto world, potentially benefiting meme coin projects related to him.

1. Bets on prediction markets correctly incorporate the possibility of heightened election meddling, voter suppression, etc affecting the outcome, but statistical models just assume the voting process is fair

(This is the pro-prediction-market explanation)

— vitalik.eth (@VitalikButerin) November 3, 2020

Our belief derives from the fact that the U.S. election cycle will attract speculative capital due to global attention and social energy around it. In addition to that, consider the advent of markets such as deadlines for ETF approvals, geopolitical conflicts, price and interest rate predictions…

So far, on-chain prediction markets have been highly niche, and very few people, particularly very few people who know much about politics, have easy access to cryptocurrency. However, with crypto being on the radar more than ever before (SBF prosecution, $BTC spot ETF, stablecoin legislation…), this can drastically change in 2024.

While some argue that prediction markets should resemble casinos, there are distinctive use cases for token utility within this ecosystem. Innovative models like Rollbit’s buyback-and-burn mechanism highlight the potential for deflationary token economics. However, specific tokens for prediction platforms can allow for novel and unique use cases.

In standard prediction markets, the actual statements on which traders bet can sometimes be ambiguous, leading to situations where both sides believe that they should win. However, by definition, a binary outcome implies that one side wins at the expense of the other side’s loss. Therefore, a dispute resolution mechanism is needed, so that there is a way to disintermediate in a decentralized way.

For instance, governance token holders can use their tokens to participate in on-chain voting processes to resolve disputes. When a dispute arises, token holders cast votes to decide the outcome, such as whether a proposed change should be implemented, a contentious decision should be reversed, or a dispute between parties should be settled.

Token holders can propose solutions or decisions to resolve disputes by submitting governance proposals. Other token holders then vote on these proposals, and the outcome with the majority of votes determines the resolution. This ensures that participants have a vested interest in the outcome and discourages frivolous disputes.

Regardless of the ultimate decision made by the DAO, all dispute resolution actions and outcomes can be recorded on a transparent and immutable blockchain, providing an auditable and tamper-resistant history of decisions.

Provided that we are wrong in our thesis that prediction markets will become a dominant market sector in the upcoming years, we still don’t think that demand for speculative vehicles is going anywhere.

The interconnected nature of human psychology and gambling is complex. Gambling activates the brain’s reward system, releasing dopamine. This creates a powerful craving to gamble again, even when people know that the odds are against them. Some people also enjoy the thrill of taking risks and the feeling of excitement that comes from gambling (the “gambler’s high”). Escapism, socialization, competition, the illusion of control, near misses, chasing losses… The reasons for engaging with these markets are endless.

However, that does not mean that speculation cannot take other forms. For instance, in the case of a presidential election, it could be the case that the demand for prediction markets is overshadowed by existing products in crypto, such as meme coins or fan tokens representing candidates.

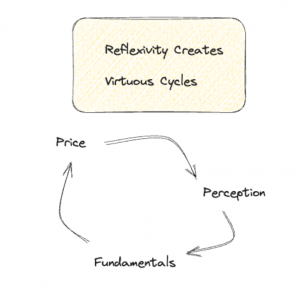

Compared to prediction market shares, crypto has shown us that meme assets clearly have unique advantages: unbounded upside, easier accessibility, less regulatory friction, and greater reflexivity.

Political meme assets and social tokens can become tribal affiliations and social statements, similar to the AMC and GME movements catalyzed by anti-Wall Street sentiment. In this context, we highlight the power of high valuations to attract attention, generate FOMO (fear of missing out), and foster reflexivity, especially for news-driven meme assets.

Political meme assets and social tokens can become tribal affiliations and social statements, similar to the AMC and GME movements catalyzed by anti-Wall Street sentiment. In this context, we highlight the power of high valuations to attract attention, generate FOMO (fear of missing out), and foster reflexivity, especially for news-driven meme assets.

We have already noticed how old narratives, like RWAs, can rise from the ashes and give birth to market leaders under very specific market conditions. With a $BTC spot ETF decision and an upcoming election year, there is no better time to delve into the intricacies of prediction markets and pick up those projects that will eventually dominate the sector.

One of the fundamental strengths of crypto prediction markets lies in their decentralization. Unlike traditional prediction markets controlled by centralized entities, crypto prediction markets operate on blockchain networks, enabling anyone, anywhere in the world, to create and participate in markets. This democratization of market creation opens up limitless possibilities for speculation, appealing to the global crypto user base.

Revelo Intel has never had a commercial relationship with any project mentioned in the content above and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.