Published: September 12, 2023

InfinityPools is a decentralized exchange that can offer trading for any asset with unlimited leverage, no counterparty risk, and no risk of liquidation. Similar to Uniswap’s breakthrough, InfinityPools stands out because it offers an unparalleled improvement over anything currently available in both the TradFi and DeFi realms.

Over the past years, the DeFi (Decentralized Finance) landscape has undergone significant transformation, particularly with the advent of Layer 2 scaling solutions. These innovations have addressed some of the scalability and cost issues associated with Ethereum, which had hitherto been a significant barrier to the development of complex financial derivatives in the DeFi space.

Initially, Layer 2s and other scaling solutions appeared to hold the promise of fostering a new era of innovation in DeFi, enabling the creation of structured products, options Automated Market Makers (AMMs), and perpetual futures that could not have thrived on Ethereum due to high transaction costs. There was a general sentiment that these developments could offer improved solutions over existing DeFi protocols, and even potentially rival centralized exchanges in terms of product offerings and efficiency.

However, as the market matured, it became evident that many of the new products and protocols that emerged in this period did not bring any substantial innovation to the table. Most of these were mere replications of existing financial derivatives, such as perpetual futures or options, without any meaningful improvements. Moreover, they often provided a worse user experience compared to centralized exchanges, characterized by lower leverage, wider spreads, and higher costs. This essentially meant that they could not compete effectively against established players, even after the downfall of some centralized exchange giants like FTX.

This phenomenon, where a wave of new products and protocols emerge but do not offer any real value or improvement over existing solutions, can be described as a cycle of pseudo-innovation. In such a cycle, despite the hype and high expectations, the market eventually realizes that the new offerings are essentially rehashed versions of existing products and cannot compete effectively with incumbents. This serves as a cautionary tale for investors and underscores the importance of critically evaluating new protocols and upcoming primitives.

Despite the presence of cycles of pseudo-innovation, DeFi has already witnessed groundbreaking zero-to-one moments, where genuine innovations have created entirely new possibilities and fundamentally transformed the industry. Uniswap stands as a quintessential example of such a zero-to-one moment in DeFi. By offering 10x more assets and 10x faster listings than centralized exchanges, Uniswap marked a paradigm shift in the way asset exchanges are conducted.

Traditional perpetual exchanges in DeFi have struggled to compete with centralized exchanges due to inherent limitations. For instance, both AMM and order book models often fall short in providing the necessary liquidity and efficiency, and Automated Market Makers (AMMs) typically rely on price oracles that fetch prices from centralized exchanges, which somewhat undermines the decentralization aspect. Furthermore, the use of oracles and long-tail assets has often led to an increased attack surface, making them more vulnerable to manipulation and security breaches.

InfinityPools addresses these limitations by introducing a groundbreaking approach to perpetual futures trading. Unlike the traditional models, InfinityPools facilitates the trading of long-tail assets with leverage, without the need to rely on oracles. This innovation does have the potential to significantly disrupt centralized exchanges by allowing users to trade a more extensive range of assets with leverage in a decentralized and secure manner.

Notably, InfinityPools boasts five distinct 10x improvements over traditional DeFi offerings:

Decentralized Finance (DeFi) has proven to be a disruptive force in the financial industry. However, as with any nascent industry, it has its set of challenges that need addressing to realize its full potential. A key issue is that many DeFi protocols rely heavily on external elements such as oracles, which introduce counterparty risk and limit the extent of improvements that can be achieved compared to traditional finance (TradFi) or Web2.

DeFi’s promise lies in its potential to provide a more open, efficient, and decentralized alternative to traditional financial systems. However, several DeFi protocols have not been able to fully capitalize on these benefits due to the following reasons:

In addition to that, it is essential to highlight the primary barrier that has so far hindered mainstream adoption of DeFi: security. Over $3.8 billion was stolen through exploits in DeFi protocols and bridges in 2022. Well-regarded teams with best practices were not exempt from these security breaches. For DeFi to gain mainstream adoption, security has to be at the forefront of the development of these protocols.

To unlock the true potential of DeFi and realize exponential improvements over traditional financial systems, it is crucial to design protocols based on first principles. This involves simplifying protocols to their most fundamental components, known as primitives. Ideally, a primitive should have zero external dependencies other than the blockchain on which it is deployed, meaning no governance, no upgradeability, and no reliance on oracles. Such primitives are immutable, governance-less, and carry zero counterparty risk.

By reimagining primitives with no external dependencies, DeFi protocols can drastically reduce their attack surfaces and mitigate the risks associated with these dependencies. This approach aligns with the concept of building on first principles, where the focus is on establishing a strong and simplified foundation. This foundation allows for the creation of more robust and efficient systems that can significantly outperform their Web2 and traditional finance counterparts by minimizing complexities and vulnerabilities.

As an example, primitives such as InfinityPools allow protocols to build structured products on any asset, immediately and without requiring permission. This fosters innovation as developers have the flexibility to create novel financial products tailored to diverse asset classes without being hampered by bureaucratic hurdles or paying a spread to market makers. Not only that, but structured products on top of InfinityPools also offer higher capital efficiency, since 100% of the assets can be deployed and users can either withdraw immediately and pay a fee, or withdraw gradually over a period of time.

In the world of DeFi, there is an abundance of protocols and platforms that claim to offer groundbreaking solutions. However, not all live up to the hype, and often the claims are more marketing ploys than actual innovations. InfinityPools, however, is a standout exception in the landscape.

Perpetual futures are one of the few derivatives instruments that have found product-market-fit in the dynamic landscape of crypto. As a derivative, perpetual futures enable traders to speculate on the price of assets over time, without the constraints of settlement or expiration. While this innovation has been well-received, InfinityPools is taking it to an unprecedented level by addressing limitations that have impeded the evolution of perpetual futures trading.

Where standard perpetual futures platforms impose limitations in leverage, and asset listings, and are susceptible to liquidation risks and dependence on oracles, InfinityPools makes a paradigm shift.

There are two sides: liquidity providers and traders.

We can see how liquidity providers are incentivized with a continuous and higher yield than what they would be earning in the underlying Uniswap pools. Even when their liquidity is out of range, they will continue accruing yield by virtue of being lent out to borrowers who pay interest.

For traders, they can post a predetermined amount of collateral and stay away from the risk of default. They will pay on-going interest to keep their loan positions open and repay their loans in either of the base assets that make up the LP.

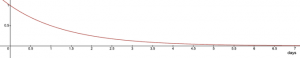

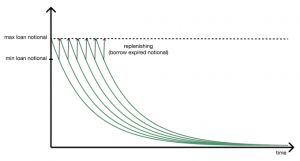

In the backend, an off-chain matching engine acts as an interest rate router in a peer-to-pool manner. Each loan is unwound over a 7-day period with a half-life of 50%, meaning that 50% of the remaining position is exited every day (exponential expiry) and the full exit is reached by day 7.

In spite of this, a trader can opt to keep the loan open by paying an on-going funding, effectively topping up the notional position from decay.

Funding is a predetermined rate prior to opening loans and is deducted from the collateral per replenishing (ie. every time you borrow more, you pay the interest upfront for the newly borrowed assets).

Besides, traders can set an interest rate tolerance threshold where their loan will be automatically and gradually exited once that level is exceeded. In this situation the replenishment does not occur and, therefore, the original 7-day unwind happens.

On the flipside, LPs have two options to withdraw:

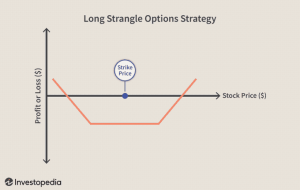

When funding is too cheap (implied volatility too low), arbitrageurs can borrow liquidity (which pushes up funding), go long and short simultaneously (aka. strangle), and exit once price moves into profit. This is analogous to betting on volatility with a long strangle position.

In other words, arbitrageurs come in when funding is perceived to be lower than the chance of X% price move, creating room to profit. This way, LPs are always paid at least the realized volatility rate.

In the realm of trading, especially in leveraged trading, one of the major challenges is managing margin efficiently. In conventional systems, if an asset’s price starts to fall, there is no assurance that the position can be sold at a sufficiently high price to repay the loan acquired through margin. The problem intensifies as the leverage ratio increases because a higher leverage ratio means a smaller amount of margin, which in turn results in smaller price movements placing the loan at risk of default. In such systems, this limits the practicality of high leverage ratios, as the threshold for the downward price move that risks default can be impractically small. As a matter of fact, this is one of the reasons why most exchanges heavily rely on insurance pools to cover shortfall events.

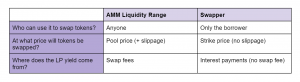

Insurance funds are not necessary for InfinityPools. The protocol addresses these limitations by securing spot liquidity in advance, which is essential for unwinding the leverage without incurring losses or defaults. In InfinityPools, leverage is created through a loan of concentrated Automated Market Maker (AMM) liquidity. Essentially, the trader borrows a liquidity range from a public pool and places it into their private pool, which only they have access to for executing swaps.

By borrowing a liquidity range, the trader essentially secures the spot liquidity required to unwind the leverage position. This ensures that the asset position can be sold for the exact amount of borrowed cash, regardless of market movements. This is because a liquidity range inherently has reserves backing it. Hence, borrowing liquidity is synonymous with borrowing the cash necessary to purchase the leveraged asset holdings.

With this system, InfinityPools essentially decouples the leverage ratio from the conventional limitations arising from spot liquidity competition. By securing the necessary spot liquidity beforehand, the system allows for significantly higher leverage ratios without the associated risks of liquidation or default that are prevalent in traditional systems.

One of the pioneering features of InfinityPools is the elimination of liquidations even when the spot price of an asset declines. Since traders borrow liquidity from a public pool and place it into their private pool, this private pool holds the liquidity for the duration of the loan.

The importance of this is that the asset position can be sold in the private pool just prior to repaying the loan, irrespective of how low the spot price has fallen in the market. Essentially, the private pool acts as a secured reserve that ensures the trader can always execute swaps for repaying the loan. This is extremely valuable for traders since they will not be exposed to liquidation penalties, which usually eat into traders’ expected returns and worsens their PnL.

Let’s work with the example where the current market price of $ETH is $2,000.

Assume a liquidity provider lends out an ETH/USDC LP token on InfinityPools. The LP token is worth 2,400 $USDC and is deployed in a tight liquidity range centered at 2,200 $USDC.

A trader looking to go long on Ethereum with leverage decides to borrow this LP token and redeem it for 2,400 $USDC. With the current market price of Ethereum at 2,000 $USDC, the trader swaps the 2,400 USDC for 1.2 $ETH (minus fees and slippage) on a spot DEX (InfinityPools currently uses 1inch in the backend).

Here, we consider three possible scenarios:

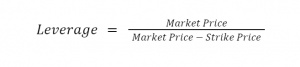

In this specific example, the minimum collateral requirement for a trader borrowing an LP token worth 2,400 $USDC at the 2,200 $USDC liquidity range would depend on how close the borrowed liquidity range is to the current market price of $ETH. The closer the liquidity range to the current market price, the more leverage it enables. For example, if the liquidity range borrowed was deployed at $1,999 $USDC, the maximum loss / initial collateral required would be 1 $USDC, which corresponds to 1,000x leverage.

One of the unique features of InfinityPools is the introduction of a fundamental primitive called “Swappers.” In InfinityPools, traders can borrow liquidity from the pool to create a Swapper, which allows them to swap borrowed tokens (e.g., $ETH) for the other token in the pool (e.g., $USDC) at a predetermined price known as the “strike price”. This process involves taking into account the liquidity range and the maximum reserves of both tokens. Essentially, a swapper is borrowing the ability to swap tokens within the specified range.

At its core, a Swapper allows traders to borrow liquidity from the pool. Borrowing this liquidity gives traders the exclusive right to swap the borrowed tokens (e.g., $ETH) for the other token in the pool (e.g., $USDC) at a predetermined price. This predetermined price is crucial as it ensures there is no liquidation risk. More specifically, by eliminating liquidation risk, InfinityPools can offer unlimited amounts of leverage for any asset.

When a swapper is created by borrowing a liquidity range or sum of ranges, it is “minted” with reserves whose amounts vary according to a predefined curve. These reserves are such that they can recreate the original liquidity ranges that the swapper borrowed. Essentially, the swapper holds enough tokens to ensure that the original liquidity can be reconstituted.

What this means is that while a swapper is being used, it must always maintain enough reserves such that it can recreate the original liquidity ranges it borrowed. This is crucial because it ensures that the liquidity providers who lent out these ranges do not take on any risk. The reserves remain secured.

For illustration, think of the reserves as tokens that are backing the borrowed liquidity range. As the swapper is used, and as the price moves within the range, these reserves are adjusted according to a curve that guarantees that there are always enough tokens to recreate the borrowed liquidity range.

Every Swapper has a single predetermined price, known as its “strike price,” at which an unlimited number of token swaps can be performed for free (i.e., without slippage or fees) using its underlying reserves. This strike price is calculated at the midpoint of the liquidity used to generate leverage.

Here, token0 and token1 are the two tokens in the pool, and max reserves are the reserves when the pool price is below or above all borrowed liquidity ranges.

Let’s take the example where token1 is $USDC, token0 is $ETH, and the liquidity range borrowed is at 2,200 $USDC. If the max reserves of $USDC when the pool price is above the liquidity ranges are 2,400, and the max reserves of $ETH when the pool price is below the liquidity range is 1.09, the strike price is calculated as 2,400/1.09 = approximately 2,201.83 $USDC.

This system is beneficial because it allows for more flexibility and functionality (like using leverage), without compromising the security or integrity of the liquidity that has been provided to the pool.

Also, it’s worth noting that a swapper is constrained in such a way that its reserves curve is always above or equal to the liquidity range curve it originated from. This is a property of convex curves, and it guarantees that the swapper always has enough reserves to recreate the original liquidity ranges.

Leverage can be created from an arbitrary number of wide or narrow liquidity ranges. These ranges can be adjacent or not. When a range (or sum of ranges) is borrowed in one transaction, it is aggregated into the Swapper. The tokens (e.g., $ETH & $USDC) that back these liquidity ranges for a given Swapper are called its reserves.

InfinityPools LPs get paid both traditional spot AMM fees plus the interest rate from the swapper. This is because the InfinityPools AMM (aka the float pool) is just a regular spot AMM where liquidity is borrowed from. As a result, yield accrues more directly to liquidity providers through the interest rate that the borrower pays to hold the liquidity. This interest rate compensates the liquidity providers for the capital they have lent out through the protocol. Since traders borrow an actual LP token, liquidity providers continue earning yield from interest payments even if their liquidity is out of range in the underlying AMM.

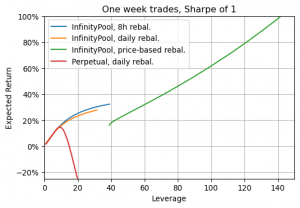

With InfinityPools, traders and LPs will always get paid at least the realized volatility if not implied volatility due to an arbitrage opportunity that uses lending as a floor on yields. Traders can buy volatility by going both long and short at the same time, betting that the premium paid upfront will be smaller than the probability of the asset’s price moving in either direction.

Furthermore, trading fees and lending rates are intrinsically linked because there’s always an arbitrage opportunity that uses lending as a floor on yields, creating a floor for yields for LPs. In fact, many Uniswap pools are currently being compensated below realized volatility levels, which is not ideal. However, with InfinityPools, there is no real ceiling to how much compensation LPs can receive depending on the utilization rate and demand for leverage in a pool.

InfinityPools offers two types of loans:

In addition to collateral requirements, traders using InfinityPools must also consider the funds needed to pay interest on their loans. Fixed-term loans require upfront payment of interest, while ongoing loans that are rolled forward require continual replenishment of capital. If a trader fails to replenish the necessary funds, the position will be automatically wound down by the protocol.

To protect traders, InfinityPools allows them to set a maximum interest rate. If the interest rate exceeds this threshold, the protocol will unwind the loan and forgo rolling it forward. Conversely, when the interest rate falls back below the tolerance rate, the protocol will reactivate the position.

One of the key features of Swappers within InfinityPools is that they are positions that are always fully collateralized by their reserves. This means that at any given time or price, the value of the reserves backing a Swapper is equal to or greater than the value of the borrowed liquidity ranges. This feature is critical in ensuring that there is no credit risk associated with the Swapper; credit risk being the risk that a borrower will default on any type of debt by failing to make required payments.

In traditional leveraged trading, if the value of a trader’s position falls below a certain threshold, they face liquidation where the position is forcibly closed to prevent further losses. In the context of InfinityPools, instead of facing liquidation, the reserves can be swapped through any cryptocurrency aggregator or decentralized exchange (such as 1inch). to adjust the ratios of token1/token0. It is worth noting that no rebalancing takes place on InfinityPools, and external aggregators are only ever used when opening/closing positions.

This benefits both liquidity providers and traders and creates a positive feedback loop where better LP yields attract more liquidity providers, leading to deeper liquidity conditions which enable better trade execution with low slippage.

While InfinityPools offers unique advantages with its closed system and lack of risks from oracles or liquidations, it still faces several challenges. Two key challenges include capital requirements and competitive fee control.

Due to the upfront acquisition of liquidity for executing liquidations and leverage, InfinityPools requires more capital compared to other perpetual protocols that take on more liquidation risk. This impacts the scalability of the protocol as acquiring additional liquidity becomes costlier and time-consuming. Additionally, managing LP capital becomes more complex as assets need to be moved to different ranges on the price curve for each market.

Another challenge lies in the higher fees associated with leveraged products on InfinityPools. Since trades are closed on external DEXs, the fees can be significantly higher compared to perpetual DEXs. For example, popular DEXs like Uniswap charge fees ranging from 0.1% to 0.3%, while dYdX fees start at 0.05% and scale down based on the notional volume traded. These higher execution costs can make it challenging to attract traders, especially for markets that are already supported by existing perpetual DEXs and centralized exchanges (CEXs). However, Infinity Pools solves this by using 1inch on the backend. For instance, Arbitrum routes could go through GMX, which offers lower fees, meaning that Infinity Pools could actually achieve better fees than the average DEX on any given chain.

The primitives introduced by InfinityPools represent a new zero-to-one moment in the DeFi space. By addressing the core limitations of previous models and offering vastly improved features, InfinityPools has the potential to reshape the landscape of leveraged asset trading and solidify the role of decentralized platforms in the future of both centralized and decentralized finance.

All things considered, InfinityPools is well-positioned to achieve product-market fit for small market cap tokens due to its ability to mitigate impermanent loss and offer LP returns closer to implied volatility. Smaller DEXs have previously benefited from catering to this niche, and InfinityPools combines the advantages of LP returns and risk mitigation.

However, establishing itself for major asset pairs may prove challenging for InfinityPools. Leverage trades are likely to have higher borrow rates, and the need to interface with spot DEXs for trade closures may result in slightly higher fees compared to competitors like Synthetix, dYdX, and centralized exchanges (CEXs). The success of InfinityPools in this competitive landscape will depend on the market’s valuation of liquidation-free trading and whether it compensates for the additional fees.

For investors and participants in the DeFi space, it is crucial to understand and capitalize on these transformative innovations when these opportunities arise. Primitives like Uniswap or InfinityPools will continue to redefine the boundaries of what is possible to build using decentralized instruments, and being aware of this makes it possible to front-run the opportunity.

Overall, the opportunities for building on top of InfinityPools are vast. While the oracle-free and liquidation-free trading experience has garnered significant attention, the permissionless asset listing and potential for composability are likely to have the most impact. The ability to easily access leverage opens doors for future yield tokens, interest rate swaps, and foreign currency stablecoins. It also paves the way for the development of more flexible structured product vaults that will simplify liquidity provision.

Revelo Intel has never had a commercial relationship with InfinityPools and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.