Published: August 21, 2023

The modularity and flexibility of the OP stack have not gone unnoticed. With protocols like Aevo and Lyra building their own application-specific chains and off-chain matching engines, Synthetix is now facing more competition and has no plans to remain on the sidelines. Instead, Kain Warwick, founder of Synthetix, has come up with his own take on how Synthetix can disrupt not only on-chain derivatives but also centralized exchanges.

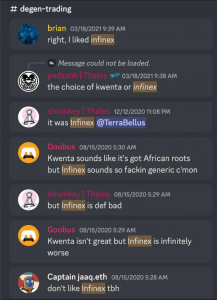

More than two years ago, the Synthetix community was debating on what the name for a Synthetix frontend should be, with Kwenta and Infinex as the major contenders.

From those conversations, Kwenta emerged as the primary derivatives trading platform built on top of Synthetix’s liquidity. Nowadays it is the leading derivatives platform on Optimism and has managed to take market share from protocols like GMX thanks to its lower fees and the help of both $OP and $SNX incentives.

However, Optimism still remains a standalone L2 chain with its own ecosystem. As more L2s start to emerge, liquidity becomes increasingly more fragmented, which is an impediment to achieving composability and protocol integrations. With Infinex, Synthetix is betting on the thesis that the infrastructure is ready to take on a more ambitious approach where DeFi can compete against centralized providers.

Perpetual futures have already solved the major friction points associated with trading on DEXs, such as high slippage, low liquidity, high fees, and exposure to impermanent loss for liquidity providers. However, there are still challenges that remain unsolved. In terms of Synthetix, friction points for users are: bridging to Optimism, buying sUSD, and needing to sign every transaction.

On its journey to solve the remaining pain points, the next step for Synthetix is to transition to a user-acquisition and user-education mode, where the protocol will raise awareness of the risks associated with trading on centralized exchanges, such as counterparty risk from custodians that require KYC information and that users must trust with how their capital is used.

While DEXs have gained popularity, this is mostly due to their ability to enable permissionless asset listings and provide instant access to their liquidity. This is not the case for centralized exchanges, where there is a listing process involved and often delays the listings of long-tail assets. However, CEXs still dominate the industry, primarily because of their user experience.

Infinex is Synthetix’s attempt to differentiate itself by prioritizing user experience. This will be achieved by offering a simplified sign-up process that generates a unique public-private key pair for each user that is stored on the browser. This unique key is used to sign trades sent to the Account Relayer on Optimism, ensuring trustless interactions while maintaining ease of use.

Infinex also enables users to deposit assets, trade with sUSD loans, and benefit from features like margin verification and emergency withdrawals.

Given that $SNX will remain as the ecosystem token, one should not have airdrop expectations or await a token migration similar to what Aevo did migrating $RBN to $AEVO.

Value can accrue to $SNX through various mechanisms:

However, this can potentially present a bearish scenario for other Synthetix frontends, especially those that are highly specialized in perpetuals, like Kwenta or Polynomial. For Lyra, which also taps into Synthetix’s liquidity, the situation might be different, since Lyra v2 will feature both perpetuals and options trading, making it a full-fledged platform for decentralized derivatives.

The core strength of Infinex will be its onboarding process and user experience. The branding will make it easy for people to find a connection with Synthetix as well, further leveraging existing network effects.

When it comes to competition with external protocols, the announcement came right at a time when GMX fees were at their lowest, right before the deployment of GMX v2. At that point in time, Kwenta was making large sums in terms of both volume and fees. However, this increased activity was largely driven by $OP and $SNX incentives, which were enough to cover most of the funding costs associated with trading on the platform.

Looking beyond the L2 landscape, it is yet to be seen what dYdX v4 looks like. Despite the development of a custom app-chain, the upgrade is a migration from the Ethereum to the Cosmos ecosystem, which is an unprecedented move and might add some friction for users who are familiar with the existing EVM tooling and might not want to consider bridging or using other tools, like wallets or block explorers.

Infinex’s ambitious vision to create a DEX that rivals centralized exchanges aligns with the growing demand for user-friendly and efficient trading experiences in DeFi.

By addressing key challenges, leveraging the Synthetix ecosystem, and focusing on user acquisition, revenue generation, and community engagement, Infinex has the potential to establish itself as a leading player in the decentralized derivatives sector.

Revelo Intel has never had a commercial relationship with Synthetix and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.