Long $RUNE

The content below is meant to explore the current state of Thorchain and the associated product iterations that might accrue value to the $RUNE token. Despite its unique value proposition, the project has struggled to achieve the Lindy effect due to a sequence of hacks.

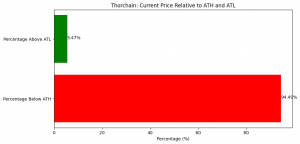

This presents an interesting scenario where a relatively old token still faces low competition. $RUNE’s price action leads to a captivating dilemma between old holders and new market participants looking for an entry as a result of the big disparity between the current price and the distance to the all-time low and all-time high.

Additionally, the valuation model for $RUNE is presented. The valuation is based on predicting market outcomes and the Total Value Locked (TVL) in the THORChain network. This is derived from $RUNE’s deterministic value as well as the market sentiment premium.

Despite experiencing two major hacks and being down -95% since the ATH reached May 19, 2021, $RUNE and Thorchain is still the only solution for non-custodial cross-chain swaps (excluding Maya’s friendly fork). This is a huge endeavor that has big repercussions for the future of the blockchain industry as a whole. Put simply, Thorchain is the only alternative where one can do trustless $BTC-$ETH swaps in a scalable manner.

We should put resources toward a proper (trustless, serverless, maximally Uniswap-like UX) ETH <-> BTC decentralized exchange. It's embarrassing that we still can't easily move between the two largest crypto ecosystems trustlessly.

— vitalik.eth (@VitalikButerin) March 24, 2020

Often confused with bridges, Thorchain is a cross-chain Dex that operates as a layer 1 built using the Cosmos SDK. There are 4 main market participants in the ecosystem:

In this report, we will focus on $RUNE in order to assess its potential value accrual from the network’s revenue streams.

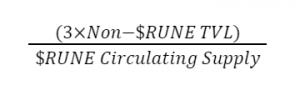

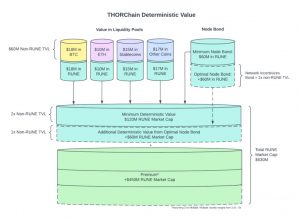

One particular aspect is that $RUNE is modeled after a deterministic value. Due to its economic design, $RUNE’s market cap should be at minimum 3x the value of all non-$RUNE assets ($BNB, $ETH, $BTC, $AVAX, $ATOM…) locked into the THORChain liquidity pools.

Hence, $RUNE’s deterministic value can be simulated by predicting market outcomes and TVL, derived from:

The more liquidity provided by $RUNE holders, the more accurate the deterministic results will become.

For example, if the current non-$RUNE TVL is $1M and the current $RUNE circulating supply is 3M, then the current $RUNE deterministic value = (3 x $1Ml) / 3M = $1.

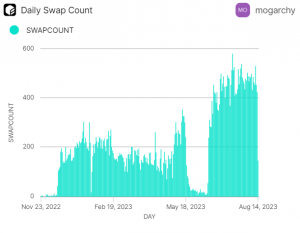

As Thorchain gets ready for streaming swaps, its primary source of income, liquidity fees, takes center stage. Since inception, only 7.8M $RUNE in liquidity fees have been collected. However, as the multi-chain thesis starts to play out, this metric has started experiencing significant growth. As a matter of fact, 807k $RUNE was collected in June 2023.

However, to put things into perspective, it is worth taking a look at the ratio of liquidity fees to pool incentives. Data shows that this ratio has been increasing in recent months as well, reaching over 50% in July.

The significance of this cannot be understated. Even ahead of the launch of ThorFi lending, July marks the first month in which liquidity fees have exceeded block reward emissions since 2021. This is extremely uncommon in crypto.

Looking ahead, streaming swaps and lending could significantly influence trading volumes and liquidity fees as a result of improved price execution and potential fee cuts of up to 90%.

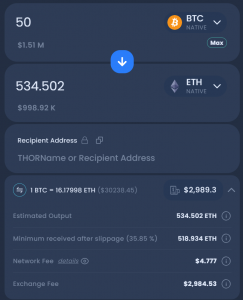

Thorchain’s business model puts it in the category of a ‘relayer market’. With the introduction of streaming swaps, Thorswap is addressing one of its most noticeable weaknesses. With Thorchain’s current pool depths, large swaps incur large slippage. As an example, a 50 $BTC swap to $ETH would result in a 36% slippage.

Streaming swaps are a solution to the recurrent slippage problem. They provide a better UX while not cutting down on the fees that are paid to the network.

Even though it is possible to split large swaps into smaller transactions (100 swaps of 0.5 $BTC each would limit the maximum slippage to 2.3% each), this is time-consuming and degrades the user experience. The user would need to manually send 100 separate on-chain transactions and receive 100 separate on-chain outbound transactions – paying 100 times more gas fees as a result.

Streaming swaps solves this issue by allowing users to send a single inbound transaction (paying a single inbound gas fee), internally splitting into smaller swaps, and finally consolidating all the outbounds into a single transaction (paying a single outbound fee). More specifically, users are free to select the number of swaps and the number of THORChain blocks between each swap

Note that ongoing streaming swaps cannot be canceled.

One important implication of this is that, while this results in a better user experience where the user pays one inbound and one outbound transaction fee, streaming swaps do not circumvent fees – they simply enable a better trade execution. Put simply, it allows swappers to get better price execution at the expense of a longer wait time.

As the industry accepts that the coexistence of multiple chains is a necessary requisite for the overall adoption of blockchain, it will be required to offer a seamless experience. That way we can expect to see an increasing number of users start transacting with Thorswap without ever noticing. This is one of the reasons why the integrations with Ledger Live, or TrustWallet are so important, since they will allow people to move funds without going through a centralized exchange first. This has the potential to significantly increase the total protocol revenue.

The impact of this is noticeable, as evidenced by the increase in the swap count since the TrustWallet integration. More integrations like this are key to reaching escape velocity.

With ThorFi, Thorchain realizes its vision to enable 3 important financial primitives: swapping, saving, and lending. Users will be able to lend one asset on one chain and borrow another asset on a different chain. The introduction of lending attracts new capital, improving liquidity and network security.

ThorFi lending features include a 0% interest loan, no liquidations, and no loan expiration. Risk is managed through collateral limits, slip-based fees, dynamic CR, and a circuit breaker on $RUNE supply. 0% interest encourages long-term loans or non-repayment to scale the system effectively.

The protocol benefits from increased capital efficiency, trading volume, fees, and scaling opportunities. Opening loans deflate $RUNE, while closing loans inflate $RUNE based on collateral asset value changes. Loans can be partially repaid, but collateral is returned only after full repayment.

Lending aims to burn more $RUNE than minted, reducing circulating supply and increasing demand. However, net inflation can still occur if collateral asset value rises compared to $RUNE between the time when the loan is opened and closed.

Simply put, when lending is turned on, $RUNE becomes deflationary:

Because of the design, we can predict that more deflationary features will be added over time. You can learn more about ThorFi in our dedicated ThorFi Lending insights report, which outlines the technical implementation details as well as the risks involved.

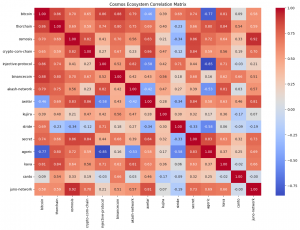

After Vitalik’s statement that “the future is multi-chain, not cross-chain”, many thought that Thorchain would be negatively impacted, especially after the success and popularity of LayerZero across multiple chains, both EVM and non-EVM. Interestingly, Ethereum keeps leading in terms of liquidity fees.

The $ETH-$BTC remains unbothered as the golden swap path (representing 11.6% of the total liquidity fees) for transferring assets between the two most popular chains.

And while many thought LayerZero could disrupt Thorchain’s business, it has turned out to provide a big activity boost. The transactions below are an example of things that are only possible by combining both protocols, such as going from native $BTC to $ARB in one transaction.

Fundamentally, the Thorchain network determines the baseline price, and the market speculates on top of that. Therefore, market sentiment can be priced in as a speculative premium.

The deterministic value of RUNE can be simulated by considering two key factors: the market cap requirement and the TVL in the THORChain liquidity pools.

Hence, the minimum market cap of $RUNE is set to be at least 3 times the total value of all non-RUNE assets (e.g., $BNB, $ETH, $BTC, $AVAX, $ATOM) locked into the THORChain liquidity pools.

For instance, if $1,000,000 worth of non-RUNE assets is staked in the THORChain network, the minimum market cap of RUNE would be calculated as follows:

Minimum RUNE Market Cap = 3 * TVL = 3 * $1,000,000 = $3,000,000

In addition to the deterministic value calculated based on TVL and market cap requirements, the value of RUNE is influenced by speculative premiums and market sentiment.

To recap, the Thorchain network sets the baseline price for $RUNE, while the market speculates on top of this baseline. Even if the TVL does not move, if the market premium increases, this will be reflected in the price as well.

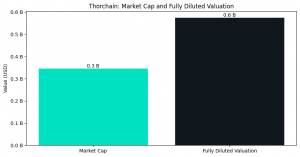

The final supply of $RUNE is 486,077,750 units. ~14m was killed off after a 12-month migration period. As a result, ETH.RUNE and BNB.RUNE can no longer be redeemed to THOR.RUNE. Thorchain is no longer reliant on external networks.

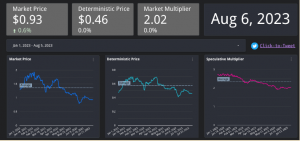

At this point, the deterministic price is $0.46. However, $RUNE is trading at a market price of ~$0.93, meaning that it is trading at a market multiplier of 2.

So, the fair value of $RUNE can be estimated as 6 times the TVL in the THORChain liquidity pools.

The observation that $RUNE is trading at the lowest market sentiment multiplier since the start of the year might suggest two things: either its upcoming features such as streaming swaps and ThorFi lending are not being priced in and $RUNE could be in undervalued territory, or there is an overall lack of attention and interest in the project.

Overall, the advent of layer 2s has negatively impacted the perception of Thorchain’s potential, since layer 2s have taken away market share from alternative layer 1 chains like Fantom, Avalanche, BSC… In addition to that, there are a lot of eyeballs looking at cross-chain communication solutions like Chainlink’s CCIP or LayerZero.

Hence, when it comes to anticipating the future outlook and adoption of Thorchain as well as the directionality of $RUNE’s price action, it becomes increasingly important to observe whether:

Revelo Intel has never had a commercial relationship with THORChain and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.