Key Points

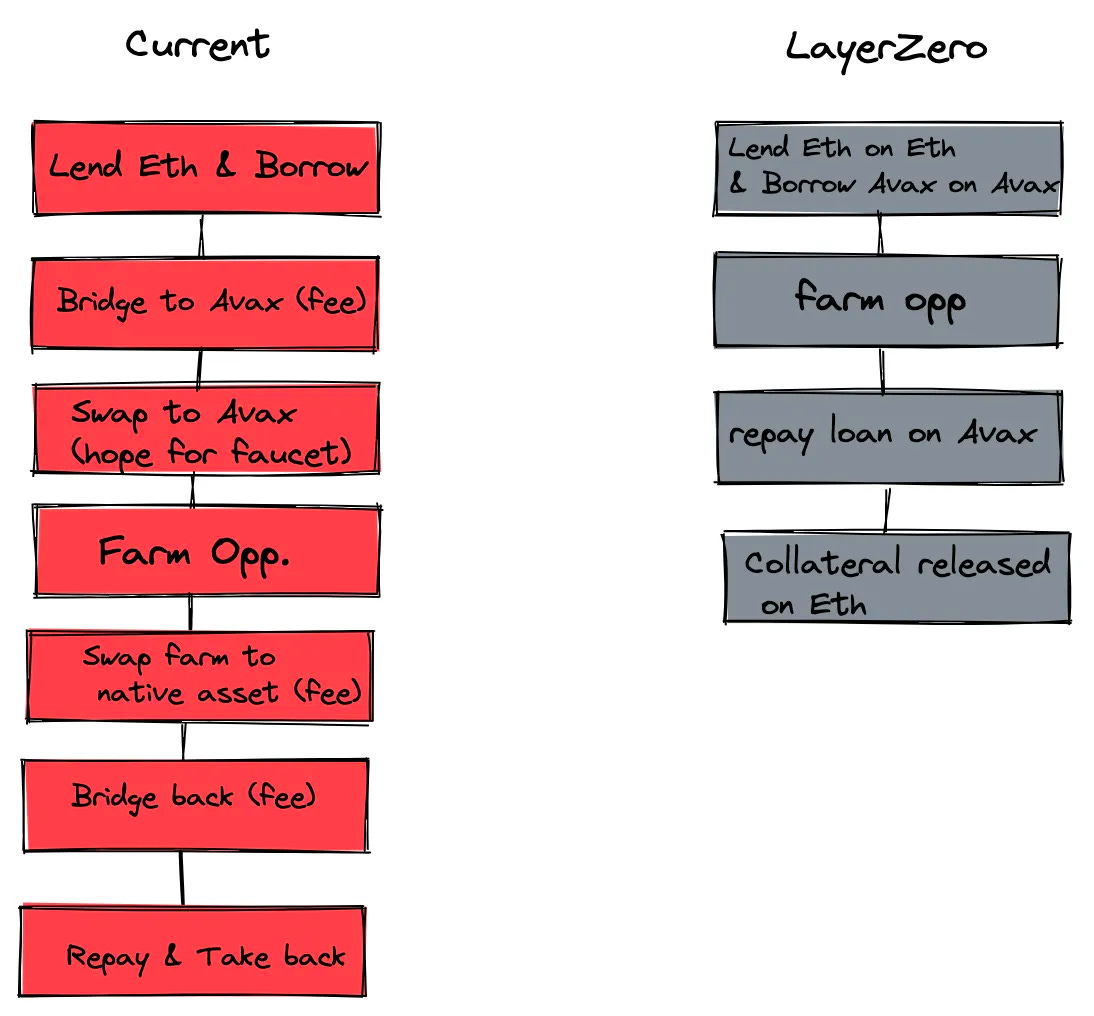

In the current multi-chain environment, blockchain users face significant inefficiencies and high costs when performing cross-chain transactions. Lending, borrowing, and swapping activities are particularly costly and inefficient.

These inefficiencies and costs create barriers for users and limit the potential for cross-chain interactions. Cross-chain interactions and interoperability are becoming increasingly important in the expanding blockchain ecosystem. There are more L1s, L2s, rollups, appchains, sidechains, etc. than ever before. A solution is needed that simplifies these processes and reduces the associated costs. This is the value proposition of Stargate: make cross-chain liquidity transfer a seamless and single transaction process.

Stargate is an Omnichain asset bridge that offers unified liquidity across 8 chains. ‘Omni’ means ‘of all things’. Omnichain implies that by default a dApp or project that is Omnichain works equally across every chain it is deployed on. Whether a project is deployed on 2 chains or 8, the UX should be the same. Currently, projects in DeFi have huge differences in UX based on what chain you use it on.

That said, Omnichain is becoming a bit of a buzzword. It’s also just one of multiple types of ‘chain’ in crypto, which can be confusing. We’ll break things down for you:

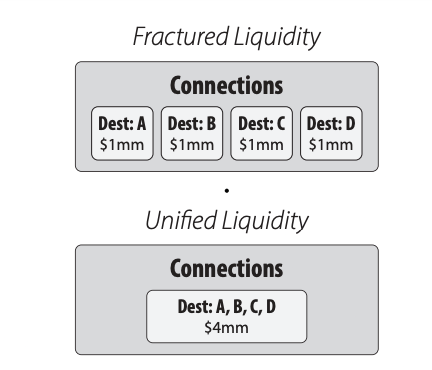

To paint the appeal of an Omnichain solution like Stargate, we’ll give an example. The most common example of a DEX plagued with fragmented liquidity issues is SushiSwap. The project was commonly criticized for ‘spreading their troops too thin’. Basically, the team opted to have smaller amounts of liquidity available on a bunch of chains, rather than have a lot of liquidity on one or two chains. This created an imbalance where people would not want to use SushiSwap on certain chains. The reason for this is that a DEX that has less liquidity results in more slippage for users and a smaller selection of tokens to swap to and from.

Take the Avalanche C-Chain, for example. While SushiSwap may have been the biggest name DEX to deploy there, it did not receive the most attention. Instead, people opted to use Avalanche native DEXs, namely Pangolin and Trader Joe. Pangolin is a DEX that was founded by the Avalanche team, and Trader Joe was started several months after SushiSwap already deployed on Avalanche. DEXs that focus on one chain are often more attractive to the users of that chain, both LPs and people just swapping tokens. Eventually, Trader Joe would go on to become the primary DEX of Avalanche, and later expand to BSC and Arbitrum. Now, both SushiSwap and Trader Joe have announced Stargate integrations.

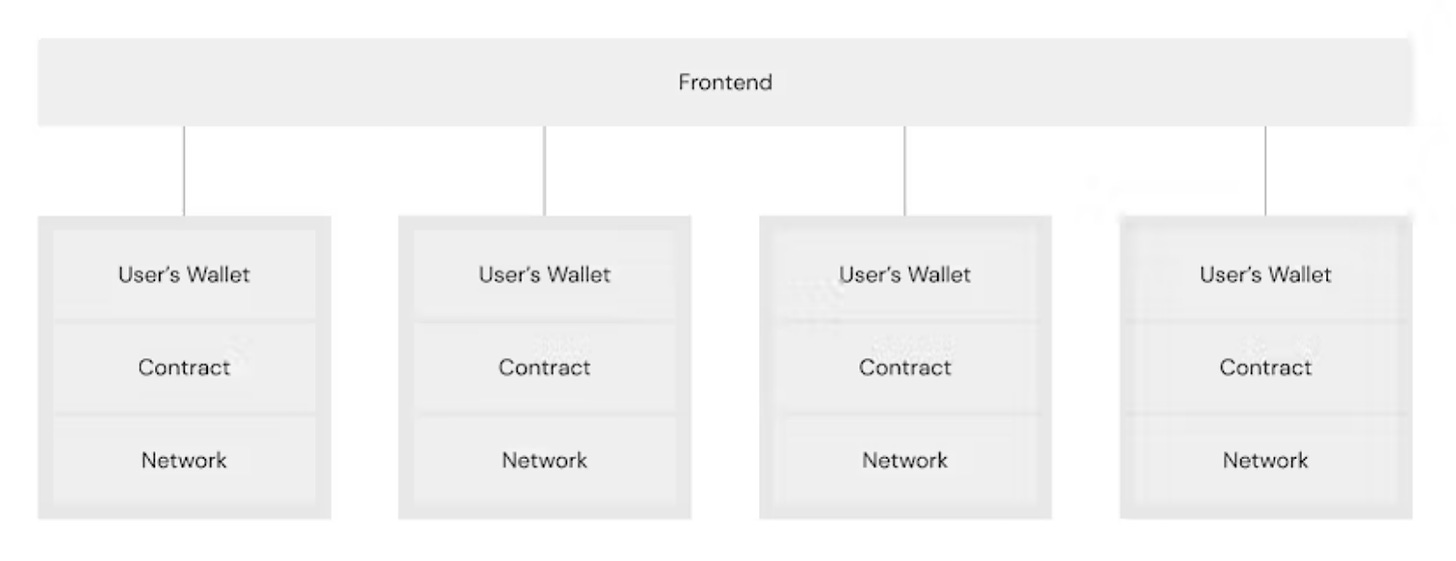

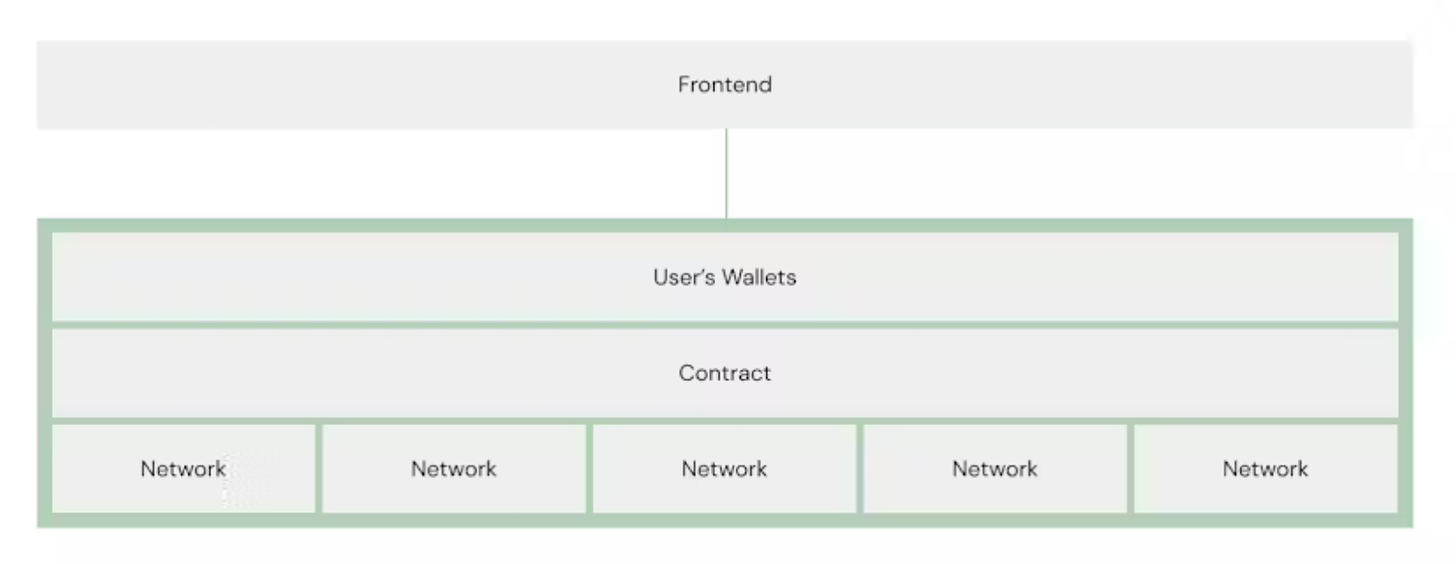

The Omnichain dream is to nullify the need for bridges and distinct liquidity pools on every chain. Users should not have to know, or care, about what chain they are using, unless they really want to. Most technologies used at scale do not require users to have much knowledge about the infrastructure the tech is built on. This is not the case in crypto. In crypto, not only is infrastructure-level knowledge common for users, it’s a requirement. Users are required to know what blockchain their favorite application is built on. Otherwise, they wouldn’t be able to add the RPC to their wallet, or even bridge funds to the chain so that they can use applications built on it.

To put things into perspective, take a look at these diagrams illustrating the current multi-chain crypto UX vs an ideal Omnichain crypto UX.

Crypto is still relatively nascent. Early adopters will need to have more knowledge about the technology than the laggards who come after them. While Stargate probably won’t make DeFi as intuitive as an iPhone, it certainly simplifies things. Users and dApps can transfer native assets cross-chain with instant guaranteed liquidity.

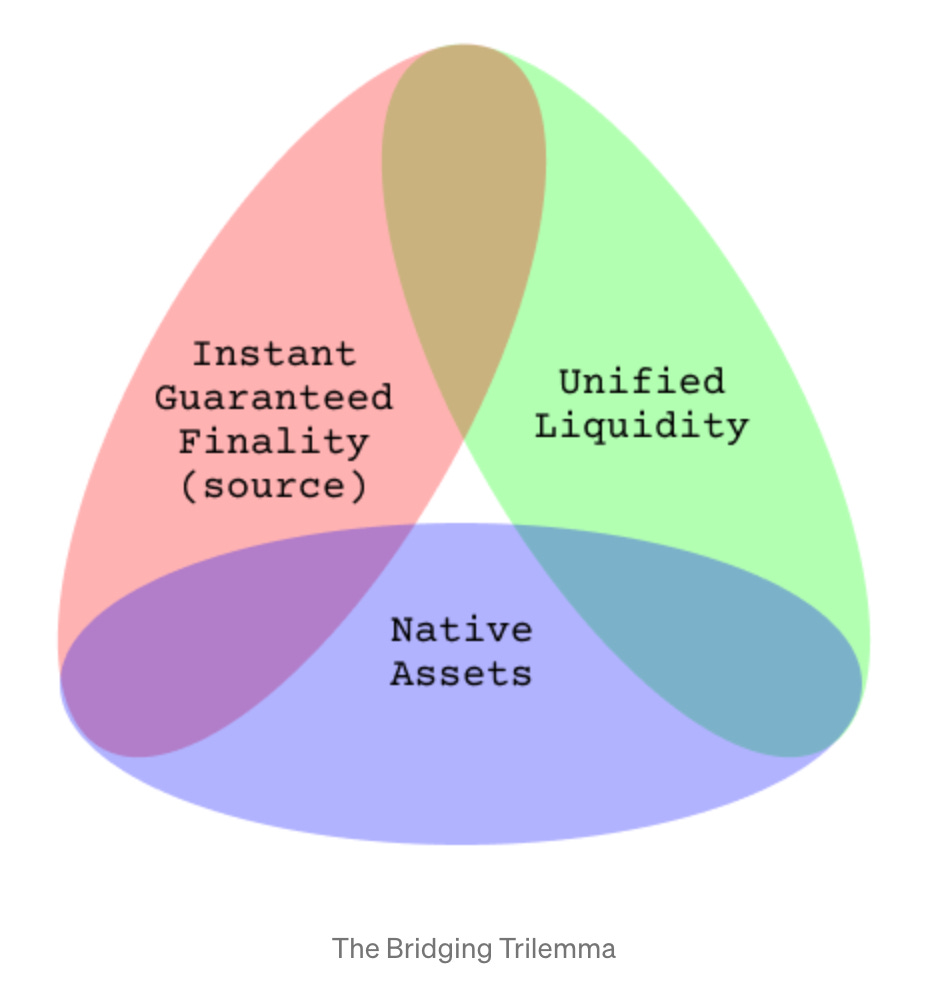

Currently, cross-chain bridges in crypto have 3 major problems:

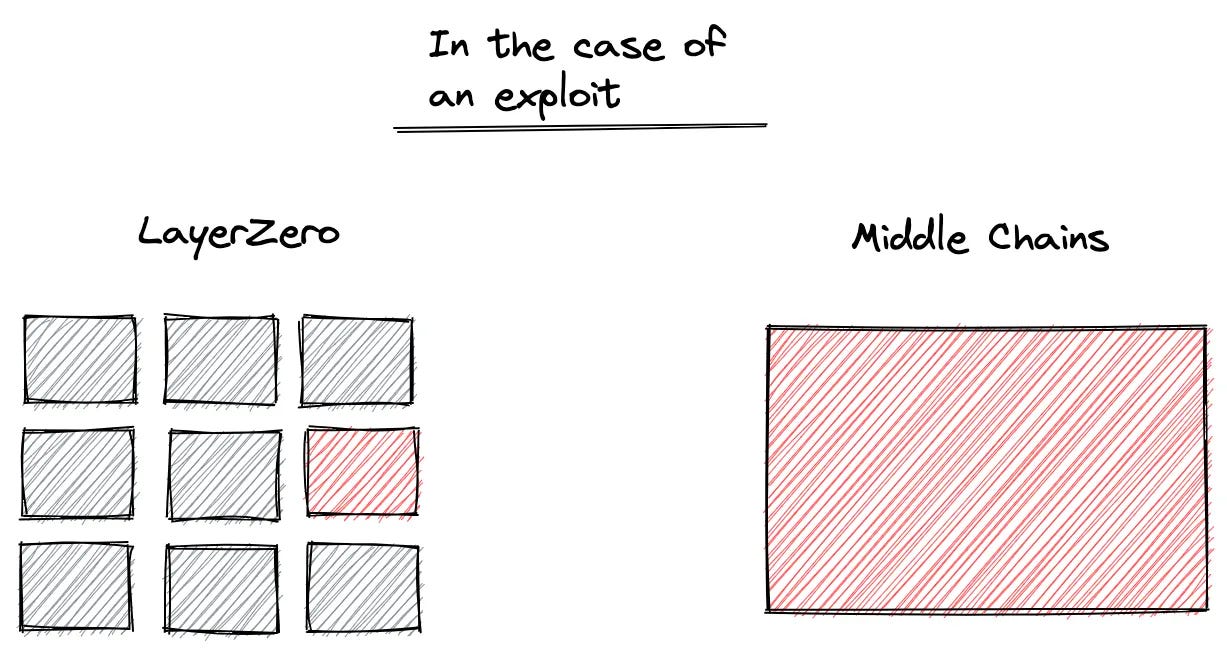

As a result, the current blockchain ecosystem is fragmented. Because of this, many dApps like SushiSwap operate in siloed environments across multiple chains. For instance, SushiSwap runs on twelve different chains, each requiring unique code for syncing with the main Ethereum instance. This in turn requires the use of multiple bridges like Wormhole, Rainbow Bridge, Polygon Network Bridge, Avalanche Bridge, etc., each with its own interface and security properties. As you can see, operating across multiple chains involves a lot of moving parts and things can get messy quickly. With the ecosystem constantly evolving, managing these multiple interfaces becomes a daunting task.

Stargate, through its LayerZero technology, simplifies this process by providing a single interface and code base for all cross-chain pairs. This means that dApps like SushiSwap only need to implement send and receive functions, significantly reducing the complexity of managing multiple chains. The send function forms a message for the destination chain, while the receive function interprets that message. Basically, Stargate makes smart contracts much simpler than what is currently the norm in multi-chain DeFi.

Stargate’s simplified system offers many benefits:

$STG is the native utility and governance token of the protocol. It can be used for providing liquidity, participating in protocol governance, or staking to receive $veSTG. Similar to the original ve model, Stargate uses a time-weighted reward system that incentivizes long-term staking. It does this by increasing the amount of $veSTG tokens that stakers receive the longer they keep their tokens locked.

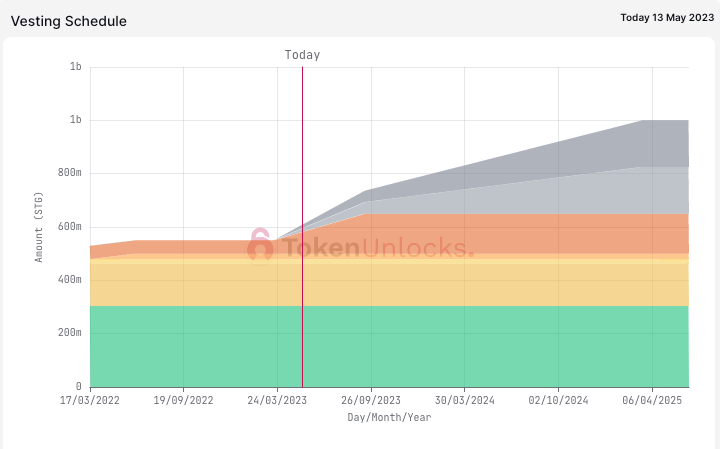

The TGE for $STG took place in March 2022. The token saw significant positive price action in the first couple of weeks of trading before sharply returning to its initial price. Since then, $STG has been underperforming through a turbulent market period that involved the downfall of Terra and the collapse of FTX among other events. More specifically, Alameda purchased 100% of the tokens that were meant to be offered to the public in a particular round (~10% of the total supply). The $STG TGE was highly anticipated and multiple interested crypto institutions attempted to secure a large stake in Stargate. Alameda ended up beating out the competition and acquired 10% of the total $STG supply. This amounts to 100M $STG that would be locked for 12 months followed by a 6-month linear unlock. In February 2023, the Stargate DAO passed a vote to reissue those 100M STG tokens following Alameda’s wallet hack. Alameda’s wallet was reportedly compromised on December 28 after a malicious actor had transferred over $1.7M via several crypto mixers.

Without a token reissuance, a malicious actor could claim the $STG tokens from the contract as they vest. The main concern is that this actor would then dump the tokens. This obviously would lower the price, but it would also drain stablecoins from the existing $STG liquidity pools.

First off: we did indeed buy all the tokens. We love the team and what they're doing, and we believe this space and the technology they're building is really important.

— Sam Trabucco (@AlamedaTrabucco) March 22, 2022

For the same reasons, we won't be selling any of the tokens we bought for at least 3 years. This was not a cash grab or anything like that, we truly believe in this project and this team, and our only goal was making a long-term investment in both.

— Sam Trabucco (@AlamedaTrabucco) March 22, 2022

We're always excited to put our money where our mouths are, and we look forward to seeing what the @StargateFinance team does moving forward.

— Sam Trabucco (@AlamedaTrabucco) March 22, 2022

Stargate’s Team and Investors are subject to a one-year cliff and two years of linear vesting unlock thereafter. Since March 17, the linear unlock was increased from:

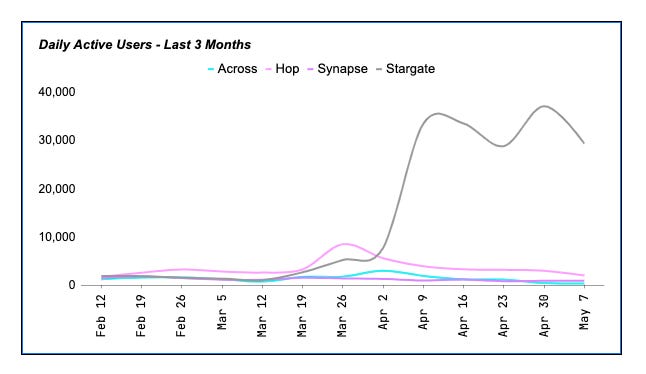

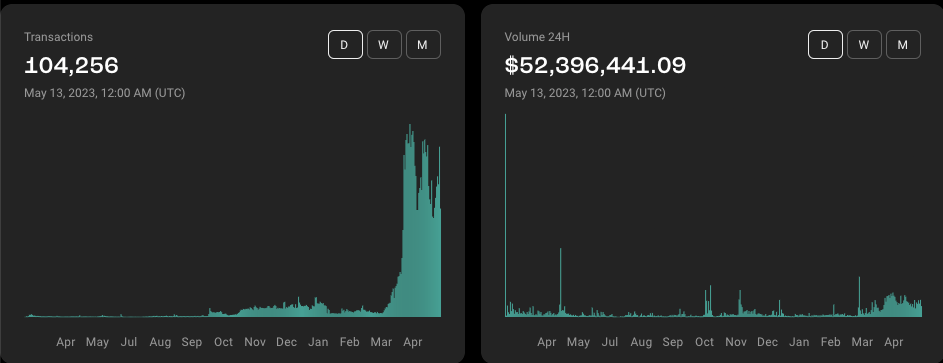

While $STG unlocks have sped up, there has been an increase in cross-chain trading activity on Stargate.

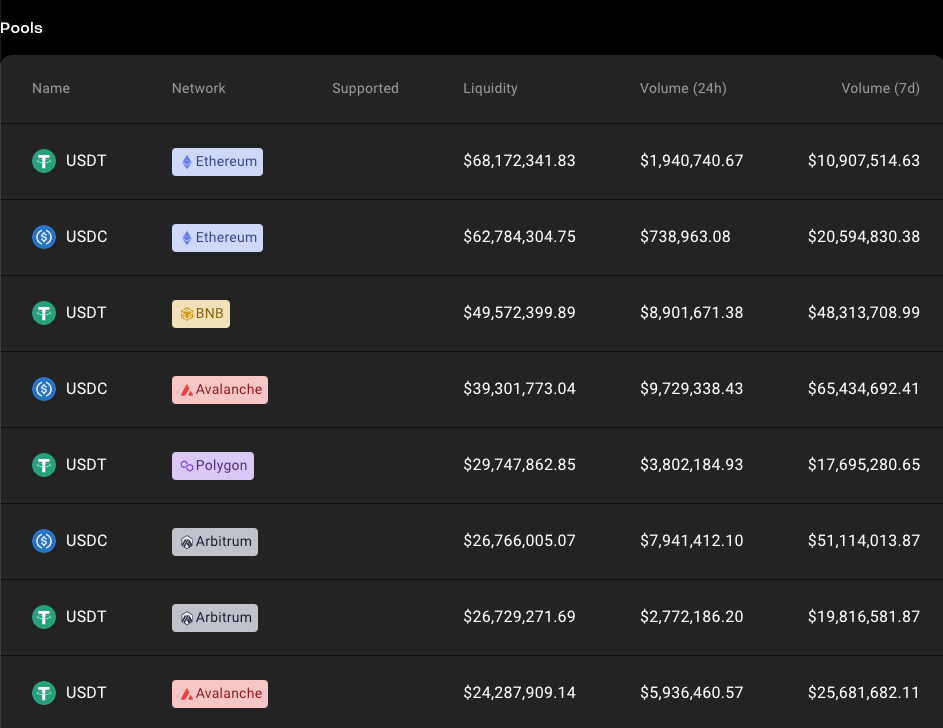

Stargate currently has a market cap of ~$130M and an FDV of ~$600M with >$400M in TVL. To this day, 39% of the total $STG supply remains locked. $STG follows a linear unlock of $613,20 per day.

TVL is down ~89% from its peak in April 2022. This can mostly be attributed to the lucrative $STG rewards that were first offered to stablecoin LPs shortly after the TGE. Some people expressed concern about how new the tech behind Stargate was and were hesitant to provide liquidity. But overall, the protocol saw significant inflows from LPs. As Incentives trickled down and the broader crypto market became more bearish, TVL naturally dropped. Despite this, Stargate has an FDV/volume ratio of 0.26. This is lower than other competitors like Multichain (0.42), Synapse (0.7), Across (0.42), or Hop (0.62).

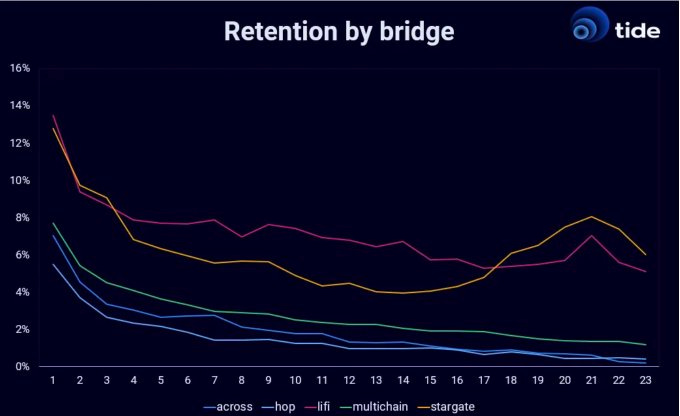

The bridge space is amongst the most competitive in all of crypto. Blockchain bridges compete against each other to attract new users and convert them into recurring ones. Stargate currently has the highest retention rate, closely followed by LiFi.

This increase in volume should come as a sign for interested investors to keep an eye on Stargate’s stats to notice any other trends. More importantly, since there is value accrual for STG stakers, it is worth keeping an eye on protocol revenue. Each non-$STG transfer that goes through Stargate incurs a 6 bps fee:

Stargate’s dominant position above the other bridges it competes against makes $STG interesting. There aren’t any particular catalysts coming soon for the protocol. Despite this, $STG should be considered by anyone who is looking to have exposure to the bridging space in crypto. With other options, investors may have to worry about token prices being negatively impacted by competing bridges. Since Stargate has already taken most of the bridging market share and seems like it may keep doing so, this could be less of a risk for $STG.

One of Stargate’s primary competitors is Synapse. As illustrated above, Synapse is losing to Stargate in the most important metrics. Synapse hopes to change this, as they are launching their Interchain Network upgrade. This upgrade will do two things:

While Synapse’s upgrade plans will help enhance the bridging UX, a lot of focus seems to be spent on new use cases that Stargate isn’t necessarily competing in. Some could interpret this as further evidence that Stargate will maintain or increase its lead over bridging protocols like Synapse. Or maybe the interesting possibilities that Synapse’s Interchain Network upgrade introduces can help its bridge see more volume. What will play out in the future is uncertain, but based on today’s data $STG could be at a decent valuation for investors looking to buy in.

Multichain, one of the other main bridge competitors to Stargate recently faced rumors that their team was arrested in China. As a result, the bridge’s native token $MULTI plunged 60%. The Fantom Foundation also withdrew millions of dollars in $MULTI from the bridge. It is unclear if the situation with Multichain’s team can be resolved and how the bridge and $MULTI token could recover.

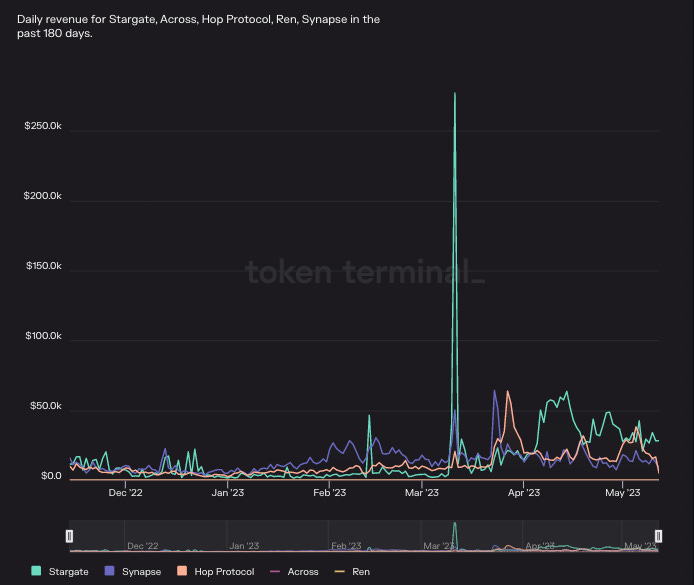

While Stargate beats out competitors like Synapse, its marketcap tells a different story. Stargate and Synapse actually have around the same marketcap. $STG’svaluation comes in at ~10% higher than Synapse’s $SYN. In early May, even Multichain’s $MULTI had a higher valuation than Stargate. This has since changed due to the situation involving uncertainty around Multichain’s team. One reason for this could be Stargate’s relatively recent statistical success. When analyzing stats like fees earned, revenue, and transfer volume, we can see Stargate has really started to pull away from the competition somewhat recently. While Stargate has maintained a lead over other protocols for months, its advantage has become even more pronounced since early May.

To those looking for an entry on $STG, this could be a decent time to enter a position before the market prices these stats in. The crypto markets in general also didn’t do too well in May, which could have held down $STG price action.

But of course, marketcap doesn’t mean everything. FDV is also extremely important to consider when comparing valuations. In terms of FDV, Stargate is priced much higher than its competitors. $SYN’s FDV comes in at ~$160M, a long way away from Stargate’s ~$600M FDV. There is definitely a case to be made that in terms of FDV, Stargate is not undervalued at all, even when considering the attractive metrics the protocol puts up.

Stargate is no underdog when it comes to the bridging solutions market in crypto. From before the launch of $STG, Stargate was a highly anticipated project. After seeing a big spike in price and large inflows of LP capital, things simmered down for Stargate. This combined with a marketwide downturn resulted in a diminished TVL and $STG price.

But Stargate has clearly proven to be the bridge of choice for many users since then. Over time, the protocol has continued its upwards trajectory and has been putting up impressive stats. Whether it’s transfer volume, fees, revenue, TVL, treasury value, or even DAU; Stargate has emerged as the clear winner.

Whether this will continue is debatable. But there doesn’t seem to be many reasons to think the other competitors in the bridging space will retake much lost market share. And while Stargate’s FDV may seem high, its circulating marketcap is on par with other bridging protocols. By implementing LayerZero technology, the Omnichain bridge can make things simpler for developers and end-users. The thesis for $STG is that Stargate is simply outperforming the other bridges in its lane. Perhaps investors will pick up on this and reprice the token accordingly. $STG very well could be the best bet for those looking for exposure to crypto’s bridging sector. Other options run the risk of having more of their market share taken by Stargate.

Revelo Intel has never had a commercial relationship with Stargate and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.