Published: May 22, 2023

Key Points

Plan an INJ buy based on when you think a marketwide bullrun will occur, & speed up as bullish catalysts present themselves.

Injective is an interoperable blockchain in the Cosmos ecosystem. It brands itself as a sector-specific blockchain, with its focus being DeFi and it aims to be the infrastructure layer for the important DeFi dApps of the future. Injective provides its own orderbook, allowing developers to build DeFi applications that may not be possible, or as feasible on EVM chains or Ethereum L2s.

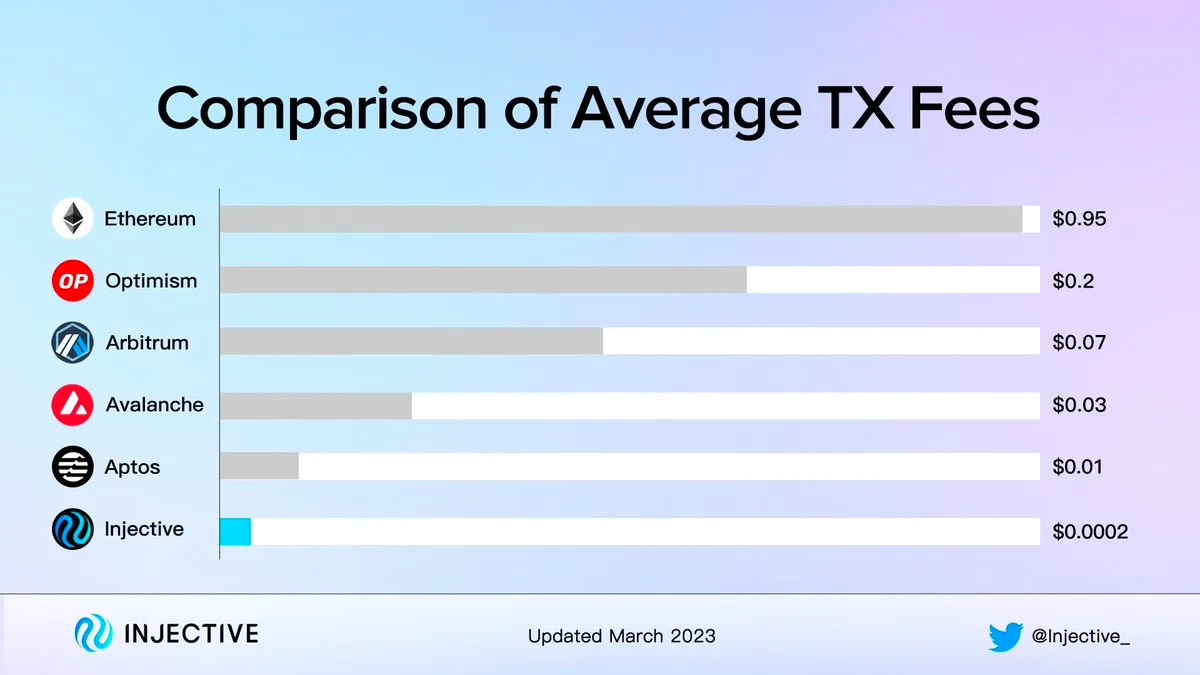

DeFi users may take an interest in the chain’s MEV-free exchange infrastructure, as well as its gasless transactions for end users. Injective also has made it a point to address the poor UX present in crypto.

As for developers, those building on the Injective blockchain can take advantage of all the features provided by Injective’s modules, including order books, auctions, insurance funds, as well as bridges.

Part of the bullish case for Injective simply comes from the fact that it is built on Cosmos; this allows the chain to be fast, but still very customizable, which is important for a blockchain implementing an order book with specific use cases in mind. This is something that many chains that prioritize scalability but aren’t built using the Cosmos SDK do not have, like Solana. By utilizing the instant finality of Tendermint, Injective achieves remarkable speeds of up to 25,000 transactions per second. This sets Injective apart from other ‘scalable’ blockchains, such as Solana, which although it can process up to 65,000 transactions per second, can only achieve “optimistic finality” within 5 seconds, with the maximum time for all validators to have voted being 12.8 seconds for full finality.

Transactions Per Second = (number of tx in a block) / (block time in seconds).

Injective is also very interoperable, with an emphasis being made on bringing in liquidity from other DeFi ecosystems (more on this later).

While there aren’t necessarily any time-sensitive catalysts that make Injective’s INJ token a position to urgently consider, Injective is an intriguing ecosystem to keep an eye on as users start to demand more sophisticated defi experiences. Injective is something you may want to bookmark as a potential play to gain exposure to the complex Comos ecosystem, or as a way to bet on the orderbook model, and the appeal a blockchain that leverages this sort of infrastructure may have to app developers.

Investors could plan to build a position in INJ on their individual view on when the crypto market at large will rebound, and speed this timeframe up if the bullish catalysts we describe begin to play out sooner than then they currently are.

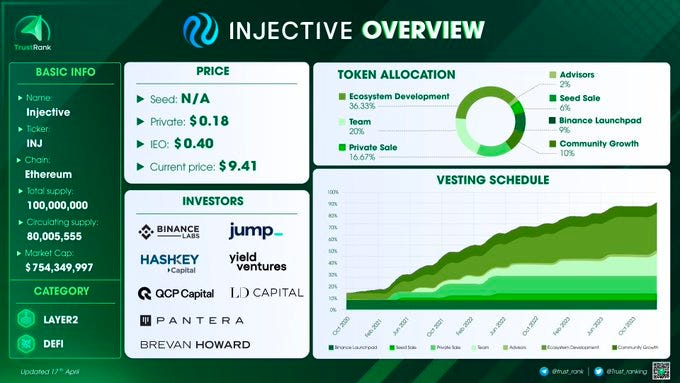

Injective was created in 2020 and introduced as a decentralized derivatives solution for Orion Protocol, a protocol aggregating liquidity from both DEXs and CEXs.

Before pivoting to the current Cosmos blockchain model it currently uses, there were plans for Injective to initially be an L2 sidechain built on top of Ethereum. Over time, Injective would opt to build on Cosmos tech, freeing it from the speed and scalability restraints that still are present on Ethereum today. Some ties to the Ethereum ecosystem still remain, such as Injective’s MetaMask compatibility, which is a positive for users, especially those coming from EVM chains who may not be used to the Cosmos ecosystem wallets, such as Keplr.

After raising money from the likes of Binance, Jump Crypto, Pantera, Cumberland, Mark Cuban, Sandeep Nailwal (Co-Founder of Polygon), and more, Injective would build out the infrastructure initiatives that it is known for today.

Since Injective’s mainnet launch in 2021 and the implementation of their order book, the Injective ecosystem is still in a growth stage. Still, the dominance of Helix (formerly Injective Pro) is notable, capturing more than 80% of the chain’s TVL.

Recently, the Injective team has put an emphasis on onboarding new liquidity from a variety of sources, both on-chain and off, which can also help increase TVL.

One of the key attractions of Injective is the blockchain’s integrated order book. In the Cosmos ecosystem, Sei Network and dYdX both offer decentralized order books, with dYdX planning to make the move from Ethereum to Cosmos soon with its v4 upgrade. dYdX is planned to be an app chain for perpetuals trading, while Sei Network is a DeFi-focused chain, similar to Injective.

Injective is taking the lead when it comes to a go-to-market strategy, acting as the first mover in the Cosmos ecosystem when it comes to deploying any sort of decentralized orderbook. Its closest competitor in the Cosmos ecosystem is Sei Network, which is still in testnet and has not launched its token yet.

The advent of other orderbook apps and app chains in the Cosmos ecosystem is not necessarily a problem for Injective, since multiple trading avenues allow for cross-exchange arbitrage opportunities in the space. dYdX and Sei also bring more attention to trading on Cosmos as a whole to those that may not be familiar with the ecosystem.

Why the interest to build orderbook chains on Cosmos? The composability of the Cosmos SDK makes trading with order books possible with a similar UX to centralized exchanges, making on-chain trading a viable option for traders or institutions that might be more accustomed to CEXs or aren’t as familiar with DeFi.

This is an advantage compared to EVM-based perpetuals protocols like GMX or Gains Network, which have to rely on external price oracles in order to price futures contracts. These protocols fetch asset prices from centralized exchanges, and there is no way for the positions of traders to have an impact on the asset price. On GMX for example, price discovery can’t happen organically, so the protocol has to pull prices from an oracle. This is a big detriment for institutional adoption since professional trading firms are not able to execute professional market-making strategies in those protocols; a problem Injective aims to solve.

EVM-compatible protocols like GMX and Gains suffer from the dilemma of having skilled traders, like institutional trading firms and market-makers for example, potentially being able to drain the protocol’s liquidity. This is because perpetual trading on EVM chains still needs some sort of liquidity pool to function. Because of this, popular perpetuals platforms like GMX act sort of like on-chain casinos where liquidity providers act as the house, in competition with traders. These platforms are then encouraged to keep their fees higher, to discourage skilled traders using the platform, as having skilled traders participating increases the chance of liquidity being drained. These fees could scare away would-be traders or institutions. These types of traders often bring a lot of size and volume, which could very well end up on an order book-based blockchain, like Injective.

But we don’t have to speculate to know that institutions like trading on decentralized order books; dYdX is regarded by many as an attractive place to trade for those with size, who want a good trading experience. Some institutions, like Selini Capital, have made their support for the orderbook trading platform known. Here we can see that dYdX has a pretty low amount of daily active users (DAU), but this has not stopped the orderbook platform from seeing massive volumes. The high amount of daily trades relative to the DAU is suggestive of high-frequency traders and market makers making use of the platform.

While dYdX might be seen as a competitor to Injective, a likely scenario is that the dYdX cosmos app simply onboards more institutions and traders into the Cosmos ecosystem. When these traders see what the ecosystem has to offer they may be willing to try out other orderbook platforms, like Sei, or perhaps more likely, Injective, which has already launched and has a functioning derivatives exchange in Helix. Institutions may want to diversify their trading volume, and use multiple decentralized platforms, rather than rely on a single application. Also worth noting; in its current state, dYdX is a single application, while Injective has a suite of featured apps, with plans to boost the development of many more to come.

But enough about dYdX; another advantage of Injective compared to EVM-based protocols, is its interoperability; the Injective Network is highly interoperable and allows both users and developers to access deep cross-chain liquidity with zero gas fees for all dApps built on top of Injective. Thanks to the modularity of the Cosmos SDK, developers can offer novel financial instruments including perpetual swaps, expirable futures, binary options, and prediction markets.

One of the differentiating features of Injective that makes it suitable for DeFi and derivatives trading comes from its Frequent Batch Auctions (FBA) model, which is used to prevent frontrunning and MEV, which improves the blockchains experience for users. In FBA, orders submitted to the mempool are executed at the end of each block (~1 second block time) and are not published on the orderbook until the auction process is complete. Veiling the information by implementing a delay time is how Injective aims to enhance the trading experience for traders. This also allows market makers to provide deeper liquidity at tighter spreads without having to worry about high-frequency traders disrupting their market-making activities.

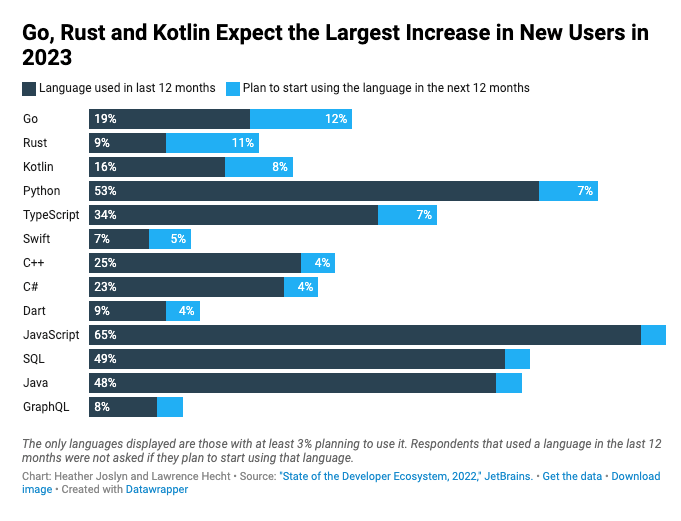

One significant factor to consider when it comes to potentially investing in Injective is its planned compatibility with dApps written in the Rust programming language, one of the most popular programming languages in Web2.

Solidity is currently the most dominant programming language for blockchain smart contracts due to the dominance of the EVM (Ethereum Virtual Machine) and EVM-compatible chains. However, it is worth noting that Solidity cannot be used in Web2, whereas Rust is among the most used programming languages in Web2, and Web3, via the Solana ecosystem, which contains applications that are written in Rust.

How is Injective integrating Rust applications? In April 2023, Injective announced the launch of Cascade, a Solana rollup on Injective, built in collaboration with Eclipse. This marked the official launch of the first SVM (SeaLevel Virtual Machine) rollup in the Cosmos ecosystem, which unlocks the $9 Billion+ Solana developer ecosystem for Injective.

Similar to Injective, Solana’s SVM is capable of parallel processing, which enables tens of thousands of transactions to be processed in parallel, rather than being restricted to one transaction at a time.

After the launch of Cascade, Solana applications can be seamlessly ported onto Cascade, and Injective. With this integration, developers can deploy Rust-based Solana smart contracts to run natively on Injective, despite the technical differences between the two blockchains. This way, developers can use the same code they have already written, and access a much wider DeFi audience in the Cosmos ecosystem through the IBC protocol.

In addition to onboarding developers from the pre-existing Solana community, building a Solana rollup can help to attract developers from Web2 to Injective as a first point of entry into crypto. Being able to deploy applications in a familiar coding language may be a significant factor that can help Injective grow and retain a Rust developer community.

Solana actually has a pool of active developers interested in order books, with one of its most popular projects being Serum, a protocol that provides its own Central-Limit Orderbook (CLOB) and matching engine to facilitate trading use cases in the Solana ecosystem. The project had its private keys held by FTX and had to make significant changes, along with the Solana DeFi ecosystem as a whole.

Solana isn’t the only ecosystem Injective is integrating with; multiple applications from the Terra ecosystem. Several significant dApps in the Injective ecosystem originated on Terra, including Astroport, White Whale, and Apollo. Other projects include exchanges like Wavely and Qwerty.

Injective is currently running two incentives programs:

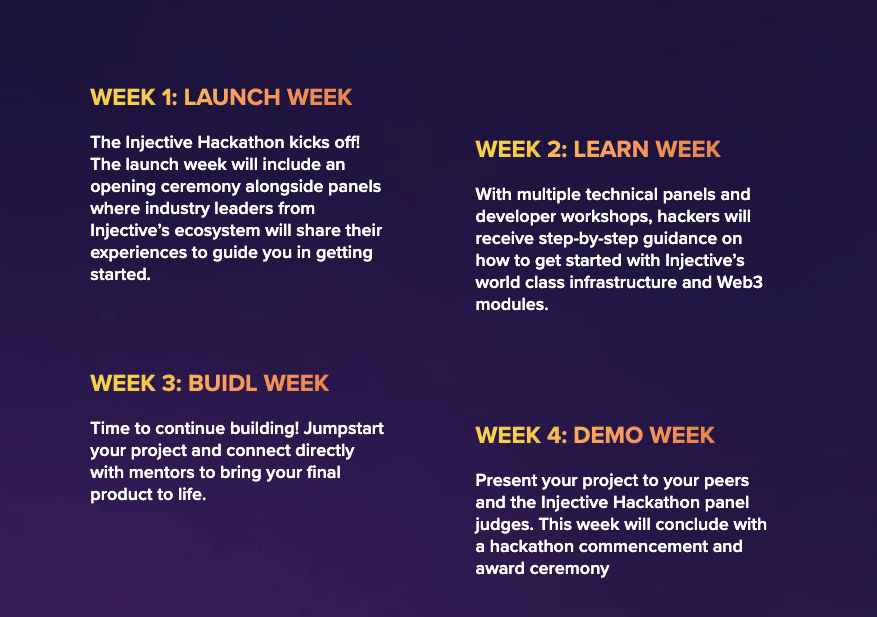

If that wasn’t enough to pique your interest, Injective’s global hackathon recently took place with over 300 project submissions and offered up to $1,000,000 in prizes and seed funding opportunities for new ecosystem builders. This was a 4-week online event that also offered mentorship from industry leaders, VC, and developers from other projects in the Cosmos ecosystem. The large prize pool aside, seeing this level of interest from developers certainly bodes well for a budding ecosystem. Considering the very small number of dApps currently deployed on Injective, the ecosystem is certainly poised for growth.

As mentioned above, Injective has made it a point to welcome existing projects with open arms, with existing efforts to onboard Solana developers and an existing community of Ex-Terra projects.

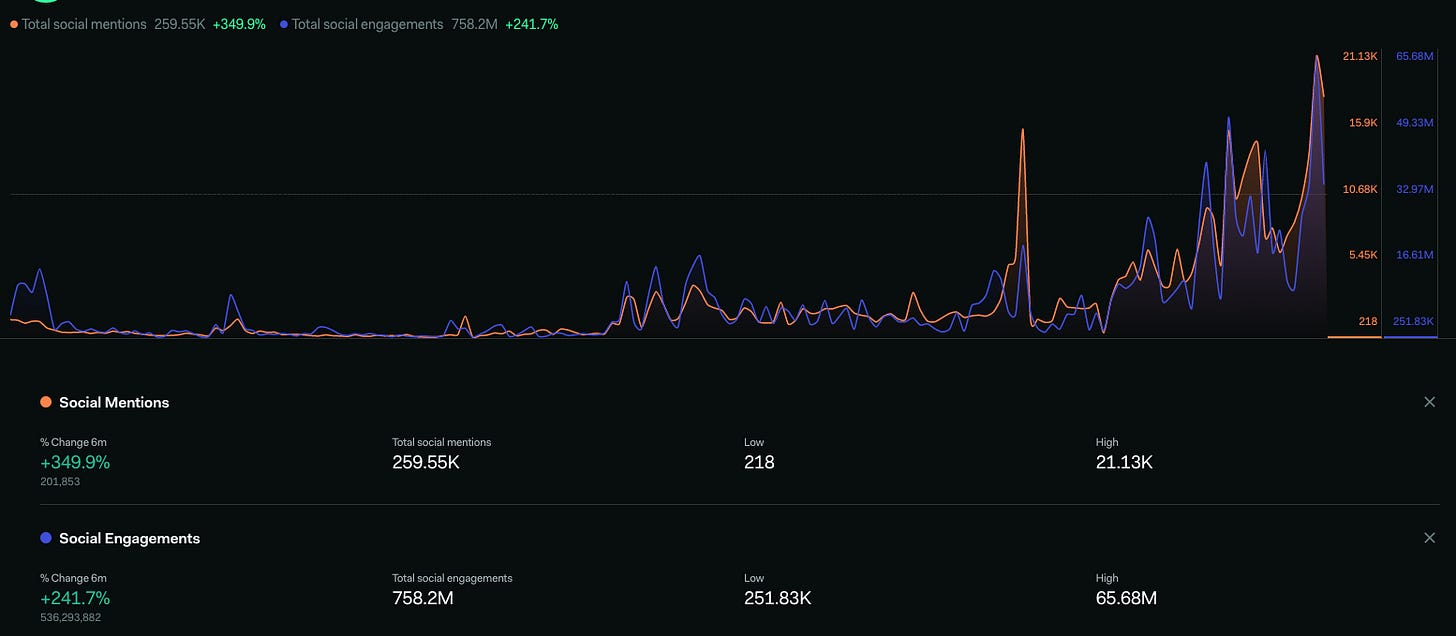

The importance of community support cannot be underestimated when it comes to valuing the growth potential of a new L1 and developer ecosystem. Growing communities and presence on social media make a chain even more attractive for developers to start building on. Injective’s strong social media presence suggests that it is well-positioned to fill the gap left by Terra after the collapse of UST and LUNA.

It is also worth noting the emphasis being made on fiat on/off-ramp. Users can use solutions like Kado Money, Payfura, Transak, or Revolut to instantly get onboard with 100+ fiat currencies.

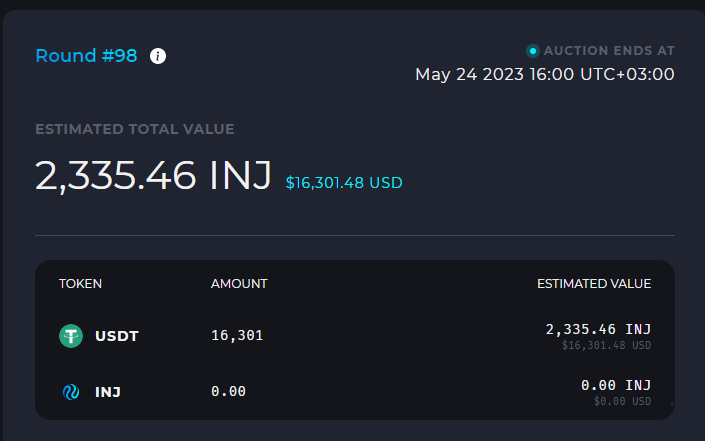

Despite the low TVL (~20M) relative to Injective’s market cap (>$700M), INJ derives its strength from weekly burn auctions that account for the amount of revenue generated by the chain from fees.

So far, cumulative trading volume has been following an uptrend which is expected to sharply increase as more applications are deployed. This way, even low amounts of TVL, as long as they result in highly productive volume, can lead to sharp increases in the amount of fees that are generated. This then increases the amount of INJ tokens that are burnt as a result. With these token burns, INJ would become more deflationary than it currently is by a couple of orders of magnitude.

Considering all this, TVL only accounts for a small part of the earnings equation, and valuing INJ by its TVL would be like valuing a company by the size of its labor force instead of its earnings.

INJ relies on a fee value capture mechanism by which 60% of all fees generated from dApps enter the on-chain buy-back-and-burn auction system explained above. The remaining 40% of fees generated by users on dApps built on Injective go directly towards incentivizing new developers, which brings an ever-growing funnel of builders to Injective.

In 2018, Injective was selected as one of eight winners for incubation with Binance Labs, Binance’s venture arm. Since then, Binance has continued to support Injective’s vision of building a product that solves major issues such as poor UX, slow speeds, centralization, and high fees. As a matter of fact, Injective became one of the first projects to launch on the Binance Launchpad in October 2020.

Now, Injective certainly has a lot going for it, but by no means does this mean interested investors should be rushing in.

For one, if there is a delay in onboarding the new applications being deployed on the chain and the on-chain volume does not increase significantly, the trading fees might not be enough to reach a significant burn ratio and impact the INJ price meaningfully.

Currently, there is more money being paid out in token incentives as there is coming in as protocol revenue.

While TVL spiking would certainly add fuel to the fire of the Injective auction system, it isn’t a requirement if the existing TVL is racking up a lot of volume, which currently seems to be the case.

But the reality is, not every investor knows this. Some, or even many, could discount any potential interest towards investing in Injective based simply on its low TVL. The TVL growth catalyst will certainly lead to more interest as INJ will start to show on the watchlists of market participants.

Delay in projects being deployed is definitely a valid concern; the Injective ecosystem is still nascent, with only 11 featured dApps. Most of the market share is taken by Helix, followed by projects that originated on Terra.

While there is an Injective incentives program and a hackathon recently took place, this will only determine what protocols will show strength to become leaders, but these project’s development and go-to-market strategies might take time to be implemented. It will also be important for Injective to gain momentum in the Delphi Labs Cosmos Hackathon, to attract even more developers from the Cosmos ecosystem.

Interested investors should certainly keep an eye on the catalysts above, but understand that there is no rush to invest in INJ, especially given the current crypto market conditions. The current valuation is pricing in a lot of growth already so waiting to see it grow into some of that potential first would derisk the play significantly. You don’t have to be first, you just need to be somewhat early in the growth curve.

An interesting play may be to short SOL against an INJ long if you decide to participate, based on the discussion above.

All things considered, the INJ token is used across a diverse range of functions such as protocol governance, dApp value capture, and Tendermint PoS security. It is also highly deflationary by design. As the ecosystem grows and dApps start generating more fees, the burn rate is expected to increase significantly. It is also worth noting that the current markets are driven by speculation and growth expectations. This works both ways so keeping an keen on eye how that conversation plays out in the public square could provide insights into timing.

To sum it up, despite the tokens’ stellar performance in Q1 2023, the chain is yet to experience a 0 to 1 moment where more dApps generate more demand for the INJ token, effectively generating a feedback loop where demand for INJ goes up whilst the INJ supply goes down due to the buy-back-and-burn auction system.

Many of Injective’s positive catalysts are not time-sensitive. Bullish catalysts including incentive programs, fundraising, migration from other chains, and token burns are either already happening or in their early stages, but have had their impact on INJ price dampened by overall market conditions. Investors should keep an eye on new developments from the Injective ecosystem, and consider upgrading INJ to a buy should there be any news relating to these catalysts. This could include new incentive programs, more rounds of funding, partnerships with incubators, and new projects deploying on the chain. Metrics like increasing TVL or volume on the Injective chain would also telegraph greater token burns and are worth watching.

Revelo Intel has never had a commercial relationship with Injective and this report was not paid for or commissioned in any way.

Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed.

This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.