Published: February 19, 2024

In the following report, we express our view that Across ($ACX), which is a bridging protocol with a $40M market capitalization approaching recent all-time highs, is positioned for substantial growth in the following months driven by two major catalysts and an upgrade to Across v3. Our overarching thesis is that the future of cross-chain transfers will be intent-based, and Across is in a unique position to solve the UX problem posed by having hundreds of L2s.

Firstly, the Dencun Upgrade, scheduled for March 13th, is expected to significantly reduce transaction costs on Layer 2s. This reduction will likely encourage more activity and value flows between L2s, especially as ecosystems like Linea, Scroll, or Starknet start to grow. As more activity shifts to fragmented L2s and from L2 to L2 (as opposed to L1 to L2), we expect 3rd party bridges to grow in usage and market share.

Secondly, the highly anticipated airdrops of $ZRO and $W, expected to debut at multibillion-dollar valuations, dwarf the current market cap of Across. This discrepancy suggests a potential for significant repricing of $ACX, reflecting its improved fundamentals and market positioning.

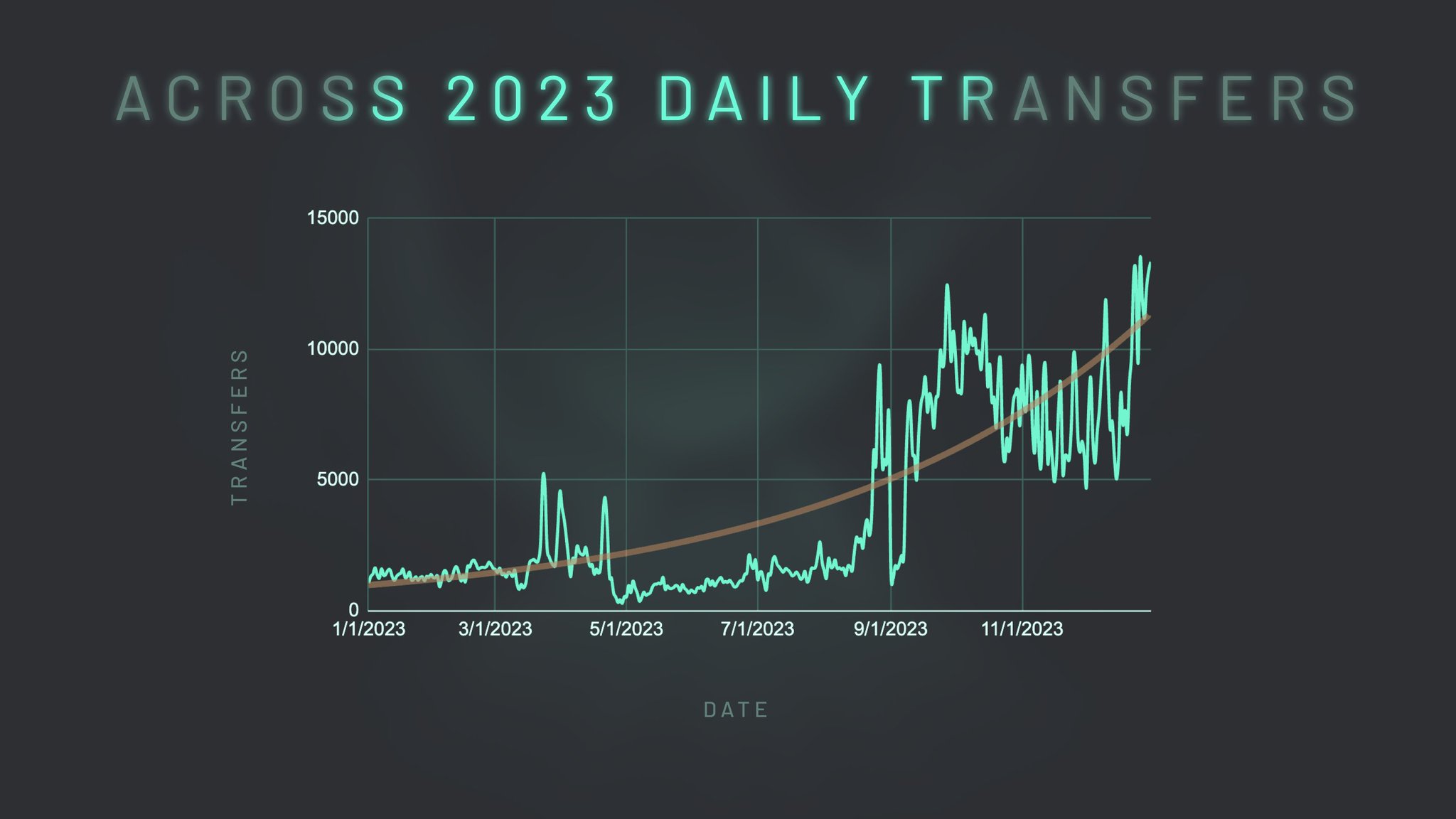

We argue that we are in the initial stages of a secular trend that will result in dozens if not hundreds of L2s and that Across can stand out versus other competitors thanks to its speed and cost-efficiency. Despite airdrop expectations and Sybil activity on competing projects such as Stargate, fundamental metrics reflect a strong uptrend in volume, fees, and capital efficiency.

As Ethereum’s Layer 2 solutions multiply and liquidity fragments, the need for efficient asset bridges becomes critical. Users demand a seamless experience, transferring native assets swiftly and affordably. Canonical bridges linked to optimistic and ZK-rollups, however, introduce significant delays, from over an hour to 7 days. Across addresses this challenge with its intent-based bridge model, ensuring rapid and cost-effective transfers between Ethereum’s mainnet and various L2s, promising expansion to more chains in the near future.

Notably, the founder’s active engagement in high-profile industry discussions like Blockwork’s Bell Curve underscores growing visibility and credibility. The project’s prominence, evident with 6 mentions in the UniswapX whitepaper and its role as a dominant non-canonical bridge within DeFi, positions it favorably amidst the upcoming EIP-4844 and the launch of more Ethereum L2s.

Launched in November 2022 by Risk Labs and incubated by UMA, Across introduced an innovative “intent-driven” bridging model, co-founded by Hart Lambur and Brittany Madruga. This model was aimed at resolving the issues of liquidity fragmentation and high bridging costs. By centralizing liquidity on the Ethereum mainnet and utilizing a network of specialized actors called relayers, Across would provide fast, cheap, and capital-efficient transfers between L2s.

The strategic incubation by UMA helped to amplify Across’ market presence and credibility among users and investors during its early days. Moving forward, as the intent-driven bridging model gains industry recognition with projects like Uniswap X, Across positions itself as a first mover, setting the standard for future bridge solutions and potentially capturing a significant market share in this nascent segment.

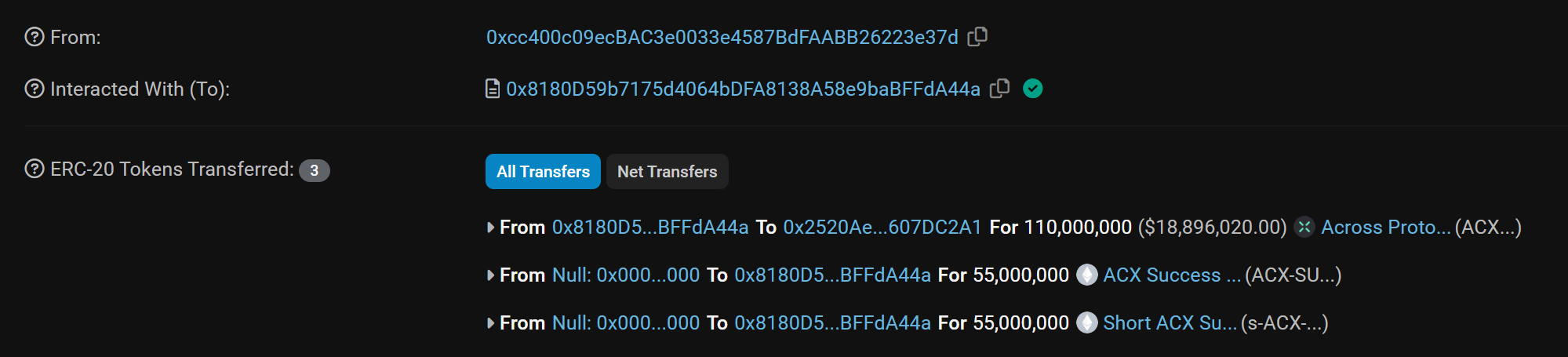

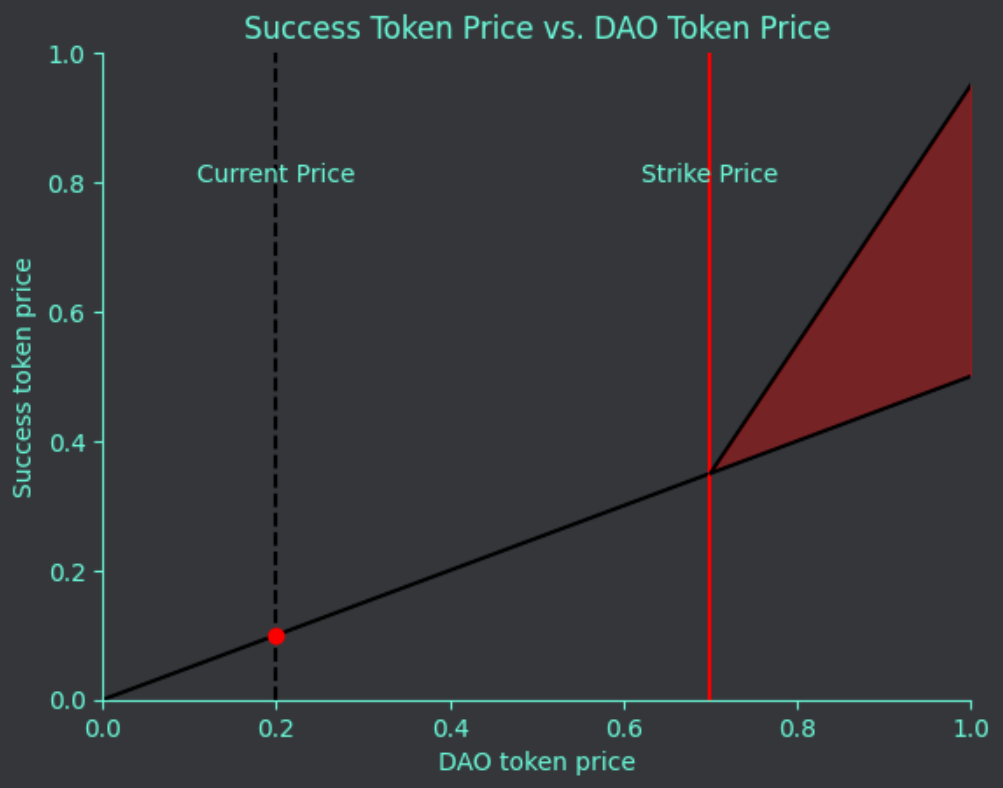

On November 23, 2022 (before TGE), Across announced a Strategic Partnership with Placeholder, Blockchain Capital, and Hack VC, raising $10M in exchange for 55M Success Tokens vested until June 30, 2025. Each Success Token is issued on-chain and combines 1 $ACX token with a call option struck at $0.50. At maturity, the investor receives 1 $ACX token in addition to the value of the $ACX call option, paid in $ACX.

Pioneered by UMA, Success Tokens offers an alternative investment structure to better align the incentives of investors with the protocol and its community. Instead of paying the VC investor a bonus upfront (in the form of a discount), the Success Token model pays the VC investor a bonus only if good things happen. In fact, VCs will have doubled exposure as the price rallies, resulting in a win-win scenario for stakeholders.

This fundraising ensures that the incentives of both the protocol and its investors are aligned. Instead of selling tokens at a discount, they are offered an alternative on-chain vehicle such that they will share the same risk as retail if things don’t work out, but also have upside exposure in the form of a call option.

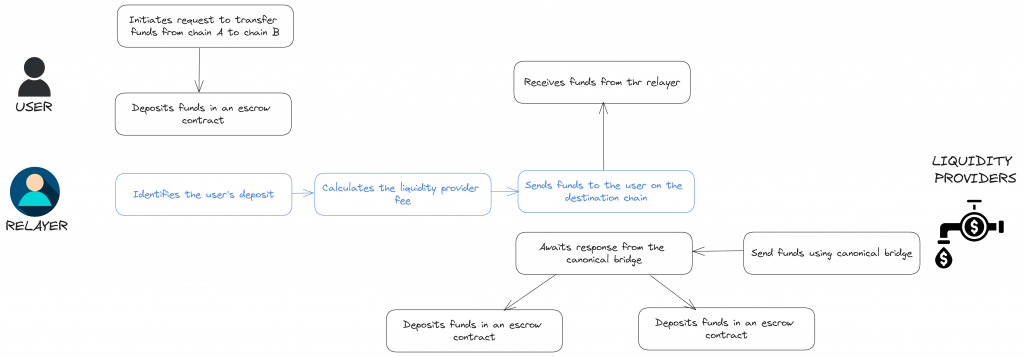

Across is an intent-based bridge designed to solve the challenges of high transaction fees and slow token transfers between Ethereum mainnet and L2s. Utilizing UMA’s Optimistic Oracle and a network of specialized actors called relayers, Across facilitates instant and trustless ERC20 token transfers, enhancing liquidity, capital flow, and interoperability across Ethereum and L2s (currently supporting Base, zkSync, Polygon, Optimism, and Arbitrum).

At the heart of Across’s model are intents. To better understand this concept, it is important to highlight the difference between a transaction and an intent. A transaction explicitly refers to “how” an action should be performed while an “intent” refers to “what” the desired outcome of that action should be. Unlike a transaction, an intent describes an ideal end state, rather than a set of instructions to be executed. For instance, if a transaction says “do A then B, pay exactly C to get X back”, an intent says “I want X and I’m willing to pay up to C”.

As a permissionless protocol, Across facilitates a competitive off-chain marketplace where relayers compete against each other, using their capital to fulfill users’ transfer requests on the spot. By using native assets and a network of relayers, assets can be transferred on behalf of users. This is what’s known as an “intent-based bridging model”, which simply means that users express their “intent” to achieve a desired end state (the user wants to bridge a certain number of tokens from chain A to chain B) but the exact path or trace to follow is not specified (that’s the job of the relayer).

The process takes place in the 3 stages detailed below.

Unlike traditional bridges that require a network of validators or multiple liquidity pools, Across utilizes a single liquidity pool on Ethereum mainnet. This strategy mitigates liquidity fragmentation and allows for native asset transfers to L2s. User requests are instantly filled by relayers out of pocket, and relayers are then compensated via liquidity providers (LPs) on Ethereum, whose liquidity is bridged using L2 canonical bridges.

The idea behind an intent-based liquidity network is that users outsource bridging risks to relayers, who will then compete to fulfill cross-chain transfer intents and in return, capture value through fees. In Across, user fees are used to pay both LPs and relayers. In return for providing liquidity, LPs are compensated for their capital by earning fees from transfers. Since users’ orders are filled by relayers and relayers are then compensated by LPs, they are effectively earning an interest rate on short-term loans.

To illustrate why LPs are essentially lending assets rather than swapping assets, consider the following example: a user seeks to bridge $ETH from Ethereum to Optimism. The user is looking for the native version of their token, not a synthetic version produced by the bridge. This transaction is fundamentally a borrow-lend interaction, where the user borrows ETH from an LP’s idle assets to facilitate immediate transfer, bypassing the canonical bridge’s 7-day delay. The cost to the user is essentially the opportunity cost of the ETH for the LP, which can be conceptualized as an interest rate, reflecting the true nature of the exchange as a lending activity rather than a token swap.

The total utilization of an asset across the protocol is what determines the fees for LPs and relayers. This results in consistent fees that can increase during periods of high utilization, ensuring that LPs are fairly compensated for increased demand. This mechanism helps to attract more capital to enter the pool, as the higher utilization rate increases the expected APY. Overall, it provides a better user experience that more accurately prices the risk exposure exchange between the bridge user and LP.

The brilliance of Across lies in its ability to bypass the time-consuming transaction verification process typical of other bridges. By enabling relayers to fulfill transfer intents before the original chain confirms the transaction, Across achieves unparalleled speed due to the competitive nature among relayers.

The key aspect is that users’ cross-transfer intents are immediately served by relayers who are compensated afterward. This guarantees maximum speed and minimal operational costs. Unlike most bridges that use on-chain actions extensively for verification, Across employs UMA’s optimistic verification, drastically reducing gas consumption by verifying repayments only in outlier cases.

By using UMA’s game theory and optimistic dispute resolution mechanism Across takes an alternative approach such that it only uses on-chain actions when relayer repayments are disputed, improving the system’s gas efficiency. Furthermore, the settlement process is optimized as well, with repayments to relayers occurring periodically (every 2-4 hours) and in batches to reduce amortized gas costs.

This mechanism not only saves costs but also improves efficiency and security. First, users do not experience latency as relayers front their assets and rely on UMA’s system to ensure repayment. Second, as dispute cases are rare, Across’s optimistic verification mechanism only requires sending messages in outlier cases, drastically reducing the number of on-chain actions required to confirm transfers.

Note that this optimistic design does not make the bridging process less secure. With Across, relayers front orders on behalf of users, so they are the ones carrying the risk. Therefore, relayers are effectively covering users when they fulfill requests. They do this because they trust UMA’s game-theoretical dispute resolution system—and they know they can earn an interest rate for lending out their assets. The end result is that optimistic verification minimizes on-chain actions to exceptional cases, so it also reduces gas expenditure.

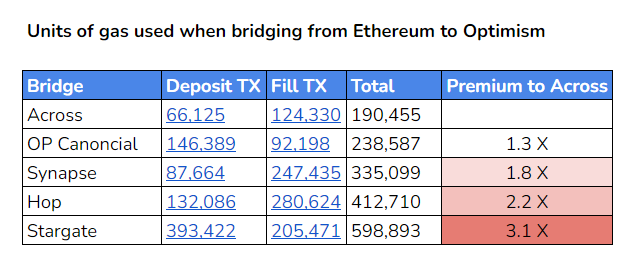

The tradeoff is that Across needs to use LP capital to pay relayers to “lend money” for ~1-2 hours until they are repaid for filling the users’ intents. But it turns out this is a good tradeoff: the cost to lend money for a couple of hours is tiny compared to these gas savings. For reference, a comparative analysis can be found in the following spreadsheet (displayed below), comparing gas costs of manually bridging 0.1 $ETH from Ethereum mainnet to Optimism.

Additionally, all deposits for LPs are single-sided and, therefore, there is no impermanent loss. Upon deposit, liquidity providers receive an LP token representing their share of the pool, which becomes more valuable over time as it accrues fees from transfers.

Withdrawals are flexible (LPs can withdraw at any time), although high demand may lead to temporary delays, requiring LPs to wait for assets to be bridged back from L2s, with a maximum wait of about one week. Nevertheless, they will always withdraw an equal or greater amount than what they deposited.

The value proposition of Across is magnified by the increasing fragmentation of the L2 landscape. As Ethereum continues to evolve with a rollup-centric approach, highlighted by the upcoming EIP-4844, the demand for efficient bridging solutions like Across, which consistently ranks in the top 2 on aggregators for supported routes 98% of the time, is set to rise. This shift towards a multi-layered ecosystem underscores the need for protocols capable of facilitating rapid and cost-effective cross-layer transactions.

However, the bridge sector faces significant security challenges, with high-profile hacks of third-party lock-and-mint bridges—such as the Ronin Bridge ($624M), Wormhole ($320M), and Nomad ($190M) incidents—highlighting the vulnerabilities associated with the use of representative assets.

All of these breaches share a common denominator: the actual hack stems from the “honeypot effect,” where the concentration of locked assets presents a tempting target for attackers. While third-party bridges offer the convenience of not requiring external liquidity by locking the native asset and minting a representative one, this model introduces multiple trust assumptions and places the burden of risk squarely on users. These representative assets are “trusted” assets because users have to trust them when they lock up their funds. Thus, the reason why these bridges are subject to hacks is that they don’t pay for security and, as a result, users are subject to risk.

The answer to this problem lies in the adoption of canonical assets for cross-chain transfers, which eliminates the reliance on trust in representative assets and significantly reduces the risk profile for users. However, canonical L2 bridges are inefficient, imposing significant wait times for withdrawals (7 days for Optimistic rollups and up to 60+ minutes for ZK-rollups). These delays represent a critical friction point for users, particularly in a fast-moving environment like crypto.

Across addresses this critical gap in the market: it avoids the security vulnerability of third-party lock-and-mint bridges and the inefficiencies of canonical L2 bridges. In essence, Across fills the market gap by merging the security benefits of using canonical assets with the speed and efficiency of an intent-based model, setting a new standard for cross-chain transfers in a multichain environment.

Effectively, Across’s design using canonical assets to transfer value has a cost. This is because someone has to put up liquidity and be fairly compensated for it. Nevertheless, this tradeoff also results in some unique benefits, making Across consistently the fastest, cheapest, and most gas-efficient means of moving assets across Ethereum L2s.

The bridging sector is becoming one of the most competitive in crypto, but Across’s strategic positioning can help it thrive under two distinct user scenarios: users who directly interface with bridge providers seeking speed, and users utilizing bridge aggregators in pursuit of cost efficiency.

On the one hand, Across’s intent-based bridging model is perfectly suited for users who prioritize speed. By employing relayers who front their capital to fulfill transfer requests immediately, Across can offer instant cross-chain transactions, setting it apart from competitors that may suffer from longer processing times due to canonical verification delays or liquidity issues.

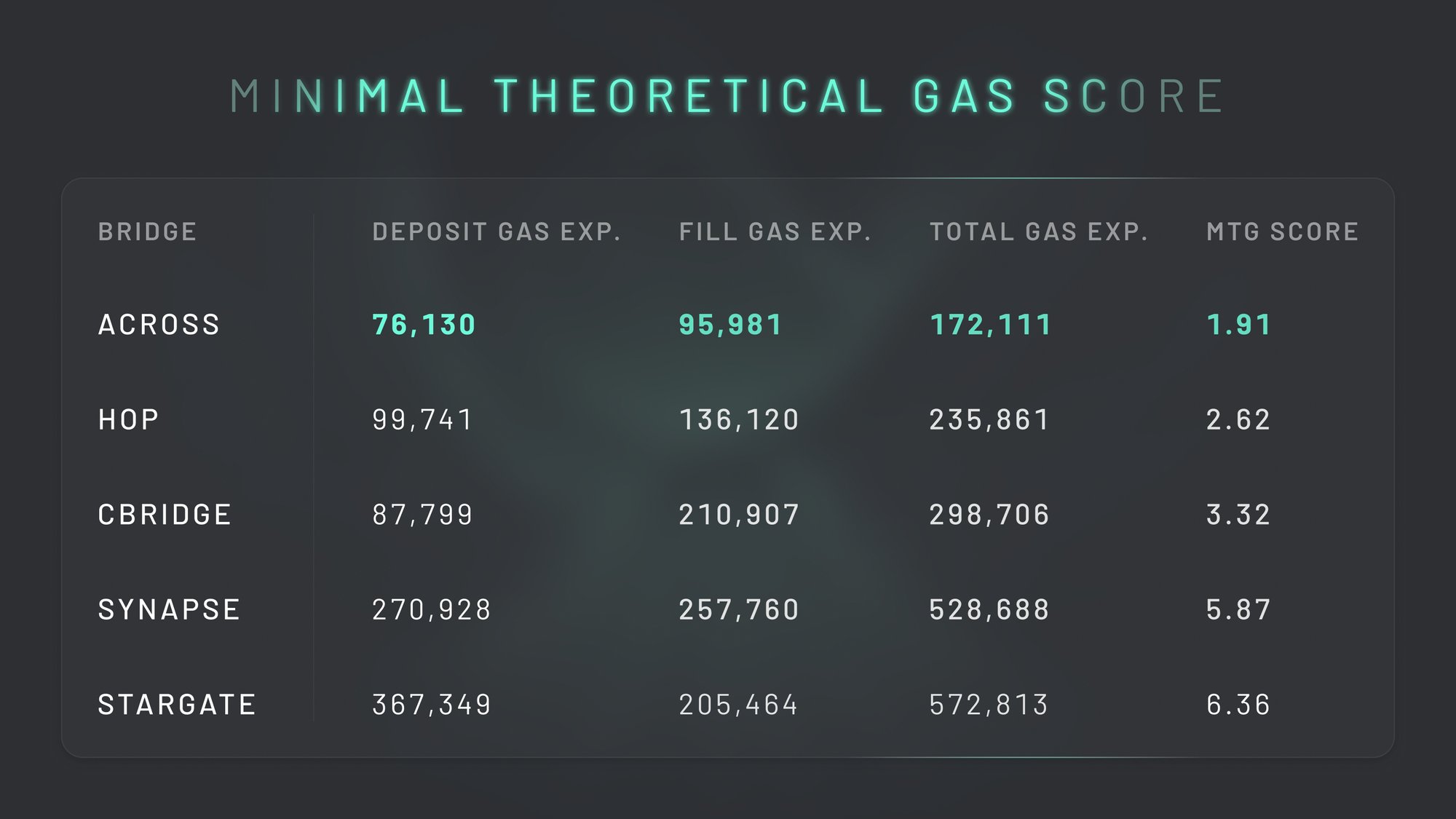

On the other hand, users prioritizing cost over speed would turn to bridge aggregators to find the cheapest bridging option. In this scenario, Across can still compete effectively by leveraging its cost-efficiency. Bridge transfers require at least two transactions: a deposit at the origin and a fill at the destination. The baseline for each of them is a simple asset transfer, which costs 45,000 gas units, so a total gas expenditure would be 90,000 gas units.

We can use this minimum expenditure as a benchmark that measures the gas efficiency of different providers. This is called the Minimal Theoretical Gas (MTG) score, such that 90,000 gas units are the equivalent of an MTG score of 1. As an example, the table below looks at the MTG score for $USDC transfers across different providers, and we can see that Across ranks on top with an MTG score of 1.91, 3x lower than Stargate.

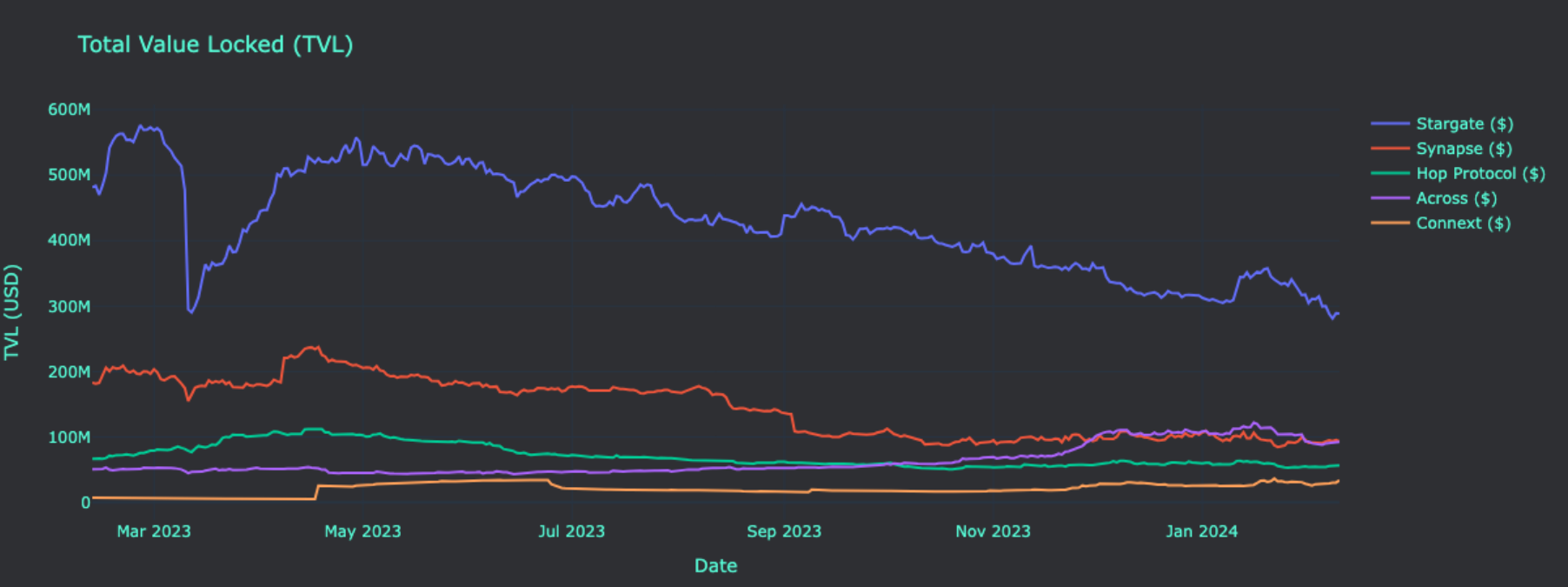

Despite Across’s strengths in gas efficiency and speed, its market adoption faces limitations due to its current focus on supporting only Ethereum L2s and select assets like $ETH, stablecoins, $OP, and $ARB. This specialization restricts its competitive edge against more versatile solutions that accommodate a broader range of chains, including EVM-compatible chains, Solana, and Move-VM platforms like Sui and Aptos. For example, Stargate, offering wider chain support, boasts nearly double the Total Value Locked (TVL).

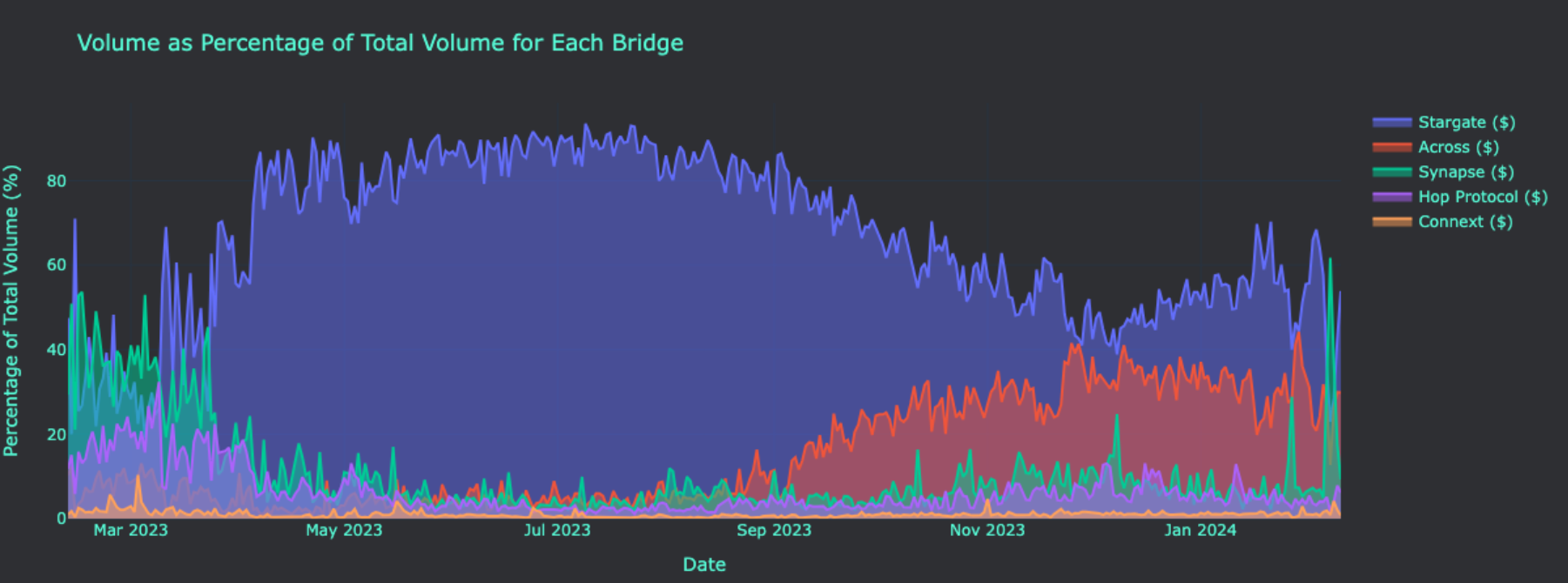

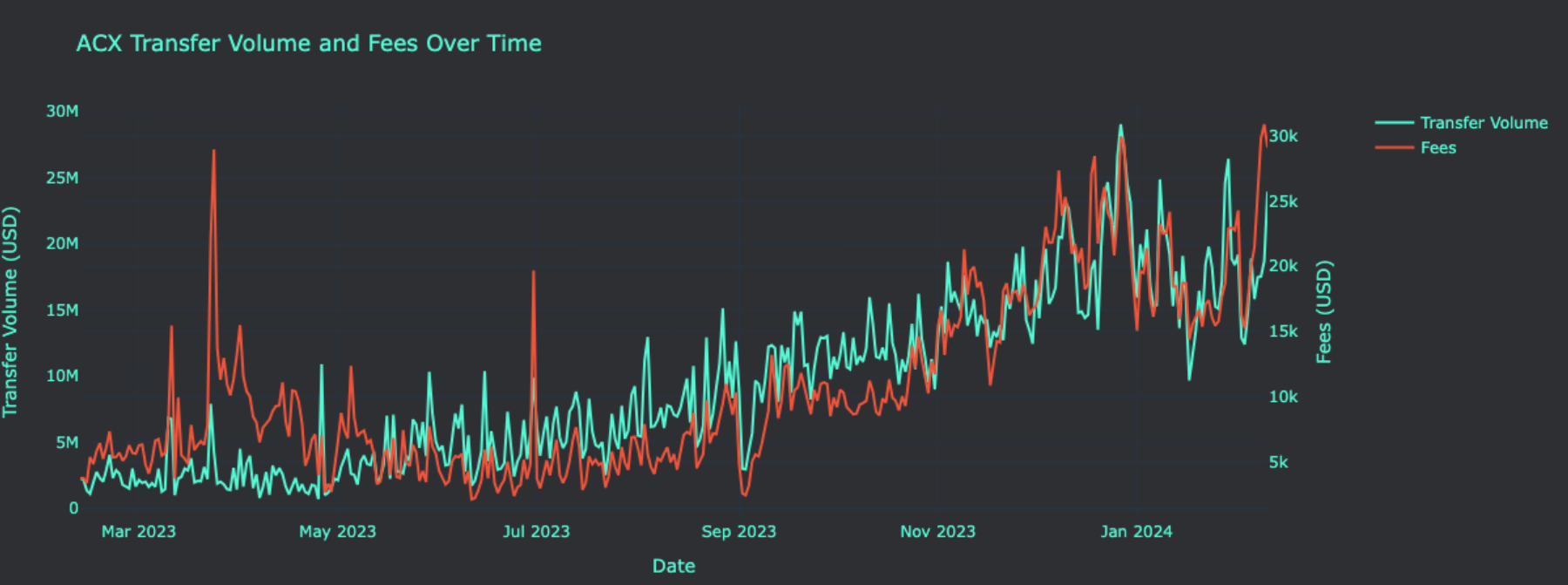

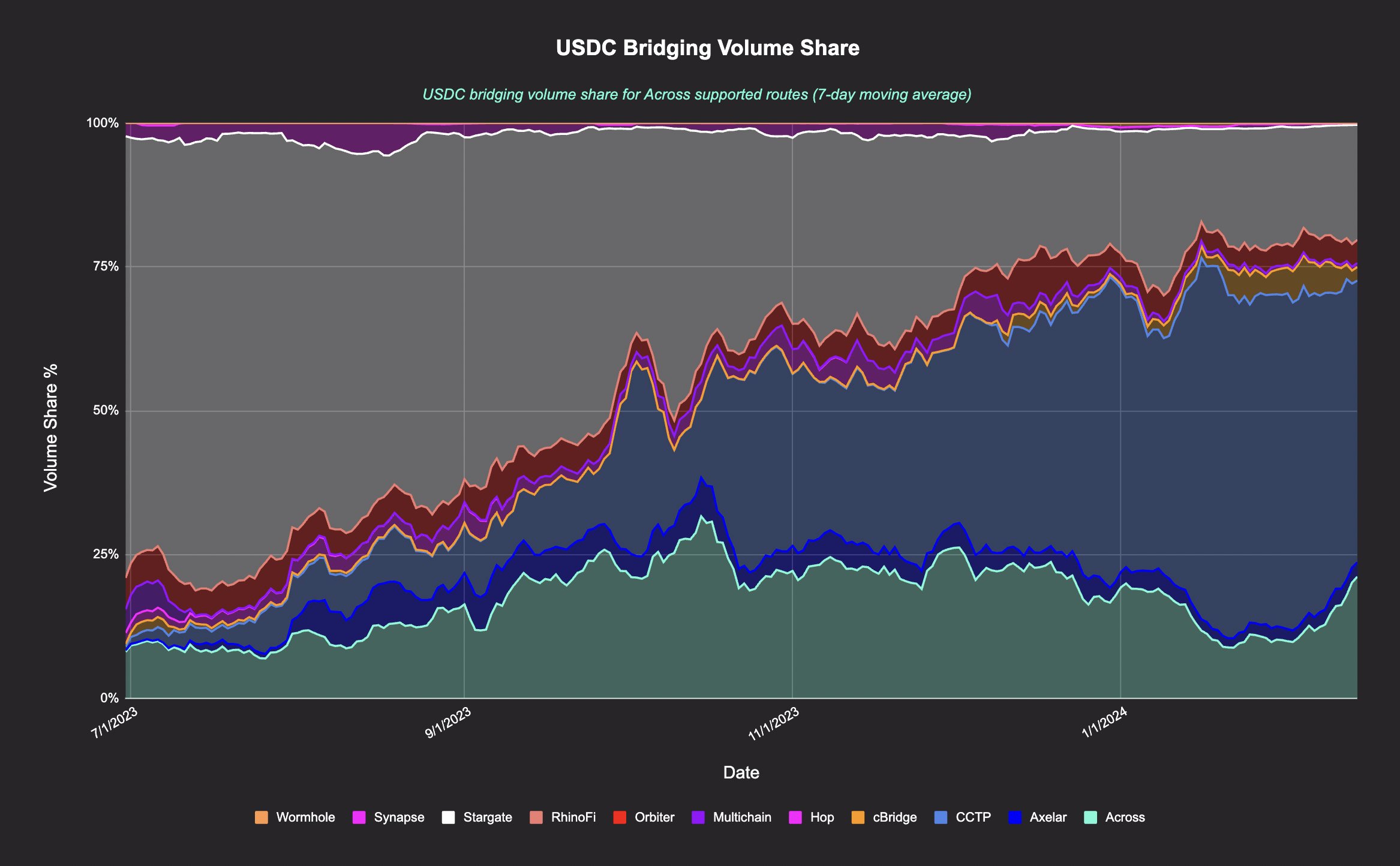

Nevertheless, despite its focus on Ethereum L2s and a limited asset range, Across is narrowing the competitive gap with Stargate, evidenced by transfer volumes. This trend persists even with Stargate’s broader asset diversity and potential Sybil activity. Impressively, Across’s bridging volume exceeded $4 billion in 2023, showcasing significant growth. A stark comparison of monthly volumes—$74M in January 2023 versus $535M in January 2024—underscores Across’s accelerating adoption and effectiveness in capturing market share.

At this time, product awareness and airdrop farming may explain why Across is not “winning” in overall market volume – although this trend is starting to show signs of reversal.

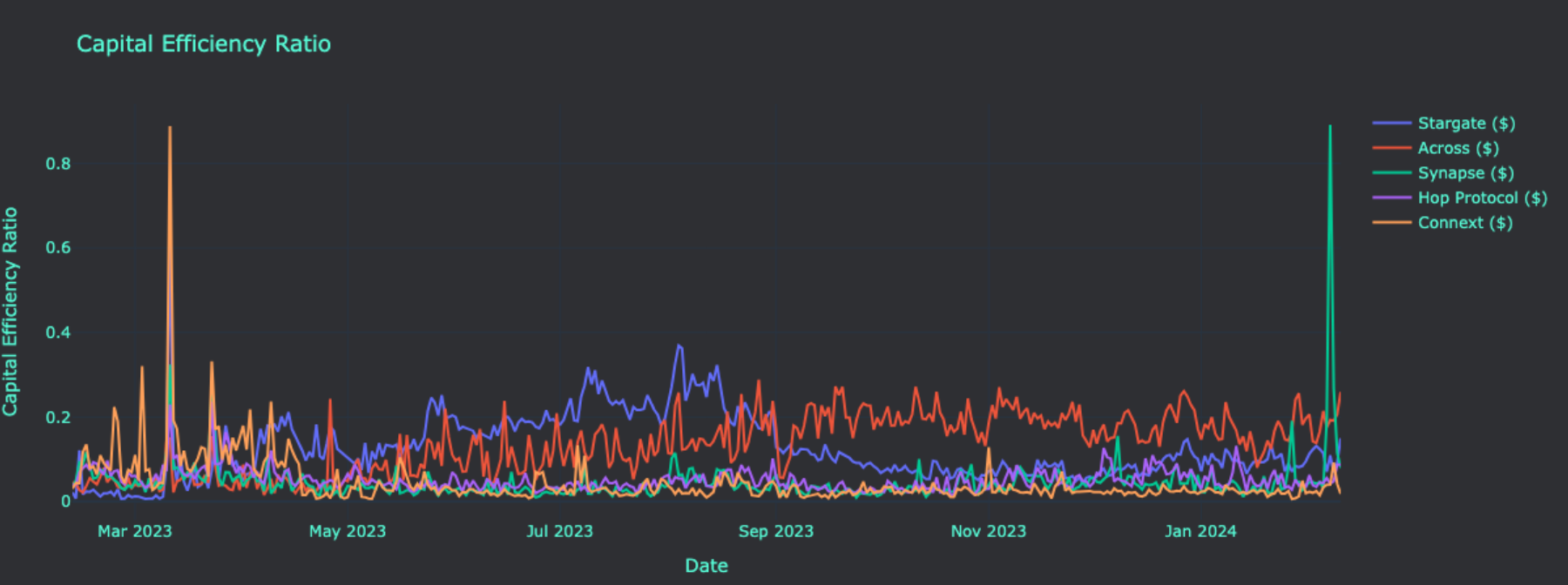

Regardless, capital efficiency remains a more accurate measure of bridge usage and asset utilization than TVL alone. Fundamentally, the better bridge is the one that requires relatively low capital to do a lot of bridge volume. In this metric, Across remains the current leader after flipping Stargate in September 2023.

Protocols that demand a larger pool of liquidity to process the same volume of transactions inevitably incur higher costs. These costs are compensated by paying higher fees to LPs, which, in turn, are passed down to users, increasing the cost of transactions. In contrast, a bridge like Across requires less capital to facilitate transfers and can maintain lower operational costs, allowing it to offer more competitive fees to its users.

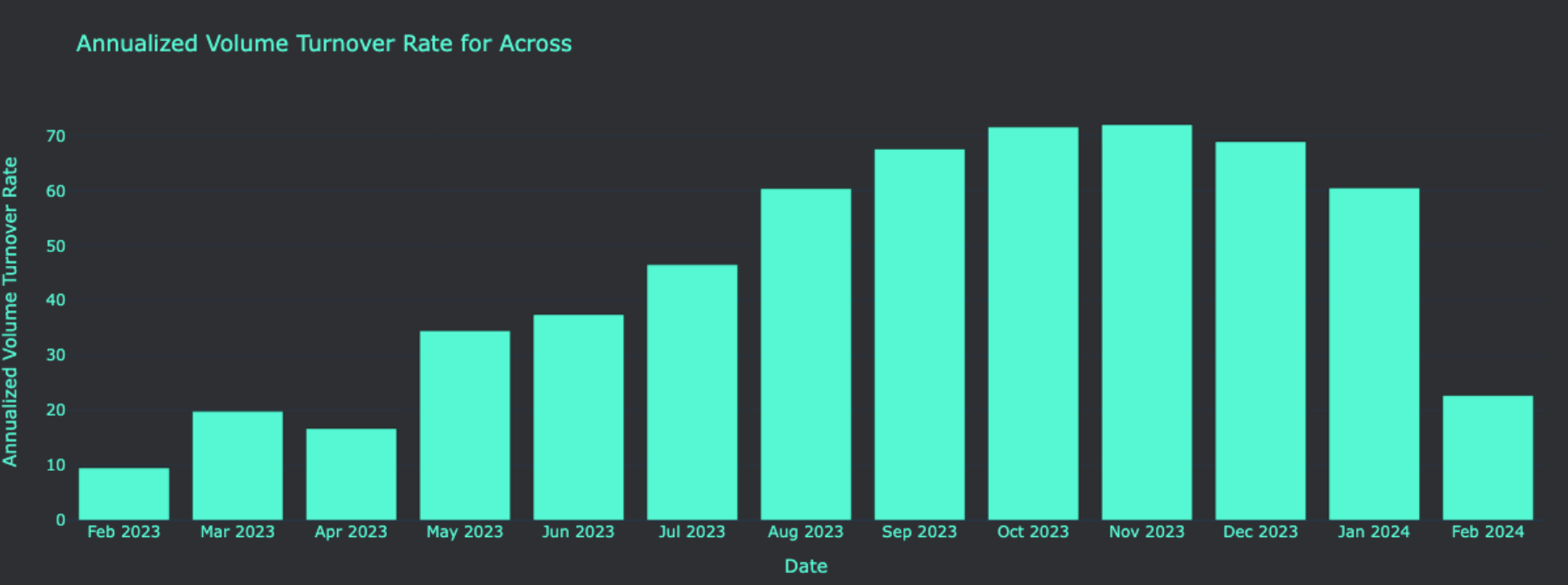

This is reflected in the annualized volume turnover rate, suggesting increasing amounts of volume being transferred per unit of TVL. Volume has grown by +342.0% in the last 365 days while TVL has grown by +84.5% in the same period of time. Due to its intent-based design, the median bridge fees on Across can be up to 75% cheaper than the competition, since all relayers are reimbursed from a main hub pool on Ethereum rather than multiple local pools on each chain.

This affordability can significantly enhance user adoption and preference for such a bridge. This might also explain why the gap in Daily Active Users (DAUs) between Across and Stargate is becoming narrower over time.

But more interestingly, the amounts being moved have risen over the course of the year, now topping $20M in daily flows. This tells us that Across is not just attracting new users by offering a great bridging experience, but also that users are moving bigger sums through the bridge than this time last year.

Capital efficiency also plays a pivotal role in determining the yields for liquidity providers. A bridge that operates with high capital efficiency—meaning it uses a smaller total value locked (TVL) to facilitate a large volume of transactions—can offer higher yields.

For instance, a bridge utilizing 50% of its TVL daily can afford to give an annual percentage yield (APY) of around 20% if it charges 0.1% in LP fees. Conversely, a bridge with only 15% daily TVL utilization might provide an APY of less than 6%. The essence here is that with lower capital requirements, the fees collected from bridge transactions are distributed among a smaller pool of capital. This not only allows for charging users lower fees but also means LPs can earn more due to the higher turnover of the capital they’ve provided.

| $WETH LP APYs | $USDC LP APYs |

|

|

|

More specifically, LPs on Across simply deposit a single asset, eliminating the risk of impermanent loss. Furthermore, since all of the liquidity is concentrated in a single pool on Ethereum, LPs are not swapping assets but lending them, thereby avoiding the pitfalls of slippage and adverse selection from arbitrage. LPs lend their assets to facilitate instant order fulfillment by relayers, who are then reimbursed through the canonical bridge, ensuring a passive income stream for LPs without the need to actively manage their funds for optimal returns. This system not only saves gas but also amplifies LP returns as asset utilization increases.

Moreover, Across incentivizes long-term liquidity provision through Reward Locking, a feature that boosts LP rewards based on the duration of capital commitment. This approach enhances the traditional liquidity mining model by rewarding the longevity of support rather than just the amount of liquidity provided. LPs can stake their LP tokens with an extra transaction and monitor their investment’s performance—including size, APY, reward multipliers, staking duration, and total rewards—via Across’ dedicated Rewards Page, allowing for a transparent and hands-off investment experience.

For those who like the idea of passively staking capital in the Ethereum Mainnet LP pools, attractive yields have consistently been available, and you can get amplified rewards the longer the capital is committed to an LP pool, incentivizing alignment instead of mercenary farming (and dumping). In the screenshot below, taken from Across’s rewards page, the APY column represents your total APY from the pool, including the pool APY plus rewards APR times your multiplier. Max APY is the maximum APY after you have staked your LP tokens for 100 days. For example, $ETH is yielding between 14% to 20% with 8.5% being the native yield paid out in $ETH from bridge transfer fees.

In addition to the Reward Locking Program, there are also Referral Rewards for those who spread the word about Across. When a user bridges using someone else’s (or their own) Across referral link, the referrer and referee earn $ACX rewards. Referrers also have the opportunity to level up their tiers; the more people they refer and the more volume they accumulate, the higher the tier and greater the rewards.

If you elect to try Across please use the Revelo referral link to do so – https://across.to?ref=0xA67680C3e940b1Ac88FADCD0ADC323D3b1D3992f

Moving beyond on-chain metrics we need to address the elephant in the room and start looking at $ACX, the native token of the protocol. As of now, it is a mere governance token that has no utility other than governance and inflationary staking rewards.

That being said, the future outlook for the token does not look as pessimistic when we take into account upcoming unlocks or sell-pressure events. To be specific, we anticipate a stable prospect in terms of supply changes, with little sell pressure in the upcoming months. This is largely attributed to the absence of large impending token unlocks.

When it comes to emissions, a governance vote was passed on December 26th, 2023 to set up an $ACX Emissions Committee (AEC). This would result in the formation of a specialized group elected to oversee and manage the emission rates of $ACX tokens to prevent excessive expenditure from the treasury. Tasked with the transparent and periodic review of emission rates based on asset pool utilization and comparative bridge yields, the AEC operates within a clear and restrictive framework, with its activities and decisions visible on a dedicated Dune dashboard.

The AEC’s mandate includes devising and executing a long-term strategy for $ACX emissions, aiming to preserve Across DAO’s treasury for sustained growth and future projects. Specifically, the committee pledges not to exceed the allocation of 400 million $ACX (40% of the total supply) for liquidity provider incentives, ensuring these resources last until at least the end of 2028.

Note that Across is one of the most capital-efficient designs, and it does not need as much liquidity as other competitors to attract the same volume. Since Across relies on a main pool on Ethereum to fill relayers, it avoids the problem of having to incentivize and pay with emissions to multiple pools on other chains. This implies that there is a reduced number of liquidity providers that need to be paid for with inflationary emissions.

This is quite positive news when we take into consideration the innovative fundraising strategy employed through Success Tokens, which largely mitigates the risk often associated with VCs dumping their allocation on the secondary market. Having focused fundraising efforts on a select group of capital allocators, Across ensures that they are motivated to contribute positively over time. The vesting of Success Tokens until June 30, 2025, further secures VC investment in the protocol’s future, with the on-chain implementation of this schedule enhancing transparency. This allows for real-time tracking of investor confidence and anticipation of potential sell-off points, stabilizing the $ACX market dynamics.

Despite Circle’s launch of CCTP allowing for native $USDC minting and redemption across chains, its impact on Across seems pretty muted. Even though $USDC comprises ~40% of bridged assets, CCTP still has slower transaction times (10-15 minutes) compared to Across’s (1-2 minutes), and therefore, most of its usage comes from backend services rather than direct user interactions. Combined with Across’ continued volume growth, we expect both solutions to co-exist, serving different user needs. Users want to move fast, and that’s where intent-based bridges like Across have an edge.

With Uniswap X entering the market, intent-based cross-chain swaps will be possible as well, offering an alternative to Across. A key challenge for Uniswap X is liquidity rebalancing across chains, where larger players have an advantage in handling larger batches. In contrast, Across leverages LP funds for rebalancing, enabling smaller participants to compete effectively with quicker fills. This is where Across is in a better position since it uses LP funds to help relayers do their job and get refunded on any chain they prefer – it is the LP funds that are rebalanced in batches, not their portfolios. This allows smaller players with smaller pockets to come in and compete with faster fills. By aligning the incentives of all participants involved, market forces will take care of ensuring that users get faster and more precise pricing on their orders. This topic was also discussed by Across’s founder on a X Space, where he explicitly mentioned “everyone asks about the intents of users but nobody asks about the intents of relayers except Across”.

That being said, while Uniswap X’s final version is not live yet, it will have one competitive advantage versus Across in its current state: it supports cross-chain swaps instead of simple asset transfers. Despite Across’s speed, UniswapX can take us into a new paradigm, where any token can be near-instantly swapped for any other token on any other chain.

It is also worth highlighting how competitive the bridging landscape has become over the last months, with entities like Stargate, Hop/Synapse, and Axelar marking their presence through strategic marketing, first-mover advantage, and expanding ecosystem integrations. Nonetheless, we argue that Across’ focus on capital efficiency remains a substantial defensive moat against competitors. As more users start using bridge aggregators, chances are high that Across will continue to gain market share and overcome this saturation.

Across’ use of canonical bridges and an optimistic design also enhances its security framework, reducing the likelihood of attacks. That being said, we still believe that Across’s greatest weakness remains its support for very few chains, only covering Ethereum L2s.

On the security front, it is also worth highlighting that, while the core team of contributors started running the first two relayers, the Across relayer ecosystem has grown over time. This removes single points of failure and increases competition between decentralized third parties, resulting in better pricing for users. Roughly ~80% of Across transactions were being filled by third-party relayers at the start of the year. For context, Across had 8 relayers at the start of 2023, and this number grew to 57 by the end of the year — a 612% growth. Over time, more intent-based protocols are expected to start offering similar services like swapping, limit orders, TWAPs, etc., and the winners will be those who manage to build a moat. While this might seem like a threat to Across, we think that the Lindy effect will prevent relayers from seeking greener pastures.

Another thing to keep in mind is that there are efforts being made towards atomic composability across L2s, which may reduce the necessity for bridging services like Across in the future. Although these technologies are in nascent stages, they represent a long-term challenge to the bridging model, especially with zk-rollups potentially enabling trustless asset transfers.

Across V3 is imminent and, although details are not fully available yet, our thought is that it will include a rollout for additional chains to be included in the offering. As we have seen the efficiency and cost effectiveness of the Across approach is attractive and unlocking growth via additional chains is a significant driver of positive momentum and price action.

Brace yourselves.#AcrossV3 incoming 🪂 pic.twitter.com/xjssF7YuJm

— Across (@AcrossProtocol) February 15, 2024

Other than that, we also expect the market share to continue growing thanks to integrations from wallets like MetaMask, Rainbow wallet, or OKX wallet, and aggregators like Dodo, and Matcha, making it seamless for users to transfer assets cross-chain utilizing Across under the hood.

Finally, it is worth reminding that turning the fee switch on can serve as an extra catalyst to start sharing revenue with token holders, making it more attractive to hold $ACX to capture the upside of a rollup-centric world. While Across is not currently monetizing the protocol and shares all fees with LPs and relayers, data relative to competitors shows that Across could easily support a 5 bps take rate (⅓ of the current 15 bps that are charged today).

Across ($ACX) is emerging as a key player in the L2 bridge sector, with its valuation approaching an all-time high and positioned for growth due to significant upcoming developments like the Dencun Upgrade and more L2s entering the market. These catalysts are expected to lower transaction costs on Layer 2 networks and potentially revalue $ACX, enhancing its market appeal with increasing transaction volumes and fee accrual.

Despite challenges from broader-market solutions, Across is gaining traction through its transaction volume and strategic capital efficiency, distinguishing itself with unmatched speed and cost advantages. The forthcoming Across v3, along with increased wallet and aggregator integrations, aims to further its market share and solidify its position as a premier cross-chain transfer solution.

Revelo Intel has never had a commercial relationship with Across and this report was not paid for or commissioned in any way. Members of the Revelo Intel team, including those directly involved in the analysis above, may have positions in the tokens discussed. This content is provided for educational purposes only and does not constitute financial or investment advice. You should do your own research and only invest what you can afford to lose. Revelo Intel is a research platform and not an investment or financial advisor.